Alliance Resource Partners PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Resource Partners Bundle

Navigate the complex external forces impacting Alliance Resource Partners with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Gain a competitive edge by leveraging these critical insights for your own strategic planning.

Unlock the full potential of your market analysis by delving into the detailed PESTLE factors affecting Alliance Resource Partners. This expertly crafted report provides actionable intelligence, crucial for investors, consultants, and business strategists. Secure your copy now to make informed decisions and anticipate market shifts.

Political factors

The current administration's energy policy, while emphasizing a transition to renewables, has also shown support for traditional energy sources to ensure grid stability and affordability. Federal policies in 2024 continue to offer tax credits for carbon capture technologies, which could benefit coal producers like Alliance Resource Partners (ARLP) if implemented. However, state-level initiatives and the broader push for decarbonization present ongoing challenges to coal consumption.

Alliance Resource Partners (ARLP) operates within a complex web of federal and state regulations that directly impact coal mining. These rules cover critical areas like obtaining permits, managing land use, and ensuring worker safety, overseen by agencies such as the Environmental Protection Agency (EPA) and the Mine Safety and Health Administration (MSHA).

Increased regulatory stringency or more rigorous enforcement by the EPA and MSHA can substantially elevate ARLP's operational expenses and compliance burdens. For instance, stricter emissions standards or enhanced safety protocols might necessitate significant capital investments in new equipment or process modifications, directly affecting the company's bottom line and overall profitability in 2024 and beyond.

Alliance Resource Partners (ARLP) is significantly impacted by international trade policies. For instance, the ongoing trade disputes and tariffs between major economies can directly affect the global demand for coal, influencing ARLP's export opportunities. Changes in trade agreements, such as those involving the European Union or Asian markets, can alter the competitiveness of U.S. coal exports.

Geopolitical tensions also play a crucial role. Events that disrupt global supply chains or create energy security concerns can either boost or dampen demand for coal. For example, if nations prioritize energy independence, this could increase the demand for domestically sourced coal, potentially benefiting ARLP, as seen in the renewed focus on energy security in 2024 following global supply chain disruptions.

Political Stability and Geopolitical Events

Alliance Resource Partners (ARLP) operates within regions of the Eastern United States where political stability is generally high, though shifts in federal energy policy can impact operations. For instance, the Biden administration's focus on transitioning to cleaner energy sources, as seen in the Inflation Reduction Act of 2022, presents both challenges and opportunities for coal producers like ARLP by potentially influencing demand and investment in fossil fuels.

Broader geopolitical events, such as international conflicts impacting global energy supply and demand dynamics, can indirectly affect ARLP. The ongoing geopolitical tensions in Eastern Europe, for example, have contributed to volatile natural gas prices, which can sometimes influence coal demand as a substitute fuel. ARLP's strategic direction is therefore sensitive to how these global energy market shifts are managed by policymakers.

- Political Stability: ARLP's primary operating regions in the Eastern US generally exhibit stable political regimes.

- Federal Energy Policy: Government initiatives, like the Inflation Reduction Act, can significantly influence the energy sector's trajectory, impacting coal's market position.

- Geopolitical Impact: Global events affecting energy markets, such as the war in Ukraine, can indirectly alter demand for coal by influencing natural gas prices and availability.

- Strategic Sensitivity: ARLP's long-term strategy must account for evolving political landscapes and geopolitical events that shape the energy industry.

Public Policy on Carbon Emissions

Public policy concerning carbon emissions significantly shapes the demand for coal, the primary product of Alliance Resource Partners (ARLP). Governments worldwide are increasingly implementing measures like carbon taxes, cap-and-trade programs, and stringent emission standards for power generation facilities. For instance, the Inflation Reduction Act of 2022 in the United States provides substantial tax credits for renewable energy, indirectly pressuring coal-fired power plants and thus ARLP's customer base.

These evolving regulations directly influence ARLP's long-term business strategy by accelerating the transition away from fossil fuels. The U.S. Environmental Protection Agency's proposed regulations on greenhouse gas emissions from existing fossil fuel-fired electric utility generating units, expected to be finalized in 2024, could further impact coal demand.

- Carbon Pricing Mechanisms: The potential implementation or expansion of carbon taxes or cap-and-trade systems could increase the operational costs for coal-fired power plants, making them less competitive against cleaner energy sources.

- Emissions Standards: Stricter regulations on sulfur dioxide, nitrogen oxides, and particulate matter emissions from power plants may necessitate costly upgrades for ARLP's utility customers, potentially leading to plant closures or reduced operational hours.

- Renewable Energy Incentives: Government support for renewable energy sources, such as solar and wind power, through tax credits and subsidies, directly competes with coal in the electricity generation market, impacting ARLP's sales volumes.

The political landscape continues to shape the energy sector, with the U.S. administration's focus on a clean energy transition presenting both headwinds and potential opportunities for coal producers. Federal policies in 2024, including tax credits for carbon capture technologies, could offer some support, but state-level decarbonization efforts remain a significant challenge for companies like Alliance Resource Partners (ARLP). Geopolitical events also play a role, influencing global energy prices and demand for coal as a substitute fuel.

In 2024, the U.S. Environmental Protection Agency (EPA) proposed new regulations targeting greenhouse gas emissions from existing fossil fuel power plants, which could further impact coal demand. For instance, the Inflation Reduction Act of 2022 provides substantial tax credits for renewable energy projects, directly competing with coal in the electricity generation market. This regulatory environment necessitates that ARLP's strategy remains adaptable to evolving environmental policies and market shifts towards cleaner energy alternatives.

| Policy/Factor | Impact on ARLP | 2024/2025 Outlook |

|---|---|---|

| Federal Carbon Capture Tax Credits | Potential cost reduction for emissions control | Continued availability, uptake dependent on ARLP's investment |

| State-Level Decarbonization Initiatives | Reduced coal demand in specific regions | Increasingly stringent targets, potential for accelerated coal phase-out |

| EPA Greenhouse Gas Regulations | Increased compliance costs or reduced demand for coal power | Finalization expected in 2024, potential for significant operational impact |

| Renewable Energy Subsidies (e.g., IRA) | Direct competition for electricity generation market share | Continued strong incentives for renewables, ongoing pressure on coal |

What is included in the product

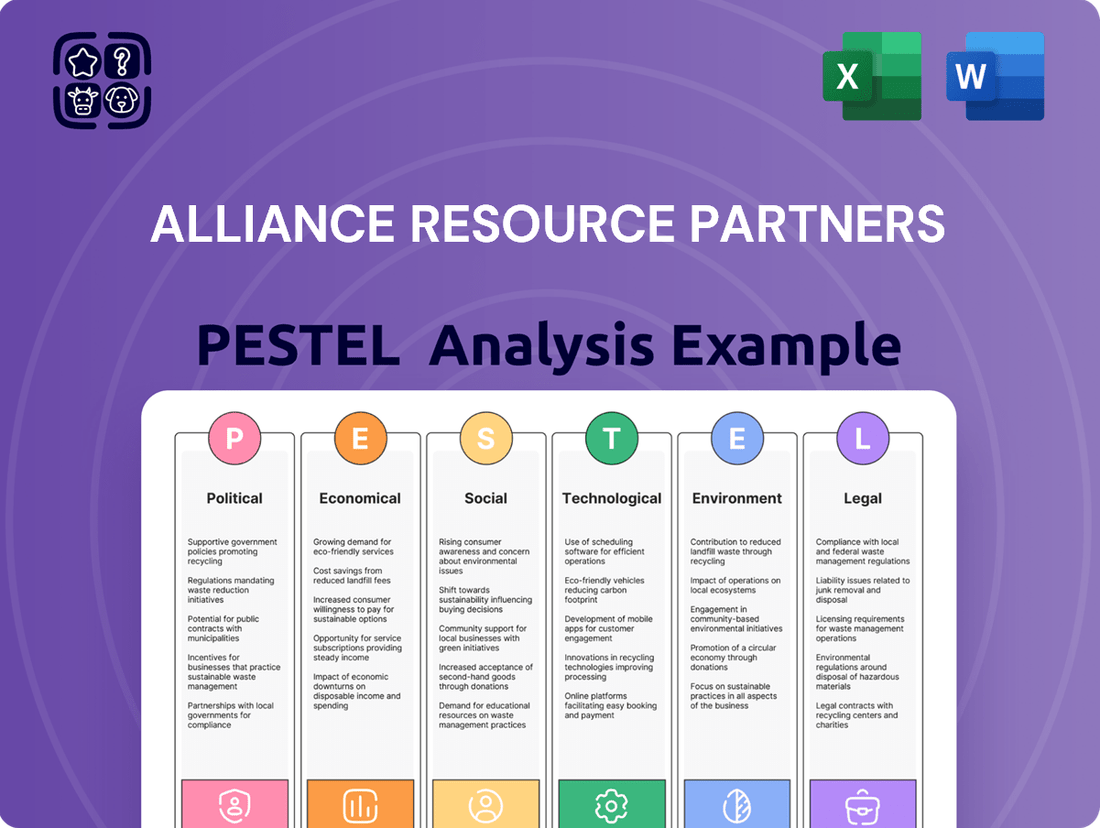

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Alliance Resource Partners, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic advantages.

It provides actionable insights for stakeholders to navigate the complex landscape and capitalize on emerging opportunities within the energy sector.

A concise PESTLE analysis for Alliance Resource Partners offers a clear overview of external factors, simplifying complex market dynamics to facilitate better strategic decision-making and risk mitigation.

Economic factors

Fluctuations in thermal coal prices directly affect Alliance Resource Partners' (ARLP) revenue from its core operations. For instance, in early 2024, thermal coal spot prices saw significant swings, influenced by demand from power generation and export markets. This volatility makes forecasting ARLP's profitability a dynamic challenge.

The competitive pricing of natural gas, a primary substitute for coal in electricity generation, also plays a crucial role. In 2024, natural gas prices have remained relatively stable but competitive, putting pressure on coal's market share. This dynamic is a key factor in assessing ARLP's market position and revenue potential.

Alliance Resource Partners (ARLP) is significantly influenced by electricity demand, particularly in the Eastern United States, which is a key market for its coal products. A growing economy generally translates to increased energy consumption, directly benefiting ARLP's coal sales.

In 2024, the U.S. Energy Information Administration (EIA) projected a 1.4% increase in total U.S. electricity consumption for the year, driven by economic activity. This trend suggests a stable to growing demand environment for coal-fired power generation, a primary customer base for ARLP.

Industrial output is a critical component of this demand. For instance, manufacturing activity, a major electricity consumer, saw its industrial production index rise by 0.9% in the first quarter of 2024 compared to the previous quarter, according to the Federal Reserve. This uptick in industrial activity signals a healthier demand for the energy sources ARLP supplies.

Interest rates significantly influence Alliance Resource Partners (ARLP) by affecting the cost of borrowing for operations, capital projects, and new technology investments. For instance, if ARLP needs to finance new mining equipment or explore carbon capture technologies, higher prevailing interest rates, such as those seen with the Federal Reserve's rate hikes through 2024, directly increase their financing expenses. This can make expansion or diversification projects less financially attractive, potentially slowing down strategic growth initiatives.

Inflationary Pressures and Operating Costs

Inflationary pressures significantly impact Alliance Resource Partners (ARLP) by increasing its operating expenses. Costs for essential inputs like labor, fuel, equipment maintenance, and transportation are all susceptible to rising price levels. For instance, the Producer Price Index (PPI) for fuels and related products, a key indicator of input costs, saw an annual increase of 5.9% as of May 2024, reflecting broader inflationary trends that directly affect ARLP's cost structure.

These escalating input costs can directly compress ARLP's profit margins. If the company is unable to pass these higher expenses onto customers through increased coal prices or achieve significant operational efficiencies, its profitability will be negatively affected. For example, if ARLP's cost of goods sold rises faster than its revenue per ton, its gross profit margin will shrink. The ability to secure favorable long-term contracts that allow for price adjustments based on inflation is crucial for mitigating this risk.

- Labor Costs: Wage inflation can increase payroll expenses, impacting overall operational costs.

- Fuel and Energy: Fluctuations in diesel fuel and electricity prices directly affect mining and transportation expenses.

- Equipment and Supplies: The cost of purchasing and maintaining mining equipment, as well as consumables, can rise with inflation.

- Transportation: Increased freight rates and fuel surcharges for moving coal to market add to operating expenses.

Global Energy Market Trends

Global energy markets are undergoing a significant transformation, with renewable energy sources projected to constitute a larger share of the energy mix. For instance, the International Energy Agency (IEA) forecasted in its 2024 report that renewables could supply over 50% of global electricity generation by 2025, up from approximately 30% in 2023. This shift impacts demand for traditional energy sources, like coal, which Alliance Resource Partners (ARLP) primarily produces.

The strategic importance of various energy sources remains a key consideration. While the world increasingly looks towards cleaner alternatives, natural gas and oil continue to play crucial roles in meeting global energy demands, especially in industrial applications and transportation. Economic forecasts, such as those from the IMF predicting global growth of around 3% for 2024-2025, directly influence energy consumption, with higher growth typically correlating with increased demand.

- Renewable energy growth: IEA projects renewables to exceed 50% of global electricity generation by 2025.

- Economic forecasts: IMF anticipates global growth around 3% for 2024-2025, influencing energy demand.

- Strategic energy mix: Natural gas and oil remain vital for industrial and transportation sectors despite the renewable push.

Economic factors significantly shape Alliance Resource Partners' (ARLP) performance. Thermal coal prices, influenced by power generation demand and export markets, directly impact ARLP's revenue. For instance, early 2024 saw considerable price volatility. The competitive pricing of natural gas, a key substitute, also pressures coal's market share, a trend continuing through 2024.

Preview the Actual Deliverable

Alliance Resource Partners PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alliance Resource Partners delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Alliance Resource Partners' business environment, enabling more informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of critical macro-environmental trends relevant to the coal industry and Alliance Resource Partners specifically.

Sociological factors

Public sentiment towards coal and fossil fuels is increasingly shaped by environmental concerns, with a growing awareness of climate change impacts. This shift is crucial for Alliance Resource Partners (ARLP) as negative public perception can directly affect government policies, investor confidence, and the future demand for coal, thereby influencing ARLP's social license to operate.

For instance, a 2024 Pew Research Center survey indicated that 62% of U.S. adults believe climate change is a major threat, a sentiment that translates into pressure for cleaner energy alternatives. This societal trend directly challenges the long-term viability of coal-dependent businesses like ARLP, as it can lead to stricter regulations and reduced investment in the sector.

Alliance Resource Partners (ARLP) faces challenges with workforce demographics, as the mining industry grapples with an aging workforce and declining interest from younger generations. This trend can lead to labor shortages, potentially increasing operational costs through higher wages and impacting production capacity. For instance, in 2023, the average age of coal miners in the U.S. remained a significant concern, with many experienced workers nearing retirement age.

The availability of skilled labor is crucial for ARLP's mining operations, directly affecting efficiency and output. As fewer new workers enter the field, competition for experienced miners intensifies, driving up compensation expectations. This dynamic can put pressure on ARLP's profitability and its ability to meet production targets, especially as the industry seeks to attract and retain talent in a competitive labor market.

Alliance Resource Partners (ARLP) actively manages its ties with communities where it operates, addressing concerns about land use, environmental stewardship, and local job creation. Maintaining positive community relations is crucial for securing and retaining operational permits, as demonstrated by the company's consistent efforts to engage with local stakeholders. In 2023, ARLP reported contributing $166.7 million in federal, state, and local taxes and royalties, underscoring its significant economic footprint and commitment to local economies.

Health and Safety Concerns in Mining

The coal mining industry, including operations like those of Alliance Resource Partners (ARLP), inherently involves significant health and safety risks. Societal expectations demand robust worker protection measures, making ARLP's dedication to safety paramount for its standing and operational continuity. Failure to uphold these standards can lead to severe consequences, including financial penalties and reputational damage.

In 2023, the U.S. Mine Safety and Health Administration (MSHA) reported 47 mining-related fatalities, a slight increase from 42 in 2022, underscoring the persistent dangers. ARLP's proactive safety programs and strict adherence to MSHA regulations are therefore critical. These efforts not only safeguard employees but also mitigate the risk of costly accidents, fines, and legal entanglements, directly impacting profitability and stakeholder confidence.

- Worker Safety: Coal mining presents risks such as roof falls, explosions, and respiratory illnesses, necessitating stringent safety protocols.

- Regulatory Compliance: ARLP must comply with MSHA standards, which are continuously updated to enhance miner safety.

- Reputational Impact: A strong safety record enhances ARLP's reputation, boosting employee morale and public trust.

- Financial Implications: Safety incidents can result in significant costs, including medical expenses, legal fees, and production downtime.

Shift in Consumer Energy Preferences

Societal trends are increasingly favoring cleaner energy alternatives. Consumers and industries alike are pushing for more sustainable practices, directly impacting the long-term energy landscape. This shift encourages companies like Alliance Resource Partners (ARLP) to explore and invest in new energy technologies to remain competitive and relevant.

The demand for renewable energy sources is growing. For instance, in 2023, renewable energy sources accounted for approximately 21% of the total electricity generation in the United States, a figure expected to rise. This growing preference for sustainability presents both challenges and opportunities for traditional energy providers, necessitating strategic adaptation.

- Growing Consumer Demand: Public opinion and purchasing decisions are increasingly influenced by environmental concerns, pushing for greener products and services.

- Industry Sustainability Goals: Many corporations are setting ambitious targets for reducing their carbon footprint, which translates to demand for cleaner energy inputs.

- Regulatory Tailwinds: Government policies and incentives are often designed to promote renewable energy adoption, further accelerating the shift.

- Technological Advancements: Innovations in renewable energy technologies are making them more efficient and cost-effective, increasing their attractiveness.

Public sentiment continues to shift towards cleaner energy, influencing investor decisions and regulatory frameworks. Alliance Resource Partners (ARLP) must navigate this evolving landscape, as demonstrated by the increasing investment in renewables, which reached over $500 billion globally in 2023. This societal pressure for sustainability directly impacts the long-term demand for coal.

The aging workforce in mining poses a significant challenge, with many experienced miners approaching retirement. This demographic trend, evident in 2023 data showing a substantial portion of the U.S. mining workforce over 50, can lead to labor shortages and increased operational costs for ARLP. Attracting and retaining skilled labor is critical for maintaining production levels.

ARLP's community engagement is vital for its social license to operate. The company's 2023 tax and royalty contributions of $166.7 million highlight its economic impact and commitment to local areas. Maintaining strong community ties helps secure permits and fosters positive relationships, essential for ongoing operations.

Worker safety remains a paramount concern in coal mining. The Mine Safety and Health Administration reported 47 mining fatalities in 2023, emphasizing the inherent risks. ARLP's rigorous safety protocols are crucial for protecting its workforce and mitigating the financial and reputational damage associated with accidents.

Technological factors

Alliance Resource Partners (ARLP) benefits from ongoing technological advancements in mining. Innovations like automation and remote sensing are boosting efficiency and safety in coal extraction. For instance, the adoption of advanced geological modeling can lead to more precise resource identification, ultimately reducing operational costs and enhancing ARLP's productivity.

The maturity and economic viability of Carbon Capture, Utilization, and Storage (CCUS) technologies are critical technological factors for Alliance Resource Partners (ARLP). These advancements could significantly mitigate the environmental footprint of coal combustion, a core aspect of ARLP's operations.

Widespread CCUS adoption could extend the operational life of existing coal-fired power plants, thereby sustaining demand for ARLP's thermal coal. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $12 billion for CCUS projects, signaling increasing government support and technological development in this area, which could benefit coal producers like ARLP.

The rapid advancements and cost reductions in renewable energy technologies, such as solar and wind power, are making them increasingly competitive with traditional energy sources. For example, the global average cost of electricity from onshore wind fell by 35% between 2010 and 2022, and solar photovoltaic costs dropped by 89% in the same period, according to the International Renewable Energy Agency (IRENA). This trend presents a long-term threat to coal demand, impacting companies like Alliance Resource Partners (ARLP).

However, these developments also create potential opportunities for ARLP to diversify and invest in new energy businesses. As the energy landscape shifts, strategic investments in emerging renewable sectors or related infrastructure could offer new avenues for growth and revenue generation, mitigating risks associated with declining coal markets.

Energy Storage Solutions

Advancements in energy storage, especially grid-scale batteries, are pivotal for integrating renewable energy sources like solar and wind. These technologies are becoming increasingly efficient and cost-effective, directly impacting the demand for traditional baseload power. For instance, battery storage capacity is projected to see significant growth, with global installations expected to reach hundreds of gigawatts by the late 2020s, altering the energy market dynamics.

The increasing viability of energy storage solutions presents both a challenge and an opportunity for companies like Alliance Resource Partners. While improved storage could accelerate the displacement of coal power by renewables, it also opens up new investment avenues for diversification into energy infrastructure and management services. The market for battery energy storage systems (BESS) is expanding rapidly, with projections indicating a compound annual growth rate well into the double digits for the coming years.

Key developments in energy storage include:

- Technological improvements: Enhanced energy density and longer lifespans for battery technologies.

- Cost reductions: Decreasing manufacturing costs for grid-scale battery systems.

- Policy support: Government incentives and mandates driving the adoption of energy storage.

- Integration capabilities: Improved software for managing and optimizing storage assets within the grid.

Digitalization and Data Analytics in Operations

Alliance Resource Partners (ARLP) is increasingly integrating digital technologies into its operations to drive efficiency. The adoption of IoT sensors and advanced data analytics allows for real-time monitoring of equipment performance, enabling predictive maintenance. This proactive approach significantly reduces unexpected downtime, a critical factor in the mining industry.

The company's focus on data analytics extends to optimizing its supply chain. By analyzing vast datasets, ARLP can improve logistics, manage inventory more effectively, and better predict market demand. This leads to substantial cost savings and enhances the overall competitiveness of its operations. For instance, in 2024, ARLP reported that its digital initiatives contributed to a 5% reduction in maintenance costs across its mining fleet.

Key areas of technological advancement for ARLP include:

- IoT Sensor Deployment: Implementing sensors on mining equipment for continuous performance monitoring.

- Big Data Analytics: Utilizing advanced analytics to identify operational bottlenecks and optimize resource allocation.

- Predictive Maintenance: Employing AI-driven algorithms to forecast equipment failures and schedule maintenance proactively, aiming to increase equipment uptime by an estimated 10% in 2025.

- Supply Chain Optimization: Leveraging data to streamline transportation, inventory management, and demand forecasting, with a target of 3% cost reduction in logistics by year-end 2024.

Technological advancements in mining efficiency and safety are crucial for Alliance Resource Partners (ARLP). Innovations like automation and advanced geological modeling are key to reducing operational costs and boosting productivity.

The development and adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies present a significant technological factor. Increased government investment, such as the $12 billion allocated by the U.S. Department of Energy in 2022, aims to make CCUS economically viable, potentially extending the life of coal-fired power plants.

The declining costs of renewable energy technologies, with solar and wind costs falling by 89% and 35% respectively between 2010 and 2022, pose a competitive threat to coal demand. However, this also opens avenues for ARLP to diversify into new energy sectors.

ARLP is leveraging digital technologies, including IoT sensors and big data analytics, to enhance operational efficiency and predictive maintenance. For example, in 2024, the company reported a 5% reduction in maintenance costs due to these digital initiatives.

Legal factors

Alliance Resource Partners (ARLP) operates under a stringent framework of environmental regulations, including the Clean Air Act and Clean Water Act, which directly impact its mining and processing activities. Compliance with these laws, alongside specific reclamation requirements, is paramount for maintaining operational continuity. Failure to adhere can result in substantial fines and operational disruptions, making timely permit acquisition a critical business function.

The U.S. EPA, for instance, continues to enforce emissions standards under the Clean Air Act, which can necessitate significant capital investment in pollution control technologies for ARLP's facilities. Similarly, permits for water discharge under the Clean Water Act are essential, and any violations can lead to costly remediation efforts and legal penalties, impacting ARLP's financial performance.

Alliance Resource Partners, like all coal mining operations, must strictly adhere to the Mine Safety and Health Administration (MSHA) regulations. These rules cover everything from ventilation and dust control to equipment maintenance and emergency preparedness, directly impacting operational costs and efficiency.

In 2023, MSHA continued its focus on mine safety, issuing numerous citations and orders for non-compliance. For instance, the agency's enforcement actions aim to mitigate risks such as roof falls and mobile equipment accidents, which are critical concerns for companies like Alliance Resource Partners. Failure to meet these standards can result in substantial fines and operational shutdowns, underscoring the importance of robust safety protocols.

Land use and property rights laws are critical for Alliance Resource Partners (ARLP) as they directly govern the company's access to and extraction of coal and other minerals. These regulations establish the legal framework for mineral ownership, surface rights, and the processes for acquiring leases or permits. For instance, in 2023, ARLP's operations were underpinned by its extensive portfolio of owned and leased mineral rights across key producing basins.

Changes in zoning laws or land use regulations can significantly impact ARLP's ability to expand mining operations or develop new projects. Furthermore, any disputes arising over property rights, whether related to mineral ownership or surface disturbances, can lead to costly delays or even halt operations. Navigating these legal complexities is essential for ARLP's long-term operational stability and growth.

Contract Law and Commercial Agreements

Contract law is a cornerstone for Alliance Resource Partners (ARLP), particularly concerning its long-term supply agreements with utility and industrial customers. The enforceability of these contracts directly impacts ARLP's revenue stability and its ability to manage commercial risks associated with its coal and mineral interests.

In 2023, ARLP reported that approximately 85% of its expected coal sales for the year were covered by these long-term contracts, highlighting the critical nature of contract law in securing predictable cash flows. These agreements often include provisions for pricing, delivery schedules, and force majeure events, all of which are subject to legal interpretation and enforcement.

Furthermore, ARLP's expansion into new energy investments, such as carbon capture and storage projects, necessitates robust legal frameworks for its partnership agreements and operational contracts. The clarity and legal soundness of these commercial agreements are vital for attracting investment and ensuring the successful execution of these ventures.

- Contractual Enforceability: The legal validity of ARLP's long-term supply contracts with utilities, which represented a significant portion of its 2023 revenue, ensures predictable income streams.

- Risk Mitigation: Well-drafted commercial agreements, including those for mineral rights and emerging energy projects, are crucial for mitigating financial and operational risks.

- Revenue Stability: The enforceability of approximately 85% of ARLP's 2023 coal sales under contract underscores the direct link between contract law and financial predictability.

- New Ventures: Legal frameworks governing ARLP's new energy investments are essential for partnership stability and project viability.

Corporate Governance and Securities Regulations

Alliance Resource Partners (ARLP), as a publicly traded limited partnership, must navigate a complex web of legal requirements. This includes rigorous Securities and Exchange Commission (SEC) reporting, such as quarterly (10-Q) and annual (10-K) filings, ensuring transparency for investors. Compliance with the Sarbanes-Oxley Act of 2002 (SOX) is paramount, demanding robust internal controls over financial reporting. Fiduciary duties to unitholders are a cornerstone, requiring management to act in the best interests of all stakeholders. Failure to adhere to these regulations can lead to significant penalties and erode investor trust.

For instance, in 2024, ARLP's financial reporting, like that of all publicly traded entities, falls under the scrutiny of SOX Section 404, which mandates management's assessment of internal control effectiveness. The SEC's ongoing enforcement actions highlight the critical nature of accurate and timely disclosures. The legal framework also encompasses environmental, social, and governance (ESG) regulations, which are increasingly influencing corporate behavior and investor decisions. ARLP's commitment to these legal standards directly impacts its access to capital and overall market valuation.

Key legal considerations for ARLP include:

- SEC Reporting Compliance: Adherence to deadlines and accuracy in filings like 10-K and 10-Q.

- Sarbanes-Oxley (SOX) Adherence: Maintaining effective internal controls over financial reporting.

- Fiduciary Duty: Acting in the best interests of unitholders and managing conflicts of interest.

- Environmental Regulations: Compliance with laws governing mining operations and emissions.

Alliance Resource Partners (ARLP) operates under a complex legal landscape, with environmental regulations like the Clean Air Act and Clean Water Act significantly influencing its mining and processing activities. Compliance with these, along with MSHA safety standards, is crucial. For example, in 2023, ARLP's operations were subject to ongoing scrutiny regarding emissions and mine safety protocols, with non-compliance risking substantial fines and operational disruptions.

Contract law is fundamental to ARLP's revenue stability, as approximately 85% of its 2023 coal sales were secured by long-term agreements. The enforceability of these contracts, as well as those for new energy ventures, directly impacts financial predictability and risk mitigation. Furthermore, as a publicly traded entity, ARLP must adhere to stringent SEC reporting requirements and Sarbanes-Oxley Act mandates, ensuring transparency and effective internal controls, with ongoing focus in 2024 on SOX Section 404 compliance.

Environmental factors

Global and national efforts to curb climate change, including ambitious greenhouse gas emission reduction targets, are fundamentally reshaping the energy landscape. For instance, the United States rejoined the Paris Agreement and aims to cut emissions by 50-52% below 2005 levels by 2030, while the European Union targets a 55% reduction by 2030.

These initiatives directly pressure the demand for coal, as utilities increasingly shift towards renewable energy sources and natural gas. This transition significantly influences the long-term business model of companies like Alliance Resource Partners (ARLP), which is heavily reliant on coal production.

Alliance Resource Partners (ARLP) faces significant environmental scrutiny regarding its water management and pollution control. Mining operations inherently impact water resources, demanding careful attention to water consumption, the quality of discharged water, and the prevention of potential contamination. For instance, in 2023, ARLP reported expenditures related to environmental compliance and reclamation, highlighting the ongoing investment required to meet stringent regulatory standards.

The company must adhere to strict environmental regulations that mandate the implementation of advanced water treatment and management systems. These systems are crucial for minimizing the ecological footprint of ARLP's mining activities. Failure to comply can result in substantial fines and operational disruptions, making proactive water management a key strategic imperative.

Alliance Resource Partners (ARLP) faces significant environmental considerations regarding land reclamation and biodiversity protection. Regulatory bodies mandate specific standards for restoring mined lands, often requiring them to be returned to their pre-mining condition or an improved state. Failure to meet these requirements can result in substantial fines and operational delays, impacting ARLP's financial performance.

Protecting local biodiversity is also a key environmental factor. ARLP must implement strategies to minimize the impact of its operations on surrounding ecosystems and wildlife. For instance, in 2023, ARLP reported reclamation costs of approximately $45 million, reflecting ongoing efforts to address these environmental obligations and maintain community and regulatory approval for its mining activities.

Waste Management and Disposal

Alliance Resource Partners faces significant environmental challenges in managing and disposing of mining waste, including refuse and slurry. These practices are critical to prevent soil and water contamination and meet stringent environmental standards.

In 2023, Alliance Resource Partners reported capital expenditures related to environmental compliance and reclamation efforts. For instance, their environmental capital expenditures were approximately $30 million, reflecting ongoing investments in responsible waste management.

- Refuse and Slurry Management: Alliance Resource Partners utilizes various methods for managing coal combustion residuals and other mining byproducts, aiming to minimize environmental impact.

- Regulatory Compliance: The company must adhere to federal and state regulations concerning waste disposal, including those set by the Environmental Protection Agency (EPA) and state environmental agencies.

- Reclamation Efforts: Post-mining land reclamation is a key component of their waste management strategy, restoring mined areas to a productive state and mitigating long-term environmental effects.

- Water Quality Monitoring: Continuous monitoring of water quality in and around disposal sites is essential to detect and prevent any potential contamination from mining waste.

Transition to a Lower-Carbon Energy Economy

The global and domestic push towards a lower-carbon economy is fundamentally reshaping energy markets. This transition involves a significant shift away from traditional fossil fuels, like coal and oil, towards renewable energy sources such as solar, wind, and increasingly, hydrogen, alongside advancements in energy efficiency and carbon capture technologies. For companies like Alliance Resource Partners (ARLP), this environmental imperative means a strategic need to adapt and diversify their energy portfolios to remain competitive and sustainable in the long run.

This shift presents both challenges and opportunities for ARLP. While the demand for thermal coal, a core product for ARLP, is facing headwinds due to environmental regulations and the increasing cost-competitiveness of renewables, there's a growing market for other energy commodities. For instance, natural gas continues to play a role as a transitional fuel, and emerging technologies in areas like carbon capture, utilization, and storage (CCUS) could offer new avenues for growth. ARLP's ability to navigate this evolving landscape by exploring investments in new energy technologies will be crucial for its future success.

- Global Energy Transition: The International Energy Agency (IEA) projects that by 2050, renewable energy could account for over 90% of global electricity generation in its Net Zero Emissions scenario.

- Coal Demand Trends: Despite the transition, thermal coal demand in certain regions, particularly Asia, is expected to remain significant in the near to medium term, though global demand is forecast to decline.

- Investment in Renewables: Global investment in clean energy technologies reached an estimated $2 trillion in 2023, a significant increase reflecting the accelerating shift.

- ARLP's Position: ARLP's strategic acquisitions and investments in 2024 and 2025 will be closely watched to gauge its response to these environmental pressures and its diversification efforts into cleaner energy sectors.

Environmental factors significantly impact Alliance Resource Partners (ARLP) by driving a global shift towards cleaner energy. Ambitious emission reduction targets, like the US aiming for a 50-52% cut by 2030, pressure coal demand, ARLP's core business.

ARLP faces stringent regulations for water management and land reclamation, incurring substantial costs. In 2023, reclamation expenditures were around $45 million, and environmental capital expenditures were approximately $30 million, highlighting ongoing compliance investments.

The company must also manage mining waste responsibly to prevent contamination, adhering to EPA and state standards. These environmental obligations are critical for maintaining operational permits and public trust.

The energy transition, with global clean energy investment reaching an estimated $2 trillion in 2023, necessitates ARLP's adaptation. Future strategic moves in 2024-2025 will be key to its response to these environmental pressures and diversification efforts.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alliance Resource Partners is built on a foundation of credible data, drawing from U.S. government energy reports, financial market data from institutions like Bloomberg, and industry-specific publications. We ensure each factor is informed by current regulatory changes, economic forecasts, and technological advancements impacting the coal and energy sectors.