Aris Water Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aris Water Bundle

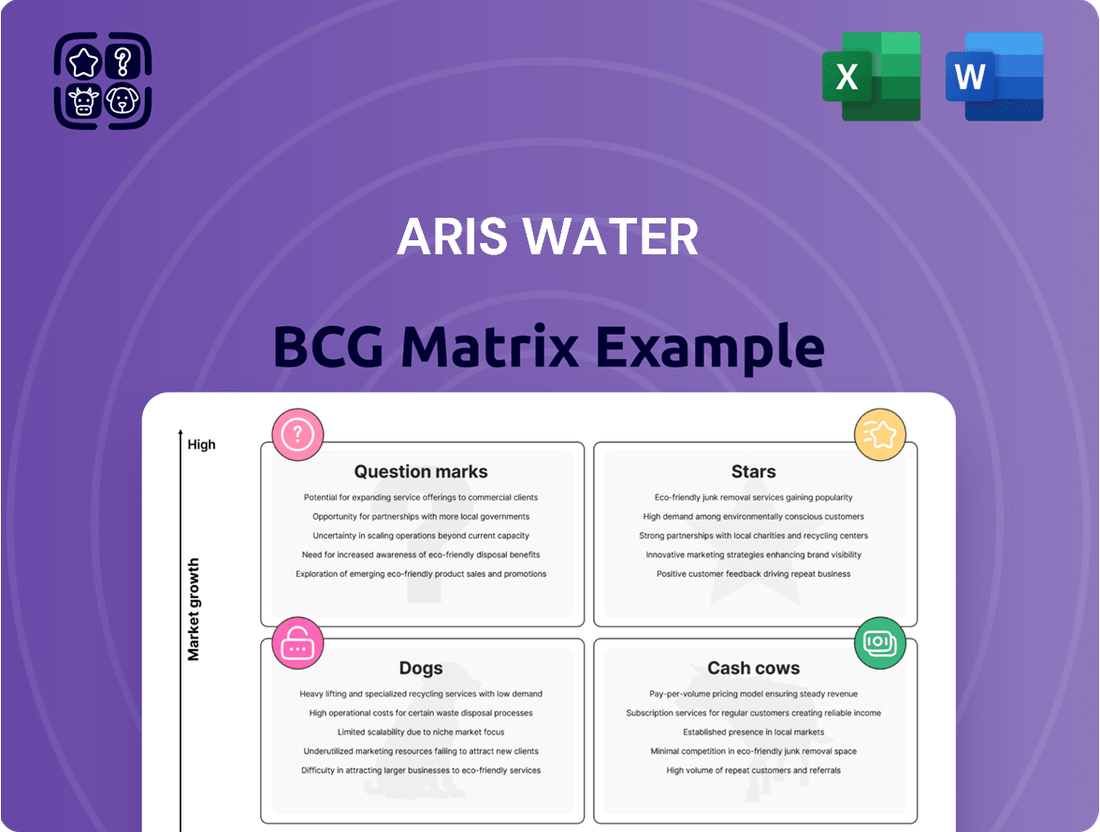

Curious about Aris Water's strategic product positioning? Our BCG Matrix preview reveals the core of their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock Aris Water's growth potential and make informed investment decisions, you need the full picture. Purchase the complete BCG Matrix for a detailed quadrant breakdown, data-driven insights, and actionable strategies to optimize their product pipeline.

Stars

Aris Water Solutions' recycled water segment is a clear star in its portfolio, exhibiting impressive growth. Recycled water volumes surged by 41% year-over-year in the first quarter of 2025, following a robust 16% increase for the entirety of 2024. This rapid expansion in a market prioritizing sustainability firmly places these offerings in a leading position.

The company's commitment to expanding these recycled water solutions aligns perfectly with the growing global demand for water recycling and reuse. Projections indicate substantial future growth for this sector, further solidifying the star status of Aris Water Solutions' recycled water offerings.

Aris Water Solutions operates a substantial integrated pipeline network within the Permian Basin, a key area for energy extraction. This extensive infrastructure is vital for managing and recycling produced water, a critical need for oil and gas companies. Their strategic positioning and the completeness of their pipeline system offer a distinct advantage, fostering ongoing growth in the volumes they handle.

Long-term dedicated acreage agreements are a cornerstone of Aris Water's strategy, offering significant stability. For instance, the seven-year extension with ConocoPhillips, pushing their commitment to 2040, dramatically extends the company's average contract length to over a decade. This secures predictable revenue and solidifies Aris Water's market position in key Permian Basin areas.

Sustainability-Focused Solutions

Aris Water's core mission centers on delivering environmental infrastructure, enabling clients to shrink their water and carbon footprints. This focus aligns perfectly with the energy sector's growing emphasis on sustainability and regulatory compliance.

This strong commitment to environmental stewardship is a significant draw for clients navigating increasing market trends and regulatory pressures. It directly translates into higher demand for Aris's specialized services.

- Environmental Infrastructure: Aris provides solutions that directly address water scarcity and reduce carbon emissions for its clients.

- Market Alignment: The company's mission resonates strongly with current energy market trends favoring sustainability.

- Regulatory Advantage: Aris's focus helps clients meet evolving environmental regulations.

- Client Appeal: This sustainability-driven approach enhances Aris's attractiveness to environmentally conscious customers.

Strategic Acquisitions for Growth

Strategic acquisitions are key for Aris Water's growth, as exemplified by the late 2024 acquisition of the 45,000-acre McNeill Ranch. This move significantly bolsters disposal capacity directly adjacent to rapidly expanding production zones.

This expansion not only enhances operational flexibility but also underpins years of projected growth in produced water handling. Furthermore, it opens avenues for developing new revenue streams, solidifying Aris Water's dominant market position.

- McNeill Ranch Acquisition: 45,000 acres secured in late 2024.

- Strategic Benefit: Enhanced disposal capacity in high-growth production areas.

- Future Outlook: Supports years of growth in water handling and new revenue opportunities.

- Market Impact: Reinforces Aris Water's leadership in the sector.

Aris Water Solutions' recycled water segment is a definite star, showing strong performance. Recycled water volumes grew 41% year-over-year in Q1 2025, following a 16% increase in 2024. This rapid expansion in a sustainability-focused market highlights its leading position.

The company's integrated pipeline network in the Permian Basin is also a star asset. This infrastructure is crucial for managing produced water, a vital service for oil and gas companies. Their extensive system provides a significant advantage, driving continued growth in handled volumes.

| Segment | Growth Metric | Performance | Key Driver | Outlook |

|---|---|---|---|---|

| Recycled Water | Volume Growth (YoY Q1 2025) | 41% | Sustainability demand | Strong |

| Pipeline Network (Permian) | Volume Handled | Consistent Increase | Energy extraction needs | Positive |

What is included in the product

This BCG Matrix overview analyzes Aris Water's business units based on market share and growth, guiding strategic decisions.

Aris Water's BCG Matrix offers a clear, visual snapshot of your portfolio, instantly relieving the pain of complex strategic analysis.

Cash Cows

Aris Water's core produced water handling services, encompassing gathering and disposal, represent a mature and stable business segment. This area boasts a substantial market share within the Permian Basin, a key oil-producing region.

While the growth rate for this segment was 3% year-over-year in Q1 2025 and 7% year-over-year in 2024, it consistently delivers robust cash flow. This stability makes it the foundational revenue generator for Aris Water.

The strength of this segment is further bolstered by its well-established infrastructure and enduring customer relationships, providing a reliable base for the company's operations.

Aris Water's produced water handling segment benefits significantly from long-term contracts with industry giants such as ConocoPhillips, Chevron, and ExxonMobil. These agreements are foundational to its stability.

These contracts frequently feature minimum volume commitments, which are crucial for Aris's predictable and steady cash flow generation. This predictability is a hallmark of a cash cow.

The extended duration of these contracts offers Aris Water excellent revenue visibility stretching out for many years, reinforcing its position as a reliable performer in the market.

Aris Water demonstrates robust operational efficiency, evidenced by its strong adjusted operating margins. In the first quarter of 2025, the company achieved an impressive $0.44 per barrel, a testament to its effective cost management strategies within its mature business segments.

This consistent profitability highlights Aris Water's ability to generate substantial cash flow, even amidst market competition. The emphasis on streamlining operations directly translates into high profit margins, solidifying its position as a cash cow.

Extensive Existing Infrastructure Network

Aris Water's extensive existing infrastructure network is a significant Cash Cow. The company boasts approximately 790 miles of produced water pipelines, a substantial 1.8 million barrels per day (MMb/d) of handling capacity, and 1.4 MMb/d of recycling capacity.

This well-established and largely completed infrastructure means that future capital investments are primarily for maintenance rather than new build-outs. This efficiency allows for robust cash generation from its existing asset base.

- Extensive Pipeline Network: Approximately 790 miles of produced water pipelines.

- High Handling Capacity: 1.8 MMb/d of total produced water handling.

- Significant Recycling Capability: 1.4 MMb/d of water recycling capacity.

- Lower Maintenance Capital: Reduced proportional capital expenditure for upkeep compared to initial construction.

Consistent Adjusted EBITDA Generation

Aris Water demonstrates consistent strength in Adjusted EBITDA, a key indicator of its operational cash-generating ability. For the first quarter of 2025, the company reported an Adjusted EBITDA of $56.5 million. This follows a robust full-year 2024 performance, where Aris achieved an Adjusted EBITDA of $211.9 million.

Looking ahead, the company's outlook for 2025 projects continued strong financial performance. Aris anticipates its full-year 2025 Adjusted EBITDA to range between $215 million and $235 million. This sustained generation of significant cash flow from core operations positions Aris Water as a solid Cash Cow within the BCG framework.

- Q1 2025 Adjusted EBITDA: $56.5 million

- Full-Year 2024 Adjusted EBITDA: $211.9 million

- Projected Full-Year 2025 Adjusted EBITDA: $215 million to $235 million

- Significance: Demonstrates strong, consistent cash generation from core operations.

Aris Water's produced water handling and disposal services are the company's Cash Cows, characterized by their mature market position and consistent, robust cash flow generation. These services benefit from significant market share in the Permian Basin and long-term contracts with major energy companies, ensuring predictable revenue streams.

The established infrastructure, including extensive pipeline networks and substantial handling capacity, requires minimal new capital investment, allowing for strong free cash flow. This operational efficiency is reflected in healthy profit margins and strong Adjusted EBITDA figures, underscoring their role as reliable cash generators for Aris Water.

| Metric | Q1 2025 | Full Year 2024 | Projected Full Year 2025 |

| Growth Rate (Produced Water Handling) | 3% YoY | 7% YoY | N/A |

| Adjusted Operating Margin | $0.44 per barrel | N/A | N/A |

| Adjusted EBITDA | $56.5 million | $211.9 million | $215 million - $235 million |

What You See Is What You Get

Aris Water BCG Matrix

The Aris Water BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This means you get the fully formatted and analysis-ready report, designed to provide clear strategic insights for Aris Water's product portfolio without any hidden surprises or demo content.

Dogs

Aris Water saw a significant decline in groundwater sales in 2024, with volumes dropping considerably from the previous year. This sharp decrease signals a deliberate strategic pivot by the company.

Concurrently, Aris experienced a surge in recycled water sales, highlighting a move towards more profitable and sustainable water sources. This trend suggests that groundwater, while still a component, is being de-emphasized as a core revenue driver.

Given these dynamics, Aris Water's groundwater sales likely fall into the 'de-emphasized' category within its business portfolio, representing a segment with low growth potential and a diminishing market share as the company prioritizes its recycled water operations.

Isolated, non-integrated disposal assets, while potentially still generating some revenue, are likely to be categorized as Dogs in Aris Water's BCG Matrix. These are typically older wells, perhaps smaller in capacity or located in areas not connected to Aris's newer, more efficient pipeline networks.

These assets may face limited growth prospects due to their lack of integration and potentially higher operating costs compared to their larger, connected counterparts. For instance, if Aris is investing heavily in expanding its centralized, high-capacity disposal facilities, these isolated wells might see minimal capital allocation for upgrades or expansion.

In 2024, Aris Water's strategic focus on integrated systems means that such standalone disposal wells are less likely to attract significant new investment. Their contribution to the overall business growth and market share might be marginal, making them candidates for eventual divestiture or continued operation with minimal reinvestment.

Aris Water's core strategy focuses on integrated pipeline systems, aiming to minimize reliance on traditional water trucking. This shift positions basic water trucking as a residual, low-margin activity within their business model.

Any remaining need for commoditized water trucking services, for areas not connected to their pipeline network, represents a segment facing intense competition and potential operational inefficiencies. This is a stark contrast to the cost savings and reliability offered by their pipeline infrastructure.

In 2024, the market for basic water trucking, particularly in regions with developing infrastructure, continues to be characterized by price sensitivity and a high degree of commoditization. Companies in this space often struggle with thin profit margins due to the readily available supply of trucks and drivers, making it a challenging segment to scale profitably compared to specialized or integrated solutions.

Peripheral, Non-Core Legacy Services

Peripheral, Non-Core Legacy Services represent Aris Water’s minor, less strategic service offerings. These are services that Aris might have historically provided but no longer align with its primary focus on large-scale, integrated, and sustainable water management solutions, particularly in the Permian Basin.

These legacy services likely contribute minimally to Aris Water's overall revenue and receive limited investment or strategic attention. In 2024, it's estimated that such services might account for less than 5% of the company's total revenue, with minimal capital expenditure allocated to their development or maintenance.

- Limited Revenue Contribution: These services are not central to Aris Water's growth strategy.

- Low Strategic Importance: They do not align with the company's core competencies in the Permian Basin.

- Minimal Investment: Capital and operational investments are not prioritized for these offerings.

- Potential for Divestment: Aris may consider divesting these services to focus resources on core operations.

Operations Highly Dependent on Uncontracted Spot Market

Operations heavily reliant on the uncontracted spot market for water handling, without secured long-term contracts or minimum volume commitments, would be classified as Question Marks in the BCG Matrix. This segment of Aris Water's business, while potentially offering short-term opportunities, faces significant volatility and intense competition. In 2024, the spot market for water disposal experienced price fluctuations, with rates varying based on regional demand and available infrastructure. This lack of predictable revenue streams makes it challenging to forecast growth and market share accurately.

These operations, by their nature, exhibit low market share and low growth potential due to their dependence on external factors rather than secured customer relationships or dedicated infrastructure. For instance, if a significant portion of Aris Water's revenue in 2024 was derived from spot market transactions, it would indicate a vulnerability to market downturns and a limited ability to scale operations predictably. The returns generated from such activities are inherently less stable and harder to project compared to contracted services.

- Low Market Share: Operations dependent on the spot market often struggle to capture consistent market share without long-term agreements.

- Low Growth Potential: Volatility and competition in the spot market limit predictable expansion and growth trajectories.

- Unpredictable Returns: Reliance on uncontracted volumes leads to fluctuating revenue streams and uncertain profitability.

- Strategic Vulnerability: Lack of dedicated acreage or minimum volume commitments exposes operations to market price swings and competitive pressures.

Aris Water's groundwater sales, particularly those from isolated, non-integrated disposal assets, are firmly positioned as Dogs in their BCG Matrix. These assets, often older wells not connected to newer pipeline networks, face limited growth due to their lack of integration and potentially higher operating costs.

In 2024, Aris's strategic shift towards integrated systems means these standalone wells are unlikely to receive significant new investment, contributing marginally to overall growth and market share.

The company's focus on pipelines de-emphasizes basic water trucking, a commoditized service facing intense competition and operational inefficiencies, further solidifying its Dog status.

Peripheral, non-core legacy services, contributing minimally to revenue and receiving little strategic attention, also fall into the Dog category. These services, estimated to account for less than 5% of Aris Water's revenue in 2024, are unlikely to see substantial capital expenditure.

| BCG Category | Aris Water Segment | Characteristics | 2024 Outlook |

|---|---|---|---|

| Dogs | Isolated Groundwater Disposal Assets | Low integration, higher operating costs, limited growth prospects. | Minimal new investment, marginal contribution to growth. |

| Dogs | Basic Water Trucking Services | Commoditized, intense competition, operational inefficiencies. | De-emphasized due to pipeline focus, low-margin activity. |

| Dogs | Peripheral Legacy Services | Low revenue contribution, low strategic importance, minimal investment. | Estimated <5% of revenue, potential for divestment. |

Question Marks

Aris Water is actively investigating technologies to extract valuable minerals like iodine from its produced water. This venture targets a new, high-growth market, though it's still in the early stages of commercialization. For instance, the global iodine market was valued at approximately $2.8 billion in 2023, with significant growth projected due to its use in pharmaceuticals and advanced materials.

Aris Water Solutions is actively exploring the beneficial reuse of treated water in sectors outside of oil and gas, particularly in agriculture. The company participates in Joint Industry Projects and field tests with key operators and the Department of Energy to make produced water suitable for non-consumptive agricultural uses.

This represents a significant growth opportunity in sustainable water management, with the market for such solutions expanding rapidly. However, Aris currently has a modest market presence within these developing applications, indicating a potential for future expansion and market share capture.

Aris Water's acquisition of Crosstek Membrane Technology LLC in February 2025 marks a significant expansion into the broader industrial water and wastewater treatment market. This move diversifies their service offerings and taps into a sector projected for substantial growth, driven by increasing regulatory pressures and the need for sustainable water management across various industries.

While this strategic diversification positions Aris for future opportunities, their current market share and operational scale within these newly entered industrial segments are relatively low. The global industrial water treatment market was valued at approximately $75 billion in 2023 and is expected to reach over $110 billion by 2030, indicating a strong growth trajectory that Aris aims to capture.

Surface Income from McNeill Ranch Development

The 45,000-acre McNeill Ranch acquisition offers Aris Water significant potential for generating surface income beyond its core water services. These new revenue avenues include rights-of-way for pipelines and infrastructure, as well as opportunities for power generation and renewable energy development, alongside other industrial uses.

While these surface income streams are in their early stages, they represent a high-growth potential for Aris Water. For instance, by mid-2024, the company was actively exploring partnerships for solar and wind energy projects on its vast landholdings, aiming to diversify its revenue base.

- Rights-of-Way: Leasing portions of the ranch for pipeline corridors and utility easements.

- Renewable Energy: Developing sites for solar farms and wind turbines, leveraging open land.

- Industrial Applications: Providing space for temporary or permanent industrial facilities requiring land access.

- Ancillary Services: Offering related services such as land management and security for these surface uses.

New Technology Commercialization Beyond Core Services

Aris Water's commitment to research and development fuels the creation of innovative water treatment technologies. These advancements aim to improve efficiency and lower operational expenses. The company is actively exploring commercialization avenues for these new technologies, especially those designed for wastewater treatment beyond its traditional oil and gas focus.

While these new technologies present significant growth potential, their market adoption and revenue generation are currently in early stages. This positions them as potential 'question marks' within the BCG matrix, requiring further investment to move towards market leadership. For instance, Aris might be developing advanced membrane filtration systems or novel chemical treatments that could be applied to municipal wastewater or industrial effluent from sectors like food processing or manufacturing.

- High Growth Potential: Technologies targeting broader wastewater treatment markets offer substantial expansion opportunities.

- Low Market Adoption: Initial customer uptake and market penetration for these novel solutions are still developing.

- R&D Investment: Aris continues to allocate resources to refine and prove the efficacy of these emerging technologies.

- Strategic Focus: Diversifying beyond core oil and gas services through technology commercialization is a key strategic objective.

Aris Water's new technologies for wastewater treatment, especially those targeting markets beyond oil and gas, represent significant growth potential but are currently in early adoption phases. These innovations, such as advanced filtration systems for municipal or industrial effluent, require further investment to achieve market leadership. This strategic focus on diversifying through technology commercialization positions these offerings as potential question marks needing development to capture their full market opportunity.

| Aris Water Business Unit | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| New Water Treatment Technologies (Beyond O&G) | High | Low | Question Mark |

| Mineral Extraction (e.g., Iodine) | High | Low | Question Mark |

| Agricultural Water Reuse | High | Low | Question Mark |

| Industrial Water & Wastewater Treatment (Post-Crosstek) | High | Low | Question Mark |

| Surface Income (McNeill Ranch) | High | Low | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position Aris Water's portfolio.