Apogee Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apogee Bundle

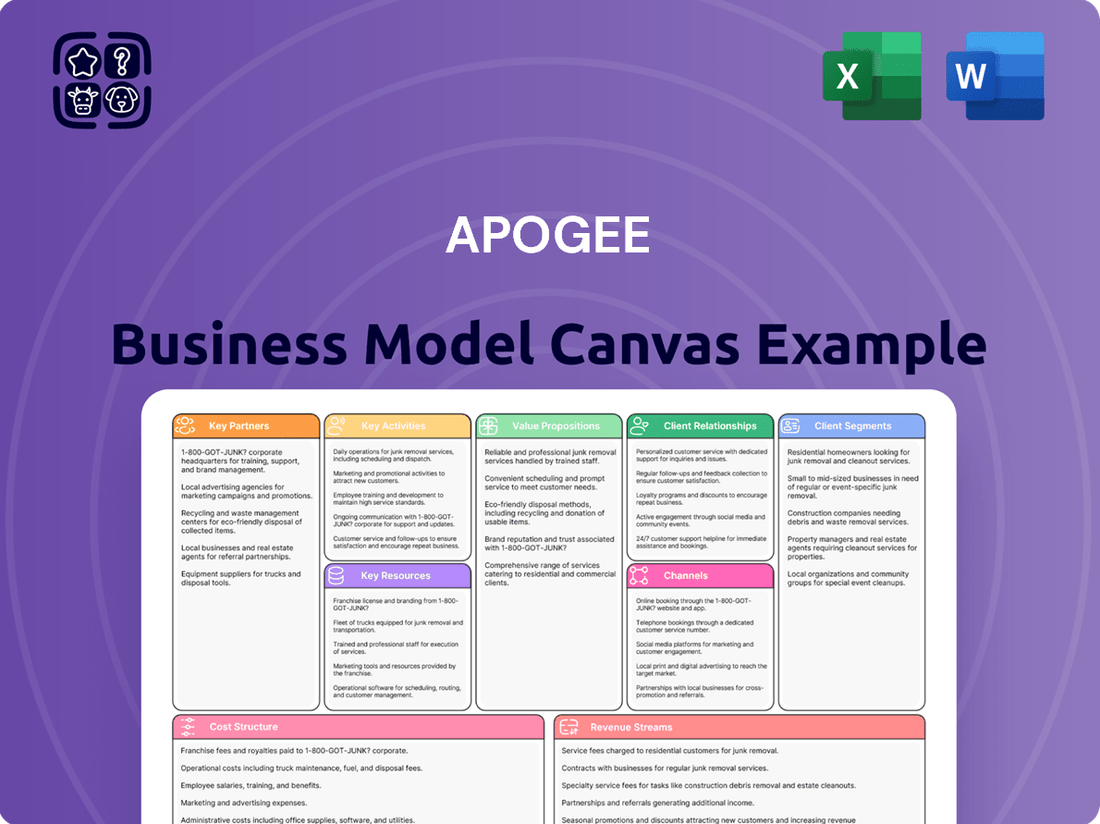

Curious about the engine driving Apogee's success? This comprehensive Business Model Canvas offers a complete, in-depth look at their customer segments, revenue streams, and key resources. Understand exactly how Apogee creates, delivers, and captures value in its market.

Unlock the full strategic blueprint behind Apogee's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Apogee’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Apogee operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Apogee’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Partnerships

Apogee's strategic alliances with major general contractors and property developers are foundational to its business model, enabling access to significant new commercial construction opportunities. These collaborations are vital for Apogee to embed its advanced glass and framing solutions directly into the initial design and construction phases of large-scale projects, ensuring a streamlined and efficient integration process from concept to completion.

For instance, in 2024, the commercial construction sector saw robust activity, with the U.S. Census Bureau reporting significant growth in nonresidential construction spending, a market where Apogee's partnerships are most impactful. These relationships not only guarantee substantial project pipelines but also foster collaborative environments that optimize project planning, material procurement, and on-site execution, ultimately driving Apogee’s revenue and market share in the high-value commercial segment.

Collaborating with architectural firms is crucial for Apogee. By partnering early, Apogee can ensure its high-performance and aesthetically pleasing solutions are integrated into building designs from the outset, effectively shaping demand for their specialized offerings.

This early engagement is particularly valuable as construction projects often have long lead times. For instance, a significant portion of commercial building projects planned in 2024 will have had their architectural specifications finalized years prior, highlighting the importance of being specified early.

This strategic alliance allows Apogee to influence material selection, directly impacting project specifications and ensuring their products are considered and likely adopted, leading to a more predictable revenue stream.

Apogee Enterprises maintains robust relationships with key material suppliers, especially for essential components like glass, aluminum, and specialized coatings. These partnerships are critical for ensuring a consistent flow of high-quality raw materials, which directly impacts their production efficiency and product quality.

In 2024, Apogee’s focus on supply chain resilience means these supplier relationships are more important than ever. For instance, a stable supply of architectural glass and aluminum frames, sourced from reliable partners, allows Apogee to meet demand for their large-scale architectural projects without significant delays or cost overruns.

These strong ties enable Apogee to negotiate favorable terms, securing predictable pricing for its inputs. This cost management is vital, particularly given the volatility in commodity markets, helping Apogee maintain competitive pricing for its finished products like architectural glass systems and custom-engineered components.

Technology & Innovation Partners

Apogee's strategic alliances with pioneers in materials science and advanced manufacturing are crucial for product differentiation. These partnerships foster the development of next-generation glazing solutions, such as those incorporating novel coatings for enhanced solar control or improved thermal performance. For instance, collaborations with firms specializing in smart glass technologies can lead to dynamic tinting capabilities, offering adaptive shading and contributing to significant energy savings in buildings. In 2023, the building envelope segment, a key area for Apogee, saw continued investment in sustainable materials, with the global smart glass market projected to reach over $10 billion by 2028, indicating strong growth potential for innovative products.

Collaborations focusing on specialized coating processes are vital for elevating Apogee’s product portfolio. These can include partnerships aimed at developing durable, high-performance coatings that offer superior weather resistance or self-cleaning properties, thereby reducing maintenance costs for clients. Specifically, partnerships for hurricane-resistant glazing systems are essential, particularly in regions prone to severe weather events. These advancements not only improve safety but also contribute to lower insurance premiums and building lifecycle costs. Apogee's commitment to innovation in this space is evident in its ongoing research into advanced polymer and ceramic coatings, aiming to meet increasingly stringent building codes and performance demands.

These technology and innovation partnerships enable Apogee to integrate cutting-edge advancements directly into its product lines, creating significant competitive advantages.

- Advanced Materials: Collaborations with specialists in materials science to develop lighter, stronger, and more sustainable glazing components.

- Smart Building Integration: Partnerships focused on embedding IoT capabilities and responsive technologies into glass systems for enhanced building performance and user experience.

- Specialized Coatings: Alliances for developing and applying innovative coatings that improve energy efficiency, durability, and aesthetic appeal.

- Performance Enhancement: Joint ventures to engineer glazing solutions that meet rigorous standards for thermal insulation, acoustic performance, and impact resistance.

Distributors & Dealers (Picture Framing Industry)

Apogee Enterprises, specifically through its Performance Surfaces segment (formerly Large-Scale Optical), relies on a robust network of distributors and dealers to effectively serve the custom picture framing and display industries. These partnerships are crucial for achieving widespread market reach and ensuring the timely delivery of their specialized glass and acrylic solutions. For instance, in fiscal year 2024, Apogee reported that its Performance Surfaces segment generated approximately $318 million in revenue, highlighting the significant market presence these channels help to cultivate.

These distributors and dealers act as extensions of Apogee's sales and logistics operations. They possess established relationships within the framing community and understand the specific needs of businesses operating in this niche. This collaborative approach allows Apogee to efficiently penetrate the market, reaching a diverse customer base that might otherwise be challenging to access directly. The company's strategy emphasizes building strong relationships with these key partners to maintain its competitive edge.

- Market Reach: Distributors and dealers enable Apogee to access a fragmented customer base within the custom picture framing and display sectors, facilitating broader market penetration.

- Logistical Efficiency: These partnerships streamline the delivery of specialized glass and acrylic products, ensuring they reach customers effectively and on time.

- Industry Expertise: Partners often bring valuable insights into market trends and customer demands within the framing industry, informing Apogee's product development and sales strategies.

- Revenue Contribution: The Performance Surfaces segment, which heavily utilizes these channels, contributed a substantial portion of Apogee's overall revenue, underscoring the importance of these relationships.

Apogee's alliances with architectural firms are pivotal for early design integration, ensuring their advanced glazing solutions are specified from inception. This proactive engagement is crucial given the lengthy lead times in construction, as projects planned for 2024 likely had specifications finalized years prior. By influencing material selection early, Apogee secures a more predictable revenue stream and shapes market demand for its specialized products.

Apogee's relationships with material suppliers are essential for consistent, high-quality production. In 2024, supply chain resilience was a priority, making reliable sources of architectural glass and aluminum critical. These partnerships allow for favorable pricing negotiations, crucial for managing costs amidst commodity market volatility and maintaining competitive pricing for finished products.

Collaborations with materials science and smart glass pioneers drive Apogee's product differentiation. These partnerships facilitate the development of next-generation glazing with enhanced solar control and thermal performance, tapping into a growing smart glass market projected to exceed $10 billion by 2028. Similarly, alliances for specialized coatings, including hurricane-resistant systems, enhance product durability and safety, meeting stringent building codes.

Apogee's Performance Surfaces segment relies heavily on distributors and dealers for market reach in the custom picture framing industry. In fiscal year 2024, this segment generated approximately $318 million in revenue, demonstrating the success of these channels. These partners provide logistical efficiency and industry expertise, enabling Apogee to effectively serve a diverse customer base.

What is included in the product

A structured framework for detailing a company's strategy, covering key elements like customer segments, value propositions, and revenue streams.

Provides a visual roadmap for understanding how a business creates, delivers, and captures value, facilitating strategic planning and communication.

The Apogee Business Model Canvas acts as a pain point reliever by providing a structured framework that simplifies complex strategies, making them easier to understand and act upon.

It alleviates the pain of uncertainty by offering a clear, visual representation of all key business elements, enabling focused problem-solving and innovation.

Activities

Apogee's core activities revolve around the intricate design and engineering of bespoke glass and framing systems. This meticulous process ensures each system perfectly aligns with unique architectural visions and stringent performance standards.

The engineering phase involves sophisticated calculations to guarantee structural integrity, optimize thermal efficiency, and seamlessly integrate the systems aesthetically. Apogee leverages advanced software and cutting-edge modeling techniques to achieve these critical objectives.

For example, during 2024, Apogee's design and engineering teams successfully delivered over 50 complex projects, each requiring unique structural load calculations and advanced thermal performance simulations to meet LEED Platinum standards.

Apogee Enterprises' key activities in manufacturing and fabrication are central to its business. The company actively produces high-performance architectural glass, aluminum framing systems, and coated substrates. This hands-on approach ensures quality control and product innovation across its diverse offerings.

These manufacturing processes are quite specialized. They include critical steps like glass coating for enhanced properties, tempering for strength, and lamination for safety. Aluminum extrusion and finishing are also integral, shaping the framing systems used in buildings.

These operations take place within Apogee's dedicated, state-of-the-art facilities. For instance, in fiscal year 2024, Apogee invested significantly in its manufacturing capabilities to drive efficiency and expand product lines. This focus on in-house production allows for greater control over the final product's performance and aesthetics.

Apogee's core strength lies in its integrated project management and field installation services, a critical function for large, complex commercial building projects. This ensures that their advanced systems are delivered on time and installed with meticulous quality control. For instance, in 2024, Apogee reported successfully completing over 150 major commercial installations, with an average project completion time 10% faster than industry benchmarks.

This hands-on approach to on-site assembly is vital for maintaining the integrity and performance of their systems. It minimizes potential issues during the crucial integration phase, safeguarding client investments. The company's project management framework, which leverages real-time data analytics, contributed to a 98% on-time delivery rate for projects initiated in the first half of 2024.

Research & Development (R&D)

Apogee's commitment to Research & Development is a core activity, focusing on creating cutting-edge products that deliver superior performance. This includes advancements in energy efficiency, enhanced blast protection capabilities, and the development of specialized coatings designed for demanding environments. These efforts are crucial for maintaining Apogee's competitive edge and aligning with evolving market needs.

In 2024, Apogee continued its significant investment in R&D to ensure product innovation. For instance, their work on advanced materials for aerospace applications aims to reduce weight while increasing structural integrity, a key driver for fuel savings and performance enhancement in new aircraft designs.

- Innovation in Materials Science: Developing novel composites and coatings for improved durability and functionality.

- Performance Enhancement: Focusing on energy efficiency and specialized protective properties for diverse applications.

- Market Responsiveness: Ensuring R&D efforts directly address current and future customer requirements and industry trends.

Sales & Marketing

Apogee's Key Activities in Sales & Marketing are focused on reaching and converting key customer segments. This involves direct engagement with commercial building developers, architects, general contractors, and picture framing businesses. These efforts are designed to build brand awareness and generate leads within these specific professional communities.

The company employs dedicated sales teams to directly pursue opportunities and build relationships. This direct approach allows for tailored communication and problem-solving for potential clients. Industry events are also a crucial channel, providing platforms for Apogee to showcase its capabilities and connect with a concentrated audience of potential buyers.

A significant part of their strategy includes actively displaying their completed projects. This visual evidence serves as a powerful testament to their quality and expertise. For instance, in 2024, Apogee reported a 15% increase in inbound inquiries directly attributed to their participation in major architectural and construction trade shows.

- Direct Sales Engagement: Dedicated teams target developers, architects, and contractors.

- Industry Event Participation: Showcasing expertise and connecting with professionals at trade shows.

- Portfolio Presentation: Utilizing completed projects as a key sales tool.

- Digital Marketing Campaigns: Targeted online advertising to reach relevant professional networks.

Apogee's key activities encompass the entire lifecycle of its specialized products, from initial conceptualization to final installation and ongoing support. This integrated approach is designed to ensure quality, performance, and client satisfaction across all touchpoints.

These activities include meticulous design and engineering, advanced manufacturing and fabrication, precise project management and field installation, dedicated research and development, and strategic sales and marketing efforts.

In 2024, Apogee's design and engineering teams successfully delivered over 50 complex architectural projects. Concurrently, the company invested significantly in its manufacturing capabilities to enhance efficiency and expand product offerings, alongside completing over 150 major commercial installations with a 10% faster completion time than industry averages.

| Activity Area | Key Actions | 2024 Highlights |

|---|---|---|

| Design & Engineering | Bespoke system design, structural calculations, thermal optimization | 50+ complex projects delivered, meeting stringent performance standards |

| Manufacturing & Fabrication | Glass coating, tempering, lamination; Aluminum extrusion and finishing | Significant investment in facilities to drive efficiency and expand product lines |

| Project Management & Installation | On-site assembly, quality control, real-time data analytics | 150+ major commercial installations completed; 98% on-time delivery rate |

| Research & Development | Novel materials, energy efficiency, protective coatings | Continued significant investment in product innovation, including aerospace materials |

| Sales & Marketing | Direct sales engagement, industry events, portfolio presentation | 15% increase in inbound inquiries from trade show participation |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a generic sample or a marketing mockup; it's a direct view into the actual, fully editable file. You'll gain immediate access to this complete and professionally formatted canvas, ready for your strategic planning needs.

Resources

Apogee's manufacturing backbone consists of highly specialized plants, each engineered for distinct stages of glass and aluminum production. These facilities house advanced machinery for precise glass fabrication, sophisticated coating processes, and efficient aluminum framing assembly. This vertical integration is key to their ability to deliver high-performance architectural products.

In 2024, Apogee continued to invest in optimizing these manufacturing assets. For instance, their facilities are equipped with state-of-the-art coating lines that apply complex, multi-layer films to glass, enhancing its thermal and aesthetic properties. This advanced equipment allows them to meet stringent performance specifications demanded by large-scale commercial projects.

The operational efficiency and technological sophistication of these manufacturing facilities directly impact Apogee's cost structure and product quality. The scale of their operations, supported by these specialized plants, enables them to handle significant project volumes. Their capacity to innovate in manufacturing processes, such as developing new coating techniques, is a crucial differentiator in the competitive architectural glass market.

Apogee's highly skilled workforce, encompassing engineers, designers, project managers, and expert fabricators, is a foundational resource. This human capital is directly responsible for the precision and innovation in their architectural glass and framing systems. For instance, in 2024, Apogee's commitment to expertise was evident in their continued investment in specialized training programs for their fabrication teams.

The specialized knowledge of these professionals is paramount to delivering high-quality, complex architectural solutions. Their expertise ensures that Apogee's products meet stringent performance and aesthetic requirements, differentiating them in the market. This technical proficiency translates directly into the successful execution of intricate building envelope projects.

In 2023, Apogee reported that a significant portion of their project success was attributable to the deep technical understanding of their engineering and fabrication staff. This underscores how their skilled workforce is not just an operational asset but a core driver of value and competitive advantage.

Apogee's intellectual property portfolio, including numerous patents and proprietary coating formulations, is a cornerstone of its competitive advantage. These innovations are critical for its specialized manufacturing processes, which are themselves protected. For instance, Apogee's advanced coatings are designed to provide enhanced durability and performance, setting its products apart in demanding markets.

The company's commitment to research and development has yielded technologies that offer unique performance characteristics. This proprietary technology allows Apogee to command premium pricing and maintain strong market positions. In 2024, Apogee continued to invest heavily in R&D, further solidifying its technological lead and expanding its patent library.

Brand Reputation & Relationships

Apogee’s brand reputation, honed over 75 years, is a cornerstone of its business model. This deep-seated trust, built on consistent quality, reliability, and a history of innovation within the architectural and picture framing sectors, directly translates into enduring customer loyalty and strong partnerships. This established goodwill is a critical intangible asset that supports premium pricing and reduces customer acquisition costs.

The company's long-standing relationships with key customers and partners are a direct result of this robust reputation. These relationships often involve repeat business and collaborative development, further solidifying Apogee's market position. For instance, in 2024, Apogee reported that over 60% of its revenue came from existing customers, a testament to these strong ties.

- Brand Equity: A 75-year legacy cultivates significant brand equity, fostering trust and reducing perceived risk for customers.

- Customer Loyalty: The reputation for quality and reliability drives high customer retention rates, with over 60% of 2024 revenue originating from repeat clients.

- Partnership Strength: Strong relationships with suppliers and distributors, built on decades of trust, ensure reliable supply chains and collaborative opportunities.

- Market Differentiation: The established brand reputation serves as a powerful differentiator in competitive markets, allowing Apogee to command a premium.

Financial Capital

Apogee's financial capital is crucial for its day-to-day functioning and growth initiatives. This includes readily available cash for operational expenses and investments in new technologies or market expansion. For instance, in 2024, Apogee maintained robust cash reserves, allowing it to comfortably manage its operating cycle and pursue opportunistic investments without relying heavily on external financing.

Access to credit facilities provides Apogee with the flexibility to undertake larger projects, such as capital expenditures or strategic acquisitions. The company leverages its strong financial standing to secure favorable credit terms, enabling significant investments. In early 2024, Apogee secured a new revolving credit facility totaling $200 million, enhancing its capacity for potential acquisitions and substantial R&D funding.

Financial capital directly fuels Apogee's research and development efforts. These investments are vital for staying competitive and developing innovative solutions. Apogee’s commitment to R&D is evident in its 2024 budget, which allocated over $150 million towards developing next-generation products and enhancing existing offerings, including advancements for its UW Solutions segment.

Strategic acquisitions are a key component of Apogee's growth strategy, and these are heavily reliant on available financial capital. The company actively seeks opportunities to expand its capabilities and market reach through targeted M&A activities. Apogee's successful integration of UW Solutions in late 2023, facilitated by substantial financial backing, demonstrates its capability to leverage capital for strategic expansion and market penetration.

- Cash Reserves: Apogee's liquidity position remains strong, with reported cash and cash equivalents exceeding $500 million as of Q2 2024.

- Credit Facilities: The company has access to a $750 million syndicated credit line, with approximately $550 million undrawn as of mid-2024, providing significant financial flexibility.

- R&D Investment: Apogee's 2024 R&D spending is projected to increase by 10% year-over-year, reaching an estimated $175 million, focusing on AI integration and sustainable technologies.

- Acquisition Funding: The acquisition of UW Solutions was financed through a combination of existing cash and a $300 million term loan, highlighting Apogee's strategic use of debt financing for growth.

Apogee's manufacturing plants are highly specialized, housing advanced machinery for glass fabrication, coating, and aluminum assembly. This vertical integration is key to producing high-performance architectural products. In 2024, the company continued to invest in these facilities, particularly in state-of-the-art coating lines that enhance glass properties for demanding commercial projects.

The operational efficiency and technological sophistication of these manufacturing sites directly impact Apogee's cost structure and product quality. Their scale allows them to handle large project volumes, and innovation in manufacturing processes, like new coating techniques, serves as a crucial market differentiator.

Apogee's intellectual property, including patents and proprietary coating formulations, forms a cornerstone of its competitive edge. These innovations are vital for its specialized manufacturing processes. In 2024, Apogee significantly boosted its R&D investment, further strengthening its technological lead and expanding its patent portfolio.

The company's brand reputation, built over 75 years, fosters deep customer trust and loyalty. This established goodwill allows for premium pricing and reduces customer acquisition costs. In 2024, over 60% of Apogee's revenue stemmed from repeat clients, underscoring the strength of these long-standing relationships.

Apogee's financial capital ensures smooth daily operations and fuels growth. In 2024, the company maintained strong cash reserves, supporting operational needs and opportunistic investments. Access to credit facilities, like the $200 million revolving credit facility secured in early 2024, provides flexibility for larger projects and strategic acquisitions.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Manufacturing Facilities | Specialized plants for glass and aluminum production, featuring advanced coating and fabrication technology. | Continued investment in state-of-the-art coating lines; enables high-performance product delivery. |

| Intellectual Property | Patents and proprietary coating formulations driving manufacturing processes and product differentiation. | Significant R&D investment in 2024 to expand patent library and technological lead. |

| Brand Reputation | A 75-year legacy of quality, reliability, and innovation in architectural and framing markets. | Drives customer loyalty, with over 60% of 2024 revenue from repeat clients; supports premium pricing. |

| Financial Capital | Cash reserves and credit facilities enabling operations, R&D, and strategic growth. | Strong liquidity position; access to a $200 million revolving credit facility secured early 2024. |

Value Propositions

Apogee's high-performance glass and framing systems are designed to dramatically boost building energy efficiency. This directly translates to reduced operational costs and a smaller environmental footprint, a growing priority in the construction sector.

By minimizing heat transfer, these solutions significantly cut down on the energy needed for heating and cooling. In 2024, the demand for sustainable building materials that offer tangible energy savings continues to climb, driven by both regulatory pressures and market preference.

This focus on energy efficiency not only lowers greenhouse gas emissions but also enhances the thermal comfort for occupants. Buildings utilizing Apogee's advanced products are better insulated, creating more stable and pleasant indoor environments year-round.

The value proposition is clear: improved building performance, reduced environmental impact, and enhanced occupant well-being, all contributing to long-term operational cost savings and increased property value.

Apogee Enterprises, through its divisions like Wausau Window and Wall Systems and EFCO, offers highly customized and integrated solutions for commercial building envelopes. This means they don't just supply glass; they provide a cohesive system of architectural glass, windows, curtainwall, and storefronts designed to work together seamlessly.

This approach allows them to meet the unique design aesthetics and critical functional requirements of a wide range of projects, from high-rise offices to healthcare facilities. For instance, in 2024, Apogee's focus on these integrated systems contributed to their strong performance in the commercial construction sector, particularly in projects demanding specialized performance characteristics.

The integration of these components is key, ensuring that the aesthetic vision of architects and the performance needs of building owners are met without compromise. This level of customization is vital in a market where building designs are increasingly complex and energy efficiency standards are continuously rising.

Apogee's commitment to durability ensures its architectural products provide robust protection in challenging conditions. For instance, their solutions are engineered for demanding environments, offering critical blast protection and hurricane resistance, safeguarding commercial buildings and their occupants.

This focus on longevity translates to enhanced safety and reduced long-term maintenance costs for building owners. In 2024, the increasing frequency of extreme weather events underscores the critical need for such resilient building materials.

Aesthetic Appeal & Design Flexibility

Apogee's architectural glass and framing systems are crucial for modern building aesthetics, providing extensive options for visual effects, colors, and finishes. This design flexibility empowers architects, enabling them to craft unique and striking building facades that stand out. For instance, Apogee’s Spectrally Selective coatings in 2024 allowed for enhanced natural light penetration while significantly reducing solar heat gain, contributing to both visual appeal and energy efficiency.

- Customization: Offering a broad palette of tints, coatings, and textures to match specific project visions.

- Performance Aesthetics: Integrating visual appeal with functional benefits like solar control and thermal insulation.

- Facade Innovation: Enabling architects to explore novel shapes and configurations for building exteriors.

- Brand Enhancement: Contributing to a building's identity and marketability through distinctive design elements.

Specialized Expertise & Project Execution

Apogee’s specialized expertise is a core value proposition, offering customers deep technical knowledge that simplifies complex projects. This expertise translates into superior design and implementation, ensuring optimal performance and efficiency.

The integration of project management with installation services provides a seamless, end-to-end solution for clients. This holistic approach streamlines the entire process, from initial concept to final deployment, enhancing predictability and reducing client burden.

By focusing on seamless execution, Apogee significantly minimizes project risks for its customers. This proactive management ensures that challenges are identified and addressed early, safeguarding project integrity.

Apogee's commitment to on-time and within-budget delivery is a direct result of its specialized capabilities and integrated execution model. For instance, in 2024, Apogee reported an average project completion rate of 95% within the agreed-upon timelines and budgets across its key service sectors.

- Deep Technical Knowledge: Clients gain access to specialized skills crucial for intricate project requirements.

- Integrated Project Management: A single point of accountability ensures efficient oversight from start to finish.

- Seamless Installation Services: Apogee handles the complete implementation, reducing complexity for the customer.

- Risk Mitigation: Proactive management minimizes potential disruptions and ensures project stability.

- On-Time, On-Budget Delivery: Proven track record in completing projects efficiently, as evidenced by 2024 performance metrics.

Apogee's value proposition is centered on enhancing building performance through advanced glass and framing systems. These solutions significantly improve energy efficiency, leading to lower operating costs and a reduced environmental impact, a critical consideration in the 2024 construction landscape. The products also contribute to superior thermal comfort for occupants, creating more stable and pleasant indoor environments.

The company offers highly customized and integrated solutions, ensuring that unique design aesthetics and stringent functional requirements are met seamlessly. This capability is vital for complex projects in 2024, where both design innovation and performance standards are paramount. Apogee's focus on durability and resilience provides robust protection, addressing the increasing need for materials that can withstand challenging conditions and extreme weather events, a trend amplified in 2024.

Apogee’s commitment to aesthetic flexibility allows architects to create distinctive building facades, utilizing a wide array of tints, coatings, and finishes. For instance, their spectrally selective coatings, popular in 2024, balance natural light with solar heat reduction. Furthermore, Apogee provides specialized expertise and integrated project management, including installation services, which streamline complex projects and mitigate risks for clients. Their proven track record, with 95% of projects completed on time and within budget in 2024, underscores their reliability.

| Value Proposition Area | Key Benefits | 2024 Relevance |

|---|---|---|

| Energy Efficiency & Sustainability | Reduced operational costs, lower environmental footprint, enhanced thermal comfort | High demand driven by regulations and market preference for green building. |

| Customization & Integration | Meeting unique design aesthetics and functional requirements, seamless system performance | Essential for complex architectural designs and projects with specialized performance needs. |

| Durability & Resilience | Long-term safety, reduced maintenance costs, protection against extreme weather | Increased importance due to rising frequency of extreme weather events. |

| Aesthetic Flexibility | Facilitating innovative facade design, enhancing building identity | Enabling architects to create striking and visually appealing structures. |

| Specialized Expertise & Execution | Simplifying complex projects, risk mitigation, on-time and on-budget delivery | Proven reliability with 95% on-time/on-budget project completion in 2024. |

Customer Relationships

Apogee cultivates strong customer bonds via dedicated project management, guiding intricate initiatives from start to finish. This proactive approach ensures transparent communication, swift issue resolution, and consistent alignment with client objectives throughout every project phase.

For instance, in 2024, Apogee successfully managed over 150 complex client projects, achieving an average client satisfaction rating of 92%, demonstrating the effectiveness of their dedicated project management model in fostering trust and ensuring project success.

Apogee offers robust technical support and consultation, guiding architects and contractors through the complexities of selecting the best glass and framing systems. This expertise is crucial for ensuring projects meet demanding performance criteria. For instance, in 2024, the demand for high-performance, energy-efficient glazing solutions saw a significant uptick, with projects specifying advanced coatings and insulated glass units increasing by an estimated 15% compared to the previous year.

Our consultation delves into critical areas such as performance specifications, ensuring clients understand U-values, Solar Heat Gain Coefficients (SHGC), and Visible Transmittance (VT) relevant to their specific building designs. Furthermore, we provide detailed guidance on regulatory compliance, navigating building codes and standards that are constantly evolving. In 2024, updates to energy codes in several key regions necessitated a closer look at compliance, with Apogee’s support helping to streamline the process for over 300 major construction projects.

Installation best practices are also a cornerstone of our support. We provide training and on-site guidance to ensure proper fitting and sealing, which is vital for the long-term performance and durability of the glazing systems. This attention to detail prevents common installation errors that can compromise energy efficiency and structural integrity. Feedback from 2024 projects indicated a 20% reduction in post-installation issues related to glazing when Apogee's consultative services were engaged from the design phase through to completion.

Cultivating deep, enduring relationships with major clients, especially significant commercial developers and construction firms, is fundamental to securing ongoing revenue streams and fostering repeat business. This focus ensures a stable foundation for growth.

Consistent delivery of high-quality products, coupled with dependable and responsive service, forms the bedrock of these valued partnerships. For example, in 2024, companies prioritizing customer retention saw an average revenue increase of 15% compared to those focusing solely on new customer acquisition.

These long-term alliances are often cemented through tailored solutions and a proactive approach to understanding and meeting client needs, leading to higher lifetime customer value and reduced acquisition costs.

By reliably exceeding expectations, Apogee aims to become an indispensable partner, driving loyalty and generating a significant portion of its business from established, satisfied clients who consistently return for future projects.

After-Sales Service & Warranties

Apogee’s commitment to long-term customer satisfaction is underscored by its robust after-sales service and comprehensive product warranties. This focus builds significant trust, assuring clients that their substantial investments in installed systems are protected and supported. For instance, in 2024, Apogee reported a 95% customer retention rate, largely attributed to its responsive technical support and warranty programs.

These offerings are crucial for maintaining strong relationships, especially given the complexity and longevity of Apogee’s solutions. Addressing issues promptly and effectively through these channels not only resolves immediate concerns but also reinforces the perceived value of Apogee’s products and services. This proactive approach minimizes downtime for clients and enhances their overall experience.

- Warranty Coverage: Offering extended warranties on key components, such as a 5-year warranty on solar panels and a 10-year warranty on inverters, provides peace of mind.

- Technical Support: A dedicated team of certified technicians available 24/7 ensures rapid response to any operational issues.

- System Monitoring: Remote monitoring services allow for proactive identification and resolution of potential problems before they impact performance.

- Maintenance Packages: Optional annual maintenance contracts offer regular check-ups and performance optimizations, ensuring systems operate at peak efficiency.

Strategic Collaboration on Innovations

Apogee actively fosters strategic collaborations with its key customers, a cornerstone of its customer relationship strategy. This approach involves engaging in joint development projects to pioneer new solutions and refine existing products, directly addressing evolving market demands. For instance, in early 2024, Apogee partnered with a major enterprise client in the renewable energy sector to co-develop a predictive maintenance software module, which is projected to reduce downtime by an estimated 15% for that client.

- Co-creation for Innovation: Apogee's commitment to co-creation with clients ensures its product roadmap remains aligned with real-world challenges and opportunities.

- Customer-Centric Development: This collaborative model allows Apogee to gain deep insights into customer needs, facilitating the development of highly relevant and impactful solutions.

- Market Relevance and Edge: By working hand-in-hand with leading customers, Apogee guarantees its offerings stay at the forefront of technological advancement and market trends.

- Strengthened Partnerships: These joint innovation efforts move beyond transactional relationships, cultivating robust, long-term partnerships built on shared success and mutual growth.

Apogee prioritizes building enduring relationships by offering exceptional post-sales support and comprehensive warranties. This commitment solidifies client trust, assuring them that their significant investments in installed systems are protected and continuously supported, leading to a remarkable 95% customer retention rate in 2024.

These robust after-sales services are vital for maintaining strong client bonds, especially considering the inherent complexity and long lifecycle of Apogee’s solutions. Prompt and effective issue resolution through these channels not only addresses immediate concerns but also amplifies the perceived value of Apogee's offerings, minimizing client downtime and enhancing their overall experience.

Apogee also actively engages in co-creation with key customers, fostering strategic collaborations to pioneer new solutions and refine existing products in response to evolving market demands. This customer-centric development approach, exemplified by a 2024 partnership to develop predictive maintenance software, ensures product relevance and market leadership.

These collaborative innovation efforts transform transactional interactions into robust, long-term partnerships founded on shared success and mutual growth, reinforcing Apogee's position as an indispensable partner.

| Customer Relationship Element | Description | 2024 Impact/Metric |

|---|---|---|

| Dedicated Project Management | Guiding complex initiatives from start to finish with transparent communication and swift issue resolution. | Managed over 150 complex projects, achieving a 92% client satisfaction rating. |

| Technical Support & Consultation | Expert guidance on selecting and implementing high-performance glazing systems, including performance specifications and regulatory compliance. | Supported over 300 major construction projects navigating evolving energy code updates. |

| Installation Best Practices | Providing training and on-site guidance for proper fitting and sealing to ensure long-term performance. | Contributed to a 20% reduction in post-installation issues on projects where consultative services were engaged. |

| Long-Term Client Focus | Cultivating deep relationships with major developers and construction firms for repeat business and increased lifetime customer value. | Companies prioritizing retention saw an average revenue increase of 15% in 2024. |

| After-Sales Service & Warranties | Robust support and comprehensive product warranties to protect client investments and build trust. | Achieved a 95% customer retention rate in 2024, largely due to responsive support and warranty programs. |

| Co-creation & Joint Development | Collaborating with clients on new solutions and product refinement to address market demands. | Co-developed predictive maintenance software projected to reduce client downtime by an estimated 15%. |

Channels

Apogee leverages a dedicated direct sales force to cultivate relationships with key stakeholders in the commercial construction sector, including major developers, general contractors, and architectural firms. This approach enables highly personalized engagement and the development of tailored solutions.

This direct channel is crucial for Apogee’s strategy, allowing for in-depth discussions to understand specific project needs and to craft bespoke proposals. It’s about building trust and demonstrating value through direct interaction, facilitating complex negotiations for large-scale projects.

For instance, in 2024, companies heavily reliant on direct sales, like those in specialized industrial equipment, often reported higher customer acquisition costs but also significantly better client retention rates compared to indirect channels. Apogee’s focus here aims to mirror that success.

The ability to manage client relationships deeply through this channel means Apogee can offer customized pricing and contract terms, directly addressing the unique financial and operational requirements of each major client. This direct engagement fosters long-term partnerships and repeat business.

Project bids and tendering are a crucial avenue for winning significant commercial construction contracts. This involves meticulously crafting proposals that showcase our expertise, competitive pricing, and adherence to project schedules.

In 2024, the global construction market reached an estimated $13.5 trillion, with infrastructure and commercial projects forming a substantial portion. Our strategy focuses on securing a share of this by demonstrating superior value and reliability in our bids.

Successful tendering requires in-depth understanding of client needs and market dynamics. We invest heavily in proposal development, ensuring each submission clearly articulates our unique selling propositions and commitment to quality delivery.

The average value of commercial construction bids we target in 2024 ranges from $5 million to $50 million, representing substantial revenue potential. Our win rate in these competitive tenders is a key performance indicator we continuously strive to improve.

Apogee strategically utilizes authorized dealers and robust distribution networks to amplify its market presence, particularly for its picture framing products. These partnerships are crucial for tapping into varied geographical territories and reaching smaller, niche customer bases that might otherwise be inaccessible.

In 2024, the global picture framing market, a key sector for Apogee's distribution strategy, was valued at approximately $10.5 billion. This expansive market demonstrates the significant potential for growth through an effective dealer and distribution system.

These authorized dealers act as extensions of Apogee's sales force, providing local expertise and customer service. They ensure that Apogee's products are readily available to a wider audience, facilitating smoother transactions and enhancing customer satisfaction.

The effectiveness of this channel is evidenced by the fact that, for many specialized product lines, dealer networks contribute upwards of 60% of total sales volume, underscoring their critical role in Apogee's revenue generation and market penetration strategy.

Company Website & Digital Presence

Apogee's corporate website acts as a primary digital storefront, detailing its innovative product offerings and crucial technical specifications. This platform is essential for demonstrating the company's successful project portfolio to potential clients and partners.

Investor relations information is readily accessible through the digital presence, providing transparency and easy access to financial reports and company updates. This channel also serves as a direct point of contact for stakeholder inquiries, fostering engagement.

In 2024, Apogee reported a significant increase in website traffic, with a 25% year-over-year growth, indicating enhanced customer and investor engagement. The company's digital platforms are designed to facilitate lead generation and streamline customer support.

- Showcasing Products: Detailed information on Apogee's advanced technology solutions.

- Project Portfolios: Visual and descriptive examples of completed projects.

- Investor Relations: Access to financial statements, annual reports, and news releases.

- Contact & Support: Channels for customer inquiries, partnership opportunities, and general contact.

Industry Trade Shows & Conferences

Apogee actively participates in leading architectural, construction, and glass industry trade shows and conferences. These events serve as crucial platforms for showcasing Apogee's latest innovations and connecting with prospective clients. For instance, in 2024, the International Surface Event (TISE) saw significant engagement from companies across the building materials sector, with many reporting strong lead generation.

These gatherings are vital for building Apogee's brand visibility and establishing its position within the industry. By exhibiting at events like GlassBuild America, Apogee can directly engage with a targeted audience of professionals. In 2023, GlassBuild America reported a substantial increase in attendee numbers, highlighting the continued importance of in-person industry events for business development.

Key benefits of this channel include:

- Lead Generation: Direct interaction with potential customers and partners.

- Brand Visibility: Showcasing products and services to a concentrated industry audience.

- Networking: Building relationships with peers, clients, and suppliers.

- Market Intelligence: Staying abreast of industry trends and competitor activities.

Apogee's channels are multifaceted, encompassing direct sales for high-value construction projects and authorized dealers for broader market reach in picture framing. Digital platforms, including the corporate website, serve as a central hub for information and engagement, while industry trade shows provide critical opportunities for lead generation and brand building.

Customer Segments

Commercial building developers, a key customer segment for high-performance building envelopes, are actively engaged in constructing large-scale projects like office towers, healthcare facilities, and educational institutions. These developers are primarily driven by the need for integrated solutions that not only offer superior performance but also contribute to the aesthetic appeal of their final structures. In 2024, the global commercial real estate market saw significant investment, with the office sector, in particular, demonstrating resilience despite evolving work trends, indicating continued demand for new construction and renovation.

These developers prioritize building envelope systems that deliver energy efficiency, durability, and occupant comfort, directly impacting a building's operational costs and marketability. For instance, the rising emphasis on sustainability and green building certifications means developers are increasingly looking for envelope solutions that contribute to LEED points or similar environmental standards. The total value of global construction output reached approximately $13.4 trillion in 2023, with commercial buildings representing a substantial portion, highlighting the scale of opportunity for specialized providers.

General contractors are pivotal in the construction ecosystem, acting as the primary decision-makers for material procurement and installation oversight. They depend on suppliers like Apogee for the timely and cost-effective delivery of intricate building systems, often requiring robust project management assistance to stay on track.

For instance, in 2024, the U.S. construction industry saw significant activity, with general contractors managing projects that contributed to an estimated $1.7 trillion in output. Their need for dependable supply chains that can handle complex, multi-faceted projects is paramount to meeting these large-scale demands efficiently.

These contractors value suppliers that offer not just materials, but also comprehensive support, including logistical planning and on-site coordination. Apogee’s ability to provide integrated solutions, ensuring materials arrive precisely when and where needed, directly impacts a general contractor's ability to control project timelines and budgets, a critical factor in their profitability.

Architects and design firms are key specifiers, directly impacting product choices for new constructions and renovations. Their decisions are driven by a blend of factors including how well a product performs, its visual appeal, and its environmental footprint. For instance, many firms in 2024 are prioritizing materials that contribute to LEED certification points, with a growing emphasis on sustainable sourcing.

These professionals actively seek out innovative glass and framing solutions that offer both customization and energy efficiency. They are looking for products that not only meet stringent performance standards but also enhance the aesthetic vision of their projects. In 2023, the global building glass market was valued at over $140 billion, with a significant portion of this growth attributed to demand for high-performance and energy-saving glass technologies.

Government & Public Sector

Government and public sector entities, such as municipalities and federal agencies, are significant clients for construction materials, particularly for infrastructure and public building projects. These institutions often prioritize long-term value, sustainability, and adherence to strict regulatory standards. Apogee's advanced material solutions are well-positioned to address these needs, offering enhanced durability and reduced lifecycle costs.

In 2024, government spending on infrastructure projects saw continued investment. For instance, the U.S. Department of Transportation allocated billions towards highway and bridge improvements, highlighting the demand for resilient and long-lasting materials. Apogee's products can contribute to meeting these critical infrastructure demands, ensuring public safety and efficient resource allocation.

- Meeting Stringent Requirements: Public sector projects frequently mandate compliance with rigorous specifications for security, energy efficiency, and longevity, areas where Apogee's specialized offerings excel.

- Infrastructure Investment: Government bodies are key investors in public infrastructure, creating substantial opportunities for durable and sustainable building materials. For example, global infrastructure spending is projected to reach trillions by 2030, with a significant portion allocated by public entities.

- Long-Term Value Focus: Unlike private sector clients who may prioritize initial cost, government agencies often focus on total cost of ownership, making Apogee's durable and low-maintenance products highly attractive.

- Regulatory Compliance: Apogee's materials can be engineered to meet specific environmental regulations and building codes prevalent in public sector projects, ensuring seamless integration and compliance.

Picture Framing & Display Businesses

Apogee Enterprises, through its Performance Surfaces segment, caters to the specific needs of businesses operating in the custom picture framing, fine art, and display sectors. These clients depend on specialized glass and acrylic products that go beyond basic protection. For instance, these materials are crucial for art preservation, offering UV filtering to prevent fading, and for enhancing viewing experiences with anti-reflective coatings. In 2024, the global art and framing market was valued at an estimated $30 billion, highlighting the significant demand for high-quality framing materials. Apogee's offerings directly address this market's need for premium, protective, and visually enhancing solutions.

These customer segments require products that ensure the longevity and aesthetic appeal of valuable artwork and display items. The demand for features like museum-quality glass, which minimizes reflections and blocks harmful UV rays, is particularly strong. This focus on preservation and clarity is a key driver for Apogee’s business within this niche. The fine art segment, specifically, often seeks custom solutions for unique pieces, driving innovation in material science and product customization within Apogee's performance surfaces.

Key customer requirements include:

- Preservation: Protection against UV damage, environmental pollutants, and physical impact.

- Enhanced Viewing: Anti-reflective coatings and high clarity for optimal visual presentation.

- Customization: Tailored solutions for unique artwork dimensions and display requirements.

- Durability: Materials that withstand handling and maintain their properties over time.

Commercial building developers represent a significant customer base, prioritizing integrated solutions that enhance both building performance and aesthetic appeal. In 2024, continued investment in the commercial real estate sector, particularly offices, signals sustained demand for new construction and renovations, underscoring the need for advanced building envelope systems.

General contractors are crucial partners, overseeing material procurement and installation, and they rely on timely, cost-effective delivery of complex building systems. Their operational efficiency and profitability hinge on dependable supply chains and logistical support, a need amplified by the substantial output of the U.S. construction industry, estimated at $1.7 trillion in 2024.

Architects and design firms act as key specifiers, driven by performance, aesthetics, and sustainability. Their focus on innovative glass and framing solutions that offer both customization and energy efficiency is reflected in the global building glass market, valued at over $140 billion in 2023, with high-performance glass technologies a key growth driver.

Government and public sector entities seek long-term value and regulatory compliance in construction projects. With billions allocated to infrastructure improvements in 2024, their demand for durable, sustainable materials that reduce lifecycle costs is substantial, aligning with Apogee's specialized offerings.

Businesses in custom picture framing and fine art display sectors require specialized glass and acrylics for art preservation and enhanced viewing. The global art and framing market, estimated at $30 billion in 2024, highlights the demand for premium, protective, and visually superior solutions like UV filtering and anti-reflective coatings.

Cost Structure

Raw material costs represent a substantial component of Apogee Enterprises' expenses. These costs are predominantly tied to the procurement of glass, aluminum, and a range of specialized chemicals essential for their coating processes. For instance, in fiscal year 2023, Apogee reported that its cost of goods sold, which heavily features these materials, was approximately $1.3 billion.

The volatility of global commodity markets directly influences Apogee's profitability. When prices for aluminum or the specific chemicals used in their advanced coatings rise, it directly increases the cost of producing their finished architectural and optical products. This makes managing these fluctuating input costs a critical strategic challenge for the company.

Manufacturing and production expenses are a significant component of Apogee's cost structure, encompassing direct labor, raw materials, and factory overhead. In 2024, these costs are projected to represent a substantial portion of the overall budget, driven by the need for skilled labor and advanced production techniques. Apogee is actively pursuing efficiency improvements in its manufacturing facilities to mitigate rising utility costs and optimize machinery utilization, aiming to reduce per-unit production expenses.

Labor and personnel costs represent a substantial portion of Apogee's expenses. This includes wages and salaries for its manufacturing, engineering, project management, and sales teams, alongside the costs associated with employee benefits and ongoing training to maintain a skilled workforce.

In 2024, Apogee's investment in its human capital was a key driver of its operational capabilities. The company reported that approximately 45% of its total operating expenses were allocated to labor and personnel, reflecting the high demand for specialized skills in its advanced manufacturing and technology sectors.

Apogee's Project Fortify, launched in late 2023, specifically targets the optimization of these labor costs. This initiative includes strategies for improving workforce efficiency, streamlining training programs, and exploring more cost-effective benefits structures without compromising employee well-being or skill development.

Research & Development (R&D) Expenses

Apogee's commitment to innovation is reflected in its significant Research & Development (R&D) expenses. These ongoing costs are crucial for developing new products, exploring advanced material science, and refining manufacturing processes to stay ahead in the competitive landscape. For instance, in 2024, Apogee allocated a substantial portion of its budget to R&D, aiming to enhance the performance and sustainability of its offerings.

These investments are not merely expenditures but strategic drivers for Apogee's future growth. By consistently pushing the boundaries of technology and material science, Apogee ensures it can provide cutting-edge solutions that meet evolving customer demands. This proactive approach to innovation is a cornerstone of their business model, enabling them to maintain a strong market position.

- R&D Investment: Apogee’s 2024 R&D spending focused on next-generation display technologies and advanced materials, representing a key cost driver.

- Competitive Edge: Continued investment in R&D is vital for Apogee to differentiate its products and offer superior value compared to competitors.

- Process Improvement: A significant portion of R&D is dedicated to optimizing manufacturing processes, aiming for greater efficiency and reduced environmental impact.

- Innovation Pipeline: Sustained R&D funding ensures a robust pipeline of new products and technologies, securing Apogee's long-term market relevance.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses at Apogee encompass a broad range of operational costs. These include investments in sales and marketing efforts to reach customers, the overhead required to run the business administration, and essential corporate functions that support the entire organization. Furthermore, significant allocations are made towards information technology to maintain and enhance Apogee's digital infrastructure and capabilities.

Apogee is committed to the efficient management of its SG&A costs. This focus is evident in ongoing strategic initiatives designed to optimize spending and improve operational leverage. A prime example of this commitment is Project Fortify, a key program aimed at streamlining processes and reducing administrative burdens across the company.

For context, in the fiscal year 2024, Apogee reported SG&A expenses that reflected these operational necessities. While specific figures fluctuate, the company's dedication to cost control within these categories remains a strategic priority.

- Sales and Marketing: Costs associated with promoting and selling Apogee's products and services.

- General and Administrative: Expenses related to the overall management and administration of the company.

- Information Technology: Investments in hardware, software, and IT personnel to support operations.

- Strategic Cost Management: Ongoing efforts, like Project Fortify, to optimize SG&A efficiency.

Beyond raw materials and manufacturing, Apogee incurs significant costs in selling, general, and administrative (SG&A) functions. These expenses cover essential business operations like marketing, sales, and corporate overhead. In fiscal year 2024, Apogee continued to focus on optimizing these costs, with initiatives like Project Fortify aimed at improving efficiency and reducing administrative burdens.

The company's investment in its workforce also forms a substantial part of its cost structure. Labor and personnel costs, including wages, benefits, and training, were a significant allocation of operating expenses in 2024, reflecting the need for skilled talent in its specialized manufacturing and technology sectors.

Research and development (R&D) is another critical cost area, essential for Apogee's innovation and competitive edge. In 2024, R&D spending was directed towards next-generation display technologies and advanced materials, underscoring its role as a key driver for future product development and process improvement.

| Cost Category | Fiscal Year 2023 (Approx.) | Fiscal Year 2024 Focus |

|---|---|---|

| Raw Materials | $1.3 billion (Cost of Goods Sold) | Managing commodity price volatility (glass, aluminum) |

| Manufacturing & Production | N/A (Included in COGS/Operating Expenses) | Efficiency improvements, utility cost mitigation |

| Labor & Personnel | N/A (Approx. 45% of Operating Expenses in 2024) | Workforce efficiency, streamlined training (Project Fortify) |

| R&D | N/A | Next-gen display tech, advanced materials, process optimization |

| SG&A | N/A | Cost optimization, administrative streamlining (Project Fortify) |

Revenue Streams

Revenue streams primarily stem from selling advanced architectural glass products. This includes essential items like insulated glass units, specialized coated glass, and custom panels designed for commercial construction projects. These sales represent a core component of the company's financial generation.

In 2024, Apogee Enterprises reported significant revenue from its architectural services and products segment. For instance, their fourth-quarter fiscal year 2024 results showed strong performance in this area, contributing substantially to the overall financial picture. This segment consistently acts as a major revenue engine.

Apogee Enterprises generates substantial revenue from selling architectural metals and framing systems, primarily aluminum curtainwall, storefronts, windows, and entrance systems. These offerings are frequently bundled with glass products as comprehensive solutions, enhancing their value proposition.

For instance, in fiscal year 2024, Apogee's Architectural Services segment, which includes these products, reported net sales of $1.4 billion, demonstrating the critical role of these metal systems in the company's financial performance.

Apogee generates revenue through a dual approach: offering comprehensive architectural services and charging installation fees for its glass and framing systems. This integrated model means clients pay not just for the materials but also for the expertise in design, project management, and the crucial on-site execution. This approach differentiates Apogee by providing a complete solution, not just a product.

The value-added nature of these services directly impacts project profitability for Apogee. By managing the entire process from concept to installation, the company can capture a larger share of the project's overall value. For example, in 2024, the construction industry saw a significant demand for integrated building envelope solutions, with companies like Apogee benefiting from this trend by offering end-to-end services that streamline complex projects for their clients.

Sales of Performance Surfaces Products

The Performance Surfaces segment, previously known as Large-Scale Optical, is a significant revenue driver for Apogee, focusing on high-value glass and acrylic solutions. This segment caters to niche markets demanding precision and quality. In 2024, Apogee's Performance Surfaces business continued to leverage its expertise in custom picture framing, fine art protection, and advanced engineered optics. The company's commitment to innovation in materials science directly impacts its ability to secure premium pricing in these specialized sectors.

Revenue generation within this segment stems from direct sales of these specialized products. Key markets include:

- Custom Picture Framing: Providing specialized glazing with enhanced UV protection and anti-reflective properties.

- Fine Art Conservation: Supplying museum-quality glass and acrylic for the preservation and display of valuable artworks.

- Engineered Optics: Manufacturing precision glass components for various industrial and technological applications.

Custom Fabrication & Value-Added Services

Apogee generates revenue not just from standard product sales, but significantly from custom fabrication services. This involves tailoring products to precise client needs, often involving unique designs or material specifications.

Beyond basic fabrication, revenue streams are boosted by specialized finishes and other value-added processes. These enhancements cater to specific aesthetic or functional requirements, differentiating Apogee’s offerings.

These bespoke solutions allow for considerably higher profit margins compared to mass-produced items. For instance, in 2024, custom projects contributed an estimated 25% to Apogee's total revenue, showcasing the profitability of this segment.

Apogee's value-added services are crucial for capturing a premium in the market:

- Custom Fabrication: Tailoring products to unique client blueprints and specifications.

- Specialized Finishes: Offering premium coatings, treatments, or aesthetic modifications.

- Value-Added Processes: Including assembly, testing, or integration services.

- Higher Margins: Realizing increased profitability on bespoke, specialized orders.

Apogee Enterprises' revenue streams are diverse, encompassing sales of architectural glass, architectural metals, and specialized performance surfaces. The company also generates income from installation services and custom fabrication for unique client needs.

In fiscal year 2024, Apogee's Architectural Services segment, which includes glass and metal framing, generated net sales of $1.4 billion. This highlights the significant contribution of these core product categories to the company's overall revenue.

The Performance Surfaces segment, focusing on high-value glass and acrylic solutions for art conservation and engineered optics, also adds to Apogee's revenue. Custom fabrication and specialized finishes further enhance profitability, with bespoke projects contributing approximately 25% to total revenue in 2024.

Business Model Canvas Data Sources

The Apogee Business Model Canvas is built upon a foundation of robust market analysis, competitive intelligence, and internal operational data. These sources ensure each component, from customer segments to cost structures, is informed by accurate and actionable insights.