Alliance Resource Partners Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Resource Partners Bundle

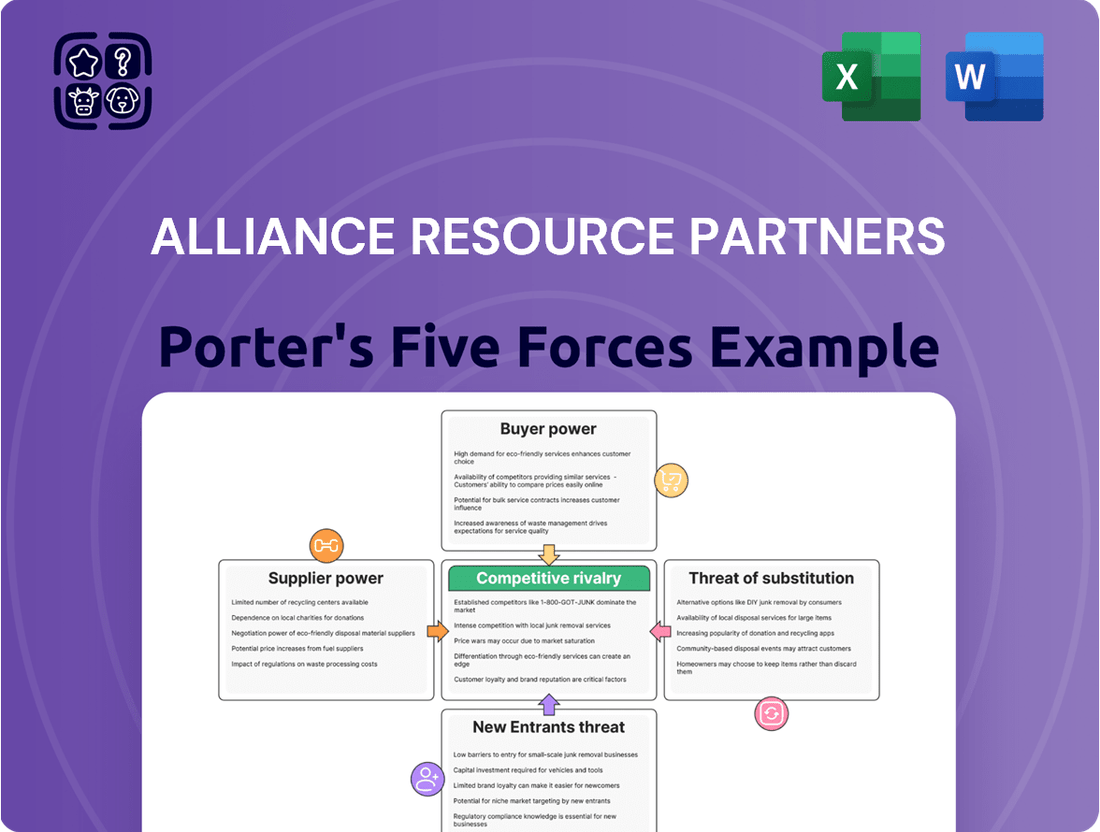

Alliance Resource Partners operates in a dynamic industry where buyer power and the threat of substitutes significantly influence profitability. Understanding these forces is crucial for any stakeholder looking to navigate the competitive landscape effectively.

The complete report reveals the real forces shaping Alliance Resource Partners’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for specialized mining equipment, skilled labor, and crucial transportation services significantly influences Alliance Resource Partners' (ARLP) operational costs. A limited number of providers for essential inputs grants these suppliers greater leverage, potentially driving up expenses for ARLP.

This dynamic is especially pronounced when considering unique, high-value machinery or access to critical rail and barge networks essential for coal distribution. For instance, in 2024, the ongoing demand for advanced longwall mining systems, often supplied by a handful of global manufacturers, means ARLP faces concentrated supplier power in this segment.

Alliance Resource Partners (ARLP) faces supplier power influenced by switching costs. If ARLP were to change its coal suppliers, it could incur significant expenses related to retooling mining equipment or retraining its workforce on new operational technologies. These potential costs make it challenging and expensive for ARLP to shift away from established suppliers, thus strengthening the suppliers' negotiating position.

The availability of substitute inputs significantly influences the bargaining power of suppliers for Alliance Resource Partners (ARLP). If ARLP relies heavily on specific types of mining equipment or specialized chemicals for its operations, and few alternatives exist, the suppliers of these critical inputs hold considerable sway. For instance, if a particular type of longwall shearer is essential for ARLP's high-efficiency production, and only a handful of manufacturers produce it, those manufacturers can command higher prices and dictate terms. This is particularly relevant in 2024, as supply chain disruptions continue to impact the availability of specialized industrial components.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into coal production, thereby directly competing with Alliance Resource Partners (ARLP), generally increases their bargaining power. This scenario is less common in the capital-intensive coal mining industry, where significant investment is required for extraction and distribution.

However, specialized service providers, such as those offering advanced mining technology or unique logistical solutions, might pose a credible threat. If these providers were to develop capabilities to directly offer coal or related services, they could leverage this to negotiate more favorable terms with ARLP.

- Forward Integration Threat: Suppliers integrating into coal production or directly competing with ARLP enhances their bargaining power.

- Capital Intensity Barrier: The high capital requirements of coal mining typically limit this threat for most suppliers.

- Specialized Service Providers: A potential threat may arise from specialized service providers who could develop direct coal offerings.

- Impact on Negotiation: Successful forward integration by suppliers would allow them to dictate terms more effectively with ARLP.

Labor Union Strength

The strength of labor unions in the coal mining sector, especially for skilled workers, directly affects Alliance Resource Partners' (ARLP) expenses and operational agility. Unionized workers often secure higher wages and more comprehensive benefits, which can increase ARLP's labor costs.

Labor disputes or strikes can halt production, giving the workforce considerable leverage. For instance, in 2023, the United Mine Workers of America (UMWA) continued to represent a significant portion of the U.S. coal mining workforce, advocating for improved safety and compensation.

- Unionized Workforce: A substantial segment of skilled miners in the U.S. coal industry are represented by unions like the UMWA.

- Wage and Benefit Pressures: Collective bargaining agreements often lead to higher labor costs compared to non-unionized operations.

- Potential for Disruptions: Strikes or work stoppages can severely impact production schedules and increase operational expenses for companies like ARLP.

Alliance Resource Partners (ARLP) faces moderate bargaining power from its suppliers. The concentration of suppliers for specialized mining equipment and transportation services, coupled with high switching costs for ARLP, grants these suppliers leverage. While the threat of forward integration by suppliers is generally low due to capital intensity, specialized service providers could pose a risk. The presence of strong labor unions also contributes to supplier power through wage and benefit negotiations.

In 2024, the demand for advanced mining technology, often sourced from a limited number of global manufacturers, means ARLP must contend with concentrated supplier power in this critical area. For example, the cost of acquiring and maintaining state-of-the-art longwall mining systems can be substantial, giving the few available suppliers significant pricing influence.

The bargaining power of suppliers is also influenced by the availability of substitutes for essential inputs. If ARLP relies on specific chemicals or specialized components with few alternatives, the suppliers of these items hold considerable sway. This situation can lead to increased operational costs if suppliers can dictate terms due to limited competition for their products.

| Supplier Factor | Impact on ARLP | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Moderate to High | Key for specialized equipment and logistics. |

| Switching Costs | High | Retooling and retraining add significant expense. |

| Substitute Availability | Low to Moderate | Limited alternatives for specialized inputs increase supplier leverage. |

| Forward Integration Threat | Low (General Suppliers) / Moderate (Specialized Services) | Capital intensity limits most suppliers; service providers may pose a risk. |

| Labor Union Strength | Moderate | UMWA's influence on wages and benefits affects labor costs. |

What is included in the product

This analysis dissects the competitive forces impacting Alliance Resource Partners, detailing buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the coal industry.

Instantly understand competitive pressures with a clear, actionable breakdown of Alliance Resource Partners' five forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Alliance Resource Partners (ARLP) primarily serves utility and industrial customers. The concentration of these customers is a key factor in their bargaining power. If a few major buyers represent a substantial percentage of ARLP's total sales, they can exert significant influence.

This influence translates into demands for lower prices or more advantageous contract conditions. For instance, if the top five customers accounted for over 60% of ARLP's revenue in 2023, their ability to negotiate better terms would directly impact ARLP's profitability and revenue streams.

The bargaining power of customers is influenced by the costs they incur when switching from Alliance Resource Partners' (ARLP) coal to another supplier. For industrial users and utilities, these switching costs can be substantial, impacting their leverage.

Factors like existing long-term contracts, the need for compatibility with specialized infrastructure, and complex transportation logistics all contribute to these switching costs. These elements make it less appealing for customers to change suppliers, even if prices fluctuate.

ARLP has strategically secured a significant portion of its future sales through committed and priced contracts. This indicates a degree of customer loyalty and reduces the immediate threat of customer defection, thereby mitigating their bargaining power.

Customer price sensitivity is a significant factor for Alliance Resource Partners, especially given the regulatory environment utilities operate within, which often mandates keeping electricity costs down. This sensitivity is amplified when alternative fuels, such as natural gas, present a more economically viable option based on prevailing market prices, directly impacting the demand for coal.

Threat of Backward Integration by Customers

The threat of customers, particularly utilities and industrial users, integrating backward into coal mining is generally low. This is primarily due to the substantial capital outlays and the specialized operational knowledge needed for coal extraction.

However, significant customers might consider investing in or acquiring smaller mining entities. Such a move would lessen their dependence on existing coal suppliers like Alliance Resource Partners (ARLP). This particular threat is considered limited for ARLP's primary customer segments.

- High Capital Investment: Establishing and operating a coal mine requires billions of dollars in upfront investment.

- Specialized Expertise: Coal mining demands specific geological, engineering, and safety knowledge.

- Potential for Consolidation: Large consumers could acquire smaller, struggling mines to secure supply.

- Limited Impact on ARLP: The core customer base for ARLP faces significant barriers to backward integration.

Customer Information Availability

When customers have readily available information about coal pricing and market trends, their ability to negotiate with Alliance Resource Partners (ARLP) significantly strengthens. This transparency enables them to benchmark ARLP's offerings against competitors, driving down prices.

The proliferation of market data and forecasts, particularly in 2024, has equipped buyers with the insights needed to secure more favorable terms. For instance, reports detailing anticipated supply and demand shifts for thermal and metallurgical coal can be leveraged during contract discussions.

- Increased Price Transparency: Customers can easily compare ARLP’s coal prices against industry benchmarks, enhancing their negotiation leverage.

- Access to Market Data: Availability of real-time and historical market data for coal allows customers to identify optimal purchasing windows.

- Impact of Forecasts: Market forecasts, such as those indicating potential shifts in global coal demand in 2024 due to energy transition policies, empower customers to negotiate based on future market conditions.

- Negotiating Power: Informed customers are better positioned to demand better pricing, contract flexibility, and service levels from ARLP.

Alliance Resource Partners' (ARLP) customers, primarily utilities and industrial users, possess moderate bargaining power. This is due to factors like price sensitivity, especially with alternative fuel costs, and the increasing availability of market data that enhances their negotiation stance. While switching costs are high, limiting immediate defection, customers can leverage market transparency to secure better terms.

| Factor | ARLP Customer Bargaining Power | Impact on ARLP |

|---|---|---|

| Customer Concentration | Moderate to High (if top customers represent significant revenue share) | Potential for price pressure and demand for favorable contract terms. |

| Switching Costs | High (due to infrastructure and logistics) | Reduces immediate threat of customer loss, providing some stability. |

| Price Sensitivity | High (especially utilities facing regulatory pressure) | Increases vulnerability to price competition from alternative fuels. |

| Information Availability | High (increasing in 2024) | Empowers customers to negotiate more effectively, potentially lowering prices. |

Preview the Actual Deliverable

Alliance Resource Partners Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis of Alliance Resource Partners details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the coal industry. This in-depth report is ready for your immediate use.

Rivalry Among Competitors

Alliance Resource Partners (ARLP) operates in a US coal market, especially the eastern regions, populated by significant competitors. Key players such as Contura Energy, CONSOL Energy, Arch Resources, and Peabody Energy are well-established. This concentration of sizable producers intensifies the competitive rivalry.

The coal industry's growth rate is a major driver of competitive rivalry. While global coal demand hit a record high in 2024 and is projected to stay strong through 2025, the US market faces a different reality. This is because natural gas and renewable energy sources are increasingly displacing coal.

This shift creates a contracting market in the United States, which naturally intensifies the competition among existing coal producers like Alliance Resource Partners. Companies fight harder for their share of a shrinking pie, leading to more aggressive pricing and strategic maneuvering.

Coal is often viewed as a commodity, meaning that for many uses, the differences in quality between suppliers are minimal. However, specific types of coal, like those used for electricity generation versus those for steelmaking, along with their energy output and impurity levels, can create some differentiation.

Alliance Resource Partners (ARLP) operates in this environment, with its primary focus on coal production in the eastern United States. While coal itself has limited differentiation, ARLP's strategy includes diversifying into oil and gas royalties and exploring new energy technologies. These moves are designed to set them apart and reduce their reliance on the often-unpredictable coal market.

Exit Barriers

High exit barriers in the coal industry, such as Alliance Resource Partners' substantial investments in mining operations and equipment, can trap companies even when profits are slim. For instance, in 2023, the U.S. coal industry continued to face significant capital expenditures, with companies needing to maintain extensive infrastructure. These barriers mean firms may continue to operate, contributing to oversupply and intensifying competition.

Long-term contractual obligations and the considerable costs associated with environmental reclamation further cement these exit barriers. Companies like Alliance Resource Partners must account for these future liabilities, making it financially prohibitive to cease operations abruptly. These ongoing commitments can force companies to remain in the market, even if current conditions are unfavorable, thus perpetuating competitive pressures.

The persistence of companies due to these high exit barriers can lead to a situation where supply outstrips demand. This dynamic forces all players, including Alliance Resource Partners, to compete more aggressively on price and volume to sustain their operations. For example, in early 2024, reports indicated that some coal producers were operating at reduced margins to secure market share.

Key exit barriers for companies like Alliance Resource Partners include:

- Significant fixed assets: Investments in mines, preparation plants, and transportation infrastructure represent substantial sunk costs.

- Long-term contractual obligations: Commitments to supply coal to power plants and other industrial users can extend for many years.

- Environmental reclamation costs: The requirement to restore mined land to its original or a usable state incurs significant future expenses.

- Specialized workforce: The need for skilled labor in mining operations can make it difficult to downsize or exit quickly.

Cost Structure and Capacity Utilization

The cost structure and capacity utilization within the coal industry significantly shape competitive rivalry. Alliance Resource Partners (ARLP), like its peers, faces pressure from companies that can achieve lower operating costs and higher capacity utilization.

Companies with efficient operations and high production levels can offer more aggressive pricing, intensifying competition for less efficient producers. For instance, ARLP's focus on improving its coal production costs is a direct response to this dynamic, aiming to maintain a competitive edge.

- Operational Efficiency: ARLP's commitment to reducing per-ton mining costs is crucial. In 2024, the company has been actively managing its operational expenditures to remain competitive.

- Capacity Utilization: Maximizing the use of its mining assets allows ARLP to spread fixed costs over a larger volume, leading to lower per-unit costs. This directly impacts its ability to compete on price.

- Price Pressure: Rivals with lower cost bases and higher utilization rates can exert significant price pressure, forcing other producers to either match those prices or risk losing market share.

Alliance Resource Partners (ARLP) competes in a concentrated US coal market with major players like Contura Energy and Peabody Energy, intensifying rivalry. Despite a strong global demand outlook for coal in 2024-2025, the US market is contracting due to natural gas and renewables, forcing producers to fight for market share.

The commodity nature of coal, with limited differentiation beyond specific uses, means price becomes a key competitive factor. High exit barriers, including significant fixed assets and environmental reclamation costs, keep companies like ARLP operating even in challenging conditions, perpetuating oversupply and price pressures.

Operational efficiency and capacity utilization are critical. Companies achieving lower costs and higher output, like ARLP's focus on cost reduction in 2024, can offer more competitive pricing, directly impacting market share.

| Key Competitors | Primary Focus | 2023 Estimated Revenue (USD Billions) |

| Contura Energy | Metallurgical and thermal coal | ~3.0 |

| CONSOL Energy | Thermal coal and natural gas | ~1.5 |

| Arch Resources | Metallurgical coal | ~2.5 |

| Peabody Energy | Metallurgical and thermal coal | ~5.0 |

SSubstitutes Threaten

The price-performance of alternative energy sources, especially natural gas and renewables like solar and wind, presents a substantial threat to coal. For instance, in 2023, natural gas prices saw volatility, influencing utility companies' fuel choices for power generation, with lower gas prices often favoring gas over coal.

Renewable energy technologies are becoming increasingly cost-competitive. By the end of 2023, global renewable energy capacity additions were projected to reach nearly 500 gigawatts, a significant increase that directly displaces coal-fired power generation in many markets.

Utilities and industrial customers are increasingly willing to explore alternatives to coal, driven by a confluence of economic pressures, stricter environmental mandates, and a growing corporate commitment to sustainability. This shift is notably influenced by the fluctuating costs of coal compared to natural gas and renewable energy sources.

The global push towards decarbonization, amplified by government incentives for cleaner energy technologies, significantly accelerates this customer propensity to substitute. For instance, in 2024, many nations continued to offer substantial tax credits and grants for renewable energy projects, making the economic case for switching away from coal more compelling than ever.

Technological advancements are making renewable energy sources increasingly competitive with traditional fossil fuels. For instance, solar panel efficiency has seen continuous improvement, with some commercially available panels now exceeding 22% efficiency, and ongoing research pushing this even higher. This makes solar power a more viable substitute for coal-fired power plants.

The cost of renewable energy, particularly solar and wind, has also dropped dramatically. In 2023, the global weighted average cost of electricity from new utility-scale solar PV projects was around $0.048 per kilowatt-hour, making it one of the cheapest sources of new electricity generation in many regions. This cost reduction directly challenges coal's position.

Innovations in battery storage technology are also crucial. Improved battery energy density and reduced costs mean that intermittent renewable sources like wind and solar can provide more reliable power, directly substituting for the consistent baseload power historically provided by coal. For example, lithium-ion battery costs have fallen by over 90% in the last decade.

Regulatory and Environmental Pressures

Stricter environmental regulations, especially those targeting carbon emissions from coal-fired power plants, significantly increase the threat of substitutes for Alliance Resource Partners (ARLP). These regulations make coal less competitive by imposing additional costs on its usage and incentivizing the adoption of cleaner energy alternatives.

Government policies actively promoting renewable energy sources like solar and wind power, along with mandates for cleaner fuel mixes, directly encourage customers to move away from coal. For instance, by mid-2024, many regions are seeing increased investment in renewable energy infrastructure, directly impacting coal demand.

- Increased regulatory costs: Environmental compliance measures can raise operational expenses for coal producers.

- Shift to cleaner energy: Government incentives and mandates favor renewables and natural gas over coal.

- Customer demand for sustainability: End-users are increasingly prioritizing environmentally friendly energy sources.

- Technological advancements: Improvements in renewable energy technology continue to drive down costs, making them more attractive substitutes.

Energy Storage and Grid Modernization

Advancements in energy storage, like improved battery technology, and the ongoing modernization of electricity grids are making renewable energy sources such as solar and wind more dependable. This increased reliability directly challenges the role of coal as a consistent, baseload power provider. For instance, by mid-2024, grid-scale battery storage capacity in the US was projected to reach over 15 gigawatts, a significant jump from previous years, illustrating this trend.

As these substitute technologies mature and become more cost-effective, they directly reduce the demand for traditional fuels like coal. This shift is particularly impactful for companies like Alliance Resource Partners, whose primary business is coal production. The decreasing cost of renewables, coupled with enhanced storage solutions, presents a growing threat by offering viable alternatives for electricity generation.

- Growing Battery Storage Capacity: Grid-scale battery storage in the US is expected to exceed 15 GW by mid-2024, significantly boosting renewable energy reliability.

- Renewable Energy Cost Reduction: The levelized cost of electricity from solar and wind has fallen dramatically, making them increasingly competitive with fossil fuels.

- Grid Modernization Initiatives: Investments in smart grid technologies improve the integration and stability of intermittent renewable sources.

The threat of substitutes for Alliance Resource Partners is significant, primarily driven by the increasing competitiveness of alternative energy sources like natural gas and renewables. These substitutes are becoming more economically viable due to falling costs and technological advancements, directly impacting coal's market share.

By mid-2024, the cost-effectiveness of solar and wind power, coupled with advancements in energy storage, is making them increasingly attractive alternatives for electricity generation, directly challenging coal's role.

Government policies and environmental regulations further bolster the adoption of these cleaner substitutes, creating a challenging landscape for coal producers.

| Substitute Energy Source | Key Driver | 2023/2024 Data Point |

|---|---|---|

| Natural Gas | Price Volatility & Availability | Utility fuel choices influenced by gas prices in 2023. |

| Solar Power | Cost Reduction & Efficiency | Global weighted average cost of solar PV around $0.048/kWh in 2023; panel efficiency exceeding 22%. |

| Wind Power | Cost Reduction & Grid Integration | Renewable capacity additions projected near 500 GW globally in 2023. |

| Battery Storage | Reliability Enhancement | US grid-scale battery storage capacity projected to exceed 15 GW by mid-2024. |

Entrants Threaten

The coal mining industry, including operations like those of Alliance Resource Partners, demands immense upfront capital. Think about acquiring land, purchasing specialized heavy machinery, building essential infrastructure like processing plants and transportation links, and navigating complex environmental and safety regulations. These costs can easily run into hundreds of millions, even billions, of dollars.

For example, establishing a new surface mine can cost upwards of $100 million, while underground mines can require investments exceeding $500 million. This significant financial hurdle deters many potential competitors from even considering entering the market, thereby protecting existing players like Alliance Resource Partners.

New entrants into the coal industry, particularly those looking to supply utilities and industrial customers, face significant hurdles in securing access to essential distribution channels. Established companies like Alliance Resource Partners (ARLP) have cultivated long-term relationships and logistical networks, making it difficult for newcomers to gain a foothold. These established channels are critical for reliable and cost-effective delivery, often involving dedicated rail lines, barge terminals, and sophisticated supply chain management.

Building these vital distribution networks from scratch requires substantial capital investment and time, presenting a formidable barrier to entry. For instance, securing long-term transportation contracts with railroads or barge operators can be challenging without a proven track record and consistent volume commitments, which new entrants lack. In 2024, the ongoing consolidation within the rail industry and the continued importance of efficient waterborne transport for bulk commodities underscore the strategic advantage held by players with established logistical capabilities.

Existing coal producers, such as Alliance Resource Partners (ARLP), leverage significant economies of scale in their mining, procurement, and transportation operations. This allows them to spread fixed costs over a larger output, leading to lower per-unit production costs. For instance, in 2023, ARLP reported total coal sales of 35.6 million tons, a volume that facilitates substantial purchasing power and optimized logistics.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the established infrastructure and massive operational volume, they would struggle to achieve comparable per-ton production costs. This inherent disadvantage makes it difficult for new companies to compete on price with established players who benefit from years of investment in scale.

Government Policy and Regulations

The coal mining sector is heavily regulated, with stringent environmental permits, safety standards, and land reclamation obligations acting as substantial barriers for potential new companies. These regulatory complexities, coupled with the possibility of policy changes favoring alternative energy sources, can significantly discourage new investment in the industry.

For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations such as the Clean Air Act and the Clean Water Act, which require extensive permitting and compliance for mining operations. Non-compliance can lead to substantial fines, further increasing the cost of entry and ongoing operations.

- Environmental Permits: Obtaining necessary permits for air emissions, water discharge, and waste management can be a lengthy and costly process, often taking years.

- Safety Standards: Compliance with Mine Safety and Health Administration (MSHA) regulations demands significant investment in training, equipment, and safety protocols.

- Land Reclamation: Post-mining land reclamation requirements, mandated by federal and state laws, necessitate substantial financial reserves and long-term planning.

- Policy Uncertainty: Evolving climate policies and potential carbon taxes create uncertainty, making long-term capital investment in coal mining a riskier proposition for new entrants.

Brand Loyalty and Established Relationships

While coal is largely a commodity, Alliance Resource Partners (ARLP) benefits from deep-seated relationships and a reputation for reliability with major utility and industrial clients. These established ties create a significant barrier for new entrants, who would need to invest heavily in building trust and demonstrating consistent supply and quality to chip away at ARLP's market position. For instance, ARLP's robust contracting activity, securing sales for a substantial portion of its projected 2024 and 2025 production, underscores the strength of these enduring customer partnerships.

New competitors face the challenge of displacing these entrenched relationships, which are often built on years of dependable service and tailored solutions. Overcoming this inertia requires not just competitive pricing but also a proven track record, which new market entrants are unlikely to possess initially.

- Established Customer Base: ARLP's long-standing relationships with major utilities and industrial consumers are a key deterrent.

- Perceived Reliability: Customers often prioritize consistent supply and quality, favoring established, trusted providers.

- Contracting Strength: ARLP's significant forward contract commitments for 2024 and beyond highlight the stickiness of its customer base.

- Barriers to Entry: New entrants must overcome the costs and time associated with building comparable trust and demonstrating operational excellence.

The threat of new entrants for Alliance Resource Partners (ARLP) is significantly mitigated by the immense capital required to establish coal mining operations. The substantial costs associated with land acquisition, heavy machinery, infrastructure development, and regulatory compliance, often running into hundreds of millions of dollars, act as a powerful deterrent. For example, establishing a new surface mine can cost over $100 million, while underground mines can exceed $500 million, creating a formidable financial barrier for potential competitors in 2024.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alliance Resource Partners is built upon a robust foundation of data, including their latest SEC filings, annual reports, and investor presentations. We also incorporate insights from industry-specific market research reports and trade publications to capture the nuances of the coal mining sector.