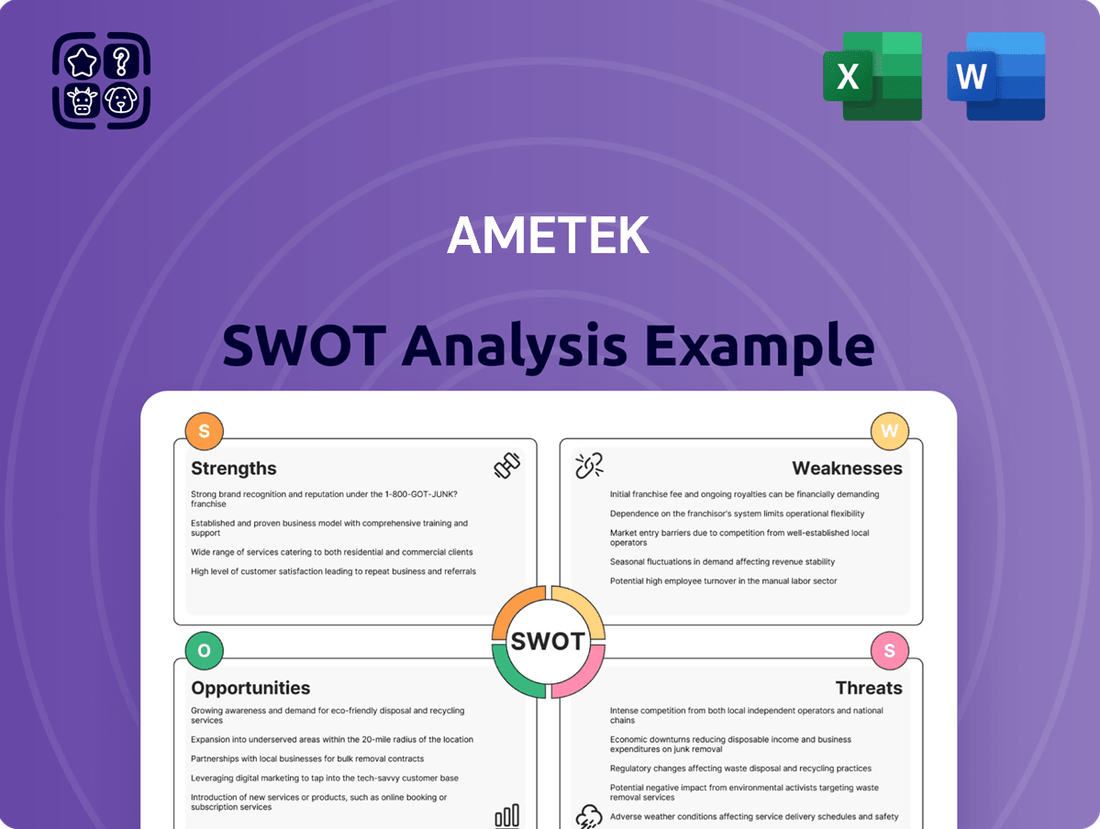

Ametek SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ametek Bundle

AMETEK's diverse portfolio and strong market positions present significant strengths, but understanding the nuances of their competitive landscape and potential regulatory shifts is crucial. Our comprehensive SWOT analysis delves into these critical areas, providing actionable intelligence.

Want the full story behind AMETEK's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AMETEK's strength lies in its diversified end markets, spanning aerospace, defense, power, process, and industrial sectors. This broad reach, managed through its Electronic Instruments Group (EIG) and Electromechanical Group (EMG), significantly reduces reliance on any single industry. For instance, in the first quarter of 2024, AMETEK reported that its Process & Power Instruments division, a key part of its EIG segment, saw strong performance driven by demand in energy and infrastructure projects.

AMETEK consistently showcases robust financial performance, highlighted by record sales and operating income. For instance, in the second quarter of 2025, the company achieved record sales of $1.78 billion, marking a 2.5% rise from the prior year's second quarter. This financial strength is a direct result of its 'Operational Excellence' strategy, which emphasizes efficient operations and consistent margin growth, as evidenced by a 3% increase in operating income to $461.6 million and an expansion of operating margins to 26.0% in Q2 2025.

AMETEK’s growth strategy heavily relies on strategic acquisitions, allowing it to enter new sectors and bolster its technological expertise. This approach has been a consistent driver of expansion.

A prime example is the May 2025 acquisition of FARO Technologies for $920 million. This move significantly bolsters AMETEK's presence in the high-growth 3D metrology and digital reality sectors, reinforcing its market standing.

These acquisitions are anticipated to be earnings-accretive, meaning they are expected to increase AMETEK's earnings per share. Furthermore, substantial synergies are projected, enhancing overall operational efficiency and profitability.

Strong Cash Flow Generation and Capital Deployment

AMETEK demonstrates a consistent ability to convert its earnings into readily available cash, a critical strength for any growing enterprise. This discipline in cash generation is clearly reflected in its capital deployment strategies.

The company's free cash flow to net income conversion rate stands as a testament to its operational efficiency. For instance, in the first quarter of 2025, this key metric reached an impressive 112%, indicating that AMETEK is not only generating strong profits but is also adept at turning those profits into actual cash.

This robust cash flow generation provides AMETEK with substantial financial flexibility. This allows the company to pursue various strategic objectives, including funding promising acquisitions, investing in the research and development of innovative new products, and importantly, returning value to its shareholders through dividends and share repurchases.

- Strong Free Cash Flow Conversion: AMETEK consistently converts net income into free cash flow, as evidenced by a 112% free cash flow to net income conversion in Q1 2025.

- Financial Flexibility: Robust cash generation provides AMETEK with significant resources to pursue strategic growth initiatives.

- Capital Deployment Options: The company can effectively fund acquisitions, invest in R&D, and return capital to shareholders.

Commitment to Sustainability and Innovation

AMETEK's dedication to sustainability isn't just a talking point; it's woven into their business strategy. They're actively developing technologies that push cleaner energy forward, aiming to cut down on carbon footprints and boost overall efficiency. This commitment is a significant draw for customers and investors who prioritize environmental responsibility, potentially strengthening AMETEK's market position.

The company's focus on innovation in the sustainability sector is paying off. For example, AMETEK's acquisition of Infranor in 2023, a leader in advanced motor and drive technology for electric vehicles and industrial automation, directly supports their clean technology initiatives. This strategic move highlights their drive to be at the forefront of solutions for a greener economy.

- Sustainable Product Development: AMETEK is investing in R&D for products that contribute to renewable energy generation, energy efficiency, and emissions reduction.

- Environmental Stewardship: The company actively seeks to minimize its own environmental impact through operational improvements and responsible resource management.

- Brand Enhancement: This strong emphasis on sustainability bolsters AMETEK's reputation, making it more attractive to a growing segment of environmentally conscious consumers and investors.

AMETEK's diversified end markets, including aerospace, defense, and industrial sectors, provide a stable revenue base. This broad exposure, managed across its Electronic Instruments Group (EIG) and Electromechanical Group (EMG), mitigates risks associated with any single industry's downturn. The company's strategic acquisitions, such as the May 2025 purchase of FARO Technologies for $920 million, enhance its technological capabilities and market reach in high-growth areas like 3D metrology.

The company consistently delivers strong financial results, with record sales and operating income. In Q2 2025, AMETEK reported $1.78 billion in sales, a 2.5% year-over-year increase, alongside a 3% rise in operating income to $461.6 million. This performance is underpinned by its Operational Excellence strategy, which focuses on efficiency and margin expansion, leading to a Q2 2025 operating margin of 26.0%.

AMETEK's robust free cash flow generation is a key strength, with a Q1 2025 free cash flow to net income conversion rate of 112%. This financial discipline provides significant flexibility for strategic investments in R&D, accretive acquisitions, and shareholder returns.

AMETEK's commitment to sustainability, demonstrated by its investment in clean technology solutions and acquisitions like Infranor, enhances its market appeal and positions it favorably for future growth.

What is included in the product

Analyzes Ametek’s competitive position through key internal and external factors, highlighting its strong market presence and potential growth opportunities while acknowledging competitive threats.

Ametek's SWOT analysis offers a clear framework to identify and address internal weaknesses and external threats, thereby alleviating strategic planning pain points.

Weaknesses

AMETEK's growth strategy heavily leans on acquisitions, which, while effective, can pose integration challenges and may not always reflect robust underlying organic performance. In the second quarter of 2025, the company noted that sales growth was primarily fueled by acquisitions and currency fluctuations, with organic sales showing no increase.

This reliance on inorganic growth means that a significant chunk of AMETEK's expansion comes from buying other companies, rather than from its existing businesses growing on their own. Such a strategy can sometimes hide slower progress within core operations and introduces risks related to successfully merging new businesses into the existing structure.

AMETEK faces significant headwinds from evolving global trade policies, including tariffs and ongoing trade disputes. These uncertainties can disrupt international sales channels and create volatility in their supply chain, impacting cost structures and delivery timelines.

The company has observed a heightened sense of caution among its customers, leading to more deliberate purchasing decisions and a potential slowdown in project-based spending across certain sectors. This customer hesitancy directly influences order visibility and revenue predictability.

In 2023, AMETEK's international sales represented a substantial portion of its total revenue, making it particularly susceptible to shifts in global economic conditions and trade relations. For instance, a 10% tariff on key imported components could directly increase production costs.

Ametek has encountered headwinds due to inventory destocking by its Original Equipment Manufacturer (OEM) clients. This trend was particularly noticeable within the automation and medical sectors, directly impacting the company's sales performance.

The destocking phenomenon was projected to continue its influence through the close of 2024. This ongoing inventory adjustment by customers poses a risk to Ametek's anticipated growth trajectory into 2025, suggesting a cautious outlook for the near term.

Potential for Slower Organic Sales Growth in Specific Segments

While Ametek generally shows robust growth, certain business segments might face headwinds affecting their organic sales. For example, the Electronic Instruments Group (EIG) experienced a 1% dip in sales in the first quarter of 2025 when compared to the same period in 2024. Furthermore, overall company organic sales were flat in the second quarter of 2025.

These figures suggest that specific areas within Ametek could be encountering softer market demand or intensified competitive pressures. This necessitates a closer look at the underlying drivers for these particular segments.

- Segment Performance: EIG saw a 1% decline in sales in Q1 2025 year-over-year.

- Overall Organic Growth: Company-wide organic sales were flat in Q2 2025.

- Potential Challenges: These trends point to possible slower organic sales growth in specific business units due to market conditions or competition.

Competitive Environment and Market Dynamics

AMETEK faces intense competition across its diverse segments, meaning shifts in the competitive landscape can significantly affect its financial performance. Staying ahead requires constant innovation and maintaining a technological edge, as falling behind could result in losing market share.

For instance, in the aerospace and defense sector, a key area for AMETEK, the market is characterized by a few large, established players and numerous specialized smaller firms. This intense rivalry puts pressure on pricing and demands continuous investment in research and development to differentiate offerings. In 2024, the global aerospace market was projected to see continued growth, but also increased competition, particularly in areas like advanced materials and digital solutions, which AMETEK targets.

The company's reliance on acquiring and integrating businesses also introduces risks. If integration is not smooth or if acquired technologies don't meet expectations, it can dilute the benefits of the acquisition and impact overall competitiveness. AMETEK's strategy often involves acquiring companies with niche technologies, and the ability to effectively integrate these into its broader portfolio is critical to maintaining its competitive standing.

AMETEK's success hinges on its ability to not only develop new products but also to market them effectively against established competitors. Failure to innovate or adapt to evolving customer needs and technological advancements could lead to a decline in its market position.

AMETEK's reliance on acquisitions for growth, while successful, introduces integration complexities and can mask slower organic progress. In Q2 2025, the company noted that acquisitions and currency effects were the primary drivers of sales growth, with organic sales remaining flat.

This inorganic growth strategy means that a substantial portion of AMETEK's expansion stems from purchasing other companies, rather than from the inherent growth of its existing operations. This approach can potentially obscure underlying performance issues within core businesses and carries inherent risks related to the successful assimilation of newly acquired entities.

Furthermore, AMETEK is susceptible to global trade policy shifts, including tariffs and trade disputes, which can disrupt international sales and supply chains, impacting costs and delivery schedules. Customer caution, observed in Q2 2025, leads to more deliberate purchasing, affecting order visibility and revenue predictability, particularly as international sales represented a significant portion of revenue in 2023.

Inventory destocking by OEM clients, notably in automation and medical sectors, impacted AMETEK's sales performance and was projected to continue through late 2024, posing a risk to 2025 growth forecasts. Specific segments, like the Electronic Instruments Group (EIG), experienced a 1% sales dip in Q1 2025 year-over-year, with overall organic sales flat in Q2 2025, indicating potential softness in certain business units.

Full Version Awaits

Ametek SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You can trust that what you see is exactly what you'll get, ensuring a transparent and professional experience.

Opportunities

AMETEK's strategic acquisitions, like the purchase of FARO Technologies, are a key opportunity. This move places AMETEK squarely in high-growth sectors such as 3D metrology and digital reality.

The 3D metrology market is expected to expand robustly, with a projected compound annual growth rate of 9.2% between 2024 and 2030. Furthermore, the digital reality market is also poised for substantial growth, presenting significant avenues for AMETEK to capitalize on emerging technological trends and solidify its market leadership.

AMETEK's strong position in the aerospace and defense sectors is a significant opportunity. These markets are experiencing robust growth, fueled by increasing air travel and evolving geopolitical landscapes. This trend directly benefits AMETEK's Electronic Instruments Group (EIG), which is a key player in providing essential components and solutions for these industries.

The company's aerospace and defense segments are expected to continue their upward trajectory. For 2025, AMETEK anticipates high single-digit organic sales growth in these specific business areas. This projected growth underscores the sector's importance to AMETEK's overall revenue and its potential for future expansion.

AMETEK's growth model prioritizes expanding its international reach and tapping into new markets. Currently, over 45% of its revenue comes from outside the U.S., indicating substantial room for further global penetration, particularly in underserved niche markets.

Continued Focus on New Product Development and Innovation

AMETEK’s dedication to new product development and engineering is a cornerstone of its long-term growth strategy. By consistently investing in innovation, the company aims to expand its highly differentiated product portfolios across its diverse business segments.

This focus allows AMETEK to effectively tackle complex customer challenges, thereby solidifying its competitive advantage. For instance, in the first quarter of 2024, AMETEK reported a 7% increase in organic sales, a significant portion of which can be attributed to new product introductions and advancements in existing offerings.

- Strategic Investment: AMETEK's R&D spending in 2023 was approximately $450 million, underscoring its commitment to innovation.

- Market Leadership: New product launches in areas like advanced sensors and specialized industrial equipment have helped AMETEK capture market share.

- Revenue Growth: The company projects that new products launched in the past two years will contribute over 25% of its total revenue in 2024.

This continuous cycle of innovation not only opens up new revenue streams but also reinforces AMETEK's standing in its existing markets, ensuring sustained relevance and profitability.

Operational Efficiency and Margin Expansion

AMETEK's commitment to operational excellence, especially within its Electronic Instruments Group (EIG) and Electromechanical Group (EMG), has been a key driver of its success. For instance, in the first quarter of 2024, the company reported a consolidated operating margin of 22.8%, demonstrating robust profitability even amidst economic headwinds. This focus allows for continuous improvement, directly contributing to margin expansion and enhanced free cash flow generation.

Further optimizing its supply chain and manufacturing processes presents a significant opportunity for AMETEK. By leveraging automation and lean methodologies, the company can reduce costs and boost productivity. This strategic approach is expected to not only improve current profitability but also build a stronger financial foundation for future growth initiatives and shareholder returns.

- Margin Expansion: AMETEK's operating margins have shown resilience, with Q1 2024 consolidated operating margin reaching 22.8%.

- Free Cash Flow: Continued operational efficiencies are projected to bolster free cash flow, providing flexibility for strategic investments.

- Cost Optimization: Opportunities exist in refining supply chain and manufacturing processes to unlock further cost savings.

AMETEK's strategic acquisitions, like the purchase of FARO Technologies, place it in high-growth sectors such as 3D metrology and digital reality, which are expected to see significant expansion. The company's strong position in the aerospace and defense sectors, fueled by increasing air travel and evolving geopolitical landscapes, offers further growth potential, with high single-digit organic sales growth anticipated in these areas for 2025. AMETEK's ongoing commitment to innovation, evidenced by a 2023 R&D spend of approximately $450 million, aims to expand its differentiated product portfolios, with new products launched in the past two years projected to contribute over 25% of its total revenue in 2024.

| Opportunity Area | Key Driver | 2024/2025 Data/Projection |

|---|---|---|

| Acquisitions & High-Growth Markets | FARO Technologies acquisition; 3D Metrology & Digital Reality Markets | 3D Metrology market CAGR: 9.2% (2024-2030) |

| Aerospace & Defense Strength | Increased air travel, geopolitical factors | Expected high single-digit organic sales growth in A&D segments (2025) |

| Innovation & New Products | R&D investment, product differentiation | 2023 R&D Spend: ~$450 million; New products to contribute >25% of 2024 revenue |

Threats

A sluggish global economy, with forecasts suggesting a modest 2.6% growth for 2024 according to the IMF, presents a considerable threat to AMETEK. This macroeconomic backdrop, characterized by persistent inflation and geopolitical tensions impacting trade, can directly dampen demand for AMETEK's specialized products and solutions across its varied industrial and technological segments.

Customer hesitancy in capital expenditures due to economic uncertainty is a key concern. For instance, a slowdown in manufacturing or aerospace sectors, both significant markets for AMETEK, could translate into deferred or reduced orders. This customer uncertainty directly impedes AMETEK's ability to forecast sales accurately and achieve its projected revenue growth targets for 2024 and into 2025.

AMETEK, like many global manufacturers, faces significant threats from supply chain disruptions and the fluctuating prices and availability of essential raw materials. These challenges are amplified by ongoing geopolitical tensions and shifting international trade policies.

For instance, the semiconductor shortage, a prominent issue throughout 2021-2023, directly impacted numerous manufacturing sectors, including those AMETEK serves. While some improvements were noted by late 2023, the underlying vulnerabilities persist, with potential for renewed shortages or price spikes in critical components and materials like specialty metals and rare earth elements throughout 2024 and into 2025.

These external factors can directly increase AMETEK's production costs and potentially delay product deliveries, affecting its ability to meet customer demand and maintain its operational efficiency.

The industrial technology sector is fiercely competitive, with rivals constantly innovating. AMETEK faces the threat of competitors introducing disruptive technologies or rapidly advancing their own offerings, potentially eroding AMETEK's market share and product uniqueness. For instance, in 2024, the semiconductor equipment market, a key area for AMETEK, saw significant investment in AI-driven process control, a segment where staying ahead is crucial.

Integration Risks of Acquisitions

While acquisitions are a key growth driver for AMETEK, successfully integrating acquired companies, such as the recent acquisition of FARO Technologies, presents significant challenges. Failure to smoothly combine operations or cultures can hinder performance.

Integration risks include:

- Cultural Misalignment: Differences in corporate culture between AMETEK and acquired entities can lead to employee resistance and decreased productivity.

- Operational System Difficulties: Merging disparate IT systems, supply chains, and operational processes can be complex, costly, and time-consuming, delaying synergy realization.

- Failure to Achieve Synergies: The inability to realize expected cost savings or revenue enhancements from an acquisition directly impacts financial performance and return on investment. For instance, if the projected $30 million in cost synergies from the FARO acquisition are not fully realized by end of 2025, it will impact AMETEK's profitability targets.

Geopolitical Tensions and Trade Barriers

Escalating geopolitical tensions and the imposition of new tariffs or trade barriers by various nations pose a significant threat to AMETEK's global sales and operational efficiency. Increased trade friction can disrupt supply chains and increase the cost of goods, impacting profitability.

AMETEK has acknowledged that evolving global trade dynamics introduce a heightened level of uncertainty. For instance, in 2023, the International Monetary Fund projected that global trade growth would slow considerably. This environment necessitates proactive mitigation strategies to counteract potential negative impacts from tariff headwinds and trade restrictions.

- Supply Chain Disruptions: Tariffs can increase the cost of imported components, forcing AMETEK to either absorb these costs or pass them on to customers, potentially reducing demand.

- Reduced International Sales: Trade barriers can limit market access in key regions, directly impacting AMETEK's revenue streams from its international operations.

- Operational Complexity: Navigating diverse and changing trade regulations across multiple countries adds significant complexity and cost to AMETEK's global business model.

- Increased Costs: The company may face higher costs for raw materials, components, and finished goods due to retaliatory tariffs or protectionist policies.

Intensifying competition in the industrial technology sector poses a significant threat, as rivals continually innovate and introduce disruptive technologies. AMETEK must remain agile to maintain its market position, especially in areas like semiconductor equipment where AI-driven advancements are rapidly reshaping the landscape in 2024.

The integration of acquired companies, while a growth strategy, carries inherent risks. Cultural misalignment, operational system difficulties, and the potential failure to achieve projected synergies, such as the $30 million in cost synergies targeted from the FARO acquisition by the end of 2025, can negatively impact financial performance.

Geopolitical tensions and evolving global trade dynamics create uncertainty, potentially disrupting supply chains and increasing costs. Forecasts for 2024 indicated a slowdown in global trade growth, highlighting the need for AMETEK to strategically navigate tariffs and trade barriers to protect its international sales and operational efficiency.

A sluggish global economy, with the IMF projecting only 2.6% growth for 2024, directly impacts AMETEK by potentially reducing customer capital expenditures. This economic uncertainty can lead to deferred orders, particularly in key sectors like manufacturing and aerospace, hindering accurate sales forecasting for 2024-2025.

SWOT Analysis Data Sources

This Ametek SWOT analysis is built upon a robust foundation of data, including their official financial statements, comprehensive market intelligence reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment, ensuring an accurate and actionable assessment.