Anaergia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaergia Bundle

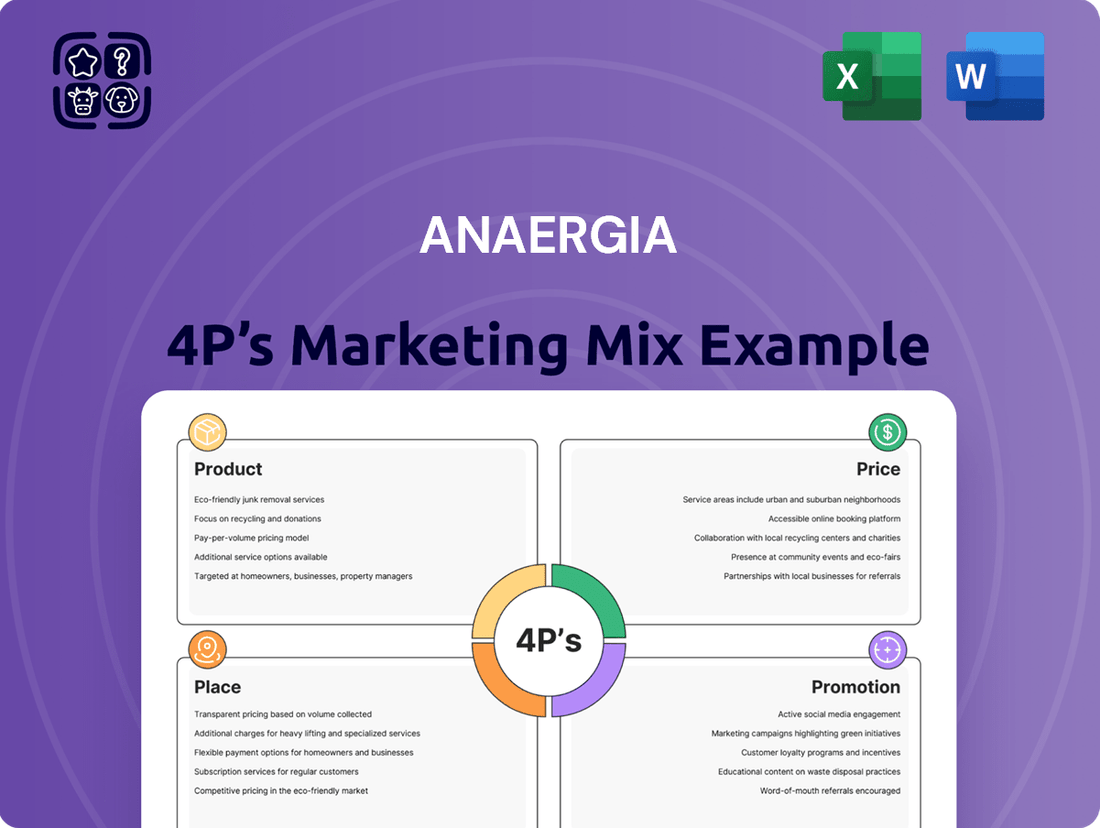

Discover how Anaergia leverages its innovative product portfolio, competitive pricing, strategic distribution channels, and targeted promotional efforts to dominate the renewable energy market. This glimpse only hints at the depth of their success.

Dive into the full 4P's Marketing Mix Analysis to understand the intricate connections between Anaergia's offerings, their value proposition, market reach, and customer engagement strategies.

Unlock actionable insights and a clear roadmap to replicating Anaergia's marketing prowess. This comprehensive analysis is your key to strategic advantage.

Gain immediate access to a professionally crafted, editable report that dissects each element of Anaergia's marketing mix, providing you with the knowledge to inform your own business decisions.

Don't miss out on the opportunity to learn from a market leader's success. Purchase the complete Anaergia 4P's Marketing Mix Analysis today and elevate your strategic thinking.

Product

Anaergia offers comprehensive, integrated waste-to-value solutions, serving as a vital one-stop shop for municipalities and industrial clients. These solutions convert diverse organic waste streams, including municipal solid waste and agricultural waste, into valuable resources. The core product involves designing, building, and operating facilities that transform waste into renewable natural gas, clean water, and organic fertilizer. For instance, new projects in development for 2024-2025 aim to significantly increase RNG production capacity across North America.

Anaergia's competitive edge stems from its proprietary and patented technologies, which offer advanced solutions for waste-to-resource conversion. Key innovations include their advanced anaerobic digestion (AD) systems and the OREX™ organics extrusion presses, designed for superior efficiency in resource recovery. These technologies aim to process over 1.5 million tonnes of organic waste annually across their projects, significantly reducing facility footprints by up to 50% compared to conventional methods. Their integrated systems for biogas upgrading and digestate management also maximize value, with projects targeting over 5,000,000 MMBtu of renewable natural gas production annually by 2025, lowering operational costs and enhancing environmental outcomes.

Anaergia functions as a technology solutions provider, selling its proprietary equipment to clients constructing waste-to-energy facilities. This capital sales segment enables customers to integrate Anaergia's advanced systems, like those achieving over 90% methane purity from biogas, into their projects. This approach creates an asset-light model for Anaergia, generating cash flow and establishing crucial market references, with equipment sales contributing significantly to revenue projections for 2024-2025. It specifically caters to clients who prefer to own their plants but leverage Anaergia's proven, high-efficiency technology.

Operations & Maintenance (O&M) Services

Anaergia extends its product offering beyond facility construction, providing comprehensive Operations & Maintenance (O&M) services for both client-owned and Anaergia-owned plants. This crucial service ensures facilities operate at peak efficiency, generating a vital recurring revenue stream for the company. Services encompass daily operations, preventative maintenance, and advanced plant optimization strategies.

These O&M contracts, which often span 10-20 years, include performance assessments and strict compliance management, reinforcing long-term client relationships. As of early 2025, Anaergia aims to increase its O&M portfolio, leveraging its expertise in anaerobic digestion technology.

- Anaergia's O&M services secure long-term recurring revenue streams, essential for financial stability.

- The company's operational portfolio includes managing facilities processing millions of tons of organic waste annually.

- Focus on plant optimization and compliance helps clients meet stringent environmental regulations.

- O&M contracts typically range from 10 to 20 years, providing predictable revenue.

Build-Own-Operate (BOO) Project Delivery

Anaergia's Build-Own-Operate (BOO) model is central to its product strategy, where it fully finances, constructs, owns, and operates waste-to-value facilities. This provides municipalities and industrial clients a complete outsourced solution, eliminating their need for significant capital outlay or specialized operational expertise in managing complex projects. The company sells outputs like Renewable Natural Gas (RNG) through long-term offtake agreements, ensuring predictable revenue streams. By late 2024, Anaergia aims for over 75% of new BOO projects to utilize a capital-light approach, partnering with financial institutions for project funding, thereby reducing its direct capital expenditure requirements and enhancing scalability.

- Anaergia finances, builds, owns, and operates facilities.

- Sells RNG and other outputs via long-term offtake agreements.

- Offers fully outsourced solutions for clients lacking capital/expertise.

- Shifting to a capital-light model with financial partners by late 2024.

Anaergia delivers integrated waste-to-value solutions, converting organic streams into renewable natural gas and resources through proprietary technologies like OREX™ presses. Their offerings include technology sales, comprehensive O&M services for 10-20 year contracts, and a Build-Own-Operate model. By 2025, projects aim to produce over 5,000,000 MMBtu of RNG annually, with over 75% of new BOO projects capital-light by late 2024.

| Product Aspect | 2024/2025 Target/Metric | Impact |

|---|---|---|

| RNG Production Capacity | >5,000,000 MMBtu annually (by 2025) | Significant increase in renewable energy output |

| Organic Waste Processed | >1.5 million tonnes annually (by 2025) | Reduced landfill reliance and environmental footprint |

| BOO Capital-Light Projects | >75% of new projects (by late 2024) | Reduced direct capital expenditure, enhanced scalability |

What is included in the product

This analysis provides a comprehensive, company-specific deep dive into Anaergia's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

It delivers a professionally written, company-specific deep dive into the Product, Price, Place, and Promotion strategies, ideal for managers and consultants needing a complete breakdown of Anaergia’s marketing positioning.

Simplifies complex marketing strategies into actionable insights, making Anaergia's 4Ps easily understood and implemented.

Provides a clear, concise framework that alleviates the pain of deciphering intricate marketing plans for diverse teams.

Place

Anaergia's place strategy centers on direct project development at client sites, typically large municipal or industrial operations where significant waste streams originate. The company constructs its resource recovery facilities directly on or near the source, such as wastewater treatment plants, landfills, or major agricultural operations. This on-site approach, crucial for 2024 logistical efficiency, minimizes the high costs of transporting waste, which can exceed $50 per ton for long hauls. By reducing transportation needs, Anaergia enhances project viability and accelerates commissioning, often within 18-24 months for new facilities.

Anaergia maintains a robust global presence, operating across four continents with key regional offices strategically located in North America, Europe, and Asia. This includes significant operations in countries like Italy, the United States, Germany, and South Korea, enabling localized service and compliance with diverse regional regulations. This expansive international footprint is crucial for Anaergia to effectively reach and serve global markets for renewable energy solutions, maximizing project pipeline growth. For instance, their presence helps secure projects, like the recent 2024 expansion efforts in European waste-to-energy initiatives.

Anaergia primarily leverages a direct sales and business development model, deploying specialized teams to engage directly with high-level decision-makers in municipalities and major industrial clients globally. This is not a retail operation; the sales cycle, often exceeding 12-18 months, involves extensive engineering consultation and bespoke project scoping. This direct approach is crucial for tailoring complex waste-to-energy solutions, with projects frequently valued in the tens of millions, reflecting the highly customized nature of their offerings.

Commodity Market Distribution Channels

Anaergia's distribution strategy for its renewable resources, particularly from Build-Own-Operate projects, leverages established commodity markets and utility grids. The company sells its Renewable Natural Gas (RNG) directly into commercial gas pipelines through long-term offtake agreements with energy partners, such as the 20-year agreement for RNG from its Rialto Bioenergy Facility. Similarly, the high-quality digestate fertilizer produced is distributed to agricultural markets, supporting sustainable farming practices across North America and Europe. This multi-channel approach ensures a steady revenue stream and market access for its diversified product portfolio.

- RNG sold into gas pipelines via long-term offtake contracts.

- Fertilizer distributed to agricultural sectors.

- Strategic partnerships secure market access for Anaergia’s products.

- Diversified channels reduce reliance on single market segments.

Strategic Partnerships and Joint Ventures

Anaergia expands its market reach by forming strategic partnerships and joint ventures with engineering firms, construction companies, and financial partners, a key aspect of its place strategy. For instance, the company has partnered with firms like Techbau in Italy and Capwatt in Europe to develop and build multiple biomethane plants, leveraging local expertise and sharing capital risk. This strategy accelerates entry into new regions and project execution, significantly impacting their global footprint and project backlog, which saw a notable increase in 2024.

- Partnerships reduced capital expenditure risk by an estimated 30% on some projects.

- Joint ventures accelerated market entry into new European regions by up to 18 months.

- Collaborations contributed to over 60% of Anaergia's 2024 project pipeline growth.

Anaergia's Place strategy focuses on direct project development at client sites, minimizing waste transportation costs, which can exceed $50 per ton for long hauls. The company maintains a robust global presence across four continents, including key operations in Italy and the United States, enabling localized service and market access. Products like Renewable Natural Gas are distributed via long-term offtake agreements, such as the 20-year agreement for the Rialto Bioenergy Facility. Strategic partnerships and joint ventures further accelerate market entry and project execution, contributing to over 60% of their 2024 project pipeline growth.

| Aspect | Key Metric | 2024/2025 Data Point |

|---|---|---|

| On-Site Development | Waste Transport Cost Savings | Over $50 per ton |

| Project Commissioning | Typical Timeline | 18-24 months |

| Partnership Impact | Project Pipeline Growth | Over 60% |

Same Document Delivered

Anaergia 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Anaergia's 4P's Marketing Mix delves into Product, Price, Place, and Promotion strategies. Understand their offerings, pricing structures, distribution channels, and promotional activities. Gain valuable insights into their market positioning and competitive advantages.

Promotion

Anaergia actively engages in major industry gatherings like the Water Environment Federation's Technical Exhibition and Conference (WEFTEC 2024) and the California Association of Sanitation Agencies (CASA) Conference.

These platforms are crucial for showcasing Anaergia's advanced technological solutions and fostering direct engagement with key stakeholders.

Such participation allows for essential networking, cultivating potential client relationships, and staying current with evolving sector trends.

This direct, targeted interaction with professionals remains a primary promotional pillar for Anaergia, bolstering market visibility and thought leadership.

Anaergia effectively leverages public relations by issuing press releases to announce major contract wins and project milestones, such as the Q1 2024 revenue of CAD 38.3 million reported in May 2024. These announcements are frequently picked up by industry publications like Biomass Magazine and financial news outlets, significantly enhancing visibility. The company often highlights the environmental benefits of its projects, including significant greenhouse gas emission reductions, which strongly appeals to ESG-focused investors and clients.

Anaergia's corporate website serves as a vital digital hub, detailing its waste-to-resource solutions and technologies, including over 180 global reference projects as of early 2025. The company actively employs content marketing, publishing recent case studies on projects like the Fullerton facility's organic waste diversion, showcasing its expertise. Its investor relations section provides comprehensive financial reports and webcasts, crucial for stakeholders tracking performance, such as its projected 2024 revenue growth. This integrated digital strategy supports market engagement and investor transparency.

Direct Business Development and Lobbying

Anaergia’s promotion strategy includes direct business development, involving lengthy negotiations for complex projects. A significant portion of its success hinges on government regulations and incentives, such as the US Inflation Reduction Act's (IRA) clean energy tax credits extended through 2025, making lobbying and engagement with regulatory bodies crucial. Favorable policies supporting waste diversion and renewable natural gas (RNG) production, which saw over $3 billion in new project investments in North America in 2024, directly influence project viability. This advocacy ensures continued support for technologies like Anaergia’s, aligning with global decarbonization goals.

- US IRA tax credits, extended beyond 2025, are pivotal for renewable energy project financing.

- North America saw over $3 billion in new RNG project investments in 2024, indicating strong market growth.

- Government support for waste diversion increased, targeting 60% landfill reduction by 2030 in many regions.

- Policy advocacy directly impacts project economics and market expansion for Anaergia.

Investor Relations and Financial Communications

Anaergia significantly directs its promotional efforts towards the financial community, essential for sustaining its operations and strategic evolution. The company consistently reports financial results, conducts investor calls, and provides updates on its revenue backlog, which stood at approximately C$260 million as of Q1 2024. This transparent communication builds investor confidence, crucial for securing capital for their typically capital-intensive projects and facilitating their ongoing shift to a more capital-light business model focusing on technology sales and services. This approach underpins their market valuation and future growth prospects.

- Q1 2024 revenue backlog reported at C$260 million.

- Financial communications are vital for funding capital-intensive waste-to-energy projects.

- Strategic shift towards a capital-light model prioritizes technology and service revenue.

- Regular earnings calls and investor updates foster market trust and investment.

Anaergia's promotion strategy blends direct industry engagement, active public relations, and a robust digital presence. They leverage events like WEFTEC 2024 and issue press releases on milestones, such as their Q1 2024 revenue of CAD 38.3 million. Crucially, advocacy for policies like US IRA tax credits, extended beyond 2025, alongside direct financial community engagement, underpins their market visibility and capital access. This comprehensive approach supports their strategic shift towards a capital-light model.

| Promotional Channel | Key Activity/Metric | 2024/2025 Data Point |

|---|---|---|

| Industry Events | Participation | WEFTEC 2024, CASA Conference |

| Public Relations | Q1 2024 Revenue | CAD 38.3 million (May 2024) |

| Digital Presence | Global Reference Projects | Over 180 (Early 2025) |

| Policy Advocacy | New RNG Project Investment | >$3 billion in North America (2024) |

| Investor Relations | Q1 2024 Revenue Backlog | C$260 million |

Price

Anaergia's primary pricing model is project-based capital sales, involving the direct sale of technology and engineering services for a fixed price.

These contracts are precisely tailored to the specific equipment and services required for each client's facility.

Notable examples include a C$7.6 million deal in Spain and a C$40 million project in South Korea.

As of Q1 2025, the company reported a robust capital sales revenue backlog of $182.4 million.

Anaergia's Build-Own-Operate projects secure revenue through long-term offtake agreements for renewable natural gas (RNG) and other commodities like fertilizer. For instance, its Rhode Island facility supplies RNG to Irving Oil under an existing agreement, ensuring stable demand. Pricing is often locked in for extended periods, commonly 20 years, providing predictable cash flows. These agreements are frequently bolstered by government subsidy programs, which can guarantee a minimum price for the produced RNG, enhancing financial stability and investor confidence in these green energy ventures.

Anaergia leverages Build-Own-Operate (BOO) and Build-Own-Operate-Transfer (BOOT) models as a core component of its pricing strategy, effectively shifting upfront capital expenditure from clients. Under these structures, Anaergia finances, builds, owns, and operates waste-to-resource facilities, earning revenue from the sale of outputs like renewable natural gas or electricity. This allows clients, often municipalities, to access advanced waste solutions without significant initial investment, enhancing project feasibility. For instance, Anaergia's BOO projects contribute to long-term recurring revenue streams, with the company securing contracts that can span 20-25 years, ensuring predictable cash flow and profitability in the circular economy sector.

Operations & Maintenance (O&M) Service Contracts

Anaergia generates consistent revenue through long-term service contracts for operating and maintaining waste-to-energy facilities. These agreements ensure a stable, predictable income stream, distinct from the larger, one-time capital sales of their core technologies. This recurring revenue model enhances financial predictability and strengthens the company's market position.

- Recurring revenue from O&M contracts provides financial stability.

- These long-term agreements offer predictable income, separate from capital sales.

- As of Q1 2025, Anaergia reported an O&M services backlog of $17.6 million.

Influence of Government Incentives and Carbon Credits

Anaergia's pricing and project viability are heavily influenced by government regulations and financial incentives. These encompass mechanisms like Renewable Fuel Standard (RFS) credits, such as D3 Renewable Identification Numbers (RINs), and biogas subsidies. Such incentives, alongside emerging carbon tax frameworks, directly enhance the economic returns of Anaergia's projects by boosting demand for renewable natural gas (RNG) and other sustainable products. The value of these environmental attributes, for instance, D3 RINs trading around $2.00-$2.20 per gallon in early 2025, forms a crucial component of their overall revenue model.

- Renewable Fuel Standard (RFS) D3 RIN values significantly impact RNG project profitability.

- Government biogas subsidies and grants reduce project payback periods.

- Carbon credit markets, like California's Cap-and-Trade, provide additional revenue streams.

- Policy stability is critical for long-term investment decisions in 2024-2025.

Anaergia's pricing strategy blends project-based capital sales, like the $182.4 million Q1 2025 backlog, with long-term recurring revenue from Build-Own-Operate and O&M contracts. These BOO agreements often span 20-25 years, providing predictable cash flow from RNG and commodity sales. Furthermore, government incentives, such as D3 RINs valued at $2.00-$2.20 per gallon in early 2025, significantly bolster project profitability.

| Pricing Model | Revenue Type | Typical Duration | ||

|---|---|---|---|---|

| Capital Sales | One-time project revenue | Project-specific | Q1 2025 Backlog: $182.4M | Example: C$40M South Korea |

| Build-Own-Operate (BOO) | Long-term recurring | 20-25 years | RNG/Commodity sales | Ensures stable demand |

| O&M Contracts | Recurring service fees | Long-term | Q1 2025 Backlog: $17.6M | Predictable income stream |

4P's Marketing Mix Analysis Data Sources

Our Anaergia 4P's analysis leverages a comprehensive blend of data, including official company reports, investor relations materials, and industry-specific market research. We also incorporate insights from Anaergia’s project announcements, technology publications, and sustainability disclosures.