Amkor Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

Navigate the complex landscape impacting Amkor Technology with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping the semiconductor packaging industry. Unlock actionable intelligence to refine your strategy and gain a competitive advantage. Download the full PESTLE analysis now for immediate insights.

Political factors

Geopolitical tensions, especially the ongoing trade disputes between the United States and China, create significant headwinds for the semiconductor industry. These tensions can manifest as export controls on advanced technologies and tariffs on critical components, directly impacting companies like Amkor Technology. For instance, in late 2023, the US government expanded restrictions on semiconductor exports to China, affecting the availability of advanced chip manufacturing equipment and materials. Amkor, with its extensive global operations and supply chains, must actively manage these risks to ensure continued access to markets and essential resources, a challenge underscored by the fact that China remains a crucial market for many semiconductor players.

Governments globally are actively promoting domestic semiconductor production through substantial subsidies. The U.S. CHIPS and Science Act is a prime example, aiming to bolster domestic manufacturing and lessen dependence on overseas suppliers.

Amkor Technology is positioned to gain significantly from these programs. The company has a preliminary agreement for up to $400 million in direct funding from the CHIPS Act, earmarked for its Arizona facility.

These financial injections are designed to invigorate the U.S. semiconductor industry and bolster national security by securing a dependable domestic supply of advanced packaging solutions.

Fluctuating trade policies and tariffs significantly impact semiconductor companies like Amkor Technology. For instance, the US-China trade tensions have led to increased tariffs on various goods, including electronic components, directly affecting production costs. In 2023, the US imposed new export controls on advanced semiconductor technology to China, creating uncertainty and potential supply chain disruptions for companies with operations in both regions.

New tariffs can escalate manufacturing expenses and potentially force Amkor to adjust pricing for its outsourced semiconductor assembly and test (OSAT) services. This could, in turn, influence demand from its global customer base, which includes major electronics manufacturers. The semiconductor industry is highly sensitive to these cost fluctuations, as even small increases can impact competitiveness.

Amkor's strategic global footprint, with significant operations in Asia (e.g., South Korea, China, Singapore), Europe, and the USA, makes it particularly vulnerable to shifts in international trade agreements and tariff structures. For example, changes in tariffs on components imported into or exported from these key manufacturing hubs can directly alter Amkor's operational costs and market access.

National Security Concerns

National security concerns significantly impact the semiconductor industry, with governments increasingly viewing semiconductors as critical strategic assets. These components are vital for everything from everyday consumer electronics to advanced defense systems, making their reliable supply a national priority. This perception fuels governmental initiatives aimed at bolstering domestic supply chains and regulating the transfer of cutting-edge technologies. Amkor Technology, as a major player in outsourced semiconductor assembly and test (OSAT), is directly intertwined with these national security imperatives, often supporting government objectives related to technological sovereignty and supply chain resilience.

In 2024, the United States CHIPS and Science Act continued to allocate billions to onshore semiconductor manufacturing and R&D, directly influencing where companies like Amkor might expand their operations. Similarly, in 2025, expect continued geopolitical tensions to drive further government scrutiny over cross-border technology transfers and foreign investment in the semiconductor sector. For Amkor, this translates to a need to navigate complex regulatory landscapes and potentially align its operational strategies with national security goals. The company's ability to adapt to these evolving political priorities will be crucial for its long-term success and market positioning.

Regional Manufacturing Initiatives

Countries worldwide are prioritizing regional manufacturing hubs to bolster supply chain security and lessen reliance on single geographic locations. This strategic shift is evident in Amkor Technology's significant capacity expansion in Vietnam, tripling its output, and its planned advanced packaging and test facility in Arizona, a move supported by government incentives.

These geographically diversified investments are crucial for mitigating supply chain disruptions, a lesson underscored by recent global events. For instance, the CHIPS and Science Act of 2022 allocated $52.7 billion to boost domestic semiconductor manufacturing, directly impacting companies like Amkor by encouraging onshoring and nearshoring efforts.

- Vietnam Expansion: Amkor Technology has tripled its manufacturing capacity in Vietnam, enhancing its regional footprint and operational flexibility.

- Arizona Facility: A new advanced packaging and test facility is planned for Arizona, leveraging government support and the need for a diversified US-based presence.

- Supply Chain Resilience: These initiatives directly address the growing global demand for more robust and geographically dispersed manufacturing capabilities.

- Government Support: The trend is fueled by government policies aimed at reshoring critical industries and strengthening domestic supply chains, as seen with US semiconductor initiatives.

Geopolitical tensions and national security concerns are reshaping the semiconductor landscape, prompting governments to invest heavily in domestic production. The US CHIPS and Science Act, with its significant funding, exemplifies this trend, directly benefiting companies like Amkor Technology through substantial grants, such as the up to $400 million earmarked for its Arizona facility. These initiatives aim to bolster national security by ensuring a reliable domestic supply of advanced packaging solutions.

Governments are also actively promoting regional manufacturing hubs to enhance supply chain security, leading Amkor to expand its capacity in Vietnam and plan a new facility in Arizona, supported by these incentives. This diversification strategy is crucial for mitigating disruptions, a lesson reinforced by global events and government policies like the CHIPS Act's $52.7 billion allocation to boost domestic semiconductor manufacturing.

| Initiative | Location | Government Support (Example) | Impact on Amkor |

|---|---|---|---|

| Domestic Semiconductor Manufacturing Boost | USA (Arizona) | CHIPS Act (up to $400M direct funding) | Expansion of advanced packaging and test capabilities, enhanced US presence. |

| Regional Hub Development | Vietnam | N/A (Strategic business decision) | Tripled manufacturing capacity, improved operational flexibility and regional footprint. |

| Supply Chain Resilience Focus | Global | Various national policies | Reduced reliance on single geographic locations, mitigated risk of disruptions. |

What is included in the product

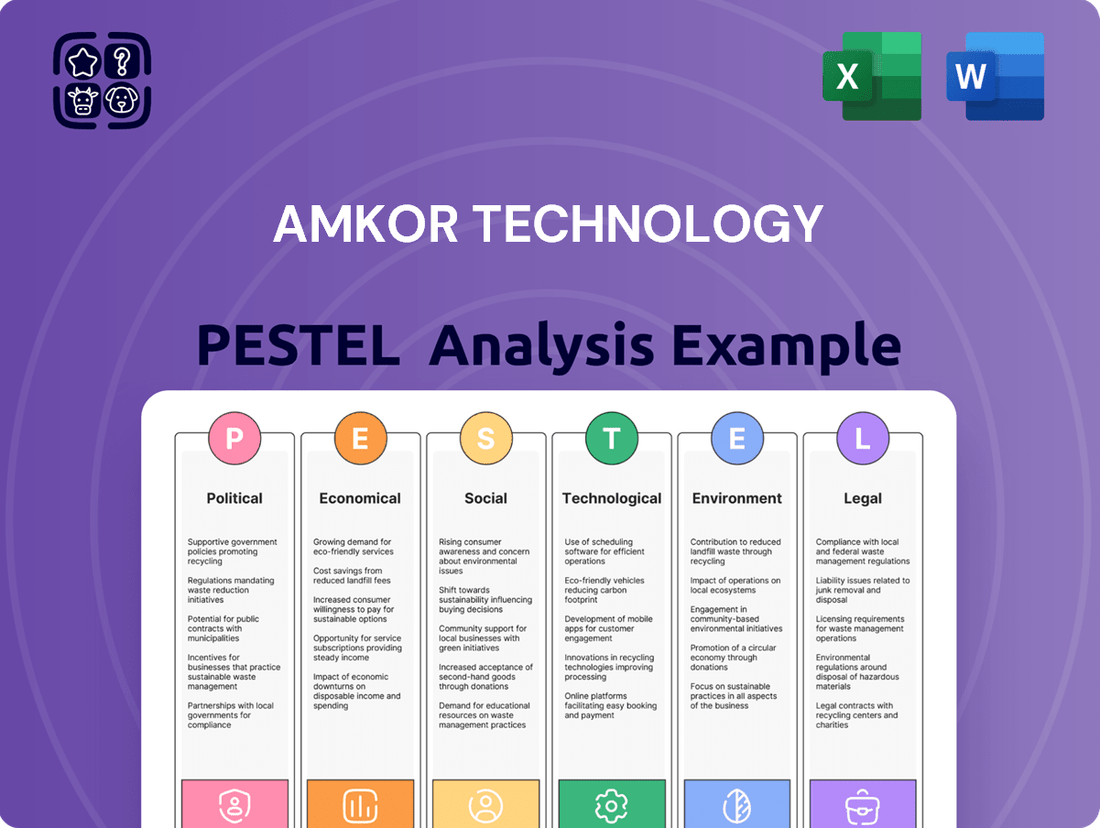

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Amkor Technology across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within Amkor's operating landscape.

A PESTLE analysis for Amkor Technology offers a clear and concise overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

The global semiconductor market is on a robust growth trajectory, fueled by escalating demand across critical sectors like high-performance computing (HPC), artificial intelligence (AI), automotive, and consumer electronics. This expansion directly benefits Amkor Technology by increasing the need for its specialized package design, assembly, and test solutions.

Industry projections indicate the semiconductor market will achieve unprecedented revenue figures in 2025, creating a favorable environment for Outsourced Semiconductor Assembly and Test (OSAT) companies like Amkor. For instance, industry analysts forecast the global semiconductor market to reach approximately $700 billion in 2025, a significant jump from recent years.

The Outsourced Semiconductor Assembly and Test (OSAT) market, a crucial sector where Amkor Technology holds a significant position, is on a trajectory for substantial expansion. This growth is primarily propelled by ongoing technological innovations in semiconductor packaging and testing methodologies.

Demand for sophisticated semiconductor devices is surging, particularly for applications in 5G networks, the Internet of Things (IoT), artificial intelligence (AI), and the rapidly evolving automotive electronics sector. This increased demand directly translates into a higher need for specialized OSAT services, creating a favorable environment for companies like Amkor.

Amkor's strategic role as a manufacturing partner positions it to effectively leverage this expanding market. For instance, the global OSAT market was valued at approximately $25 billion in 2023 and is projected to reach over $40 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 10% during this period.

The semiconductor industry, including Amkor Technology, has been navigating significant supply chain dynamics and inventory corrections. While pandemic-induced shortages have largely subsided, some sectors experienced a surplus of chips in 2023 and early 2024, creating market instability and dampening order growth for manufacturers like Amkor.

Amkor, as a leading OSAT (Outsourced Semiconductor Assembly and Test) provider, actively manages its inventory levels in response to these shifts. This proactive approach is crucial for adapting to fluctuating customer demand across diverse end markets, ensuring operational efficiency and financial resilience amidst these cyclical industry trends.

Capital Expenditures and Investment

Amkor Technology is actively investing in its future, with substantial capital expenditures aimed at boosting operational capacity and technological advancement. A prime example is the significant investment in its Vietnam facility, which is slated to triple its production capacity. This expansion is key to meeting anticipated demand in rapidly growing markets.

Further underscoring this commitment, Amkor is establishing a new manufacturing site in Arizona. These strategic capital outlays are designed to solidify Amkor's competitive edge and prepare it for future market opportunities.

- Vietnam Expansion: Amkor plans to triple capacity at its Vietnam factory, a significant investment to meet growing demand.

- Arizona Facility: Construction of a new plant in Arizona highlights Amkor's commitment to expanding its US presence and technological capabilities.

- Market Focus: These investments are strategically aligned with capturing growth in high-demand sectors like advanced packaging for semiconductors.

- Competitive Positioning: Enhanced operational capabilities through these capital expenditures are crucial for maintaining and improving Amkor's standing in the competitive semiconductor packaging industry.

Pricing Pressures and Cost Efficiency

Amkor Technology, like many in the Outsourced Semiconductor Assembly and Test (OSAT) sector, faces significant pricing pressures. This is particularly acute in competitive markets such as China and Southeast Asia, where intense competition can directly impact revenue growth. For instance, reports from late 2024 indicated a general trend of price moderation across the OSAT industry due to overcapacity in certain segments.

To navigate these challenges and maintain profitability, Amkor's strategic imperative is to relentlessly pursue cost efficiency and operational optimization. This focus is crucial for staying competitive. The value proposition for chipmakers outsourcing to OSAT providers like Amkor hinges on achieving cost efficiencies and maintaining scalability, especially as the semiconductor industry experiences volatility in demand throughout 2024 and into 2025.

- Intensified Pricing Pressure: OSAT providers are experiencing heightened price competition, especially from manufacturers in China and Southeast Asia, impacting revenue potential.

- Cost Efficiency Imperative: Amkor must prioritize optimizing its operational costs to remain competitive in a market sensitive to pricing.

- Scalability and Cost Savings: Chipmakers rely on OSAT partners for cost-effective scaling and manufacturing, a critical factor given fluctuating semiconductor demand in 2024-2025.

Economic factors present a mixed but generally positive outlook for Amkor Technology. The global semiconductor market is projected for substantial growth, with forecasts indicating revenues could approach $700 billion in 2025, creating a strong demand for OSAT services. However, the industry has experienced inventory corrections and price pressures, particularly from Asian competitors, necessitating a focus on cost efficiency.

| Factor | Trend | Impact on Amkor |

|---|---|---|

| Global Semiconductor Market Growth | Projected to reach ~$700 billion in 2025 | Increased demand for Amkor's OSAT services |

| OSAT Market Growth | Projected to exceed $40 billion by 2028 (10% CAGR) | Favorable expansion opportunities for Amkor |

| Pricing Pressures | Intensified competition, especially from China/SEA | Requires cost optimization and value-added services |

| Inventory Corrections | Surpluses in some segments during 2023-2024 | Requires agile inventory management and demand forecasting |

Preview the Actual Deliverable

Amkor Technology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Amkor Technology delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

You'll gain a clear understanding of the external forces shaping Amkor Technology's industry landscape, presented in the same detailed format you see now.

Sociological factors

The semiconductor industry, vital for Amkor Technology, is grappling with a significant global talent shortage, particularly in engineering and technical positions. This scarcity is exacerbated by high employee turnover, an aging workforce, and a pipeline of new graduates that isn't keeping pace with demand.

For Amkor, this talent deficit directly impacts its ability to maintain operations and pursue growth, especially as it brings new facilities online. A report from the Semiconductor Industry Association in late 2023 highlighted that the industry needed to add approximately 70,000 new jobs in the US alone by 2030 to meet projected growth, underscoring the urgency of talent acquisition.

The semiconductor industry faces escalating labor costs driven by a heightened demand for specialized skills and increasing employee turnover. Companies like Amkor Technology must invest in competitive compensation and benefits packages to secure and keep valuable talent. For instance, Amkor's strategy in Vietnam, where attractive monthly incomes are a key component, highlights the importance of financial incentives in workforce management.

The semiconductor industry, like much of the tech sector, sees a strong demand for workplace flexibility and clear career progression paths. These are key drivers for retaining skilled employees. Companies that foster a culture of knowledge sharing and inclusivity are more successful in attracting and holding onto specialized talent. For Amkor, a global player, adapting to these shifting workforce expectations is crucial for maintaining a competitive edge.

Consumer Demand Trends

Consumer demand is a powerful force shaping the semiconductor industry, directly impacting companies like Amkor Technology. As people increasingly embrace new technologies, the need for the sophisticated components that power them grows. This shift is evident in the booming markets for 5G-enabled devices, smart home gadgets, and electric vehicles, all of which rely heavily on advanced semiconductor packaging.

The widespread adoption of 5G, for instance, is a significant driver. By the end of 2024, it's projected that over 40% of global mobile connections will be on 5G networks, creating a massive demand for the specialized chips that facilitate these faster speeds. Similarly, the Internet of Things (IoT) continues its rapid expansion, with estimates suggesting over 29 billion connected devices by 2024, each requiring semiconductor solutions.

Amkor is well-positioned to capitalize on these trends. The company's expertise in advanced packaging is crucial for meeting the performance and miniaturization demands of these growing sectors. The electric vehicle market, projected to reach over 14 million sales globally in 2024, also presents a substantial opportunity, as these vehicles require numerous power management and sensor chips.

- 5G Adoption: Over 40% of global mobile connections expected to be 5G by end of 2024.

- IoT Growth: Projections indicate over 29 billion connected IoT devices by 2024.

- Electric Vehicles: Global EV sales anticipated to exceed 14 million units in 2024.

- AI Devices: Increasing demand for AI-enabled smartphones and other consumer electronics.

Local Community Impact

Amkor Technology's manufacturing presence significantly shapes local communities by generating employment and stimulating economic growth. Its operations, like the Vietnam facility which employs over a thousand local workers and is slated for further expansion, are key drivers of regional development.

These substantial operations not only boost local economies but also lead to improvements in infrastructure and foster crucial partnerships with regional stakeholders, integrating Amkor into the fabric of the community.

- Job Creation: Amkor's facilities, such as the Vietnam plant with over 1,000 local employees, directly contribute to employment opportunities.

- Economic Development: The company's expansion plans signal continued investment, promising further economic uplift for surrounding areas.

- Stakeholder Relations: Large-scale operations necessitate and foster strong relationships with local governments and community leaders.

Societal expectations regarding corporate social responsibility are increasingly influencing business operations. Consumers and employees alike are prioritizing companies that demonstrate ethical practices and contribute positively to society. Amkor Technology, by focusing on its workforce development and community engagement, aligns with these growing expectations.

The semiconductor industry, including Amkor, faces scrutiny regarding its environmental impact. Growing awareness of climate change and resource depletion pressures companies to adopt sustainable manufacturing processes and reduce their carbon footprint. This societal trend is pushing for greater transparency and accountability in environmental stewardship.

The demand for diversity and inclusion within the workplace is a significant sociological factor. Companies are expected to foster equitable environments that reflect the broader population. Amkor's commitment to creating a positive and inclusive work culture is essential for attracting and retaining a diverse talent pool in the competitive semiconductor sector.

The global semiconductor talent pool is a critical sociological consideration. The industry grapples with a significant shortage of skilled engineers and technicians, a situation exacerbated by an aging workforce and insufficient new talent entering the field. For instance, the Semiconductor Industry Association projected a need for approximately 70,000 new jobs in the US alone by 2030, highlighting the intense competition for qualified personnel.

Technological factors

Advanced packaging innovations like 2.5D/3D ICs, System-in-Package (SiP), and flip-chip are crucial for boosting semiconductor performance and shrinking device sizes. Amkor Technology is at the forefront of developing and bringing these advanced packaging and testing solutions to market, which are vital for the latest electronic gadgets.

These technologies enable greater integration of components and better heat dissipation, allowing for more powerful and compact devices. For instance, Amkor's continued investment in these areas supports the demand for high-performance computing and advanced mobile applications, areas that saw significant growth in 2024 and are projected to expand further in 2025.

The insatiable appetite for artificial intelligence and high-performance computing is a significant tailwind for semiconductor manufacturers like Amkor Technology. These advanced applications demand specialized, high-density chips, directly fueling growth in the advanced packaging sector. Amkor is strategically positioned to capitalize on this, offering solutions that enhance compute capabilities and power efficiency, crucial for AI and HPC advancements.

The relentless drive for smaller, more powerful electronics is a huge tailwind for companies like Amkor. Think about your smartphone; it’s packed with incredible technology, and that’s only possible because of advanced packaging that allows all those tiny components to fit and work together reliably. This trend is only accelerating, especially in the booming consumer electronics market.

Amkor's expertise in advanced packaging is crucial here. They provide the solutions that let integrated circuits, the brains of these devices, be housed in incredibly compact and efficient packages. This means we get thinner phones, smarter wearables, and a whole new generation of Internet of Things (IoT) gadgets that are both powerful and small enough to be truly useful. For instance, the global semiconductor packaging market was valued at approximately $25 billion in 2023 and is projected to grow significantly, driven by these miniaturization trends.

Automation and Robotics in Manufacturing

The semiconductor industry is grappling with a significant talent shortage, which is accelerating the adoption of automation and robotics in manufacturing. These advanced technologies are crucial for boosting efficiency, enhancing product yields, and mitigating the impact of workforce gaps. For instance, the International Federation of Robotics reported that in 2023, robot installations in the electronics sector saw a substantial increase, reflecting this trend. Amkor Technology, as a leading Outsourced Semiconductor Assembly and Test (OSAT) provider, is likely making strategic investments in these automated solutions to optimize its production processes and drive down operational expenses.

This technological shift offers several key advantages for companies like Amkor:

- Increased Throughput: Automation can significantly speed up assembly and testing cycles, allowing for higher production volumes.

- Improved Precision and Quality: Robotic systems offer greater accuracy and consistency compared to manual labor, leading to fewer defects and higher-quality finished products.

- Workforce Augmentation: Robotics can handle repetitive, physically demanding, or hazardous tasks, freeing up human workers for more complex roles and addressing labor scarcity.

- Cost Reduction: While initial investment can be high, the long-term benefits include reduced labor costs, minimized material waste, and improved overall operational efficiency.

Research and Development Investments

Continued investment in research and development is crucial for Amkor Technology to stay ahead in the fast-paced semiconductor sector. This commitment to innovation is evident in their focus on advanced packaging and test technologies.

The CHIPS Act, enacted in 2022, is a significant technological factor, dedicating substantial funding to semiconductor R&D and workforce development. For example, the act authorized over $52 billion in subsidies and tax credits for domestic semiconductor manufacturing and research. This legislative push creates opportunities and intensifies the need for cutting-edge solutions.

Amkor's strategic investments in R&D are designed to capitalize on these trends. Their efforts are directed towards developing and commercializing next-generation packaging solutions, which are essential for enabling higher performance and greater functionality in advanced electronics.

- Semiconductor R&D Funding: The CHIPS Act provides over $52 billion for domestic semiconductor research and manufacturing, fostering innovation.

- Amkor's Focus: The company prioritizes developing and commercializing advanced packaging and test technologies.

- Industry Evolution: Continuous R&D is vital for maintaining a competitive edge in the rapidly changing semiconductor landscape.

The relentless demand for AI and high-performance computing is a major driver for advanced semiconductor packaging, a core area for Amkor Technology. These applications require specialized, high-density chips, directly boosting the need for Amkor's solutions that enhance compute capabilities and power efficiency. The global semiconductor packaging market is projected for significant growth, fueled by these technological advancements.

Automation and robotics are increasingly vital in semiconductor manufacturing due to talent shortages, aiming to boost efficiency and product yields. Amkor, as a leading OSAT provider, is likely investing in these technologies to optimize production and manage operational costs, mirroring the trend of increased robot installations in the electronics sector observed in 2023.

The CHIPS Act, with its over $52 billion allocation for semiconductor R&D and manufacturing, is a critical technological factor creating opportunities and driving innovation. Amkor's strategic R&D investments are geared towards next-generation packaging solutions to meet this evolving landscape.

Legal factors

The U.S. CHIPS and Science Act, enacted in 2022 with $52.7 billion in funding, imposes strict conditions on recipients. A key regulation prohibits expanding semiconductor manufacturing capacity in countries identified as national security risks, notably China. Amkor Technology, having secured CHIPS Act funding for its Arizona expansion, must meticulously adhere to these limitations.

Compliance with these CHIPS Act provisions directly impacts Amkor's global operational strategy. This means carefully navigating investments and partnerships to avoid violating the act's restrictions on expanding advanced semiconductor manufacturing in designated nations, thereby shaping its international business development plans.

Governments worldwide are tightening export controls on advanced semiconductor technologies, a trend that directly impacts Amkor Technology's market reach and revenue potential. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has progressively expanded its entity list and implemented stringent licensing requirements for exports to certain countries, affecting the availability of critical manufacturing equipment and materials. This regulatory environment necessitates careful navigation of international trade policies, potentially causing supply chain disruptions and increased operational costs as Amkor seeks alternative sourcing or markets.

Intellectual property (IP) is the lifeblood of the semiconductor sector. Amkor Technology, a leader in advanced semiconductor packaging and test services, heavily depends on its proprietary technologies. Safeguarding this IP is critical, especially given global trends towards technology nationalization and the rise of new competitors. Amkor's strategy involves leveraging strong legal frameworks and forming strategic alliances to protect its innovations and maintain its edge in a rapidly evolving market.

Environmental Regulations

Environmental regulations are significantly shaping the semiconductor industry, and Amkor Technology is no exception. The manufacturing of semiconductors is known for its heavy reliance on resources like water and energy, placing companies under increasing scrutiny to adopt more sustainable practices. This pressure is translating into new legislation globally.

For instance, the European Union is implementing stricter water usage limits and mandating the adoption of water recycling technologies. In the United States, the CHIPS and Science Act of 2022 includes sustainability provisions that encourage environmentally conscious manufacturing processes. Amkor, with its operations spanning multiple continents, must navigate and comply with these diverse and evolving environmental standards to maintain its license to operate and its reputation.

- Stricter Water Management: Amkor must invest in advanced water treatment and recycling systems to meet tightening regulations, particularly in water-scarce regions.

- Energy Efficiency Mandates: Compliance with energy efficiency standards and potential carbon pricing mechanisms will require upgrades to manufacturing facilities and processes.

- Chemical Handling and Disposal: Adherence to stringent rules regarding the safe handling, storage, and disposal of hazardous chemicals used in semiconductor fabrication is critical.

- Sustainability Reporting: Growing expectations for transparent reporting on environmental impact, including greenhouse gas emissions and waste reduction, will necessitate robust data collection and disclosure frameworks.

Labor Laws and Employment Regulations

Amkor Technology's global operations necessitate strict adherence to varied labor laws and employment regulations across its international sites. These regulations dictate crucial aspects like minimum wages, working hours, safety standards, and employee benefits, all of which directly impact operational costs and workforce management. For instance, in 2024, countries like Germany continued to enforce robust worker protections, while regions in Asia might have different compliance landscapes, requiring tailored HR strategies.

Navigating these diverse legal frameworks is paramount for Amkor. Failure to comply can lead to significant penalties, operational disruptions, and damage to the company's reputation. With ongoing investments in factory expansions and a strategic emphasis on retaining skilled talent, understanding and proactively managing these labor laws is a key operational imperative for Amkor Technology in 2024 and beyond.

- Compliance with minimum wage laws: Amkor must ensure its compensation practices align with the statutory minimums in all operating countries, which can vary significantly.

- Adherence to working condition standards: This includes regulations on work hours, overtime, rest periods, and workplace safety, crucial for employee well-being and productivity.

- Respect for employee rights: Amkor is bound by laws concerning collective bargaining, non-discrimination, and fair termination procedures in each jurisdiction.

- Impact of labor law changes: Anticipating and adapting to evolving labor legislation, such as potential increases in minimum wages or new worker protections, is vital for strategic planning.

The U.S. CHIPS and Science Act of 2022, with its $52.7 billion allocation, imposes significant restrictions on recipients, including a ban on expanding advanced semiconductor manufacturing in nations deemed national security risks, such as China. Amkor Technology, having secured funding for its Arizona facility, must strictly adhere to these stipulations, impacting its global expansion strategies and partnerships.

Governmental export controls on advanced semiconductor technologies are intensifying globally, directly affecting Amkor's market access and revenue. The U.S. Department of Commerce's Bureau of Industry and Security (BIS) has expanded its entity list and tightened licensing, potentially disrupting supply chains and increasing operational costs for Amkor as it navigates international trade policies and seeks alternative sourcing.

Amkor's reliance on intellectual property is substantial, necessitating robust legal protection against technology nationalization trends and new competitors. The company's strategy involves leveraging legal frameworks and alliances to safeguard its innovations, crucial for maintaining its competitive edge in the dynamic semiconductor packaging and testing sector.

Amkor Technology must navigate a complex web of labor laws across its international operations, impacting wages, working hours, safety, and benefits. For example, in 2024, Germany maintained strong worker protections, while Asian regions presented different compliance challenges, requiring tailored HR strategies to avoid penalties and operational disruptions.

Environmental factors

The semiconductor sector, including Amkor Technology's operations, is a major energy consumer, contributing significantly to global carbon emissions. The industry's annual CO2e output is substantial, estimated at around 500 million metric tons.

As a key player in the OSAT (outsourced semiconductor assembly and test) space, Amkor is increasingly scrutinized for its environmental impact. This pressure necessitates a focus on reducing energy consumption and actively participating in the semiconductor industry's broader decarbonization initiatives.

Water scarcity presents a significant environmental challenge for the semiconductor industry, a sector that demands vast quantities of ultra-pure water for its manufacturing processes. This reality is pushing companies to prioritize water conservation, exploring advanced recycling technologies and aiming for net-positive water usage. Amkor Technology, operating multiple manufacturing sites, directly faces these environmental pressures and the regulatory frameworks designed to minimize its water footprint.

Semiconductor manufacturing, including Amkor's operations, inherently produces diverse waste streams. The industry is actively pursuing waste reduction and circular economy principles, with many aiming for zero waste to landfill by 2030. For instance, Intel reported a 34% reduction in hazardous waste generation between 2019 and 2022, showcasing a tangible industry shift.

Amkor must embed robust, sustainable waste management practices throughout its production lifecycle. This includes exploring innovative recycling methods for materials like silicon, metals, and plastics, and partnering with specialized waste management firms to maximize resource recovery and minimize environmental impact.

Supply Chain Sustainability

Supply chain sustainability is a critical environmental factor for Amkor Technology. A significant portion of the semiconductor industry's environmental footprint stems from its vast supply chain, encompassing everything from raw material extraction to the logistics of transporting components globally. For instance, the energy-intensive nature of semiconductor manufacturing, coupled with the global movement of goods, contributes substantially to greenhouse gas emissions. Amkor's extensive international operations mean managing this complex web of suppliers and transportation routes with a keen eye on environmental impact.

There's a pronounced and increasing demand for sustainability across the entire semiconductor value chain. This includes ensuring responsible mining practices for essential minerals and the ethical sourcing of all materials used in chip packaging and testing. Companies are increasingly scrutinized for their environmental, social, and governance (ESG) performance, directly impacting investor confidence and market access. For example, in 2024, many major semiconductor companies are setting ambitious net-zero targets, which will cascade down to their supply chain partners like Amkor.

Amkor's global footprint, with facilities in numerous countries, underscores the necessity of a robust and sustainable supply chain management strategy. This involves not only reducing direct emissions but also collaborating with suppliers to improve their environmental performance. Key areas of focus include reducing waste, optimizing energy consumption in logistics, and promoting circular economy principles within the supply chain. The company's commitment to these principles is becoming a competitive differentiator in the market.

- Emissions Source: The semiconductor supply chain, including material sourcing and transportation, is a major contributor to industry emissions.

- Growing Emphasis: There is a significant push for sustainability throughout the value chain, from responsible mining to ethical material sourcing.

- Global Operations: Amkor's worldwide presence necessitates a strong focus on managing its supply chain sustainably.

- Investor Scrutiny: ESG performance, including supply chain practices, is increasingly important for investor confidence and market positioning in 2024-2025.

Renewable Energy Adoption

The semiconductor industry, including companies like Amkor Technology, is actively pursuing a shift towards renewable energy to meet sustainability objectives. Many firms are setting ambitious goals to power their manufacturing sites entirely with clean energy sources, often through direct power purchase agreements.

This trend is driven by increasing environmental regulations and stakeholder pressure. For instance, the Semiconductor Industry Association (SIA) has highlighted the importance of decarbonization, with member companies aiming for significant reductions in greenhouse gas emissions by 2030 and beyond. Amkor is expected to align with these industry-wide initiatives by integrating more renewable energy into its operations.

The adoption of renewable energy is critical for reducing the carbon footprint associated with energy-intensive semiconductor manufacturing. By investing in or contracting for renewable sources such as solar and wind power, Amkor can mitigate its environmental impact and enhance its corporate social responsibility profile. This transition is supported by growing global investments in renewable energy infrastructure, making it increasingly feasible for large industrial consumers to secure clean power.

Amkor Technology, like others in the semiconductor sector, faces increasing pressure to adopt sustainable practices, particularly concerning energy consumption and waste management. The industry's substantial carbon footprint, estimated at around 500 million metric tons of CO2e annually, necessitates a proactive approach to decarbonization. Water scarcity is another critical environmental concern, pushing companies to invest in water conservation and recycling technologies, a challenge Amkor directly addresses across its global facilities.

PESTLE Analysis Data Sources

Our Amkor Technology PESTLE Analysis is built on a robust foundation of data, drawing from official government reports, leading economic indicators, and reputable industry publications. We meticulously gather information on political stability, economic forecasts, technological advancements, environmental regulations, and social trends to provide comprehensive insights.