Apogee Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apogee Bundle

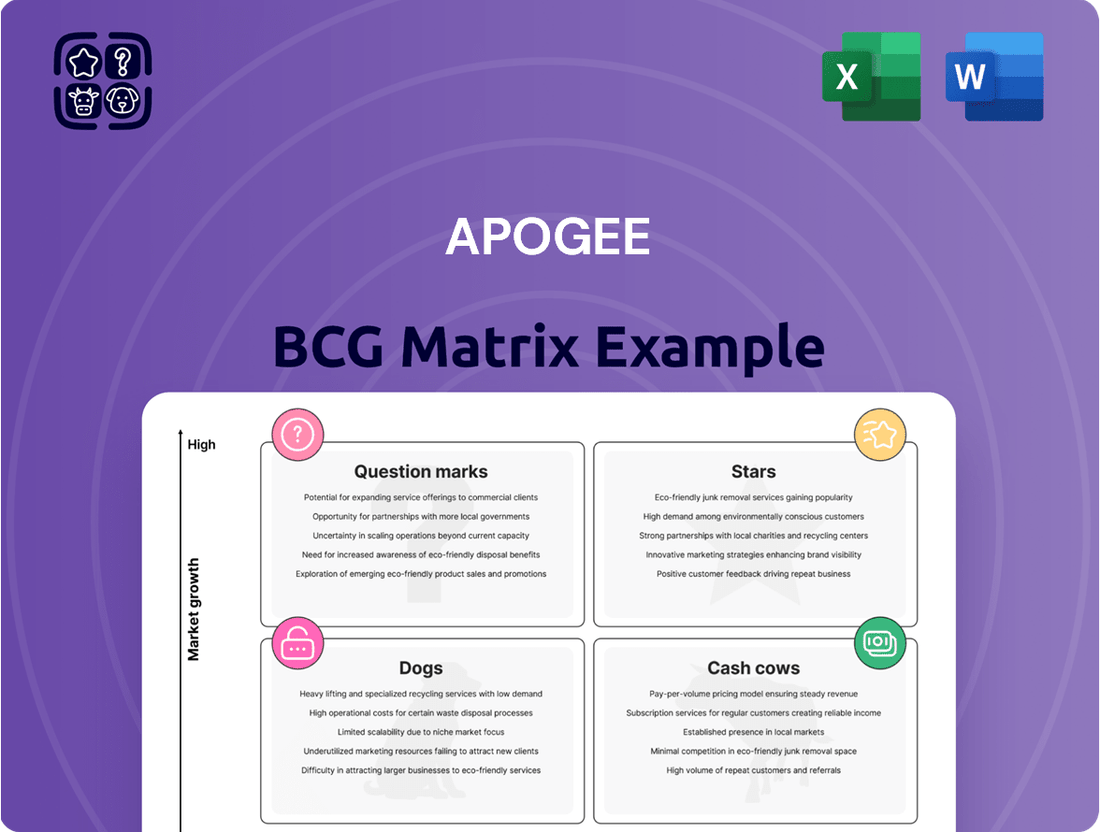

Curious about where this company's products truly shine and where they might be faltering? The BCG Matrix is your key to unlocking this vital strategic information. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual snapshot of market performance and potential.

Understanding these placements is crucial for informed decision-making, helping you allocate resources effectively and identify areas for growth or divestment. This preview offers a glimpse into the power of such analysis.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Apogee's specialized, high-performance architectural glass solutions, featuring advanced coatings for enhanced energy efficiency and sustainability, are strong contenders in the market. The global architectural glass market was valued at approximately $134.5 billion in 2023 and is projected to grow significantly, driven by the increasing demand for green buildings and smart technologies. Apogee's strategic focus on these premium, higher-value products has translated into robust profitability within this expanding sector.

Architectural Services are a star within Apogee's portfolio, exhibiting robust growth. The company reported double-digit sales growth in this segment for the fiscal year 2023, a trend that has continued into early 2024. This expansion is fueled by a growing backlog, which reached over $700 million by the end of 2023, signaling strong future demand for their integrated project management and installation services for complex building glass and curtainwall systems.

Apogee Enterprises, Inc. (APOG) has made substantial investments in smart glass technology, notably through its SageGlass® division and the strategic acquisition of UW Solutions in 2024. This focus positions smart glass as a high-growth area with considerable future potential for the company. The global smart glass market is experiencing robust expansion, projected to reach approximately $12.9 billion by 2030, fueled by increasing demand for energy-efficient building solutions.

Sustainable and Recycled Glass Offerings

Apogee's sustainable and recycled glass offerings are a strong contender in the market, reflecting a growing demand for eco-friendly building materials. This segment is capitalizing on the global shift towards circular economy principles, a trend that has seen significant acceleration in recent years.

The construction industry's increasing emphasis on sustainability directly benefits Apogee's eco-conscious product lines. For instance, the demand for recycled content glass in architectural projects has been on an upward trajectory, driven by both regulatory pressures and consumer preference for greener solutions.

- Market Growth: The global market for green building materials is projected to reach hundreds of billions of dollars by 2027, with recycled glass contributing a substantial portion.

- Industry Trends: Apogee is well-positioned to capitalize on the growing investor and consumer interest in companies with strong environmental, social, and governance (ESG) credentials.

- Competitive Advantage: By focusing on these sustainable offerings, Apogee differentiates itself and captures market share in a rapidly expanding, environmentally conscious segment.

- Innovation: Continued investment in R&D for recycled glass processing and other sustainable innovations will be crucial for maintaining leadership in this area.

Advanced Glazing for Complex Projects

Apogee Enterprises, through its specialized divisions, excels in delivering intricate, tailor-made glazing systems for monumental architectural endeavors. These projects frequently involve bespoke engineering and design, a testament to their Star status in the BCG matrix. This specialization commands premium pricing, aligning with the increasing demand for avant-garde building aesthetics that heavily feature expansive glass elements.

The company's ability to undertake such demanding projects is underscored by its significant backlog. For instance, as of the third quarter of fiscal year 2024, Apogee reported a record backlog of approximately $1.2 billion, with a substantial portion attributed to large, complex projects in its Architectural Services and Products segments. This strong pipeline reflects the market's recognition of Apogee's unique capabilities.

- Record Backlog: Apogee's fiscal year 2024 backlog exceeded $1.2 billion, indicating robust demand for its specialized glazing solutions.

- High Expertise Niche: The complexity and customization required for these projects position Apogee as a leader in a high-margin segment of the construction market.

- Premium Pricing Power: The unique engineering and design services offered allow Apogee to command higher prices, contributing to strong revenue generation.

- Trend Alignment: Apogee is well-positioned to capitalize on the growing architectural trend favoring sophisticated designs with extensive glass facades.

Apogee's architectural glass and glazing systems represent a significant Star in its product portfolio. These offerings cater to high-demand, growth-oriented segments of the construction industry. The company's focus on premium, complex projects with extensive glass facades is a key driver of this Star status.

The company's strength in specialized architectural glass, particularly for large-scale, complex projects, positions it as a Star. This is evidenced by a robust backlog, which reached approximately $1.2 billion by the end of fiscal year 2024, with a substantial portion tied to these high-value projects. This indicates strong market demand and Apogee's competitive advantage in delivering sophisticated glazing solutions.

Apogee's commitment to innovation in smart glass technology, exemplified by its SageGlass division and strategic acquisitions like UW Solutions in 2024, solidifies this segment as a Star. The global smart glass market is expanding rapidly, projected to reach around $12.9 billion by 2030, driven by energy efficiency demands.

Apogee's architectural services are a clear Star, showing double-digit sales growth in fiscal year 2023, a trend continuing into 2024. With a backlog exceeding $700 million by the end of 2023, these integrated project management and installation services for complex glass systems are experiencing strong market traction.

| Segment | BCG Category | Key Growth Drivers | Financial Highlight (FY24)** |

|---|---|---|---|

| Specialized Architectural Glass & Glazing Systems | Star | Demand for complex, large-scale projects; unique design capabilities | Record backlog of $1.2 billion |

| Smart Glass Technology | Star | Energy efficiency mandates; growing adoption in commercial buildings | Strategic acquisition of UW Solutions |

| Architectural Services | Star | Increased backlog for integrated project management; demand for complex installations | Double-digit sales growth |

What is included in the product

The Apogee BCG Matrix provides a strategic framework to analyze a company's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis guides investment decisions, suggesting which product lines to nurture, harvest, develop, or divest for optimal resource allocation.

Eliminates the struggle of visually categorizing business units, simplifying strategic decision-making.

Cash Cows

Apogee's standard commercial curtainwall and storefront systems are firmly positioned as cash cows. These established product lines likely hold a significant market share within the mature, yet steady, commercial construction sector.

Their widespread adoption in commercial buildings ensures a consistent and reliable revenue stream, minimizing the need for substantial promotional spending compared to emerging technologies.

For instance, in 2024, the commercial construction market continues to see demand for these foundational building envelope solutions, contributing a substantial portion to Apogee's overall profitability.

These systems are critical for generating predictable cash flow, allowing Apogee to fund investments in its more innovative product segments.

Viracon, Apogee’s core architectural glass business, functions as a classic cash cow. This segment, focused on high-performance glass fabrication and coatings, consistently generates substantial profits. Despite some industry-wide volume softness, Viracon has bolstered its earnings through operational efficiencies and strategic price adjustments, underscoring its leadership in a well-established market.

The Tru Vue brand, a key player in Apogee's Performance Surfaces segment, likely operates as a Cash Cow within the BCG Matrix. This segment caters to the niche market of high-performance glazing for custom framing and fine art, a sector characterized by stable, albeit low, growth prospects.

Apogee benefits from a strong, established market position for Tru Vue, leveraging its extensive distribution networks to generate consistent and reliable cash flow. While not a high-growth area, its predictable revenue stream makes it a vital contributor to the company's overall financial health.

In 2023, Apogee Enterprises reported that its Architectural Services segment, which includes framing glass operations like Tru Vue, saw a revenue increase of 6% year-over-year, indicating sustained demand in this specialized market. This segment's mature nature and strong market share position it squarely as a Cash Cow, providing essential funding for other business units.

Architectural Metals Segment's Core Offerings

The Architectural Metals segment, now primarily focused on its core offerings after exiting lower-margin products, likely commands a significant market share within its specialized niches. These products are fundamental to commercial construction, ensuring a consistent revenue flow and a well-entrenched market position.

Consider these key aspects:

- High Market Share in Niches: Following restructuring, the remaining products within Architectural Metals are positioned to dominate their specific market segments.

- Essential Building Components: These metals are crucial for the structural integrity and aesthetic appeal of commercial buildings, making demand relatively stable.

- Steady Revenue Stream: The segment's core offerings provide a reliable and predictable income, characteristic of cash cows.

- Established Market Presence: Years of operation have built a strong brand reputation and customer loyalty, reinforcing its dominant position.

Integrated Project Management and Installation Services

Integrated project management and installation services for Apogee’s architectural projects represent significant cash cows. Once a project is secured, the ongoing management and execution of these large-scale installations generate consistent, high-margin revenue streams. This predictable cash flow is a cornerstone of Apogee's financial stability.

Apogee's integrated approach, encompassing design, engineering, fabrication, and final installation, is key to maintaining this cash cow status. By controlling the entire lifecycle of a project, Apogee ensures efficiency and profitability. This end-to-end capability allows for better cost management and higher quality delivery, directly contributing to strong margins.

- Predictable Revenue: Apogee's project management and installation services provide a reliable source of income, reducing financial volatility.

- High Margins: The integrated nature of their services allows for greater control over costs and higher profit margins on completed projects.

- Customer Retention: Successful project execution fosters strong client relationships, leading to repeat business and further cash flow generation.

- Operational Efficiency: Streamlined processes from design to installation minimize waste and maximize profitability.

Apogee's established product lines, like standard commercial curtainwall and storefront systems, function as cash cows. These foundational offerings hold substantial market share in the steady commercial construction sector. Their consistent revenue generation, as seen in 2024, minimizes promotional spending and fuels investments in newer ventures. Viracon, Apogee’s architectural glass business, also operates as a classic cash cow, generating significant profits through operational efficiencies and strategic pricing in a mature market.

The Tru Vue brand, serving the niche market of high-performance glazing, is another cash cow. Its stable demand and strong distribution network provide predictable cash flow. In 2023, Apogee's Architectural Services segment, which includes Tru Vue, saw a 6% year-over-year revenue increase, highlighting its sustained contribution. Similarly, the Architectural Metals segment, focused on core offerings, benefits from a dominant market share in its niches, providing a reliable revenue stream crucial for funding other business units.

Apogee's integrated project management and installation services are powerful cash cows, delivering consistent, high-margin revenue. Controlling the entire project lifecycle ensures efficiency and profitability, contributing to strong margins. This predictable cash flow is vital for Apogee's financial stability, fostering customer retention and repeat business.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Relevance |

| Standard Curtainwall & Storefront | Cash Cow | High market share, mature market, steady revenue | Continued demand in commercial construction, significant profitability driver |

| Viracon (Architectural Glass) | Cash Cow | Strong profits, operational efficiencies, market leadership | Bolstered earnings through strategic adjustments, essential for funding growth |

| Tru Vue (Performance Surfaces) | Cash Cow | Niche market, stable demand, strong distribution | 6% YoY revenue increase in Architectural Services segment (incl. Tru Vue) |

| Architectural Metals (Core Offerings) | Cash Cow | Dominant niche market share, essential building components, predictable income | Reliable revenue stream, supports overall financial health |

| Integrated Project Management & Installation | Cash Cow | High margins, predictable cash flow, customer retention | End-to-end capability ensures efficiency and high profitability |

Full Transparency, Always

Apogee BCG Matrix

The Apogee BCG Matrix you see here is the identical, fully unlocked document you will receive immediately after purchase. This means no watermarks, no sample data, and no limitations – just the comprehensive strategic tool ready for your immediate application.

Dogs

Apogee Enterprises is strategically divesting lower-margin architectural framing products as part of its 'Project Fortify'. These offerings, likely found in mature or highly competitive markets, represent a strategic pruning to enhance overall profitability and operational efficiency within the Architectural Metals segment. The company is focusing resources on areas with greater growth potential and higher margins.

Outdated glass technologies, such as older single-pane windows, fall into the "Dogs" category of the Apogee BCG Matrix. These products often fail to meet current energy efficiency standards and are less appealing aesthetically, contributing to Apogee's low market share in these segments. Demand for these older technologies is steadily declining, and they face fierce price competition from more modern alternatives.

Maintaining these legacy products can become unprofitable due to low sales volume and the associated costs of production and inventory. For instance, if a particular type of insulating glass unit from the early 2000s has seen its market share shrink to under 5% and demand has dropped by over 15% year-over-year, it would be a prime candidate for divestment or discontinuation.

Underperforming regional operations are those geographic areas or specific facilities within a company that consistently fail to meet performance expectations. This underperformance can stem from a variety of factors, including low market penetration, where a company struggles to gain a significant share of customers in a particular region, or persistently high operational costs that erode profitability. Intense local competition can also be a major drain, making it difficult to achieve favorable margins or market share. Crucially, these operations are not aligned with the company's broader strategic growth plans, meaning they are unlikely to receive the investment or attention needed for a turnaround. Apogee's reported restructuring efforts in 2024, which aimed to optimize its manufacturing footprint, likely included evaluating and potentially divesting or consolidating such underperforming regional units to improve overall efficiency and focus resources on more promising areas.

Commoditized Standard Glass Products

Apogee Enterprises, while aiming for high-performance glass solutions, likely categorizes any standard, undifferentiated glass products as commodities within its BCG matrix. These products face intense competition and significant price pressure from a multitude of players, where Apogee’s market share is not substantial. Such offerings often contribute little to profitability and can divert valuable resources away from more strategic growth areas. For instance, in 2024, the global flat glass market, which includes commodity products, was valued at approximately $200 billion, but with intense competition, profit margins for standard offerings are often in the low single digits.

These commoditized standard glass products can be characterized by several key traits:

- Low Differentiation: Products lack unique features or technological advantages, making them easily substitutable.

- Price Sensitivity: Customers primarily base purchasing decisions on cost, leading to constant downward price pressure.

- High Competition: Numerous global and regional manufacturers compete, often on price alone.

- Limited Profitability: Margins are typically thin, often struggling to cover innovation and marketing costs.

Niche Picture Framing Products with Declining Demand

Within Apogee's Performance Surfaces segment, certain niche picture framing products are facing a challenging market. These specialized items, perhaps those with unique materials or intricate designs, are seeing a drop in consumer interest.

This decline is often driven by newer, more affordable alternatives that cater to current trends, impacting the market share of these older styles. Apogee's overall framing sales have reflected this trend, with lower volumes contributing to a sales decrease.

- Declining Consumer Interest: Specific niche picture frames are no longer as popular with consumers.

- Competition from Cheaper Alternatives: More budget-friendly options are taking market share.

- Low Market Share and Growth: These products have a small portion of the market and are not growing.

- Impact on Overall Sales: Apogee's framing division has experienced reduced sales due to lower product volumes.

Products categorized as "Dogs" within Apogee's BCG Matrix represent offerings with low market share and low growth potential. These items often require significant resources to maintain but yield minimal returns, hindering overall company performance. Apogee's strategy involves divesting or minimizing investment in these areas to redirect capital towards more promising ventures.

Examples of Apogee's "Dogs" include outdated glass technologies and niche picture framing products that have fallen out of favor. These segments face declining demand and intense competition, making them unprofitable to sustain. In 2024, Apogee's strategic pruning, as part of Project Fortify, likely targeted such underperforming assets.

The divestment of these "Dog" products allows Apogee to streamline operations and improve its financial health. By shedding low-margin, low-growth items, the company can focus on innovation and expansion in its higher-performing segments.

Maintaining "Dogs" consumes resources that could be better allocated. For instance, if a specific product line generated only 2% of revenue in 2024 but required 5% of R&D spending, it would be a clear candidate for divestment.

Question Marks

Apogee's smart glass technology, while a proven success in commercial buildings, is actively being explored for new frontiers like the residential and automotive sectors. These areas represent significant growth potential, but Apogee's current market penetration is minimal, positioning them as Question Marks within the BCG matrix. This strategic pivot necessitates substantial investment to develop tailored solutions and build brand awareness in these diverse markets.

The global smart glass market is projected to reach USD 39.6 billion by 2029, growing at a CAGR of 9.8% from 2024, according to recent industry analyses. This expansive growth, particularly in segments outside of traditional commercial applications, highlights the opportunity for Apogee to diversify its product portfolio and capture new market share, albeit with the inherent risks of entering less established territories.

Apogee's strategic push into new geographic markets for its Architectural Services represents a classic "Question Mark" in the BCG matrix. This means they are entering regions with potentially high growth but currently hold a low market share. For instance, Apogee's recent expansion into Southeast Asia in 2024, targeting burgeoning urban development projects, exemplifies this strategy.

These new ventures demand significant capital for establishing local operations, building brand recognition, and understanding diverse regulatory environments. Without successful penetration, these markets could drain resources.

Consider the firm’s foray into the Middle Eastern market in late 2023, aiming to capitalize on large-scale infrastructure projects. While the region shows robust GDP growth projections, Apogee's initial market share is minimal, making it a high-risk, high-reward proposition.

The success of these geographic expansions hinges on Apogee's ability to convert these "Question Marks" into "Stars" through sustained investment and effective market penetration strategies.

Investments in cutting-edge sustainable building materials, such as next-generation recycled glass compositions or novel low-carbon glass manufacturing processes, are prime examples of Question Marks within the Apogee BCG Matrix. These represent high-growth areas of innovation, but currently possess low market share due to their early development or adoption phases. For instance, the global market for sustainable building materials was projected to reach $390.2 billion by 2024, with advanced materials like those mentioned expected to drive future growth, though their individual penetration remains nascent.

Building-Integrated Photovoltaics (BIPV)

The Building-Integrated Photovoltaics (BIPV) market is rapidly expanding, turning conventional structures into active energy producers through solar cells embedded within building materials like glass facades. This sector is experiencing substantial growth, with global BIPV market size projected to reach approximately USD 40.5 billion by 2027, growing at a CAGR of 19.1% from 2022 to 2027.

If Apogee Enterprises (APOG) were to enter or significantly invest in this nascent but high-potential BIPV space, its offerings would likely be categorized as a Question Mark within the BCG Matrix. This designation reflects the substantial investment required to establish a strong market presence and gain a competitive edge in a rapidly evolving technology landscape.

- High Growth Potential: The BIPV market is a burgeoning sector, attracting significant investment and innovation.

- Market Uncertainty: As a relatively new and developing market, BIPV faces technological hurdles and evolving customer adoption rates.

- Investment Needs: Entering or expanding in BIPV demands considerable capital for research, development, manufacturing, and market penetration.

- Strategic Importance: Success in BIPV could position Apogee as a leader in sustainable building solutions, aligning with global energy trends.

Specialty Glazing for Niche High-Growth Sectors

Apogee Enterprises is actively exploring specialty glazing for niche, high-growth sectors beyond its core commercial construction market. This strategic pivot aims to capture new revenue streams in areas like advanced healthcare facilities and specialized industrial applications, where its current market share is minimal. These ventures necessitate targeted investment to foster development and market penetration.

The company’s focus includes developing advanced glazing solutions tailored for specific demands within these emerging sectors. For instance, in healthcare, this could mean enhanced antimicrobial properties or specialized light transmission for surgical suites. In industrial settings, it might involve high-impact resistance or specific chemical inertness.

- Targeted Investment: Apogee's strategy involves allocating capital specifically for R&D and market entry into these niche sectors.

- Market Expansion: The goal is to diversify revenue streams by establishing a presence in advanced healthcare and specialized industrial markets.

- Product Innovation: Development efforts are concentrated on creating glazing solutions with unique functionalities suited to these demanding applications.

- Growth Potential: These niche sectors represent significant growth opportunities that could drive future revenue and profitability for Apogee.

Question Marks in Apogee's portfolio represent ventures with high growth potential but low current market share, demanding significant investment for development and market penetration. These are strategic areas where Apogee is investing to capture future market leadership.

These investments are crucial for diversifying Apogee's revenue streams beyond its established commercial markets, aiming to transform these nascent opportunities into future revenue drivers.

The success of these Question Mark initiatives hinges on Apogee's ability to navigate market uncertainties, innovate effectively, and execute targeted strategies to gain market share.

Apogee is strategically investing in areas like Building-Integrated Photovoltaics (BIPV) and specialized glazing for healthcare and industrial sectors, both of which are categorized as Question Marks.

| Category | Apogee Venture Example | Market Growth Potential | Current Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Building-Integrated Photovoltaics (BIPV) | High (CAGR 19.1% projected 2022-2027) | Minimal/New Entry | Requires substantial investment for R&D and market entry. |

| Question Mark | Specialty Glazing for Healthcare | Significant growth in niche applications | Minimal | Targeted investment needed for product adaptation and market penetration. |

| Question Mark | Specialty Glazing for Industrial Applications | High-growth specialized segments | Minimal | Capital allocation for tailored solutions and market development. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing financial statements, industry performance metrics, and competitive analysis to provide a clear strategic overview.