Amkor Technology Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

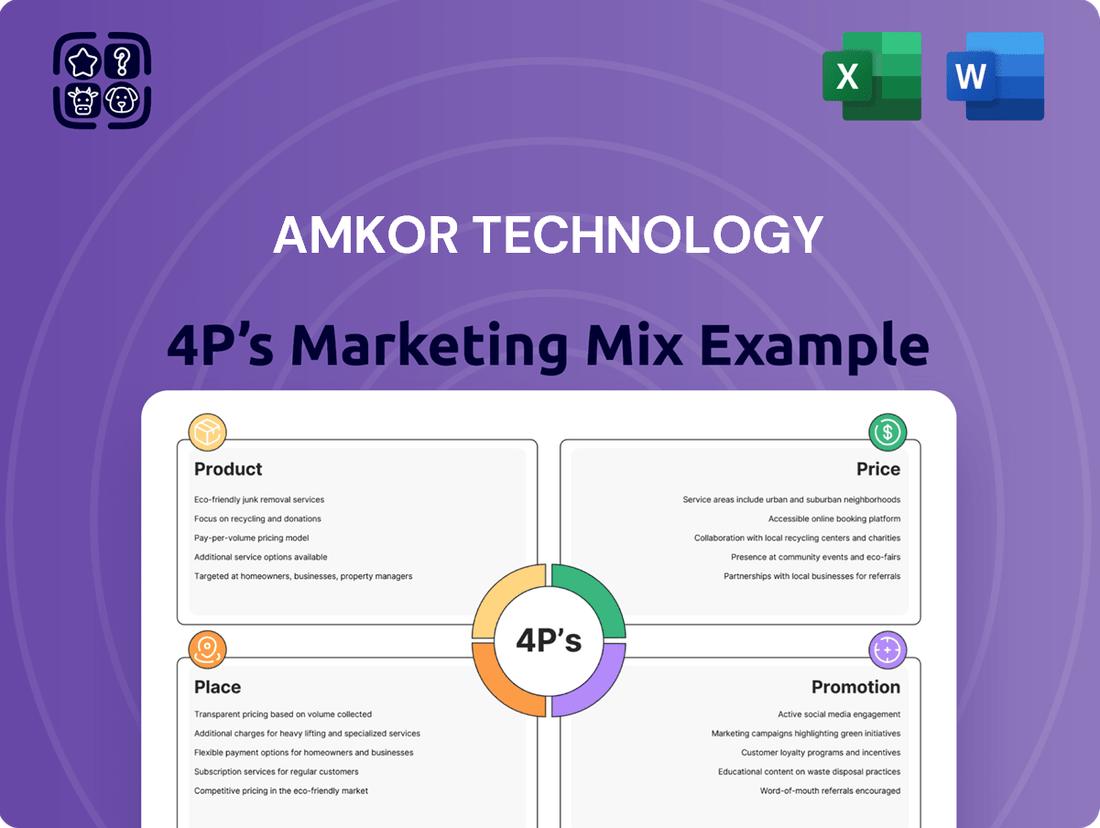

Amkor Technology's marketing success is built on a robust 4Ps strategy, from their innovative product offerings to their strategic pricing and distribution channels. This analysis delves into how they effectively promote their advanced packaging solutions to a global clientele.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Amkor Technology's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the semiconductor packaging industry.

Product

Amkor Technology's Advanced Semiconductor Packaging & Test Services are the core of their Product offering, providing essential outsourced semiconductor assembly and test (OSAT) solutions. These services are crucial for the electronics industry, allowing chip manufacturers to focus on innovation rather than the complexities of physical production and quality assurance. Amkor's comprehensive approach covers everything from initial package design and intricate assembly to demanding testing procedures, delivering complete, ready-to-deploy components.

Amkor Technology's comprehensive turnkey solutions represent a significant aspect of their Product strategy. They offer a complete suite of back-end manufacturing services for integrated circuits, encompassing everything from wafer bumping and probing to package assembly and final testing.

This end-to-end approach streamlines the supply chain for their clients, ensuring a seamless and high-quality manufacturing process. For instance, Amkor's advanced packaging technologies, crucial for high-performance computing and advanced automotive applications, are delivered through these integrated solutions. In 2024, the demand for advanced packaging, a core component of Amkor's turnkey offerings, continued to surge, driven by AI and 5G deployments, with the global advanced packaging market projected to reach over $70 billion by 2025.

Amkor Technology strategically targets high-growth sectors like communications, consumer electronics, automotive, and industrial applications, serving a broad global clientele.

In 2024, Amkor saw significant traction in the computing segment, driven by the rise of ARM-based personal computers and artificial intelligence-enabled devices. The company also reported robust growth in its advanced System-in-Package (SiP) revenue streams.

This deliberate focus on burgeoning markets directly supports Amkor's growth trajectory by aligning its offerings with dominant industry shifts and technological advancements.

Continuous Innovation in Packaging Technologies

Amkor Technology’s product strategy centers on continuous innovation in advanced packaging technologies, positioning them as a leader in the semiconductor industry. They consistently invest heavily in research and development to deliver next-generation solutions. This commitment is evident in their focus on sophisticated offerings like 2.5D/3D packaging, High-Density Fan-Out (HDFO), advanced flip chip, and System-in-Package (SiP) technologies.

These cutting-edge packaging solutions are critical enablers for demanding applications, particularly in the rapidly growing fields of high-performance computing (HPC) and artificial intelligence (AI). For instance, Amkor’s HDFO technology is instrumental in enabling smaller, more powerful chips for AI accelerators. In 2024, the advanced packaging market, driven by these innovations, was projected to reach over $50 billion, with Amkor holding a significant share.

- 2.5D/3D Packaging: Enabling chiplets and higher integration for HPC and AI.

- High-Density Fan-Out (HDFO): Facilitating miniaturization and improved electrical performance.

- Advanced Flip Chip: Supporting higher pin counts and thermal management for complex designs.

- System-in-Package (SiP): Integrating multiple functionalities into a single package for greater efficiency.

Strategic Partnerships for Technology Development

Amkor Technology strategically leverages its partnerships to drive innovation in semiconductor packaging. The company actively collaborates with industry leaders and technology partners, fostering the development of next-generation packaging designs and cutting-edge advancements. These alliances are crucial for staying ahead in the rapidly evolving semiconductor market.

Key alliances include collaborations with major foundries and semiconductor manufacturers such as TSMC and Infineon Technologies. For instance, in 2024, Amkor announced a joint development program with a leading foundry to advance wafer-level fan-out packaging technologies, aiming for higher density and improved thermal performance. Such collaborations are vital for Amkor to integrate new materials and manufacturing processes, ensuring its offerings meet the demands of advanced chip architectures.

These strategic partnerships reinforce Amkor's competitive position. By working closely with key players, Amkor gains early access to new semiconductor technologies and market trends. This collaborative approach allows Amkor to co-develop solutions tailored to the specific needs of its partners, solidifying its role as a critical enabler in the semiconductor supply chain.

- Collaboration with TSMC: Amkor's ongoing work with TSMC focuses on developing advanced packaging solutions for high-performance computing and AI applications, leveraging TSMC's leading-edge process nodes.

- Infineon Technologies Alliance: Partnerships with Infineon often target automotive and industrial semiconductor packaging, emphasizing reliability and advanced thermal management.

- Next-Generation Technology Development: Amkor's R&D investments, bolstered by partner contributions, aim to address future market needs for miniaturization, power efficiency, and increased functionality in semiconductor packaging.

Amkor Technology's product portfolio centers on advanced semiconductor packaging and test services, offering essential outsourced assembly and test (OSAT) solutions that are critical for chip manufacturers. Their comprehensive approach spans package design, assembly, and testing, delivering ready-to-deploy components. The company's strategic focus on advanced packaging technologies like 2.5D/3D, HDFO, and SiP directly addresses the surging demand in high-growth sectors such as AI and high-performance computing.

Amkor's product strategy is deeply intertwined with its commitment to innovation, evidenced by significant R&D investments in cutting-edge packaging solutions. These offerings are vital for enabling smaller, more powerful chips, particularly for AI accelerators and advanced computing. The global advanced packaging market, projected to exceed $70 billion by 2025, highlights the critical nature of Amkor's product development in driving industry advancements.

In 2024, Amkor experienced robust growth, particularly in the computing segment driven by AI and ARM-based PCs, and saw strong performance in its advanced SiP revenue. This growth underscores the market's increasing reliance on Amkor's specialized packaging expertise to meet the demands of next-generation electronics.

| Product Focus | Key Technologies | Target Markets | 2024/2025 Market Drivers | Amkor's Strategic Position |

| Advanced Semiconductor Packaging & Test Services | 2.5D/3D, HDFO, Advanced Flip Chip, SiP | Communications, Consumer Electronics, Automotive, Industrial, High-Performance Computing (HPC), Artificial Intelligence (AI) | AI adoption, 5G deployment, IoT growth, Automotive electrification | Leading OSAT provider, enabling advanced chip architectures |

| Turnkey Solutions | Wafer bumping, probing, package assembly, final testing | Broad semiconductor industry | Supply chain simplification, quality assurance | End-to-end manufacturing efficiency |

| Continuous Innovation | Next-generation packaging R&D | Future semiconductor needs | Miniaturization, power efficiency, increased functionality | Key R&D investments and partnerships |

What is included in the product

This analysis delves into Amkor Technology's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their marketing positioning within the semiconductor packaging industry.

It provides a grounded view of Amkor's marketing approach, using actual brand practices and competitive context to inform its strategic implications.

Streamlines Amkor Technology's marketing strategy by clearly defining how Product, Price, Place, and Promotion address customer needs, alleviating the pain of complex market positioning.

Place

Amkor Technology boasts a strategic global manufacturing footprint, crucial for its position in the semiconductor packaging and test industry. This network includes numerous production facilities, R&D hubs, and sales offices strategically located in Asia, Europe, and the United States, enabling proximity to key customers and markets.

This extensive geographical spread is vital for navigating complex global supply chains and ensuring timely delivery to a diverse clientele. For instance, Amkor's significant presence in Asia, a major hub for electronics manufacturing, allows for efficient production and access to a skilled workforce.

As of the first quarter of 2024, Amkor Technology reported revenue of $1.49 billion, underscoring the scale of operations supported by its global infrastructure. This widespread network is a core component of its ability to offer comprehensive solutions across the semiconductor value chain.

Amkor Technology is strategically expanding its global footprint to bolster production and supply chain robustness. A key development is the ramp-up of its new, advanced facility in Vietnam, which commenced operations in 2024. This move positions Amkor to leverage regional manufacturing advantages and meet growing demand.

Further enhancing its capabilities, Amkor is investing in a significant advanced packaging and test facility in Arizona, USA. This project, supported by government funding, underscores Amkor's commitment to onshore advanced manufacturing and diversification of its operational base, aiming to mitigate geopolitical risks and improve delivery times.

Amkor Technology's distribution strategy hinges on a direct sales approach, fostering close relationships with its global customer base, which includes major semiconductor firms and electronics original equipment manufacturers (OEMs). This direct engagement allows Amkor to deeply understand and cater to the unique technical and commercial requirements of each client.

Supporting this direct model is an extensive global network of sales offices. As of early 2024, Amkor operates in key markets across Asia, North America, and Europe, ensuring localized support and rapid response times for its international clientele. This geographical presence is crucial for providing tailored solutions and building strong, collaborative partnerships.

Integrated B2B Customer Support

Amkor Technology's commitment to its business clients is evident in its integrated B2B customer support. A dedicated global team ensures seamless operations, offering centralized monitoring and round-the-clock assistance. This focus on client convenience and efficiency is a cornerstone of their service offering.

The company's B2B architecture is designed for a fluid, real-time exchange of critical manufacturing data. This includes instant updates on lot status, transaction histories, and billing information, fostering transparency and streamlining client workflows. Such integration directly enhances operational efficiency for Amkor's partners.

Amkor's approach to B2B customer support directly impacts client retention and satisfaction. By providing robust, accessible, and data-rich communication channels, they build stronger partnerships. This infrastructure is crucial for managing complex supply chains in the semiconductor industry, where timely information is paramount.

- Global B2B Support: Centralized monitoring and 24/7 customer assistance for business clients.

- Real-time Data Exchange: Facilitates instant access to lot status, transactions, and billing details.

- Operational Efficiency: Maximizes convenience and streamlines processes for B2B partners.

- Client-Centric Approach: Enhances transparency and strengthens relationships through accessible information.

Proximity to Key Customers and Foundries

Amkor Technology strategically places its facilities near key customers and wafer fabrication plants to streamline operations. This proximity is crucial for efficient supply chain management and faster product delivery. For instance, Amkor's planned facility in Arizona is positioned to support chips manufactured at TSMC's nearby fabrication plant, benefiting shared clientele by reducing transit times and speeding up product development cycles.

This approach to 'Place' in Amkor's marketing mix is designed to capitalize on geographical advantages, ensuring that Amkor can effectively serve the semiconductor industry's demanding production schedules. By being close to both chip designers and manufacturers, Amkor minimizes logistical complexities and enhances its responsiveness to market needs.

- Proximity to TSMC Arizona Fab: Amkor's new Arizona facility is strategically located to leverage TSMC's significant investment in advanced chip manufacturing in the region, aiming to serve the burgeoning demand for advanced packaging solutions.

- Reduced Lead Times: Locating near major customers and foundries allows Amkor to cut down on shipping times and costs, directly impacting the speed at which finished semiconductor components reach their destinations.

- Enhanced Collaboration: Physical closeness facilitates closer collaboration with customers and foundry partners, enabling quicker problem-solving and more integrated development processes.

Amkor Technology's strategic placement of manufacturing and R&D facilities is central to its value proposition, ensuring proximity to major semiconductor hubs and key customers. This global network, with significant operations in Asia, Europe, and North America, facilitates efficient supply chain integration and rapid response times.

The company's recent investments, including its advanced facility in Vietnam operational since 2024 and its planned Arizona facility, highlight a commitment to expanding capacity and diversifying its operational base. This strategic positioning is designed to mitigate geopolitical risks and enhance delivery reliability.

Amkor's presence in Arizona, for example, is directly linked to supporting advanced chip manufacturing, such as TSMC's nearby fabrication plant, aiming to reduce lead times and foster closer collaboration with clients. This geographical strategy underpins its ability to meet the dynamic demands of the semiconductor industry.

| Location | Key Function | Strategic Advantage |

|---|---|---|

| Asia (e.g., Vietnam) | Advanced Packaging & Test | Access to skilled labor, cost efficiencies, proximity to major Asian electronics manufacturing |

| Arizona, USA | Advanced Packaging & Test | Onshoring capabilities, proximity to TSMC fab, mitigating geopolitical risks |

| Europe | Sales & Support, R&D | Localized customer engagement, market access for automotive and industrial sectors |

What You Preview Is What You Download

Amkor Technology 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Amkor Technology's 4P's Marketing Mix is fully complete and ready for your immediate use.

This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering a detailed breakdown of Amkor's strategies.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use, and providing valuable insights into Amkor Technology's market approach.

Promotion

Amkor Technology's promotional strategy heavily relies on a direct sales engagement model, fostering personalized relationships with semiconductor manufacturers and electronics Original Equipment Manufacturers (OEMs). This approach allows Amkor's sales teams to deeply understand the unique technical specifications and business needs of each client.

This direct interaction is paramount in the business-to-business semiconductor sector, where customized solutions and technical expertise are critical differentiators. By engaging directly, Amkor can tailor its advanced packaging and test services to meet specific performance, cost, and reliability requirements.

For instance, Amkor's sales force actively participates in client design reviews and technical discussions, a key element in securing long-term partnerships. This direct engagement was a significant factor in Amkor's reported revenue growth, with the company achieving approximately $6.4 billion in revenue for the fiscal year 2023, underscoring the effectiveness of its client-centric promotional efforts.

Amkor Technology effectively utilizes its corporate website and various online channels as key avenues for sharing product details and fostering customer engagement. This digital presence is crucial for disseminating information and interacting with its global customer base.

The importance of digital engagement continues to grow for Amkor. The company reported a significant 10% increase in website traffic during the first quarter of 2024, demonstrating successful efforts to enhance its online reach and attract more visitors seeking information.

Amkor Technology actively utilizes content marketing, publishing technical papers, whitepapers, and detailed case studies. These materials highlight their advanced semiconductor packaging and testing capabilities, positioning Amkor as a key innovator and thought leader within the industry.

This approach is vital for cultivating brand recognition and attracting potential clients in their niche market. For instance, Amkor's commitment to sharing technical insights directly supports their goal of being a go-to resource for complex packaging solutions, a strategy that has proven effective in a sector valuing deep technical expertise.

Industry Event Participation

Amkor Technology strategically leverages industry event participation as a key component of its marketing efforts. These events serve as vital touchpoints for engaging with customers, partners, and investors, reinforcing Amkor's market presence and technological capabilities. For instance, Amkor's presence at major semiconductor industry conferences in 2024 and early 2025 allows for direct dialogue and demonstration of their advanced packaging solutions.

These engagements are crucial for building relationships and identifying new business opportunities. Amkor's participation in investor conferences, such as those hosted by financial institutions in late 2024 and throughout 2025, directly supports its investor relations strategy, providing a platform to communicate financial performance and future outlook. This direct interaction helps to solidify Amkor's reputation as an industry leader.

The company's commitment to these events underscores its focus on visibility and market penetration. Specific examples of their engagement include:

- Participation in key semiconductor trade shows in Q4 2024 and Q1 2025 to showcase new packaging technologies.

- Presentations at investor conferences throughout 2024, with planned participation in early 2025 events, highlighting growth strategies.

- Hosting or attending customer-specific technical forums to deepen client relationships and address evolving needs.

- Engaging in panel discussions and speaking opportunities at industry summits to position Amkor as a thought leader in advanced packaging.

Strategic Alliances and Collaborations

Amkor Technology actively pursues strategic alliances and collaborations as a core promotional strategy within the competitive semiconductor landscape. These partnerships are crucial for driving innovation and expanding market reach for their advanced packaging solutions.

Key collaborations, such as those with industry giants like TSMC and Infineon Technologies, directly contribute to Amkor's top-line growth and bolster their market share in sophisticated packaging segments. For instance, Amkor's role in enabling TSMC's advanced chip technologies through specialized packaging solutions highlights the symbiotic nature of these relationships, directly impacting revenue streams.

These strategic alliances not only foster revenue growth but also significantly enhance Amkor's brand visibility and solidify its reputation as a premier Outsourced Semiconductor Assembly and Test (OSAT) provider. By working closely with leading foundries and chip manufacturers, Amkor reinforces its position as an indispensable partner in the semiconductor value chain.

- Partnership Impact: Collaborations with TSMC and Infineon are vital for Amkor's revenue growth and market share expansion in advanced packaging.

- Brand Enhancement: Alliances strengthen Amkor's brand presence and reinforce its standing as a leading OSAT provider.

- Innovation Driver: Strategic partnerships facilitate the co-development and deployment of next-generation packaging technologies.

Amkor Technology's promotion strategy is deeply rooted in direct client engagement and robust digital content. This dual approach effectively communicates their advanced packaging and testing capabilities to a discerning B2B audience.

The company's direct sales force actively participates in client technical discussions, a strategy that contributed to Amkor's $6.4 billion revenue in 2023. Furthermore, a 10% increase in website traffic during Q1 2024 highlights the growing importance of their online presence for information dissemination and customer interaction.

Amkor also leverages industry events and strategic alliances, such as those with TSMC and Infineon, to enhance brand visibility and drive innovation. These collaborations are crucial for market penetration and reinforcing Amkor's position as a leading OSAT provider.

| Promotional Tactic | Key Activities | Impact/Data Point |

|---|---|---|

| Direct Sales Engagement | Personalized client relationships, technical discussions, design reviews | Contributed to $6.4 billion revenue (FY2023) |

| Digital Marketing | Corporate website, content marketing (technical papers, case studies) | 10% website traffic increase (Q1 2024) |

| Industry Events | Trade shows, investor conferences, technical forums | Showcasing new technologies, reinforcing market presence (Q4 2024-2025) |

| Strategic Alliances | Collaborations with TSMC, Infineon | Revenue growth, market share expansion, brand enhancement |

Price

Amkor Technology employs value-based pricing for its specialized outsourced semiconductor assembly and test (OSAT) services. This approach directly links pricing to the significant value delivered to chip manufacturers, reflecting the advanced technological expertise and substantial capital investment required for their sophisticated solutions.

The pricing strategy acknowledges the escalating complexity and performance requirements of contemporary semiconductors. Amkor's advanced packaging solutions, crucial for enabling these high-performance chips, are priced to mirror the intricate engineering and manufacturing processes involved.

For instance, Amkor's advanced packaging technologies, such as Fan-Out Wafer Level Packaging (FOWLP) and 2.5D/3D integration, are critical for high-growth sectors like AI and 5G. These services command premium pricing due to their enabling role in next-generation chip performance. In 2024, the global OSAT market, where Amkor is a key player, was projected to reach over $50 billion, with advanced packaging being a significant growth driver, underscoring the value perception of these specialized services.

Amkor Technology navigates a fiercely competitive OSAT landscape where pricing is paramount. In 2023, the global OSAT market was valued at approximately $30 billion, with Amkor holding a significant share. To remain competitive, Amkor must offer cost-effective solutions, a crucial factor for clients increasingly reliant on outsourcing to manage expenses and focus on core competencies.

Balancing attractive pricing with profitability is a constant challenge. Amkor’s pricing must reflect the value delivered through advanced packaging technologies and reliable testing services. The company's ability to achieve economies of scale and optimize its supply chain directly impacts its pricing flexibility and ability to secure long-term contracts in this price-sensitive industry.

Amkor Technology's commitment to growth is evident in its significant capital expenditures. For the full year 2025, the company has planned capital investments of around $850 million. These investments are crucial for expanding their manufacturing facilities and enhancing advanced packaging technologies.

These substantial capital outlays are not just expenses; they are integral to Amkor's cost structure. By incorporating these investments into their pricing strategies, Amkor ensures that they can achieve a healthy return on investment and maintain financial stability over the long term.

Revenue Growth and Profitability Focus

Amkor Technology's financial strategy emphasizes robust revenue growth, consistently aiming to expand its top line. The company actively works to maintain healthy gross margins, which are crucial for overall profitability. For instance, in the first quarter of 2024, Amkor reported net sales of $1.37 billion, demonstrating significant market presence.

While net income can be influenced by external factors, Amkor's core objective remains profitability expansion. Their pricing strategies are carefully calibrated to not only capture market share but also to ensure sustainable financial returns. This approach is evident in their commitment to reinvesting in advanced manufacturing capabilities, supporting long-term value creation.

- Revenue Growth: Amkor reported net sales of $1.37 billion in Q1 2024, showcasing continued revenue generation.

- Gross Margin Focus: The company prioritizes maintaining strong gross margins to support profitability.

- Profitability Expansion: Amkor aims for consistent profitability growth despite market fluctuations.

- Strategic Pricing: Pricing is designed to balance market competitiveness with financial performance objectives.

Long-Term Contractual Agreements

Amkor Technology, operating in the business-to-business semiconductor packaging and testing sector, likely secures its market position through robust, long-term contractual agreements with key clients. These agreements are fundamental to ensuring supply chain stability and predictable revenue streams, given the critical nature of their services in the global electronics industry.

These contracts typically involve intricate pricing mechanisms, often tailored to specific customer volumes and the complexity of the packaging technologies employed. For instance, Amkor might offer tiered pricing based on annual shipment volumes, providing cost efficiencies for larger partners. Furthermore, pricing can be influenced by the advanced nature of the semiconductor packaging solutions, such as advanced leadframes or substrate-based packages, reflecting the R&D investment and specialized manufacturing capabilities required.

- Revenue from major customers: In the first quarter of 2024, Amkor reported that its top two customers accounted for approximately 36% of its total net sales, highlighting the importance of these long-term relationships.

- Contractual stability: These long-term agreements provide a degree of revenue visibility, crucial for capital-intensive industries like semiconductor manufacturing.

- Strategic partnerships: Beyond pricing, contracts often define service level agreements (SLAs), intellectual property protection, and joint development initiatives, fostering deep strategic alliances.

- Pricing flexibility: Negotiated terms can include clauses for price adjustments based on raw material costs or significant technological shifts, ensuring mutual benefit and long-term viability.

Amkor Technology's pricing strategy is deeply intertwined with its value proposition, focusing on premium pricing for advanced packaging solutions that enable high-performance semiconductors. This is evident in their significant planned capital expenditures for 2025, totaling around $850 million, which directly impacts their cost structure and pricing flexibility.

The company balances competitive pricing in the $30 billion OSAT market (2023 estimate) with the need to maintain healthy gross margins, as demonstrated by $1.37 billion in net sales for Q1 2024. Their pricing is also shaped by long-term contractual agreements with major clients, who accounted for 36% of Q1 2024 net sales, often featuring tailored pricing mechanisms and volume-based tiers.

| Key Pricing Considerations | 2023 OSAT Market Value | Q1 2024 Net Sales | 2025 Capital Expenditure Plan | Top Customer Revenue Share (Q1 2024) |

| Value-Based Pricing for Advanced Packaging | ~$30 Billion | $1.37 Billion | ~$850 Million | ~36% |

4P's Marketing Mix Analysis Data Sources

Our Amkor Technology 4P's Marketing Mix Analysis is constructed using a blend of official company disclosures, including SEC filings and investor presentations, alongside in-depth industry reports and competitive intelligence. We also leverage Amkor's official website and press releases to capture their product strategies, pricing structures, distribution networks, and promotional activities.