Ametek Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ametek Bundle

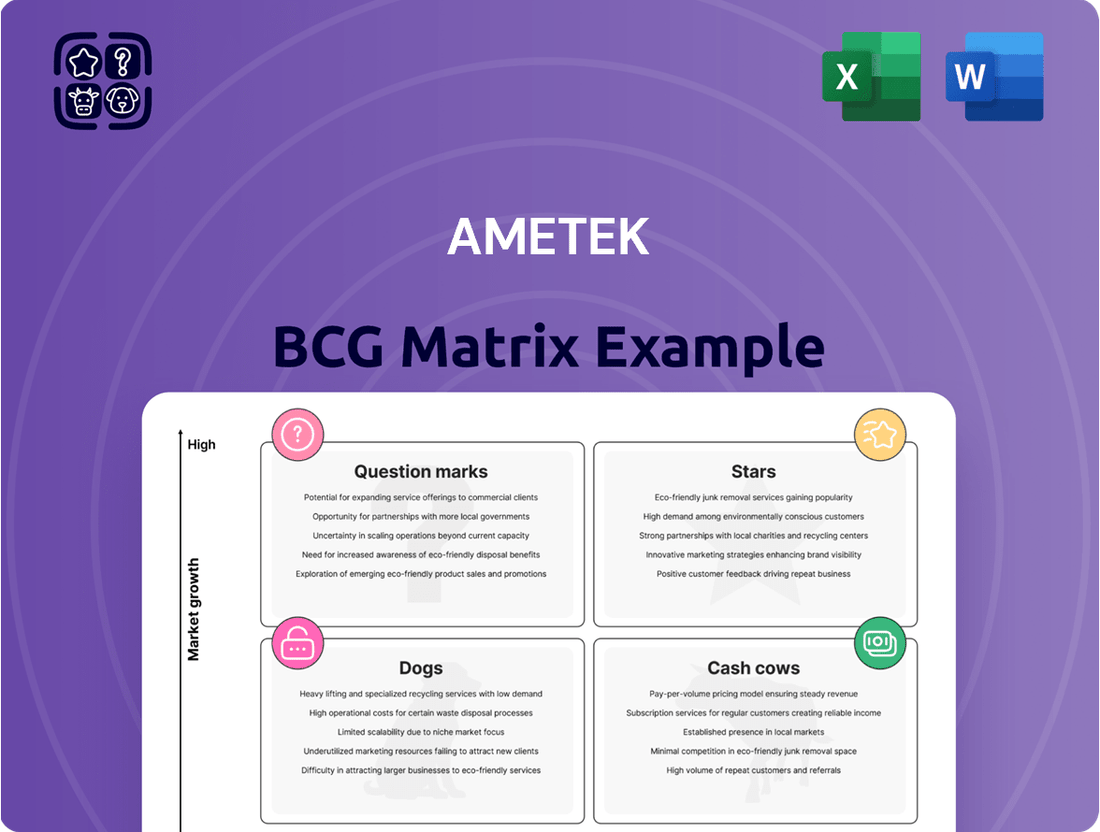

Unlock the strategic potential of Ametek's product portfolio with a clear view of its BCG Matrix. Understand which products are thriving as Stars, which are reliable Cash Cows, which are underperforming Dogs, and which hold promise as Question Marks.

This initial glimpse is just the beginning. Purchase the full BCG Matrix for a comprehensive breakdown, including data-driven recommendations and actionable insights to optimize your investment and product strategy.

Don't miss out on the complete picture; the full Ametek BCG Matrix report provides the strategic clarity you need to navigate your market with confidence and make informed decisions.

Stars

AMETEK's aerospace and defense solutions are a strong performer, consistently achieving high single-digit sales growth. This demonstrates their leading position in a sector experiencing significant expansion.

Robust global defense budgets, especially from the US and Europe, are a major driver for this segment. For instance, the US Department of Defense's budget for fiscal year 2024 was approximately $886 billion, reflecting substantial investment.

This sustained demand, coupled with AMETEK's established market presence, firmly places these offerings in the Stars category of the BCG matrix. Continued strategic investment is crucial to fully leverage the ongoing market growth opportunities.

AMETEK's acquisition of FARO Technologies for $920 million significantly bolsters its position in the burgeoning 3D metrology and digital reality sectors. This strategic integration creates a powerful, high-growth segment within AMETEK's Ultra Precision Technologies. The 3D metrology market is forecast to hit $19.5 billion by 2030, while digital reality is expected to surpass $200 billion by the same year, highlighting the immense potential of this combined offering.

Within Ametek's Electronic Instruments Group, advanced analytical and testing instruments hold a significant market position. These instruments are vital for industries demanding high accuracy, such as pharmaceuticals and semiconductors, where reliable data is paramount. For example, Ametek's Spectro division, a key player in this segment, reported strong performance in 2024, driven by demand for its elemental analysis solutions.

Precision Motion Control Solutions

AMETEK's precision motion control solutions, a key offering within its Electromechanical Group, are firmly positioned as Stars in the BCG matrix. These highly specialized components cater to demanding niche markets like aerospace, defense, and sophisticated automation, where performance is paramount. The increasing global adoption of advanced manufacturing and robotics directly fuels the demand for these advanced motion control systems. For instance, the global industrial automation market was valued at approximately $155.4 billion in 2023 and is projected to grow significantly, with motion control being a critical sub-segment.

These products are characterized by their high precision, reliability, and ability to operate in challenging environments, justifying their Star classification. Their specialized nature often commands premium pricing and sustained demand from industries investing heavily in technological advancement. The aerospace sector alone, a major consumer of precision motion control, saw global aircraft production orders continue to rise through 2024, reflecting ongoing investment in advanced aircraft systems.

- Market Position: Leading niche segments in aerospace, defense, and automation.

- Growth Drivers: Expanding industrial automation and advanced manufacturing sectors.

- Key Attributes: High performance, reliability, and specialized application focus.

- Financial Indicator: Strong demand and premium pricing contribute to robust revenue streams.

Specialty Metals and Components for Critical Applications

Ametek's specialty metals and components business, particularly those catering to critical applications in the medical and industrial sectors, demonstrates a robust market position. These offerings are well-positioned due to demanding industry standards and extended product life cycles, which translate into stable demand within an expanding market for high-reliability parts. For instance, in 2023, Ametek reported that its Engineered Materials and Industrial Products segment, which includes many of these specialty components, saw organic growth driven by strong performance in medical and aerospace markets.

The company's strategic focus on investing in advanced material science and enhancing its manufacturing capabilities is designed to further solidify its competitive edge. This commitment ensures that Ametek remains at the forefront of innovation, meeting the evolving needs of its high-stakes customer base.

- Strong Market Share: Products for critical medical and industrial applications hold a significant market share.

- Demand Drivers: Stringent industry requirements and long product lifecycles ensure consistent demand.

- Market Growth: The market for high-reliability components is experiencing steady growth.

- Competitive Advantage: Investments in material science and manufacturing capabilities reinforce Ametek's position.

AMETEK's advanced analytical and testing instruments are a prime example of their Star performers. These instruments are essential for industries like pharmaceuticals and semiconductors, where precision is non-negotiable. For instance, AMETEK's Spectro division saw robust demand for its elemental analysis solutions throughout 2024, highlighting the segment's strong market traction.

The acquisition of FARO Technologies for $920 million significantly enhances AMETEK's presence in the rapidly expanding 3D metrology and digital reality markets. These combined offerings are poised for substantial growth, with the 3D metrology market projected to reach $19.5 billion by 2030 and digital reality expected to exceed $200 billion in the same timeframe.

AMETEK's specialty metals and components, particularly those for critical medical and industrial uses, also represent a Star. These products benefit from stringent industry standards and long product lifecycles, ensuring consistent demand in a growing market for high-reliability parts. In 2023, AMETEK's Engineered Materials and Industrial Products segment showed organic growth, largely driven by the medical and aerospace sectors.

| AMETEK Star Segments | Market Position | Growth Drivers | Key Attributes | 2024 Data Point |

|---|---|---|---|---|

| Aerospace & Defense Solutions | Leading | Robust global defense budgets | High single-digit sales growth | US DoD budget ~$886 billion (FY24) |

| 3D Metrology & Digital Reality (via FARO) | Emerging Leader | Digital transformation, advanced manufacturing | High growth potential | 3D Metrology market ~$19.5B by 2030 |

| Advanced Analytical & Testing Instruments | Strong | Demand for precision in pharma, semiconductors | Accuracy, reliability | Strong performance reported by Spectro division in 2024 |

| Precision Motion Control | Leading niche | Industrial automation, robotics adoption | High performance, reliability in challenging environments | Industrial automation market ~$155.4B (2023) |

| Specialty Metals & Components (Medical/Industrial) | Strong | Stringent industry standards, long lifecycles | High reliability | Medical & aerospace markets driving growth (2023) |

What is included in the product

Strategic guidance on resource allocation, identifying which business units to invest in, hold, or divest based on market growth and share.

Quickly identify underperforming business units for strategic intervention.

Cash Cows

Many established product lines within Ametek's Electronic Instruments Group, particularly those serving mature industrial measurement and control markets, likely function as cash cows. These offerings, benefiting from high market share and a loyal customer base, consistently generate significant and stable cash flow, even with slower market growth. For instance, in 2024, Ametek's Process & Analytical Instruments division, which heavily features such mature product lines, continued to demonstrate robust performance, contributing substantially to the company's overall profitability.

Certain traditional electromechanical devices serving stable, low-growth markets, like some general industrial applications, are likely cash cows for Ametek. These products benefit from a strong installed base and brand recognition, providing reliable revenue streams. For instance, Ametek's Electro-Mechanical Group reported robust performance in 2023, with its electromechanical solutions contributing significantly to overall segment profitability, reflecting the stability of these offerings.

AMETEK's offerings for the power and process sectors are true cash cows, especially within established infrastructure and long-term client relationships. These mature markets provide a steady, reliable demand for their critical monitoring and control solutions.

The company's strong market position allows it to command premium pricing, translating into impressive profit margins and robust cash flow generation. For instance, AMETEK's Process & Analytical Instruments division, a key player in these sectors, consistently demonstrates strong performance, contributing significantly to the company's overall profitability.

Standard Electrical Interconnects

Standard electrical interconnects, a segment within Ametek's Electromechanical Group, are strong candidates for the Cash Cow quadrant of the Boston Consulting Group (BCG) matrix. These components are fundamental across a wide array of industries, benefiting from consistent, high-volume demand within a well-established market. Their significant market share allows them to generate substantial cash flow, even with limited future growth expectations.

The mature nature of the electrical interconnects market means that while growth is modest, the established customer base and Ametek's strong market position ensure a steady revenue stream. For instance, the global electrical connector market was valued at approximately $25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030. This stability is characteristic of a cash cow, where profits are reliably generated.

- Mature Market: The electrical interconnects sector operates in a stable, high-volume environment with predictable demand.

- High Market Share: Ametek's established presence in this segment likely translates to a dominant market share, driving strong cash generation.

- Stable Cash Flow: These products are essential, ensuring consistent sales and profitability with minimal reinvestment needed for growth.

- Low Growth Prospects: While not high-growth, the essential nature of these components provides a reliable, albeit slower, revenue stream.

Aftermarket Services and Replacement Parts

Ametek's aftermarket services and replacement parts are a significant Cash Cow, generating high-margin, recurring revenue by serving its extensive installed product base across both the Electronic Instruments Group (EIG) and Electronic Materials Group (EMG) segments.

These offerings capitalize on existing customer relationships and product deployments, minimizing the need for costly new market penetration efforts. The strategy prioritizes customer loyalty and streamlined service operations.

- High-Margin Revenue: Aftermarket services and parts typically boast higher profit margins compared to initial product sales.

- Recurring Revenue Stream: This segment provides a predictable and consistent income flow, enhancing financial stability.

- Leverages Installed Base: Existing customers and deployed products form the foundation for this revenue source.

- Customer Retention Focus: Excellent service delivery is key to keeping customers engaged and purchasing parts and services.

Ametek's established product lines in mature industrial markets, such as certain measurement and control instruments, function as cash cows. These products, benefiting from high market share and customer loyalty, consistently generate stable cash flow with limited reinvestment needs. For example, Ametek's Process & Analytical Instruments division, featuring many such mature offerings, showed strong profitability in 2024, underscoring the reliable cash generation from these segments.

| Segment/Product Type | BCG Quadrant | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Industrial Measurement & Control Instruments | Cash Cow | High Market Share, Stable Demand, Mature Market | Strong, consistent contribution to overall profitability. |

| Electromechanical Devices (Industrial Applications) | Cash Cow | Established Base, Brand Recognition, Predictable Revenue | Robust performance in 2023, highlighting stability. |

| Aftermarket Services & Replacement Parts | Cash Cow | High Margin, Recurring Revenue, Leverages Installed Base | Significant contributor to high-margin revenue streams. |

What You See Is What You Get

Ametek BCG Matrix

The Ametek BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures absolute transparency; you'll download the complete, analysis-ready report without any watermarks or demo content. It's designed for immediate application in your strategic planning and decision-making processes.

Dogs

Ametek's legacy products, rapidly outpaced by advancements, represent potential Dogs in their BCG matrix. These items likely hold minimal market share within stagnant or shrinking sectors, making further investment a poor strategic choice. For instance, if Ametek still manufactured older, less efficient industrial testing equipment that has been superseded by digital, AI-driven alternatives, these would fit the Dog profile. Such products offer limited scope for meaningful upgrades and face dwindling demand.

Niche products in highly fragmented, low-growth markets are often classified as Dogs in the Boston Consulting Group (BCG) matrix. These are specialized offerings that operate in markets with limited expansion potential and many small competitors, making it difficult to achieve significant market penetration. For instance, a company might have a small line of specialized industrial filters sold in a market where demand is stagnant and numerous small, regional manufacturers exist.

These "Dog" segments typically contribute minimally to a company's overall revenue and profitability. Their low growth and fragmented nature mean they require substantial effort for little return, potentially draining resources that could be better allocated elsewhere. In 2024, many companies are re-evaluating such portfolios, with a focus on optimizing resource allocation. For example, some industrial conglomerates are divesting non-core, low-growth product lines that fit this Dog profile, aiming to sharpen their strategic focus on higher-potential areas.

Products facing persistent inventory destocking by original equipment manufacturers (OEMs) can signal Dog status within the BCG Matrix, especially if other growth avenues don't compensate. This situation typically results in diminished demand and a weak market position for those specific offerings.

Ametek's Electromechanical Group, for instance, encountered inventory normalization challenges in 2024, particularly within its Automation & Engineered Solutions segment. This segment’s struggles with destocking directly impacted its market share and demand, aligning with the characteristics of a Dog product in the BCG framework.

Underperforming Businesses from Past Acquisitions

AMETEK's strategic acquisition approach means that any acquired businesses or product lines that haven't integrated smoothly or met their growth targets could fall into the Dogs category. These are the ventures that consistently drain resources without delivering sufficient profits. For instance, if an acquisition in 2023, intended to expand AMETEK's presence in a niche industrial automation market, failed to achieve its projected 10% revenue growth by the end of 2024, it might be flagged.

The key indicator for a Dog is a persistent inability to generate adequate returns relative to the capital invested. If such an entity is consuming cash and not contributing to the company's overall profitability or market position, AMETEK would evaluate its future. The company's stated goal of pursuing acquisitions with a strong strategic fit implies that underperforming units, especially those lacking synergy, would be subject to review for potential divestiture.

- Underperforming Acquisitions: Businesses acquired that haven't met integration or growth expectations.

- Cash Consumption: Entities that require ongoing investment without generating satisfactory returns.

- Divestiture Consideration: Potential sale or closure if they don't align with strategic goals or improve performance.

- AMETEK's Strategy: Focus on acquisitions that offer compelling strategic advantages and market synergy.

Non-Core, Low-Margin Offerings Without Strategic Fit

Non-core, low-margin offerings without strategic fit in AMETEK's BCG Matrix would represent its Dogs. These are products or services that are not central to AMETEK's core strategy and consistently generate low profit margins, especially in low-growth markets. Such offerings might divert valuable resources without providing a significant competitive advantage or substantial future potential, potentially hindering the company's overall growth and profitability.

AMETEK's strategic focus on differentiated technology and high-performance solutions suggests a deliberate tendency to avoid or actively divest such non-strategic assets. For instance, if a particular product line consistently reported operating margins below AMETEK's overall average, which has historically hovered in the high teens to low twenties, and operated within a mature, stagnant market, it would likely be categorized as a Dog.

- Low Profitability: Offerings with operating margins significantly below AMETEK's typical performance benchmarks, often struggling to reach double digits.

- Stagnant Market Growth: Products or services operating in industries with minimal expansion prospects, limiting revenue and profit upside.

- Lack of Strategic Alignment: Business units that do not leverage AMETEK's core competencies in specialized technologies or integrated solutions.

- Resource Drain: Assets requiring disproportionate management attention or capital investment relative to their contribution to the company's strategic objectives or financial results.

Dogs in AMETEK's BCG matrix are typically legacy products or acquired businesses that have low market share in slow-growing or declining industries. These units often consume resources without generating significant returns, and AMETEK's strategy involves identifying and addressing these areas. For example, AMETEK's focus on high-performance solutions means that products failing to meet this standard, especially those in mature markets, are candidates for re-evaluation.

In 2024, AMETEK's Electromechanical Group experienced inventory normalization, particularly impacting segments like Automation & Engineered Solutions. This situation, characterized by reduced demand and market share, aligns with the profile of Dog products. The company's approach to acquisitions also means that underperforming ventures, failing to meet projected growth targets by year-end 2024, could be classified as Dogs.

A key characteristic of Dogs is their inability to generate sufficient returns on invested capital, often acting as cash drains. AMETEK's commitment to strategic acquisitions with strong synergy implies that units lacking these qualities, especially those with operating margins below AMETEK's historical high teens to low twenties, are prime candidates for divestiture or restructuring.

AMETEK's strategic divestiture of non-core, low-margin offerings that lack a clear strategic fit also contributes to managing its Dog portfolio. These segments, often operating in stagnant markets, divert resources without offering substantial competitive advantages or future potential. The company's emphasis on differentiated technology reinforces its tendency to move away from such underperforming assets.

Question Marks

Newly acquired technologies, such as Kern Microtechnik acquired in February 2025 and Virtek Vision International in October 2024, represent AMETEK's strategic move into high-growth sectors like advanced manufacturing and laser-based systems. These acquisitions are currently positioned as Question Marks because, despite their promising technological capabilities and emerging market potential, their market share within AMETEK's broader portfolio is still nascent.

The success of these ventures hinges on significant investment and effective integration strategies. For instance, Kern Microtechnik's precision machining solutions and Virtek's laser projection systems are innovative, but their ability to capture substantial market share and generate high revenue growth will determine their transition from Question Marks to Stars in the BCG matrix.

AMETEK's commitment to early-stage new product development is evident in its substantial R&D investments. For 2025, the company has allocated $85 million, a significant sum dedicated to fostering innovation. This investment fuels a pipeline of promising technologies in rapidly expanding markets, positioning them as potential future stars within the BCG framework.

These early-stage developments, while holding considerable promise, are characterized by their unproven market traction and nascent market share. Products such as Gatan's EDAX Elite Ultra system and Vision Research's Phantom KT-series cameras are prime examples of these investments. They represent AMETEK's strategy to cultivate next-generation offerings, aiming to capture significant market share as adoption grows.

When AMETEK expands existing product lines into new geographic markets where it currently has low market share but the market itself is growing, these initiatives become Stars in the BCG Matrix. This strategic move is crucial for future growth, as demonstrated by the increasing demand for industrial automation solutions in emerging economies. For instance, the global industrial automation market was projected to reach $273.1 billion in 2024, with significant growth expected in Asia-Pacific.

Success hinges on effective market penetration strategies and adapting products to local needs, which requires substantial investment. AMETEK's focus on expanding its electrical testing and measurement equipment into markets like India, where industrialization is rapidly advancing, exemplifies this Star strategy. The Indian electrical testing equipment market alone is anticipated to grow at a compound annual growth rate of over 8% through 2029.

Automation Solutions in Developing Industrial Sectors

AMETEK's automation solutions targeting developing industrial sectors, such as advanced manufacturing or emerging biotech, are positioned as potential Question Marks in the BCG Matrix. These areas represent significant growth opportunities, with the global industrial automation market projected to reach $323.1 billion by 2025, according to Mordor Intelligence. However, AMETEK's market share in these specific niches is still developing, necessitating strategic investment to establish a strong foothold and capture future growth.

The recent acquisition of FARO Technologies, a leader in 3D measurement and imaging solutions, exemplifies this strategy. While FARO is categorized as a Star due to its established market leadership and strong growth, specific automation applications derived from this acquisition might still be considered Question Marks within AMETEK's broader portfolio. These applications require further development and market penetration to realize their full potential and contribute significantly to AMETEK's overall market position.

- Targeting nascent sectors: AMETEK is focusing automation solutions on rapidly evolving industries where its market presence is still being established.

- Investment for market capture: Significant investment is required to gain substantial market share in these specific, high-growth industrial automation applications.

- FARO acquisition synergy: The FARO acquisition, while a Star, offers potential automation applications that are still in the Question Mark phase of AMETEK's strategic development.

- Market growth context: The broader industrial automation market's expansion provides a favorable backdrop for these developing AMETEK initiatives.

Specific Medical Technology Solutions (e.g., Paragon Medical integration)

Ametek's acquisition of Paragon Medical in December 2023 positions it within the high-growth medical technology market. While the overall segment is promising, specific product lines inherited from Paragon might initially be considered question marks in the BCG matrix. This means they could have low market share in a growing market, requiring strategic investment to develop their potential.

The medical market itself is projected for robust expansion, with various segments expected to see significant growth through 2024 and beyond. However, for Ametek to truly capitalize on the Paragon acquisition, it's crucial to focus on targeted investments. These investments will be key to integrating Paragon's offerings effectively and driving substantial market share gains across its product portfolio.

- Paragon Medical Acquisition: Completed in December 2023, this acquisition expanded Ametek's presence in the medical technology sector.

- Market Dynamics: The medical technology market is characterized by high growth, presenting significant opportunities.

- Integration Challenges: Specific product lines from Paragon may initially require focused investment and strategic integration to achieve substantial market share.

- Strategic Focus: Success hinges on targeted investments to overcome potential question mark status and convert opportunities into market leadership.

Question Marks within AMETEK's portfolio represent emerging technologies or business units operating in high-growth markets but possessing a low market share. These ventures, such as specific automation applications derived from the FARO acquisition or certain product lines from Paragon Medical, require substantial investment to increase market penetration and achieve growth.

AMETEK's strategic investments, including R&D spending of $85 million for 2025 and acquisitions like Kern Microtechnik and Virtek Vision International, are geared towards nurturing these Question Marks into future Stars. The success of these initiatives is contingent on effective integration and market capture strategies, aiming to leverage the expanding global industrial automation market, projected to reach $323.1 billion by 2025.

The company's focus on developing next-generation offerings, like Gatan's EDAX Elite Ultra system and Vision Research's Phantom KT-series cameras, underscores its commitment to cultivating these nascent areas. These efforts are crucial for AMETEK to solidify its position in rapidly evolving sectors and ensure long-term competitive advantage.

The medical technology market, where AMETEK expanded with the December 2023 acquisition of Paragon Medical, exemplifies this dynamic. While the sector is high-growth, specific product lines may initially be Question Marks, demanding targeted investment to achieve market leadership.

| Business Unit/Technology | Market Growth Rate | AMETEK Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Kern Microtechnik | High (Advanced Manufacturing) | Low | Question Mark | Investment for market penetration |

| Virtek Vision International | High (Laser Systems) | Low | Question Mark | Product development and market expansion |

| Paragon Medical Product Lines | High (Medical Technology) | Low | Question Mark | Targeted investment and integration |

| FARO Automation Applications | High (3D Measurement) | Low | Question Mark | Strategic development and market capture |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.