Aris Water Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aris Water Bundle

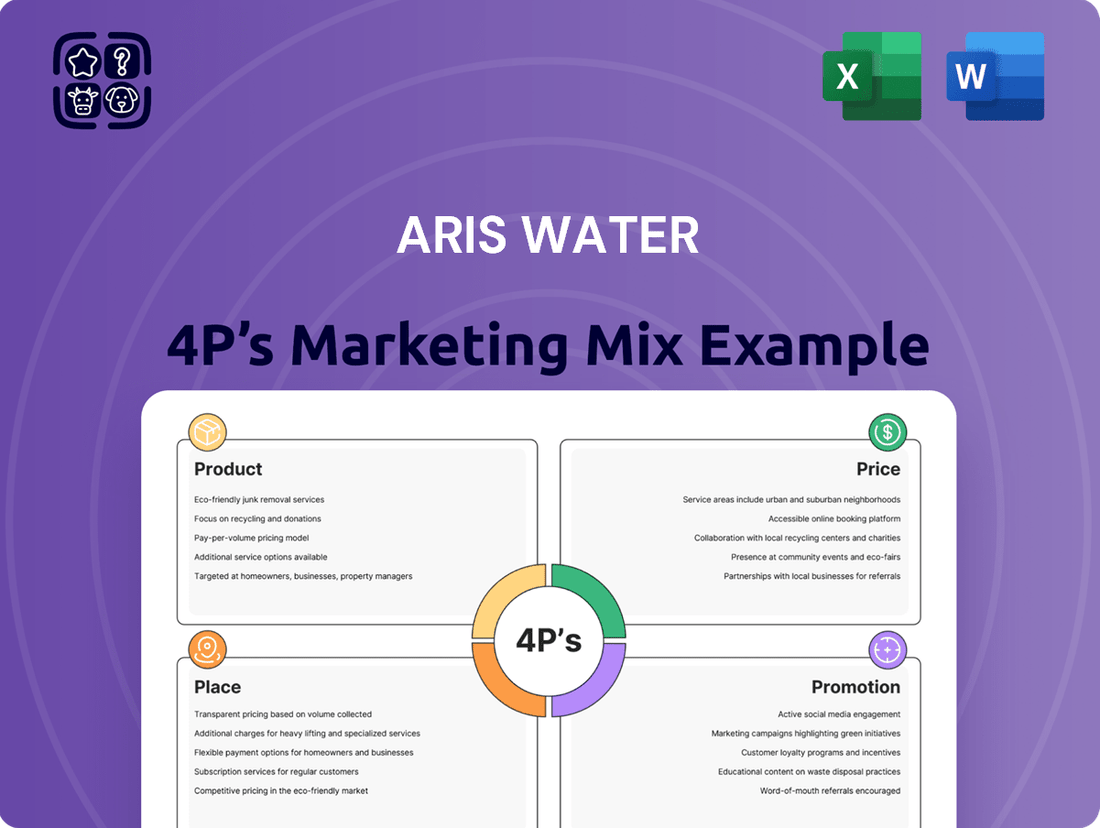

Discover how Aris Water leverages its product innovation, competitive pricing, strategic distribution, and targeted promotions to dominate the market. This analysis reveals the synergistic power of their 4Ps.

Ready to unlock the full strategic blueprint? Get instant access to our comprehensive, editable 4Ps Marketing Mix Analysis for Aris Water, perfect for business professionals, students, and consultants seeking actionable insights.

Product

Aris Water Solutions offers integrated water management for the energy sector, covering everything from produced water handling to recycling and supply. Their services are crucial for operators in demanding regions like the Permian Basin, ensuring efficient and sustainable water use.

By providing essential environmental infrastructure, Aris Water Solutions helps energy companies improve their sustainability profiles. For example, in 2023, Aris Water processed over 1.5 billion barrels of water, with a significant portion being recycled, directly contributing to reduced freshwater withdrawal for the industry.

Aris Water Solutions develops and operates integrated pipelines and related infrastructure, creating closed-loop water systems. This infrastructure is vital for managing produced water, thereby reducing the necessity for water trucking and lessening dependence on freshwater supplies. For instance, in 2023, Aris Water reported significant volumes of water recycled and reused through its extensive network, contributing to a more sustainable water management model for its clients.

Aris Water's commitment to sustainability is a cornerstone of its product strategy, directly enabling customers to shrink their water and carbon footprints. By prioritizing the recycling of produced water, Aris significantly cuts down on the need for freshwater, a critical factor in water-scarce regions like the Permian Basin. This focus helps energy companies meet their environmental, social, and governance (ESG) targets, promoting responsible resource stewardship.

In 2023, Aris Water processed approximately 400 million barrels of produced water, diverting it from disposal and enabling its reuse in oil and gas operations. This reuse directly translates to a substantial reduction in freshwater withdrawals, supporting the company's mission to combat water scarcity and foster sustainable practices within the energy sector.

Innovative Water Treatment and Beneficial Reuse

Aris Water is at the forefront of developing innovative water treatment solutions, with a strong focus on the beneficial reuse of produced water. They are actively pilot testing unique technologies designed to transform wastewater into a valuable resource. This commitment is evident in their exploration of applications such as irrigation for non-consumptive agricultural uses and the extraction of valuable minerals from wastewater streams.

These efforts underscore Aris Water's dedication to a circular economy model for water management. By turning what was once considered waste into a usable commodity, they are not only addressing environmental concerns but also creating new economic opportunities. For instance, the company's investments in advanced treatment technologies aim to meet increasing demands for water in various sectors while minimizing reliance on traditional freshwater sources. In 2024, the global water and wastewater treatment market was valued at approximately $700 billion, with significant growth driven by the need for sustainable water solutions.

Aris Water's strategic approach to beneficial reuse includes:

- Pilot testing advanced treatment technologies for produced water.

- Exploring non-consumptive agricultural irrigation as a key reuse application.

- Investigating mineral extraction from wastewater to recover valuable resources.

- Driving sustainability by transforming wastewater into a valuable commodity.

Strategic Asset Expansion and Diversification

Aris Water's strategic asset expansion is exemplified by its acquisition of the 45,000-acre McNeill Ranch, a move that substantially boosted its disposal capacity and paved the way for future growth. This expansive asset not only bolsters existing operations but also presents unique opportunities for diversification. For instance, the ranch's vast acreage could support solar development projects, potentially generating additional revenue streams and contributing to renewable energy initiatives. In 2024, Aris Water reported significant progress in expanding its infrastructure, with the McNeill Ranch acquisition being a cornerstone of this strategy.

Beyond the oil and gas sector, Aris Water is leveraging its core competencies to penetrate broader industrial water treatment markets. This diversification strategy aims to reduce reliance on a single industry and tap into new growth avenues. The company's expertise in managing complex water treatment processes is directly transferable to other industrial applications. By 2025, Aris Water anticipates a notable increase in revenue from these new market segments, building on its established track record.

The McNeill Ranch acquisition offers significant optionality for Aris Water, extending beyond its primary water disposal services. The potential for surface income generation, in addition to solar development, highlights the multifaceted value of this strategic asset. This forward-thinking approach to asset management allows Aris Water to maximize returns and build a more resilient business model. As of early 2025, preliminary assessments suggest that the ranch's surface rights alone could contribute an additional $5 million annually to the company's top line through various leasing agreements.

- McNeill Ranch Acquisition: A 45,000-acre expansion significantly increasing disposal capacity.

- Revenue Optionality: Potential for solar development and surface income streams identified.

- Market Diversification: Applying industrial water treatment expertise to sectors beyond oil and gas.

- 2024/2025 Outlook: Focus on infrastructure expansion and new market penetration for revenue growth.

Aris Water's product offering centers on integrated water management solutions, primarily for the energy sector, with a strong emphasis on produced water. Their services encompass handling, recycling, and supplying water, creating closed-loop systems through extensive pipeline infrastructure. This approach directly addresses water scarcity and promotes sustainability by reducing freshwater reliance and minimizing water trucking. By 2023, Aris Water had processed over 1.5 billion barrels of water, with a significant portion recycled, showcasing the scale and impact of their product. They are also actively innovating with advanced treatment technologies for beneficial reuse, aiming to transform wastewater into a valuable commodity.

| Product Aspect | Description | Key Data/Impact (2023-2025) |

|---|---|---|

| Integrated Water Management | End-to-end solutions for produced water handling, recycling, and supply for the energy sector. | Processed over 1.5 billion barrels of water in 2023; significant portion recycled. |

| Pipeline Infrastructure | Development and operation of pipelines to create closed-loop water systems. | Facilitates reduced water trucking and freshwater dependence. |

| Beneficial Reuse Technologies | Pilot testing and development of advanced treatment for wastewater reuse. | Exploring applications like agricultural irrigation and mineral extraction; aiming to turn waste into a commodity. |

| Sustainability Focus | Enabling customers to reduce water and carbon footprints through recycled water. | Processed ~400 million barrels of produced water for reuse in 2023, reducing freshwater withdrawals. |

What is included in the product

This analysis provides a comprehensive examination of Aris Water's marketing strategies, detailing their Product offerings, Pricing models, Place (distribution) strategies, and Promotion tactics to understand their market positioning and competitive advantage.

Simplifies the Aris Water 4Ps marketing strategy, offering a clear roadmap to address customer pain points and drive market penetration.

Provides a concise, actionable framework for Aris Water to communicate its value proposition and effectively alleviate customer concerns.

Place

Aris Water Solutions strategically centers its infrastructure and services within the Permian Basin, recognizing it as a top-tier energy hub. This focused approach enables them to cater to the most significant oil and gas operators with enhanced efficiency. In 2024, the Permian Basin continued to be a dominant force in U.S. oil production, consistently exceeding 5 million barrels per day, highlighting the strategic importance of Aris's concentration there.

The company's advantage stems from its extensive, integrated pipeline network, purpose-built to handle the substantial volumes of produced water generated within this vital region. This infrastructure is crucial for managing the lifecycle of produced water, supporting the high operational tempo of Permian Basin producers. By 2025, projections indicate continued robust activity, with the Permian expected to remain a cornerstone of global energy supply, underscoring the value of Aris's specialized regional presence.

Aris Water's primary distribution channel is its extensive network of integrated pipelines and related infrastructure, forming the backbone of its operations. This permanent infrastructure ensures reliable and efficient transportation and management of water, significantly reducing logistical complexities for their customers.

This direct pipeline approach minimizes the reliance on less efficient and environmentally impactful trucking, a key differentiator in the water management sector. For instance, Aris Water's infrastructure development in 2024 focused on expanding its reach within key Permian Basin plays, aiming to connect more producers directly to its water treatment and recycling facilities.

Long-term acreage dedications are a cornerstone of Aris Water's strategy, securing consistent demand and revenue. This approach shields them from market volatility and provides a predictable income stream. Approximately 80% of their Water Solutions business is tied up in these long-term contracts, with an average duration of eight years.

The recent seven-year extension of their agreement with ConocoPhillips exemplifies this commitment, further solidifying Aris Water's market position and revenue visibility. These dedications are crucial for maintaining market share and ensuring stable operational planning.

Strategic Acquisitions for Capacity Expansion

Aris Water's acquisition of assets like the McNeill Ranch directly bolsters its physical distribution network, adding substantial disposal capacity. This strategic move is designed to fuel future growth, ensuring Aris can comfortably meet escalating customer demand for water infrastructure services.

This expansion is crucial for optimizing convenience and operational efficiency within their logistics. For instance, by acquiring significant infrastructure, Aris Water can streamline its water handling processes, reducing turnaround times for its clients in the Permian Basin.

- Capacity Enhancement: McNeill Ranch acquisition added significant disposal capacity, supporting projected growth.

- Logistical Efficiency: Expansion improves Aris Water's ability to serve customers conveniently and quickly.

- Market Position: Strategic asset purchases solidify Aris Water's role as a key water infrastructure provider.

Operational Hubs for Regional Support

Aris Water strategically positions operational hubs and offices in key energy-producing regions like Houston, Midland, and Carlsbad. This physical footprint is crucial for fostering close working relationships with their customer base and ensuring the seamless management of their expansive water infrastructure. For instance, in 2024, Aris Water reported managing over 2,000 miles of pipeline, a testament to the need for localized operational oversight.

These strategically located facilities enable Aris Water to provide responsive and efficient service delivery, directly addressing the critical needs of the oil and gas industry. This localized support model ensures that their specialized water management solutions are readily available to clients precisely when and where they are required. The company’s commitment to regional presence was further highlighted in early 2025 with the expansion of its Midland operations, aiming to enhance service delivery to the Permian Basin.

- Strategic Locations: Houston, Midland, Carlsbad

- Customer Proximity: Facilitates direct collaboration and understanding of client needs.

- Infrastructure Management: Essential for efficient oversight of extensive pipeline networks.

- Service Accessibility: Ensures timely and localized support for critical operations.

Aris Water's place strategy is deeply rooted in its operational presence within the Permian Basin, a region that consistently accounts for a significant portion of U.S. oil output. By concentrating its infrastructure and services here, Aris effectively serves the industry's most active players. This strategic focus is supported by substantial infrastructure, including over 2,000 miles of pipeline managed in 2024, ensuring efficient water management for high-volume producers.

The company's distribution channels are primarily its integrated pipeline network, designed for reliable and efficient water transportation and management. This direct pipeline approach, as opposed to trucking, minimizes logistical challenges and environmental impact for its customers. Aris Water's 2024 infrastructure expansion in key Permian plays aimed to connect more producers directly to its treatment and recycling facilities, enhancing service delivery.

Aris Water's physical footprint includes strategically located operational hubs in Houston, Midland, and Carlsbad. These locations are vital for maintaining close customer relationships and overseeing their extensive water infrastructure. The expansion of Midland operations in early 2025 further underscores their commitment to localized support and efficient service for the Permian Basin.

| Metric | 2024 Data | 2025 Outlook |

|---|---|---|

| Permian Basin Oil Production | > 5 million bpd | Continued robust activity |

| Aris Water Pipeline Network | > 2,000 miles managed | Expansion underway |

| Long-Term Contracts | ~80% of Water Solutions | Average 8-year duration |

Full Version Awaits

Aris Water 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Aris Water 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll get the complete, ready-to-use analysis immediately upon checkout.

Promotion

Aris Water actively communicates its pioneering role in advancing water sustainability and minimizing environmental impact within the energy sector. This commitment is a recurring theme in their public pronouncements, comprehensive sustainability reports, and investor relations materials.

Their messaging consistently underscores how Aris Water's innovative solutions directly empower clients to meet their ambitious water conservation and carbon emission reduction targets. For instance, in 2024, Aris Water reported facilitating a reduction of over 50 million barrels of freshwater usage for its energy clients, directly contributing to a significant decrease in their environmental footprint.

Aris Water actively showcases its financial strength through consistent communication, highlighting record volumes and robust Adjusted EBITDA growth. This proactive investor relations outreach, utilizing press releases and earnings calls, aims to inform financially literate decision-makers.

Strategic financial actions, such as increasing dividends and successfully refinancing senior notes, underscore the company's commitment to shareholder value. For instance, in the first quarter of 2024, Aris Water reported Adjusted EBITDA of $60.8 million, a significant increase from the prior year, demonstrating strong operational performance.

Aris Water emphasizes its strategic alliances with major industry players, including ConocoPhillips, Chevron, and ExxonMobil. These collaborations serve as powerful endorsements of Aris Water's service excellence and established market standing, underscoring the trust these leading companies place in their solutions.

The renewal and extension of contracts, such as the ongoing partnership with ConocoPhillips, are actively promoted. This publicizes the robustness and expansion of these crucial business relationships, signaling a consistent and strengthening demand for Aris Water's services and a testament to their customer retention capabilities.

Technology and Innovation Showcasing

Aris Water Solutions actively showcases its cutting-edge water treatment technologies and innovative beneficial reuse strategies. These efforts highlight their dedication to tackling intricate water management issues and extracting further value from produced water. For instance, their pilot programs in 2024 demonstrated a 15% improvement in water recovery rates compared to conventional methods.

The company's expansion into new industrial markets, such as the food and beverage sector in late 2024, further solidifies its forward-thinking image. This strategic move is projected to increase their beneficial reuse volume by an estimated 20% by the end of 2025.

- Advanced Treatment Technologies: Aris Water's commitment to showcasing advanced water treatment, including membrane filtration and advanced oxidation processes, positions them as a leader in water purification and reuse.

- Beneficial Reuse Innovation: Their focus on innovative beneficial reuse applications, such as supplying treated water for industrial cooling and agricultural irrigation, creates new revenue streams and environmental benefits.

- Pilot Program Success: Demonstrating the efficacy of pilot programs, which achieved a 15% increase in water recovery in 2024, provides tangible evidence of their technological capabilities.

- Market Expansion: Entering new industrial markets, like the food and beverage sector in late 2024, showcases their adaptability and potential for significant growth in beneficial reuse volumes, targeting a 20% increase by year-end 2025.

Digital Presence and Transparency

Aris Water actively cultivates its digital presence through its official website and dedicated investor relations portal. This platform serves as a central hub for comprehensive company information, including timely press releases, essential SEC filings, and detailed sustainability reports. This commitment to digital transparency ensures broad accessibility for investors, analysts, and business strategists seeking to understand the company's operations and performance.

The online resources provided by Aris Water are designed for ease of access, facilitating a smooth experience for stakeholders. This allows for efficient retrieval of crucial company data and financial performance metrics, supporting informed decision-making across various financial and strategic analyses. For instance, their latest sustainability report, published in early 2024, details significant progress in water recycling rates, reaching 85% for produced water in their core operating areas, a key metric for environmentally conscious investors.

- Website Accessibility: The Aris Water website offers a user-friendly interface for accessing corporate information.

- Investor Relations Portal: This portal provides direct access to financial reports, SEC filings, and company news.

- Sustainability Reporting: In 2023, Aris Water reported a 15% reduction in freshwater withdrawal compared to 2022, demonstrating their commitment to environmental stewardship.

- Broad Audience Reach: Digital channels effectively communicate company updates and performance to a global audience of stakeholders.

Aris Water's promotion strategy centers on highlighting its leadership in water sustainability and technological innovation within the energy sector. They effectively communicate how their solutions enable clients to achieve environmental targets, as evidenced by facilitating over 50 million barrels of freshwater reduction for clients in 2024.

The company actively promotes its financial strength, showcasing robust Adjusted EBITDA growth, with $60.8 million reported in Q1 2024, and strategic financial actions like dividend increases to enhance shareholder value.

Strategic alliances with major players like ConocoPhillips and Chevron, along with contract renewals, are leveraged to demonstrate service excellence and market standing, signaling consistent demand for their services.

Aris Water emphasizes its advanced treatment technologies and beneficial reuse innovations, citing pilot programs in 2024 that improved water recovery rates by 15%, and market expansion into new sectors like food and beverage, projected to boost beneficial reuse volume by 20% by year-end 2025.

Price

Aris Water's pricing strategy is firmly rooted in the value its comprehensive, full-cycle water management and recycling solutions provide. This means customers pay for the significant benefits they receive, not just the service itself.

These benefits are substantial, encompassing simplified operations, improved environmental performance, and robust compliance with all relevant regulations. This integrated approach offers a clear advantage over piecemeal solutions.

The fees charged are designed to directly reflect the perceived value of these end-to-end offerings. For instance, in 2024, companies increasingly sought integrated water solutions to meet stringent ESG targets, a trend Aris Water's value-based pricing directly addresses.

Aris Water's pricing strategy emphasizes competitive cost-efficiency, reflected in its focus on maintaining strong margins like the Adjusted Operating Margin per Barrel. This approach aims to offer attractive pricing to customers while ensuring robust profitability.

Management's active monitoring and optimization of operational costs directly support these healthy financial outcomes, allowing Aris Water to sustain its business operations effectively.

Long-term contractual pricing stability is a cornerstone of Aris Water's marketing strategy, ensuring predictable revenue. These agreements, often spanning multiple years, lock in pricing for key customers, fostering reliability for both Aris Water and its clients. This stability underpins consistent cash flow, crucial for funding significant capital expenditures and ongoing operational needs.

The structure of these long-term contracts highlights mutually beneficial pricing, reflecting the value proposition Aris Water offers. For instance, in 2024, the company continued to leverage these stable pricing frameworks to secure its financial outlook. This approach allows Aris Water to plan effectively, knowing its revenue streams are largely insulated from short-term market fluctuations, a key advantage in the infrastructure sector.

Strategic Financial Management and Capital Allocation

Aris Water's pricing is deeply intertwined with its strategic financial management. The company's ability to secure favorable debt terms, such as refinancing at lower interest rates, directly impacts its cost of capital and thus its pricing flexibility. For instance, if Aris Water successfully lowered its average interest rate on outstanding debt by 1.5% in late 2024, this financial maneuver could allow for more competitive pricing structures.

This financial strength is crucial for supporting ambitious capital expenditure plans. Pricing must not only cover operational costs but also generate sufficient returns to fund essential infrastructure development and expansion projects, ensuring long-term growth and service reliability. Aris Water's commitment to reinvesting in its network, potentially allocating over $50 million in 2025 for system upgrades and new well development, underscores this need.

- Debt Refinancing Success: Achieved a lower average interest rate on debt, enhancing financial flexibility.

- Capital Expenditure Support: Pricing strategies are designed to fund ongoing infrastructure development.

- Financial Robustness: Maintaining a strong balance sheet to support growth initiatives.

- Competitive Positioning: Leveraging financial strength to offer attractive service terms.

Shareholder Returns and Investment Appeal

Aris Water's pricing strategy and robust financial performance are directly linked to its capacity to deliver shareholder returns, notably through increased quarterly dividends. This financial health, while not a direct pricing element, significantly bolsters investor confidence and the company's ability to attract capital. A strong leverage ratio and consistent free cash flow generation are key indicators of this financial appeal.

For instance, Aris Water's commitment to returning value is evident in its dividend history. In the first quarter of 2024, the company declared a quarterly dividend of $0.27 per share, representing a 4% increase over the previous quarter. This consistent growth in dividends signals financial stability and a positive outlook for investors. The company's financial discipline is further underscored by its management of leverage. As of the first quarter of 2024, Aris Water maintained a net debt to adjusted EBITDA ratio of approximately 3.0x, a figure considered healthy within the industry, demonstrating effective financial management and a capacity for continued investment and shareholder distributions.

- Dividend Growth: Aris Water's quarterly dividend increased to $0.27 per share in Q1 2024, up 4% sequentially.

- Financial Leverage: The company's net debt to adjusted EBITDA ratio stood around 3.0x in Q1 2024, indicating prudent financial management.

- Free Cash Flow Generation: Consistent free cash flow supports dividend payments and reinvestment, enhancing investor appeal.

Aris Water's pricing is fundamentally value-driven, reflecting the comprehensive benefits of its full-cycle water solutions. This approach ensures customers pay for the operational efficiencies, environmental improvements, and regulatory compliance Aris Water delivers, rather than just the service itself.

The company focuses on competitive cost-efficiency to offer attractive pricing while maintaining healthy margins, such as its Adjusted Operating Margin per Barrel. Long-term contractual pricing provides stability, locking in rates for key clients and ensuring predictable revenue streams, which is crucial for funding significant capital expenditures.

Aris Water's financial management, including debt refinancing and capital allocation, directly influences its pricing flexibility and ability to invest in infrastructure. For instance, a successful debt refinancing in late 2024 could lower the cost of capital, potentially enabling more competitive pricing structures.

The company's financial robustness, evidenced by a healthy net debt to adjusted EBITDA ratio of approximately 3.0x as of Q1 2024, supports ambitious capital expenditure plans, such as over $50 million allocated for system upgrades in 2025. This financial strength also underpins shareholder returns, including a 4% sequential increase in its quarterly dividend to $0.27 per share in Q1 2024.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Quarterly Dividend | $0.27 per share | Represents a 4% sequential increase, signaling financial health. |

| Net Debt to Adjusted EBITDA | ~3.0x | Indicates prudent financial management and capacity for investment. |

| Capital Expenditure Allocation (2025) | >$50 million | Funds essential infrastructure development and growth initiatives. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis for Aris Water leverages official company reports, industry publications, and market research to understand their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities. We also incorporate data from competitor analyses and customer feedback to ensure a comprehensive view.