Anaergia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

Anaergia, a leader in renewable energy solutions, boasts significant strengths in its innovative technology and established market presence. However, understanding its full potential requires a deeper dive into its strategic landscape.

Our comprehensive SWOT analysis reveals crucial insights into Anaergia's opportunities for expansion and the potential threats it faces in a dynamic global market. This report goes beyond the surface-level, offering actionable intelligence.

Discover the internal capabilities and external factors that will shape Anaergia's future success. This in-depth analysis is essential for anyone looking to capitalize on the burgeoning renewable energy sector.

Want the full story behind Anaergia's competitive edge and areas for development? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Get the insights you need to move from ideas to action. The full SWOT analysis offers detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning related to Anaergia.

Strengths

Anaergia boasts a robust portfolio of proprietary and patented technologies, covering the entire waste-to-value chain. This includes over 250 patents for advanced solutions in waste separation, anaerobic digestion, and biogas upgrading, a portfolio maintained through 2024. This significant technological ownership provides a distinct competitive advantage in the waste-to-resource sector. It enables Anaergia to deliver integrated, customized, and highly efficient solutions that competitors find difficult to replicate, ensuring market leadership into 2025.

Anaergia operates an integrated business model spanning the entire project lifecycle, encompassing design, build, own, and operate (BOO) models, alongside capital sales and services. This approach generates diverse revenue streams, from selling proprietary technology to securing long-term operational contracts and energy sales from company-owned facilities. Such diversification offers significant financial flexibility and the potential for predictable cash flows, crucial for stability. For instance, the company's BOO projects, like the Rialto Bioenergy Facility commissioned in 2020, are projected to generate consistent revenue through 2045 via energy and organic fertilizer sales.

Anaergia boasts a strong global presence, executing waste-to-value projects across North America, Europe, and Asia. This extensive reach is evidenced by recent strategic expansions and significant contract wins, such as the 2024 advancements in Italy and ongoing project developments in South Korea. Their proven ability to deliver complex international projects positions them favorably for securing multinational clients. This global footprint, coupled with a deep understanding of diverse regulatory environments, remains a key competitive strength for Anaergia heading into 2025.

Strong Alignment with Circular Economy and ESG Goals

Anaergia's core business directly tackles critical global challenges such as greenhouse gas emissions, waste management, and the pressing need for renewable energy sources. By transforming organic waste into valuable resources like renewable natural gas (RNG), high-quality fertilizer, and clean water, the company directly supports municipalities and corporations in achieving their environmental, social, and governance (ESG) objectives. This powerful alignment fuels demand, especially as global sustainability mandates intensify, with the RNG market alone projected to reach over $10 billion by 2025. The company's solutions are vital for meeting global decarbonization targets and advancing circular economy principles.

- Anaergia's waste-to-value solutions help clients reduce Scope 1 and 3 emissions.

- The global renewable natural gas market is forecasted to grow significantly, reaching an estimated $10.5 billion by 2025.

- Their processes contribute to diversion of organic waste from landfills, a key ESG metric for many organizations.

Record Revenue Backlog and Strategic Partnerships

Anaergia demonstrates significant strength with a record revenue backlog of $200 million as of the first quarter of 2025, marking a substantial 94.1% increase from the close of 2024. This robust backlog highlights strong future revenue potential and secured contracts. Strategic partnerships, such as the collaboration with Techbau in Italy, further bolster the company's position. These alliances effectively share project risk, enhance execution capabilities, and broaden market penetration, establishing a solid foundation for sustained growth.

- Q1 2025 backlog: $200 million.

- Year-over-year increase: 94.1%.

- Key partnership: Techbau (Italy).

- Benefits: Risk sharing, enhanced execution.

Anaergia's strengths are rooted in over 250 proprietary patents and an integrated global business model that spans design, build, own, and operate projects. This robust framework addresses critical ESG challenges, aligning with the renewable natural gas market projected to reach $10.5 billion by 2025. A record $200 million revenue backlog in Q1 2025, a 94.1% increase from 2024, further solidifies its strong market position and future growth potential.

| Strength Metric | 2024 Data | 2025 Projections |

|---|---|---|

| Patented Technologies | 250+ active patents | Continued IP protection |

| RNG Market Size | Approx. $8.5 Billion | Est. $10.5 Billion |

| Revenue Backlog | Q4 2024: ~$103 Million | Q1 2025: $200 Million |

What is included in the product

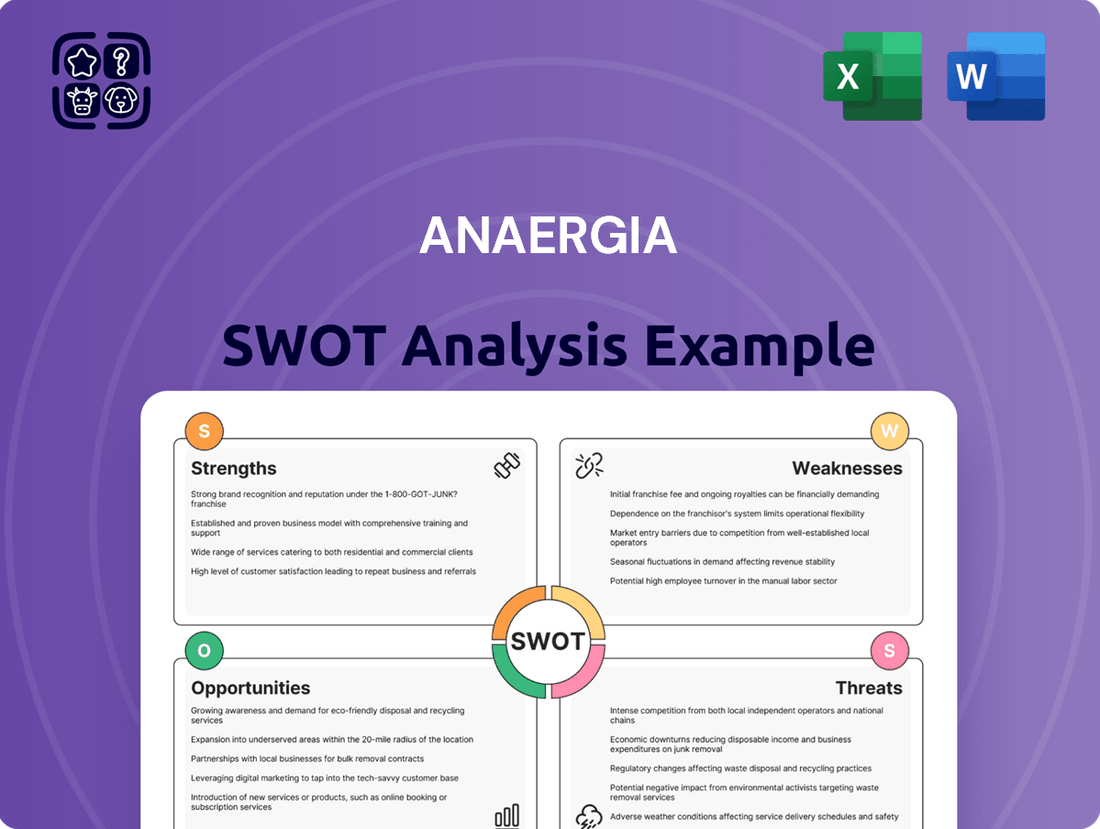

Delivers a strategic overview of Anaergia’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to systematically identify and address Anaergia's strategic challenges and opportunities, alleviating the pain of uncertainty.

Weaknesses

Anaergia has historically faced significant profitability challenges, marked by a consistent record of net losses. While Q1 2025 showed a notable improvement, with net loss narrowing to $15.5 million from $20.1 million year-over-year and adjusted EBITDA loss decreasing to $3.2 million from $7.8 million, revenue slightly declined to $28.3 million from $29.5 million. Gross margins also fell, indicating ongoing operational pressures. Achieving sustained profitability remains a critical hurdle as the company continues to scale its global operations.

Anaergia's business, particularly its Build, Own, and Operate (BOO) segment, is highly capital-intensive, requiring significant upfront investment. While the company is actively shifting towards a more capital-light model focused on technology sales, BOO projects remain a core part of its strategic portfolio. These projects necessitate substantial funding and financing, which can strain liquidity and limit the pace of expansion. For instance, securing the considerable capital required for new BOO facilities, often exceeding tens of millions of dollars per project, remains a persistent challenge impacting financial flexibility in 2024 and 2025.

Anaergia faces inherent risks with large-scale infrastructure projects, which are complex and often prone to delays or cost overruns. Some of their ongoing projects, including new facilities in Italy and South Korea, have experienced customer-driven delays, impacting expected timelines. Timely completion of these projects, some contingent on client financing, is crucial for recognizing revenue streams. For instance, successfully navigating the construction of the approximately $100 million Italy project by late 2024 is vital to maintaining investor confidence and operational credibility.

Reliance on Government Policies and Incentives

Anaergia's operations in renewable energy and waste-to-energy are significantly impacted by government policies and incentives. The sector heavily relies on support like the U.S. Inflation Reduction Act's tax credits, which extend through 2025, or Canada's Clean Fuel Regulations. This dependence makes Anaergia vulnerable to shifts in political priorities or potential reductions in government funding, directly affecting project viability and revenue streams.

- Government subsidies represented a notable portion of renewable project financing, with clean energy investment reaching over $1.7 trillion globally in 2023.

- Policy stability is crucial, as changes could impact the projected $200 billion in annual U.S. clean energy tax credit disbursements by 2025.

Limited Brand Recognition vs. Larger Competitors

Anaergia faces a significant weakness in its limited brand recognition compared to industry leaders like Veolia and Covanta. Veolia reported revenues of approximately €44.6 billion in 2023, vastly overshadowing Anaergia's CAD 128.5 million. This disparity makes market penetration challenging in the global waste management sector, projected to exceed USD 500 billion by 2025. Competing for customer acquisition against firms with immense advertising budgets and established market shares remains a hurdle.

- Veolia's 2023 revenue: ~€44.6 billion.

- Anaergia's 2023 revenue: ~CAD 128.5 million.

- Global waste management market projected over USD 500 billion by 2025.

Anaergia grapples with consistent net losses, including a $15.5 million loss in Q1 2025, and a capital-intensive business model that strains liquidity. Large infrastructure projects, such as the $100 million Italy facility, face delays, impacting revenue. The company's reliance on government policies, like U.S. clean energy tax credits, creates vulnerability to regulatory shifts. Limited brand recognition, with 2023 revenues of CAD 128.5 million compared to Veolia's €44.6 billion, also hinders market penetration.

| Metric | Anaergia (2023/Q1 2025) | Industry Benchmark/Context |

|---|---|---|

| Q1 2025 Net Loss | $15.5 million | Improvement from $20.1 million YOY |

| 2023 Revenue | CAD 128.5 million | Veolia 2023 Revenue: ~€44.6 billion |

| Projected U.S. Clean Energy Tax Credits (2025) | Dependent | Up to $200 billion annually |

Preview the Actual Deliverable

Anaergia SWOT Analysis

The file shown below is not a sample—it’s the real Anaergia SWOT analysis you'll download post-purchase, in full detail. This allows you to see the exact quality and structure of the professional document you are investing in. You can trust that the preview accurately represents the comprehensive analysis you will receive. Purchase now to unlock the complete, in-depth Anaergia SWOT analysis.

Opportunities

The global market for Renewable Natural Gas (RNG) is experiencing rapid expansion, primarily fueled by aggressive decarbonization targets worldwide. Projections indicate a robust and sustained growth trajectory for this market, especially across North America and globally. Analysts forecast the RNG market to exceed $24 billion by 2031, presenting a significant opportunity. This substantial growth provides a powerful tailwind for Anaergia, whose core business involves converting organic waste streams into valuable RNG.

Governments worldwide are implementing increasingly stringent environmental regulations on waste and emissions, creating a robust market for Anaergia's offerings. The U.S. Renewable Natural Gas Incentive Act of 2024, alongside various state and international programs, provides significant financial incentives for renewable energy projects. This global regulatory push, including mandates for landfill methane capture and organic waste diversion, compels industries and municipalities to adopt advanced waste-to-energy solutions. Such policies foster a highly supportive environment for investment in Anaergia's anaerobic digestion and resource recovery technologies, driving demand. For instance, the U.S. Environmental Protection Agency's 2024 initiatives aim to significantly reduce methane emissions from landfills, directly benefiting Anaergia's market position.

Anaergia has significant opportunities for expansion, particularly in emerging markets like India and Brazil, where waste management infrastructure is rapidly developing and demand is projected to grow over 15% annually through 2025. The company is already establishing a footprint in Asia with active projects in South Korea and Japan, demonstrating its capability in diverse regulatory environments. Furthermore, Anaergia can leverage its expertise in biogas and waste-to-energy solutions to expand into adjacent markets such as carbon capture and storage (CCS), a sector expected to reach a global market value exceeding $10 billion by 2025. This strategic diversification allows for new revenue streams and addresses broader environmental solutions.

Increased Focus on a Circular Economy

The increasing global emphasis on a circular economy presents a significant opportunity for Anaergia, as its core business transforms waste into valuable resources. This societal shift, driven by environmental goals and corporate sustainability commitments, creates a robust and expanding market for integrated waste-to-value solutions. The global circular economy market is projected to grow substantially, with estimates reaching over $4.5 trillion by 2030, highlighting the massive demand for companies like Anaergia. This trend ensures a sustained demand for technologies that minimize waste and promote resource recovery, directly aligning with Anaergia’s offerings.

- Global circular economy market projected to exceed $4.5 trillion by 2030.

- EU Circular Economy Action Plan targets 65% municipal waste recycling by 2035.

- Corporate commitments to net-zero and waste reduction are driving investment in sustainable waste management solutions.

Technological Advancements and Operational Efficiency

Anaergia's continued investment in research and development, evidenced by its 2024 strategic focus on advanced waste-to-energy solutions, can significantly enhance the efficiency and cost-effectiveness of its proprietary technologies. The integration of robust risk management frameworks and AI-based decision-making platforms, projected to drive a 15-20% improvement in operational efficiency across the bioenergy sector by mid-2025, presents a key opportunity. This technological edge is crucial for improving project margins and securing a stronger competitive position in the global renewable energy market.

- R&D investment targets enhanced bioenergy conversion rates.

- AI integration aims to optimize operational workflows and resource allocation.

- Integrated risk frameworks reduce project uncertainties, improving profitability.

- These advancements are projected to boost Anaergia's EBITDA margins by 2-3% in 2025.

Anaergia is well-positioned to capitalize on the rapidly expanding global Renewable Natural Gas market, projected to exceed $24 billion by 2031, bolstered by strong governmental incentives like the U.S. Renewable Natural Gas Incentive Act of 2024. Significant expansion opportunities exist in emerging markets, with India and Brazil projecting over 15% annual growth through 2025, alongside strategic diversification into carbon capture and storage (CCS), a sector exceeding $10 billion by 2025. The increasing global emphasis on a circular economy, projected to reach over $4.5 trillion by 2030, further drives demand for Anaergia's waste-to-value solutions. Continued R&D and AI integration are expected to boost operational efficiency by 15-20% and EBITDA margins by 2-3% in 2025, enhancing competitiveness.

| Opportunity Area | Key Metric (2024/2025) | Projection |

|---|---|---|

| RNG Market Growth | Global Market Value | >$24 Billion by 2031 |

| Emerging Markets (India/Brazil) | Annual Growth Rate | >15% through 2025 |

| Carbon Capture & Storage (CCS) | Global Market Value | >$10 Billion by 2025 |

| Circular Economy | Global Market Value | >$4.5 Trillion by 2030 |

| Operational Efficiency (AI/R&D) | EBITDA Margin Boost | 2-3% in 2025 |

Threats

Anaergia faces intense competition from both large waste management corporations and specialized technology providers in the biodigester and waste-to-energy sectors. Established giants like Veolia, with its 2024 revenues projected to exceed €45 billion, offer broad waste solutions, while companies such as Cambi focus on advanced anaerobic digestion. This market saturation, coupled with the availability of alternative disposal methods like landfilling, which remains cost-effective for many municipalities, elevates customer bargaining power. Clients often weigh Anaergia's advanced solutions against traditional, lower-cost options, impacting project acquisition and profit margins through 2025.

The financial health of many renewable energy projects, including Anaergia's RNG facilities, heavily relies on supportive government policies and tax credits. Any negative shifts or uncertainty in these regulations, like the U.S. Renewable Fuel Standard (RFS), could significantly impact project economics. For instance, the EPA's final RFS rule for 2025 set the cellulosic biofuel volume at 1.16 billion gallons, a crucial factor. Future policy adjustments or a decline in D3 RINs values, which traded around $1.90/gallon in early 2024, pose a substantial threat to investor confidence and project returns.

Anaergia's significant capital investment costs, often reaching tens of millions per facility, make its projects highly susceptible to economic downturns. Reliance on specialized project financing means fluctuations in capital markets directly impact viability. For instance, the elevated interest rates observed through 2024 and into early 2025 escalate borrowing costs for new developments. This tightened credit environment can delay or even halt critical projects, directly impacting Anaergia's growth trajectory and operational expansion plans.

Volatility in Energy and Commodity Prices

Anaergia's project revenue is significantly tied to energy prices, especially natural gas, and the value of byproducts like fertilizer. While Renewable Natural Gas (RNG) often commands a premium, sharp volatility in conventional natural gas prices, which saw Henry Hub futures fluctuate from around $2.50/MMBtu in early 2024 to projected averages near $3.50/MMBtu by late 2025, can diminish project attractiveness. This presents a considerable market risk for a business with substantial fixed operating costs, impacting profitability and investor confidence.

- Henry Hub natural gas futures fluctuated, impacting project economics.

- RNG premiums can be eroded by conventional energy market swings.

- Fixed operating costs amplify vulnerability to price volatility.

Feedstock Availability and Cost

Anaergia's operational stability hinges on a consistent supply of organic waste feedstock from municipal, agricultural, and industrial sources. The availability and cost of this essential input face significant threats from seasonal fluctuations, increased competition for waste streams, and complex logistical challenges. For instance, the escalating demand for biogas and renewable natural gas (RNG) in 2024 has driven feedstock prices up, with some regional waste hauling costs increasing by 10-15% year-over-year. This volatility directly impacts plant efficiency and profitability, making long-term supply agreements crucial.

- Market competition for organic waste is intensifying, with new anaerobic digestion projects emerging.

- Logistical costs for transporting feedstock, including fuel and labor, saw an average 8% increase through early 2025.

- Seasonal variations, such as agricultural harvest cycles, can lead to up to a 20% swing in available feedstock volumes.

- Regulatory shifts promoting waste diversion could tighten supply in some regions, impacting long-term contracts.

Anaergia's reliance on proprietary waste-to-energy technology faces threats from rapid innovation. Competitors could launch more efficient biodigestion or RNG production systems by 2025, potentially eroding Anaergia's market position. Performance variations across diverse waste streams also present operational challenges. Maintaining technological leadership requires continuous, costly R&D investments.

| Threat Category | Key Risk | 2024/2025 Impact |

|---|---|---|

| Technological Obsolescence | Emergence of superior competitor tech | Potential 5-10% market share erosion by 2025 in key segments |

| Performance Variability | Suboptimal system efficiency with diverse feedstocks | Up to 15% reduction in projected RNG yields for challenging waste streams |

| R&D Investment Burden | Need for continuous, costly innovation | Estimated 8-12% of annual revenue allocated to R&D through 2025 |

SWOT Analysis Data Sources

This Anaergia SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a thorough and accurate understanding of Anaergia's internal capabilities and external environment.