Alliance Resource Partners Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliance Resource Partners Bundle

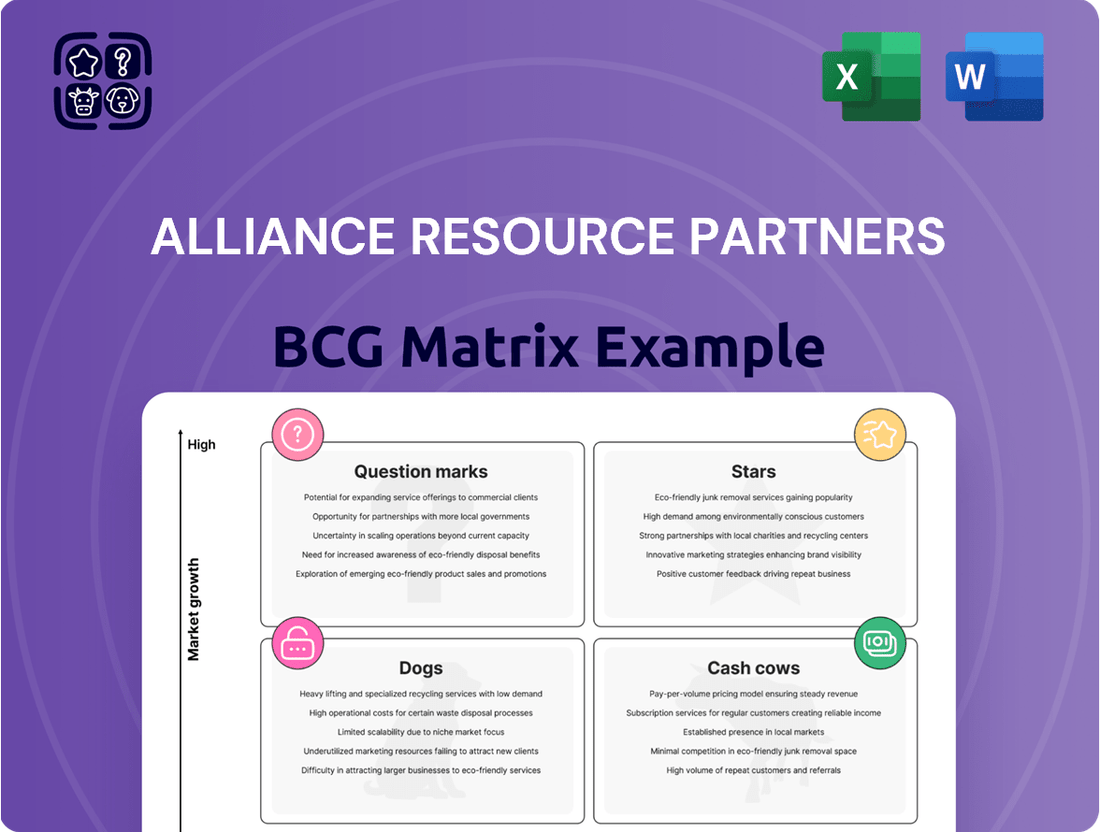

Uncover the strategic positioning of Alliance Resource Partners with our comprehensive BCG Matrix analysis. See which of their ventures are market leaders and which require careful consideration for future investment. This preview offers a glimpse into their portfolio's potential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Alliance Resource Partners' Illinois Basin coal operations, notably the Hamilton and River View mines, are performing exceptionally well. These mines achieved record monthly shipping volumes in June 2025, underscoring their operational efficiency and market demand. This segment holds a significant market share in Eastern U.S. coal production, with year-over-year sales volume increases reflecting robust demand.

The company's confidence in this segment is further evidenced by an upward revision of its Illinois Basin volume guidance for the entirety of 2025. This strategic increase in guidance suggests a positive outlook and continued growth expectations for these key operations, positioning them as a strong contributor to Alliance Resource Partners' overall portfolio.

Alliance Resource Partners (ARLP) is experiencing robust growth in its oil and gas royalty volumes. In the second quarter of 2025, these volumes saw a healthy 7.7% increase compared to the same period in the previous year. This upward trend is further supported by management's decision to raise the full-year 2025 guidance for barrels of oil equivalent (BOE) volumes by roughly 5%, indicating a strong outlook for organic expansion.

The company's strategic focus on expanding its oil and gas segment is also evident through its acquisition activities. In 2024, ARLP completed several key acquisitions within the oil and gas sector, reinforcing its commitment to growing this crucial part of its business and enhancing its royalty volume base.

Alliance Resource Partners (ARLP) boasts a strong foundation through its secured long-term coal contracts, a key strength in its BCG Matrix positioning. The company has committed and priced a substantial 17.4 million tons for delivery between 2025 and 2029, with an aggregate of 35.1 million tons secured over the next four and a half years. This impressive order book, with 97% of 2025 sales already committed and priced, signals robust customer confidence and provides a predictable revenue stream for ARLP.

Strategic Investments in Energy Transition Technologies

Alliance Resource Partners (ARLP) is making strategic moves into the energy transition space, reflecting a forward-looking approach to portfolio diversification. These investments are designed to tap into high-growth potential markets beyond their core coal operations.

ARLP’s commitment to new energy technologies is evident through its investments in companies like Ascend Elements, which focuses on sustainable battery materials, and Infinitum, a developer of efficient electric motors. Additionally, their subsidiary, Matrix Design Group, contributes mining technology expertise, further broadening their operational scope.

These ventures, though in their nascent stages, represent significant opportunities for future growth and could become substantial revenue streams if they achieve their projected market penetration. For instance, the global battery materials market is projected to reach hundreds of billions of dollars by the end of the decade, offering substantial upside.

- Ascend Elements: Focus on sustainable battery materials, a rapidly expanding market driven by electric vehicle adoption.

- Infinitum: Investing in efficient electric motor technology, crucial for electrification across various industries.

- Matrix Design Group: Enhancing mining technology, potentially improving efficiency and safety in resource extraction.

- Diversification Strategy: Aiming to reduce reliance on traditional fossil fuels and capture emerging market opportunities.

Strong Domestic Coal Market Fundamentals

The domestic coal market, especially in the Eastern U.S., is showing positive signs. This is largely due to rising electricity needs from data centers and the return of manufacturing to the U.S.

Higher natural gas prices and a more favorable regulatory environment are also contributing. These factors highlight coal's importance for grid stability and are slowing down the closure of coal-fired power plants.

Alliance Resource Partners (ARLP), as the second-largest coal producer in the Eastern U.S., is strategically positioned to benefit from these developments. In 2024, U.S. coal consumption for electricity generation was projected to be around 460 million short tons, a notable increase from previous years.

- Increased Demand: Data centers and reshoring efforts are driving higher electricity consumption, boosting demand for coal.

- Favorable Pricing: Higher natural gas prices make coal more competitive for power generation.

- Regulatory Support: A more constructive regulatory landscape is helping to maintain coal's role in the energy mix.

- ARLP's Position: As a major Eastern U.S. producer, ARLP is well-placed to capture market share in this strengthening environment.

Alliance Resource Partners' (ARLP) Illinois Basin coal operations, particularly the Hamilton and River View mines, are performing exceptionally well, demonstrating strong market demand and operational efficiency. These mines achieved record monthly shipping volumes in June 2025, and ARLP has upwardly revised its Illinois Basin volume guidance for 2025, signaling continued growth expectations.

The company’s oil and gas royalty volumes also saw a healthy 7.7% increase in Q2 2025 year-over-year, with a 5% upward revision to full-year 2025 BOE volume guidance. Strategic acquisitions in the oil and gas sector during 2024 further bolster this segment's growth.

ARLP's diversification into energy transition technologies, including investments in Ascend Elements and Infinitum, positions it for future growth in high-potential markets like battery materials and electric motors.

The domestic coal market, especially in the Eastern U.S., is experiencing a resurgence driven by increased electricity demand from data centers and manufacturing reshoring, coupled with higher natural gas prices and a more favorable regulatory environment. ARLP, as the second-largest coal producer in the Eastern U.S., is well-positioned to capitalize on this strengthening market, with 97% of its 2025 sales already committed and priced.

| Segment | Performance/Outlook | Key Data/Facts (as of mid-2025) |

|---|---|---|

| Illinois Basin Coal | Star (Strong Growth) | Record monthly shipping volumes (June 2025); Upwardly revised 2025 volume guidance. |

| Oil & Gas Royalties | Star (Strong Growth) | 7.7% YoY volume increase (Q2 2025); 5% upward revision to 2025 BOE guidance; 2024 acquisitions. |

| Energy Transition | Question Mark (Developing) | Investments in Ascend Elements, Infinitum; Potential for significant future revenue. |

| Domestic Coal Market | Star (Strong Demand) | Driven by data centers, reshoring, higher natural gas prices; 97% of 2025 sales committed. |

What is included in the product

Highlights which units to invest in, hold, or divest for Alliance Resource Partners.

A clear BCG Matrix visualizes Alliance Resource Partners' portfolio, easing the pain of understanding strategic positioning.

Cash Cows

Alliance Resource Partners (ARLP) holds a significant position as the second-largest coal producer in the Eastern U.S., a business segment that functions as a classic cash cow. This segment primarily serves utilities and industrial users, a market characterized by its maturity and ARLP's substantial market share. The consistent demand from these sectors fuels substantial and reliable cash flow for the partnership.

The operational efficiency and diligent cost reduction efforts within ARLP's coal segment are key drivers of its robust profit margins. For instance, in the first quarter of 2024, ARLP reported total coal revenue of $464.7 million, with a significant portion stemming from its Eastern operations. This segment’s ability to generate strong, predictable earnings underscores its cash cow status within the BCG matrix.

Alliance Resource Partners' established coal royalty income segment is a prime example of a cash cow within their business. The company benefits from substantial royalty payments derived from its vast mineral interests, particularly coal, situated in key production areas. This stream of income is remarkably stable and comes with minimal operational expenses, a hallmark of a mature and profitable business unit.

In 2023, Alliance Resource Partners reported significant royalty income, demonstrating the segment's consistent revenue generation. For instance, their coal royalty segment generated approximately $741 million in revenue for the full year 2023, a testament to its enduring strength and the strategic value of their mineral assets.

Alliance Resource Partners (ARLP) leverages its existing transportation infrastructure, notably its Ohio River coal loading terminal, as a significant cash cow. This terminal is crucial for efficiently moving its coal production to market, directly supporting its marketing efforts and generating consistent cash flow.

In 2023, ARLP's transportation segment generated $175.2 million in revenue, a testament to the reliable income stream provided by this asset. The terminal’s operational efficiency directly translates into a steady cash flow, reinforcing its position as a strong performer within ARLP's portfolio.

Further strategic investments in this infrastructure, such as upgrades or capacity expansions, hold the potential to enhance operational efficiency even more, thereby increasing overall cash flow generation from this established asset.

Disciplined Capital Allocation and Shareholder Returns

Alliance Resource Partners (ARLP) demonstrates disciplined capital allocation, a key trait of a cash cow. The company has a history of returning capital to its unitholders through consistent cash distributions.

For instance, in 2024, ARLP declared a quarterly cash distribution of $0.50 per unit, reflecting its commitment to shareholder returns. This focus on providing substantial returns, coupled with a robust balance sheet, underscores its cash cow status.

- Disciplined Financial Management: ARLP consistently prioritizes prudent financial practices.

- Shareholder Returns: The company actively returns capital to unitholders through distributions.

- Consistent Dividends: ARLP has a track record of maintaining regular cash distributions.

- Strong Balance Sheet: A solid financial foundation supports its cash cow strategy.

Diversified Customer Base with Long-Standing Relationships

Alliance Resource Partners (ARLP) benefits from a diversified customer base, primarily consisting of major domestic and international utilities and industrial users. These relationships are not new; they are long-standing, which is a significant advantage.

These established relationships are the bedrock of ARLP's stable demand for its coal products. This stability translates directly into consistent sales volumes and reliable cash generation, key characteristics of a cash cow.

The company's success in securing multi-year contracts for substantial volumes further solidifies this stability. For instance, as of its first quarter 2024 earnings report, ARLP had secured sales commitments for approximately 37.5 million tons for 2024 and 27.3 million tons for 2025, demonstrating the forward visibility and dependable revenue streams.

- Diversified Clientele: ARLP serves a broad range of utilities and industrial clients, reducing reliance on any single customer.

- Long-Term Contracts: The company's ability to secure multi-year contracts provides predictable revenue streams and cash flow.

- Stable Demand: Established relationships foster consistent demand for ARLP's coal, ensuring steady sales volumes.

Alliance Resource Partners' coal segment, particularly its Eastern operations, functions as a quintessential cash cow. This segment benefits from a mature market with consistent demand from utilities and industrial users, supported by ARLP's substantial market share.

The segment's operational efficiency and cost management contribute to strong profit margins, evident in its first quarter 2024 coal revenue of $464.7 million. This consistent generation of predictable earnings solidifies its cash cow status within ARLP's portfolio.

ARLP's coal royalty income segment is another prime example of a cash cow, generating stable revenue with minimal operational costs. In 2023, this segment alone brought in approximately $741 million in revenue, highlighting the enduring strength of its mineral assets.

The company's transportation infrastructure, such as its Ohio River coal loading terminal, also acts as a cash cow, generating consistent cash flow through efficient coal movement. This segment reported $175.2 million in revenue in 2023, underscoring its reliable income stream.

| Segment | 2023 Revenue | Key Characteristic |

| Coal (Eastern Operations) | Significant portion of total coal revenue ($464.7M Q1 2024) | Mature market, consistent demand, operational efficiency |

| Coal Royalties | $741 million | Stable income, minimal operational expenses |

| Transportation | $175.2 million | Efficient logistics, reliable income stream |

Preview = Final Product

Alliance Resource Partners BCG Matrix

The Alliance Resource Partners BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks or placeholder content, just the comprehensive, analysis-ready BCG Matrix report ready for your strategic decision-making. You can be confident that the insights and formatting displayed here are precisely what will be delivered to you, enabling immediate application in your business planning and competitive analysis.

Dogs

Alliance Resource Partners' (ARLP) Appalachia coal operations, specifically Tunnel Ridge and MC Mining, are positioned as question marks in their BCG matrix. These segments have seen production dip and fewer tons sold recently, indicating potential market weakness or internal operational hurdles.

Operational difficulties and increased per-ton costs have weighed on the financial performance of these mines. For instance, ARLP revised its 2025 Appalachia volume forecast downward, reflecting these ongoing challenges and a significant customer default at MC Mining.

Alliance Resource Partners (ARLP) experienced a $25.0 million non-cash impairment loss in Q2 2025 related to a preferred equity investment in a battery materials company. This situation highlights an investment in a sector with strong growth potential that has not yet delivered expected returns and might be draining resources without a clear profitability roadmap.

Such underperforming assets, if they lack demonstrable future upside, can be categorized as 'Dogs' within a diversified investment portfolio. This classification suggests that these investments are not contributing positively to overall performance and may require divestment or restructuring.

Alliance Resource Partners (ARLP) is experiencing a shift as higher-priced legacy coal contracts, secured during the 2022 energy crisis, are rolling off. This natural contract expiration is leading to a decrease in the average coal sales price per ton for ARLP. For instance, in the first quarter of 2024, ARLP reported an average coal sales price of $48.75 per ton, down from $51.14 per ton in the first quarter of 2023, reflecting this contract repricing.

While ARLP is proactively negotiating and securing new contracts, the immediate impact of transitioning from these exceptionally profitable older agreements to potentially lower-priced new ones can temporarily dampen revenue and overall profitability. This segment, characterized by declining revenue per ton, could be viewed as a 'Dog' within the BCG matrix if cost management doesn't offset the price pressure.

Segments with Persistent Lower Sales Prices

Certain coal sales segments, particularly within the Illinois Basin, have seen lower domestic price realizations in recent quarters. Despite increases in sales volumes, these reduced prices, without corresponding cost efficiencies, can negatively impact profitability. For instance, Alliance Resource Partners (ARLP) reported in their 2024 first-quarter earnings that their Illinois Basin segment experienced a decrease in average sales price per ton compared to the previous year, even as production volumes rose. This persistent pressure on sales prices, if not offset by operational improvements or a market turnaround, places these specific sales channels in a position that mirrors the characteristics of a 'Dog' in a BCG Matrix.

This situation highlights a challenge where increased activity doesn't translate into proportional financial gains. The continued downward trend in pricing, even with higher volumes, can erode margins.

- Illinois Basin Price Pressure: Lower domestic price realizations in specific coal sales segments, notably in the Illinois Basin.

- Volume vs. Price Disconnect: Increased sales volumes have not been matched by corresponding price increases, impacting overall profitability.

- Profitability Concerns: Persistent declines in sales prices without significant cost reductions can diminish profit margins for these segments.

Investments with Unclear or Limited Strategic Alignment

Investments with unclear or limited strategic alignment within Alliance Resource Partners (ARLP) could be categorized as 'Dogs' in a BCG Matrix analysis. These are ventures that don't clearly fit with ARLP's core competencies in coal production or its broader diversification strategy, and importantly, are not yielding substantial returns or demonstrating promising future growth. While specific examples beyond the previously disclosed impairment related to battery materials are not publicly detailed, a consistent portfolio evaluation is crucial for identifying and divesting these underperforming assets.

The impairment of approximately $146 million in battery materials during the fourth quarter of 2023 serves as a concrete example of an investment that did not meet expectations and likely falls into this 'Dog' category. This write-down signals a recognition that the strategic alignment and financial performance of this venture were not as anticipated. Such assets can tie up capital and management attention that could be better deployed in areas with stronger strategic fit and higher growth potential.

- Impairment Impact: The $146 million impairment in battery materials highlights the financial consequences of investments lacking strategic alignment or failing to deliver expected returns.

- Portfolio Review Necessity: Continuous assessment of ARLP's investment portfolio is vital to identify and address underperforming assets that do not contribute to core competencies or diversification goals.

- Capital Reallocation: Divesting from 'Dog' investments frees up resources that can be strategically reinvested into higher-potential opportunities, thereby enhancing overall portfolio performance.

- Strategic Focus: Maintaining a clear strategic direction ensures that all investments, whether in traditional or emerging sectors, are aligned with ARLP's long-term objectives and competitive advantages.

Alliance Resource Partners' (ARLP) Illinois Basin coal segment, experiencing lower domestic price realizations despite volume increases, exemplifies a 'Dog' in the BCG matrix. For instance, in Q1 2024, ARLP's average coal sales price in the Illinois Basin decreased year-over-year, impacting profitability. Similarly, the company's $146 million impairment in battery materials in Q4 2023 signifies an investment that failed to meet expectations and is a clear 'Dog'.

| Segment/Investment | BCG Category | Key Performance Indicator | 2024 Data Point |

| Illinois Basin Coal Sales | Dog | Average Sales Price per Ton | Decreased year-over-year in Q1 2024 |

| Battery Materials Investment | Dog | Financial Performance | $146 million impairment in Q4 2023 |

Question Marks

Alliance Resource Partners (ARLP) has ventured into bitcoin mining, utilizing surplus electricity from its coal operations. This move positions their crypto-mining activities as a question mark within the BCG matrix, reflecting its status as a new, high-growth but inherently volatile market. While the value of their Bitcoin holdings has shown appreciation, the long-term impact on revenue generation is still uncertain.

Alliance Resource Partners (ARLP) is actively exploring new energy technologies beyond its core operations. These ventures, while currently holding a small market share, represent significant growth potential. ARLP's strategy involves substantial investment and focused marketing to drive adoption and establish leadership in these nascent sectors.

For example, ARLP's 2024 investments in emerging clean energy solutions aim to diversify its portfolio. While specific financial figures for these early-stage projects are often proprietary, the company's overall capital expenditure for growth initiatives in 2024 was reported to be in the hundreds of millions of dollars, with a portion earmarked for these innovative areas.

The success of these new energy technology investments hinges on future market acceptance and ARLP's capacity to scale operations effectively. These are long-term plays, requiring patience and strategic execution to navigate the competitive landscape and secure a strong market position.

Alliance Resource Partners (ARLP) is strategically eyeing the burgeoning data center market, recognizing the significant surge in electricity demand fueled by artificial intelligence and cloud computing advancements. This presents a compelling opportunity for coal to serve as a crucial baseload energy source in this rapidly expanding sector.

While ARLP's precise market share and long-term impact within this nascent data center energy landscape are still taking shape, the company has already made a tangible commitment. A notable $25 million investment has been directed towards a coal-fired power plant, with explicit considerations for potential data center energy supply agreements.

Specific Geographic Expansions or New Market Entries

Alliance Resource Partners (ARLP), if it were to embark on significant geographic expansion into new coal or oil and gas producing regions where its current market presence is minimal, would classify these ventures as question marks within a BCG Matrix framework. Similarly, venturing into entirely new energy markets or diversifying into different product lines would also fall under this category, demanding considerable capital outlay to build market share and brand recognition.

ARLP's stated diversification strategy suggests a forward-looking approach that could encompass such new market entries. For instance, if ARLP were to explore opportunities in emerging energy storage solutions or expand its footprint into international energy markets with established production but limited ARLP involvement, these would represent question mark initiatives.

- Geographic Expansion: Targeting regions with substantial untapped coal reserves or active oil and gas exploration where ARLP currently has little to no operational presence.

- New Market Entry: Diversifying into adjacent or entirely new energy sectors, such as renewable energy infrastructure development or specialized industrial gas production.

- Investment Requirement: These ventures typically necessitate significant upfront capital for exploration, infrastructure development, regulatory compliance, and market penetration.

- Strategic Rationale: Such moves align with a broader strategy to reduce reliance on specific commodity cycles and capture growth in evolving energy landscapes.

Advanced Carbon Capture and Storage Technologies

Alliance Resource Partners (ARLP) might consider advanced Carbon Capture and Storage (CCS) technologies as a potential 'Question Mark' in their BCG Matrix. This sector is experiencing significant growth, fueled by increasing environmental regulations and a global push towards decarbonization.

While ARLP's current direct involvement in developing or commercializing advanced CCS isn't a primary focus, any future strategic investment in this area would place it in the Question Mark category. The technology is still maturing, and the path to widespread market adoption and profitability remains uncertain.

The CCS market is projected for substantial expansion. For instance, the International Energy Agency (IEA) has highlighted the critical role of CCS in achieving net-zero emissions, with projections suggesting a significant increase in operational capacity by 2030 and beyond. This growth potential, coupled with the inherent technological and market risks, defines its Question Mark status for ARLP.

- Market Growth Potential: The global CCS market is anticipated to grow significantly, driven by climate targets.

- Technological Evolution: Advanced CCS technologies are still under development, presenting both opportunities and uncertainties.

- Investment Requirements: Establishing a competitive presence in CCS necessitates substantial capital investment.

- Market Adoption Risk: The pace and scale of market adoption for CCS solutions remain a key variable.

Alliance Resource Partners' (ARLP) foray into bitcoin mining, leveraging surplus electricity from coal operations, places this venture as a Question Mark. This sector is characterized by high growth potential but also significant volatility, making its long-term revenue impact uncertain, despite recent appreciation in Bitcoin holdings.

ARLP's investments in emerging clean energy technologies also fall into the Question Mark category. While these initiatives, such as their 2024 capital expenditures in innovative areas, represent substantial growth potential, they require significant investment and face market acceptance risks, with specific project financials often being proprietary.

The company's strategic interest in the data center market, fueled by AI and cloud computing demand, positions it as a Question Mark. ARLP's $25 million investment in a coal-fired power plant with data center supply considerations highlights this nascent but potentially lucrative area, where market share is still developing.

Venturing into new geographic regions for coal or oil and gas, or entering entirely new energy markets like energy storage or international expansion, would also be considered Question Marks. These require considerable capital outlay for infrastructure, regulatory compliance, and market penetration to build share and brand recognition.

BCG Matrix Data Sources

Our Alliance Resource Partners BCG Matrix leverages a blend of internal financial disclosures, industry growth projections, and competitor market share data to accurately position each business segment.