Apogee PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apogee Bundle

Navigate the complex external forces shaping Apogee’s trajectory with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that could impact your investment or strategy. Equip yourself with the foresight needed to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis for Apogee now and gain a decisive competitive advantage.

Political factors

Government infrastructure spending is a significant driver for companies like Apogee. Increased investment in public buildings, transportation, and urban development directly fuels demand for commercial building materials. For instance, in 2024, the US federal government allocated over $130 billion for infrastructure projects through initiatives like the Infrastructure Investment and Jobs Act.

This elevated spending translates into substantial opportunities for Apogee, a key supplier of glass and framing systems. As governments push for modernization and upgrades, Apogee's high-performance products, often designed with energy efficiency in mind, are well-positioned to meet these evolving project requirements. The emphasis on sustainable and advanced building materials in these public works aligns perfectly with Apogee's product portfolio.

Changes in international trade policies, particularly the imposition of tariffs on essential imported materials such as steel, aluminum, or specialized glass components, can significantly affect Apogee's operational expenses and the reliability of its supply chains. For instance, the United States imposed tariffs on steel and aluminum imports in 2018, which increased costs for many manufacturers, and similar measures on other components could impact Apogee's raw material expenses.

Potential tariffs on goods from key trading partners in 2024 or 2025 could lead to higher material costs, directly influencing project profitability and necessitating adjustments to overall pricing strategies. For example, if tariffs are placed on glass from China, a significant supplier for many industries, Apogee might see a substantial increase in its procurement costs.

Apogee will need to strategically adapt to these evolving trade regulations by exploring options such as diversifying its supplier base to reduce reliance on single countries or adjusting its product pricing to absorb or pass on increased expenses. This proactive approach is crucial for maintaining competitive pricing and ensuring consistent project execution in a dynamic global market.

Evolving building codes, especially those emphasizing energy efficiency and environmental performance, present a dynamic landscape for Apogee. For instance, updates to the International Energy Conservation Code (IECC) 2021 and ASHRAE 90.1-2019 are driving demand for more sophisticated building envelope solutions. Apogee’s commitment to high-performance glass and framing systems aligns directly with these stricter mandates, creating a clear market advantage.

Political Stability and Geopolitical Tensions

Global political stability significantly impacts investor sentiment and the pace of construction projects worldwide, areas crucial for Apogee's business. For instance, heightened geopolitical tensions in the Middle East during late 2023 and early 2024 led to increased shipping costs and delays, directly affecting companies reliant on international logistics.

Geopolitical friction, like ongoing trade disputes or regional conflicts, can severely disrupt global supply chains. This disruption affects the availability and price of essential raw materials and components for Apogee's manufacturing processes. A report by the World Bank in early 2024 indicated that supply chain disruptions due to geopolitical events could add 1-2% to global inflation.

This inherent instability creates considerable uncertainty in market forecasting. Companies like Apogee must therefore prioritize agile procurement and adaptable production strategies to navigate these unpredictable environments effectively. The need for resilient supply chains became a paramount concern for many businesses in 2024, with numerous companies actively diversifying their supplier base.

- Global political stability: Directly influences investor confidence and project development timelines, affecting Apogee's market opportunities.

- Geopolitical tensions: Can disrupt supply chains, impacting raw material availability and costs, as seen with increased shipping rates in late 2023.

- Market uncertainty: Necessitates agile strategies for procurement and production to mitigate risks associated with geopolitical instability.

- Supply chain resilience: A growing imperative, with companies actively seeking to diversify suppliers to counter potential disruptions.

Government Incentives for Green Building

Government programs and incentives are increasingly steering the construction industry toward sustainability, directly benefiting companies like Apogee. These initiatives, often designed to promote green building certifications, energy-efficient construction, and the use of sustainable materials, create a more favorable market for Apogee's eco-friendly glass and framing products. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for energy-efficient building upgrades and renewable energy installations, encouraging developers to adopt greener solutions. In 2024, many states and municipalities continue to enhance their own incentive programs, offering property tax abatements or expedited permitting processes for projects meeting stringent environmental standards.

These incentives, which can manifest as tax breaks, direct subsidies, or grants, effectively lower the upfront costs for developers and builders, making environmentally conscious choices more economically viable. This push encourages investment in solutions that not only reduce environmental impact but also improve a building's energy performance and long-term operational costs. Apogee's strategic focus on sustainability and its product offerings are well-aligned with these governmental pushes, positioning the company to capitalize on this growing demand for green building technologies.

- Tax Credits: Programs like the U.S. federal energy investment tax credit can significantly offset the cost of implementing energy-efficient building materials.

- Subsidies & Grants: Local and state governments frequently offer grants for projects that achieve specific green building certifications, such as LEED or BREEAM.

- Regulatory Support: Evolving building codes that mandate higher energy efficiency standards indirectly favor companies providing compliant, sustainable solutions.

- Market Demand: Growing investor and tenant preference for sustainable buildings, often driven by ESG (Environmental, Social, and Governance) considerations, amplifies the impact of government incentives.

Government infrastructure spending is a significant driver for companies like Apogee, with over $130 billion allocated for US infrastructure projects in 2024. This investment directly fuels demand for commercial building materials, aligning with Apogee's offerings in high-performance glass and framing systems designed for energy efficiency.

Changes in international trade policies, such as potential tariffs on key materials like aluminum or glass in 2024-2025, can increase Apogee's raw material costs and impact supply chain reliability. For example, tariffs on glass imports could significantly raise procurement expenses.

Evolving building codes emphasizing energy efficiency, such as updates to the IECC 2021, create a market advantage for Apogee's advanced building envelope solutions. Global political stability also plays a crucial role, with geopolitical tensions in late 2023 and early 2024 impacting shipping costs and supply chain resilience, a concern highlighted by the World Bank's 2024 inflation report.

What is included in the product

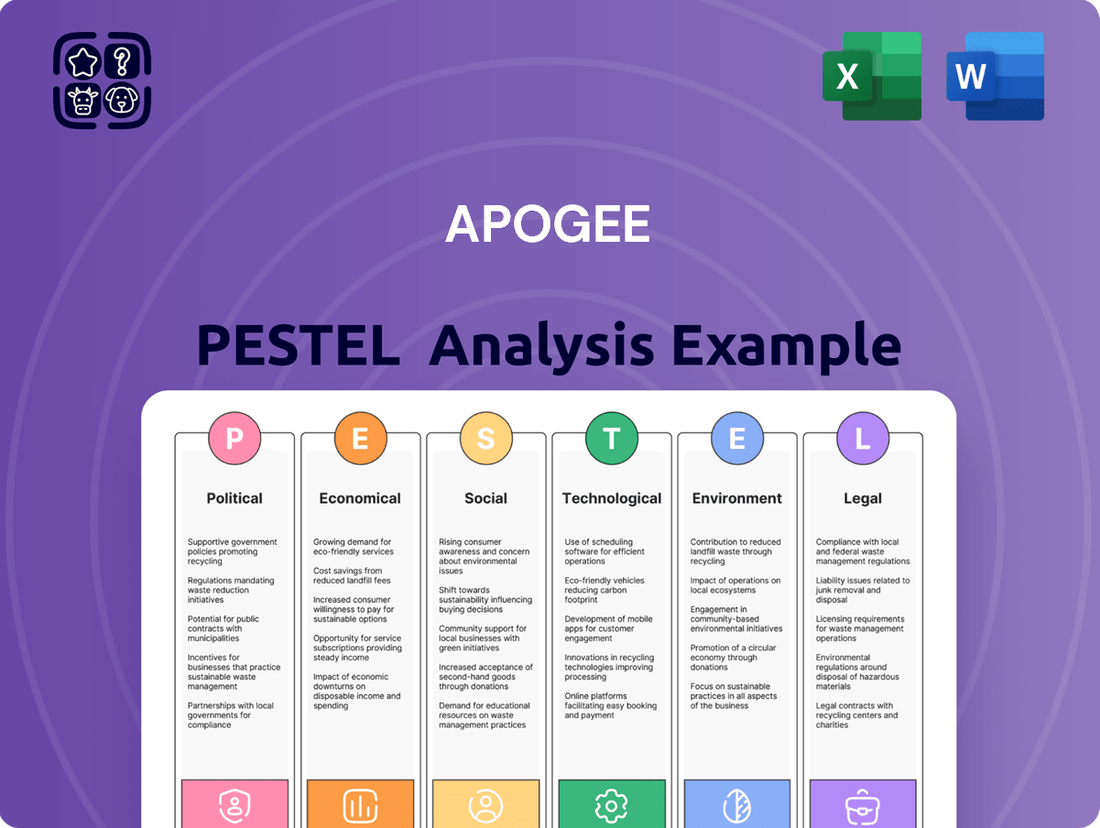

The Apogee PESTLE Analysis provides a comprehensive examination of external macro-environmental factors, breaking them down into Political, Economic, Social, Technological, Environmental, and Legal dimensions to reveal their impact on Apogee.

Provides actionable insights derived from complex external factors, simplifying strategic decision-making and reducing the burden of extensive research.

Economic factors

The commercial construction market's expansion is a critical driver for Apogee, influencing its core revenue. Projections indicate a steady, albeit moderate, increase in nonresidential construction expenditures for 2025 and 2026. Specifically, the institutional sector is expected to see significant investment, which directly translates to demand for Apogee's architectural solutions.

This anticipated growth is underpinned by data suggesting a 3.5% rise in nonresidential construction spending for 2025, with institutional segments like healthcare and education leading the charge. However, Apogee must navigate the persistent challenge of escalating material prices, which saw a 5% increase in key building components in late 2024, and a 4% uptick in construction labor costs.

Fluctuations in interest rates directly impact the cost of borrowing for construction and real estate ventures, influencing the viability and speed of new commercial building projects. For instance, the Federal Reserve's benchmark interest rate, which stood at 5.25%-5.50% in early 2024, has seen increases from its near-zero levels in 2021, making capital more expensive.

Higher interest rates can decelerate the initiation of new projects, potentially dampening demand for Apogee's products and services. This trend was evident in the slowdown of housing starts in late 2023 and early 2024 as borrowing costs rose.

Developers rely on accessible and affordable capital to drive their projects forward, which in turn shapes the order pipeline for companies like Apogee. A tighter lending environment, characterized by increased scrutiny and higher collateral requirements, can further constrain development activity.

The European Central Bank's policy rate, for example, moved from negative territory to 4.00% by early 2024, illustrating a global trend of rising borrowing costs impacting development pipelines across various markets.

The cost and availability of essential raw materials like glass and aluminum are critical economic drivers for Apogee. For instance, fluctuations in global aluminum prices, which saw a notable increase in early 2024, directly impact Apogee's manufacturing expenses.

Persistent supply chain disruptions, exacerbated by geopolitical tensions and shipping challenges throughout 2024, continue to lengthen lead times and elevate input costs for Apogee. This volatility can add significant pressure to Apogee's operational budget.

Inflationary pressures observed globally in 2024 also contribute to rising raw material expenses, directly affecting Apogee's cost of goods sold. The potential for future tariffs on imported components presents an additional layer of economic uncertainty for the company.

Apogee's profitability is intrinsically linked to the stability and predictability of these material prices. A sustained upward trend in raw material costs, as seen in several key commodities during 2024, could negatively impact Apogee's margins if not effectively managed.

Labor Availability and Costs in Construction

The construction sector continues to grapple with a significant shortage of skilled labor, a trend that intensified through 2024 and is projected to persist into 2025. This scarcity, driven by an aging workforce retiring and a lack of new entrants, directly impacts project timelines and escalates labor expenses. For instance, the U.S. Bureau of Labor Statistics reported that in April 2024, there were 436,000 job openings in construction, highlighting the demand-supply gap.

This labor crunch poses a direct challenge for Apogee's clients, potentially hindering their project execution capabilities and, consequently, influencing Apogee's sales volumes and delivery schedules. Higher labor costs can also squeeze project budgets, making clients more hesitant about new investments. The average hourly wage for construction laborers in the U.S. saw an increase, reaching approximately $25.50 by early 2025, up from $24.00 in early 2024.

To mitigate these effects, strategic investments in workforce development programs and the adoption of advanced construction technologies are becoming critical. These initiatives aim to attract new talent and improve the efficiency of the existing workforce.

- Skilled Labor Shortage: Construction industry faces a persistent deficit of skilled workers.

- Impact on Apogee: Project delays and increased labor costs for customers can reduce Apogee's sales and affect project timelines.

- Wage Growth: Average hourly wages for construction laborers in the U.S. reached around $25.50 in early 2025.

- Mitigation Strategies: Investment in workforce development and technology adoption are key solutions.

Inflationary Pressures and Economic Uncertainty

Broad inflationary pressures are a significant concern for Apogee and its clients. In May 2024, the U.S. Consumer Price Index (CPI) rose 3.3% year-over-year, indicating persistent cost increases that can reduce purchasing power and elevate operational expenses. This environment requires Apogee to conduct meticulous cost analyses and develop flexible strategies to navigate rising material and labor costs, directly impacting project profitability.

Economic uncertainty further compounds these challenges. Geopolitical tensions and shifting monetary policies contribute to a climate where businesses may delay or scale back investments in new commercial construction projects. For instance, the Federal Reserve's interest rate decisions in 2024, aimed at controlling inflation, can increase the cost of capital for developers, leading to a slowdown in project pipelines. Apogee must remain agile, adapting its service offerings and project management approaches to accommodate fluctuating client demand and investment appetites.

- Inflation Impact: Persistent inflation, with CPI at 3.3% year-over-year in May 2024, erodes purchasing power and increases Apogee's operational costs.

- Reduced Investment: Economic uncertainty, influenced by global events and interest rate policies, prompts cautious spending by businesses, potentially slowing new construction projects.

- Strategic Adaptation: Apogee needs to perform rigorous cost analysis and implement adaptive business strategies to mitigate the effects of inflation and economic volatility.

- Cost of Capital: Higher interest rates in 2024, a tool to combat inflation, can make financing more expensive for clients, further dampening demand for construction services.

Persistent inflation, with the U.S. CPI at 3.3% year-over-year in May 2024, directly increases Apogee's operational expenses and reduces client purchasing power. Economic uncertainty, fueled by geopolitical events and monetary policies, prompts businesses to delay investments, potentially slowing new construction projects. Apogee must conduct rigorous cost analyses and adapt strategies to navigate these volatile conditions.

| Economic Factor | Data Point/Trend | Impact on Apogee |

|---|---|---|

| Inflation (US CPI) | 3.3% year-over-year (May 2024) | Increases operational costs, reduces client spending power. |

| Interest Rates (Fed Funds Rate) | 5.25%-5.50% (Early 2024) | Raises cost of capital for developers, potentially slowing projects. |

| Construction Labor Costs | ~ $25.50/hour (Early 2025) | Increases project expenses for clients, potentially impacting demand. |

| Aluminum Prices | Notable increase (Early 2024) | Elevates raw material expenses for Apogee. |

Full Version Awaits

Apogee PESTLE Analysis

The preview shown here is the exact Apogee PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a comprehensive understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Apogee.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

The file you’re seeing now is the final version of the Apogee PESTLE Analysis—ready to download right after purchase and immediately applicable to your business needs.

Sociological factors

Societal awareness regarding environmental impact is rapidly growing, directly fueling the demand for sustainable and green buildings. This isn't just a niche interest; it's becoming a mainstream expectation for new constructions and renovations.

Apogee is well-positioned to capitalize on this shift. Its advanced glass and framing systems are engineered for superior energy efficiency, a cornerstone of green building standards. For instance, Apogee's offerings can significantly reduce a building's heating and cooling loads, contributing to lower operational carbon footprints.

The market for green buildings is expanding robustly. By 2025, it's projected that green buildings will represent a substantial portion of new commercial construction in many developed economies. This growing preference translates into a direct market opportunity for Apogee's specialized, environmentally conscious products, as developers increasingly prioritize certifications like LEED (Leadership in Energy and Environmental Design).

The shift towards remote and hybrid work models has profoundly reshaped workspace expectations, driving a demand for more flexible, collaborative, and visually appealing environments. This trend favors adaptive reuse of existing buildings and new construction that incorporates natural light, open layouts, and attractive facades. For instance, in 2024, the global flexible workspace market was valued at approximately $60 billion, with projections indicating continued robust growth, underscoring the market's receptiveness to innovative architectural solutions.

There’s a significant shift towards prioritizing occupant health and well-being in commercial spaces, driving demand for designs that incorporate natural light, superior indoor air quality, and elements connecting people with nature, often called biophilic design.

Apogee's glass solutions are perfectly aligned with this trend. Their products are engineered to allow ample natural light to permeate buildings, a key component of biophilic design, while advanced coatings can further enhance this by managing heat and glare effectively.

For instance, studies consistently show that access to natural light can boost productivity by up to 40% and improve employee morale. This directly translates into a market advantage for companies like Apogee, whose offerings facilitate these crucial environmental improvements.

The market for green building materials, which includes advanced glass technologies, is projected for substantial growth. In 2024, the global green building materials market was valued at over $200 billion, with continued expansion expected as sustainability and occupant health become even more central to construction and renovation projects.

Urbanization and Population Shifts

Urbanization continues to be a significant driver for industries like Apogee. As more people move into cities, there's a constant demand for new buildings – think offices, apartments, and shops. This sustained need for construction directly benefits companies supplying building materials and solutions.

Population shifts are also key. For instance, the United Nations projected that by 2050, two-thirds of the world's population would live in urban areas. This trend means that specific cities or regions experiencing rapid growth will see a surge in construction activity. Apogee needs to be agile, adjusting its sales and distribution to tap into these localized construction booms.

- Urban Growth: Global urbanization rates are projected to continue, with developing nations often leading this trend.

- Metropolitan Focus: Major metropolitan areas are typically the epicenters of population growth and, consequently, construction demand.

- Regional Impact: Apogee's success hinges on understanding where these population shifts are most pronounced to tailor its regional strategies.

Aesthetic and Design Trends in Architecture

Societal preferences are increasingly leaning towards modern architectural aesthetics. This includes a strong demand for large glass panels, dynamic facades that change appearance, and highly customized designs. These trends directly impact the demand for Apogee's specialized glass and framing systems, as builders look for innovative ways to bring these visions to life.

Architects and developers are actively seeking visually striking and unique building envelopes. This aligns perfectly with Apogee's core strengths in providing custom-tailored and high-performance architectural solutions. For instance, the global market for architectural glass was valued at approximately USD 115 billion in 2023 and is projected to grow substantially, driven by these aesthetic demands.

- Growing demand for minimalist and open-concept designs

- Increased use of smart glass and energy-efficient glazing

- Emphasis on sustainable and biophilic architectural elements

- Popularity of bespoke and digitally fabricated building components

Growing environmental consciousness is a powerful sociological force, driving demand for sustainable construction and energy-efficient buildings. This trend directly benefits companies like Apogee that offer specialized, eco-friendly solutions, as evidenced by the over $200 billion valuation of the global green building materials market in 2024.

Urbanization continues to fuel construction demand, particularly in metropolitan areas. As global populations increasingly concentrate in cities, the need for new residential, commercial, and mixed-use developments presents a sustained opportunity for building material suppliers. The United Nations projected two-thirds of the world's population living in urban areas by 2050.

Societal preferences are leaning towards modern aesthetics, emphasizing large glass facades and custom designs. The global architectural glass market, valued at approximately USD 115 billion in 2023, reflects this demand for visually striking and innovative building envelopes, aligning with Apogee's product offerings.

There's an increasing focus on occupant well-being, driving demand for designs that maximize natural light and incorporate biophilic elements. Studies show natural light can boost productivity by up to 40%, making Apogee's light-enhancing glass solutions highly attractive to developers prioritizing healthy work environments.

| Sociological Factor | Impact on Apogee | Supporting Data (2024-2025) |

|---|---|---|

| Environmental Awareness | Increased demand for green building solutions | Global green building materials market valued over $200 billion in 2024. |

| Urbanization | Sustained construction activity in cities | UN projects two-thirds of global population in urban areas by 2050. |

| Modern Aesthetics | Demand for custom glass and facade solutions | Global architectural glass market valued at ~USD 115 billion in 2023. |

| Occupant Well-being | Preference for natural light and biophilic design | Natural light can boost productivity by up to 40%. |

Technological factors

The rapid evolution of smart glass technologies, including electrochromic and IoT-enabled variants, offers substantial growth avenues for Apogee. These advancements enable dynamic adjustments in transparency and energy performance, boosting efficiency and privacy in commercial structures. For instance, electrochromic glass, which changes tint electronically, is projected to see its global market grow significantly, reaching an estimated USD 13.9 billion by 2030, according to some market research reports from early 2024.

Apogee can capitalize on these innovations by integrating or developing smart glass solutions that provide dynamic control over light and heat. This aligns with increasing demand for sustainable building materials and smart building features. The global smart glass market was valued at approximately USD 5.2 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of around 10-12% through 2030, driven by these technological leaps.

Technological advancements in low-emissivity (Low-E) coatings and solar control glass are driving significant improvements in building energy efficiency. These innovations, coupled with advanced insulation in framing systems, are essential for meeting increasingly strict energy codes and growing sustainability demands in the construction sector.

Apogee's success hinges on its capacity to innovate and deliver glass and framing solutions that demonstrably reduce heat transfer and maximize natural light utilization. This capability is a direct determinant of its market competitiveness in an era prioritizing environmental performance.

These technological upgrades are directly supportive of global green building initiatives, aligning with market trends toward environmentally responsible construction practices. For instance, the global smart glass market, which includes dynamic tinting and energy-saving features, was valued at approximately $5.9 billion in 2023 and is projected to reach $11.5 billion by 2030, indicating strong demand for such innovations.

Apogee's manufacturing processes are increasingly benefiting from advanced techniques like automation and robotics. This adoption is crucial for boosting production efficiency and cutting down labor expenses, as seen in the broader construction materials sector where automation can reduce manufacturing costs by up to 20%. These technologies enable more precise fabrication of complex architectural glass and framing systems, directly supporting Apogee's custom design offerings and accelerating project delivery timelines.

Building Information Modeling (BIM) and Digital Twins

The construction sector is increasingly adopting Building Information Modeling (BIM) and digital twin technologies, enhancing project planning, design, and management. These digital tools are revolutionizing how buildings are conceived and constructed. For instance, by 2023, over 70% of global construction firms were utilizing BIM in some capacity, with widespread adoption expected to continue its upward trajectory through 2025.

Apogee's strategic alignment with these advancements is crucial. By ensuring its product data and design specifications are compatible with BIM software and digital twin platforms, Apogee can significantly ease the specification and integration process for architects and contractors. This interoperability translates directly into smoother project execution and reduced on-site issues.

Consider the impact on project efficiency: BIM can reduce design clashes by up to 30%, leading to fewer costly rework instances. Apogee's contribution to this ecosystem, by providing accurate and accessible digital product information, positions it as a preferred supplier for projects leveraging these sophisticated digital workflows. This integration is not just about convenience; it's about enabling more predictable and cost-effective construction outcomes.

- Increased BIM Adoption: Over 70% of global construction firms used BIM in 2023, with continued growth projected through 2025.

- Efficiency Gains: BIM can reduce design clashes by as much as 30%, minimizing rework.

- Digital Integration: Apogee's product data compatibility with BIM streamlines specification and project implementation.

- Market Advantage: Offering interoperable digital assets enhances Apogee's appeal to technologically forward construction partners.

Material Science Innovations

Breakthroughs in material science are continuously enhancing the properties of glass and framing systems, directly impacting companies like Apogee. Innovations leading to stronger, lighter, and more durable materials can unlock new market segments and applications, such as advanced architectural facades or specialized industrial glazing.

For instance, advancements in nanotechnology for self-cleaning glass coatings can significantly reduce maintenance costs for building owners, a key selling point. Similarly, the development of advanced composite materials for framing offers superior insulation properties and increased resistance to corrosion and extreme weather conditions. Apogee's ability to integrate these material innovations into its product lines can lead to enhanced performance, extended product lifecycles, and a stronger competitive edge.

The 2024 market for advanced building materials is seeing significant growth, driven by demand for sustainability and performance. For example, the global smart glass market, which often incorporates advanced material science, was projected to reach over $8 billion in 2024, with continued strong growth expected. This highlights the potential for Apogee to leverage new material developments.

- Enhanced Durability: New materials offer greater resistance to impact and weathering, extending the lifespan of Apogee's products.

- Lightweighting: Innovations in composites can reduce material weight, leading to easier installation and lower transportation costs.

- Improved Performance: Advanced coatings and materials can offer better thermal insulation, solar control, and self-cleaning properties.

- New Applications: Material science breakthroughs can enable Apogee to enter markets requiring specialized glass and framing solutions, such as high-performance aerospace or advanced energy systems.

Technological advancements, particularly in smart glass and energy-efficient coatings, are reshaping the building materials sector. Apogee can leverage innovations like electrochromic glass and low-emissivity (Low-E) coatings to enhance building performance and meet sustainability demands. The global smart glass market, valued at approximately $5.9 billion in 2023, is projected to reach $11.5 billion by 2030, underscoring the significant demand for these technologies.

Legal factors

Apogee must navigate a complex web of evolving building energy efficiency standards, impacting product design and market access. For instance, the International Energy Conservation Code (IECC) and ASHRAE Standard 90.1 are regularly updated, requiring continuous product validation and potential redesign to meet stricter requirements. Failure to comply, as seen in past instances where non-compliant HVAC components led to project delays and financial penalties, can exclude products from lucrative construction projects.

Staying ahead of these regulatory shifts is crucial for Apogee's competitive edge. By actively participating in the development and adaptation of these standards, Apogee can position its offerings as compliant and desirable solutions for the growing segment of energy-conscious builders and specifiers. This proactive stance can prevent costly retrofits and ensure Apogee remains a preferred supplier in a market increasingly driven by sustainability and performance metrics.

Environmental regulations significantly influence Apogee's manufacturing and waste handling, directly affecting operational expenses and necessitating investment in eco-friendly technologies. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards on industrial emissions, with proposed updates to air quality regulations expected to increase compliance costs for manufacturers.

Apogee must adhere to various environmental laws, from sourcing sustainable materials to managing product end-of-life, to bypass substantial fines and protect its brand image. Failure to comply with directives, such as those mandated by the European Union's Waste Electrical and Electronic Equipment (WEEE) directive, could result in penalties and reputational damage, as seen with other tech firms facing scrutiny in recent years.

Apogee must navigate a landscape of stringent workplace health and safety regulations, impacting both its manufacturing operations and the installation of its products on construction sites. These legal frameworks demand strict adherence to ensure employee well-being, minimize potential liabilities, and prevent disruptions to business continuity.

Failure to comply can lead to significant fines and operational shutdowns. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) in the United States issued over 80,000 citations, with penalties often reaching tens of thousands of dollars per violation, underscoring the financial risks associated with non-compliance.

Apogee's proactive approach, evidenced by its enterprise-wide health and safety program, aims to mitigate these risks. This commitment is crucial, especially considering the inherent hazards in manufacturing and on-site installations, where a strong safety culture is paramount for operational integrity and employee retention.

Product Liability and Quality Standards

Legal requirements for product performance, durability, and safety are paramount for Apogee. Failure to meet these stringent standards, such as those outlined by the Consumer Product Safety Commission (CPSC) or specific industry bodies, can result in substantial product liability claims. For instance, in 2023, product liability lawsuits in the U.S. saw an average settlement of $1.5 million, highlighting the financial risks involved.

Apogee's commitment to rigorous quality control and adherence to industry standards is crucial. This directly impacts its ability to avoid costly recalls and protect its brand reputation. A significant product recall can cost millions; for example, a major automotive recall in late 2024 reportedly cost the manufacturer over $500 million.

- Product Performance: Ensuring products meet advertised specifications and expected functionality is a legal requirement.

- Durability: Products must reasonably withstand normal use over their expected lifespan.

- Safety Standards: Adherence to mandatory safety regulations, such as those from UL or CE marking, is non-negotiable.

- Liability Claims: Non-compliance can lead to lawsuits, fines, and mandated product recalls.

Trade and Import/Export Laws

Apogee's global operations are significantly shaped by international trade and import/export laws. Complex regulations govern how Apogee sources components and sells its products worldwide, impacting everything from sourcing efficiency to market reach. For instance, the World Trade Organization (WTO) reported that global trade in goods grew by an estimated 0.2% in 2023, a figure that will influence Apogee's market dynamics.

Fluctuations in trade policy, such as the imposition of new tariffs or the negotiation of trade agreements, can directly affect Apogee's supply chain costs and its ability to access international markets. Companies like Apogee must remain vigilant, continuously monitoring legal changes to adapt their strategies and maintain competitive pricing. For example, the ongoing trade discussions between major economic blocs could introduce new compliance burdens or create new market opportunities.

- Tariff Changes: Recent tariff adjustments, like those seen in US-China trade relations, can increase the cost of imported components or exported finished goods for Apogee.

- Export Controls: Strict export control regulations, particularly for technology-related items, can limit Apogee's sales in certain sensitive markets.

- Trade Agreements: Favorable trade agreements, such as the EU's trade pacts, can reduce barriers and facilitate smoother international distribution for Apogee's products.

- Customs Procedures: Navigating diverse customs clearance processes in different countries requires specialized knowledge and can impact delivery timelines and operational costs.

Apogee's adherence to building codes and energy efficiency standards is a critical legal factor. For example, the 2024 updates to the International Energy Conservation Code (IECC) mandate higher performance levels for building envelopes and HVAC systems, directly impacting Apogee's product development and sales strategies. Non-compliance can lead to product rejection in new construction projects, a risk underscored by millions in lost revenue for non-compliant suppliers in previous years.

Environmental regulations, such as the EPA's proposed updates to air quality standards in 2025, will increase compliance costs for manufacturers like Apogee. Failure to manage emissions and waste responsibly, as mandated by directives like the EU's WEEE, can result in substantial fines and damage brand reputation, with companies historically facing multi-million dollar penalties.

Workplace health and safety laws, enforced by bodies like OSHA, necessitate robust safety programs. Given that OSHA issued over 80,000 citations in 2023, with penalties often in the tens of thousands per violation, Apogee's investment in its safety culture is a direct legal and financial imperative to avoid operational disruptions and liabilities.

Product liability laws require Apogee to meet stringent safety and performance standards, such as those from UL. With average product liability settlements in the U.S. reaching $1.5 million in 2023, and major recalls costing hundreds of millions, rigorous quality control is essential for mitigating legal exposure and maintaining market trust.

Environmental factors

Global awareness of climate change is intensifying, leading to a significant push for buildings that are more energy-efficient and produce fewer emissions. This directly translates into a greater need for advanced building materials that can help achieve these goals.

Apogee's specialized glass and framing systems play a vital role here, as they are engineered to minimize the energy required for heating and cooling. For instance, in 2024, the U.S. Green Building Council reported that buildings seeking LEED certification often prioritize high-performance glazing, a market where Apogee is a key player.

These products are not just about reducing energy bills; they are essential for meeting stringent environmental regulations and obtaining green building certifications like LEED and WELL. This demand positions Apogee's innovations as critical enablers of sustainable construction practices.

The ongoing focus on decarbonization and energy efficiency continues to be a primary catalyst for Apogee’s product development and market strategy. As of early 2025, analysts project continued growth in the high-performance building envelope market, driven by these environmental mandates.

Growing global awareness of finite resources is compelling manufacturers like Apogee to prioritize sustainable material sourcing and investigate alternative options. This shift is driven by increasing consumer demand for eco-friendly products and evolving regulatory landscapes.

Apogee encounters hurdles in obtaining essential raw materials such as sand for glass production and aluminum. For instance, the International Energy Agency reported in 2024 that demand for critical minerals used in clean energy technologies, including those relevant to advanced materials, is projected to surge significantly by 2030.

However, these challenges also present opportunities for Apogee to innovate by incorporating recycled content into its product lines. Exploring more environmentally benign production methods, such as those reducing energy consumption or waste, can also enhance its market position.

Implementing circular economy principles, which focus on reusing, repairing, and recycling materials, is a key strategy for Apogee. This approach not only mitigates resource scarcity but also fosters greater operational efficiency and can lead to cost savings in the long run.

Environmental regulations and corporate sustainability goals are increasingly prioritizing reduced waste generation across manufacturing and construction sectors. Apogee must integrate efficient waste management practices within its own facilities, focusing on minimizing output and maximizing resource recovery. This includes exploring avenues for recycling glass and framing materials generated from construction projects, directly supporting circular economy principles.

The global waste management market is projected to reach over $1.5 trillion by 2027, underscoring the growing economic significance of effective waste handling. For Apogee, this presents an opportunity to not only comply with evolving standards but also to create value from waste streams. For instance, in 2024, the construction industry alone generated millions of tons of waste globally, much of which could be recycled or repurposed.

Water Usage and Pollution Control

Industrial operations, particularly glass manufacturing, are inherently water-intensive. Apogee’s production processes, for example, rely heavily on water for cooling, cleaning, and as a raw material component. In 2023, the manufacturing sector in the United States consumed approximately 13.5 billion gallons of water per day, highlighting the scale of industrial water needs.

Apogee faces stringent regulations regarding both water consumption and wastewater discharge. Compliance with these environmental laws is crucial for operational continuity and maintaining a positive corporate image. For instance, the Environmental Protection Agency (EPA) sets limits on pollutants in industrial wastewater, requiring companies to invest in treatment technologies.

To address these challenges, Apogee must prioritize implementing advanced technologies to reduce its water footprint and control pollution. This includes investing in closed-loop water systems, optimizing cooling processes, and employing effective wastewater treatment methods. Such measures are not only vital for environmental stewardship but also for long-term cost efficiency.

- Water Consumption: Industrial water use is a significant concern, with manufacturing being a major consumer.

- Regulatory Compliance: Adherence to EPA and state-level water quality standards is mandatory for all industrial facilities.

- Pollution Control: Wastewater from glass manufacturing can contain suspended solids, heavy metals, and elevated temperatures, necessitating robust treatment.

- Technological Investment: Companies like Apogee are increasingly investing in water-saving technologies and advanced filtration systems.

Extreme Weather Events and Resilient Design

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, are significantly boosting the demand for resilient and impact-resistant building materials. Apogee’s capacity to offer advanced glass and framing systems capable of withstanding severe weather, like high winds and seismic activity, is evolving from a competitive edge into a fundamental requirement for contemporary construction projects.

This trend underscores the growing importance of incorporating durability and safety into architectural designs. For instance, the United States experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, according to the National Oceanic and Atmospheric Administration (NOAA), highlighting the increasing economic impact of such events. Apogee's product portfolio, designed to meet stringent building codes and performance standards for these challenging conditions, positions them favorably in a market increasingly prioritizing safety and longevity.

- Increased Demand: Climate change fuels demand for materials that can withstand extreme weather, such as hurricanes and earthquakes.

- Competitive Advantage: Apogee's resilient glass and framing systems offer a key differentiator in the construction market.

- Market Necessity: The ability to withstand severe weather is becoming a standard requirement, not just a premium feature.

- Economic Impact: With 28 billion-dollar weather disasters in the US in 2023, building resilience is crucial for mitigating financial losses.

Apogee's commitment to sustainable materials and resource management is increasingly critical as global awareness of finite resources grows. This trend is bolstered by consumer demand for eco-friendly products and evolving regulatory frameworks, pushing companies like Apogee to explore recycled content and more environmentally benign production methods.

The company faces challenges in sourcing raw materials like sand and aluminum, with demand for critical minerals projected to surge by 2030, according to the International Energy Agency's 2024 report. However, these hurdles also create opportunities for Apogee to innovate through recycling and by adopting circular economy principles to enhance efficiency and reduce costs.

Environmental regulations and corporate sustainability goals are intensifying the focus on waste reduction. Apogee must integrate efficient waste management, including recycling glass and framing materials, to align with circular economy principles and capitalize on the growing waste management market, which is expected to exceed $1.5 trillion by 2027.

The increasing frequency of extreme weather events, driven by climate change, is fueling demand for resilient building materials. Apogee's advanced glass and framing systems, designed to withstand severe weather, are becoming a necessity, especially considering the 28 billion-dollar weather disasters recorded in the U.S. in 2023 alone, as reported by NOAA.

| Environmental Factor | Impact on Apogee | Key Data/Trend | Opportunity/Challenge |

| Climate Change & Energy Efficiency | Increased demand for energy-efficient buildings and materials | LEED certifications prioritize high-performance glazing (2024 USGBC data) | Opportunity: Market leadership in sustainable building solutions |

| Resource Scarcity | Challenges in raw material sourcing (sand, aluminum) | Critical minerals demand to surge by 2030 (IEA 2024 projection) | Challenge: Supply chain vulnerability; Opportunity: Innovation in recycled content |

| Waste Management & Circular Economy | Need for efficient waste reduction and recycling | Global waste management market to exceed $1.5T by 2027 | Opportunity: Value creation from waste streams, operational efficiency |

| Extreme Weather Events | Growing demand for impact-resistant and resilient building materials | 28 U.S. billion-dollar weather disasters in 2023 (NOAA data) | Opportunity: Market differentiator through durable, safe products |

PESTLE Analysis Data Sources

Our Apogee PESTLE Analysis is meticulously constructed using a diverse range of data sources, including reports from reputable market research firms, official government publications, and leading academic journals. This comprehensive approach ensures that every aspect of the macro-environment is thoroughly examined, providing a robust foundation for strategic decision-making.