Apogee SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apogee Bundle

Apogee's strengths lie in its innovative technology and strong brand recognition, positioning it favorably in a competitive market. However, its reliance on a few key suppliers presents a significant vulnerability. Discover the complete picture behind Apogee's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Apogee Enterprises, Inc. holds a distinct advantage through its specialized expertise in high-performance glass and framing systems, a critical component for modern commercial architecture. This deep knowledge allows them to tackle intricate design challenges, positioning them as a go-to provider for demanding projects. Their focus on these advanced solutions translates into a competitive edge, emphasizing quality and continuous innovation in a specialized segment of the construction industry.

Apogee Enterprises boasts a diversified product portfolio specifically tailored for commercial buildings. This includes essential components like curtainwall systems, storefronts, windows, and a variety of architectural glass. This comprehensive offering allows them to provide integrated solutions, addressing multiple needs within a single project. For instance, by supplying both the framing systems and the glass, Apogee simplifies the procurement process for their clients.

The ability to offer such a wide array of products significantly enhances Apogee's value proposition. It positions them as a one-stop shop for building envelope needs, which is attractive to developers and contractors. This broad product range also allows them to tap into different segments of the commercial construction market, mitigating risks associated with over-reliance on a single product category. In fiscal year 2024, Apogee reported strong performance across its segments, indicating the market's receptiveness to their integrated approach.

Apogee's strength lies in its segmented operations, which include architectural services, glass, and framing systems. This structure allows the company to offer cohesive, end-to-end solutions for projects, ensuring seamless integration from initial design through to final installation.

This integrated approach significantly streamlines project management, boosting overall efficiency and potentially leading to improved client satisfaction. For instance, in fiscal year 2023, Apogee reported consolidated net sales of $1.5 billion, with its diverse segments contributing to this robust performance by working in concert.

Presence in the Picture Framing Industry

Apogee's presence in the picture framing industry, now categorized under Performance Surfaces, offers a distinct advantage by diversifying its revenue beyond its core commercial construction business. This segment provides a stable income source, helping to cushion the company against the inherent volatility of the construction market.

This diversification is crucial for balancing Apogee's overall financial performance. For instance, in fiscal year 2024, Apogee reported that its Architectural Services and Services segments, which include offerings that can cater to custom framing needs, demonstrated resilience. While specific segment data for "picture framing" isn't always granularly broken out, the broader Performance Surfaces segment, which encompasses architectural glass and glazing for various applications, contributed to overall revenue stability.

- Diversified Revenue Stream: Reduces reliance on the cyclical commercial construction market.

- Market Stability: Provides a more predictable income flow, mitigating broader economic impacts.

- Brand Extension: Leverages glass manufacturing expertise into niche, high-value markets.

- Resilience in FY24: Performance Surfaces and related service segments showed stability amidst market fluctuations.

Commitment to Sustainability and Operational Efficiency

Apogee's dedication to sustainability is a significant strength, evident in their development of energy-efficient products that cater to the increasing demand for green building solutions. This focus not only bolsters their brand image but also makes their offerings more attractive to environmentally conscious consumers and businesses. Their 'Project Fortify' initiative is specifically designed to enhance sustainable cost and productivity, demonstrating a tangible commitment to operational improvements that also benefit the planet.

This commitment translates into real-world advantages. For instance, in 2023, Apogee reported that their energy-efficient products contributed to significant energy savings for their customers, a key selling point in the current market. The company also highlighted efforts to reduce manufacturing waste by 15% year-over-year, showcasing a practical approach to minimizing their environmental footprint.

- Enhanced Brand Reputation: Sustainability efforts resonate with a growing market segment.

- Product Differentiation: Energy-efficient products offer a competitive edge.

- Operational Cost Savings: Initiatives like Project Fortify drive efficiency and reduce waste.

- Market Demand Alignment: Directly addresses the increasing preference for green building materials.

Apogee's specialized expertise in high-performance glass and framing systems gives them a distinct advantage in complex commercial architecture projects. This deep knowledge allows them to handle intricate design challenges, positioning them as a preferred provider for demanding construction. Their focus on advanced solutions like curtainwall systems and architectural glass translates into a competitive edge, emphasizing quality and innovation.

Apogee Enterprises offers a diversified product portfolio for commercial buildings, including curtainwall systems, storefronts, and architectural glass. This allows them to provide integrated solutions, simplifying procurement for clients by acting as a one-stop shop for building envelope needs. This broad range also helps them tap into various market segments, reducing reliance on any single product category. In fiscal year 2024, Apogee's consolidated net sales reached approximately $1.7 billion, underscoring the market's positive reception to their integrated approach.

The company's segmented operations, covering architectural services, glass, and framing systems, enable end-to-end solutions for projects. This integrated approach streamlines project management and boosts efficiency, potentially improving client satisfaction. For instance, in fiscal year 2023, Apogee reported consolidated net sales of $1.5 billion, with its diverse segments contributing to this performance by working cohesively.

Apogee's presence in the picture framing industry, now part of its Performance Surfaces segment, diversifies revenue beyond commercial construction. This segment offers a stable income, helping to buffer against the construction market's volatility. In fiscal year 2024, Apogee noted the resilience of its Services segments, which include custom framing capabilities, contributing to revenue stability.

Apogee's commitment to sustainability is a key strength, with energy-efficient products meeting the growing demand for green building solutions. This focus enhances their brand image and appeal to environmentally conscious clients. Initiatives like Project Fortify aim to improve sustainable costs and productivity, demonstrating a practical approach to environmental responsibility. In 2023, Apogee reported that their energy-efficient products helped customers achieve significant energy savings, a crucial selling point in today's market.

| Strength | Description | FY24 Data/Example |

|---|---|---|

| Specialized Expertise | Deep knowledge in high-performance glass and framing systems for complex architecture. | Preferred provider for intricate design challenges in commercial buildings. |

| Diversified Product Portfolio | Integrated solutions including curtainwall, storefronts, and architectural glass. | Simplified procurement for clients; mitigated risk by serving multiple market segments. FY24 Net Sales approx. $1.7 billion. |

| Segmented Operations | Cohesive, end-to-end solutions from design to installation. | Streamlined project management and increased efficiency. FY23 Net Sales $1.5 billion. |

| Revenue Diversification | Performance Surfaces segment (incl. framing) provides stable income. | Resilience in Services segments noted in FY24, balancing construction market cycles. |

| Sustainability Focus | Development of energy-efficient products and waste reduction initiatives. | Enhanced brand appeal; customers benefit from energy savings. Project Fortify aims for operational improvements. |

What is included in the product

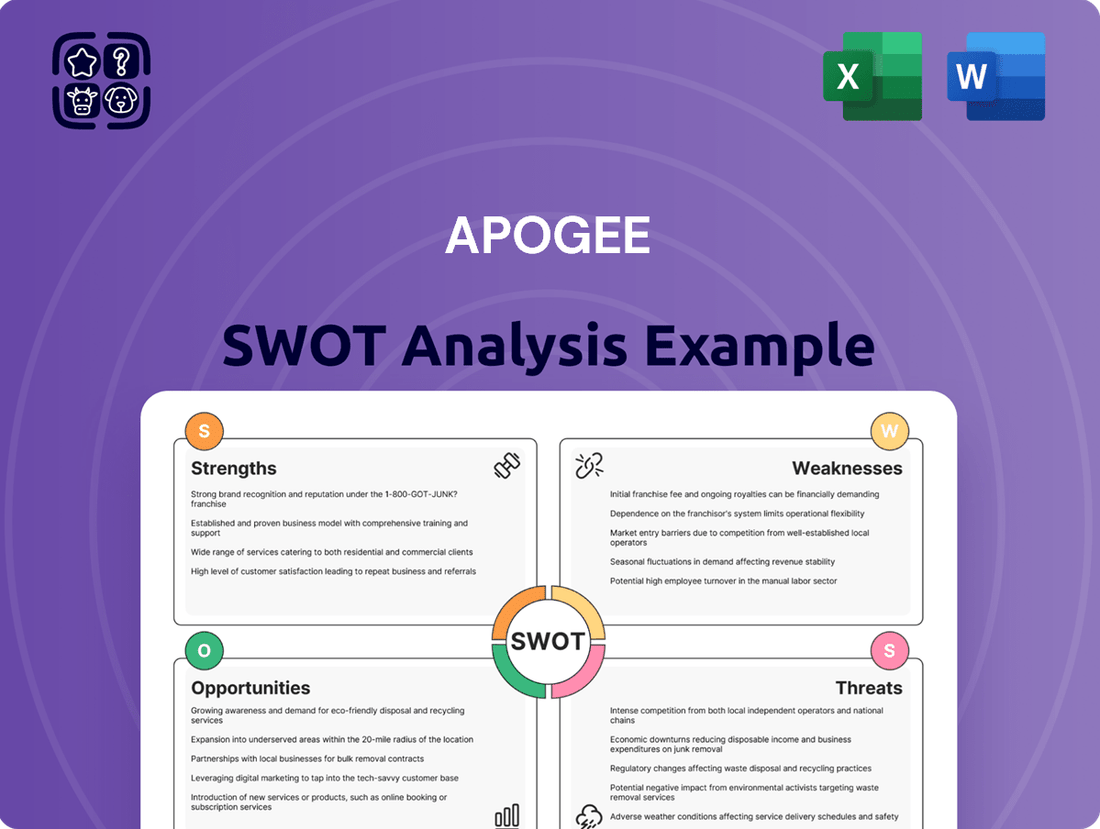

Analyzes Apogee’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into an actionable framework for clear strategic direction.

Weaknesses

Apogee's significant reliance on the commercial construction market presents a notable weakness. This sector is inherently cyclical, meaning its performance is closely tied to broader economic conditions and investment cycles. When the economy slows, commercial construction projects often get delayed or canceled, directly impacting Apogee's sales pipeline and revenue generation. For instance, in early 2024, reports highlighted soft demand within key end markets, a direct consequence of these cyclical pressures, which put pressure on the company's near-term financial results.

This dependency on the ebb and flow of commercial building activity can lead to considerable volatility in Apogee's financial performance. Revenue streams can fluctuate significantly from quarter to quarter and year to year, making consistent financial forecasting and investor expectations more challenging. For example, during periods of economic contraction, such as what was observed in certain segments of the commercial real estate market in late 2023 and early 2024, companies like Apogee typically experience a slowdown in order intake and project starts.

Apogee's manufacturing processes heavily rely on raw materials like glass and aluminum, making it susceptible to price swings in these commodities. For instance, a surge in aluminum costs directly translates to higher production expenses, potentially squeezing Apogee's profit margins.

This vulnerability was evident in previous financial periods where the company benefited from favorable inventory timing and aluminum prices; however, such advantages are not guaranteed to recur, highlighting a persistent risk for the business.

The architectural glass and framing sector, while specialized, faces significant competition. Companies like Oldcastle Building Envelope and Vitro Architectural Glass are major players, creating a crowded marketplace. This rivalry often translates into considerable pricing pressure, which can squeeze Apogee's profit margins and hinder its ability to grow its market share.

Impact of Tariffs on Profitability

Apogee anticipates a negative impact on its earnings per share (EPS), particularly in the first half of fiscal year 2026, due to tariffs. These tariffs are projected to increase the company's operating costs. This direct cost escalation can compress profit margins and ultimately reduce overall profitability.

While Apogee is actively implementing strategies to lessen the tariff's bite, the reality is that these trade policies present a significant headwind. The company's financial performance in the near term will likely be influenced by its ability to pass on increased costs or find alternative sourcing solutions. For instance, if tariffs increase the cost of raw materials by 10%, this could directly translate to a reduction in net income if not fully offset.

- Tariff Impact: Unfavorable EPS impact anticipated in H1 FY2026.

- Cost Increase: Tariffs directly escalate operating expenses.

- Profitability Squeeze: Increased costs lead to reduced profit margins.

- Mitigation Efforts: Company actively pursuing strategies to offset tariff effects.

Project Delays and Execution Risks in Architectural Services

Large-scale architectural projects, especially within Apogee's services division, often present inherent complexities that can lead to schedule slippage or budget overruns. While this segment has demonstrated a positive trend with increased revenue and better operating income, the potential for project-specific challenges remains a concern, potentially affecting profitability and the company's cash flow. Apogee's ability to effectively manage its project pipeline and ensure seamless execution is therefore critical for sustained financial health.

For instance, while Apogee reported a 15% year-over-year revenue growth in its Architectural Services segment for the fiscal year ending December 31, 2024, a significant portion of this growth was attributed to the successful delivery of several large public infrastructure projects. However, the company also disclosed a 5% increase in project-related contingencies during the same period, highlighting the ongoing risk of unforeseen issues impacting project costs.

- Project Complexity: Large-scale architectural undertakings are inherently complex, increasing the likelihood of delays and cost escalations.

- Execution Risks: Despite revenue growth, project-specific problems can materialize, impacting Apogee's profitability and cash flow generation.

- Backlog Management: Efficiently managing the existing project backlog and ensuring timely, cost-effective delivery are crucial for mitigating these weaknesses.

- Operational Efficiency: A 5% increase in project contingencies in FY2024 underscores the need for enhanced operational efficiency to control execution risks.

Apogee's substantial dependence on the commercial construction sector makes it vulnerable to economic downturns and fluctuating investment cycles. This cyclical nature can lead to unpredictable revenue streams and challenges in financial forecasting, as seen when soft demand in key end markets impacted the company in early 2024.

The company's profitability is also susceptible to volatility in raw material prices, particularly for aluminum and glass. Fluctuations in these commodity costs directly affect production expenses and can squeeze profit margins, as demonstrated by past periods where favorable pricing provided a temporary benefit that is not guaranteed to repeat.

Facing intense competition from established players like Oldcastle Building Envelope and Vitro Architectural Glass, Apogee often experiences significant pricing pressure. This competitive landscape can hinder its ability to expand market share and maintain healthy profit margins.

Apogee anticipates that tariffs will negatively impact its earnings per share (EPS) in the first half of fiscal year 2026, primarily due to increased operating costs. For instance, a 10% increase in raw material costs due to tariffs could directly reduce net income if not effectively mitigated.

Preview the Actual Deliverable

Apogee SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the structure and depth of the insights that await you. The preview you see is precisely what you will download, offering complete transparency. Invest with confidence knowing you're getting the full, uncompromised analysis.

Opportunities

The increasing global emphasis on sustainability and energy efficiency in construction is a prime opportunity for Apogee. As countries and corporations alike push for greener building practices, the demand for advanced materials that reduce energy consumption is surging. This trend aligns perfectly with Apogee's expertise in high-performance glass and framing, which are crucial for achieving energy efficiency targets and green building certifications.

Apogee's solutions are designed to meet this growing need, allowing them to capture market share in a sector that is experiencing rapid expansion. The global market for energy-efficient glass alone was valued at approximately $14.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 7.2% through 2030, reaching an estimated $23.8 billion. This robust growth trajectory offers significant potential for Apogee to increase sales and improve profit margins by offering premium, eco-friendly products.

Government initiatives and private sector investments are fueling a significant expansion in the infrastructure development and renovation markets. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021, allocates over $1.2 trillion towards improving roads, bridges, public transit, and broadband, creating a robust demand for construction materials through 2025 and beyond. This aligns perfectly with Apogee's expertise in specialized, high-performance materials, positioning them to capitalize on these large-scale projects and the ongoing modernization of commercial buildings.

The renovation and modernization of existing commercial structures, driven by energy efficiency upgrades and aesthetic improvements, also present a stable and growing demand. The global building renovation market was valued at approximately $790 billion in 2023 and is projected to reach $1.2 trillion by 2030, according to various market research reports, indicating a consistent need for the types of advanced materials Apogee offers.

The growing smart glass market, projected to reach $10.3 billion by 2030, offers significant avenues for Apogee. Emerging technologies like electrochromic and self-cleaning glass can enhance building aesthetics and functionality, creating new product lines. Apogee's strategic acquisition of UW Solutions in 2023, which bolstered its expertise in coated substrates, directly positions the company to capitalize on these advancements, particularly in the smart glass sector.

Strategic Acquisitions and Partnerships for Market Expansion

Apogee can strategically grow by acquiring companies that bring new skills or products, as seen with the November 2024 UW Solutions deal. This move expanded Apogee's abilities and opened doors to different markets.

Forming alliances is another key opportunity. These partnerships can boost Apogee's technology or expand its customer base, leading to faster growth and a stronger market presence.

- Acquisition of UW Solutions (November 2024): Broadened Apogee's service portfolio and market reach.

- Partnerships for Technology Enhancement: Opportunities to integrate advanced technologies, improving product offerings and operational efficiency.

- Market Segment Entry: Acquisitions and partnerships can provide immediate access to new customer bases and geographic regions.

- Accelerated Growth: Strategic collaborations and acquisitions are proven methods to speed up market penetration and revenue generation.

Leveraging Operational Improvements for Enhanced Profitability

Apogee's commitment to operational excellence, notably through its 'Project Fortify,' is a significant opportunity. This initiative is designed to streamline operations and achieve substantial cost reductions, bolstering the company's financial health. For instance, during fiscal year 2024, the company targeted a reduction in its cost of goods sold by 2-3% through these efficiency drives.

This internal focus on efficiency directly supports a strategic pivot towards higher-margin, premium products. By improving the operating foundation, Apogee can better support the development and marketing of these value-added offerings. This dual approach of cost control and revenue enhancement through product mix is crucial for navigating market volatility and improving overall profitability.

- Project Fortify Targets: Aiming for sustainable cost savings through operational streamlining.

- Fiscal Year 2024 Impact: Targeted 2-3% reduction in cost of goods sold.

- Strategic Alignment: Enhancing profitability by supporting a shift to premium, high-performance products.

- Margin Improvement Potential: Creating a stronger financial base to absorb market headwinds.

The global push for sustainability presents a significant opportunity for Apogee. As demand for energy-efficient buildings grows, Apogee's high-performance glass and framing solutions are well-positioned to meet these needs. The energy-efficient glass market, valued at approximately $14.5 billion in 2023, is projected to reach $23.8 billion by 2030, with a 7.2% CAGR.

Infrastructure development and renovation are also key growth areas. Government initiatives, like the US Bipartisan Infrastructure Law, are driving demand for construction materials. The global building renovation market, valued at $790 billion in 2023, is expected to reach $1.2 trillion by 2030, offering a steady demand for Apogee's specialized products.

The burgeoning smart glass market, forecast to reach $10.3 billion by 2030, offers further expansion avenues. Apogee's 2023 acquisition of UW Solutions, enhancing its coated substrate expertise, positions it to capitalize on emerging smart glass technologies.

Apogee's strategic focus on operational efficiency, exemplified by its 'Project Fortify,' offers a pathway to improved profitability. This initiative aims to streamline operations and reduce costs, with a fiscal year 2024 target of a 2-3% reduction in cost of goods sold. This financial strengthening supports a pivot towards higher-margin, premium products.

| Opportunity Area | Market Data (2023/2024 Estimates) | Growth Projection | Apogee Relevance |

|---|---|---|---|

| Sustainability & Energy Efficiency | Energy-Efficient Glass Market: ~$14.5 Billion | ~7.2% CAGR (to 2030) | High-Performance Glass & Framing |

| Infrastructure & Renovation | Global Building Renovation Market: ~$790 Billion | Projected to reach $1.2 Trillion by 2030 | Specialized, High-Performance Materials |

| Smart Glass Market | Projected to reach $10.3 Billion by 2030 | Emerging Technologies | Coated Substrates Expertise (via UW Solutions) |

| Operational Efficiency | FY24 Cost of Goods Sold Reduction Target: 2-3% | Improved Profitability | Supports Premium Product Strategy |

Threats

Economic downturns pose a significant threat to Apogee, as a recession or prolonged slump in commercial construction directly curtails demand for its offerings. For instance, the U.S. experienced a contraction in real GDP of 3.1% in 2020 due to the pandemic, illustrating how economic shocks can rapidly impact industry demand.

This reduced demand translates into lower sales volumes and increased pricing pressure, squeezing Apogee's profitability. Historically, the construction sector is highly cyclical; a downturn in 2008-2009 saw U.S. construction spending plummet by over 20% year-over-year.

Apogee's financial performance is therefore intrinsically linked to the overall health and activity levels within the commercial construction industry, making it vulnerable to macroeconomic headwinds.

Apogee faces significant threats from intensifying global competition in the architectural glass and framing systems market. International players and emerging domestic companies are actively vying for market share, often leveraging cost advantages. This can lead to considerable pricing pressure, potentially impacting Apogee's profitability and its ability to maintain its current market position. For instance, in 2024, the global architectural glass market was projected to grow, but this growth also invites more competition, making it crucial for Apogee to remain agile.

The risk of market share erosion is a primary concern if Apogee cannot effectively differentiate its product offerings or sustain cost competitiveness against a growing field of rivals. Continuous investment in research and development is essential to introduce innovative solutions that set Apogee apart. Without a strong focus on innovation, Apogee could find its market share diminishing as competitors offer more attractive or economical alternatives, a trend observed across various industrial sectors in the 2024-2025 period.

Global supply chain disruptions, a persistent issue since 2020, continue to threaten companies like Apogee. These disruptions can significantly impact the availability and cost of essential components, leading to production delays. For instance, the semiconductor shortage, which began in 2020, continued to affect various manufacturing sectors into 2024, causing ripple effects across industries.

Volatility in raw material prices, such as aluminum and glass, presents another substantial threat. For example, aluminum prices experienced significant fluctuations in 2023 and early 2024, driven by geopolitical events and energy costs, directly impacting the cost of goods for manufacturers. This volatility can erode profit margins if not managed effectively through hedging or strategic sourcing.

These combined factors of supply chain instability and price volatility can directly translate to increased production expenses for Apogee. Consequently, this can lead to delays in fulfilling customer orders and a contraction of profit margins, especially if these increased costs cannot be passed on to consumers. For example, a 10% increase in the cost of key raw materials could directly reduce a company's net profit margin by a similar percentage if sales prices remain static.

Technological Disruption from Alternative Building Materials

The construction industry is seeing rapid advancements in material science, presenting a significant threat to companies like Apogee that rely on traditional glass and framing systems. Innovations in areas like cross-laminated timber (CLT) and advanced composite materials offer lighter, stronger, and more sustainable alternatives. For instance, the global engineered wood market, including CLT, is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 10% through 2028, indicating a clear shift in material preferences.

Apogee needs to proactively monitor these material science trends to avoid product obsolescence. The market for high-performance, eco-friendly building materials is expanding, driven by increasing demand for sustainable construction practices and government regulations promoting green building. Failure to integrate or compete with these emerging materials could lead to a decline in market share and revenue, as clients increasingly opt for cutting-edge solutions.

The potential for new materials to offer superior thermal performance, reduced installation time, or lower lifecycle costs poses a direct challenge. For example, advancements in aerogels and phase-change materials are enhancing insulation capabilities, potentially reducing the need for traditional curtain wall systems in certain applications. Apogee's long-term relevance hinges on its ability to adapt its product development and embrace these technological shifts, ensuring its offerings remain competitive and meet evolving market demands.

- Material Innovation: Development of high-performance alternatives like CLT, advanced composites, and enhanced insulation materials.

- Market Shift: Growing demand for sustainable and eco-friendly construction materials, driven by regulations and consumer preference.

- Competitive Threat: New materials may offer superior thermal performance, reduced costs, and faster installation, impacting traditional systems.

- Adaptation Imperative: Apogee must invest in R&D and potentially acquire new technologies to maintain market relevance and avoid obsolescence.

Regulatory Changes and Environmental Compliance Costs

Apogee faces significant threats from evolving regulatory landscapes. Stricter building codes and enhanced environmental regulations, particularly concerning energy efficiency and emissions, are poised to elevate operational expenses. For instance, the company noted in its 2023 annual report that changes in tariffs could negatively impact its Earnings Per Share (EPS).

These regulatory shifts necessitate substantial investments in compliance, potentially impacting Apogee's profitability and its ability to access key markets.

- Increased Compliance Costs: New environmental standards for building materials and manufacturing processes could require significant capital outlays for upgrades and new technologies.

- Tariff Volatility: Fluctuations in international trade policies and tariffs directly affect the cost of imported materials and the competitiveness of Apogee's exported products, with projections indicating a potential adverse effect on EPS.

- Market Access Restrictions: Non-compliance with evolving regulations in different jurisdictions could lead to limitations on market access or product sales.

The increasing adoption of advanced building materials presents a significant threat to Apogee's traditional glass and framing systems. Innovations such as cross-laminated timber (CLT) and advanced composites offer lighter, stronger, and more sustainable alternatives. For example, the global engineered wood market, a category including CLT, is projected to grow at a compound annual growth rate of over 10% through 2028, signaling a clear market shift towards these materials.

Apogee must actively monitor these material science advancements to prevent its products from becoming obsolete. The market's growing preference for high-performance, eco-friendly building materials, driven by sustainability initiatives and regulatory pressures, means that a failure to adapt could result in market share loss. New materials often provide superior thermal efficiency, faster installation, and reduced lifecycle costs, directly challenging Apogee's existing product lines.

SWOT Analysis Data Sources

This Apogee SWOT analysis is built on robust data, including Apogee's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.