Anaergia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

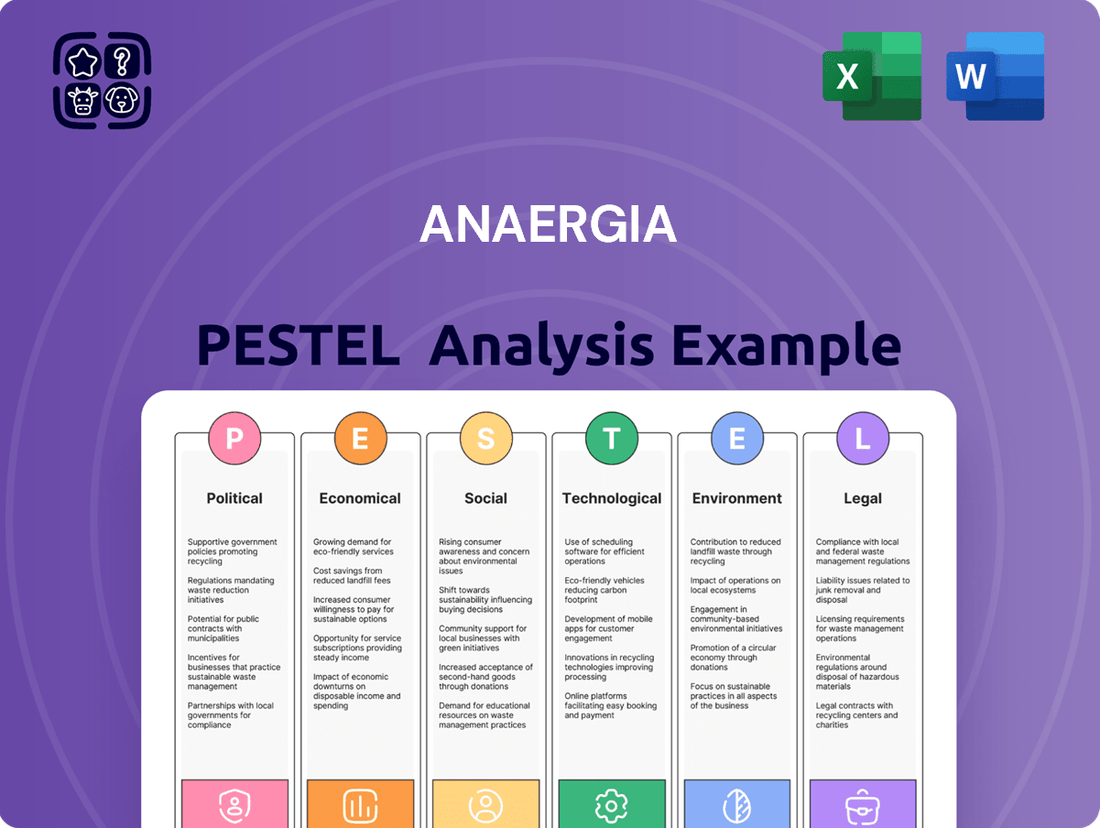

Uncover the critical external factors shaping Anaergia's trajectory with our comprehensive PESTLE analysis. We delve into the political, economic, social, technological, legal, and environmental landscapes impacting this vital player in the circular economy.

Gain a strategic advantage by understanding how evolving regulations, shifting consumer preferences, and technological advancements create both opportunities and challenges for Anaergia. Our analysis provides actionable intelligence to inform your decisions.

Whether you're an investor, strategist, or industry observer, this PESTLE analysis offers the deep insights needed to navigate the complex operating environment. Don't be left behind by external forces.

Secure your competitive edge and make informed strategic choices. Download the full PESTLE analysis for Anaergia now and equip yourself with the knowledge to anticipate market shifts and capitalize on emerging trends.

Political factors

Government support for renewable energy and waste diversion significantly impacts Anaergia. Policies like the U.S. Inflation Reduction Act offer incentives, with a 30% investment tax credit for eligible biogas projects. The U.K.'s Green Gas Support Scheme further aids renewable natural gas production. EU initiatives such as REPowerEU target 35 billion cubic meters of biomethane by 2030, creating vast market opportunities. These global targets for emission reduction and landfill diversion foster a favorable climate for Anaergia's technologies.

Anaergia's global reach exposes it to geopolitical shifts and various international agreements. Political instability or changes in trade policies, such as potential tariffs or new regulations expected by 2025 in key operating regions like Europe or North America, can disrupt project timelines and profitability. Conversely, global climate commitments, like those targeting methane emission reductions by 2030, directly boost demand for Anaergia's waste-to-resource solutions. Ensuring regional stability where Anaergia has facilities, including projected new sites in 2024, is paramount for securing long-term investments and smooth operations.

Public-private partnerships are a core political strategy for Anaergia, enabling long-term contracts for upgrading and operating waste treatment facilities. Collaborations, such as the ongoing work with the City of Riverside, California, ensure stable revenue streams for the company's energy-from-waste projects. These partnerships frequently benefit from government grants and substantial funding, like the over $100 million in cumulative project financing secured for various municipal initiatives by 2024. The sustained success of these ventures heavily relies on the political commitment of local governments to invest in sustainable infrastructure development and circular economy solutions.

Environmental Regulations

Stringent environmental regulations are a significant political driver for Anaergia, directly boosting demand for its waste-to-value solutions. California's SB 1383, mandating a 75% reduction in organic waste sent to landfills by 2025, exemplifies policies creating this market. As more jurisdictions globally adopt similar measures to curb methane emissions and enhance resource recovery, Anaergia's addressable market expands. These policies underscore a global shift towards sustainable waste management, reinforcing Anaergia's strategic position.

- By 2025, California aims to divert 75% of organic waste from landfills under SB 1383.

- Global methane reduction targets drive demand for anaerobic digestion technologies.

Permitting and Land Use

Navigating permitting and land use regulations is a critical political factor for Anaergia's operations. The development or expansion of waste-to-resource facilities is subject to a complex web of federal, state, and local environmental and zoning laws. Delays in securing necessary permits, which can extend project timelines by 6-18 months in some jurisdictions, directly escalate costs and impact project viability. For instance, the average cost of permitting a large-scale anaerobic digestion facility can exceed $500,000, excluding direct construction. Therefore, cultivating strong relationships with regulatory bodies and local communities is essential for successful project execution and to mitigate potential opposition, which can significantly slow down or halt a project.

- Regulatory complexity: Federal and state environmental impact assessments, like those under the Clean Air Act, often require extensive documentation and public review periods.

- Local zoning hurdles: Municipal land use bylaws vary significantly, requiring detailed site-specific approvals for facility construction or expansion.

- Project delays: Permitting bottlenecks can delay project commissioning, impacting anticipated revenue streams and increasing financing costs.

- Community engagement: Successful projects often involve proactive community outreach to address concerns and build local support, crucial for timely approvals.

Government incentives, such as the US 30% investment tax credit and EU targets for 35 billion cubic meters of biomethane by 2030, significantly bolster Anaergia's market. Regulatory frameworks, like California's SB 1383 aiming for 75% organic waste diversion by 2025, directly drive demand. Navigating geopolitical shifts and permitting complexities, which can delay projects by 6-18 months, remains critical. Public-private partnerships, securing over $100 million in project financing by 2024, ensure stable long-term revenue.

| Political Factor | Impact on Anaergia | 2024/2025 Data Point |

|---|---|---|

| Government Incentives | Enhanced project viability | US 30% Investment Tax Credit for biogas |

| Regulatory Drivers | Increased market demand | CA SB 1383: 75% organic waste diversion by 2025 |

| Permitting Delays | Higher costs, project setbacks | 6-18 month average project delays |

| Public-Private Partnerships | Secured revenue streams | >$100M cumulative project financing by 2024 |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Anaergia across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable intelligence to support strategic decision-making and identify both challenges and opportunities within the biogas and renewable energy sectors.

A concise, actionable PESTLE analysis for Anaergia that cuts through the noise, providing clear insights into external factors impacting their business.

This PESTLE analysis for Anaergia offers a focused overview, helping leadership quickly identify and address potential external challenges and opportunities.

Economic factors

The global market for Renewable Natural Gas (RNG) is experiencing robust expansion, presenting a significant economic opportunity for Anaergia. Projections indicate a substantial market size increase, with a Compound Annual Growth Rate (CAGR) potentially reaching 33.8% from 2024 to 2034. This growth is fueled by rising demand for sustainable energy and RNG's versatility in sectors like electricity generation and vehicle fuel. The market value is anticipated to reach hundreds of billions of dollars over the next decade.

Anaergia is strategically shifting to a capital-light business model, which initially impacted its top-line financial performance, leading to lower reported revenues in early 2024. Despite this, the company has shown improvements in adjusted EBITDA as it streamlines operations. Recent financial reports from late 2024 and Q1 2025 indicate a significant increase in revenue backlog, reaching approximately $310 million by March 2025, signaling a positive outlook for future sales growth. This growing backlog and strategic focus are bolstering investor confidence for the upcoming periods.

Securing capital is vital for Anaergia's project development and expansion, particularly given the high upfront costs in waste-to-energy. The company significantly bolstered its financial standing through a C$145 million equity investment from MIRA in late 2023, which was critical for debt reduction and operational stability heading into 2024. Future investment attraction hinges on sustained growth in the global renewable natural gas market, successful execution of its active project pipeline, and robust investor confidence in the broader cleantech sector through 2025.

Competition

Anaergia operates in a highly competitive landscape within the global renewable energy and waste management sectors, facing established players with substantial market share and financial resources. To maintain its competitive edge, Anaergia strategically leverages its proprietary technologies and integrated solutions, which are crucial for securing new projects. The company holds a significant portfolio of patents, totaling over 200 globally as of early 2024, protecting its innovative processes in anaerobic digestion and resource recovery. This intellectual property helps differentiate Anaergia from competitors vying for contracts in a market projected to grow significantly by 2025.

- Global renewable energy market valued at over $1.5 trillion in 2024.

- Waste-to-energy sector expected to exceed $40 billion by 2025.

- Anaergia holds over 200 patents as of early 2024.

Economic Downturns and Interest Rates

Economic downturns significantly impact Anaergia's operations, as a recession could curtail investment in renewable energy projects. For instance, the International Energy Agency (IEA) projected a slowdown in global renewable energy investment growth for 2024 if economic conditions deteriorate, affecting new project financing. Fluctuations in interest rates directly influence the cost of capital for Anaergia's new ventures.

Rising interest rates, such as the Federal Reserve's potential rate hikes in late 2024 or early 2025, increase borrowing costs for large-scale infrastructure projects, potentially reducing Anaergia's overall profitability and project feasibility. This economic sensitivity necessitates robust financial planning and risk mitigation strategies for the company.

- Global renewable energy investment growth is projected to slow in 2024 amid economic uncertainty.

- Rising interest rates, potentially reaching 5.50%-5.75% by late 2024, increase Anaergia's project financing costs.

- A 1% increase in borrowing rates can significantly reduce the internal rate of return (IRR) on long-term renewable projects.

The robust global Renewable Natural Gas market, projected for substantial growth with a 33.8% CAGR from 2024 to 2034, presents significant economic opportunities for Anaergia. The company’s strategic shift to a capital-light model, alongside a C$145 million MIRA equity investment in late 2023, is bolstering its financial stability. A revenue backlog of $310 million by March 2025 indicates strong future sales. However, rising interest rates, potentially reaching 5.50%-5.75% by late 2024, increase project financing costs and necessitate robust planning.

| Economic Factor | 2024 Data | 2025 Outlook |

|---|---|---|

| RNG Market CAGR | 33.8% (2024-2034) | Continued high growth |

| Anaergia Revenue Backlog | $310M (March 2025) | Positive future sales |

| Interest Rates (Fed) | Potential hikes to 5.50%-5.75% | Increased borrowing costs |

Preview Before You Purchase

Anaergia PESTLE Analysis

The preview shown here is the exact Anaergia PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real glimpse into the comprehensive PESTLE analysis of Anaergia, delivered exactly as shown, no surprises.

The content and structure of this Anaergia PESTLE analysis preview is the same document you’ll download after payment.

What you’re previewing here is the actual, detailed PESTLE analysis for Anaergia—professionally structured and ready for your strategic planning.

Sociological factors

Growing public awareness of climate change and landfill impacts significantly drives demand for Anaergia's solutions. Surveys in early 2024 show over 70% global public concern for environmental issues, boosting support for sustainable waste management. This societal shift encourages governments and businesses to adopt technologies that reduce greenhouse gas emissions. Regions like the EU aim for over 50% landfill diversion by 2025, accelerating the transition towards a circular economy. This strong public sentiment creates a favorable market for Anaergia's anaerobic digestion and resource recovery systems.

The global shift towards a circular economy, emphasizing waste minimization and resource reuse, is increasingly prominent. Anaergia's business model aligns perfectly, transforming organic waste into valuable resources like renewable natural gas, fertilizer, and clean water. This societal move away from a linear take-make-dispose model fosters a highly favorable environment for Anaergia's growth, with the global waste-to-energy market projected to reach over $40 billion by 2025.

Rapid urbanization and global population growth are significantly increasing municipal solid waste (MSW) generation, with global MSW projected to reach 3.88 billion tonnes annually by 2050, up from roughly 2.3 billion tonnes in 2024. This escalating waste volume presents a critical challenge for urban centers but also a substantial market opportunity for sustainable solutions. Anaergia's advanced technologies offer municipalities a cost-effective and environmentally sound approach to manage this rising organic waste, converting it into renewable energy and resources. Their systems directly address the pressing need for sustainable waste diversion and resource recovery in densely populated areas.

Public Perception of Waste-to-Energy Facilities

Public perception significantly influences the development of new waste-to-energy facilities, directly impacting Anaergia's project pipeline. While there is increasing support for renewable energy, with a 2024 global survey indicating 75% of respondents support renewable infrastructure, local communities often express concerns about WtE facility construction near their homes due to perceived environmental or aesthetic impacts. Anaergia must proactively engage these communities, demonstrating the tangible benefits like diverting organic waste from landfills and producing biogas, which can reduce greenhouse gas emissions by up to 80% compared to traditional waste disposal. Successfully addressing these concerns through transparent communication and highlighting local economic advantages, such as job creation and energy security, is crucial for securing project approvals and fostering long-term community acceptance.

- 75% of global citizens surveyed in early 2024 expressed support for increased renewable energy infrastructure.

- Waste-to-energy projects, particularly those utilizing organic waste like Anaergia's, can reduce methane emissions by over 80% compared to landfilling.

- Community engagement is vital, as public opposition can delay project timelines by 1-3 years on average.

- Local job creation from WtE facilities often includes 50-100 operational roles per plant.

Demand for Sustainable Products

The escalating consumer and industrial demand for sustainable products and services presents a significant opportunity for Anaergia. This includes a growing market for renewable energy, organic fertilizers, and sustainably sourced water. By transforming waste into valuable resources, Anaergia directly addresses this evolving market need, aligning with global shifts towards a more sustainable supply chain.

- Global renewable energy capacity additions are projected to exceed 500 GW in 2024.

- The global organic fertilizer market is estimated to reach over USD 14 billion by 2025.

- Industrial water recycling and reuse markets are seeing significant expansion by 2025.

- Consumer preference for eco-friendly products continues to rise, impacting purchasing decisions.

Societal values increasingly prioritize environmental sustainability, with over 70% global public concern for climate issues by early 2024, driving demand for Anaergia's circular economy solutions. Rapid urbanization and escalating waste generation, projected to reach 3.88 billion tonnes by 2050, necessitate sustainable waste management technologies. While community engagement is crucial for project acceptance, consumer and industrial demand for renewable energy and eco-friendly products, with the global organic fertilizer market over USD 14 billion by 2025, creates a favorable market. This collective shift fosters a strong societal tailwind for Anaergia's advanced resource recovery systems.

| Sociological Factor | Impact on Anaergia | 2024/2025 Data Point |

|---|---|---|

| Public Environmental Awareness | Increased demand for sustainable waste solutions | 70%+ global public concern for environmental issues (early 2024) |

| Circular Economy Adoption | Alignment with business model, favorable market | Global waste-to-energy market >$40 billion (2025 projection) |

| Urbanization & Waste Growth | Expanded market for MSW solutions | Global MSW 3.88 billion tonnes annually (2050 projection) |

| Sustainable Consumption Trends | Growing market for renewable resources | Organic fertilizer market >$14 billion (2025 estimate) |

Technological factors

Anaergia maintains a significant technological edge through its robust portfolio of proprietary and patented technologies. As of early 2025, the company holds over 230 granted and pending patents, covering innovative solutions in waste processing, anaerobic digestion, and resource recovery. This extensive intellectual property underpins Anaergia's ability to deliver integrated and highly efficient waste-to-resource solutions. Such technological leadership strongly differentiates Anaergia within the competitive environmental infrastructure market, reinforcing its market position.

Anaergia's core strategy hinges on continuous innovation in anaerobic digestion, pivotal for processing diverse organic waste streams. The company actively advances technologies to enhance the efficiency and cost-effectiveness of converting this waste into high-value renewable natural gas (RNG). For example, their proprietary Omnivore system can process mixed waste, contributing to a projected global RNG market growth to $10.2 billion by 2028, up from $6.1 billion in 2023. These technological breakthroughs are crucial for maximizing value extraction from municipal solid waste and agricultural byproducts, positioning Anaergia competitively in the evolving bioenergy sector.

Anaergia's technological strength lies in its integrated waste-to-value solutions, offering clients a comprehensive, end-to-end approach to waste management. This system combines various proprietary technologies, from anaerobic digestion to resource recovery, enabling the processing of diverse waste streams and the extraction of multiple valuable outputs like renewable natural gas and fertilizer. For instance, Anaergia's facilities, such as the Rialto Bioenergy Facility, are projected to process over 300,000 tons of waste annually by 2025, significantly reducing landfill reliance and maximizing resource recovery. This integrated model simplifies operations for municipalities and industries, enhancing both environmental sustainability and economic returns by converting liabilities into valuable assets.

Digitalization and Process Optimization

Digitalization and data analytics are crucial for Anaergia to optimize its facility performance, enhancing efficiency and ensuring consistent renewable energy production. By continuously monitoring operational parameters, the company can reduce downtime and improve output quality, which is vital for maintaining a competitive edge in the evolving waste-to-value sector. This data-driven approach supports the company's operational targets for 2024-2025, aiming for higher resource recovery rates.

- Anaergia's 2024 operational efficiency improvements target a 5-7% reduction in unscheduled downtime across its facilities through predictive maintenance enabled by data analytics.

- The company projects a 10% increase in biogas yield consistency by mid-2025 due to enhanced process optimization algorithms.

- Digital twin technology implementation is expanding to key facilities by late 2024, aiming to simulate and optimize processes before physical changes.

- Investment in advanced sensor technology and AI-driven platforms is expected to reach $15-20 million in 2024-2025 to further bolster data collection and analysis capabilities.

Research and Development

Ongoing research and development are vital for Anaergia to maintain its technological leadership in sustainable waste management and renewable energy. The company continuously invests in developing new and improved technologies, essential for addressing evolving global waste challenges and meeting increasing demand for sustainable solutions. This commitment to innovation is key for long-term growth and market relevance.

- Anaergia's R&D expenditure for fiscal year 2024 is projected to be approximately $15 million, reflecting continued investment in advanced anaerobic digestion and resource recovery technologies.

- Key R&D focuses include enhancing biogas yield efficiency and improving nutrient recovery processes to create higher-value products.

Anaergia maintains a strong technological edge with over 230 patents as of early 2025, specializing in advanced anaerobic digestion. The company continuously innovates to convert organic waste into high-value renewable natural gas, targeting a 10% increase in biogas yield consistency by mid-2025. Significant investments, approximately $15 million in R&D for 2024 and $15-20 million in digital technologies, aim for a 5-7% reduction in downtime by 2024. This focus on integrated, data-driven solutions like the Rialto Bioenergy Facility, processing over 300,000 tons annually by 2025, solidifies its market position.

| Metric | 2024 Target/Projection | 2025 Target/Projection |

|---|---|---|

| Patents (Granted/Pending) | >230 | >230 |

| R&D Expenditure | ~$15 Million | Ongoing investment |

| Unscheduled Downtime Reduction | 5-7% | Continued optimization |

| Biogas Yield Consistency Increase | N/A | 10% (by mid-2025) |

| Rialto Bioenergy Facility Processing | >300,000 tons/year | >300,000 tons/year |

Legal factors

Anaergia's business is deeply influenced by a complex framework of environmental and waste management legislation, which are critical legal factors. These laws, varying significantly across jurisdictions, govern waste collection, transportation, and the operation of treatment facilities. For instance, new EU methane emission reduction targets for 2024/2025 impact anaerobic digestion facilities, necessitating advanced monitoring. Compliance with these stringent regulations is mandatory, requiring substantial legal and technical expertise to navigate the evolving global regulatory landscape and ensure operational viability.

Securing essential permits and regulatory approvals is a paramount legal challenge for Anaergia's new projects. This process is often protracted and intricate, involving various governmental bodies from federal agencies like the EPA to state and local environmental departments. Delays, which can extend project timelines by 12-24 months for complex infrastructure, significantly impact financial viability and capital expenditure forecasts for 2024 and 2025. For instance, new biogas facilities face stringent environmental impact assessments, potentially delaying revenue generation. Regulatory shifts, such as stricter emissions standards implemented in early 2025, necessitate adaptive project planning to maintain compliance and avoid penalties.

The legal framework governing contracts and public-private partnership agreements is fundamental to Anaergia's business model, particularly given the 2024 focus on sustainable infrastructure. These legally binding agreements define precise terms of collaboration with municipalities and other clients, outlining project scope, financial arrangements, and operational responsibilities. The clarity and robustness of these contracts are crucial for mitigating significant project risks, especially as global PPP spending in the environmental sector is projected to maintain strong growth into 2025. Strong contractual foundations ensure the long-term viability and success of Anaergia's waste-to-resource facilities, underpinning revenue stability and operational continuity.

Intellectual Property Law

Protecting its extensive portfolio of patents and other intellectual property is a key legal priority for Anaergia, especially given its advanced waste-to-resource technologies. Intellectual property laws provide a significant competitive advantage, preventing unauthorized use of its proprietary innovations like the Omnivore system. The company actively manages its global patent portfolio, which included over 100 granted patents by early 2024, to safeguard its cutting-edge solutions for organic waste treatment and renewable energy generation.

- Anaergia's patent portfolio exceeded 100 granted patents as of early 2024.

- IP protection is crucial for maintaining market leadership in waste-to-resource technologies through 2025.

Corporate and Securities Law

As a publicly traded company on the TSX, Anaergia is subject to stringent corporate and securities laws. These regulations govern its corporate governance, financial reporting, and shareholder rights, ensuring transparency. Compliance with Canadian securities regulations, like those enforced by the Ontario Securities Commission, is essential for maintaining investor confidence and market integrity. For instance, the company's 2024 annual information form (AIF) and quarterly financial statements must adhere strictly to IFRS standards.

- Anaergia's listing on the TSX mandates compliance with National Instrument 51-102 Continuous Disclosure Obligations.

- The company's latest financial reports, such as its Q1 2025 earnings, are subject to scrutiny by regulatory bodies.

- Shareholder rights, including proxy voting and access to information, are protected under Canadian corporate law.

- Failure to comply with these laws can result in significant fines or delisting, impacting its market capitalization.

Anaergia navigates a complex legal landscape driven by evolving environmental regulations, requiring extensive compliance with 2024/2025 emission standards. Securing project permits can delay timelines by 12-24 months, impacting 2024/2025 forecasts. Robust contracts and its 100+ patent portfolio (early 2024) are vital. Public company status mandates strict adherence to TSX regulations for 2024/2025 financial reporting.

| Legal Area | 2024/2025 Impact | Key Metric |

|---|---|---|

| Permit Delays | Project timelines | 12-24 months |

| IP Protection | Competitive advantage | 100+ patents (early 2024) |

| Regulatory Compliance | Operational viability | EU methane targets (2024/2025) |

Environmental factors

Anaergia's core business directly contributes to climate change mitigation by capturing methane from organic waste, a potent greenhouse gas. This process converts waste into renewable natural gas, significantly reducing overall greenhouse gas emissions. For instance, such projects are crucial as global efforts target over 30% methane emission cuts by 2030, impacting future energy policies through 2025. This environmental benefit, reducing reliance on fossil fuels, serves as a primary value proposition for the company and its stakeholders.

Anaergia's operations exemplify the circular economy, transforming organic waste into valuable resources. By mid-2024, their facilities globally were converting millions of tonnes of waste annually, producing renewable natural gas (RNG) and high-quality biofertilizer. This approach significantly reduces landfill reliance and greenhouse gas emissions, contributing to a more sustainable future. For instance, some of Anaergia’s key projects are projected to collectively produce over 2.5 million MMBtu of RNG annually by early 2025, displacing fossil fuels. This resource recovery model closes the loop on waste, fostering environmental resilience.

Anaergia's technologies offer a primary environmental benefit by diverting organic waste from landfills, which are significant sources of methane emissions. Methane is a potent greenhouse gas, and landfill emissions contribute substantially to global warming. In 2024, landfill gas continued to be a major contributor, making up over 15% of total U.S. methane emissions. By providing an alternative to landfilling, Anaergia helps mitigate these environmental risks, fostering a cleaner and healthier environment globally.

Water Quality and Conservation

Anaergia's advanced technologies significantly contribute to improved water quality and conservation, particularly through their wastewater treatment solutions. Their processes effectively treat municipal and industrial wastewater, generating clean water suitable for various reuse applications, which is crucial as global water demand escalates. By 2025, the global water and wastewater treatment market is projected to reach approximately 465 billion USD, underscoring the critical need for sustainable solutions like Anaergia's. This focus on water reuse is vital for regions facing severe water scarcity, enhancing environmental resilience.

- Anaergia's wastewater treatment capacity can significantly reduce pollutant discharge.

- Clean water output supports irrigation and industrial non-potable uses.

- Global water scarcity affects over 2 billion people by 2025, increasing demand for such technologies.

- The company's systems contribute to circular economy principles by recovering water resources.

Soil Health and Sustainable Agriculture

Anaergia's operations yield high-quality organic fertilizer from waste, a significant environmental benefit. This product enhances soil health, reducing the reliance on synthetic fertilizers across agricultural sectors. By returning vital nutrients to the earth, Anaergia supports more sustainable farming practices. This approach fosters a regenerative food system, aligning with ecological goals for 2024 and 2025.

- Anaergia processes municipal and industrial organic waste, converting it into valuable resources.

- The resulting fertilizer enriches soil, potentially improving crop yields.

- This process minimizes landfill waste and greenhouse gas emissions from decomposition.

- It supports circular economy principles by recycling nutrients back into agriculture.

Anaergia significantly mitigates climate change by capturing potent methane from organic waste, converting it into renewable natural gas and reducing greenhouse gas emissions. Their processes divert millions of tonnes of waste from landfills annually by 2024, supporting a circular economy. This approach also yields high-quality biofertilizer and clean water, addressing critical environmental challenges like soil degradation and water scarcity by 2025.

| Environmental Impact | Key Metric (2024/2025) | Benefit |

|---|---|---|

| GHG Reduction | Over 2.5 million MMBtu RNG annually | Displaces fossil fuels |

| Waste Diversion | Millions of tonnes organic waste | Reduces landfill emissions |

| Resource Recovery | Biofertilizer, clean water output | Enhances soil health, water reuse |

PESTLE Analysis Data Sources

Our PESTLE Analysis is constructed using a comprehensive blend of data from leading global economic bodies, environmental agencies, and reputable industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and authoritative.