Alliance Resource Partners Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Resource Partners Bundle

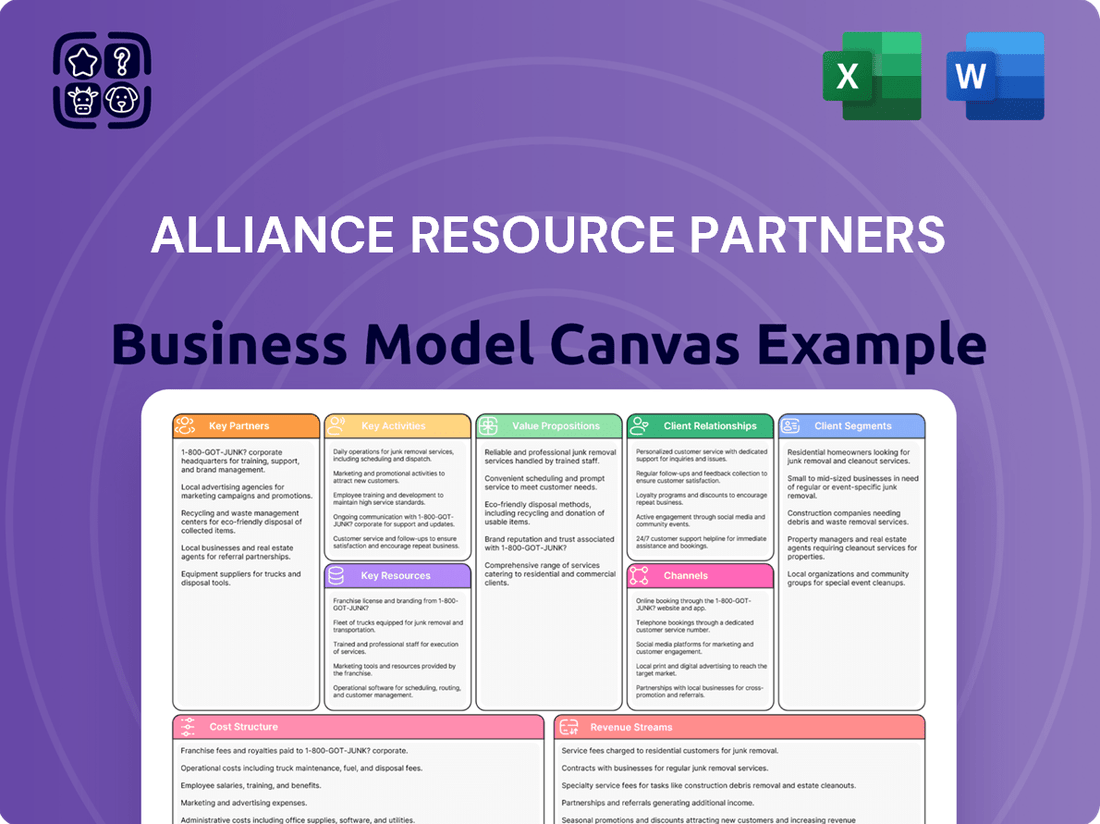

Explore the core components of Alliance Resource Partners's strategic framework with our comprehensive Business Model Canvas. This in-depth analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

Alliance Resource Partners' key partnerships are primarily with utility and industrial customers, who are the main buyers of their coal. This relationship is fundamental to their business model, ensuring a consistent market for their product.

The stability of these partnerships is a significant strength. For instance, in 2024, Alliance Resource Partners had over 90% of its sales committed and priced at levels comparable to the previous year. Furthermore, 78% of their 2025 sales tonnage was already under contract, highlighting the predictable demand generated through these crucial relationships.

Alliance Resource Partners (ARLP) generates substantial royalty income from its mineral interests strategically located in key oil and gas producing areas like the Permian, Anadarko, and Williston basins. These partnerships are vital for their oil and gas royalty segment's expansion and revenue. For example, ARLP's 2023 performance highlighted this, with its oil and gas royalty segment contributing significantly to overall results, demonstrating the value of these collaborations.

Alliance Resource Partners (ARLP) is strategically investing in and fostering the growth of new energy technology companies, recognizing their importance in a diversifying energy landscape. These collaborations are central to ARLP's long-term vision of becoming a comprehensive energy solutions provider.

A prime example of this strategy is ARLP's investment in Ascend Elements, a company focused on developing sustainable battery materials. Additionally, their backing of Infinitum, an innovator in more efficient electric motor technology, highlights ARLP's commitment to advancing energy efficiency across various sectors.

These partnerships are crucial for ARLP's diversification efforts, aiming to position the company as a forward-thinking and dependable energy partner. By supporting these emerging technologies, ARLP is actively contributing to the expansion of both the energy sector and its related infrastructure.

Transportation and Logistics Providers

Alliance Resource Partners (ARLP) relies heavily on transportation and logistics providers to move its primary product, coal. These partnerships are fundamental to ensuring coal reaches customers efficiently and at a competitive price. For instance, in 2024, ARLP's success in marketing coal is directly tied to its ability to leverage these critical transportation networks.

ARLP operates a significant coal loading terminal on the Ohio River. This infrastructure highlights a crucial dependence on river transportation, necessitating strong relationships with barge operators and related logistics services. These partnerships are the backbone of their distribution capabilities.

- Rail Partnerships: Essential for long-haul transportation of coal from mines to various destinations.

- Barge and River Logistics: Crucial for moving coal along waterways, particularly given ARLP's Ohio River terminal.

- Trucking Services: Important for last-mile delivery and shorter hauls, complementing rail and barge networks.

Mining Technology and Equipment Suppliers

Alliance Resource Partners (ARLP) cultivates key partnerships with mining technology and equipment suppliers to ensure peak operational efficiency and safety. These relationships are crucial for accessing and integrating cutting-edge solutions that drive productivity in their mining operations.

A prime example of this is ARLP's ownership of Matrix Design Group, a subsidiary focused on developing advanced safety and productivity technology. This internal capability streamlines the adoption of new technologies, but ARLP also collaborates with external tech providers to augment their offerings and maintain a competitive edge.

These collaborations are fundamental to optimizing every stage of the mining process, from extraction and processing to overall mine performance. For instance, in 2023, ARLP reported capital expenditures of $375.3 million, a significant portion of which would be allocated to acquiring and upgrading technologically advanced equipment, underscoring the financial commitment to these partnerships.

- Technology Integration: Partnerships facilitate the adoption of advanced equipment like continuous miners and automated haulage systems, directly impacting production volumes.

- Safety Enhancements: Collaborations with technology suppliers, including those focused on monitoring and automation, are vital for maintaining ARLP's strong safety record, which saw a lost-time injury frequency rate of 0.68 per 200,000 hours worked in 2023.

- Operational Efficiency: Access to innovative equipment and software from partners helps ARLP optimize resource extraction and reduce operational costs, contributing to their ability to generate strong cash flows.

- Innovation Pipeline: Working with suppliers ensures ARLP stays abreast of technological advancements, allowing for continuous improvement in mining techniques and equipment utilization.

Alliance Resource Partners' key partnerships are primarily with utility and industrial customers, who are the main buyers of their coal, ensuring a consistent market. The stability of these relationships is a significant strength, with over 90% of 2024 sales committed and 78% of 2025 sales tonnage already under contract.

ARLP also generates substantial royalty income through partnerships in key oil and gas basins, demonstrating the value of these collaborations for segment expansion and revenue. Furthermore, ARLP is strategically investing in and fostering growth in new energy technology companies, such as Ascend Elements and Infinitum, to position itself as a comprehensive energy solutions provider.

Crucial partnerships with transportation and logistics providers, including rail, barge, and trucking services, are fundamental to efficiently delivering coal. ARLP's Ohio River terminal highlights a particular dependence on barge operators. Additionally, collaborations with mining technology and equipment suppliers, including their subsidiary Matrix Design Group, are vital for operational efficiency and safety, with significant capital expenditures in 2023 directed towards advanced equipment acquisition and upgrades.

What is included in the product

Alliance Resource Partners' business model focuses on providing essential mining services and resources to major utility and industrial customers, leveraging their extensive reserves and operational expertise.

This model is built on strong customer relationships, efficient production, and strategic resource management to deliver consistent value and profitability.

Alliance Resource Partners' Business Model Canvas provides a clear, one-page snapshot of their operations, simplifying complex strategies for quick understanding and actionable insights.

It effectively distills their value proposition and customer segments, offering a pain-point reliever by presenting a digestible framework for strategic analysis and adaptation.

Activities

Alliance Resource Partners, L.P. (ARLP) centers its operations on the safe and efficient extraction of coal from its seven underground mining complexes. These facilities are strategically located across the Illinois Basin, Central Appalachian, and Northern Appalachian regions, forming the backbone of their coal production activities.

The company's key activities encompass the entire mining lifecycle, from initial mine development and complex longwall moves to the consistent daily output of coal. This meticulous approach ensures they remain a significant coal producer in the eastern United States, navigating industry challenges.

In 2023, ARLP reported total coal sales of 37.2 million tons, a slight decrease from 37.6 million tons in 2022, demonstrating their continued large-scale production capabilities. The company also achieved an impressive safety record, with a lost-time injury frequency rate of 0.55 per 200,000 hours worked in 2023, highlighting their commitment to operational safety.

Alliance Resource Partners' key activity of coal marketing and sales focuses on strategically placing both thermal and metallurgical coal with a wide array of customers. This includes significant domestic and international utility companies and various industrial consumers who rely on these essential resources.

A core element of this strategy is the negotiation and securing of long-term, multi-year contracts. These agreements are vital for buffering against the inherent price fluctuations in the coal market, thereby creating more predictable and stable revenue streams for the company. For instance, as of their latest reports, Alliance Resource Partners has a substantial portion of their future sales volumes already committed through these contracts, providing a strong foundation for financial planning.

Alliance Resource Partners (ARLP) actively manages a diverse mineral interest portfolio, primarily focusing on coal and oil & gas, to secure royalty income. This strategic management includes identifying and acquiring promising mineral acreage, ensuring a consistent stream of revenue from these assets.

The company diligently oversees drilling and completion operations on its royalty acreage, aiming to optimize oil and gas production volumes. This hands-on approach is crucial for maximizing the royalty income generated from these valuable resources.

This segment represents a substantial and increasingly important component of ARLP's overall business operations. For instance, in the first quarter of 2024, ARLP's royalty segment contributed significantly to its adjusted EBITDA, underscoring its growing financial impact.

Investment in New Energy Technologies

Alliance Resource Partners (ARLP) is actively investing in new energy technologies as a crucial strategy for future growth and diversification. This involves a keen focus on developing and acquiring businesses that align with the global energy transition.

This proactive stance includes evaluating opportunities in emerging sectors such as sustainable battery materials and highly efficient electric motors. By doing so, ARLP aims to position itself as a forward-looking partner in the evolving energy landscape, adapting to changing market demands.

- Investment Focus: ARLP is channeling resources into the development and acquisition of businesses related to new energy technologies.

- Areas of Interest: Key areas being evaluated include sustainable battery materials and efficient electric motors, reflecting a commitment to energy transition initiatives.

- Strategic Positioning: This investment strategy is designed to adapt ARLP to the evolving energy sector and secure its role as a forward-looking energy partner.

Logistics and Transportation Management

Alliance Resource Partners' core operations heavily rely on the efficient management of coal logistics and transportation. This involves the intricate process of moving coal from its mining sites to various end-users, ensuring it arrives on schedule and at a competitive price.

A key asset in this activity is their ownership and operation of a coal loading terminal situated on the Ohio River. This terminal acts as a crucial hub, facilitating the transfer of coal from rail or truck to barges for onward shipment. Coordinating with multiple transportation providers, including rail companies and barge operators, is essential for seamless, cost-effective delivery.

- Ohio River Terminal Operations: Alliance Resource Partners operates a significant coal loading terminal on the Ohio River, a vital artery for transporting bulk commodities.

- Multi-modal Transportation Coordination: The company manages the complex coordination of various transportation modes, including rail, truck, and barge, to ensure efficient coal delivery.

- Supply Chain Optimization: Effective logistics are paramount for maintaining customer satisfaction and optimizing the entire coal supply chain, from mine to market.

Alliance Resource Partners' key activities revolve around the safe and efficient extraction of coal from its mining complexes, ensuring consistent daily output and managing complex mining operations like longwall moves. They also focus on marketing and selling both thermal and metallurgical coal through long-term contracts to domestic and international customers, providing revenue stability.

Furthermore, ARLP actively manages a mineral interest portfolio, generating royalty income from oil and gas operations, and is strategically investing in new energy technologies like sustainable battery materials and electric motors to diversify and adapt to the evolving energy landscape.

| Activity | Description | 2023/Q1 2024 Data Points |

|---|---|---|

| Coal Extraction & Mining | Operating 7 underground mining complexes; safe and efficient extraction. | 37.2 million tons of coal sold in 2023; 0.55 lost-time injury frequency rate in 2023. |

| Coal Marketing & Sales | Strategic placement of thermal and metallurgical coal with diverse customers. | Secured substantial portion of future sales volumes through long-term contracts. |

| Royalty Segment Management | Managing mineral interests (coal, oil & gas) for royalty income. | Significant contribution to adjusted EBITDA in Q1 2024. |

| New Energy Investments | Developing and acquiring businesses in sustainable battery materials and electric motors. | Focus on adapting to global energy transition. |

What You See Is What You Get

Business Model Canvas

The Alliance Resource Partners Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. You'll gain immediate access to this fully functional and professionally prepared Business Model Canvas, ready for your strategic planning and analysis.

Resources

Alliance Resource Partners' key resource is its vast coal reserves, totaling 663.2 million tons of proven and probable coal, primarily situated in the Illinois and Appalachia Basins. This forms the bedrock of their core coal mining operations.

Beyond coal, the company holds significant mineral interests, encompassing approximately 70,000 net royalty acres. These interests are strategically located in prime oil and gas producing areas, contributing substantially to their diversified revenue streams through royalty income.

Alliance Resource Partners’ mining infrastructure is anchored by its seven underground mining complexes and associated processing plants. These facilities, coupled with extensive heavy machinery and a strategic coal loading terminal on the Ohio River, form the backbone of their operations, enabling efficient coal extraction and delivery.

The company's commitment to maintaining a low-cost production position is evident in its continuous investments in these critical physical assets. These upgrades and expansions are designed to boost productivity and ensure the longevity and competitiveness of their mining operations.

Alliance Resource Partners (ARLP) relies heavily on its highly skilled workforce, a crucial intangible asset. This includes experienced miners, engineers, and management professionals who possess decades of operational know-how in the coal and natural resource sectors. Their collective expertise is fundamental to maintaining safe, efficient, and productive mining activities.

This operational expertise is vital for ARLP to effectively navigate the complexities of market fluctuations and the ever-evolving regulatory landscape. For instance, in 2023, ARLP's commitment to operational excellence contributed to them achieving a strong safety record, a testament to their skilled workforce's dedication.

Long-Term Customer Contracts

Long-term customer contracts are a cornerstone for Alliance Resource Partners, acting as a vital intangible resource. These multi-year agreements with major domestic and international utilities and industrial clients offer substantial visibility into future sales volumes and cash flows. This visibility helps to smooth out any potential price fluctuations and ensures a consistent demand for their coal products.

- Contractual Stability: Multi-year contracts with major utilities and industrial users provide predictable revenue streams.

- Demand Assurance: These agreements guarantee a stable market for Alliance Resource Partners' coal production, reducing reliance on spot market fluctuations.

- Financial Visibility: Contracts offer clear insight into future sales volumes and cash flows, aiding financial planning and risk management.

- Secured Tonnage: Alliance Resource Partners has already secured 17.4 million committed and priced sales tons for the years 2025 through 2029, demonstrating the strength and forward-looking nature of their contractual portfolio.

Financial Capital and Investment Capacity

Alliance Resource Partners (ARLP) leverages its financial capital, encompassing robust cash reserves and established credit facilities, as a critical resource. This financial strength is paramount for funding daily operations, investing in significant infrastructure upgrades, and acquiring promising new mineral interests. For instance, ARLP's strong liquidity and solid balance sheet, exemplified by their consistent ability to generate free cash flow, directly support their ambitious growth strategies and diversification efforts into emerging energy technologies.

ARLP's investment capacity is further bolstered by its proven ability to attract external investments, a testament to its financial stability and strategic vision. This access to capital allows them to undertake substantial capital expenditure projects, such as the development of new mining operations or the expansion of existing ones. In 2024, ARLP continued to demonstrate this capacity, with significant investments planned across its portfolio to enhance efficiency and expand production capabilities.

- Access to Capital: ARLP maintains access to a diverse range of financial resources, including cash on hand and revolving credit facilities.

- Operational Funding: Financial capital directly supports ongoing operational needs, ensuring smooth and efficient production across all segments.

- Strategic Investments: The company utilizes its financial capacity to fund major infrastructure projects and strategic acquisitions of mineral rights.

- Growth and Diversification: ARLP's financial strength underpins its ability to pursue new growth opportunities and diversify into evolving energy sectors.

Alliance Resource Partners' key resources are its extensive coal reserves, estimated at 663.2 million tons of proven and probable coal, primarily in the Illinois and Appalachia Basins. This vast resource base is central to its core coal mining operations.

In addition to coal, ARLP possesses significant mineral interests, covering around 70,000 net royalty acres in productive oil and gas regions. These interests contribute to diversified revenue through royalty income, complementing its primary coal business.

The company's operational backbone comprises seven underground mining complexes, processing plants, and extensive heavy machinery, including a strategic Ohio River coal loading terminal. These physical assets are continuously upgraded to maintain low-cost production and operational efficiency.

ARLP's skilled workforce, comprising experienced miners, engineers, and management, represents a critical intangible asset. Their collective expertise is vital for safe, efficient operations and navigating market and regulatory complexities, as evidenced by their strong 2023 safety record.

Long-term customer contracts are another key intangible resource, providing revenue visibility and stability. ARLP has secured 17.4 million committed and priced sales tons for 2025-2029, underscoring the strength of its contractual portfolio.

Financial capital, including robust cash reserves and credit facilities, is essential for operations, infrastructure investment, and mineral interest acquisition. ARLP's strong liquidity and free cash flow generation in 2024 support its growth and diversification strategies.

| Key Resource | Description | Significance | 2024 Data/Context |

|---|---|---|---|

| Coal Reserves | 663.2 million tons (proven & probable) | Foundation of core coal mining | Primarily in Illinois and Appalachia Basins |

| Mineral Interests | Approx. 70,000 net royalty acres | Diversified revenue via oil & gas royalties | Located in prime producing areas |

| Mining Infrastructure | 7 underground mining complexes, processing plants, heavy machinery, Ohio River terminal | Enables efficient extraction and delivery | Continuous investment for low-cost production |

| Skilled Workforce | Experienced miners, engineers, management | Ensures safe, efficient, and productive operations | Contributed to strong 2023 safety record |

| Customer Contracts | Multi-year agreements with utilities/industrial clients | Provides revenue visibility and stability | 17.4 million tons secured for 2025-2029 |

| Financial Capital | Cash reserves, credit facilities | Funds operations, investments, acquisitions | Supports growth and diversification efforts |

Value Propositions

Alliance Resource Partners (ARLP) delivers a consistent and cost-effective supply of baseload energy, primarily coal, to utilities and industrial clients. Their operational scale and extensive reserves guarantee dependability, a critical factor for customers facing rising electricity demand and grid stability challenges.

ARLP's commitment to reliability is underscored by its position as a top-tier provider of affordable energy. In 2024, the company continued to demonstrate this, with its operations generating significant volumes of coal, contributing to the nation's energy needs.

Alliance Resource Partners (ARLP) is actively diversifying its energy portfolio beyond its established coal operations. This includes a strategic expansion into oil and gas mineral interests, which offers a complementary revenue stream and exposure to different market dynamics.

ARLP's commitment to a broader energy landscape is further evidenced by its investments in new energy technologies. This forward-thinking approach aims to position the company for the evolving energy transition, appealing to stakeholders interested in a more varied energy exposure.

This diversification strategy is crucial for risk mitigation. By not relying solely on coal production, ARLP can better navigate the inherent volatility and potential long-term shifts associated with any single commodity, enhancing financial stability.

Alliance Resource Partners (ARLP) provides customers with long-term supply contracts, securing a significant portion of future sales volumes at predetermined prices. This commitment offers crucial stability and predictability for their clients' energy needs, enabling better cost and operational management.

This contractual stability is a vital advantage, especially in an energy market prone to price fluctuations. For instance, as of the first quarter of 2024, ARLP had approximately 70% of its expected 2024 production and 40% of its projected 2025 production committed under these long-term agreements, underscoring their dedication to supply security.

Responsible Operations and Environmental Stewardship

Alliance Resource Partners (ARLP) highlights its dedication to responsible operations and environmental stewardship as a core value proposition. The company actively seeks to lessen its environmental footprint through the adoption of advanced technologies and diligent operational practices. This focus on sustainability is not just a statement; it's embedded in their approach to business, aiming to resonate with stakeholders who increasingly value eco-conscious partners.

ARLP's commitment translates into tangible actions such as reducing energy consumption and conserving precious water resources. They also prioritize biodiversity preservation, demonstrating a holistic view of environmental responsibility. These efforts are crucial for attracting customers and investors who are aligning their own strategies with sustainable business models. For instance, in their 2023 corporate responsibility report, ARLP detailed a reduction in greenhouse gas emissions intensity by 12% compared to 2022, showcasing concrete progress.

- Commitment to sustainability: ARLP integrates environmental stewardship into its operational framework.

- Resource management: Focus on reducing energy use and conserving water resources.

- Biodiversity preservation: Efforts to protect and maintain local ecosystems.

- Stakeholder appeal: Attracting environmentally conscious customers and investors through transparent reporting.

Operational Efficiency and Cost Competitiveness

Alliance Resource Partners (ARLP) focuses on operational efficiency and cost competitiveness by strategically investing in its mining infrastructure. This commitment allows them to be a low-cost producer in the eastern US.

This efficiency translates directly into competitive pricing for their customers, a key value proposition that holds strong even when market conditions are unpredictable. For example, in 2023, ARLP reported total revenues of $2.1 billion, demonstrating their ability to maintain sales volumes through pricing advantages.

- Strategic Infrastructure Investments: ARLP consistently invests in modernizing its mining equipment and facilities to enhance productivity and reduce per-unit production costs.

- Continuous Improvement Initiatives: The company actively pursues operational improvements, such as optimizing extraction processes and supply chain management, to further drive down costs.

- Cost Leadership: These efforts position ARLP as one of the most reliable, low-cost coal producers in the eastern United States, enabling them to offer attractive pricing.

- Market Resilience: Competitive pricing provides a buffer against market volatility, ensuring consistent value for customers.

ARLP offers dependable, cost-effective energy supply, primarily coal, to utilities and industrial clients, ensuring grid stability. Their extensive reserves and operational scale guarantee reliability for customers facing increasing energy demands.

ARLP's value proposition extends to a diversified energy portfolio, including oil and gas mineral interests, which provides complementary revenue streams and market exposure. This strategic expansion aims to mitigate risks associated with reliance on a single commodity.

The company secures long-term supply contracts, offering clients price stability and predictability crucial for their operational and cost management. As of Q1 2024, ARLP had approximately 70% of its 2024 and 40% of its 2025 production committed under these agreements.

ARLP emphasizes responsible operations and environmental stewardship, investing in advanced technologies to reduce its environmental footprint. This commitment includes efforts in energy conservation, water resource management, and biodiversity preservation, appealing to eco-conscious stakeholders.

Operational efficiency and cost competitiveness are key, driven by strategic investments in mining infrastructure. This allows ARLP to be a low-cost producer in the eastern US, offering attractive pricing even amidst market volatility. In 2023, ARLP reported $2.1 billion in total revenues.

| Value Proposition | Description | Supporting Data/Fact (as of latest available, focusing on 2024/early 2025) |

|---|---|---|

| Reliable Energy Supply | Consistent and cost-effective supply of baseload energy (primarily coal) to utilities and industrial clients. | Operational scale and extensive reserves guarantee dependability for customers. |

| Portfolio Diversification | Expansion into oil and gas mineral interests for complementary revenue streams and market exposure. | Strategic investments in new energy technologies to position for the evolving energy transition. |

| Contractual Stability | Long-term supply contracts with predetermined prices offering clients crucial stability and predictability. | As of Q1 2024, ~70% of 2024 and ~40% of 2025 production committed under long-term agreements. |

| Environmental Stewardship | Commitment to responsible operations and reducing environmental footprint through advanced technologies and practices. | 2023 report detailed a 12% reduction in greenhouse gas emissions intensity compared to 2022. |

| Cost Competitiveness | Operational efficiency and strategic infrastructure investments leading to low-cost production. | Positioned as a low-cost coal producer in the eastern US; reported $2.1 billion in total revenues for 2023. |

Customer Relationships

Alliance Resource Partners (ARLP) builds lasting connections with its key utility and industrial clients by entering into multi-year supply agreements. These contracts are the bedrock of their customer relationships, ensuring a stable and reliable flow of coal, which in turn builds significant trust through consistent supply and pricing.

The company's strategy heavily relies on these long-term contractual arrangements, which are crucial for their business model. For instance, ARLP consistently reports a high percentage of its sales volumes committed for future years, a testament to the strength and duration of these customer partnerships, which often extend for many years.

Alliance Resource Partners likely utilizes dedicated sales and account management teams to foster strong relationships with its key clients. These professionals are tasked with deeply understanding customer needs, skillfully negotiating contracts, and ensuring seamless, consistent service delivery across all interactions.

This personalized approach is crucial for maintaining high levels of customer satisfaction and effectively addressing the unique and evolving requirements of their diverse clientele. For instance, in 2023, Alliance Resource Partners reported that its customer retention rates remained robust, a testament to the effectiveness of its relationship management strategies.

Alliance Resource Partners (ARLP) cultivates strong customer relationships by ensuring a reliable supply of coal and upholding strict quality assurance measures. This commitment directly supports their value proposition of providing affordable and dependable energy to their clientele.

For utility companies, in particular, ARLP's consistent coal quality and dependable delivery are paramount. This operational steadiness allows utilities to maintain uninterrupted power generation, a critical need for grid stability. In 2023, ARLP reported an average realized price of $46.54 per ton for their coal, reflecting their ability to deliver a consistent product at competitive rates, which fosters customer loyalty and repeat business.

Investor Relations and Transparency

Alliance Resource Partners (ARLP) cultivates strong investor relations through consistent communication. They conduct regular earnings calls, issue timely SEC filings, and distribute press releases to keep unitholders and the financial community informed. This commitment to transparency helps build and maintain trust.

ARLP's investor relations strategy includes detailed investor presentations that offer insights into their operations and financial performance. This proactive approach is crucial for attracting and retaining a stable investor base. For instance, their 2024 investor presentations highlighted a focus on operational efficiency and strategic capital allocation.

- Regular Communication Channels: ARLP utilizes earnings calls, SEC filings, and press releases to disseminate crucial information.

- Transparency and Trust: Their investor relations program is designed to foster trust by providing clear and consistent updates.

- Investor Presentations: Detailed presentations offer stakeholders a deeper understanding of ARLP's business and financial health.

- Attracting and Retaining Investors: A focus on open communication is key to securing and maintaining investor confidence.

Strategic Dialogue on Energy Transition

Alliance Resource Partners (ARLP) actively cultivates strategic dialogues with its customer base to navigate the dynamic energy transition. This involves proactive discussions about evolving energy needs and the integration of new technologies.

These conversations position ARLP as a forward-thinking partner, offering solutions that span beyond traditional coal, aligning with customers' long-term sustainability goals. For instance, in 2023, ARLP continued to explore opportunities in lower-carbon energy sectors, indicating a commitment to diversifying its customer offerings.

- Customer Engagement: ARLP's strategy involves direct engagement with clients to understand their shifting energy requirements and investment priorities in emerging technologies.

- Solution-Oriented Approach: The company aims to provide integrated energy solutions, moving beyond solely supplying fossil fuels to offering broader support for the energy transition.

- Market Adaptability: By fostering these dialogues, ARLP demonstrates its ability to adapt to market changes and anticipate future energy demands, ensuring continued relevance and partnership.

Alliance Resource Partners (ARLP) solidifies customer relationships through multi-year supply agreements, prioritizing consistent quality and dependable delivery. This approach fosters trust and loyalty, particularly with utility clients who rely on stable energy sources for uninterrupted power generation. For example, in 2023, ARLP reported an average realized coal price of $46.54 per ton, reflecting their ability to provide a reliable product at competitive rates.

The company actively engages in strategic dialogues with its customer base to address the evolving energy landscape and the transition to lower-carbon solutions. This forward-thinking approach positions ARLP as a partner capable of offering integrated energy solutions that align with customers' long-term sustainability objectives.

| Customer Relationship Aspect | Key Strategy | Supporting Data/Insight |

|---|---|---|

| Long-Term Supply Agreements | Multi-year contracts ensuring stable coal flow | High percentage of future sales volumes committed (consistent across reporting periods) |

| Quality and Reliability | Strict quality assurance and dependable delivery | Average realized price of $46.54 per ton in 2023 |

| Strategic Dialogue | Proactive discussions on energy transition and new technologies | Exploration of lower-carbon energy sectors in 2023 |

Channels

Alliance Resource Partners, L.P. (ARLP) relies heavily on its direct sales force to engage with major utility and industrial clients. This direct approach is key to negotiating and securing multi-year contracts, ensuring stable revenue streams. For instance, in 2023, ARLP reported that a significant portion of its coal sales were under long-term agreements, highlighting the success of this strategy.

The direct sales channel facilitates the creation of customized agreements, tailored to the specific needs of each large customer. This allows ARLP to build strong, lasting relationships, which is essential for maintaining committed sales volumes over extended periods. Such direct engagement ensures that solutions are precisely matched to customer requirements.

Alliance Resource Partners (ARLP) leverages its own strategically located coal loading terminal on the Ohio River as a key physical distribution channel, ensuring efficient and cost-effective movement of coal. This terminal is a critical asset for reaching both domestic and international customers.

The company's extensive reliance on a multi-modal transportation network, including rail, barge, and potentially trucking, is fundamental to its operational success. This integrated approach allows ARLP to serve a broad customer base across various geographies, meeting diverse delivery needs.

Beyond facilitating coal sales, ARLP's transportation segment also acts as a direct revenue generator. In 2024, the company's transportation segment reported revenues of approximately $240 million, underscoring its importance as a profit center within the overall business model.

Alliance Resource Partners (ARLP) leverages its investor relations website as a crucial channel for communicating with financial stakeholders. This platform provides direct access to vital documents such as quarterly and annual financial reports, SEC filings, and press releases, ensuring transparency and accessibility for individual investors, financial professionals, and academic researchers alike. In 2024, ARLP continued to maintain a robust online presence, facilitating informed decision-making for its diverse audience.

Industry Conferences and Trade Shows

Industry conferences and trade shows are vital channels for Alliance Resource Partners (ARLP) to engage with the energy sector. These events facilitate networking, allow ARLP to showcase its capabilities, and help identify new business avenues, particularly as the energy landscape continues to transform.

ARLP actively participates in key industry gatherings like the Energy Infrastructure Council CEO & Investor Conference. This strategic presence enables direct interaction with potential customers, crucial partners, and investors, fostering valuable relationships and market visibility.

- Networking: Connect with peers, potential clients, and industry leaders.

- Showcasing Capabilities: Present ARLP's services and expertise to a targeted audience.

- Opportunity Identification: Discover emerging trends and potential new business ventures.

- Investor Relations: Engage with investors to communicate company performance and strategy.

Strategic Partnerships and Joint Ventures

Alliance Resource Partners (ARLP) actively utilizes strategic partnerships and joint ventures as key channels for entering new energy markets and pursuing oil and gas royalty acquisitions. These collaborations are crucial for gaining access to cutting-edge technologies, specialized expertise, and previously untapped markets, effectively extending ARLP's operational footprint beyond its established coal business.

For instance, ARLP's strategic investments extend into companies focused on developing sustainable battery materials and enhancing the efficiency of electric motors. These ventures demonstrate a forward-looking approach to energy diversification. In 2024, ARLP reported significant progress in its strategic investment initiatives, with a particular focus on expanding its presence in the energy transition sector.

- Market Entry: Joint ventures provide a less capital-intensive pathway into new geographic regions or specialized energy sub-sectors.

- Technology Access: Partnerships enable ARLP to leverage proprietary technologies and innovations from collaborators, accelerating development in areas like battery materials.

- Risk Mitigation: Sharing investment and operational risks with partners reduces the financial burden and potential downside for ARLP.

- Expanded Reach: Collaborations open doors to new customer bases and supply chains, augmenting ARLP's market penetration capabilities.

Alliance Resource Partners (ARLP) employs a multi-faceted channel strategy. Their direct sales force is paramount for securing long-term contracts with major utilities and industrial clients, a strategy that proved effective in 2023 with a substantial portion of coal sales under such agreements. This direct engagement allows for tailored solutions, fostering strong customer relationships.

ARLP also utilizes its own Ohio River terminal for efficient distribution, complemented by a robust multi-modal transportation network (rail, barge). This transportation segment is not only crucial for delivery but also a significant revenue driver, generating approximately $240 million in 2024.

Furthermore, ARLP leverages its investor relations website for transparent communication with financial stakeholders and actively participates in industry conferences to network and identify new opportunities. Strategic partnerships and joint ventures are key to expanding into new energy markets and acquiring oil and gas royalties, as seen in their 2024 investments in battery materials and electric motor efficiency.

| Channel | Description | Key Benefit | 2023/2024 Data Point |

| Direct Sales Force | Engaging directly with major utility and industrial clients. | Secures long-term contracts and customized agreements. | Significant portion of 2023 coal sales under long-term agreements. |

| Physical Distribution Terminal & Transportation Network | Utilizing owned Ohio River terminal and multi-modal transport (rail, barge). | Ensures efficient, cost-effective delivery to a broad customer base. | Transportation segment revenue of ~$240 million in 2024. |

| Investor Relations Website | Online platform for financial reporting and company updates. | Provides transparency and accessibility to financial stakeholders. | Maintained robust online presence in 2024. |

| Industry Conferences & Trade Shows | Participation in energy sector events. | Facilitates networking, showcases capabilities, and identifies new business. | Active participation in key industry gatherings. |

| Strategic Partnerships & Joint Ventures | Collaborations for market entry and acquisitions. | Access to new markets, technologies, and risk mitigation. | Significant progress in strategic investment initiatives in 2024, focusing on energy transition. |

Customer Segments

Large domestic utilities represent a foundational customer segment for Alliance Resource Partners (ARLP). These are primarily major power generation companies situated in the eastern United States, and their operations are heavily dependent on coal to meet baseload electricity demands.

These utilities prioritize a consistent, dependable, and cost-effective supply of thermal coal for their power plants. This reliability is crucial for maintaining stable energy output. A substantial portion of ARLP's coal sales are secured by this segment through long-term contractual agreements, underscoring the strategic importance of these relationships.

Alliance Resource Partners (ARLP) also caters to a vital segment of industrial users across the eastern United States. These businesses rely on coal for their manufacturing and other industrial needs. For example, in 2024, ARLP's industrial segment continued to supply critical materials to sectors like steel production, where metallurgical coal is essential for the smelting process.

Customers in this industrial user segment place a premium on two key factors: consistent coal quality and unwavering delivery reliability. To secure these essential attributes, they frequently engage in long-term supply agreements, ensuring a stable and predictable input for their operations. This focus on dependability is crucial for industries where production continuity is paramount.

While Alliance Resource Partners (ARLP) primarily serves domestic markets, a portion of its coal production is directed towards international utilities and industrial users. This global reach, though currently smaller than its U.S. operations, offers important diversification benefits and exposure to varying global energy demand trends.

In 2024, ARLP's commitment to expanding its international presence continued, aiming to capitalize on opportunities in regions with robust industrial and power generation needs. This strategic move allows ARLP to leverage its production capacity beyond domestic constraints, creating additional sales channels and enhancing overall business resilience.

Oil & Gas Exploration and Production Companies

Alliance Resource Partners (ARLP) engages with oil and gas exploration and production (E&P) companies as a key customer segment, primarily through its mineral interests. These E&P companies are the active operators on ARLP's royalty acreage, generating the production that forms the basis of ARLP's revenue. In 2024, ARLP's royalty income is directly tied to the drilling and production activities of these partners.

These E&P partners are typically substantial, well-established entities with significant capital investment in active drilling programs. They often focus on strategically important basins where ARLP holds substantial mineral rights. Their operational success directly translates into ARLP's financial performance, highlighting a symbiotic relationship.

- E&P Company Activity: ARLP's revenue is a direct function of the drilling and production volumes achieved by these E&P operators on its leased lands.

- Strategic Basin Focus: The customer base for ARLP's mineral interests consists of E&P companies actively developing resources in key basins where ARLP holds significant acreage.

- Revenue Generation: ARLP acts as a passive revenue generator, receiving royalties from the production activities of these E&P partners.

Investors and Financial Stakeholders

Alliance Resource Partners (ARLP) recognizes investors and financial stakeholders as a critical customer segment. This group encompasses individual investors, financial professionals like analysts and portfolio managers, and academic researchers. They are the ones who evaluate ARLP’s performance and future prospects, directly impacting its access to capital and overall market valuation.

These stakeholders rely on ARLP for detailed financial data, strategic outlooks, and performance metrics to guide their investment decisions. For instance, ARLP's investor relations efforts are designed to provide transparency and build confidence. In 2024, ARLP continued to focus on delivering shareholder value, demonstrated by its consistent distributions and strategic operational execution.

- Investor Base: Includes individual retail investors, institutional investors, and financial analysts covering the energy sector.

- Information Needs: Require access to quarterly earnings reports, annual filings (10-K), investor presentations, and management commentary on market conditions and operational performance.

- Impact on ARLP: Their investment decisions influence ARLP's stock price, cost of capital, and ability to raise funds for growth initiatives or debt repayment.

- ARLP's Engagement: Proactive investor relations, including conference calls and investor conferences, are key to satisfying this segment's demand for information and building trust.

Alliance Resource Partners (ARLP) serves a diverse customer base, with large domestic utilities forming a core segment, relying on ARLP for consistent and cost-effective thermal coal. Industrial users, including steel manufacturers, also depend on ARLP for quality coal and reliable delivery, often secured through long-term contracts.

Beyond domestic markets, ARLP engages with international utilities and industrial clients, diversifying its revenue streams. Furthermore, oil and gas E&P companies are crucial partners, generating royalties from their drilling activities on ARLP's mineral interests, a relationship that directly impacts ARLP's financial performance.

Finally, investors and financial stakeholders represent a vital segment, scrutinizing ARLP's performance and influencing its market valuation and access to capital. ARLP actively engages this group through transparent reporting and investor relations to foster confidence and support its financial strategy.

Cost Structure

Direct mining expenses represent the most significant portion of Alliance Resource Partners' (ARLP) cost structure. These costs encompass everything directly involved in extracting coal, such as wages and benefits for miners, essential materials like roof supports and maintenance supplies, and the energy needed to power heavy machinery, including electricity and fuel. Equipment upkeep is also a major factor here.

These operational expenditures are closely linked to the volume of coal ARLP produces. Factors like the specific geological conditions encountered during mining and broader inflationary pressures can significantly influence these costs. For instance, in the second quarter of 2025, ARLP reported a Segment Adjusted EBITDA expense per ton sold of $41.27, illustrating the direct cost associated with each ton of coal brought to market.

Alliance Resource Partners incurs significant expenses for moving coal from its mining sites to end-users. These transportation and logistics costs encompass rail freight, barge operations, and trucking services, all crucial for delivering their product.

Factors like fluctuating fuel prices, the availability and condition of transportation infrastructure, and the sheer distances involved directly impact these substantial outlays. For instance, in 2023, the company reported that transportation costs represented a considerable portion of their overall operating expenses, though specific figures vary based on market conditions and customer locations.

Alliance Resource Partners' cost structure is significantly influenced by mineral interest acquisition and development. These expenses encompass the upfront investments needed to secure new coal and oil & gas mineral rights, including lease bonuses and other initial outlays to grow their royalty holdings.

In the fourth quarter of 2024, ARLP made substantial moves in this area, completing $9.6 million in oil & gas mineral interest acquisitions. These strategic purchases are crucial for expanding their asset base and future revenue potential.

Capital Expenditures (CAPEX)

Alliance Resource Partners (ARLP) allocates significant capital to its operations. These capital expenditures, or CAPEX, are crucial for keeping their mining facilities up-to-date and efficient, as well as for acquiring new machinery and exploring new energy projects. This investment is a key component of their long-term cost structure.

ARLP's CAPEX reflects ongoing investments in its core business and future growth. For instance, in 2024, the company reported capital expenditures of $429 million. Looking ahead to 2025, the guidance for CAPEX is projected to be just over $300 million, indicating a planned decrease in spending compared to the previous year.

- Maintaining and upgrading mining infrastructure

- Purchasing new equipment

- Investing in new energy ventures

- 2024 CAPEX: $429 million

- 2025 CAPEX Guidance: Over $300 million

General, Administrative, and Royalty Expenses

Alliance Resource Partners' (ARLP) cost structure includes significant general and administrative (G&A) expenses. These encompass administrative salaries, office rent, utilities, insurance, and professional services like legal and accounting fees, all essential for day-to-day operations. For instance, in 2023, ARLP reported G&A expenses of $183.3 million.

Beyond direct operational costs, ARLP also manages royalty expenses. While ARLP is a significant royalty generator, it also incurs costs related to royalties on mineral interests it leases. These expenses are a direct cost of securing and utilizing mineral reserves.

Furthermore, non-cash items like accruals for long-term liabilities and potential impairment charges on assets can impact ARLP's reported profitability. These accounting adjustments, while not direct cash outflows, are crucial components of the overall cost structure.

- General & Administrative Expenses: $183.3 million in 2023.

- Royalty Expenses: Incurred on leased mineral interests, impacting net revenue.

- Non-Cash Items: Accruals for liabilities and impairment charges affect profitability.

Alliance Resource Partners' cost structure is largely driven by direct mining expenses, which include labor, materials, and energy for extraction. These costs are directly tied to production volume, with segment adjusted EBITDA expense per ton sold at $41.27 in Q2 2025, highlighting the cost of bringing each ton to market.

Transportation and logistics represent another significant cost, covering rail, barge, and trucking services essential for product delivery. Fluctuating fuel prices and infrastructure availability heavily influence these outlays, which formed a considerable part of overall operating expenses in 2023.

Investments in mineral interest acquisition and development, such as the $9.6 million in oil & gas mineral interests acquired in Q4 2024, are crucial for asset growth. Capital expenditures, totaling $429 million in 2024 and projected over $300 million for 2025, are vital for maintaining and upgrading mining infrastructure and exploring new projects.

| Cost Category | Key Components | 2023 Data/2024-2025 Outlook |

| Direct Mining Expenses | Wages, benefits, materials, energy, equipment maintenance | Segment Adjusted EBITDA Expense per Ton Sold: $41.27 (Q2 2025) |

| Transportation & Logistics | Rail, barge, trucking, fuel costs | Significant portion of operating expenses (2023) |

| Mineral Interest Acquisition | Lease bonuses, initial outlays for mineral rights | $9.6 million in oil & gas acquisitions (Q4 2024) |

| Capital Expenditures (CAPEX) | Infrastructure upgrades, new equipment, new energy ventures | $429 million (2024); Over $300 million guidance (2025) |

| General & Administrative (G&A) | Salaries, rent, utilities, insurance, professional services | $183.3 million (2023) |

Revenue Streams

Alliance Resource Partners' main income comes from selling coal. They sell this coal to power plants and other industries. The amount of money they make depends on how much coal they sell and the price they get for each ton. These prices can change based on what's happening in the market and any deals they have in place.

In the fourth quarter of 2024, the company brought in $1.61 billion from coal sales. This significant amount represented about 76.7% of their total earnings for that period, highlighting coal sales as their dominant revenue source.

Alliance Resource Partners (ARLP) generates substantial royalty income from its ownership of oil and gas mineral interests in key producing areas. This income is directly tied to the extraction volumes from their royalty lands and the fluctuating prices of oil and gas.

In the fourth quarter of 2024, ARLP's oil and gas royalty income reached $138.31 million. Furthermore, the company saw a positive trend with a 7.7% year-over-year increase in royalty volumes during the second quarter of 2025, indicating strong operational performance and favorable market conditions.

Alliance Resource Partners (ARLP) diversifies its revenue beyond direct coal sales by earning royalty income. This income stems from coal mineral interests leased to third-party mining operations or those located near ARLP's own mining complexes.

This royalty stream offers a stable, supplementary revenue within the coal segment. For Q2 2025, coal royalty revenue saw a modest increase of 0.2% compared to the previous year, demonstrating its consistent contribution to ARLP's financial performance.

Transportation and Other Operating Revenues

Alliance Resource Partners (ARLP) diversifies its income beyond direct coal sales through transportation and other operating revenues. This includes services like operating a coal loading terminal situated on the Ohio River, facilitating the movement of their products and potentially others.

While these ancillary revenue streams are not as substantial as their primary coal sales, they play a valuable role in the company's overall financial picture. For instance, in the fourth quarter of 2024, the transportation segment alone brought in $112.59 million.

- Transportation Services: Revenue generated from operating infrastructure like coal loading terminals.

- Other Operating Activities: Income derived from various operational ventures beyond core coal mining.

- Q4 2024 Performance: The transportation segment reported $112.59 million in revenue for the fourth quarter of 2024.

- Revenue Mix Contribution: These segments, though smaller than coal sales, add to the company's total revenue diversification.

New Energy Venture Returns/Investments

Alliance Resource Partners (ARLP) is actively exploring new energy ventures as a diversification strategy, aiming to tap into future revenue streams beyond its core coal operations. These investments are strategically positioned to capitalize on the growing demand for sustainable technologies.

ARLP's new energy segment anticipates generating returns from investments in areas like sustainable battery materials and efficient electric motors. While these ventures are in their early stages, they represent a forward-looking approach to income generation as these businesses mature and scale.

- Diversification into New Energy: ARLP is expanding its portfolio to include investments in sustainable battery materials and efficient electric motors, signaling a move towards less carbon-intensive sectors.

- Future Income Generation: These new energy ventures are expected to mature into significant income-generating assets, supplementing ARLP's traditional revenue.

- Digital Asset Gains: The company also anticipates revenue from gains realized through digital assets, such as Bitcoin, further broadening its income sources.

Alliance Resource Partners' revenue streams are primarily driven by coal sales, which accounted for a substantial 76.7% of their earnings in Q4 2024, totaling $1.61 billion. Beyond direct sales, ARLP benefits from oil and gas royalty income, which reached $138.31 million in Q4 2024, and a 7.7% increase in royalty volumes in Q2 2025. Additionally, the company generates revenue from transportation services, including operating a coal loading terminal, contributing $112.59 million in Q4 2024, and is diversifying into new energy sectors like sustainable battery materials and electric motors.

| Revenue Stream | Q4 2024 Revenue | Q2 2025 Data Point |

|---|---|---|

| Coal Sales | $1.61 billion (76.7% of total) | N/A |

| Oil & Gas Royalties | $138.31 million | 7.7% increase in royalty volumes (YoY) |

| Transportation Services | $112.59 million | N/A |

| Coal Royalties | N/A | 0.2% increase (YoY) |

| New Energy Ventures | N/A (Early Stage) | Investments in battery materials and electric motors |

Business Model Canvas Data Sources

The Alliance Resource Partners Business Model Canvas is constructed using a combination of publicly available financial disclosures, industry-specific market research reports, and internal operational data. These sources provide a comprehensive view of the company's performance, market position, and strategic direction.