Aris Water Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aris Water Bundle

Aris Water operates within a dynamic energy sector, where understanding the interplay of competitive forces is paramount. Our analysis reveals the significant influence of buyer power and the constant pressure from substitute products, shaping Aris Water's strategic landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aris Water’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Aris Water Solutions operates in a specialized niche, providing essential water handling and recycling services to the energy sector. The suppliers of highly specialized equipment, advanced treatment technologies, and integrated pipeline components for these operations are often limited in number. This scarcity can grant these niche suppliers a moderate level of bargaining power, as Aris may have fewer alternatives for critical inputs. For instance, in 2024, the demand for advanced water treatment membranes, crucial for Aris's recycling efforts, saw a slight increase in pricing due to supply chain constraints affecting a few key global manufacturers.

Suppliers of essential, large-scale infrastructure components like specialized pipes and high-capacity pumps hold significant sway over Aris Water's operational capabilities. The cost fluctuations and supply chain reliability of these critical materials directly impact Aris's ability to meet project deadlines and maintain profitability. For instance, a surge in steel prices, a key component in many pipes, could increase project costs substantially.

Landowners and entities controlling rights-of-way are crucial, acting as powerful gatekeepers for infrastructure development, even if not typical suppliers. Their ability to grant or deny access significantly impacts Aris Water Solutions' operational capabilities and expansion plans.

Aris Water Solutions' acquisition of the McNeill Ranch for an undisclosed sum in early 2024 highlights a strategic move to internalize land access. This acquisition aims to bolster future growth by securing essential acreage and diminishing dependence on third-party agreements for pipeline routes and operational sites.

Energy and Utility Providers

Aris Water's business, which involves treating and transporting water, is very reliant on energy. This makes energy and utility providers a significant force. For instance, in 2024, the average industrial electricity price in Texas, where Aris Water operates, saw fluctuations impacting operational costs.

The cost and consistent availability of electricity and other utilities are crucial inputs for Aris Water's processes. Any disruptions or significant price increases from utility providers can directly affect the company's bottom line.

Given the energy-intensive nature of water treatment and movement, utility providers hold considerable bargaining power. Fluctuations in energy prices, such as the reported 5% increase in wholesale electricity prices in Texas during the first half of 2024, can directly impact Aris Water's operating margins, granting these providers leverage.

- Energy Intensity: Aris Water's operations require substantial energy for water treatment and transportation.

- Input Costs: Electricity and utility costs are a major component of Aris Water's operating expenses.

- Price Volatility: Fluctuations in energy prices, like those observed in Texas industrial electricity rates in 2024, can squeeze profit margins.

- Supplier Leverage: The essential nature of energy supply gives utility providers significant bargaining power over Aris Water.

Labor Market for Skilled Professionals

The bargaining power of suppliers in the skilled labor market for water management professionals significantly impacts Aris Water. A tight labor market for specialized engineers and technicians in the energy sector can drive up wages and benefits, increasing Aris's operational costs. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a persistent demand for environmental engineers, with projected job growth of 5% from 2022 to 2032, indicating a potentially competitive landscape for talent acquisition.

A scarcity of skilled personnel, particularly those with expertise in water treatment and recycling for oil and gas operations, can empower these workers. This leverage may translate into demands for higher compensation, better working conditions, or more flexible employment terms. Such pressures could affect Aris's ability to secure and retain the necessary workforce, potentially leading to project delays or increased project execution costs.

- Talent Scarcity: Limited availability of specialized water management engineers and technicians for the energy sector.

- Wage Inflation: Shortages can drive up labor costs, impacting Aris's operating expenses.

- Project Delays: Difficulty in acquiring skilled staff may hinder project timelines and execution efficiency.

- Competitive Hiring: Aris faces competition from other energy and industrial companies for the same pool of talent.

Suppliers of specialized water treatment chemicals and advanced filtration media can exert moderate bargaining power due to limited alternatives and the critical nature of these inputs for Aris Water's services. In 2024, the global market for water treatment chemicals saw steady demand, with some niche product prices increasing by an average of 3-5% due to raw material costs and specialized manufacturing processes.

The bargaining power of suppliers for Aris Water Solutions is influenced by the specialization of their offerings and the availability of substitutes. For highly technical equipment or proprietary treatment solutions, suppliers often hold more leverage. For instance, in 2024, the cost of advanced membrane technology, essential for high-efficiency water recycling, saw a slight uptick due to increased demand from various industrial sectors, impacting Aris's procurement costs.

| Supplier Type | Impact on Aris Water | 2024 Data/Trend |

| Specialized Equipment Manufacturers | Moderate to High | Increased demand for advanced membranes led to 3-5% price hikes in niche products. |

| Chemical & Consumable Providers | Moderate | Steady demand for water treatment chemicals, with some specialized product prices rising. |

| Landowners/Right-of-Way Holders | High | Strategic land acquisitions in 2024 to mitigate dependence on third-party access. |

| Energy & Utility Providers | High | Texas industrial electricity prices saw fluctuations, impacting operational costs by an estimated 5% increase in wholesale prices in H1 2024. |

| Skilled Labor Market | Moderate to High | Persistent demand for environmental engineers (5% projected job growth 2022-2032) can drive up labor costs. |

What is included in the product

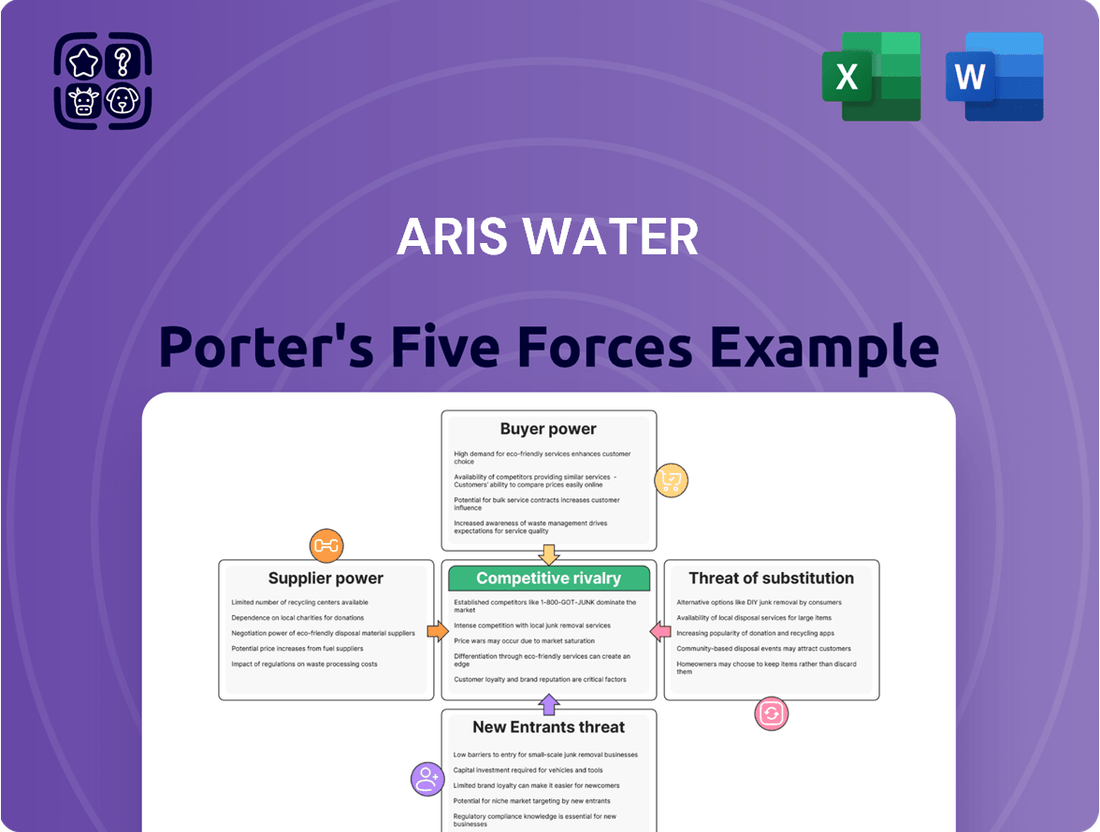

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Aris Water's market position.

Aris Water Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making and understanding strategic pressure.

Customers Bargaining Power

Aris Water Solutions' primary clientele consists of substantial oil and gas companies, including prominent names like ConocoPhillips, Chevron, and ExxonMobil, many of whom operate extensively within the Permian Basin. These major operators wield considerable influence due to the sheer volume of water services they procure, which can significantly impact market conditions and pricing. For instance, in 2024, these large customers often negotiate favorable terms, leveraging their substantial water needs and the competitive landscape of water management services.

Aris Water Porter effectively counters customer bargaining power by securing long-term contracts and acreage dedication agreements. These strategic commitments are crucial for ensuring predictable revenue streams and enhancing financial stability.

A prime example of this strategy in action is Aris's recent seven-year extension of a water gathering and disposal agreement with ConocoPhillips. This deal, extending through 2040, significantly bolsters Aris's revenue visibility and customer retention.

Aris Water's solutions are a direct boon to its customers striving to meet their environmental, social, and governance (ESG) targets. By significantly cutting down on freshwater usage and lowering carbon emissions, Aris helps clients achieve their sustainability mandates. This crucial alignment with customer-driven ESG objectives enhances Aris's appeal, potentially making its services less susceptible to aggressive price negotiations.

Integrated Solutions and Closed-Loop Systems

Aris Water Solutions' integrated, closed-loop water handling and recycling services create significant switching costs for its customers. By providing a comprehensive solution, Aris embeds itself deeply into a customer's operational workflow, making it more than just a vendor but a critical partner. This integration fosters customer loyalty and reduces the bargaining power of customers who would face substantial disruption and expense if they were to seek alternative providers.

The complexity and cost associated with transitioning away from Aris's established closed-loop systems are a key factor in their reduced bargaining power. Customers benefit from the efficiency and environmental advantages these systems offer, but in doing so, they become reliant on the specialized infrastructure and processes Aris provides. This interdependence limits their ability to easily negotiate lower prices or demand different terms without impacting their own operational continuity and sustainability goals.

- High Switching Costs: Customers face significant financial and operational hurdles when considering a change from Aris's integrated water solutions.

- Operational Integration: Aris's closed-loop systems are designed to be integral to customer operations, increasing dependence and reducing customer leverage.

- Value Proposition: The efficiency and environmental benefits offered by Aris's comprehensive services further solidify customer relationships, diminishing their inclination to seek alternatives.

Permian Basin Concentration

Aris Water Solutions' significant concentration within the Permian Basin, a hub of energy production, presents a notable aspect of customer bargaining power. This geographic focus means that a substantial portion of Aris's revenue is tied to the economic health and operational decisions of a relatively concentrated customer group within this specific region.

The Permian Basin, as of early 2024, continued to be a dominant force in U.S. oil and gas production, with activity levels directly influencing demand for water solutions. However, this concentration makes Aris vulnerable; if major Permian operators decide to consolidate their water management services internally or shift to different service providers, it could significantly impact Aris's revenue streams.

- Permian Basin Dominance: Aris Water Solutions operates primarily within the Permian Basin, a key U.S. energy production area.

- Customer Concentration Risk: A downturn in Permian activity or strategic shifts by its major customers in the region could disproportionately affect Aris's financial performance.

- Potential for Consolidation: If large customers in the Permian choose to bring water services in-house, it directly reduces the addressable market for Aris.

- Leverage for Customers: The concentration of Aris's customer base can empower these large operators to negotiate more favorable terms, given their significant contribution to Aris's business.

Aris Water Solutions' major clients, large oil and gas companies, possess significant bargaining power due to their substantial water service needs, particularly within the Permian Basin. In 2024, these clients often leveraged their volume to negotiate favorable contract terms, impacting pricing. Aris mitigates this by securing long-term contracts, such as a seven-year extension with ConocoPhillips through 2040, which enhances revenue predictability and customer loyalty.

The company's integrated, closed-loop water recycling systems create high switching costs for customers, embedding Aris deeply into their operations and reducing their leverage. This reliance on Aris's specialized infrastructure and processes limits customers' ability to easily negotiate lower prices without risking operational continuity or ESG goals.

| Customer Type | Bargaining Power Factor | Aris's Mitigation Strategy |

|---|---|---|

| Major Oil & Gas Operators | High Volume Procurement | Long-term Contracts, Acreage Dedication |

| Geographic Concentration (Permian Basin) | Integrated Solutions, ESG Alignment | |

| Need for ESG Compliance | Value Proposition of Water Recycling |

Same Document Delivered

Aris Water Porter's Five Forces Analysis

This preview displays the complete Aris Water Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely what you will receive instantly after purchase, ensuring no discrepancies or hidden elements. You can confidently expect this professionally formatted and ready-to-use analysis to be delivered immediately, allowing you to leverage its insights without delay.

Rivalry Among Competitors

The water management market, especially within the energy sector like the Permian Basin, shows a dynamic where many smaller companies operate, creating fragmentation. However, this landscape is actively shifting as larger entities acquire smaller ones, leading to consolidation. This trend means that while Aris Water faces a broad range of competitors, the market structure is evolving towards fewer, more dominant players.

Key competitors for Aris Water include established firms such as Tetra Tech and Eneraqua Technologies, alongside specialized water midstream providers like H2O Midstream and EMS. The consolidation trend suggests that these players, and potentially new entrants, will continue to shape the competitive environment through strategic acquisitions and service expansions.

Aris Water Solutions distinguishes itself by providing integrated, full-cycle water management and recycling services, a key factor in mitigating competitive rivalry. This approach includes significant investments in advanced technologies for water treatment and beneficial reuse, setting them apart from companies offering more basic services.

Their commitment to sustainable solutions, such as closed-loop systems and pipeline infrastructure, creates a sticky customer base and higher switching costs. For instance, Aris reported a substantial increase in water recycled and reused in 2023, demonstrating the effectiveness of their integrated strategy in a competitive market.

Securing and extending long-term contracts with major operators is a crucial element of competitive rivalry in the water midstream sector. These agreements provide revenue stability and visibility, allowing companies like Aris Water Solutions to plan infrastructure investments and operational scaling. The ability to lock in clients for extended periods directly impacts market share and competitive positioning.

Aris Water's success in extending its agreements, notably the significant renewal with ConocoPhillips in 2024, underscores its competitive strength. This extension, which covers a substantial portion of their existing services, not only solidifies Aris's market share but also signals to competitors the company's strong customer relationships and reliable service delivery, making it harder for rivals to gain traction.

Capital-Intensive Nature of Infrastructure

The capital-intensive nature of infrastructure development is a significant factor in competitive rivalry for companies like Aris Water. Building and maintaining extensive pipeline networks and treatment facilities demands massive upfront investment. This high capital requirement naturally creates a substantial barrier to entry for potential new competitors. For instance, in 2024, the estimated cost to construct new water infrastructure can range from millions to billions of dollars depending on the scale and complexity.

Established players, having already made these substantial investments, possess a distinct competitive advantage. They have the existing assets and operational scale that new entrants would struggle to replicate. This can lead to a more concentrated market where a few large, well-capitalized companies dominate. The sheer financial commitment required to compete effectively means that only those with deep pockets can realistically enter or expand within this sector.

- High Upfront Costs: Developing water infrastructure requires significant capital, often in the hundreds of millions or billions of dollars.

- Barrier to Entry: The substantial investment needed deters new companies from entering the market, reducing competitive intensity.

- Established Player Advantage: Existing infrastructure and operational scale provide a competitive edge for companies like Aris Water.

- Long-Term Investment Horizon: Infrastructure projects are long-term commitments, requiring sustained capital allocation and patience.

Service Quality and Operational Efficiency

Competitive rivalry in the water management sector, including for Aris Water Solutions, is significantly influenced by service quality and operational efficiency. Companies vie to provide reliable, efficient, and cost-effective water management solutions to their clients.

Aris Water Solutions demonstrates its competitive strength through a consistent focus on operational improvements. This dedication is reflected in its financial performance, with Aris reporting strong adjusted operating margins per barrel, highlighting its ability to manage costs effectively while delivering high-quality services.

- Service Reliability: Clients demand consistent and dependable water management, making service reliability a key differentiator.

- Operational Efficiency: Streamlined processes and optimized resource allocation directly impact cost-effectiveness and client satisfaction.

- Cost-Effectiveness: Competitive pricing, driven by efficient operations, is crucial for winning and retaining business in this sector.

Competitive rivalry within the water management sector, particularly for Aris Water Solutions, is characterized by a fragmented market undergoing consolidation, with established players like Tetra Tech and H2O Midstream being key rivals. Aris differentiates itself through integrated, full-cycle water management and recycling services, backed by substantial investments in advanced treatment technologies and pipeline infrastructure.

The ability to secure and extend long-term contracts, such as Aris's 2024 renewal with ConocoPhillips, is a critical factor in competitive positioning, providing revenue stability and demonstrating strong customer relationships. Furthermore, the capital-intensive nature of infrastructure development, with new projects potentially costing hundreds of millions to billions of dollars in 2024, creates significant barriers to entry, favoring established companies with existing assets and scale.

Operational efficiency and service reliability are paramount, with Aris Water Solutions highlighting strong adjusted operating margins per barrel as evidence of its cost-effective service delivery. This focus on efficient operations and dependable service is essential for winning and retaining business in a market where clients prioritize both quality and cost-effectiveness.

| Competitor Type | Key Players | Differentiation Strategy | 2024 Market Observation |

|---|---|---|---|

| Specialized Water Midstream | H2O Midstream, EMS | Pipeline infrastructure, dedicated water handling | Continued investment in infrastructure expansion |

| Integrated Water Management | Aris Water Solutions | Full-cycle services, recycling, advanced treatment | Securing long-term contracts, e.g., ConocoPhillips renewal |

| Engineering & Consulting | Tetra Tech, Eneraqua Technologies | Technical expertise, project management, broader environmental services | Focus on sustainable water solutions and regulatory compliance |

SSubstitutes Threaten

Historically, the oil and gas industry relied heavily on trucking produced water to disposal wells or open pits. This method was common, but it came with significant logistical and environmental drawbacks. For instance, in 2024, the cost of trucking water can range from $0.50 to $2.00 per barrel, depending on distance and volume, making it a substantial operational expense.

Aris Water Solutions offers a direct substitute to these traditional methods through its extensive pipeline infrastructure. By transporting produced water via pipelines, Aris significantly reduces the need for trucking, which in turn lowers operational costs and minimizes the environmental footprint associated with vehicle emissions and potential spills.

The threat of these traditional methods substituting Aris's services is low because pipeline solutions are generally more cost-effective and sustainable at scale. For example, pipeline transport can reduce disposal costs by 30-50% compared to trucking, especially for operators with large volumes of produced water, making Aris's offering inherently more attractive.

Large oil and gas operators might consider managing their water needs internally, a move that could serve as a substitute for services offered by companies like Aris Water Solutions. However, the significant capital investment, intricate operational requirements, and the need for specialized technical knowledge in water treatment and recycling often make outsourcing a more practical and cost-effective solution for many.

The complexity of managing produced water, including treatment, recycling, and disposal, presents a substantial barrier to entry for self-management. For instance, advanced treatment technologies capable of achieving stringent regulatory standards and enabling reuse in operations require considerable upfront investment and ongoing expertise. This complexity inherently limits the number of operators who can effectively substitute external water management services.

While Aris Water Solutions primarily handles produced water, the threat of substitutes for drilling operations is present. For instance, oil and gas companies could opt to use alternative freshwater sources, or even municipal water supplies, instead of recycled produced water. This choice would depend on factors like availability, cost, and regulatory approval in specific regions.

Aris's strategic focus on recycling produced water is designed to mitigate this threat by offering a more sustainable and often cost-effective solution. By reducing the industry's reliance on scarce freshwater resources, Aris aims to make its recycled water services more attractive. For example, in 2023, Aris reported recycling over 1.5 billion barrels of water, highlighting the scale of their operations and their commitment to providing an alternative to freshwater.

Emerging Water Treatment Technologies

Advances in water treatment technologies from competitors pose a significant threat. Companies developing novel methods for produced water management or beneficial reuse could offer Aris Water Solutions viable alternatives, potentially eroding its market share. For instance, breakthroughs in membrane filtration or advanced oxidation processes could present more cost-effective or efficient solutions for its clients.

Aris Water Solutions actively mitigates this threat through substantial investment in research and development. By dedicating resources to innovation, the company aims to maintain a technological edge. Furthermore, participation in joint industry projects allows Aris to collaborate and stay informed about emerging trends and potential substitute technologies before they become widespread market disruptions.

- Technological Advancements: Competitors' innovations in water treatment could offer cheaper or more efficient alternatives to Aris's services.

- R&D Investment: Aris Water Solutions prioritizes its own R&D to stay competitive and develop superior solutions.

- Industry Collaboration: Participation in joint industry projects helps Aris anticipate and respond to emerging substitute technologies.

Regulatory Changes and Environmental Pressure

Increasing environmental regulations and societal pressure for more sustainable water management practices represent a significant threat of substitutes for traditional water disposal methods. As governments and communities demand cleaner operations, water recycling and reuse technologies become more attractive alternatives, directly impacting the need for services like those offered by Aris Water Solutions. For instance, by 2024, many states have seen stricter regulations on wastewater discharge, pushing industries to explore advanced treatment and recycling.

This shift can accelerate the adoption of alternative water management strategies, potentially reducing reliance on conventional disposal. For Aris Water, this translates to a growing market for their environmentally conscious solutions, positioning them as a preferred substitute for outdated practices. The company's focus on recycling and beneficial reuse aligns with these evolving industry standards.

- Growing demand for water recycling: Increased regulatory scrutiny on wastewater discharge is driving industries to adopt water recycling technologies.

- Societal pressure for sustainability: Public awareness and demand for environmentally friendly business practices are pushing companies towards cleaner water management.

- Aris Water's competitive advantage: The company's focus on water recycling and beneficial reuse positions it as a strong substitute for traditional, less sustainable water disposal methods.

The threat of substitutes for Aris Water Solutions' services primarily stems from traditional water disposal methods like trucking to disposal wells, which are becoming less viable due to rising costs and environmental concerns. For example, trucking costs in 2024 can range from $0.50 to $2.00 per barrel, making pipeline solutions, like those Aris offers, significantly more cost-effective, potentially reducing disposal costs by 30-50%.

Internal water management by large operators is another substitute, but the substantial capital investment and technical expertise required for advanced treatment and recycling limit its practicality for many. Furthermore, the availability of alternative freshwater sources or municipal water, while a potential substitute, is increasingly constrained by scarcity and regulatory hurdles, making recycled water a more sustainable option.

| Substitute Method | Associated Costs (2024 Est.) | Aris Water Advantage |

|---|---|---|

| Trucking to Disposal Wells | $0.50 - $2.00 per barrel | Lower cost, reduced environmental impact via pipelines |

| Internal Management | High capital investment, ongoing operational costs | Outsourcing offers cost-effectiveness and expertise |

| Alternative Freshwater Sources | Variable availability and cost, regulatory constraints | Sustainable and reliable recycled water supply |

Entrants Threaten

The significant capital required to establish integrated water handling and recycling infrastructure, encompassing extensive pipeline networks and advanced treatment facilities, acts as a formidable barrier to entry for potential competitors. For instance, companies in this sector often need to invest hundreds of millions, if not billions, of dollars to build out the necessary physical assets. This substantial upfront cost deters many smaller or less-capitalized firms from entering the market, thereby protecting existing players.

The water management industry, particularly for produced water in the energy sector, faces intricate environmental regulations and requires numerous permits. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stringent water quality standards, impacting disposal and recycling methods.

New entrants must navigate this complex web of federal, state, and local rules, which can be time-consuming and costly. Obtaining the necessary permits, such as those related to the Clean Water Act or state-specific waste management licenses, can present a substantial barrier to entry, deterring potential competitors from entering the market.

Aris Water Solutions thrives on deeply entrenched customer relationships, often solidified through long-term contracts and acreage dedications with major oil and gas producers. This creates a significant barrier for newcomers.

A new entrant would struggle immensely to replicate these established trust networks and secure comparable volumes of business. For instance, Aris's ability to secure multi-year agreements with companies like Pioneer Natural Resources, a key player in the Permian Basin, highlights the difficulty new firms face in gaining immediate traction and reliable revenue streams. The capital and time required to build such credibility are substantial, directly impacting the threat of new entrants.

Specialized Expertise and Technology

The provision of advanced water recycling and treatment solutions, as Aris Water Solutions offers, necessitates highly specialized technical expertise and often proprietary technologies. New entrants would face significant hurdles in developing or acquiring this knowledge, a process that is both time-consuming and capital-intensive.

For instance, the development of advanced membrane filtration or specific chemical treatment processes can take years of research and significant investment. Companies like Aris Water Solutions have likely invested heavily in R&D, creating a barrier to entry for those without comparable resources or established technical know-how. The need for specialized engineering talent and ongoing innovation further solidifies this challenge.

- High R&D Investment: Developing proprietary water treatment technologies requires substantial, long-term investment in research and development.

- Skilled Workforce Demand: Access to engineers and technicians with expertise in advanced water treatment processes is critical and often scarce.

- Intellectual Property Protection: Patents and trade secrets related to treatment methods create exclusive advantages for established players.

- Capital Expenditure: Building the infrastructure for advanced water recycling necessitates significant upfront capital, which new entrants may struggle to secure without a proven track record.

Economies of Scale and Network Effects

Existing players in the water solutions sector, such as Aris Water, leverage significant economies of scale. Their extensive infrastructure, particularly in prolific basins like the Permian, allows for lower per-unit operating costs. For instance, Aris Water's substantial water handling capacity, estimated in the hundreds of thousands of barrels per day, directly contributes to this cost advantage.

Network effects also create a formidable barrier. As Aris Water expands its service footprint and customer base, its ability to efficiently manage and transport water across a wider area increases. This enhanced operational network makes it more challenging for new entrants to achieve comparable efficiency and cost-competitiveness, as they would need to replicate substantial capital investment and operational expertise.

- Economies of Scale: Aris Water's large-scale operations in the Permian Basin lead to lower per-unit costs for water treatment and disposal.

- Network Effects: A more extensive service network allows Aris Water to offer integrated solutions and optimize logistics, a difficult feat for new, smaller competitors.

- Cost Competitiveness: These advantages enable Aris Water to offer more attractive pricing, presenting a significant hurdle for new entrants aiming to gain market share.

The threat of new entrants for Aris Water Solutions is significantly mitigated by the immense capital required for infrastructure development, stringent regulatory hurdles, and established customer relationships. The industry demands substantial upfront investment in pipelines and treatment facilities, often in the hundreds of millions of dollars, creating a high barrier. Furthermore, navigating complex environmental regulations and securing necessary permits, as emphasized by the EPA in 2024, adds considerable time and cost for any new player.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building integrated water handling and recycling infrastructure requires massive investment, often exceeding hundreds of millions of dollars. | Deters smaller, less-capitalized firms. |

| Regulatory Compliance | Navigating complex environmental regulations and obtaining permits (e.g., Clean Water Act) is time-consuming and costly. | Increases operational costs and time-to-market for new entrants. |

| Customer Relationships | Deeply entrenched, long-term contracts and acreage dedications with major oil and gas producers are difficult to replicate. | New entrants struggle to gain immediate traction and secure reliable revenue streams. |

| Technical Expertise | Developing or acquiring specialized knowledge in advanced water treatment technologies is capital-intensive and time-consuming. | Creates an advantage for established players with proprietary technologies and R&D investment. |

| Economies of Scale & Network Effects | Large-scale operations and extensive service networks lead to lower per-unit costs and optimized logistics. | Makes it challenging for new entrants to compete on price and efficiency. |

Porter's Five Forces Analysis Data Sources

Our Aris Water Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company financial statements, and regulatory filings. This comprehensive approach ensures a thorough understanding of competitive dynamics.