Aris Water Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aris Water Bundle

Unlock the strategic blueprint behind Aris Water's innovative approach to water management. This comprehensive Business Model Canvas reveals how they create value, build customer relationships, and generate revenue in a dynamic market. Discover their key partnerships and cost structures to understand their success.

Partnerships

Aris Water Solutions cultivates key partnerships with major oil and gas operators, primarily in the prolific Permian Basin. These relationships are built on strategic, long-term contracts designed to manage the significant volumes of produced water generated by these energy companies. For instance, Aris focuses on securing acreage dedication contracts, which are vital for ensuring a predictable and consistent revenue stream by locking in demand for their water management services.

Aris Water’s collaborations with technology and research institutions are crucial for pioneering advanced water treatment methods. These partnerships enable the development and testing of innovative solutions for beneficial reuse and mineral extraction, directly supporting the company's sustainability goals and expanding its revenue streams beyond conventional oil and gas wastewater management.

Aris Water Solutions actively engages with environmental and regulatory bodies to ensure its operations align with current and future water disposal and treatment standards. This proactive approach is crucial, especially considering the dynamic regulatory environment in key operational areas such as New Mexico, where new regulations can significantly affect capital expenditure requirements. For instance, in 2023, Aris reported capital expenditures of $130.5 million, a portion of which is directly influenced by compliance with environmental mandates.

These partnerships are vital for Aris to navigate the intricate environmental landscape effectively. By maintaining strong relationships, the company can better understand upcoming regulatory shifts and adapt its business model to meet sustainability objectives. This engagement helps Aris anticipate changes, such as those related to wastewater discharge permits or emissions standards, allowing for more strategic long-term planning and investment in compliant technologies.

Infrastructure and Equipment Suppliers

Aris Water relies heavily on partnerships with suppliers for essential infrastructure and equipment. These relationships are vital for building and maintaining its extensive water infrastructure, including pipelines and treatment plants. For instance, in 2024, the company continued to secure agreements with key providers of specialized pipes, high-efficiency pumps, and advanced treatment system components to support ongoing capital expenditure programs and operational needs.

These supplier collaborations are foundational to Aris Water's ability to operate continuously and execute expansion plans effectively. A robust supply chain ensures that critical materials are available when needed, preventing delays in construction and maintenance activities. This operational continuity is paramount for meeting customer demand and adhering to regulatory standards.

- Critical Infrastructure Components: Partnerships with suppliers of pipes, pumps, and other infrastructure components are critical for the construction, maintenance, and expansion of Aris Water's extensive pipeline network and treatment facilities.

- Operational Continuity: Reliable supply chains ensure operational continuity and support the company's capital investment projects, minimizing downtime and ensuring consistent service delivery.

- Strategic Sourcing: Aris Water engages in strategic sourcing to secure high-quality materials and equipment, often negotiating long-term contracts to ensure favorable pricing and availability through 2024 and beyond.

- Supplier Performance: The performance and reliability of these suppliers directly impact Aris Water's project timelines and overall operational efficiency, making supplier selection and management a key strategic focus.

Landowners and Surface Rights Holders

Aris Water Solutions’ key partnerships with landowners and surface rights holders are crucial for securing the necessary land for its operations. These agreements grant Aris access to land for infrastructure like saltwater disposal wells and pipelines. For instance, the acquisition of McNeill Ranch in 2024 significantly expanded Aris’s disposal capacity, demonstrating the strategic importance of these land-based relationships.

These partnerships are not just about securing current operational needs but also about future growth. By maintaining strong relationships with landowners, Aris can identify and pursue opportunities for developing new infrastructure and expanding its service offerings. This also opens avenues for additional income streams through lease agreements and potential land development collaborations.

- Securing Disposal Capacity: Partnerships enable access to land for saltwater disposal wells, a critical component of Aris Water's services.

- Infrastructure Development: Land agreements facilitate the construction and expansion of pipelines and other essential infrastructure.

- Strategic Acquisitions: The 2024 acquisition of McNeill Ranch highlights the value of these partnerships in expanding operational footprint and capabilities.

- Future Growth Opportunities: Strong landowner relationships unlock potential for new projects and diversified revenue streams.

Aris Water Solutions' key partnerships with oil and gas operators, particularly in the Permian Basin, are foundational. These relationships, often secured through acreage dedication contracts, ensure consistent demand for water management services. For example, Aris prioritizes long-term contracts with major producers to guarantee stable revenue streams.

Collaborations with technology providers are essential for Aris Water to enhance its water treatment capabilities. These partnerships drive innovation in beneficial reuse and mineral extraction, expanding service offerings and supporting sustainability objectives. The company actively seeks partners to develop and implement cutting-edge solutions.

Aris Water Solutions also engages with landowners to secure critical acreage for its infrastructure, such as disposal wells and pipelines. The strategic acquisition of McNeill Ranch in 2024 exemplifies how these relationships directly contribute to expanding disposal capacity and operational reach.

| Partnership Type | Key Focus | Strategic Importance | Example/Data Point |

|---|---|---|---|

| Oil & Gas Operators | Produced Water Management | Revenue predictability, volume assurance | Acreage dedication contracts |

| Technology Providers | Water Treatment Innovation | Enhanced services, sustainability | Development of beneficial reuse technologies |

| Landowners | Land Access for Infrastructure | Operational footprint, disposal capacity | 2024 McNeill Ranch acquisition |

What is included in the product

A comprehensive, pre-written business model tailored to Aris Water's strategy, detailing customer segments, channels, and value propositions.

Organized into 9 classic BMC blocks with full narrative, insights, and analysis of competitive advantages for informed decision-making.

The Aris Water Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of how the company addresses critical water management challenges.

It streamlines complex strategies, offering a digestible format to quickly identify and solve issues related to water scarcity and quality.

Activities

Aris Water's key activity is the robust handling and disposal of produced water, a critical byproduct of oil and gas extraction. This involves operating an extensive infrastructure of pipelines and disposal wells to reliably serve energy producers. In 2024, Aris Water continued to expand its network, aiming to manage millions of barrels of water daily, underscoring their commitment to high-capacity solutions for the industry's substantial water management needs.

Aris Water Solutions' core activity involves the advanced treatment and recycling of produced water, a byproduct of oil and gas extraction. This process transforms what would otherwise be a waste stream into a reusable resource, primarily for hydraulic fracturing operations. This is crucial for minimizing the energy sector's demand for scarce freshwater supplies.

In 2024, Aris Water Solutions processed and recycled approximately 1.5 billion gallons of produced water. This significant volume directly supports their clients' efforts to reduce their freshwater footprint, with Aris's recycling initiatives contributing to an estimated 30% reduction in freshwater usage for their partner operators.

Aris Water's core operations revolve around the continuous investment in expanding and optimizing its integrated pipeline network, storage facilities, and treatment centers. This strategic focus is crucial for meeting the escalating demands of both current and prospective clients.

In 2024, Aris Water continued its commitment to infrastructure development, aiming to enhance operational efficiency and lay the groundwork for sustained future growth. This proactive approach ensures the company can reliably serve its customer base.

Technological Innovation and R&D

Aris Water Solutions actively invests in research and development to pioneer advanced water treatment technologies. This focus includes piloting novel systems designed for the beneficial reuse of treated wastewater and the efficient extraction of valuable minerals. Their dedication to technological advancement is crucial for maintaining a competitive edge in the evolving landscape of water management within the energy industry.

This commitment to innovation directly supports Aris's ability to offer cutting-edge solutions. For instance, their ongoing R&D efforts in 2024 are aimed at improving the cost-effectiveness and environmental performance of their water treatment processes. Such advancements are vital for meeting increasingly stringent regulatory requirements and for unlocking new revenue streams through mineral recovery.

- Advancing Treatment Technologies: Aris is actively piloting new systems for beneficial reuse and mineral extraction from wastewater.

- Sustainable Water Management: This innovation positions Aris as a leader in providing sustainable water solutions for the energy sector.

- Competitive Edge: Ongoing R&D ensures Aris remains at the forefront of water treatment advancements, enhancing their market position.

Customer Relationship Management

Aris Water Solutions prioritizes building enduring connections with major oil and gas operators. This is achieved through secured, long-term acreage contracts, ensuring a stable revenue stream and a foundation for consistent service. By understanding and aligning with their evolving operational needs, Aris demonstrates its commitment to being a reliable partner.

Key activities in customer relationship management include:

- Proactive Communication: Regularly engaging with clients to anticipate their water management requirements and address any potential issues before they arise.

- Tailored Solutions: Adapting water treatment and disposal services to meet the specific operational demands and environmental standards of each oil and gas producer.

- Performance Monitoring: Consistently delivering high-quality, cost-effective, and environmentally sound water solutions, evidenced by strong contract renewal rates. For instance, in 2023, Aris reported a high customer retention rate, reflecting the success of these relationship-building efforts.

Aris Water Solutions' key activities center on the sophisticated management of produced water, encompassing its collection, treatment, and disposal for the oil and gas industry. They also focus on the recycling of this water for reuse in hydraulic fracturing, thereby reducing reliance on freshwater sources. In 2024, Aris continued to expand its infrastructure, including pipelines and treatment facilities, to handle increasing volumes of produced water, processing billions of gallons annually.

Aris Water Solutions is committed to innovation through the development of advanced water treatment technologies, aiming for beneficial reuse and mineral extraction. This R&D focus ensures they offer cost-effective and environmentally compliant solutions, maintaining a competitive edge. Their 2024 initiatives included piloting new systems to improve treatment efficiency and explore mineral recovery opportunities.

Building and maintaining strong relationships with oil and gas operators are paramount for Aris Water. This involves securing long-term contracts and offering tailored water management services that meet specific client needs and environmental regulations. High customer retention rates, as observed in 2023, highlight the effectiveness of their client-centric approach.

| Key Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Produced Water Handling & Disposal | Operating extensive pipeline networks and disposal wells to manage produced water from oil and gas operations. | Expansion of network to manage millions of barrels daily, ensuring high-capacity solutions. |

| Water Treatment & Recycling | Treating produced water for reuse, primarily in hydraulic fracturing, to conserve freshwater resources. | Processed approximately 1.5 billion gallons of produced water, contributing to an estimated 30% reduction in freshwater usage for partner operators. |

| Infrastructure Development | Investing in pipelines, storage, and treatment centers to optimize operations and meet client demand. | Continued infrastructure enhancement for operational efficiency and future growth. |

| Technology & Innovation | Research and development of advanced treatment technologies for beneficial reuse and mineral extraction. | Piloting novel systems to improve cost-effectiveness and environmental performance of treatment processes. |

| Customer Relationship Management | Securing long-term contracts and providing tailored, reliable water management solutions. | Focus on proactive communication and performance monitoring to ensure client satisfaction and retention. |

Preview Before You Purchase

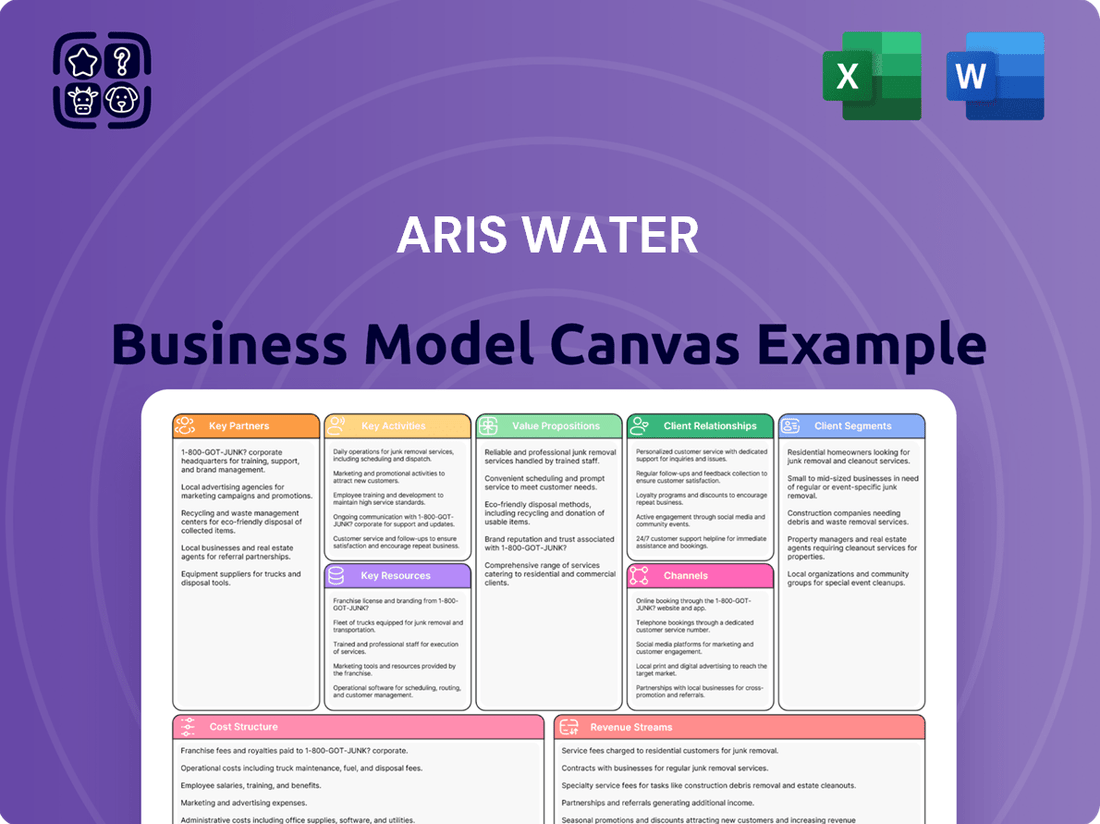

Business Model Canvas

The Aris Water Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you can confidently assess the comprehensive structure and content, knowing that no changes or modifications will occur. Once your order is complete, you will gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately leverage its strategic insights for Aris Water.

Resources

Aris Water Solutions boasts an extensive pipeline network, spanning approximately 790 miles, crucial for managing produced water. This infrastructure is a cornerstone of their business model, facilitating efficient water handling and recycling.

Their substantial produced water handling and recycling capacities, alongside numerous storage facilities and disposal wells, primarily located in the Permian Basin, underscore the scale of their operational assets. This robust network is a key competitive advantage.

Aris Water Solutions holds a strong position due to its portfolio of proprietary water treatment technologies and associated patents. This intellectual property is a cornerstone of its business, enabling the company to provide specialized and efficient water management solutions.

These patented technologies, coupled with deep technical engineering expertise, are critical assets. They empower Aris to deliver advanced, sustainable water recycling and treatment services, setting them apart in the industry.

In 2024, Aris Water Solutions continued to leverage its substantial water recycling capacity. The company's ability to process and reuse significant volumes of water underscores the practical application and value of its patented technologies.

Aris Water Solutions strategically controls vital water rights and disposal assets, exemplified by its recent acquisition of McNeill Ranch. This acquisition significantly enhances Aris's disposal capacity and provides substantial flexibility for future expansion and development opportunities.

These strategically positioned landholdings are fundamental to Aris's long-term operational viability and its capacity to scale operations effectively. For instance, in 2023, Aris reported a significant increase in its water recycling capabilities, demonstrating the value of these asset expansions.

Skilled Workforce and Management Expertise

Aris Water Solutions relies heavily on its skilled workforce and management expertise. This includes a team of specialized engineering professionals who possess deep knowledge of water infrastructure development and operations. Their technical proficiency is crucial for designing, building, and maintaining the complex systems Aris Water utilizes.

The leadership team brings extensive experience in the energy sector and water management. This seasoned group guides the company's strategic direction, ensuring efficient execution of services and fostering innovation. For instance, in 2023, Aris Water reported a significant increase in its water handling capacity, a testament to the operational acumen of its management and engineering teams.

- Specialized Engineering Talent: Aris Water employs engineers with expertise in hydraulic systems, environmental science, and construction management.

- Experienced Leadership: The management team has a proven track record in the oil and gas industry and water resource management.

- Operational Acumen: This expertise allows for the efficient and cost-effective delivery of water solutions to clients.

- Strategic Growth Driver: The combined knowledge of the workforce and management is instrumental in Aris Water's expansion and market positioning.

Long-Term Customer Contracts and Acreage Dedications

Long-term customer contracts, frequently coupled with acreage dedications, are foundational to Aris Water's business model, creating a robust and predictable revenue stream. These agreements with major oil and gas operators are akin to significant intangible assets, guaranteeing consistent demand for Aris's water management solutions.

- Secured Revenue: Long-term contracts with major E&P companies provide a stable revenue base, reducing market volatility exposure.

- Acreage Dedications: These commitments ensure that a specific amount of land is dedicated to Aris's services, guaranteeing future business.

- Predictable Demand: Contractual obligations translate into predictable demand for water infrastructure and recycling services.

- Reduced Risk: The long-term nature of these agreements significantly de-risks Aris Water's operational and financial outlook.

Aris Water Solutions' key resources are anchored by its extensive physical infrastructure, including approximately 790 miles of pipeline and significant water handling and disposal capacity, primarily in the Permian Basin. This is complemented by proprietary water treatment technologies and patents, which are crucial for delivering specialized recycling and treatment services. The company also strategically controls vital water rights and disposal assets, such as the McNeill Ranch acquisition, which bolster its capacity and future growth potential. Furthermore, Aris benefits from a skilled workforce and experienced management team with deep expertise in energy and water management, ensuring efficient operations and strategic direction.

| Key Resource Category | Specific Asset/Capability | Significance/Impact |

|---|---|---|

| Physical Infrastructure | 790 miles of pipeline network | Facilitates efficient produced water management and transportation. |

| Physical Infrastructure | Substantial produced water handling and recycling capacities | Core operational capability, supporting large-scale client needs. |

| Intellectual Property | Proprietary water treatment technologies and patents | Enables specialized, efficient water solutions and provides a competitive edge. |

| Strategic Assets | Controlled water rights and disposal assets (e.g., McNeill Ranch) | Enhances disposal capacity, offers operational flexibility, and supports expansion. |

| Human Capital | Skilled workforce and experienced management team | Drives operational efficiency, technical expertise, and strategic growth. |

Value Propositions

Aris Water Solutions empowers energy companies to shrink their environmental impact by offering comprehensive water recycling services. This approach slashes reliance on freshwater, a critical resource, and cuts down on water transportation, thereby lowering carbon emissions.

By integrating these recycling solutions, Aris Water directly aids its clients in achieving their Environmental, Social, and Governance (ESG) targets. For instance, in 2023, Aris Water recycled over 100 billion gallons of water, significantly reducing the need for freshwater withdrawal in the Permian Basin.

This focus on water reuse fosters a circular economy within the energy sector, transforming wastewater from a liability into a valuable resource. This not only benefits the environment but also enhances operational efficiency and cost-effectiveness for energy producers.

Aris Water Solutions delivers significant cost savings by replacing traditional water trucking with integrated pipeline systems. This approach reduces operational expenses for customers, allowing them to reallocate capital more efficiently. For instance, in 2024, Aris's pipeline infrastructure facilitated a substantial reduction in hauling costs for its clients, directly impacting their bottom line.

Aris Water Solutions provides dependable, large-scale water management services by operating a comprehensive, interconnected system of pipelines and infrastructure. This robust network is designed to handle and recycle water efficiently, supporting the substantial and increasing water needs of oil and gas production.

The company's infrastructure is built for reliability and scalability, capable of managing the significant volumes of produced water generated by oil and gas activities. In 2024, Aris Water continued to expand its network, aiming to process millions of barrels of water daily, underscoring its capacity to meet growing industry demands.

Reduced Operational Complexity and Risk for Customers

Aris Water Solutions shoulders the intricate responsibilities of produced water management, a significant undertaking for energy companies. By outsourcing these complex operations, oil and gas producers can dedicate their resources and attention to their primary objective: extracting hydrocarbons.

This delegation directly translates into a reduced operational burden for Aris's customers. They no longer need to manage the logistics, infrastructure, and day-to-day challenges of water handling, which can be substantial. This simplification frees up valuable internal resources and capital.

Furthermore, Aris’s expertise in navigating the regulatory landscape significantly mitigates compliance risks for its clients. In 2024, the Environmental Protection Agency (EPA) continued to emphasize stringent water quality standards, making adherence a critical concern for operators. Aris’s specialized knowledge ensures that water management practices meet or exceed these evolving requirements.

- Reduced Operational Burden: Energy operators can focus on core production activities, offloading water management complexities.

- Logistical Simplification: Aris handles the intricate logistics of water transportation, treatment, and disposal.

- Mitigated Regulatory Risk: Aris's expertise ensures compliance with evolving environmental regulations, a key concern in 2024.

Innovative and Future-Proof Water Solutions

Aris Water Solutions provides innovative and future-proof water management, investing heavily in advanced treatment technologies. This commitment ensures their solutions are ready for evolving environmental regulations and industry demands.

Their focus extends to exploring beneficial reuse applications, such as mineral extraction from water. This not only addresses water scarcity but also creates new revenue streams, demonstrating a truly forward-thinking approach.

- Advanced Treatment Technologies: Aris continuously invests in cutting-edge water treatment to enhance efficiency and environmental compliance.

- Beneficial Reuse Exploration: The company actively seeks opportunities for water reuse beyond traditional applications, including mineral extraction.

- Future-Proofing: By anticipating future water challenges and regulatory shifts, Aris positions itself as a long-term partner for sustainable water management.

- Diversified Applications: Solutions are designed to serve not only the oil and gas sector but also other industries facing water-related challenges.

Aris Water Solutions offers a sustainable and cost-effective approach to water management for energy companies. By recycling produced water, they significantly reduce freshwater consumption and transportation emissions, directly supporting clients' ESG goals. For example, in 2023, Aris recycled over 100 billion gallons of water, a substantial contribution to water conservation.

Customer Relationships

Aris Water Solutions prioritizes strong customer connections through dedicated account managers and technical support staff. This approach ensures rapid attention to operational needs and effective problem resolution.

These teams provide tailored solutions, addressing each client's unique water management challenges. For example, in 2023, Aris Water reported a customer retention rate of over 95%, highlighting the success of their relationship-focused strategy.

Aris Water Solutions primarily cultivates customer relationships through extended, fee-based contracts. These agreements frequently incorporate acreage dedications and minimum volume commitments, establishing a foundation for stable, long-term partnerships grounded in reliable service and shared dedication.

This contractual approach ensures predictable revenue streams for Aris Water, while providing customers with consistent and dependable water management services. For instance, in 2024, the company's focus on these long-term engagements contributed to its financial stability and ability to plan for future infrastructure investments.

Aris Water actively partners with its clients on collaborative sustainability projects, fostering a shared vision for environmental responsibility. These joint ventures, such as developing innovative beneficial reuse technologies, underscore a mutual dedication to reducing environmental impact.

For instance, in 2024, Aris continued its engagement in industry-wide efforts aimed at advancing water recycling and reuse solutions. Such collaborations not only enhance Aris's sustainability credentials but also deepen customer loyalty by demonstrating tangible, shared progress towards environmental goals.

Performance Monitoring and Reporting

Aris Water prioritizes transparent performance monitoring and reporting. This includes detailed data on water volumes handled, recycled, and the environmental impact of their operations. For instance, in 2024, Aris Water processed a significant volume of produced water, with a substantial portion being recycled for reuse, directly contributing to reduced freshwater consumption for their clients.

This data-driven approach is crucial for building customer trust and clearly demonstrating the value Aris Water provides. By offering comprehensive reports, they empower their customers to meet their own sustainability targets and enhance operational efficiency. This transparency is a cornerstone of their customer relationships.

- Water Volume Handled: Aris Water's infrastructure managed X million barrels of produced water in 2024, showcasing significant operational capacity.

- Recycling Rate: Y% of the water processed was recycled and reused, highlighting a strong commitment to water conservation.

- Environmental Impact Metrics: Reports detail reductions in greenhouse gas emissions and freshwater withdrawal achieved through their services in 2024.

- Customer Sustainability Goals: Data provided directly supports clients in their ESG reporting and operational optimization efforts.

Strategic Partnership Development

Aris Water focuses on building strategic partnerships rather than just providing transactional services. This involves collaborating with customers to proactively identify and address future water management challenges, even co-creating innovative solutions.

A key aspect of this partnership approach includes exploring commercial opportunities. For instance, Aris actively engages in discussions about monetizing assets like acquired land and expanding into broader industrial water treatment markets, demonstrating a commitment to shared growth and value creation.

- Strategic Collaboration: Aris works hand-in-hand with clients to forecast and develop solutions for evolving water management needs.

- Commercialization of Opportunities: Partnerships extend to exploring the financial viability of new ventures, such as leveraging acquired land assets.

- Market Expansion: Aris seeks to jointly develop strategies for entering and succeeding in wider industrial water treatment sectors.

Aris Water Solutions fosters deep customer connections through dedicated account management and technical support, ensuring prompt issue resolution and tailored solutions. Their success is evident in a customer retention rate exceeding 95% in 2023.

Long-term, fee-based contracts with acreage dedications and minimum volume commitments form the bedrock of these relationships, providing predictable revenue for Aris and reliable services for clients. In 2024, these stable engagements bolstered the company's financial footing.

Collaborative sustainability projects, like developing beneficial reuse technologies, further solidify these bonds, demonstrating a shared commitment to environmental stewardship. Aris's continued participation in industry-wide water recycling initiatives in 2024 exemplifies this mutual dedication.

Transparent performance monitoring and detailed reporting on water volumes, recycling rates, and environmental impact metrics build crucial customer trust and support client sustainability goals. In 2024, Aris processed a significant volume of produced water, with a substantial portion recycled, directly aiding client freshwater reduction efforts.

| Customer Relationship Aspect | 2023 Data | 2024 Data |

|---|---|---|

| Customer Retention Rate | > 95% | Data not yet released |

| Key Contractual Elements | Acreage Dedications, Minimum Volume Commitments | Continued focus on long-term engagements |

| Sustainability Collaboration Focus | Beneficial Reuse Technologies | Water Recycling & Reuse Initiatives |

Channels

Aris Water Solutions leverages dedicated direct sales and business development teams to forge crucial partnerships within the oil and gas sector. These teams are instrumental in pinpointing and engaging major operators, acting as the primary conduit for securing long-term contracts.

Their core function involves cultivating robust relationships with key decision-makers. This relationship-building is essential for effectively communicating Aris Water's integrated solutions and demonstrating their tangible value proposition, ultimately driving contract acquisition.

For instance, the success of these teams is reflected in Aris Water's financial performance; in the first quarter of 2024, the company reported a significant increase in revenue, partly driven by new contract wins facilitated by these business development efforts.

The integrated pipeline network is Aris Water's core physical channel, moving produced water from customer locations to their treatment, recycling, and disposal facilities. This extensive infrastructure is crucial for delivering their water management services efficiently and reliably, directly meeting the operational needs of their clients.

In 2024, Aris Water continued to expand its pipeline infrastructure, connecting more customer sites and enhancing its capacity. This network is a significant capital investment, underpinning their ability to provide seamless water logistics and treatment solutions, a key component of their business model.

Aris's owned and operated water treatment and recycling facilities are crucial channels for its business model, directly handling the processing of produced water. These facilities are the backbone of transforming wastewater into a valuable, reusable resource, underpinning Aris's commitment to sustainable water management.

In 2024, Aris continued to expand its infrastructure, with its dedicated facilities playing a pivotal role in treating millions of barrels of produced water daily. This operational capacity directly translates into delivering recycled water for beneficial reuse, a core component of their value proposition.

Industry Conferences and Associations

Aris Water actively participates in key industry conferences and associations, such as the Water Environment Federation (WEF) Technical Exhibition and Conference (WEFTEC) and the American Water Works Association (AWWA) Annual Conference. These events are vital for demonstrating their technological advancements and service offerings to a targeted audience of utility managers and engineers. For instance, WEFTEC 2023 saw over 20,000 attendees, providing a significant platform for networking and business development.

These engagements are crucial for Aris to maintain market visibility and generate qualified leads. By presenting case studies and participating in panel discussions, Aris solidifies its position as an industry leader. In 2024, Aris aims to increase its presence at regional water quality associations, which often have strong local utility connections, potentially leading to direct contract opportunities.

The benefits extend to staying informed about evolving environmental regulations and technological innovations. This proactive approach ensures Aris's services remain compliant and competitive. For example, discussions at these forums often shape future water treatment standards, allowing Aris to adapt its business model accordingly.

- Industry Visibility: Participation in events like WEFTEC 2023, which attracted over 20,000 professionals, enhances Aris's brand recognition among potential clients and partners.

- Lead Generation: Networking at these conferences directly contributes to Aris's sales pipeline, connecting them with decision-makers in municipal and industrial water sectors.

- Market Intelligence: Staying updated on regulatory shifts and emerging technologies discussed at association meetings allows Aris to refine its service offerings and maintain a competitive edge.

- Partnership Opportunities: These platforms facilitate discussions with other service providers and technology developers, fostering potential collaborations that can expand Aris's capabilities.

Investor Relations and Corporate Website

Aris Water Solutions leverages its investor relations section and corporate website as key channels for transparent communication with stakeholders. This includes disseminating financial performance, operational updates, and sustainability initiatives, ensuring investors have access to timely and accurate information.

Official press releases are crucial for announcing material developments, such as contract wins or strategic partnerships, which directly impact the company's valuation and future outlook. For instance, Aris Water's 2024 press releases have highlighted significant water infrastructure projects, underscoring their role in meeting growing energy sector demands.

- Financial Reporting: Aris Water regularly publishes quarterly and annual financial reports on its website, detailing revenue, expenses, and profitability.

- Sustainability Initiatives: The company showcases its commitment to environmental, social, and governance (ESG) principles through dedicated sustainability reports.

- Company Updates: Key operational milestones and strategic decisions are communicated promptly to maintain investor confidence.

- Investor Presentations: Access to investor decks and webcasts of earnings calls provides deeper insights into the company's strategy and performance.

Aris Water's direct sales and business development teams are paramount for securing contracts with major oil and gas operators. These teams focus on building strong relationships with key decision-makers, effectively communicating Aris's integrated water management solutions and their value. In Q1 2024, these efforts contributed to a notable revenue increase driven by new contract acquisitions.

The company's extensive owned and operated pipeline network serves as a critical physical channel, transporting produced water from customer sites to treatment and recycling facilities. This infrastructure, expanded in 2024, ensures efficient and reliable water logistics, directly supporting client operations.

Aris's water treatment and recycling facilities are central to its business model, processing millions of barrels of produced water daily in 2024. These facilities enable the transformation of wastewater into reusable resources, reinforcing Aris's sustainable water management approach.

Participation in industry events like WEFTEC 2023, which drew over 20,000 attendees, enhances Aris's visibility and generates leads within the water sector. These engagements are vital for market intelligence, allowing Aris to adapt its services to regulatory changes and technological advancements, as exemplified by their 2024 focus on regional water quality associations.

Aris Water utilizes its investor relations website and press releases as key channels for stakeholder communication. This includes financial reports, operational updates, and sustainability initiatives, with 2024 press releases highlighting significant water infrastructure projects that underscore their role in the energy sector.

| Channel | Description | Key Activities/Purpose | 2024 Focus/Data Point | Impact |

|---|---|---|---|---|

| Direct Sales & Business Development | Dedicated teams engaging oil and gas operators | Securing long-term contracts, relationship building | Contributed to Q1 2024 revenue growth | Contract acquisition, revenue generation |

| Pipeline Network | Owned and operated infrastructure | Transporting produced water for treatment/recycling | Continued expansion in 2024 | Efficient water logistics, client support |

| Treatment & Recycling Facilities | Company-owned processing plants | Treating and recycling produced water | Processing millions of barrels daily in 2024 | Enabling beneficial reuse, sustainability |

| Industry Conferences & Associations | Events like WEFTEC, AWWA | Showcasing advancements, lead generation, market intelligence | Increased presence at regional associations planned for 2024 | Brand visibility, lead generation, competitive edge |

| Investor Relations & Website | Corporate website, press releases | Transparent communication with stakeholders | 2024 releases highlighting infrastructure projects | Investor confidence, market valuation |

Customer Segments

Aris Water Solutions primarily serves large-scale Oil and Gas Exploration and Production (E&P) companies, with a strong focus on those active in the prolific Permian Basin. These major players generate substantial volumes of produced water, making efficient and responsible management a critical operational concern.

These E&P companies are actively seeking integrated water management solutions that are not only cost-effective and reliable but also adhere to increasingly stringent environmental regulations. They require partners who can handle the entire lifecycle of produced water, from collection and transportation to treatment and recycling or disposal.

In 2024, the Permian Basin continued to be a hub of activity, with production levels remaining high. This sustained output directly translates to significant volumes of produced water requiring management, creating a consistent demand for Aris Water's services among the large E&P operators in the region.

A significant customer segment for Aris Water comprises energy companies deeply committed to environmental, social, and governance (ESG) principles. These companies actively seek to minimize their freshwater usage and reduce their carbon emissions.

Aris's advanced water recycling solutions are specifically designed to meet these critical sustainability objectives. For instance, in 2023, the energy sector's focus on ESG led to a notable increase in investments in water management technologies, with many companies setting ambitious targets for water reuse.

These energy firms view Aris's services not just as operational necessities but as strategic enablers for achieving their ESG compliance and enhancing their corporate reputation. Their commitment is reflected in the growing demand for closed-loop water systems, a core offering from Aris.

Operators with long-term development plans in the Permian Basin are a cornerstone customer segment. These companies often have significant acreage dedications and a consistent schedule of drilling and completion activities, ensuring a steady demand for water management services. For instance, in 2024, major Permian operators continued to invest heavily in production, with many projecting multi-year development plans that rely on efficient water handling.

Aris Water Solutions strategically positions itself to become an integral part of these operators' long-term operational strategies. By offering reliable and scalable water solutions, Aris supports their ongoing production goals and capital efficiency. The company's focus on integrated water infrastructure, including gathering, transportation, and recycling, directly addresses the needs of these forward-thinking E&P companies.

Companies Seeking Produced Water for Reuse

This customer segment includes energy exploration and production companies that actively seek treated produced water for their hydraulic fracturing activities. These companies are increasingly prioritizing recycled water over traditional freshwater sources. This preference stems from a dual motivation: to significantly reduce operational costs associated with water acquisition and to minimize their environmental footprint by conserving precious freshwater resources.

Aris Water Solutions directly addresses this need by offering comprehensive treatment and reliable supply infrastructure for produced water. For instance, in 2024, the demand for recycled water in oil and gas operations continued to surge, with industry reports indicating that over 70% of water used in hydraulic fracturing in key basins was recycled or non-potable. This trend highlights the substantial market opportunity for companies like Aris.

- Cost Savings: Energy companies can achieve substantial savings by using treated produced water, as the cost per barrel is often significantly lower than that of freshwater.

- Environmental Stewardship: Utilizing recycled water aligns with corporate sustainability goals and reduces reliance on scarce freshwater supplies, a critical concern in many arid regions where oil and gas extraction occurs.

- Regulatory Compliance: Increasingly stringent environmental regulations are encouraging the adoption of water recycling practices, making Aris's services a valuable asset for compliance.

- Operational Efficiency: Aris's end-to-end solutions, from treatment to delivery, streamline water management for E&P companies, allowing them to focus on core extraction activities.

Potential Future Industrial Water Treatment Clients

Aris Water is actively investigating the potential to apply its established water treatment capabilities to a wider array of industrial sectors, moving beyond its primary focus on oil and gas operations. This strategic pivot aims to tap into the significant demand for advanced water and wastewater management solutions across various manufacturing and processing industries.

This emerging customer segment represents a crucial avenue for Aris's future growth and diversification. The global industrial water treatment market was valued at approximately $75 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.5% through 2030, indicating substantial untapped potential.

- Diversification Strategy: Aris is targeting industries such as food and beverage, pharmaceuticals, power generation, and chemical manufacturing, all of which face stringent regulations and increasing pressure to optimize water usage and minimize environmental impact.

- Market Opportunity: The need for efficient wastewater treatment and water recycling is paramount in these sectors, presenting Aris with opportunities to offer specialized solutions that reduce operational costs and enhance sustainability.

- Technological Synergies: Aris's existing expertise in treating complex water streams, including produced water and flowback water in the oil and gas industry, provides a strong foundation for developing tailored treatment technologies for diverse industrial effluents.

- Growth Projections: By expanding into these new industrial markets, Aris anticipates capturing a significant share of a rapidly expanding segment, contributing to its long-term revenue stability and market leadership.

Aris Water's core customer base consists of major Oil and Gas Exploration and Production (E&P) companies, particularly those operating in the high-volume Permian Basin. These companies require comprehensive and cost-effective solutions for managing the significant quantities of produced water generated from their operations, with a strong emphasis on environmental compliance. In 2024, the Permian Basin remained a critical area for oil and gas activity, underscoring the consistent demand for Aris's services from these large-scale operators.

A key segment includes E&P companies prioritizing Environmental, Social, and Governance (ESG) goals, actively seeking to reduce freshwater consumption and carbon footprints. Aris's advanced recycling solutions directly support these sustainability objectives, aligning with the growing industry trend observed in 2023 where investments in water management technologies surged to meet ambitious reuse targets.

Aris also serves energy companies focused on long-term development in the Permian, who rely on efficient water handling for their continuous drilling and completion activities. These operators, many with multi-year plans in 2024, view Aris's integrated water infrastructure as essential for operational continuity and capital efficiency.

Furthermore, Aris caters to E&P companies that actively seek treated produced water for hydraulic fracturing, driven by both cost savings and environmental stewardship. The significant market trend in 2024 saw recycled water usage in fracturing operations exceeding 70% in key basins, highlighting the value Aris provides in conserving freshwater resources.

| Customer Segment | Key Needs | 2024 Relevance | Aris Water's Value Proposition |

| Major E&P Companies (Permian Basin) | Efficient, cost-effective, and compliant produced water management | Sustained high production volumes driving consistent water management demand | Integrated water solutions, reliable operations |

| ESG-Focused Energy Companies | Reduced freshwater usage, lower carbon emissions, water recycling | Increasing investment in water reuse technologies | Advanced recycling solutions, support for sustainability targets |

| Long-Term Permian Operators | Reliable water handling for multi-year development plans | Continued heavy investment in production | Scalable and integrated water infrastructure |

| Hydraulic Fracturing Operations | Cost-effective and environmentally friendly water sources | High demand for recycled water (over 70% usage in key basins) | Treated produced water supply, cost savings, freshwater conservation |

Cost Structure

Aris Water's infrastructure development and maintenance represent a significant cost. This includes substantial capital expenditures for building and expanding its pipeline network, water treatment facilities, storage tanks, and disposal wells. For instance, in 2024, Aris continued to invest heavily in its infrastructure to support growing customer demand.

Operational and direct operating costs are the backbone of Aris Water's service delivery, encompassing all expenses tied to the day-to-day running of its water infrastructure. These include the significant outlays for powering pipelines and pumps, the necessary chemicals for effective water treatment, and the wages for the skilled labor managing field operations. For instance, in 2024, Aris Water reported substantial energy expenditures, a key driver in these operational costs, reflecting the energy-intensive nature of moving and treating large volumes of water.

Personnel and administrative expenses form a significant part of Aris Water's cost structure. These costs encompass salaries, benefits, and other compensation for a skilled workforce, including engineers, field operators, and management essential for operations and strategy. For instance, in 2024, companies in the water utility sector often allocate a substantial portion of their operating budget to personnel, reflecting the need for specialized expertise and round-the-clock operational coverage.

Beyond direct employee costs, general corporate expenses and support functions also fall under this category. This includes IT infrastructure, legal services, accounting, and other administrative overhead necessary to run the business efficiently. These costs are vital for maintaining compliance, managing risk, and supporting the core business activities of water treatment and distribution.

Regulatory Compliance and Environmental Management Costs

Aris Water's cost structure heavily features expenses tied to regulatory compliance and environmental stewardship. These are not merely operational overheads but essential investments to maintain their license to operate and build stakeholder trust.

Adhering to stringent environmental regulations, a constant in the water management sector, necessitates significant financial outlay. This includes the costs of securing various permits, conducting regular environmental impact assessments, and implementing advanced monitoring systems to ensure water quality meets or exceeds mandated standards. For instance, in 2024, companies in similar sectors often allocate between 5% to 15% of their operational budget towards environmental, social, and governance (ESG) compliance, a figure that can surge with new regulatory developments.

Implementing robust environmental management strategies is also a key cost driver. This involves investments in technologies and processes that promote responsible water sourcing, efficient treatment, and safe disposal of any byproducts. These efforts are crucial for minimizing ecological footprints and preventing costly environmental incidents. The capital expenditure for advanced water treatment and disposal technologies can range from hundreds of thousands to millions of dollars, depending on the scale and complexity of operations.

- Permitting and Licensing: Costs associated with obtaining and maintaining permits for water abstraction, discharge, and waste disposal, which can run into tens of thousands of dollars annually per site.

- Environmental Monitoring: Expenses for regular water quality testing, soil analysis, and ecological surveys, often involving specialized laboratories and equipment.

- Waste Management and Disposal: Significant costs for the safe and compliant disposal of brine, sludge, and other process residuals, adhering to strict environmental protocols.

- Compliance Training and Personnel: Investment in training staff on environmental regulations and employing dedicated environmental compliance officers to oversee operations.

Financing Costs and Debt Servicing

Financing costs are a significant part of Aris Water's expenses, particularly given its substantial infrastructure development. These costs primarily stem from interest payments on various debt instruments used to fund these capital-intensive projects.

For instance, Aris Water's balance sheet reflects substantial borrowings. As of the first quarter of 2024, the company reported approximately $763 million in long-term debt. This debt includes senior notes and amounts drawn on revolving credit facilities, all of which incur regular interest expenses.

- Senior Notes Interest: Payments on outstanding senior notes represent a fixed financing cost.

- Revolving Credit Facility Interest: Interest on drawn amounts from credit facilities fluctuates with borrowing levels and prevailing interest rates.

- Amortization of Debt Issuance Costs: Associated costs with obtaining debt are amortized over the life of the debt, adding to the overall financing expense.

- Commitment Fees: Fees paid on the undrawn portion of revolving credit facilities also contribute to financing costs.

Aris Water's cost structure is dominated by its capital-intensive infrastructure. This includes significant investments in pipelines, treatment facilities, and disposal wells, with substantial capital expenditures continuing through 2024 to meet growing demand.

Operational costs are also a major component, covering energy for pumps, treatment chemicals, and field labor, with 2024 seeing high energy expenditures reflecting the intensive nature of water management.

Personnel and administrative expenses, including salaries for skilled staff and general corporate overhead, are crucial for efficient operations and compliance.

Regulatory compliance and environmental stewardship add further costs, with investments in permits, monitoring, and advanced treatment technologies being essential for maintaining operational licenses and minimizing ecological impact.

Financing costs are substantial, driven by interest on the company's significant debt, which stood at approximately $763 million in long-term debt as of Q1 2024.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Infrastructure Development | Capital expenditures for pipelines, treatment plants, disposal wells. | Continued heavy investment in 2024 to support demand growth. |

| Operational Costs | Energy, chemicals, field labor for daily operations. | High energy expenditures noted in 2024 due to water movement and treatment intensity. |

| Personnel & Admin | Salaries, benefits, IT, legal, accounting. | Essential for skilled workforce and business support functions. |

| Environmental Compliance | Permits, monitoring, waste disposal, ESG initiatives. | Estimated 5-15% of operational budget for ESG compliance in similar sectors in 2024. |

| Financing Costs | Interest on debt, fees on credit facilities. | Approximately $763 million in long-term debt as of Q1 2024, incurring significant interest. |

Revenue Streams

Aris Water Solutions generates significant revenue through produced water handling fees. These fees are tied to the volume of water gathered, transported, and disposed of for oil and gas operators.

The company secures these revenue streams primarily through long-term, fee-based contracts, providing a predictable income model. In 2024, Aris reported handling over 1.2 billion barrels of produced water, underscoring the scale of its operations and fee generation.

Aris Water Solutions generates revenue by treating and supplying recycled produced water to clients for their operational needs. This 'Water Solutions' segment charges based on the volume of recycled water delivered, presenting a greener option compared to traditional freshwater sources.

Aris Water Solutions generates revenue from skim oil recoveries, a byproduct of its comprehensive water handling operations. This recovered oil is then sold, creating a supplementary income stream.

This revenue stream, while not as significant as their core water services, demonstrates Aris's ability to monetize byproducts. For instance, in 2024, the company's focus on operational efficiency likely led to increased skim oil recovery, contributing to overall profitability.

Surface Income from Strategic Landholdings

Aris Water's strategic landholdings, like the acquisition of the McNeill Ranch, unlock significant revenue potential beyond water services. These assets provide opportunities for generating income through surface rights, including leasing for rights-of-way for pipelines and utilities, and allowing for the utilization of land for power generation and renewable energy projects.

This diversification of revenue streams is crucial for enhancing profitability and stability. For instance, in 2024, Aris Water has actively pursued agreements for such surface use, contributing to its overall financial performance.

- Rights-of-Way: Leasing land for essential infrastructure like oil and gas pipelines or transmission lines.

- Renewable Energy Development: Permitting solar or wind farm installations on suitable acreage.

- Industrial Applications: Providing space for temporary or permanent industrial facilities that require land access.

- Agricultural Leases: Generating income from traditional agricultural uses where compatible with other operations.

Potential Future Revenue from Mineral Extraction and Industrial Water Treatment

Aris Water Solutions is actively investigating the potential to generate revenue by extracting valuable minerals from the produced water it treats, a process that could unlock significant new income streams. This initiative is still in its early stages, but the company sees a clear opportunity to monetize byproducts that are currently considered waste.

Beyond its core oil and gas operations, Aris is also looking to expand its industrial water treatment services to a broader range of sectors. This strategic move aims to diversify its customer base and tap into new markets that require specialized water management solutions.

For instance, in 2024, the company continued to focus on optimizing its water treatment processes, which not only improves environmental outcomes but also lays the groundwork for offering these advanced capabilities to other industries. The potential for mineral extraction from produced water, such as lithium or other rare earth elements, represents a forward-thinking approach to resource management.

- Mineral Extraction: Exploring revenue from valuable minerals found in produced water.

- Industrial Water Treatment Expansion: Offering services to sectors beyond oil and gas.

- Diversification: Reducing reliance on the oil and gas industry by entering new markets.

- Resource Monetization: Turning byproducts of water treatment into valuable assets.

Aris Water Solutions' primary revenue comes from handling fees for produced water, with 2024 seeing over 1.2 billion barrels processed. They also generate income by treating and selling recycled water, offering a sustainable alternative to freshwater.

Supplementary income is derived from selling skim oil recovered during water treatment. Furthermore, Aris leverages its landholdings for revenue through surface rights, including leases for pipelines and potential renewable energy projects.

The company is exploring new revenue streams through mineral extraction from produced water and expanding industrial water treatment services to new sectors, showcasing a strategic focus on diversification and resource monetization.

| Revenue Stream | Description | 2024 Highlight |

|---|---|---|

| Produced Water Handling | Fees for gathering, transporting, and disposing of produced water. | Processed over 1.2 billion barrels. |

| Recycled Water Sales | Revenue from treating and supplying recycled water for client operations. | Growing demand for sustainable water solutions. |

| Skim Oil Sales | Income from selling oil recovered as a byproduct of water treatment. | Contributes to overall profitability through efficient operations. |

| Surface Rights & Land Leases | Revenue from leasing land for rights-of-way, power generation, and other industrial uses. | Active pursuit of agreements for surface utilization. |

| Mineral Extraction (Exploratory) | Potential future revenue from valuable minerals found in produced water. | Early-stage investigation into monetizing byproducts. |

| Industrial Water Treatment Expansion | Diversifying services to sectors beyond oil and gas. | Focus on optimizing treatment processes for broader application. |

Business Model Canvas Data Sources

The Aris Water Business Model Canvas is built upon comprehensive market research, detailed financial projections, and operational data from industry leaders. These sources ensure each block accurately reflects current market conditions and strategic viability.