Anaergia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

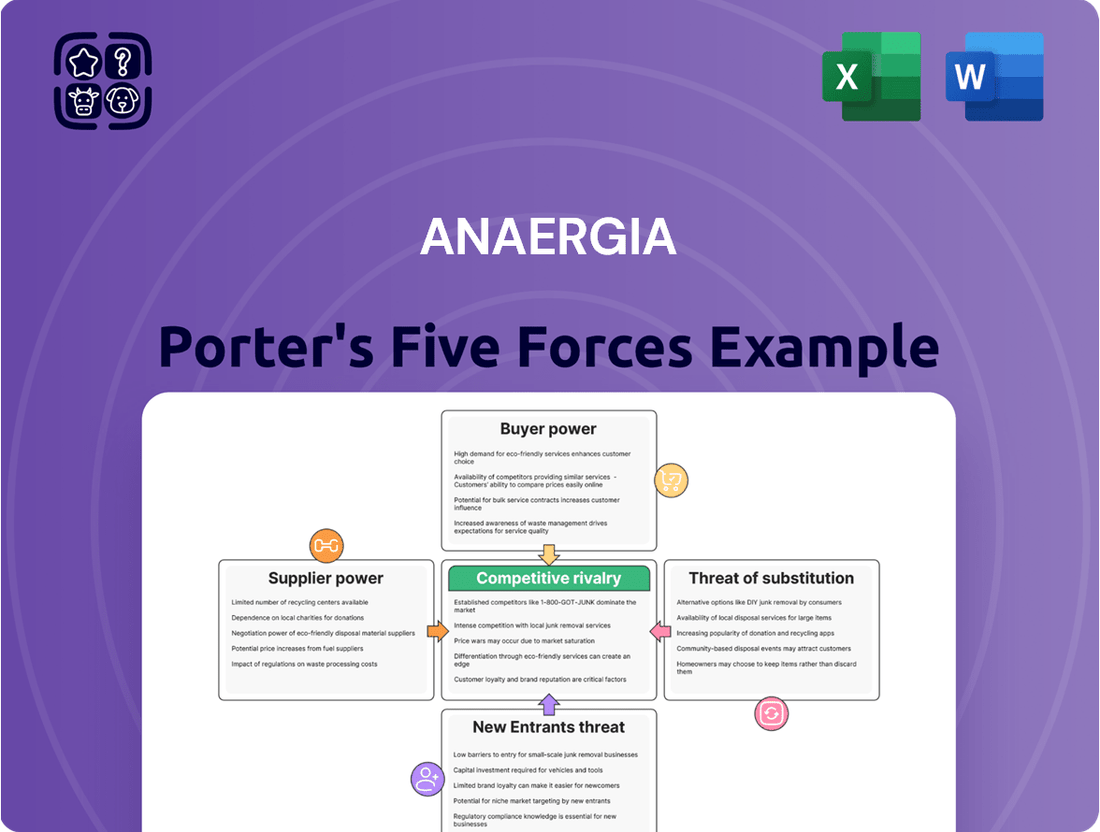

Anaergia operates within a dynamic waste-to-energy sector where understanding competitive forces is paramount. A Porter's Five Forces analysis reveals the intensity of rivalry, the bargaining power of both buyers and suppliers, and the ever-present threats of new entrants and substitutes. These forces directly shape Anaergia's strategic options and profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Anaergia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Anaergia relies on specialized technology and equipment providers for its waste-to-value processes, including anaerobic digestion and biogas upgrading. Suppliers of patented or highly efficient core components can exert bargaining power, impacting project costs and timelines. For instance, advanced membrane systems for biogas purification, critical for renewable natural gas projects in 2024, often come from a limited pool of vendors. However, Anaergia's extensive portfolio of over 250 patents, as reported in recent company statements, somewhat mitigates this supplier influence by offering proprietary alternatives.

Anaergia's core raw material is organic waste, sourced from diverse suppliers like municipalities, industries, and agricultural sectors. The bargaining power of these suppliers varies significantly by region, influenced by local waste management infrastructure and the availability of alternative disposal options such as landfills. For instance, in areas with limited landfill capacity, supplier power can increase. To mitigate this, Anaergia often secures long-term contracts with municipal and large industrial clients, which helps stabilize feedstock supply and cost, as seen in their ongoing operational agreements in 2024.

The specialized design, construction, and operation of Anaergia's waste-to-energy facilities demand a highly skilled workforce, including engineers and project managers. The limited availability of such expertise, particularly for complex anaerobic digestion and resource recovery projects, grants these professionals and their employers significant bargaining power. While Anaergia’s in-house team mitigates some of this risk, competition for top talent intensified in 2024, with renewable energy engineering roles seeing strong demand. This talent market dynamic means retaining and attracting skilled labor remains a key consideration for operational efficiency and project timelines.

Construction and Engineering Partners

Anaergia frequently collaborates with engineering, procurement, and construction (EPC) firms for project execution. The bargaining power of these suppliers hinges on the limited number of highly qualified firms capable of handling specialized waste-to-energy projects, a critical factor in 2024. Establishing robust, long-term relationships, as seen with partners like Techbau and RDR S.p.A., is crucial for Anaergia to mitigate this power and ensure project quality and timely delivery. Their ability to secure favorable terms depends on the competitive landscape for large-scale anaerobic digestion infrastructure.

- Global EPC market projected at $10.4 trillion in 2024, with specialized segments facing higher demand.

- High entry barriers exist for new EPC firms in complex renewable energy infrastructure.

- Anaergia's project pipeline in 2024 relies on efficient EPC collaboration for timely completion.

- Strategic alliances reduce supplier switching costs and improve negotiation leverage.

Capital Providers and Financial Institutions

The development of waste-to-energy projects demands substantial capital, making financial institutions powerful suppliers. Banks, investment funds, and other lenders hold significant sway due to the high upfront investment required for Anaergia's operations. Anaergia's strategic ability to secure diverse funding streams helps mitigate this power, ensuring project viability and expansion.

- Capital-intensive projects grant considerable bargaining power to financial providers.

- Anaergia's funding, including a 2024 line of credit from Royal Bank of Canada, diversifies its capital sources.

- Strategic investments, like from Marny Investment SA, are crucial for reducing reliance on single lenders.

- Securing adequate financing is paramount for Anaergia's global growth in the waste-to-energy sector.

Suppliers of specialized technology, skilled labor, and EPC services hold significant bargaining power due to high demand and limited qualified options in 2024. Financial institutions also exert considerable influence given the capital-intensive nature of Anaergia's projects. Anaergia mitigates this through its proprietary patent portfolio, long-term contracts for waste, strategic EPC alliances, and diverse funding sources, including a 2024 line of credit from Royal Bank of Canada.

| Supplier Type | Power Level | Mitigation Strategy |

|---|---|---|

| Specialized Tech/EPC | High | Proprietary IP, Strategic Alliances |

| Skilled Labor | High | Internal Teams, Talent Retention |

| Financial Institutions | High | Diversified Funding (e.g., 2024 RBC LoC) |

What is included in the product

This analysis unpacks the competitive forces impacting Anaergia, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the renewable energy sector.

Instantly visualize competitive pressures with a dynamic, interactive dashboard for Anaergia's market landscape.

Streamline strategic planning by easily adapting the Porter's Five Forces model to Anaergia's specific operational context.

Customers Bargaining Power

Municipalities and government agencies represent significant customers for Anaergia, engaging in long-term contracts for waste management and renewable energy solutions. These entities often possess substantial bargaining power due to the sheer scale of projects, like the estimated $200 million Lystek International contract secured in early 2024 for waste processing infrastructure. However, the increasing global emphasis on environmental sustainability and stricter regulations, such as those driving net-zero targets by 2050, enhance Anaergia's value proposition. This shift towards sustainable waste solutions strengthens Anaergia's negotiating stance, as municipalities seek advanced and compliant technologies.

Industrial waste producers, especially large agricultural and food and beverage companies, represent significant customers for Anaergia. Their bargaining power is notably high due to the substantial waste volumes they generate and the availability of diverse waste management alternatives, including landfilling or other processing facilities. For instance, the US industrial waste market was projected to reach over 300 million tons in 2024, highlighting the scale of potential customers. However, Anaergia's integrated solutions, which convert waste into valuable resources like renewable natural gas (RNG), can mitigate this power. By offering economic and environmental benefits, such as carbon credit generation and reduced disposal costs, Anaergia provides a compelling value proposition that reduces customer leverage compared to conventional disposal options.

Energy and utility companies purchasing renewable natural gas (RNG) represent a significant customer segment for Anaergia. Their bargaining power is influenced by the availability of alternative renewable energy sources and the prevailing price of conventional natural gas, which saw Henry Hub prices averaging around $2.50-$3.00/MMBtu in early 2024. However, government mandates, such as the U.S. Renewable Fuel Standard (RFS) requiring increased renewable fuel volumes in 2024, and various state-level clean energy incentives, significantly boost demand for RNG. This regulatory push for decarbonization and sustainable energy sources tends to reduce the bargaining power of these utility customers, as their need for RNG is often driven by compliance requirements and ESG targets.

Project Developers and Partners

Anaergia sells its unique waste-to-energy technology and equipment to project developers and partners, influencing their bargaining power. The efficiency and distinctiveness of Anaergia's proprietary solutions, such as their anaerobic digestion technologies, are key factors. Their established operational track record, evident in projects like the Rialto Bioenergy Facility in California, significantly strengthens Anaergia's negotiating stance. Furthermore, the company's extensive patent portfolio, which included over 100 patents and applications as of early 2024, provides a robust competitive moat against alternative suppliers.

- Technology Uniqueness: Anaergia's patented processes reduce the availability of direct substitutes.

- Proven Track Record: Successful large-scale projects enhance customer confidence and reduce perceived risk.

- Patent Portfolio: Over 100 patents as of 2024 protect their intellectual property, limiting competitive leverage.

- Efficiency Gains: Demonstrated higher efficiency in waste conversion strengthens value proposition.

Fertilizer and Soil Amendment Buyers

The digestate from Anaergia's anaerobic digestion offers a valuable co-product sold as fertilizer and soil amendment. Customer bargaining power in this market is generally lower, given it serves as a secondary revenue stream for Anaergia, rather than its primary focus. However, the value of this digestate is directly influenced by the fluctuating prices of conventional fertilizers, with urea prices in early 2024 averaging around $300-350 per short ton. Local agricultural demand also significantly impacts pricing and sales volume for these buyers.

- Digestate serves as a valuable co-product for soil enrichment.

- Customer bargaining power is typically lower due to it being a secondary revenue stream.

- Value is highly susceptible to conventional fertilizer price volatility; urea was around $300-350/short ton in Q1 2024.

- Local agricultural demand dictates market absorption and pricing for these amendments.

Anaergia's customers, spanning municipalities to energy utilities, possess varied bargaining power; large-scale industrial waste producers, representing over 300 million tons in the 2024 US market, often have leverage due to alternatives. However, Anaergia's unique, patented waste-to-value technologies and integrated solutions, like RNG production, significantly mitigate this power. Regulatory drivers, such as 2024 U.S. Renewable Fuel Standard mandates, further enhance Anaergia's position. Their over 100 patents as of 2024 reinforce their competitive advantage, reducing customer options.

| Customer Segment | Bargaining Power | 2024 Data/Context |

|---|---|---|

| Municipalities | Moderate-High | $200M Lystek contract; net-zero 2050 targets |

| Industrial Waste Producers | High | 300M tons US industrial waste market; alternative disposal |

| Energy/Utility Companies | Moderate | Henry Hub $2.50-$3.00/MMBtu; U.S. RFS mandates |

| Project Developers | Low | >100 patents; Rialto Bioenergy operational track record |

| Digestate Buyers | Low-Moderate | Urea $300-350/short ton; secondary revenue stream |

What You See Is What You Get

Anaergia Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces Analysis of Anaergia you'll receive immediately after purchase. The document details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the biogas and waste-to-energy sector. You'll find a thorough examination of each force, providing actionable insights for strategic decision-making. This professionally written analysis is fully formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

The waste management industry is dominated by formidable, established players like Waste Management Inc., Veolia, and Suez. These global leaders, with Waste Management Inc. reporting over $20 billion in 2023 revenue, are increasingly investing in advanced recycling and waste-to-energy technologies. This strategic shift creates direct, intense competition for Anaergia, especially as these giants expand their resource recovery capabilities. Their extensive operational networks and substantial financial resources make them formidable rivals in securing contracts and developing new sustainable solutions.

The renewable energy sector features a growing number of specialized companies focused on anaerobic digestion, biogas, and RNG production. Competitors range from technology providers, like Brightmark, to project developers and operators across North America. For instance, the US RNG project pipeline reached over 400 projects by early 2024, indicating intense competition. This dynamic landscape demands constant innovation and operational efficiency as key differentiators for market share.

Anaergia faces intense competitive rivalry from technology and equipment providers specializing in anaerobic digestion and biogas upgrading solutions. This segment's competition centers on technological performance, system efficiency, and the cost-effectiveness of their offerings. Companies like ADI Systems and Linde Engineering are significant players, with Linde reporting over 170 biogas upgrading plants globally as of early 2024. A robust portfolio of proprietary technology, such as advanced digester designs or membrane separation processes, provides a crucial competitive advantage in securing new projects and market share.

Regional and Niche Players

The waste-to-energy market faces competition from numerous smaller, regional, or niche players. These agile firms often specialize in specific waste streams or geographic areas, leveraging strong local relationships. For instance, in 2024, many localized anaerobic digestion plants, like those processing agricultural waste in specific regions, continued to expand. While these players pose a competitive threat in their particular niches, Anaergia's global footprint and capacity to handle diverse waste types, including municipal solid waste and industrial organics, provide a significantly broader market reach.

- Regional players like Bioenergy DevCo focus on specific U.S. states.

- Niche firms might specialize in only food waste digestion.

- Anaergia's 2024 project pipeline included diverse waste-to-resource facilities globally.

- Local companies can offer competitive pricing in their immediate vicinity.

Internal Development by Customers

Large municipalities or industrial clients could theoretically develop their own waste processing and energy generation facilities, becoming direct competitors. However, this internal development is a less common threat due to significant hurdles. The high capital costs, often exceeding $500 million for a large-scale waste-to-energy plant in 2024, are a major deterrent. Additionally, the technological complexity and specialized operational expertise required create substantial barriers for most potential clients.

- Capital expenditure for new waste-to-energy facilities can exceed $500 million.

- Specialized engineering and operational knowledge are essential for these complex systems.

- Long permitting processes and regulatory compliance add further difficulty.

Anaergia navigates intense competitive rivalry from formidable waste management giants like Waste Management Inc. and specialized renewable energy developers. The US RNG project pipeline exceeded 400 projects by early 2024, reflecting significant activity. Technology providers, such as Linde Engineering with over 170 global biogas upgrading plants, also pose direct competition. Furthermore, smaller regional players and the high capital cost of over $500 million for self-development by clients further define this competitive environment.

| Competitor Type | Key Players | 2024 Market Data |

|---|---|---|

| Large Integrators | Waste Management Inc. | $20B+ 2023 Revenue (WM) |

| RNG Developers | Brightmark | 400+ US RNG projects (early 2024) |

| Tech Providers | Linde Engineering | 170+ global biogas plants (early 2024) |

SSubstitutes Threaten

Traditional waste disposal methods like landfilling and incineration persist as significant substitutes for Anaergia's advanced resource recovery solutions. These conventional approaches often present a lower-cost alternative, particularly in regions with less stringent environmental regulations. However, they face escalating regulatory pressure globally, driven by concerns over methane emissions and pollution; for example, the US EPA continues to tighten methane emission standards for landfills in 2024. The primary impetus shifting demand away from these substitutes towards sustainable options is increasingly stringent environmental legislation and a growing global emphasis on circular economy principles.

Renewable natural gas faces significant competition from other clean energy sources like solar, wind, and hydropower, all vying for crucial investment and government incentives. In 2024, global renewable energy investments are projected to exceed 600 billion USD, with solar and wind dominating new capacity additions. The choice among these technologies often hinges on regional resource availability, project cost-effectiveness, and supportive policy frameworks. However, RNG holds a distinct advantage through its ability to leverage existing natural gas infrastructure and provide a reliably dispatchable energy source.

Composting presents a significant substitute for Anaergia's anaerobic digestion solutions in organic waste treatment. While composting effectively converts organic waste into valuable soil amendments, it fundamentally differs by not generating renewable energy like biogas, a key output of anaerobic digestion. In 2024, the global composting market continued its growth, driven by soil health initiatives, but the renewable energy focus often steers waste managers towards biogas. The strategic decision between these methods frequently hinges on whether the waste management program primarily prioritizes soil improvement or aims for energy generation and decarbonization.

Alternative Fuel Vehicles

The transportation sector presents a significant threat of substitutes for Anaergia's RNG-fueled vehicles, primarily from electric vehicles (EVs) and those powered by hydrogen or other biofuels. The rapid growth of the EV market, projected to capture over 20% of global car sales in 2024, supported by government incentives and declining battery costs, represents a major substitute. However, RNG remains a particularly viable and often superior option for heavy-duty vehicles, where electrification faces significant range and charging infrastructure challenges.

- EV market share expansion continues, with global EV sales expected to surpass 17 million units in 2024.

- Hydrogen fuel cell technology is advancing, especially for long-haul transport and industrial applications.

- Biofuels beyond RNG, such as bio-diesel and ethanol, also compete for market share in the sustainable fuel space.

- RNG offers immediate decarbonization for existing heavy-duty fleets without extensive infrastructure overhauls.

Energy Efficiency and Waste Reduction

A primary substitute for waste-to-energy solutions, like those offered by Anaergia, is the upfront reduction of waste generation combined with enhanced energy efficiency. Successful initiatives such as reduce, reuse, and recycle programs directly diminish the volume of organic waste available as feedstock. For instance, in 2024, many municipalities are targeting significant reductions in landfill-bound organic waste, impacting feedstock availability. While environmentally beneficial, this trend poses a long-term limitation on the growth potential for the waste-to-energy market.

- Global organic waste generation is projected to stabilize or decrease in some regions due to circular economy efforts by 2024.

- Increased energy efficiency measures in commercial and residential sectors reduce overall energy demand.

- Recycling rates for organic waste saw an average increase of 3-5% in key North American and European markets in 2023-2024.

- The European Union's 2024 targets for waste reduction directly compete with waste-to-energy feedstock.

Anaergia faces significant substitution threats from traditional waste methods like landfilling and incineration, despite tightening 2024 environmental regulations. Competition also arises from other renewable energy sources, such as solar and wind, which are attracting substantial investment globally. Furthermore, evolving waste reduction efforts and the rapid growth of electric vehicle technology in transportation present ongoing challenges to Anaergia's feedstock supply and market for renewable natural gas.

| Substitute Category | 2024 Market Trend/Data | Impact on Anaergia |

|---|---|---|

| Traditional Waste Disposal | US EPA continues tightening methane emission standards for landfills in 2024. | Shifts demand towards sustainable resource recovery. |

| Other Renewable Energy | Global renewable energy investments projected to exceed 600 billion USD in 2024. | Intensifies competition for investment and policy support. |

| Composting | Global composting market continued growth in 2024, driven by soil health. | Diverts organic waste feedstock from energy generation. |

| EVs & Other Biofuels | Global EV sales expected to surpass 17 million units in 2024. | Reduces demand for RNG in the transportation sector. |

| Waste Reduction/Efficiency | Recycling rates for organic waste saw an average increase of 3-5% in key North American and European markets in 2023-2024. | Limits available feedstock for waste-to-energy solutions. |

Entrants Threaten

The waste-to-energy sector demands exceptionally high upfront capital investments for constructing advanced processing facilities and power generation plants. For instance, a typical large-scale anaerobic digestion or gasification plant can require hundreds of millions of dollars in initial outlay, with some projects exceeding $500 million as of 2024. This substantial financial barrier significantly deters new entrants, as securing such vast funding for large-scale infrastructure projects proves immensely challenging.

Success in the waste-to-resource sector hinges on advanced, often proprietary, technology and deep engineering expertise. Anaergia holds a strong defensive position, boasting an extensive portfolio of over 250 patents as of early 2024. New entrants face significant barriers, needing to either develop their own competitive technologies or license existing ones. This process is both costly and time-consuming, deterring potential competitors from entering the market.

Navigating the complex web of environmental regulations and permitting processes presents a significant barrier for new entrants in the waste-to-energy sector. Obtaining necessary permits for facilities, such as those converting waste into renewable natural gas, can be a lengthy and uncertain process, often extending beyond three years for major projects. This regulatory burden effectively deters potential new competitors from entering the market. Established players like Anaergia possess the accumulated experience and relationships from years of operation, enabling them to manage these intricate challenges more efficiently.

Economies of Scale and Experience Curve

Established companies like Anaergia benefit significantly from economies of scale in procurement, operations, and project development. By 2024, their extensive global footprint, including hundreds of completed projects, provides a substantial experience advantage. New entrants struggle to match this entrenched cost structure and operational efficiency. Anaergia's established supply chains and optimized processes create a formidable barrier.

- Anaergia's operational efficiency is enhanced by over 170 projects globally by 2024.

- Procurement advantages stem from bulk purchasing for large-scale anaerobic digestion facilities.

- New entrants face higher per-unit costs without comparable project volume.

- The experience curve reduces operational risks and improves project timelines for incumbents.

Access to Feedstock and Customer Relationships

New entrants into the waste-to-energy sector, like those potentially competing with Anaergia, face substantial barriers in securing reliable feedstock. Long-term contracts for organic waste are crucial, often spanning 10-20 years, ensuring project viability. Established players, including Anaergia, benefit from long-standing relationships with municipalities and large industrial waste generators, making it difficult for newcomers to gain access to these essential resources. For instance, in 2024, many major waste collection contracts are already locked in with incumbent providers, limiting opportunities for new market entrants.

- Securing consistent organic waste feedstock is critical for project sustainability.

- Incumbent companies often have multi-year contracts with waste producers.

- New entrants struggle to compete for existing waste streams.

- Municipal and industrial waste contracts are typically long-term, creating high entry barriers.

The waste-to-energy sector presents significant entry barriers for new competitors, primarily due to exceptionally high upfront capital investments, with large plants often exceeding $500 million by 2024. Anaergia's extensive patent portfolio, boasting over 250 patents as of early 2024, creates formidable technological and expertise hurdles. New entrants also struggle with complex, multi-year permitting processes and difficulty securing long-term feedstock contracts, which are largely held by incumbents. Anaergia’s economies of scale, stemming from over 170 global projects by 2024, further solidifies its position, making new market entry challenging.

| Barrier Type | Anaergia's Advantage (2024) | Impact on New Entrants |

|---|---|---|

| Capital Investment | Existing infrastructure, established funding channels | Requires >$500M initial outlay for large projects |

| Technology & Expertise | 250+ patents, proprietary systems | Need to develop or license costly, time-consuming tech |

| Regulatory & Permitting | Experienced navigation, established relationships | Lengthy processes, often >3 years for major permits |

| Economies of Scale | 170+ global projects, optimized operations | Higher per-unit costs, less efficient operations |

| Feedstock Access | Long-term contracts, municipal relationships | Difficulty securing consistent, long-term waste streams |

Porter's Five Forces Analysis Data Sources

Our Anaergia Porter's Five Forces analysis is built on a foundation of comprehensive data from Anaergia's investor relations website, annual reports, and SEC filings. We also incorporate insights from industry-specific market research reports and competitor announcements.