Aris Water PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aris Water Bundle

Navigate the complex external forces shaping Aris Water's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements directly impact their operations and market position. Equip yourself with the strategic foresight needed to capitalize on opportunities and mitigate risks. Download the full PESTLE analysis now for actionable intelligence that drives informed decision-making.

Political factors

Governments are tightening their grip on water management, especially concerning the energy industry. This means stricter rules on how water is used, what can be discharged, and the necessity of recycling. For Aris Water Solutions, this translates directly into operational compliance needs and, importantly, a greater demand for their eco-friendly services.

These evolving regulations, like lower limits on disposing of produced water or requirements to boost recycling efforts, can really shape Aris Water's entire business approach and its potential for expansion. For instance, in 2024, several US states saw proposed legislation aimed at increasing water recycling rates in oil and gas operations, directly impacting companies like Aris Water.

Political support for the oil and gas industry directly impacts Aris Water Solutions, as its clients are primarily in this sector. Policies favoring domestic energy production, such as those seen in the 2024 US energy strategy, can boost investment in extraction, thereby increasing demand for Aris Water's services.

Conversely, shifts towards renewable energy, evidenced by the Biden administration's continued focus on clean energy initiatives and potential carbon pricing mechanisms in 2025, could temper growth in fossil fuel extraction. This would likely affect the scale of operations for Aris Water's core customer base.

Government incentives for fossil fuel extraction, like tax credits for certain types of drilling or infrastructure development, can directly translate into greater demand for water management and recycling solutions. For instance, in 2024, several states offered incentives for enhanced oil recovery, a process heavily reliant on water management.

Government initiatives, such as the Inflation Reduction Act of 2022, offer substantial tax credits for clean energy and sustainable infrastructure projects. These credits, potentially covering a significant portion of capital expenditures for water recycling and conservation technologies, directly enhance the financial viability of Aris Water Solutions' offerings for its clients.

The political landscape increasingly favors fiscal policies that incentivize the adoption of green technologies. For instance, state-level programs in Texas, where Aris Water operates, often provide grants and low-interest loans specifically for water infrastructure improvements and water reuse projects, making closed-loop systems more accessible and cost-effective.

These financial incentives not only lower the upfront investment for Aris Water's customers but also improve the overall return on investment for sustainable water management. This political support makes Aris's advanced water treatment and recycling solutions a more compelling and competitive choice in the market.

Trade Policies and Global Energy Markets

International trade policies, including tariffs and sanctions, directly impact global energy prices and market stability. For Aris Water Solutions, which supports the energy sector, shifts in these policies can alter its clients' production levels and, consequently, their water management requirements. For instance, the US imposition of tariffs on certain imported goods in 2023, while not directly energy-focused, illustrates how trade disputes can ripple through global supply chains, potentially affecting energy commodity prices.

Geopolitical tensions, such as those in Eastern Europe, have demonstrated the vulnerability of global energy markets. The ongoing conflict and related sanctions have led to significant price volatility for oil and natural gas throughout 2023 and into 2024. This volatility directly influences the operational budgets and investment decisions of energy producers, which in turn affects the demand for Aris Water Solutions' services.

- Trade Agreements: The continuation or renegotiation of trade agreements, like the USMCA, can create more predictable energy markets, encouraging long-term infrastructure investment.

- Tariff Impact: Tariffs on energy-related equipment or materials can increase project costs for exploration and production companies, potentially slowing down activity and water management needs.

- Geopolitical Risk Premium: Elevated geopolitical risk in major energy-producing regions can add a premium to energy prices, influencing exploration and production decisions.

Geopolitical Stability in Operating Regions

Geopolitical stability in the regions where Aris Water Solutions operates is a critical consideration. Political unrest or conflicts can directly impact energy production, a key driver for water management services in the oil and gas sector. For instance, in 2024, ongoing geopolitical tensions in certain energy-producing regions could lead to supply chain disruptions and project delays, indirectly affecting demand for Aris Water's services.

Shifts in government policies or the emergence of new regulatory frameworks due to political instability can create an uncertain operating environment. This uncertainty can deter the long-term capital investments necessary for significant infrastructure development, including water treatment and recycling facilities. For Aris Water Solutions, this translates to potential impacts on business continuity and future growth prospects.

- Impact on Energy Production: Geopolitical instability can disrupt oil and gas operations, a primary client base for Aris Water, potentially reducing demand for their services.

- Infrastructure Investment Deterrence: Political uncertainty discourages long-term capital allocation for essential water infrastructure projects.

- Operational Risk: Operating in politically volatile areas increases the risk of supply chain interruptions and operational disruptions for Aris Water.

Government policies significantly shape the demand for Aris Water Solutions' services, with stricter environmental regulations driving the need for advanced water treatment and recycling. For example, proposed legislation in several US states during 2024 aimed to increase water recycling in oil and gas operations, directly benefiting companies like Aris Water.

Political support for domestic energy production, as seen in US energy strategies throughout 2024, bolsters investment in extraction and, consequently, boosts demand for water management solutions. Conversely, a political pivot towards renewable energy, a trend likely to continue into 2025, could temper fossil fuel extraction and impact Aris Water's client base.

Financial incentives and tax credits, such as those under the Inflation Reduction Act of 2022, make sustainable water management technologies more economically attractive. State-level programs in Texas, for instance, offer grants for water reuse projects, directly lowering the cost of closed-loop systems for Aris Water's customers.

Geopolitical stability and international trade policies also play a crucial role. Tensions and sanctions in energy-producing regions in 2023-2024 led to price volatility, influencing energy producers' operational budgets and their demand for water services. Trade agreements can foster market predictability, encouraging infrastructure investment.

What is included in the product

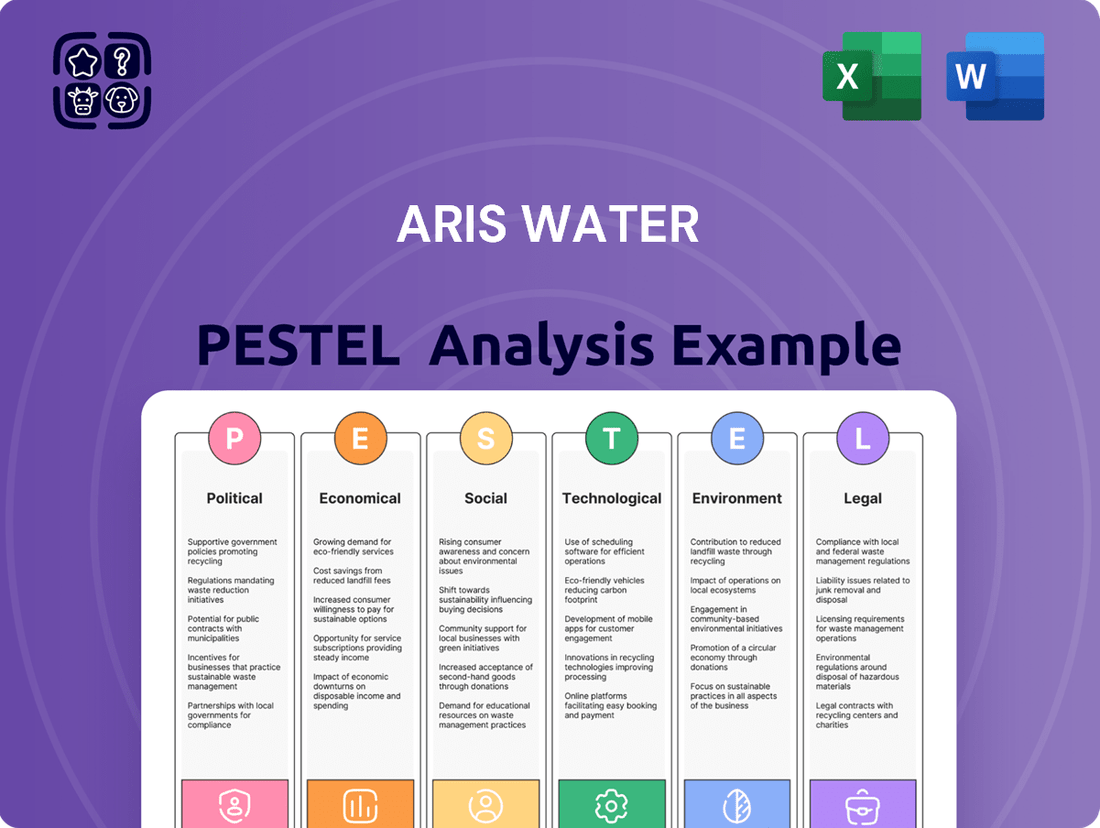

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces influencing Aris Water's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends, potential threats, and emerging opportunities within Aris Water's operating landscape.

Aris Water's PESTLE analysis provides a clear, actionable framework for understanding external factors, thereby alleviating the pain point of strategic uncertainty and enabling more confident decision-making.

Economic factors

Crude oil and natural gas prices are a critical economic factor for Aris Water Solutions, directly impacting their clients' profitability and capital expenditure. When oil prices, like West Texas Intermediate (WTI), hover around $75-$80 per barrel in early 2024, it generally signals a healthy market for exploration and production, which in turn drives demand for Aris Water's services.

Sustained periods of lower commodity prices, for instance, if WTI were to fall below $60 per barrel, can curtail drilling and production activities. This downturn directly translates to reduced demand for water handling and recycling services, potentially impacting Aris Water's revenue. Conversely, a surge in natural gas prices, perhaps to over $3.00 per million British thermal units (MMBtu), often spurs increased investment in new wells and infrastructure, creating a more favorable environment for Aris Water's business.

Aris Water Solutions' fortunes are closely linked to the capital expenditure (CapEx) decisions of oil and gas exploration and production (E&P) companies. When E&P firms boost their spending on new well development or operational expansions, it directly translates to increased demand for Aris Water's integrated water management services. For instance, in 2023, U.S. oil and gas companies planned to spend around $100 billion on upstream activities, a significant portion of which supports water infrastructure needs.

Conversely, economic slowdowns or periods of market uncertainty often prompt E&P companies to scale back their CapEx. This reduction in spending can directly impact Aris Water's project pipeline and revenue generation. The volatility in oil prices, a key driver of E&P CapEx, means Aris Water must remain adaptable to fluctuating investment cycles within the energy sector.

Inflationary pressures in 2024 and 2025 are directly impacting Aris Water Solutions' operational expenses. For instance, the Producer Price Index (PPI) for construction materials, a key input for infrastructure projects, saw a year-over-year increase of 4.5% in April 2024, signaling higher costs for pipes, concrete, and other essential components. This directly translates to increased outlays for Aris Water's project execution.

Furthermore, the Federal Reserve's monetary policy, which has kept interest rates elevated through much of 2024, presents a dual challenge. Higher borrowing costs for Aris Water itself can impede its ability to finance new developments or acquisitions. Simultaneously, clients undertaking large-scale water infrastructure projects may face increased capital costs, potentially delaying or scaling back their investment plans, thereby affecting Aris Water's project pipeline and revenue growth.

Operational Costs of Water Management

The economic viability of Aris Water Solutions hinges on controlling operational costs in water management. Fluctuations in energy prices, particularly for pumping, directly impact profitability. For instance, rising electricity tariffs in key operational regions can significantly increase expenses.

Chemicals used in water treatment also represent a substantial cost component. The price of coagulants, disinfectants, and other treatment agents can vary based on global supply and demand, affecting Aris Water's cost structure. Labor expenses, including salaries for skilled technicians and operational staff, are another critical factor influencing their margins.

Efficiency in managing these expenditures is paramount for Aris Water to offer competitive pricing. By optimizing energy consumption and streamlining treatment processes, the company can enhance its cost-effectiveness.

- Energy Costs: Increased electricity prices in 2024-2025 directly elevate pumping expenses for water transfer and treatment.

- Chemical Procurement: Volatility in the global chemical market impacts the cost of treatment agents, potentially squeezing margins.

- Labor Expenses: Competitive wages for skilled water treatment operators and maintenance staff are a significant operational outlay.

- Efficiency Gains: Investments in energy-efficient equipment and process optimization are crucial for cost control.

Overall Economic Growth and Industrial Activity

Overall economic growth directly impacts Aris Water Solutions by influencing the energy demand of its clients. A strong economy typically means higher energy consumption and more drilling activity, which is beneficial for Aris Water. For instance, the U.S. economy experienced a GDP growth of 2.5% in 2023, signaling robust industrial activity that would likely support increased oil and gas production.

Conversely, economic downturns can significantly dampen demand for energy services. A contraction in industrial activity leads to reduced drilling and production, directly affecting Aris Water's revenue streams. For example, if a recession were to occur, leading to a projected GDP contraction of 1% in 2025, this would likely translate to lower oilfield service demand.

- Economic Growth Indicator: U.S. real GDP growth was 2.5% in 2023, indicating a healthy economic environment.

- Industrial Activity Impact: Higher industrial output generally correlates with increased demand for oil and gas, benefiting Aris Water's clients.

- Recessionary Impact: Economic contractions can lead to a slowdown in drilling and production, negatively affecting Aris Water's business.

Economic factors like commodity prices and capital expenditure directly influence Aris Water Solutions' demand. For example, West Texas Intermediate (WTI) crude oil prices, which averaged around $77 per barrel in early 2024, signal a generally robust market for exploration, boosting demand for Aris Water's services. Conversely, a sustained drop below $60 per barrel could curtail activity and reduce service needs.

Inflation and interest rates are also key economic considerations. Higher inflation, evidenced by a 4.5% year-over-year increase in construction materials PPI in April 2024, raises Aris Water's operational costs. Elevated interest rates through 2024 increase borrowing costs for the company and its clients, potentially impacting project financing and Aris Water's revenue pipeline.

Overall economic growth directly correlates with energy demand and, consequently, Aris Water's business. The U.S. economy's 2.5% GDP growth in 2023 supported industrial activity and oil production, benefiting Aris Water. A projected 1% GDP contraction in 2025, however, could lead to reduced drilling and negatively impact demand for their services.

| Economic Factor | Indicator/Trend (Early-Mid 2024) | Impact on Aris Water | Data Point |

| Crude Oil Prices (WTI) | Moderate to High | Increased demand for water services | ~$77/barrel (Early 2024 average) |

| Capital Expenditure (E&P) | Significant, driven by price stability | Higher project pipeline | ~$100 billion planned upstream spending (2023) |

| Inflation (PPI - Construction Materials) | Elevated | Increased operational costs | +4.5% YoY (April 2024) |

| Interest Rates | High | Higher borrowing costs, potential project delays | Federal Reserve policy maintained elevated rates |

| GDP Growth (U.S.) | Positive | Supports energy demand and activity | +2.5% (2023) |

Preview Before You Purchase

Aris Water PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aris Water PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate insight into the external forces shaping Aris Water's strategic landscape.

Sociological factors

Public awareness of environmental sustainability, especially concerning water usage and the energy sector's impact, is on the rise. This growing concern fuels the demand for eco-friendly solutions. For instance, a 2024 survey indicated that 78% of consumers consider a company's environmental practices when making purchasing decisions.

Aris Water Solutions is well-positioned to capitalize on this trend. Their closed-loop systems directly address public anxieties about water resources and the energy industry's environmental footprint. This not only bolsters the public image of their energy clients but also strengthens their own operational legitimacy. In 2023, companies with strong ESG (Environmental, Social, and Governance) ratings saw an average stock performance 13% higher than those with weaker ratings.

Beyond client benefits, a positive public perception can significantly attract top talent and investors. Studies in 2024 show that companies prioritizing sustainability are 30% more likely to attract and retain skilled employees. Furthermore, sustainable investment funds experienced a 15% growth in assets under management in the first half of 2024 alone.

Investors and stakeholders are increasingly prioritizing companies with strong Environmental, Social, and Governance (ESG) performance. This trend means businesses that can demonstrate tangible sustainability efforts are more appealing. For instance, by 2024, a significant majority of global investors were integrating ESG factors into their investment decisions, with many actively seeking out companies that align with their sustainability goals.

Aris Water Solutions' services directly address the environmental component of ESG for its energy sector clients. By reducing reliance on freshwater and minimizing water transportation through trucking, Aris Water helps its partners lower their carbon footprint and environmental impact. This focus on sustainability makes Aris Water a favored partner for energy companies aiming to bolster their ESG ratings and attract environmentally conscious capital.

Companies with robust ESG performance are better positioned to attract investment capital and enhance their corporate reputation. In 2024, companies with high ESG scores often saw lower costs of capital and a stronger market valuation compared to their peers with weaker ESG profiles. This societal shift towards valuing sustainability translates into a direct demand for services like those offered by Aris Water.

Aris Water Solutions' success hinges on robust community engagement and securing a social license to operate. Local residents often voice concerns regarding water consumption, potential environmental impacts, and increased truck traffic associated with water infrastructure projects. By proactively addressing these issues through transparent communication and offering solutions that minimize disruption, Aris Water can cultivate favorable community relationships, thereby reducing project opposition and ensuring operational continuity.

Workforce Availability and Specialized Skills

The availability of a skilled workforce, including engineers, technicians, and pipeline operators, is absolutely critical for Aris Water Solutions to manage its complex water infrastructure projects. Demographic shifts, such as an aging workforce and changing educational trends, coupled with intense competition for specialized talent, directly affect Aris Water's ability to recruit and retain the necessary personnel. For instance, the U.S. Bureau of Labor Statistics projected a 4% job growth for water and wastewater treatment plant operators between 2022 and 2032, indicating a competitive landscape for these essential roles.

Aris Water's success hinges on securing specialized human capital. Investing in robust training and development programs is paramount to upskill existing employees and attract new talent. Furthermore, cultivating a positive and supportive work environment is key to ensuring employee retention, especially for roles requiring specific certifications and hands-on experience in water treatment and distribution.

- Workforce Needs: Aris Water requires a consistent supply of skilled engineers, technicians, and operators for its operations.

- Talent Competition: Demographic trends and industry demand create a competitive environment for acquiring specialized water sector talent.

- Investment in People: Training, development, and a positive work culture are essential for securing and retaining the workforce Aris Water needs.

Consumer and Industrial Water Conservation Awareness

Growing societal awareness of water scarcity, extending beyond the energy industry, is fueling a significant push for water conservation and recycling. This heightened consciousness influences consumer behavior and industrial practices alike, creating a favorable environment for water management solutions.

Aris Water Solutions, while focused on the energy sector, benefits from this broader societal value. The increasing acceptance of water-saving technologies and practices reinforces the importance and marketability of Aris Water's offerings, potentially shaping future regulatory landscapes and investment priorities.

- Growing Public Concern: Surveys indicate a significant portion of the population is concerned about water availability. For instance, a 2024 survey by the American Water Works Association found that 75% of Americans are concerned about local water scarcity.

- Industrial Adaptation: Industries are increasingly adopting water-efficient processes. The U.S. Environmental Protection Agency's WaterSense program has helped save billions of gallons of water annually, with industrial users showing a growing commitment to reducing their water footprint.

- Policy Implications: This societal shift can translate into more stringent water regulations and incentives for water conservation, directly impacting companies like Aris Water Solutions.

- Market Reinforcement: The widespread understanding of water's finite nature validates Aris Water's business model and its contribution to sustainable resource management.

Societal expectations regarding corporate responsibility, particularly concerning environmental stewardship and community impact, are increasingly influencing business operations. Aris Water Solutions must navigate public perception and maintain a social license to operate, addressing concerns about water usage and infrastructure development. A 2024 study revealed that 65% of consumers are more likely to support companies demonstrating strong community engagement.

The demand for skilled labor in the water and energy sectors is a critical sociological factor. Aris Water Solutions faces competition for specialized talent, including engineers and technicians, as demographic shifts and evolving educational pathways impact workforce availability. The U.S. Bureau of Labor Statistics projected a 4% job growth for water and wastewater treatment plant operators between 2022 and 2032, highlighting the need for strategic talent acquisition and retention.

Public awareness of water scarcity is a significant driver for Aris Water Solutions' business model. Growing concern over water availability, with 75% of Americans expressing concern about local water scarcity in a 2024 survey, reinforces the market need for efficient water management. This societal trend encourages the adoption of water-saving technologies and practices, directly benefiting companies like Aris Water.

Technological factors

Continuous innovation in water treatment and recycling technologies is crucial for Aris Water Solutions to enhance its service offerings and operational efficiency. For instance, advancements in membrane filtration, such as improved reverse osmosis and nanofiltration, are enabling higher water recovery rates. In 2024, the global water and wastewater treatment market was valued at approximately $650 billion, with a significant portion driven by technological upgrades.

Developments in chemical treatment, including more efficient coagulants and disinfectants, alongside enhanced biological processes like advanced anaerobic digestion, can improve the quality of recycled water. This allows Aris Water to reduce operational costs by minimizing chemical usage and energy consumption. By 2025, the market for advanced water treatment technologies is projected to see robust growth, fueled by increasing demand for sustainable water management solutions.

The reliability and safety of Aris Water Solutions' integrated pipeline infrastructure are critical. Technological advancements are significantly enhancing how this is managed.

Smart sensors, drone inspections, and predictive analytics are key developments in pipeline monitoring. These tools enable proactive maintenance and swift leak detection, bolstering operational integrity. For instance, the adoption of AI-powered predictive maintenance in the energy sector, which Aris Water serves, is projected to reduce unplanned downtime by up to 30% by 2025, according to industry reports.

These sophisticated monitoring systems directly minimize environmental risks, a major concern in water management and energy infrastructure. By ensuring continuous service and preventing potential spills or disruptions, Aris Water can maintain client trust and operational efficiency, aligning with increasing regulatory demands for environmental stewardship.

Aris Water Solutions can leverage advanced data analytics and artificial intelligence to significantly enhance its operational efficiency. By analyzing vast datasets, AI can predict water demand with greater accuracy, allowing for more proactive resource allocation. For instance, AI algorithms can optimize flow rates across the distribution network, minimizing energy consumption and reducing water loss.

These AI-driven insights are crucial for identifying potential system inefficiencies, such as leaks or pressure anomalies, before they escalate. This predictive maintenance capability not only saves costs but also ensures a more reliable water supply. In 2024, companies adopting AI in utility management reported an average of 15% reduction in operational costs related to water loss and energy usage.

Furthermore, AI can refine decision-making processes for water allocation and treatment. By processing real-time data on water quality, source availability, and consumption patterns, Aris Water can implement more cost-effective and environmentally sound water management strategies, ensuring compliance with increasingly stringent regulations.

Automation in Water Infrastructure Operations

Automation is significantly reshaping water infrastructure operations, directly impacting companies like Aris Water Solutions. Increased automation in pumping stations, treatment facilities, and pipeline control systems can boost efficiency and lower labor expenses. For instance, the global smart water management market was valued at approximately USD 16.8 billion in 2023 and is projected to grow substantially, indicating a strong trend towards adopting these technologies. This trend is driven by the need for better resource management and operational cost reduction.

Automated systems enable real-time adjustments and remote monitoring, which are crucial for maintaining consistent service delivery. This allows for quicker responses to any operational issues, ensuring greater reliability for clients. By 2025, it's anticipated that automation in industrial processes, including water treatment, will see a significant uptick in adoption rates, with many facilities aiming to integrate AI and IoT solutions to optimize their operations.

- Enhanced Operational Efficiency: Automation streamlines processes in pumping, treatment, and pipeline control.

- Reduced Labor Costs: Automating routine tasks can lead to significant savings on staffing.

- Improved Safety: Remote monitoring and control minimize human exposure to potentially hazardous environments.

- Real-time Adjustments: Automated systems allow for immediate responses to changing conditions, optimizing performance.

Innovation in Materials for Corrosion Resistance and Durability

Innovation in materials science is a significant technological factor impacting Aris Water Solutions. The longevity and maintenance expenses of water infrastructure are directly tied to the materials employed. For instance, advancements in corrosion-resistant alloys and advanced polymer composites are leading to extended lifespans for pipelines and treatment facilities.

These material improvements translate to tangible economic benefits for Aris Water. By reducing the frequency of repairs and replacements, the company can lower its long-term capital expenditures. This enhanced durability of their infrastructure, particularly in closed-loop systems where water is repeatedly treated and reused, directly bolsters economic viability and operational efficiency.

- Extended Infrastructure Lifespan: New composite pipes can offer 50+ year lifespans compared to traditional metal pipes requiring more frequent replacement.

- Reduced Maintenance Costs: Advanced coatings can decrease corrosion-related maintenance by up to 30% annually.

- Lower Capital Expenditures: Investing in durable materials upfront can reduce the total cost of ownership over the asset's lifecycle.

- Improved Operational Reliability: Enhanced material integrity minimizes unexpected failures and downtime in critical water treatment processes.

Technological advancements are pivotal for Aris Water Solutions, driving efficiency and sustainability. Innovations in water treatment, such as advanced membrane filtration and chemical processes, are improving water recovery rates and reducing operational costs. The global water and wastewater treatment market's growth, projected to reach $700 billion by 2025, underscores the importance of these technological upgrades.

Smart sensors, drones, and AI-powered predictive analytics are revolutionizing pipeline monitoring, enabling proactive maintenance and minimizing environmental risks. By 2025, AI in utility management is expected to cut operational costs by an average of 15% through reduced water loss and energy use.

Automation in pumping, treatment, and control systems is boosting efficiency and lowering labor expenses, with the smart water management market poised for significant growth. These automated systems ensure real-time adjustments and remote monitoring, enhancing service reliability and operational performance.

| Technology Area | Key Advancement | Impact on Aris Water | Market Trend/Data (2024-2025) |

|---|---|---|---|

| Water Treatment | Advanced Membrane Filtration, Enhanced Biological Processes | Higher water recovery, reduced chemical/energy use | Global market ~ $650 billion (2024), growing demand for sustainable solutions |

| Pipeline Monitoring | Smart Sensors, AI Predictive Analytics | Proactive maintenance, leak detection, reduced downtime | AI in utilities projected to reduce downtime by up to 30% by 2025 |

| Operational Efficiency | AI for demand prediction, flow optimization | Accurate resource allocation, minimized energy consumption, reduced water loss | AI adoption in utilities reported 15% operational cost reduction (2024) |

| Automation | Automated Pumping/Treatment, IoT Integration | Increased efficiency, lower labor costs, real-time adjustments | Smart water management market ~$16.8 billion (2023), strong adoption trend |

Legal factors

Aris Water Solutions operates under a strict framework of federal and state water quality standards, notably the Clean Water Act. This necessitates meticulous compliance for any water discharge or reuse activities, impacting operational costs and treatment efficacy. For instance, in 2023, the Environmental Protection Agency (EPA) continued to emphasize advanced treatment technologies, with proposed revisions to the National Primary Drinking Water Regulations for PFAS compounds potentially increasing compliance burdens for water utilities nationwide.

Aris Water Solutions' infrastructure development hinges on navigating a complex web of land use and eminent domain laws. Obtaining rights-of-way for its extensive pipeline network requires meticulous adherence to local zoning and permitting, a process that can be lengthy and resource-intensive.

The company's reliance on eminent domain, while a necessary tool for securing critical land access, introduces legal complexities and potential opposition. For instance, in 2024, similar infrastructure projects in Texas faced an average of 18 months for right-of-way acquisition, with legal challenges adding an average of 6 months to project timelines.

Any disruptions or legal battles stemming from land access disputes directly translate into increased project costs and delayed revenue generation for Aris Water. These legal factors are paramount to managing operational efficiency and financial predictability.

Aris Water Solutions navigates a landscape where environmental liabilities are a significant concern. The company could face substantial costs and legal repercussions stemming from accidental spills, leaks, or improper handling of produced water, a key component of its operations.

Stringent environmental regulations, such as those enforced by the Environmental Protection Agency (EPA) and state-level bodies, mandate specific remediation protocols and impose penalties for non-compliance or environmental damage. For instance, under the Clean Water Act, violations can lead to significant fines, with penalties often reaching tens of thousands of dollars per day per violation, and even criminal charges in severe cases.

To counter these risks, Aris Water Solutions must implement proactive environmental management systems, robust operational controls, and secure comprehensive environmental liability insurance. Such measures are critical for mitigating potential financial exposure and ensuring adherence to the complex legal framework governing water management and environmental protection.

Worker Safety Regulations

Aris Water Solutions, as an infrastructure company in the energy sector, faces stringent worker safety regulations, notably those enforced by OSHA. In 2023, OSHA reported over 5,000 worker fatalities nationwide, highlighting the critical need for compliance. Aris's commitment to rigorous safety protocols, comprehensive training, and high equipment standards is paramount to mitigating these risks.

Adherence to these safety laws is not merely a compliance issue but a cornerstone of operational integrity. Failure to comply can result in significant financial penalties; for instance, OSHA’s willful violation penalties can reach tens of thousands of dollars per incident. Beyond financial repercussions, maintaining a strong safety record is vital for Aris's corporate reputation and its ability to attract and retain talent in a competitive industry.

Key aspects of Aris Water's worker safety compliance likely include:

- Mandatory safety training programs covering hazard recognition and emergency procedures.

- Regular site inspections and audits to ensure adherence to safety standards.

- Provision and enforcement of personal protective equipment (PPE) usage.

- Development and implementation of robust emergency response plans.

Contractual Agreements and Regulatory Compliance

Aris Water Solutions' operations are fundamentally underpinned by long-term contractual agreements with its clients in the energy sector. These critical contracts dictate service standards, pricing structures, liability clauses, and adherence to evolving regulatory frameworks. For instance, in 2023, the company reported that a significant portion of its revenue was derived from these multi-year agreements, highlighting their importance to financial stability.

Ensuring strict adherence to a complex web of industry-specific regulations is paramount for Aris Water. This includes compliance with environmental protection laws governing water sourcing, treatment, disposal, and transportation, as well as safety regulations for its workforce and equipment. Failure to comply can result in substantial fines and operational disruptions, impacting the company's bottom line and reputation.

- Contractual Dependencies: Aris Water's revenue streams are heavily reliant on the terms and longevity of its contracts with oil and gas producers, a model that requires constant client relationship management and contract negotiation.

- Regulatory Landscape: The company must navigate a dynamic regulatory environment, particularly concerning water management and environmental impact, which can influence operational costs and service offerings.

- Compliance Costs: Investing in technology and processes to meet stringent regulatory requirements, such as those mandated by the EPA for wastewater management, represents a significant operational expenditure for Aris Water.

Aris Water Solutions operates under a stringent legal framework, including federal and state environmental laws like the Clean Water Act, demanding rigorous compliance for water discharge and reuse. The EPA's continued focus on advanced treatment technologies, as seen with proposed PFAS regulations in 2023, suggests increasing compliance burdens and costs for water management companies.

Navigating land use and eminent domain laws is critical for Aris Water's infrastructure development. Securing rights-of-way for pipelines involves complex local zoning and permitting, a process that can be lengthy, with Texas infrastructure projects in 2024 averaging 18 months for acquisition, plus an additional 6 months for legal challenges.

Environmental liabilities, such as accidental spills, are a significant concern, with potential fines under the Clean Water Act reaching tens of thousands of dollars per day per violation. Aris must maintain robust environmental management systems and insurance to mitigate these risks and ensure legal adherence.

Worker safety regulations, enforced by OSHA, are paramount, especially given the over 5,000 worker fatalities reported nationwide in 2023. Non-compliance can lead to substantial penalties, with OSHA's willful violation fines potentially reaching tens of thousands of dollars per incident, impacting operational integrity and reputation.

Environmental factors

Increasing water scarcity and more frequent drought conditions in Aris Water Solutions' operating regions, particularly in the Permian Basin, are significantly boosting demand for their water recycling services. For instance, Texas has faced persistent drought conditions in recent years, impacting freshwater availability for industrial use.

As freshwater sources become scarcer and consequently more expensive, the economic and environmental value of reusing produced water for operations, such as hydraulic fracturing, dramatically increases. This escalating cost of traditional water sources directly drives the adoption of closed-loop systems, a core offering of Aris Water's business model, making their solutions more attractive and essential.

The broader environmental impact of energy production, encompassing land disturbance and potential ecosystem disruption, is increasingly driving demand for sustainable operational practices. This shift directly influences companies like Aris Water Solutions.

Aris Water Solutions' infrastructure is designed to significantly reduce the environmental footprint associated with energy extraction. By minimizing truck traffic, which lessens road wear and associated emissions, and decreasing freshwater withdrawals for operations, Aris Water helps energy companies lessen their impact on local ecosystems and biodiversity. For instance, in 2024, the energy sector's reliance on water for hydraulic fracturing remained a key concern, with estimates suggesting millions of gallons are used per well, highlighting the importance of water recycling and conservation solutions.

Global and national climate change policies, such as carbon pricing and emissions reduction targets, are increasingly influencing the energy sector. For instance, the US Environmental Protection Agency (EPA) continues to implement regulations aimed at reducing greenhouse gas emissions from industrial sources, which indirectly impacts water management practices.

As energy companies face growing pressure to decarbonize, there's a heightened demand for water solutions that minimize their environmental impact. Aris Water Solutions' focus on reducing energy-intensive water transportation, like trucking, and promoting water recycling directly addresses this need, making their services more appealing as sustainability becomes a core business objective.

The push for renewable energy mandates also plays a role. Increased reliance on renewable energy sources for operations can lead to changes in water usage patterns and demands from the energy sector, potentially creating new opportunities for efficient water management services like those offered by Aris Water.

Biodiversity Protection and Habitat Preservation

Concerns about biodiversity protection and habitat preservation are increasingly shaping the permitting process for industrial projects. This can lead to delays and increased scrutiny for companies involved in infrastructure development.

Aris Water Solutions' approach to water management, particularly its pipeline networks, offers a potential benefit by reducing reliance on truck traffic. This can translate to less habitat fragmentation and disturbance, which is a significant win for environmental conservation efforts aimed at protecting natural landscapes and wildlife corridors. For instance, a reduction in trucking can mean fewer new roads and less disruption to sensitive ecosystems.

- Reduced Habitat Fragmentation: Aris Water's pipeline infrastructure can lessen the need for extensive road networks, thereby minimizing the fragmentation of natural habitats.

- Lower Environmental Disturbance: By consolidating water transport through pipelines, the overall physical disturbance to land and wildlife is reduced compared to frequent truck movements.

- Alignment with Conservation Goals: This operational model supports broader environmental objectives focused on preserving biodiversity and maintaining ecological integrity.

Waste Management and Disposal Regulations for Produced Water

Environmental regulations surrounding the disposal of produced water are tightening considerably, compelling energy companies to explore more sustainable practices. This shift directly benefits companies like Aris Water Solutions, whose recycling and reuse services present a more environmentally sound option compared to traditional methods such as deep-well injection. These stricter rules aim to mitigate risks like groundwater contamination and seismic activity, thereby increasing the demand for Aris's innovative solutions.

The market for produced water recycling and reuse is expanding significantly. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize water quality standards, influencing state-level regulations on wastewater disposal. This regulatory pressure is a key driver for the adoption of advanced water treatment technologies. Aris Water Solutions is well-positioned to capitalize on this trend, offering services that align with both environmental stewardship and operational efficiency goals for energy producers.

- Increasing Regulatory Scrutiny: Federal and state agencies are implementing more stringent rules for produced water disposal, impacting traditional methods.

- Growth in Water Recycling: The demand for produced water recycling and reuse solutions is projected to grow substantially in the coming years as companies seek compliance and sustainability.

- Mitigation of Environmental Risks: Aris Water's approach directly addresses concerns associated with deep-well injection, such as potential groundwater contamination and induced seismicity.

Increasing water scarcity, particularly in regions like the Permian Basin, is a major driver for Aris Water Solutions' services. Texas, for example, has experienced ongoing drought conditions, making freshwater less accessible and more costly for industrial operations. This escalating cost of traditional water sources directly boosts the economic and environmental value of reusing produced water, a core aspect of Aris Water's business model.

Stricter environmental regulations regarding produced water disposal are compelling energy companies to adopt more sustainable practices. This regulatory pressure, aimed at preventing groundwater contamination and seismic activity, increases demand for Aris Water's recycling and reuse solutions over methods like deep-well injection. The market for produced water recycling is expanding, with the EPA continuing to emphasize water quality standards in 2024, influencing state regulations.

Aris Water's pipeline infrastructure offers a significant environmental benefit by reducing the need for extensive truck traffic. This consolidation of water transport minimizes habitat fragmentation and overall land disturbance, aligning with conservation goals for biodiversity and ecological integrity. In 2024, the energy sector's substantial water usage for hydraulic fracturing, estimated at millions of gallons per well, underscores the critical importance of water recycling and conservation solutions.

| Environmental Factor | Impact on Aris Water | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Water Scarcity & Drought | Increased demand for water recycling services | Persistent drought conditions in Texas; rising freshwater costs for industry. |

| Produced Water Disposal Regulations | Favoring recycling over traditional disposal methods | Stricter EPA water quality standards influencing state regulations; concerns over groundwater contamination and seismicity. |

| Habitat Fragmentation & Biodiversity | Reduced environmental footprint via pipeline infrastructure | Minimizing truck traffic lessens road construction and land disturbance; supports conservation efforts. |

| Energy Sector Sustainability Push | Demand for low-impact water solutions | Energy companies under pressure to decarbonize and reduce environmental impact; focus on efficient water management. |

PESTLE Analysis Data Sources

Our Aris Water PESTLE Analysis is meticulously constructed using data from reputable sources including government environmental agencies, international water management bodies, and leading industry research firms. This ensures a comprehensive understanding of regulatory landscapes, technological advancements, and economic factors impacting the water sector.