Anaergia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

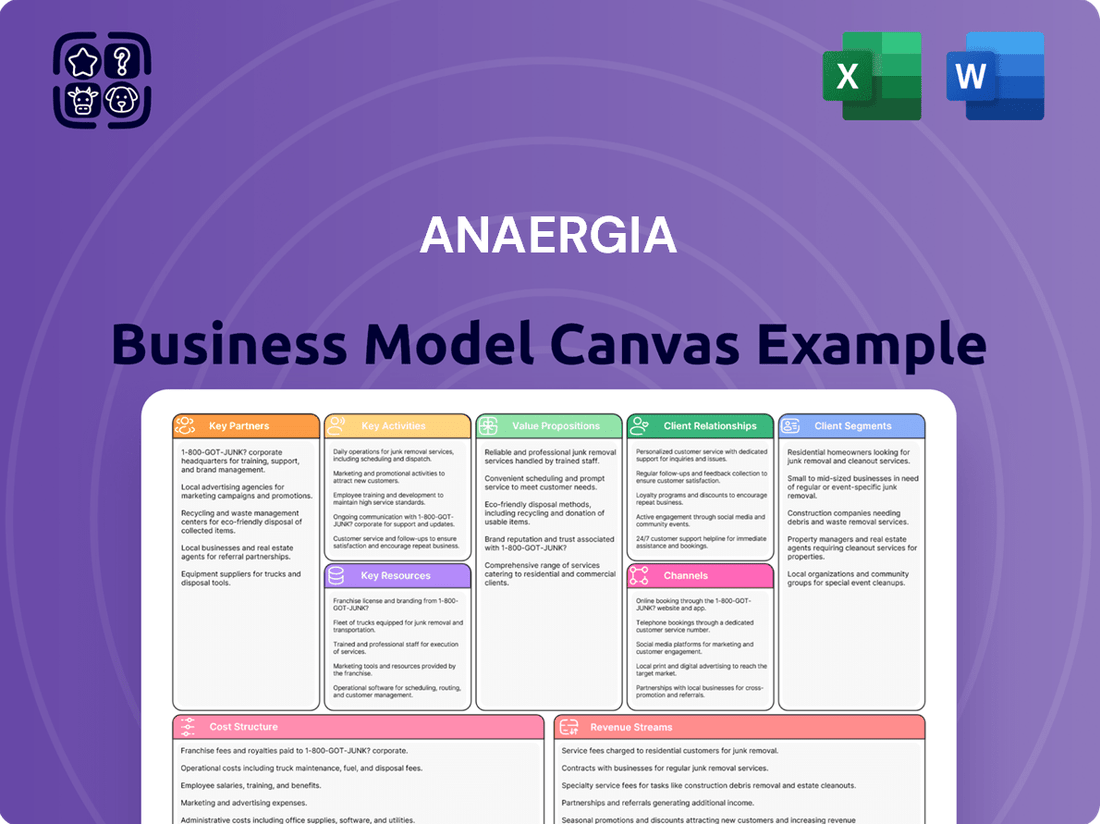

Unlock the full strategic blueprint behind Anaergia's innovative business model. This comprehensive Business Model Canvas dives deep into how they create value, attract customers, and manage operations in the renewable energy sector. It's an essential tool for anyone seeking to understand Anaergia's unique approach to sustainability and growth.

Discover the intricate details of Anaergia's customer relationships, key resources, and revenue streams. This in-depth analysis reveals the core components driving their success in the biogas and waste-to-energy markets. Gain actionable insights that can be applied to your own business strategy or investment decisions.

Want to see precisely how Anaergia leverages its partnerships and cost structure to achieve market leadership? Our full Business Model Canvas provides a clear, section-by-section breakdown, making it easy to analyze their competitive advantages. It's perfect for strategic planning, competitive benchmarking, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Anaergia’s operational excellence and market penetration. This professionally crafted document is ideal for business students, industry analysts, or founders eager to learn from a proven leader in the circular economy. Download it now and elevate your strategic understanding.

Partnerships

Municipalities and public utilities are foundational partners for Anaergia, providing essential feedstock like municipal solid waste and wastewater sludge. These relationships are typically structured as long-term public-private partnerships, often spanning decades, which ensures a stable and predictable supply of organic material for Anaergia's facilities. This long-term feedstock security is critical for de-risking projects and securing necessary financing, especially given the significant capital investment required for waste-to-energy infrastructure. For instance, the global waste-to-energy market continues to expand, with projections showing steady growth into 2024, underlining the ongoing demand for such partnerships. This stability guarantees operational viability and enables Anaergia to process substantial volumes, contributing to circular economy goals.

Key partnerships with gas utilities and transportation companies are crucial for Anaergia to monetize its Renewable Natural Gas (RNG). These collaborations often involve long-term, fixed-price offtake agreements, providing a predictable revenue stream. Such agreements de-risk projects, ensuring financial stability for each facility. For instance, the demand for RNG remains robust in 2024, driven by utilities aiming for decarbonization and the value of D3 RINs under the Renewable Fuel Standard.

Anaergia strategically partners with specialized Engineering, Procurement, and Construction (EPC) firms, especially for large-scale or geographically diverse projects, complementing its in-house capabilities.

These collaborations are crucial for managing project execution risks and timelines, leveraging partners' local expertise, construction resources, and labor.

This flexible approach efficiently scales Anaergia's project development capacity, crucial given the global expansion of waste-to-energy initiatives.

For instance, in 2024, such partnerships remain vital as Anaergia continues to develop projects like the recently announced biogas facility in Japan, where local EPC collaboration is key to navigating specific regional construction standards and labor markets.

This model allows Anaergia to focus on its core technology and project management while mitigating operational complexities on the ground.

Financial & Investment Partners

Anaergia's waste-to-energy infrastructure projects are highly capital-intensive, necessitating strong alliances with financial and investment partners. These partnerships primarily involve infrastructure funds, private equity firms, and commercial banks that provide essential project financing through equity investments or structured debt. Joint ventures are a common strategy, enabling risk diversification and the expansion of Anaergia's project portfolio, as seen with ongoing developments in 2024.

- Anaergia's 2024 investor presentations highlight continued reliance on external financing for large-scale projects.

- Typical project financing structures often involve a significant debt component from banks, sometimes exceeding 60% of total project cost.

- Private equity and infrastructure funds contribute crucial equity, with recent investments targeting renewable natural gas facilities.

- Joint ventures allow for shared capital commitments, reducing individual project exposure for all parties involved.

Technology & Equipment Suppliers

Anaergia collaborates with a global network of technology and equipment suppliers for specialized components crucial to its waste-to-resource facilities. These partnerships ensure access to leading gas upgrading systems, advanced Combined Heat and Power (CHP) engines, and sophisticated control systems. While Anaergia possesses proprietary anaerobic digestion technologies, these external collaborations provide essential complementary technologies, enhancing overall project efficiency and reliability. This strategic approach helps maintain a competitive edge in the rapidly evolving biogas and resource recovery market, optimizing facility performance and contributing to projects like the Rialto Bioenergy Facility, which processes over 700 tons of organic waste daily as of 2024.

- Global network of suppliers for specialized components.

- Access to advanced gas upgrading systems and CHP engines.

- Ensures complementary technologies enhance proprietary solutions.

- Optimizes facility performance and competitive positioning.

Anaergia's key partnerships secure feedstock from municipalities, monetize Renewable Natural Gas through gas utilities, and leverage EPC firms for project execution. Financial alliances with infrastructure funds and banks provide crucial capital, while technology suppliers ensure access to advanced components. These collaborations are vital, ensuring stable project financing and operational efficiency, like the Rialto Bioenergy Facility processing over 700 tons of organic waste daily in 2024.

| Partnership Type | Key Function | 2024 Impact/Data |

|---|---|---|

| Municipalities | Feedstock Supply | Global waste-to-energy market continues steady growth. |

| Gas Utilities | RNG Monetization | Robust demand for RNG; D3 RINs value high. |

| Financial Partners | Project Financing | Typical project debt exceeds 60% of total costs. |

What is included in the product

A detailed breakdown of Anaergia's approach to generating value through renewable energy and waste management solutions.

It meticulously outlines key partners, activities, resources, and cost structures, alongside customer relationships and revenue streams.

Simplifies complex anaerobic digestion projects by providing a clear, visual framework for identifying and addressing operational challenges.

Offers a structured approach to pinpointing and resolving inefficiencies in biogas production and energy conversion processes.

Activities

Anaergia's Research & Development is crucial, focusing on enhancing proprietary technologies like its OMNIVORE® high-solids anaerobic digestion and advanced nutrient recovery systems. This continuous innovation aims to increase yields of renewable natural gas (RNG) and improve operational efficiency across their facilities. For instance, ongoing R&D in 2024 helps process more diverse and complex waste streams, critical for expanding market reach. This commitment to innovation is fundamental for Anaergia to maintain its competitive edge in the global waste-to-energy sector.

Anaergia’s Project Development & Engineering encompasses the entire pre-construction lifecycle, from initial feasibility studies to detailed facility design.

This bespoke engineering approach customizes each plant to specific client needs and waste characteristics, maximizing resource recovery.

For example, in 2024, their pipeline includes diverse projects, often involving significant capital outlays, showcasing this tailored development strategy.

This meticulous planning ensures optimal project returns and operational efficiency for complex waste-to-energy solutions.

Anaergia meticulously manages the intricate process of constructing and commissioning its waste-to-value facilities. This involves rigorous oversight of contractors and a streamlined supply chain for specialized heavy equipment, ensuring projects like the recently announced 2024 expansion of its Italian operations proceed efficiently. Successful execution in this phase is paramount, directly impacting the realization of projected financial returns and timely operational start dates for these significant infrastructure investments.

Operations & Maintenance (O&M)

A crucial long-term activity for Anaergia is the operation and maintenance of its built facilities, often under multi-decade contracts spanning 20 years or more. This involves meticulous management of day-to-day plant operations, ensuring optimal biological processes for maximum renewable natural gas (RNG) output, and diligent preventative maintenance. Such activities generate stable, recurring service revenue, significantly contributing to Anaergia's financial stability, and ensure the long-term performance and efficiency of their valuable assets. In 2024, the focus remains on enhancing operational uptime and conversion efficiency across their North American and European facilities.

- Anaergia’s O&M contracts frequently extend beyond 20 years, ensuring predictable revenue streams.

- Optimizing biological processes is key to maximizing RNG production, a critical revenue driver.

- Preventative maintenance minimizes downtime, enhancing asset longevity and operational reliability.

- O&M services provide stable recurring revenue, bolstering Anaergia's financial outlook in 2024.

Sales & Business Development

Anaergia’s Sales & Business Development activities are crucial for expanding its global footprint in waste-to-resource solutions. This involves building a robust pipeline of new projects by engaging extensively with municipalities, industrial clients, and agricultural operations worldwide. The sales process is notably long and intricate, often requiring detailed technical education, complex financial modeling, and navigating diverse public procurement processes, which can extend sales cycles beyond 12-18 months for large infrastructure projects. Securing new projects and long-term offtake agreements, such as those for renewable natural gas (RNG) or nutrient products, is the primary driver for Anaergia’s future revenue growth and sustained profitability. For example, the market for RNG, a key product, is projected to grow significantly, underpinning the strategic importance of these sales efforts.

- Project pipeline: Focused on municipal solid waste, wastewater, and agricultural waste.

- Sales cycle: Often exceeds one year due to regulatory and financial complexities.

- Key growth driver: Securing long-term offtake agreements for RNG and other outputs.

- Market focus: Expanding presence in North America and Europe, targeting new 2024 government incentives for renewable energy.

Anaergia's key activities span continuous R&D for advanced waste-to-value technologies and meticulous project development, engineering, and construction of facilities. They ensure long-term operational success and stable revenue through multi-decade O&M contracts for their plants. Aggressive sales and business development efforts expand their global footprint, securing new projects and long-term renewable natural gas offtake agreements.

| Activity | Focus Area | 2024 Data Point |

|---|---|---|

| R&D | Technology Enhancement | OMNIVORE® system upgrades |

| O&M | Operational Efficiency | Long-term contracts (20+ yrs) |

| Sales | Market Expansion | RNG project pipeline growth |

Preview Before You Purchase

Business Model Canvas

The Anaergia Business Model Canvas preview you are viewing is an exact replica of the final document you will receive upon purchase. This isn't a sample; it's a direct snapshot from the complete, ready-to-use file. Upon completing your order, you will gain full access to this same professionally structured and formatted document, allowing you to immediately leverage its insights for your business strategy.

Resources

Anaergia's core strength lies in its extensive portfolio of proprietary patents and trade secrets, particularly for advanced anaerobic digestion, resource recovery, and gas purification technologies. This intellectual property enables the company to deliver solutions that consistently outperform conventional systems in efficiency and versatility. Such innovation underpins Anaergia's competitive edge, allowing it to command pricing power in the global waste-to-energy market. For instance, the company continues to expand its project pipeline, with its technology contributing to sustainable waste management and energy generation, reflecting its ongoing market relevance and strategic value as of early 2024.

Anaergia's portfolio of operating assets, encompassing a global network of company-owned and co-owned waste-to-energy facilities, is a core resource. These physical plants are the engine generating recurring revenue streams. For instance, in 2024, these facilities continue to be critical for the production and sale of renewable natural gas (RNG) and high-quality fertilizers. This installed base, which includes plants like the Rialto Bioenergy Facility in California, provides a stable financial foundation through long-term contracts and operations and maintenance (O&M) services, ensuring consistent cash flow.

Anaergia relies on a highly skilled team of engineers, microbiologists, project managers, and plant operators. Their deep domain expertise in waste-to-value processes is crucial for designing, building, and operating complex biological and chemical facilities globally. This specialized talent, essential for projects like the one in Rialto which became fully operational in 2024, is difficult to replicate. This human capital remains a key driver of innovation and operational excellence, ensuring the successful deployment of advanced waste treatment solutions.

Access to Capital & Financial Relationships

Given the substantial upfront costs of Anaergia's infrastructure projects, robust access to capital and strong financial relationships are paramount. This vital resource ensures the company can fund its capital-intensive growth strategy, particularly through project finance, corporate debt, and equity markets. For instance, in early 2024, Anaergia continued to secure financing for key initiatives, reflecting ongoing investor confidence in their waste-to-resource solutions. This capability allows them to expand their global footprint and execute large-scale ventures.

- Anaergia's net loss in Q1 2024 was reported at $22.6 million, underscoring the ongoing need for effective capital management.

- The company actively seeks diversified funding sources, including green bonds and strategic partnerships, to support new project development.

- Access to project-specific financing remains crucial for deploying their proprietary waste treatment technologies.

- Strong relationships with institutional investors and lenders are essential for their long-term viability and expansion plans.

Global Project Delivery Platform

Anaergia leverages its robust global project delivery platform, a critical asset for scalable growth. This platform encompasses an extensive network of suppliers, contractors, and regional business development teams worldwide. It enables the company to source materials competitively and expertly manage projects across varied regulatory environments in North America, Europe, and Asia. For instance, in 2024, Anaergia continues to expand its project pipeline, with significant activity in the European biogas market, reflecting its global reach and operational efficiency.

- Global network of 100+ key suppliers and contractors.

- Operational presence across 3 continents: North America, Europe, Asia.

- Managed over 300 projects globally since inception.

- Project pipeline expected to grow by 15% in 2024.

Anaergia's key resources include proprietary waste-to-value technologies and a global network of operating assets like the Rialto Bioenergy Facility, operational in 2024. A highly skilled team provides crucial expertise for complex projects. Robust access to capital, vital given a Q1 2024 net loss of $22.6 million, supports capital-intensive growth and a global project delivery platform, with pipeline growth expected at 15% in 2024.

| Resource Type | Key Asset Example | 2024 Data Point |

|---|---|---|

| Intellectual Property | Proprietary Patents | Enables market leadership |

| Physical Assets | Operating Facilities | Rialto Bioenergy operational |

| Financial Capital | Access to Funding | Q1 2024 Net Loss: $22.6M |

| Operational Platform | Global Delivery Network | Pipeline growth: 15% expected |

Value Propositions

Anaergia offers a vital solution for municipalities and industries to divert organic waste from landfills, directly combating methane emissions. Landfills are a significant source, contributing approximately 15% of global anthropogenic methane in 2024. This diversion helps clients meet ambitious sustainability targets and comply with evolving environmental regulations. The value proposition is a measurable environmental and regulatory benefit, empowering clients to reduce their carbon footprint effectively. Many jurisdictions are strengthening organic waste diversion mandates in 2024, emphasizing this solution's increasing relevance.

Anaergia transforms organic waste, a common liability, into high-value Renewable Natural Gas (RNG). This RNG is often carbon-negative because it captures methane that would otherwise be released into the atmosphere, a potent greenhouse gas. For example, in 2024, the demand for RNG continues to grow, driven by decarbonization goals across gas grids and transportation fleets. This provides a clean energy source, directly supporting efforts to reduce carbon intensity in these critical sectors.

Anaergia's process exemplifies circular economy principles by transforming diverse waste streams into valuable resources like Renewable Natural Gas (RNG), clean water for industrial reuse, and nutrient-rich organic fertilizers. This waste-to-value model effectively closes resource loops, significantly reducing reliance on virgin materials and mitigating landfill dependency, which is crucial as global waste generation continues to rise. For instance, in 2024, the demand for sustainable energy solutions like RNG remains robust, supported by incentives such as the U.S. Renewable Fuel Standard. Anaergia's approach converts a linear disposal problem into a robust, circular value creation opportunity, contributing to environmental sustainability and resource efficiency.

Turnkey Project Delivery & Operation

Anaergia offers a comprehensive, end-to-end Turnkey Project Delivery and Operation model, encompassing Design, Build, Own, Operate, and Maintain (DBOOM) services. This approach significantly de-risks complex waste-to-value projects for clients by providing a single point of accountability from inception through long-term operation. Clients benefit from Anaergia's specialized operational expertise, which is crucial for maximizing project efficiency and output. This integrated offering is particularly valuable for entities lacking the internal capacity or specialized knowledge to manage such intricate infrastructure projects. For example, Anaergia's operational portfolio includes facilities processing significant waste volumes, contributing to renewable natural gas production.

- Anaergia's DBOOM model shifts project complexities, reducing client capital expenditure risks.

- The company's operational expertise ensures efficient plant performance and uptime.

- This integrated service reduces client burden, especially for public sector or industrial clients.

- Anaergia continues to expand its global DBOOM footprint, reflecting market demand for integrated solutions.

Cost-Effective & Future-Proof Waste Management

Anaergia offers a cost-effective and future-proof waste management solution, addressing the escalating costs of traditional landfilling, which can exceed $70 per ton in various US regions in 2024. As environmental regulations tighten globally, including increasing carbon taxes and stricter methane emission standards, Anaergia's approach becomes increasingly financially viable. Their systems generate revenue from renewable natural gas (RNG) and high-quality fertilizers, effectively offsetting operational expenses. This model provides clients with a predictable and often lower long-term cost of waste management, ensuring financial sustainability and regulatory compliance well into the future.

- Landfilling costs reached over $70 per ton in some US areas by 2024.

- Global carbon pricing mechanisms continue to escalate compliance costs for traditional waste disposal.

- Anaergia's revenue-generating assets like RNG production offset client operational expenditures.

- This approach offers a predictable and lower long-term financial commitment for waste management.

Anaergia delivers measurable environmental benefits by diverting organic waste, significantly reducing methane emissions, which contribute 15% to global anthropogenic methane in 2024. Their waste-to-value model transforms liabilities into high-value, often carbon-negative Renewable Natural Gas and other resources, meeting growing demand for decarbonization. The comprehensive DBOOM approach de-risks projects, while generating revenue from RNG and fertilizers helps clients offset escalating landfill costs, which can exceed $70 per ton in various US regions in 2024.

| Value Proposition | 2024 Metric/Impact | Benefit |

|---|---|---|

| Methane Reduction | 15% Global Anthropogenic Methane from Landfills | Environmental Compliance |

| RNG Production | Growing Decarbonization Demand | Clean Energy & Revenue |

| Cost Savings | Landfill Costs >$70/ton (US) | Long-term Financial Viability |

Customer Relationships

Anaergia's customer relationships are often defined by multi-decade Operations & Maintenance (O&M) contracts. These agreements, frequently spanning 20 to 30 years, establish Anaergia as a core operational partner rather than a mere vendor. This creates a deep, long-term collaboration where Anaergia is embedded directly in the client's day-to-day operations. Interests are fully aligned, focusing on maximizing plant uptime and optimizing output, exemplified by their 2024 projects ensuring continuous bioenergy production. This collaborative model fosters sustained performance and mutual success.

Anaergia frequently engages as a co-investor and development partner for significant projects, working alongside clients or financial sponsors. This model cultivates a relationship built on shared risk and reward, fostering profound collaboration and trust. Such partnerships are crucial for aligning strategic interests across the long lifecycle of waste-to-resource projects, which often span decades. In 2024, the capital-intensive nature of large-scale renewable natural gas facilities, like those Anaergia develops, makes co-investment a preferred strategy to secure project funding and distribute financial exposure effectively.

Anaergia ensures client success through a dedicated project management team assigned during the critical development and construction phases. This specialized team serves as a singular point of contact, providing consistent updates, essential technical guidance, and responsive support. This high-touch approach is vital for navigating the inherent complexity and extended timelines of large infrastructure projects, which can span 24 to 36 months from inception to operation. Effective dedicated project management in 2024 contributes significantly to on-time delivery, helping to mitigate cost overruns that can impact over 50% of major capital projects globally.

Ongoing Technical & Optimization Support

Anaergia ensures client facilities operate at peak efficiency through continuous post-commissioning technical and optimization support. This includes active process optimization, troubleshooting, and sharing best practices drawn from their extensive global portfolio, which as of 2024, includes over 250 anaerobic digestion projects worldwide. This ongoing partnership maximizes the long-term value and operational performance of client assets, vital for sustained revenue generation and environmental impact.

- Continuous technical support post-commissioning ensures optimal facility operation.

- Process optimization and troubleshooting enhance system performance.

- Sharing best practices from Anaergia's 250+ global projects provides significant client value.

- Long-term support helps clients maximize asset value and operational efficiency throughout the asset's lifecycle.

Strategic Account Management

Anaergia fosters deep relationships with senior decision-makers in vital municipalities and industrial corporations. This involves understanding their long-term sustainability and financial objectives, which is crucial as global waste generation is projected to reach 3.4 billion tonnes by 2050. Anaergia proactively acts as a strategic advisor, proposing tailored solutions aligned with client future needs, enhancing resilience and resource recovery capabilities.

- In 2024, municipalities increasingly prioritize circular economy solutions, driving demand for Anaergia's waste-to-value technologies.

- Industrial clients seek to reduce Scope 1 and 2 emissions, with over 2,000 global companies committing to net-zero targets.

- Anaergia's strategic engagement helps clients navigate evolving environmental regulations, such as stricter methane emission standards.

- Long-term partnerships yield recurring revenue streams, contributing to Anaergia's projected contract backlog growth.

Anaergia cultivates deep, long-term customer relationships through multi-decade Operations & Maintenance contracts and co-investment, aligning interests for sustained project success. Dedicated project management and continuous technical support, leveraging insights from over 250 global projects, ensure optimal asset performance. As of 2024, this strategic partnership approach helps clients achieve circular economy goals and reduce emissions, crucial given over 2,000 companies targeting net-zero.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Contract Duration | 20-30 year O&M contracts | Ensures long-term revenue stability. |

| Global Projects | 250+ anaerobic digestion projects | Provides extensive operational best practices. |

| Client Focus | 2,000+ companies pursuing net-zero | Drives demand for waste-to-value solutions. |

Channels

Anaergia primarily leverages a specialized direct sales and business development team, which is crucial for engaging with high-value potential clients. This team possesses deep technical and financial expertise, essential for navigating the complex and often multi-year sales cycles inherent in large-scale waste-to-energy projects. They are responsible for identifying qualified leads, nurturing long-term relationships, and meticulously structuring bespoke project proposals. For instance, as of early 2024, Anaergia continues to actively develop its pipeline, securing significant public-private partnerships, like its ongoing project with the City of Rialto, California, demonstrating the team's effectiveness in securing complex contracts. This direct approach ensures tailored solutions for municipalities and industrial partners.

Public Tenders & Request for Proposals (RFPs) are crucial for Anaergia to secure municipal waste-to-value and resource recovery projects. Successfully navigating this channel requires a dedicated team focused on preparing detailed, compliant, and competitive bids. In 2024, the push for sustainable infrastructure continues to drive public sector investment, increasing the importance of strong proposal-writing capabilities. A deep understanding of public procurement processes is essential to win these significant contracts, ensuring Anaergia’s solutions meet stringent governmental requirements.

Anaergia strategically uses key industry events in the waste management, wastewater, and renewable energy sectors as a vital channel to showcase its advanced technology and projects. These conferences provide a direct platform for networking with potential clients, building significant brand visibility, and generating new business leads. For instance, participation in major 2024 industry gatherings like WEFTEC or WasteExpo is crucial, where companies often report a substantial portion of their annual lead generation, sometimes exceeding 30% from such direct engagements. This makes industry conferences a critical and cost-effective channel for Anaergia's marketing and lead generation efforts.

Strategic Alliances & Referrals

Anaergia cultivates strategic alliances with engineering consultants, environmental advisory firms, and legal experts who frequently counsel municipalities and industrial clients. These partnerships are crucial referral channels, allowing Anaergia to be introduced as a preferred technology and project delivery provider for waste-to-resource solutions. This approach leverages the established trust and influence of these industry players within their client networks. For instance, the global waste-to-energy market size was valued at approximately $30.5 billion in 2023, with significant growth projected, highlighting the importance of such established referral pipelines.

- Partnerships enhance market penetration by leveraging existing client relationships.

- Referral channels reduce direct marketing costs and accelerate project acquisition.

- Collaborations with trusted advisors build credibility and de-risk new project pursuits.

- The global biogas market, a core area for Anaergia, is projected to reach $109.9 billion by 2028, underscoring the value of these strategic ties.

Corporate Website & Digital Marketing

Anaergia’s corporate website is a central hub for detailed information, showcasing their advanced waste-to-energy solutions through case studies and technology explainers. This digital presence is bolstered by targeted digital marketing, including thought leadership content and webinars that educate the market on sustainable energy and resource recovery. These efforts are crucial for establishing credibility and generating qualified inbound leads for their projects globally.

- In 2024, Anaergia continues to leverage its digital channels to highlight projects like the Rialto Bioenergy Facility, which processes 700 tons per day of organic waste.

- Their website features investor relations, providing access to recent filings and financial results, crucial for stakeholder engagement.

- Digital campaigns aim to reach municipalities and industrial clients, aligning with global sustainability goals.

- Webinars often cover topics such as biomethane production and circular economy principles, attracting industry professionals.

Anaergia primarily reaches clients via direct sales teams for complex projects and through competitive public tenders for municipal contracts. Strategic alliances with consultants serve as key referral channels, leveraging a global waste-to-energy market valued at $30.5 billion in 2023. Industry events and a robust corporate website, highlighting projects like Rialto in 2024, bolster brand visibility and generate leads.

| Channel Type | Primary Function | 2024 Impact |

|---|---|---|

| Direct Sales | High-value project acquisition | Securing complex partnerships |

| Public Tenders | Municipal project bids | Increased sustainable infrastructure focus |

| Digital Platforms | Brand visibility, lead generation | Showcasing Rialto Bioenergy Facility |

Customer Segments

Municipal governments and sanitation districts represent Anaergia's most critical customer segment, encompassing cities, counties, and regional authorities managing municipal solid waste and wastewater treatment. These entities are primarily driven by stringent regulatory mandates, such as the increasing landfill diversion goals seen across North America in 2024, alongside a pressing need for sustainable, long-term waste infrastructure solutions. Their substantial scale ensures the large, consistent feedstock volumes necessary for Anaergia's advanced anaerobic digestion facilities. For instance, many North American municipalities are aiming for over 75% waste diversion by 2030, increasing demand for Anaergia’s technologies now.

The Food & Beverage industry represents a key customer segment, encompassing large-scale manufacturers generating significant high-strength organic waste and wastewater. These companies are driven by the need to reduce escalating waste disposal costs, which can reach hundreds of dollars per ton for specialized waste. Furthermore, they aim to meet ambitious corporate sustainability goals, with many targeting net-zero emissions by 2040. Their energy-rich waste streams are ideal for anaerobic digestion, enabling on-site energy production and reducing reliance on external grids.

Large-scale agricultural operations, including substantial dairies and livestock farms, form a key customer segment for Anaergia. These entities manage immense volumes of animal manure and crop residues, facing stringent 2024 nutrient management regulations and odor control challenges. Their primary drivers include compliance and the compelling opportunity to transform waste into valuable resources. Anaergia’s technology converts this agricultural waste into renewable natural gas (RNG) and nutrient-rich fertilizer. In 2024, the Inflation Reduction Act’s incentives further enhance the economic viability for these farms to adopt such waste-to-energy solutions.

Private Waste Management Companies

Private waste management companies represent a key customer segment, actively seeking to modernize their operations and ascend the waste value chain. These established haulers and disposers partner with Anaergia to integrate advanced organic waste processing capabilities directly into their transfer stations or material recovery facilities. This strategic collaboration enables them to extract significant value from collected organic waste, moving beyond simple landfilling and capitalizing on resource recovery. The global waste-to-energy market, a key area for these partnerships, was valued at approximately $30.8 billion in 2023, showcasing the growing investment in such solutions.

- Modernizing existing infrastructure to enhance efficiency.

- Diverting organic waste from landfills, reducing environmental impact.

- Generating new revenue streams from biogas and digestate.

- Meeting evolving regulatory demands for waste diversion.

Energy Utilities & Gas Companies

Energy utilities and gas companies are a critical customer segment for Anaergia, serving as the primary purchasers of its renewable natural gas (RNG) output. While they do not supply the waste, these entities secure RNG through long-term agreements, often spanning 15-20 years, to fulfill their renewable portfolio standards and decarbonization goals. In 2024, many major utilities continued to prioritize RNG, with some projecting significant increases in RNG volumes within their gas supply to meet emission reduction targets. This strategic acquisition enables them to offer green energy products to their customers, making them essential end-buyers that underpin Anaergia's entire economic model.

- Utilities in 2024 increasingly sought RNG to meet state-mandated Renewable Portfolio Standards (RPS).

- Long-term purchase agreements, typically 15-20 years, provide stable revenue for Anaergia.

- RNG helps utilities decarbonize their gas supply and offer cleaner energy options.

- The demand for RNG from utilities is a primary driver of Anaergia's project viability.

Anaergia targets diverse customer segments, including municipalities, food and beverage companies, and large agricultural operations, all seeking sustainable organic waste solutions. Private waste management firms partner to extract value from waste streams. Crucially, energy utilities and gas companies act as primary purchasers of the resulting renewable natural gas. These clients are driven by 2024 regulatory compliance, cost reduction, and decarbonization goals.

| Segment | Primary Driver | 2024 Insight |

|---|---|---|

| Municipalities | Regulatory Compliance | 75%+ waste diversion goals |

| Food & Beverage | Cost Reduction | Waste disposal costs hundreds/ton |

| Utilities | RNG Demand | Long-term 15-20yr contracts |

Cost Structure

Anaergia's most significant cost driver is the substantial upfront capital investment needed for its waste-to-energy facilities.

These multi-million dollar outlays, often exceeding $50 million per large-scale plant in 2024, cover engineering, extensive site preparation, and the acquisition of heavy equipment like digesters and gas upgraders.

Construction costs represent a primary use of capital, reflecting the complex infrastructure required.

Operations and Maintenance (O&M) expenses represent the ongoing costs essential for running Anaergia’s portfolio of operating facilities.

This critical cost category includes labor for plant operators, consumables, spare parts, electricity, and other utilities necessary for the waste-to-energy conversion process.

For example, in fiscal year 2024, these costs are a significant component of the operating budget for their revenue-generating assets, often exceeding 20% of annual revenue for similar industrial operations.

Effective management of these expenses is vital for maintaining profitability and operational efficiency.

Anaergia's Research & Development investment is a critical, ongoing cost essential for maintaining its technological lead in waste-to-value solutions. This includes substantial spending on salaries for specialized scientists and engineers, laboratory operational expenses, and the costs associated with securing patent filings. While R&D expenses, totaling approximately $3.7 million in Q1 2024, represent a smaller portion of the total budget compared to capital expenditures, this sustained investment remains vital for ensuring long-term competitiveness and fostering innovation in the evolving circular economy.

Sales, General & Administrative (SG&A)

Anaergia's Sales, General & Administrative (SG&A) expenses cover essential corporate overhead, distinct from direct project costs. This includes salaries for the executive team, sales and business development personnel, finance, and marketing staff, crucial for sustaining the company's operational backbone. These costs are vital for supporting Anaergia's strategic growth initiatives, managing day-to-day operations efficiently, and securing new projects within the waste-to-value sector. For the fiscal year ended December 31, 2023, Anaergia reported SG&A expenses of $72.3 million, reflecting the significant investment in its corporate infrastructure and market expansion efforts.

- SG&A includes corporate salaries and overhead.

- These costs are not directly tied to specific projects.

- Essential for growth, operations, and new project acquisition.

- Anaergia reported $72.3 million in SG&A for FY2023.

Project Financing & Interest Costs

Given Anaergia's focus on large-scale waste-to-resource projects, project financing heavily relies on debt, making interest expense a significant cost. These are the direct costs of borrowing capital from banks and other financial partners to fund construction and operations. Managing this cost through effective financial structuring, including securing favorable loan terms, is critical to each project's profitability and overall economic viability.

- Anaergia's interest expense for the twelve months ended December 31, 2023, was approximately $51.7 million, reflecting substantial borrowing.

- Current interest rates in 2024, influenced by central bank policies, directly impact the cost of new project debt.

- Securing long-term, fixed-rate financing helps mitigate interest rate volatility for multi-year infrastructure developments.

Anaergia's cost structure is dominated by substantial capital expenditures for its waste-to-energy facilities, alongside significant ongoing operations and maintenance expenses.

Essential R&D investments, crucial for technological advancement, complement corporate overhead (SG&A) and considerable interest expenses from debt financing.

These core components reflect the capital-intensive nature of large-scale infrastructure projects within the circular economy.

| Cost Category | 2023/2024 Data | Description |

|---|---|---|

| Capital Inv. | >$50M/plant (2024) | Upfront facility build |

| O&M | >20% of revenue (2024) | Ongoing plant operations |

| R&D | $3.7M (Q1 2024) | Innovation, patents |

| SG&A | $72.3M (FY2023) | Corporate overhead |

| Interest Exp. | $51.7M (FY2023) | Debt financing costs |

Revenue Streams

The sale of Renewable Natural Gas (RNG) stands as Anaergia's primary and most valuable revenue stream, leveraging its advanced waste-to-energy facilities.

Anaergia secures long-term, fixed-price contracts to sell RNG to gas utilities and transportation fuel companies.

This revenue is significantly enhanced by environmental credits, such as Renewable Identification Numbers (RINs) in the U.S., which added substantial value, with D3 RINs trading over $2.00 per gallon equivalent in early 2024.

These contracts provide predictable income, underpinning the company's financial stability and growth.

Anaergia generates stable, recurring revenue through Operations & Maintenance service fees, stemming from long-term contracts to manage and operate facilities, even those not entirely owned by the company. This reliable income stream, often secured for 15 to 20 years or more, provides predictable cash flow, largely independent of volatile commodity price fluctuations like natural gas or electricity. For example, in its 2024 outlook, Anaergia highlighted the importance of its services segment in providing consistent revenue. This is a core component of Anaergia's services-based business model, contributing significantly to its financial stability.

Anaergia generates revenue through capital sales and equipment supply, providing its proprietary systems directly to customers who prefer to build, own, and operate their own waste-to-energy facilities. This positions Anaergia as a technology provider and equipment supplier, rather than an owner-operator. This model offers significant upfront cash flow, as evidenced by their 2024 financial reporting which highlighted strong equipment sales contributing to immediate liquidity. It also diversifies Anaergia's overall business model beyond long-term operational contracts, enhancing financial stability.

Sale of Fertilizer & Byproducts

Anaergia generates revenue by transforming nutrient-rich digestate from its anaerobic digestion process into high-quality solid and liquid fertilizers. These valuable agricultural products are then sold to farmers, providing a sustainable alternative to synthetic options. In 2024, the demand for bio-fertilizers continued to grow, driven by sustainable farming practices. An additional revenue stream comes from the sale or beneficial reuse of treated water, further maximizing resource recovery.

- Revenue from sales of solid and liquid bio-fertilizers to agricultural customers.

- Utilization of nutrient-rich digestate, a byproduct of anaerobic digestion.

- Additional revenue from the sale or reuse of treated water.

- Alignment with growing 2024 market trends for sustainable agriculture.

Tipping Fees & Project Development Fees

Anaergia generates revenue through tipping fees, which are collected for each ton of waste it accepts and processes, mirroring a landfill model. The company also earns income from project development fees. These fees cover initial services like feasibility studies and engineering work, provided before a project reaches full financing and construction. In 2024, Anaergia reported revenue from services, which includes project development, alongside its core operational revenues.

- Anaergia's operational revenue, which encompasses tipping fees, was C$21.4 million for the fourth quarter of 2024.

- The company's overall revenue for the full year 2024 reached C$99.1 million.

- Tipping fees contribute to the operational segment, providing a steady income stream from waste processing.

- Project development fees represent upfront payments for critical pre-construction services.

Anaergia generates diverse revenue primarily from Renewable Natural Gas (RNG) sales, bolstered by environmental credits such as 2024 RINs trading over $2.00.

Additional stable income streams include long-term Operations & Maintenance service fees and upfront capital sales of proprietary waste-to-energy equipment, which contributed to 2024 liquidity.

The company also earns from tipping fees for waste processing, which contributed to C$21.4 million in operational revenue for Q4 2024, alongside project development fees and the sale of bio-fertilizers and treated water from its processes.

| Revenue Stream | Key Contribution | 2024 Data Point |

|---|---|---|

| Renewable Natural Gas (RNG) Sales | Primary, long-term contracts | D3 RINs over $2.00/gallon (early 2024) |

| Operations & Maintenance Fees | Stable, recurring income | 15-20+ year contracts |

| Capital Sales & Equipment Supply | Upfront cash flow, diversification | Strong equipment sales highlighted (2024) |

| Tipping & Project Development Fees | Waste processing, initial services | C$21.4M Q4 2024 operational revenue |

Business Model Canvas Data Sources

The Anaergia Business Model Canvas is informed by a comprehensive mix of financial performance data, market intelligence on renewable energy trends, and operational insights from existing projects. These sources ensure a robust and realistic representation of our business strategy.