Amkor Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

Amkor Technology's position within the BCG Matrix is crucial for understanding its product portfolio's health and future potential. Discover which of their offerings are leading the market, which are generating consistent revenue, and which require careful consideration for resource allocation.

Unlock the complete Amkor Technology BCG Matrix to gain a comprehensive view of their strategic landscape, complete with actionable insights and data-driven recommendations. This detailed analysis will equip you to make informed decisions about investment and product development. Purchase the full report today for a clear roadmap to optimizing Amkor's market performance.

Stars

Amkor's advanced packaging, including 2.5D/3D integration and high-density fan-out (HDFO), is essential for AI and HPC. These technologies enable the complex chip architectures required for demanding computational tasks. For instance, HDFO allows for more transistors in a smaller space, directly benefiting AI processors.

The market for AI and HPC is experiencing significant expansion, with the AI chip market alone projected to reach over $100 billion by 2027. Amkor's focus on these high-growth segments positions it as a crucial supplier, facilitating the performance gains needed in these sectors.

Amkor's strategic investments, such as its new facility in Arizona, underscore its commitment to advanced packaging. This facility is slated to support the growing demand for AI and HPC solutions, aiming to capture a larger share of this burgeoning market and drive substantial revenue growth.

Amkor Technology's Automotive Semiconductor Packaging segment is a strong performer, particularly driven by the burgeoning automotive sector. The increasing demand for advanced driver-assistance systems (ADAS) and the rapid expansion of electric vehicles (EVs) are fueling significant growth opportunities for Amkor.

The company is collaborating closely with key automotive clients to pioneer sophisticated packaging solutions, such as 2.5D technology, essential for next-generation automotive electronics. This strategic focus is yielding impressive results, with the segment demonstrating robust sequential growth, underscoring Amkor's expanding market share and promising future prospects in this vital industry.

Amkor Technology's planned $2 billion advanced packaging and test facility in Arizona, bolstered by CHIPS Act funding, is a significant strategic star. This investment is poised to establish a critical domestic supply chain for advanced semiconductors, essential for burgeoning sectors like AI and next-generation communication technologies (5G/6G).

This initiative solidifies Amkor's standing within the US market and directly supports national security objectives, positioning the company for substantial growth and market leadership in a high-demand segment.

Advanced System-in-Package (SiP) Solutions

Amkor Technology's Advanced System-in-Package (SiP) Solutions are a significant driver of its business. SiP technology enables the consolidation of diverse semiconductor components into a single, highly integrated package. This approach is vital for creating smaller, more powerful electronic devices across numerous sectors.

The company's proficiency in SiP is demonstrated by its successful ramp-up of production at its new facility in Vietnam. This expansion specifically targets SiP and memory package manufacturing, indicating strong demand and Amkor's strategic investment in this high-growth area. For instance, Amkor reported that its revenue for the first quarter of 2024 reached $1.63 billion, with advanced packaging solutions, including SiP, contributing substantially to this figure.

- SiP Integration: Combines multiple semiconductor dies into a single package.

- Performance Enhancement: Achieves higher processing speeds and reduced latency.

- Miniaturization: Enables smaller form factors for advanced electronic devices.

- Vietnam Facility: Production ramp-up for SiP and memory packages highlights growth.

Turnkey Test Services Expansion

Amkor Technology is strategically expanding its turnkey test services, a move that directly impacts its position within the BCG matrix. This expansion is particularly focused on its Korean operations, with a clear vision to replicate these advanced capabilities at its new facility in Arizona. This proactive expansion is designed to meet the growing demand for comprehensive semiconductor testing solutions.

The computing market has been a significant driver for Amkor's test revenue, experiencing robust year-over-year growth. This upward trend underscores the increasing complexity of modern semiconductor devices, which necessitates sophisticated, end-to-end testing processes. Amkor's turnkey test services offer a holistic solution, addressing these evolving customer needs and reinforcing its competitive edge.

- Turnkey Test Expansion: Amkor is enhancing its turnkey test capabilities, notably in Korea, with plans to integrate these services into its Arizona facility.

- Market Growth: Test revenue within the computing sector has demonstrated substantial year-over-year increases, highlighting strong market demand.

- Customer Value: This expansion provides customers with a comprehensive solution, addressing the increasing complexity of semiconductor devices and solidifying Amkor's market leadership.

Amkor's advanced packaging for AI and HPC, including HDFO and 2.5D/3D integration, positions it as a Star. These technologies are crucial for the high-performance demands of AI processors, a market projected to exceed $100 billion by 2027. The company's strategic investments, such as the Arizona facility, further solidify its leading role in this rapidly expanding, high-growth segment.

Amkor's Automotive Semiconductor Packaging is also a Star. The increasing demand for ADAS and EVs fuels this segment's growth, with Amkor collaborating on advanced solutions like 2.5D technology. This focus has resulted in robust sequential growth, indicating a strong and expanding market share in the vital automotive industry.

The company's planned $2 billion advanced packaging and test facility in Arizona, supported by CHIPS Act funding, represents a significant Star. This investment is critical for building a domestic supply chain for advanced semiconductors, essential for AI and 5G/6G technologies, and reinforces Amkor's market leadership and national security contributions.

Amkor's advanced System-in-Package (SiP) solutions are a Star, driven by the demand for miniaturized, high-performance electronic devices. The successful ramp-up of SiP and memory package manufacturing at its Vietnam facility, coupled with Q1 2024 revenue of $1.63 billion where advanced packaging was a substantial contributor, highlights its strength in this high-growth area.

| Segment | BCG Classification | Key Drivers | Recent Performance/Investment |

| AI/HPC Packaging | Star | Demand for AI chips ($100B+ by 2027), advanced computational needs | Arizona facility investment, HDFO technology |

| Automotive Packaging | Star | Growth in ADAS and EVs, need for advanced automotive electronics | Robust sequential growth, 2.5D technology adoption |

| Advanced SiP Solutions | Star | Miniaturization, integration of diverse components, high-performance devices | Vietnam facility ramp-up, strong contribution to Q1 2024 revenue ($1.63B) |

| Turnkey Test Services | Star | Increasing semiconductor complexity, demand for end-to-end solutions | Expansion in Korea, planned integration into Arizona facility, strong computing sector growth |

What is included in the product

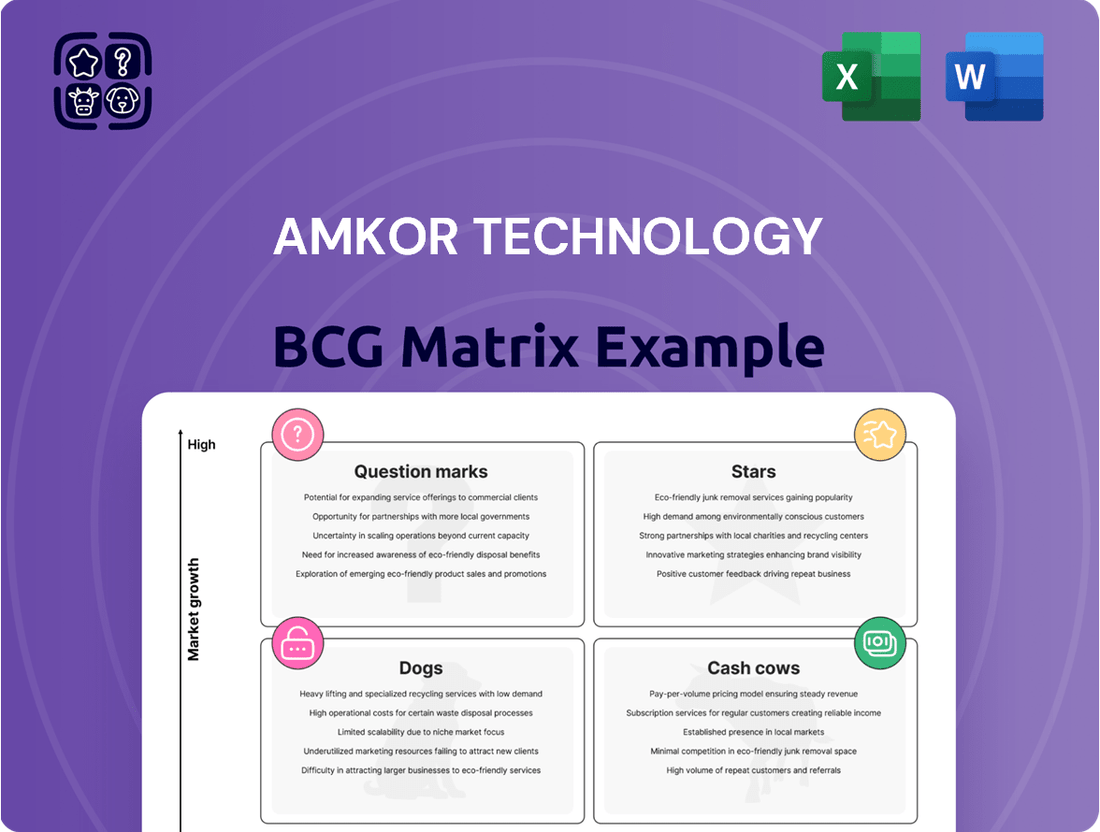

Amkor's BCG Matrix offers a strategic view of its product portfolio, guiding investment decisions.

It categorizes Amkor's offerings into Stars, Cash Cows, Question Marks, and Dogs to inform resource allocation.

A clear BCG Matrix visually identifies Amkor's Stars, Cash Cows, Question Marks, and Dogs, simplifying strategic resource allocation.

Cash Cows

Amkor Technology's established communication segment packaging, particularly for smartphones and tablets, represents a significant cash cow. This sector remains its largest market, consistently contributing a substantial portion of overall sales.

Despite potential cyclical downturns and year-over-year dips in premium device sales, the sheer volume and Amkor's entrenched position ensure robust revenue and cash flow generation. For instance, in 2023, the communications sector was a primary driver of Amkor's performance, underscoring its role as a stable, high-volume contributor.

Amkor Technology's broad-based consumer electronics packaging services, covering traditional products beyond the latest gadgets, form a stable cash cow. This segment, while not experiencing explosive growth, delivers consistent demand and significant cash flow for the company.

The consumer electronics market saw a notable boost in recent times, with IoT wearables, AI-powered devices, and ARM-based PCs driving demand. This sustained interest in a wide array of consumer products underpins the ongoing strength of Amkor's packaging solutions in this mature sector.

Amkor Technology's legacy packaging technologies, such as wirebond, represent a significant portion of its business. These established methods, while not experiencing the explosive growth of advanced packaging, continue to serve a broad and consistent customer base. This stability makes them a reliable source of revenue for the company.

In 2024, Amkor reported that its wirebond packaging segment remained a crucial contributor to its overall financial performance. While specific revenue breakdowns for individual legacy technologies are not always granularly disclosed, the company has consistently highlighted the enduring demand for these solutions across various electronics sectors. This steady income stream requires less capital expenditure than cutting-edge technologies, contributing to Amkor's profitability.

Global Manufacturing Footprint

Amkor Technology's extensive global manufacturing footprint, spanning Asia, Europe, and the USA, is a key strength. This widespread presence allows for significant operational efficiencies and cost-effectiveness by leveraging diverse regional advantages. In 2023, Amkor operated numerous facilities, enabling them to cater to a broad international customer base.

This established infrastructure is crucial for consistent production and robust revenue generation. By diversifying its manufacturing locations, Amkor mitigates risks associated with single-region disruptions and ensures reliable supply chains. This stability makes its manufacturing operations a strong cash generator for the company.

- Global Reach: Facilities in key manufacturing hubs across Asia, Europe, and North America.

- Operational Efficiency: Optimized production processes and cost structures due to diverse locations.

- Market Access: Ability to serve a wide array of customers worldwide, ensuring consistent demand.

- Revenue Stability: Diversified revenue streams from various geographical markets contribute to predictable cash flow.

Long-Standing Customer Relationships

Amkor Technology's long-standing customer relationships are a cornerstone of its Cash Cow status. These deep ties with major semiconductor firms, particularly in the mobile and computing sectors, translate into a dependable and predictable revenue stream. For instance, Amkor's consistent engagement with leading smartphone manufacturers ensures ongoing demand for their advanced packaging solutions.

These enduring partnerships, forged over many years, are built on Amkor's proven reliability and quality in packaging and testing. This trust fosters consistent business, as these critical customers continue to rely on Amkor for their essential semiconductor needs. This stability is a key indicator of a Cash Cow business.

- Stable Revenue: Amkor's relationships with major mobile and computing chipmakers provide a consistent and predictable revenue base.

- Recurring Demand: Decades of trust ensure ongoing demand for Amkor's core packaging and test services.

- Market Leadership: Partnerships with industry leaders solidify Amkor's position in high-volume, established markets.

Amkor Technology's established communication segment packaging, particularly for smartphones and tablets, represents a significant cash cow. This sector remains its largest market, consistently contributing a substantial portion of overall sales. Despite potential cyclical downturns, the sheer volume and Amkor's entrenched position ensure robust revenue and cash flow generation. For instance, in 2023, the communications sector was a primary driver of Amkor's performance, underscoring its role as a stable, high-volume contributor.

Amkor Technology's broad-based consumer electronics packaging services, covering traditional products beyond the latest gadgets, form a stable cash cow. This segment, while not experiencing explosive growth, delivers consistent demand and significant cash flow for the company. The sustained interest in a wide array of consumer products underpins the ongoing strength of Amkor's packaging solutions in this mature sector.

Amkor Technology's legacy packaging technologies, such as wirebond, represent a significant portion of its business. These established methods continue to serve a broad and consistent customer base, making them a reliable source of revenue. In 2024, Amkor reported that its wirebond packaging segment remained a crucial contributor to its overall financial performance, requiring less capital expenditure and contributing to profitability.

Amkor Technology's extensive global manufacturing footprint is a key strength, allowing for operational efficiencies and cost-effectiveness. This established infrastructure is crucial for consistent production and robust revenue generation, mitigating risks and ensuring reliable supply chains. This stability makes its manufacturing operations a strong cash generator for the company.

Amkor Technology's long-standing customer relationships, particularly with major semiconductor firms in the mobile and computing sectors, translate into a dependable and predictable revenue stream. These enduring partnerships, built on Amkor's proven reliability, foster consistent business and solidify its position in high-volume, established markets, making them a key indicator of a Cash Cow business.

| Segment | BCG Classification | Revenue Contribution (Illustrative) | Growth Outlook | Cash Flow Generation |

| Communications Packaging (Smartphones/Tablets) | Cash Cow | High (Largest Market) | Mature/Stable | Strong & Consistent |

| Consumer Electronics Packaging (Broad) | Cash Cow | Significant | Mature/Stable | Consistent |

| Legacy Technologies (e.g., Wirebond) | Cash Cow | Substantial | Stable/Low | Reliable |

| Global Manufacturing Footprint | Enabler of Cash Cows | Supports Revenue Stability | N/A | Operational Efficiency |

| Long-standing Customer Relationships | Enabler of Cash Cows | Drives Predictable Revenue | N/A | Recurring Demand |

Delivered as Shown

Amkor Technology BCG Matrix

The Amkor Technology BCG Matrix you are currently previewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no incomplete sections—just the comprehensive strategic analysis ready for your immediate use. You can confidently expect to download the exact same professionally formatted report, allowing you to seamlessly integrate its insights into your business planning and decision-making processes without any further modifications.

Dogs

Commoditized Standard Packaging Services within Amkor Technology's portfolio would likely fall into the 'Cash Cows' quadrant of the BCG Matrix. These are mature, high-market-share offerings with low growth potential, generating consistent cash flow that can be used to fund other business areas. While specific revenue figures for purely commoditized services aren't broken out, Amkor's overall revenue in 2023 was $5.3 billion, reflecting a diverse range of packaging solutions.

Amkor Technology's "Dogs" category likely encompasses outdated or low-demand packaging processes. These are technologies that are gradually being replaced by newer, more efficient methods, or those catering to shrinking market segments. While they might still generate some revenue from legacy products or specialized applications, their growth potential is minimal.

For instance, older lead-frame based packaging technologies, while still functional for certain established chip architectures, face declining demand as the industry shifts towards advanced substrate-based solutions like flip-chip and wafer-level packaging. The semiconductor packaging market, valued at approximately $50 billion in 2023, is increasingly dominated by these advanced technologies, pushing legacy processes towards obsolescence.

Underperforming regional facilities within Amkor Technology's global network can be categorized as Dogs in the BCG Matrix. These are operations that consistently show low utilization rates, leading to elevated per-unit operational costs. For instance, a facility in a region experiencing a significant downturn in local demand for electronic components, a key Amkor market, would fall into this category.

These underperforming units often require substantial ongoing investment to maintain, yet yield minimal returns, acting as a drain on the company's overall profitability. In 2023, Amkor reported that its Asia-Pacific segment, which includes many of its manufacturing hubs, saw revenue growth, but specific older facilities within this segment might still be facing challenges related to modernization or market shifts, impacting their individual performance metrics.

Segments Heavily Impacted by Prolonged Market Downturns

Certain end-market segments facing prolonged downturns or significant inventory corrections could be classified as 'Dogs' in Amkor Technology's BCG Matrix. These are areas where Amkor's revenue and profitability are disproportionately impacted due to sustained weakness.

While Amkor's communications segment saw a decline, it remains a substantial revenue contributor, indicating it's not a 'Dog' but rather experiencing temporary challenges. However, if a specific sub-segment within communications or another market faces a persistent, irreversible decline, it could indeed become a 'Dog'. For instance, if a particular type of legacy mobile device component experiences a permanent drop in demand, Amkor's business in that niche would be considered a 'Dog'.

- Persistent Demand Erosion: Segments where the fundamental demand for Amkor's products is permanently shrinking, such as older generations of consumer electronics components that have been superseded by newer technologies.

- Intense Competitive Pressure with Low Differentiation: Markets where Amkor faces overwhelming competition and its offerings are not sufficiently differentiated, leading to declining market share and profitability.

- Technological Obsolescence: If Amkor fails to adapt to new technological shifts and continues to rely on manufacturing processes or product types that become obsolete, these areas would fall into the 'Dog' category.

- Specific End-Market Weakness: For example, if a particular automotive sub-segment, crucial for Amkor's revenue, enters a protracted slump due to regulatory changes or a shift in consumer preference away from those vehicle types.

Non-Core or Divested Business Units

Non-core or divested business units within Amkor Technology, identified through a BCG matrix analysis, would fall into the 'Dogs' category. These are typically segments with low market share and low growth potential, making them less attractive for continued investment. Amkor's strategic emphasis on advanced packaging and emerging high-growth markets naturally leads to the consideration of divesting these underperforming ventures to reallocate resources more effectively.

For instance, if Amkor Technology had a legacy business in a mature, low-demand semiconductor component that showed minimal growth and a declining market share, it would be classified as a Dog. Such a unit would likely be a prime candidate for divestiture. This strategic pruning allows Amkor to concentrate its capital and operational expertise on its more promising segments.

Consider Amkor's historical portfolio. While specific divested units aren't publicly detailed in BCG matrix terms, the company has consistently shifted focus. For example, in 2023, Amkor continued to invest heavily in advanced packaging solutions like flip-chip and wafer-level packaging, which represent high-growth areas. This strategic reallocation implies that any business units not contributing to these growth objectives, and exhibiting characteristics of low market share and low growth, would be candidates for divestiture, fitting the 'Dogs' quadrant.

- Low Market Share: Units with a minimal presence in their respective markets.

- Low Growth Potential: Segments operating in industries with stagnant or declining growth rates.

- Strategic Divestiture Candidates: Businesses that do not align with Amkor's core focus on advanced packaging and high-growth sectors.

- Resource Reallocation: Divesting 'Dogs' frees up capital and management attention for more profitable and growth-oriented business units.

Amkor Technology's 'Dogs' in the BCG Matrix likely represent legacy packaging technologies or niche market segments experiencing persistent decline. These are areas with low market share and minimal growth prospects, often due to technological obsolescence or intense competition.

For example, older, less sophisticated packaging types that are being phased out by advancements like wafer-level packaging would fit this description. The semiconductor packaging market, while growing overall, sees rapid shifts, making older technologies vulnerable. In 2023, Amkor's revenue was $5.3 billion, with a strategic focus on advanced solutions, implying less investment in declining legacy areas.

Underperforming regional operations or specific end-market segments facing prolonged downturns also fall into the 'Dogs' category. These units may have low utilization rates or suffer from shrinking demand, requiring careful management or potential divestiture to optimize resource allocation.

Amkor's strategic divestiture of non-core or low-performing assets aligns with identifying and managing 'Dogs'. This allows the company to concentrate resources on high-growth areas like advanced packaging, which is crucial in a market that saw significant investment in 2023.

Question Marks

Amkor Technology is actively engaging with key clients to understand the evolving requirements for AI-powered edge devices. This proactive approach is crucial as the company develops sophisticated packaging solutions designed to accommodate these advanced technologies.

The market for AI edge device packaging represents a significant growth opportunity, with projections indicating substantial expansion in the coming years. For instance, the global edge AI hardware market was valued at approximately $12.5 billion in 2023 and is expected to reach over $100 billion by 2030, demonstrating a compound annual growth rate (CAGR) of over 30%.

Given that this is a relatively new and rapidly developing segment, Amkor's current market share is likely still being established. This positions Amkor's emerging AI edge device packaging solutions as a 'Question Mark' within the BCG matrix, necessitating substantial investment to secure a leading position and capitalize on its high-growth potential.

Amkor Technology is making significant strides in co-packaged optics (CPO), a technology that merges optical and electrical components within a single package. This innovative approach is poised for substantial growth, particularly within the data center and high-speed communication sectors, driven by increasing demand for bandwidth and efficiency.

While CPO represents a cutting-edge advancement with considerable growth potential, its market penetration and Amkor's specific market share are still in their nascent stages. The company is actively securing new design wins, signaling confidence in this burgeoning market. However, widespread adoption hinges on successful qualification programs and ongoing substantial investments to solidify Amkor's position.

Next-generation advanced System-in-Package (SiP) solutions for emerging applications, such as advanced AI accelerators and next-generation automotive sensors, would likely be categorized as Question Marks in Amkor Technology's BCG Matrix. These areas represent high-growth potential markets, but Amkor's current market share and established presence in these specific, unproven niches are still developing. This necessitates substantial investment in research and development, alongside dedicated market development initiatives to capture future opportunities.

New Geographic Market Expansions (Beyond Established Regions)

Venturing into new, undeveloped geographic markets for semiconductor packaging, such as certain regions in Africa or South America with burgeoning tech sectors but low current Amkor penetration, would position Amkor Technology within the Question Marks quadrant of the BCG Matrix. These markets, while offering significant long-term growth potential, demand substantial upfront investment in infrastructure, talent acquisition, and localized market development to establish a foothold and gain market share. For instance, Amkor's 2024 strategic initiatives might involve pilot programs in a select African nation where smartphone adoption is rapidly increasing, aiming to build foundational relationships and distribution networks.

- High Growth Potential: Emerging economies often exhibit faster GDP growth and increasing demand for electronics, creating a fertile ground for semiconductor packaging services.

- Substantial Investment Required: Establishing manufacturing facilities, supply chains, and sales channels in new territories necessitates significant capital outlay, potentially impacting short-term profitability.

- Market Development Focus: Success hinges on understanding local regulatory landscapes, building partnerships, and tailoring services to meet the specific needs of nascent industries.

- Strategic Importance: Early entry into these markets can secure a competitive advantage and shape future market dynamics, aligning with Amkor's long-term vision for global diversification.

Specialized Packaging for Quantum Computing

While Amkor Technology's current portfolio might not explicitly detail quantum computing packaging, any early-stage R&D in this area would place it firmly in the Question Mark category of the BCG matrix. This sector represents a high-growth potential market, but it's still in its infancy, meaning Amkor's market share would be minimal, requiring substantial investment with uncertain future returns.

The quantum computing industry, though nascent, is projected for significant expansion. For instance, the global quantum computing market size was valued at approximately $1.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 30% in the coming years, reaching tens of billions by the early 2030s. This rapid growth trajectory underscores the high-potential aspect of this segment.

- High Growth Potential: The quantum computing market is expected to experience exponential growth, driven by advancements in research and potential applications in fields like drug discovery, materials science, and complex optimization problems.

- Low Market Share: As a developing technology, Amkor's current presence in quantum computing packaging would be negligible, reflecting the early stage of market penetration.

- High Investment Required: Developing specialized packaging for quantum processors demands significant capital expenditure for advanced materials, precision manufacturing, and specialized testing equipment.

- Uncertain Returns: The timeline for widespread commercial adoption of quantum computing remains uncertain, making the return on investment for packaging solutions highly speculative at this stage.

Amkor's ventures into emerging technologies like AI edge device packaging and co-packaged optics (CPO) represent significant growth opportunities. However, these areas are still developing, meaning Amkor's market share is not yet established, requiring substantial investment to capture future market leadership.

Next-generation advanced System-in-Package (SiP) solutions for AI accelerators and automotive sensors, along with expansion into nascent geographic markets, also fall into the Question Mark category. These require dedicated R&D and market development to build a strong presence and capitalize on high growth potential.

The quantum computing sector, while offering immense future growth, is still in its infancy, demanding significant capital for specialized packaging development with uncertain near-term returns.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Investment Strategy |

| AI Edge Device Packaging | High | Low | Question Mark | Invest to gain share |

| Co-Packaged Optics (CPO) | High | Low | Question Mark | Invest to gain share |

| Advanced SiP (AI Accelerators) | High | Low | Question Mark | Invest to gain share |

| Emerging Geographic Markets | High | Low | Question Mark | Invest to gain share |

| Quantum Computing Packaging | Very High | Negligible | Question Mark | Invest cautiously, monitor |

BCG Matrix Data Sources

Our Amkor Technology BCG Matrix is constructed using comprehensive data, including Amkor's financial reports, industry growth rates, and market share analysis from leading research firms.