Ametek PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ametek Bundle

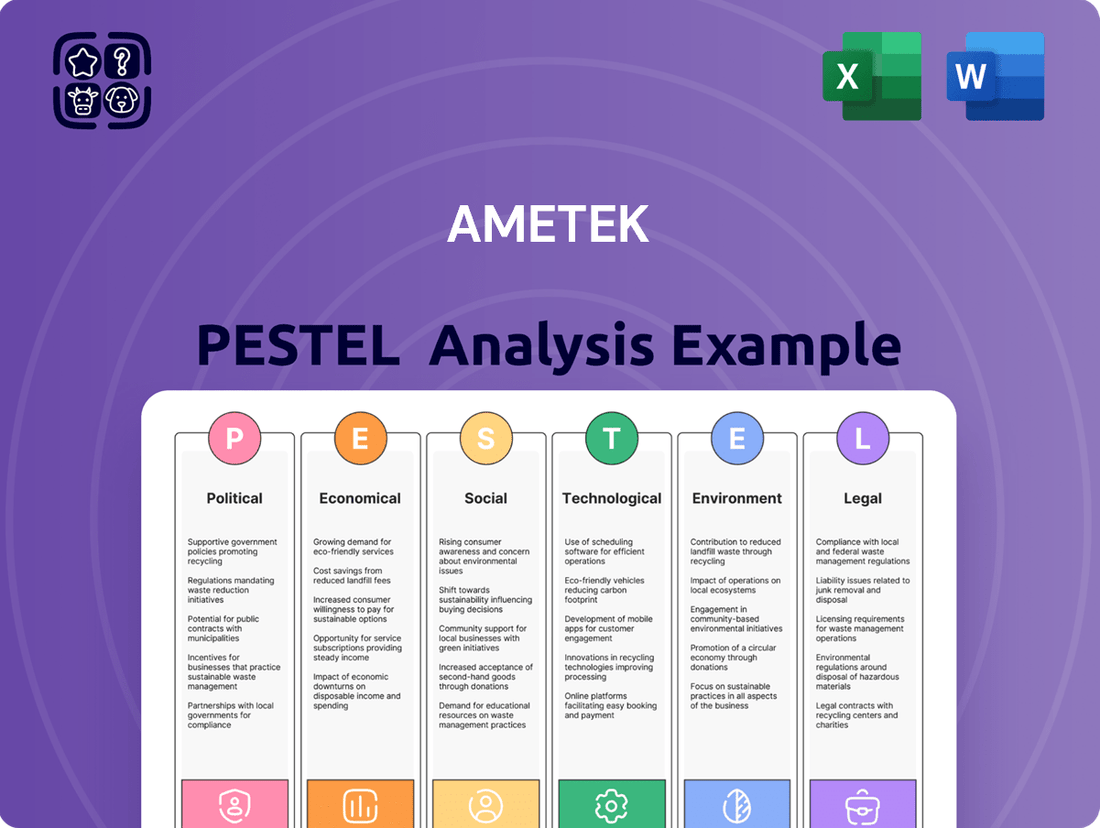

Navigate the complex external forces shaping Ametek's trajectory with our comprehensive PESTLE analysis. Unlock critical insights into political, economic, social, technological, legal, and environmental factors that influence its operations and strategic direction. Download the full version to gain a competitive edge and inform your investment decisions.

Political factors

AMETEK's performance is closely tied to government spending, especially in defense and aerospace, which represent a significant portion of its revenue. For instance, the US Department of Defense budget for fiscal year 2024 was set at $886 billion, indicating robust government investment in these areas. This increased global defense spending, seen in countries like Germany and the UK, acts as a positive driver for AMETEK's aerospace segment.

However, these budgets are not static. Geopolitical shifts and evolving government policies can cause fluctuations, directly affecting the demand for AMETEK's specialized electronic instruments and electromechanical components. For example, a sudden change in defense priorities could lead to reduced procurement of certain technologies, impacting AMETEK's order book.

Global trade policies, including tariffs and ongoing trade disputes, significantly influence AMETEK's operational costs and supply chain stability. For instance, the U.S. imposed tariffs on goods from various countries, impacting the cost of raw materials and components AMETEK sources internationally.

AMETEK actively manages these risks through strategic pricing adjustments, a growing emphasis on supply chain localization, and by utilizing its extensive global manufacturing network to source and produce goods closer to its end markets. This approach helps buffer the direct impact of tariffs on its cost of goods sold.

Furthermore, a degree of macroeconomic certainty surrounding U.S. tariff policies, particularly as they stabilize or become more predictable, is anticipated to stimulate capital expenditure across numerous global markets. This trend is beneficial for AMETEK, as increased investment by its customers often translates into higher demand for its specialized products and solutions.

AMETEK's global manufacturing footprint makes it susceptible to shifts in international relations and geopolitical stability. Escalating global conflicts, as observed through increased defense spending in 2024, can create opportunities for AMETEK's aerospace and defense divisions. For instance, defense budgets in major economies saw a notable uptick, with the US defense budget alone exceeding $886 billion for fiscal year 2024.

However, political instability or deteriorating international relations in critical markets pose risks. Such conditions can lead to supply chain disruptions, impact market access, and dampen consumer or industrial demand. For example, trade tensions or sanctions imposed on key regions could directly affect AMETEK's ability to source components or sell its products, potentially impacting revenue streams in those areas.

Regulatory Environment and Compliance

AMETEK's operations are significantly shaped by government regulations, especially within its key aerospace, defense, and industrial markets. Navigating complex international and domestic rules concerning product safety, quality standards, and export controls is paramount for compliance and continued market access. For instance, the aerospace sector faces stringent FAA and EASA regulations, while defense contracts often involve ITAR (International Traffic in Arms Regulations) compliance, impacting AMETEK's supply chain and product development cycles.

Changes in these regulatory landscapes can directly influence AMETEK's strategic decisions. For example, shifts in environmental regulations, such as those concerning emissions or hazardous materials, might require substantial investment in redesigning manufacturing processes or product components. In 2023, the global regulatory environment saw increased scrutiny on data privacy and cybersecurity, areas critical for AMETEK's advanced manufacturing and instrumentation businesses, potentially leading to updated compliance protocols and system investments.

- Aerospace & Defense Compliance: Adherence to FAA, EASA, and ITAR regulations impacts product certification and sales channels.

- Industrial Sector Regulations: Compliance with environmental, safety, and quality standards (e.g., ISO certifications) is critical for market entry and customer trust.

- Export Controls: Navigating OFAC and BIS regulations is vital for international sales, especially for advanced technologies.

- Emerging Regulations: Staying ahead of evolving rules in areas like cybersecurity and sustainability is a growing operational imperative.

Government Support for Industrial Technology

Government initiatives aimed at boosting industrial technology, automation, and advanced manufacturing directly benefit AMETEK. For instance, the U.S. government's continued investment in semiconductor manufacturing through the CHIPS and Science Act, passed in 2022, signals strong support for advanced industrial capabilities. This legislation, allocating billions of dollars, is designed to onshore critical technologies and foster innovation, areas where AMETEK's specialized instruments and automation solutions play a vital role.

Policies that champion Industry 4.0 principles and smart factory adoption are also significant drivers. Many nations, including those in Europe and Asia, are actively promoting the integration of digital technologies into manufacturing processes. This push can translate into increased demand for AMETEK's sophisticated testing, measurement, and automation equipment, as companies seek to upgrade their facilities to meet these evolving standards. For example, Germany's Industry 4.0 strategy continues to encourage the adoption of interconnected manufacturing systems.

Furthermore, government incentives for research and development (R&D) and the adoption of new technologies create a more conducive environment for companies like AMETEK. These incentives can reduce the cost of innovation and accelerate the deployment of cutting-edge solutions. In 2024, many governments are expected to maintain or even increase R&D tax credits and grants, particularly for sectors involved in critical infrastructure, aerospace, and advanced materials, all of which are key markets for AMETEK.

- Government Support for Industrial Technology: Policies promoting Industry 4.0 and automation create favorable conditions for AMETEK.

- CHIPS and Science Act: U.S. legislation supporting advanced manufacturing, including semiconductors, directly benefits AMETEK's markets.

- R&D Incentives: Government grants and tax credits for innovation encourage the adoption of AMETEK's advanced instruments and solutions.

- Infrastructure Investment: Investments in critical infrastructure globally can drive demand for AMETEK's specialized testing and measurement devices.

Government spending, particularly in defense and aerospace, significantly impacts AMETEK's revenue. The U.S. Department of Defense budget for fiscal year 2024 was $886 billion, underscoring substantial government investment in these sectors, which benefits AMETEK's aerospace segment. Geopolitical shifts and evolving policies can create volatility in demand for AMETEK's specialized products, as changes in defense priorities might reduce procurement.

Trade policies, including tariffs, affect AMETEK's operational costs and supply chain. For instance, U.S. tariffs on imported goods increase the cost of raw materials and components. AMETEK mitigates these impacts through localized sourcing and its global manufacturing network to reduce the direct effect of tariffs on its cost of goods sold.

Government regulations are crucial for AMETEK's operations, especially in aerospace and defense. Compliance with FAA, EASA, and ITAR regulations is essential for market access and impacts product development. Evolving rules in areas like cybersecurity and data privacy, as seen in 2023, necessitate ongoing investment in compliance protocols.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Ametek, providing a comprehensive understanding of its external operating landscape.

Provides a clear, actionable framework that helps Ametek identify and mitigate potential external threats, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

AMETEK's revenue is intrinsically linked to the pulse of global economic expansion and the vigor of industrial sectors. As a supplier to critical areas like power generation, chemical processing, and general manufacturing, the company thrives when these industries invest heavily. For instance, in the first quarter of 2024, AMETEK reported a 4% organic revenue growth, demonstrating its ability to navigate varied economic conditions.

Despite economic headwinds, AMETEK has exhibited remarkable resilience, a testament to its diversified portfolio and strategic acquisitions. However, a robust global economic environment typically translates into higher capital expenditures by its customers, directly boosting demand for AMETEK's advanced technologies and solutions. Projections for global GDP growth in 2024, estimated around 3%, suggest a supportive, albeit moderate, backdrop for industrial demand.

AMETEK's performance is closely tied to the health of its major customer industries. For example, strong demand in aerospace, driven by increased air travel, and defense spending, bolstered by geopolitical events, directly translate into higher sales for AMETEK's specialized components and systems. In 2023, the aerospace and defense segment showed resilience, contributing significantly to overall revenue.

However, market dynamics can shift. The process industries, for instance, can be sensitive to global economic slowdowns, impacting capital expenditure and thus demand for AMETEK's instrumentation and automation solutions. Similarly, while the medical device market generally shows stability, periods of inventory correction, as observed in certain segments in late 2023 and early 2024, can temporarily temper growth.

Fluctuations in interest rates directly impact AMETEK's borrowing costs. For instance, if the Federal Reserve raises its benchmark rate, AMETEK's expenses for new debt, whether for acquisitions or capital expenditures, would likely increase. This is particularly relevant as AMETEK’s growth strategy heavily depends on acquiring other companies.

Access to affordable capital is a cornerstone of AMETEK's acquisition-driven growth. In late 2023 and early 2024, while interest rates remained elevated compared to previous years, the market still offered opportunities for well-positioned companies like AMETEK to secure financing, albeit at potentially higher costs.

AMETEK's robust financial health, evidenced by a relatively low leverage ratio, strengthens its capacity to navigate changing interest rate environments and pursue its strategic acquisition pipeline. This financial discipline allows the company to remain agile in its pursuit of growth opportunities.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for global manufacturers like AMETEK. As a company with substantial international operations, changes in currency values directly influence the reported revenue and profits generated from overseas markets. For instance, in the first quarter of 2025, foreign currency impacts were relatively flat, but this can change rapidly.

Even minor shifts in exchange rates can have a noticeable effect on AMETEK's bottom line. A stronger U.S. dollar, for example, can make AMETEK's products more expensive for international buyers, potentially dampening sales volume. Conversely, a weaker dollar can boost reported earnings when international revenue is translated back into U.S. dollars.

- Impact on Sales: Fluctuations can make AMETEK's products more or less competitive in international markets.

- Profitability Concerns: Changes in currency value directly affect the translation of foreign earnings into U.S. dollars.

- Q1 2025 Performance: Foreign currency impacts were neutral in the first quarter of 2025, but this is subject to change.

Inflationary Pressures and Supply Chain Costs

Inflationary pressures continue to be a significant concern, directly impacting AMETEK's raw material, energy, and labor expenses. For instance, the U.S. Producer Price Index (PPI) for intermediate goods, a key indicator of upstream costs, saw a notable increase throughout 2024, placing upward pressure on manufacturing inputs. AMETEK's commitment to operational excellence, including lean manufacturing and automation initiatives, is designed to offset these rising costs by enhancing efficiency and productivity across its diverse business segments.

Supply chain disruptions, exacerbated by geopolitical events and shifting global trade dynamics, also pose a challenge. These disruptions can lead to extended lead times for critical components and increased freight costs, potentially affecting production schedules and the timely delivery of AMETEK's specialized products. The company's strategy involves diversifying its supplier base and optimizing logistics to build greater resilience against these external shocks.

- Rising Input Costs: Persistent inflation in 2024 and early 2025 has driven up costs for key materials like specialty metals and electronic components, directly affecting AMETEK's cost of goods sold.

- Energy Price Volatility: Fluctuations in global energy prices in 2024 have added another layer of unpredictability to AMETEK's operational expenses, impacting manufacturing facilities worldwide.

- Labor Market Dynamics: Tight labor markets in key operating regions throughout 2024 have contributed to increased wage pressures, a factor AMETEK manages through its focus on automation and workforce development.

- Supply Chain Bottlenecks: Ongoing disruptions in global shipping and logistics throughout 2024 have led to longer lead times and higher transportation costs for AMETEK's international operations.

Global economic conditions significantly influence AMETEK's performance, with industrial sector health and capital expenditure by customers being key drivers. Despite moderate global GDP growth projections for 2024, around 3%, AMETEK's diversified portfolio and strategic focus on resilient markets like aerospace and defense provide a stable foundation. The company's ability to achieve 4% organic revenue growth in Q1 2024 highlights its operational strength amidst varied economic landscapes.

Interest rate fluctuations directly affect AMETEK's financing costs, crucial for its acquisition-driven growth strategy. While rates remained elevated in late 2023 and early 2024, AMETEK's strong financial health and manageable leverage ratio position it to secure necessary capital. Currency exchange rates also play a vital role, with Q1 2025 showing neutral foreign currency impacts, though this can shift, affecting international revenue translation.

Inflationary pressures continue to impact AMETEK's operating costs, particularly for raw materials, energy, and labor, as seen in rising producer prices for intermediate goods through 2024. The company counters these pressures through operational efficiencies and automation. Supply chain disruptions, a persistent challenge in 2024, increase lead times and freight costs, which AMETEK addresses by diversifying its supplier base and optimizing logistics.

| Economic Factor | AMETEK Impact | 2024/2025 Data Point |

| Global GDP Growth | Supports industrial demand and capital expenditure | Projected ~3% for 2024 |

| Interest Rates | Affects cost of capital for acquisitions and operations | Elevated in late 2023/early 2024 |

| Currency Exchange Rates | Impacts reported international revenue and profits | Neutral impact in Q1 2025, subject to change |

| Inflation (PPI for Intermediate Goods) | Increases raw material, energy, and labor costs | Notable increase throughout 2024 |

| Supply Chain Disruptions | Leads to extended lead times and higher freight costs | Persistent challenge throughout 2024 |

Full Version Awaits

Ametek PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Ametek PESTLE analysis includes all the detailed insights you see here, ready for your strategic planning. You'll receive the fully formatted and professionally structured report immediately upon purchase.

Sociological factors

AMETEK's success hinges on access to a skilled workforce, especially in advanced manufacturing and technology sectors. In 2024, the U.S. Bureau of Labor Statistics reported a persistent demand for engineers and technicians, with projected job growth for mechanical engineers at 4% and electrical engineers at 5% through 2032, underscoring the need for specialized talent.

The company actively addresses this by investing in employee development programs, aiming to cultivate expertise in areas like advanced materials and digital manufacturing. This focus on upskilling is vital as technological advancements accelerate, requiring continuous learning to maintain a competitive edge in their specialized markets.

However, potential shortages in highly specialized technical fields, such as those requiring expertise in complex instrumentation or niche electromechanical systems, could pose a risk to AMETEK's production schedules and its capacity for groundbreaking innovation in 2024 and beyond.

There's a significant societal push towards sustainability, impacting what consumers and industries want. This trend directly benefits AMETEK's clean technology solutions, as demand grows for products that help reduce carbon footprints and boost energy efficiency.

AMETEK's strategic alignment with these preferences means they are actively innovating in areas like renewable energy components and emissions reduction technologies. For instance, the global market for green technology and sustainability consulting was projected to reach over $11.5 billion in 2024, highlighting the substantial economic opportunity.

Societal expectations and regulatory mandates for robust health and safety in industrial settings directly influence AMETEK's operational procedures and the very design of its products. This heightened awareness means companies like AMETEK must prioritize worker well-being and minimize environmental impact, driving innovation in safety-focused technologies.

AMETEK's dedication to fostering a safer global environment is evident in its product portfolio, which includes sophisticated solutions aimed at improving operational safety. For instance, their advanced automatic systems for steel tapping significantly reduce human exposure to hazardous conditions, a critical factor in the metals industry where worker safety is paramount.

The global industrial safety market, a key area for AMETEK's solutions, is projected to reach approximately $60 billion by 2025, indicating a strong demand for products that enhance safety and compliance. This growth underscores the increasing importance of health and safety standards as a societal and regulatory driver.

Demographic Shifts and End-Market Needs

Changes in global demographics significantly shape AMETEK's diverse end markets. An aging global population, projected to reach 1.6 billion people aged 65 and over by 2050, directly fuels demand for advanced medical devices and diagnostic equipment within AMETEK's healthcare segment.

Concurrently, rapid industrialization in emerging economies, where over 80% of the world's population resides, is a key driver for AMETEK's automation and industrial solutions. For example, countries in Southeast Asia are experiencing substantial GDP growth, leading to increased investment in manufacturing and infrastructure, thereby boosting the need for sophisticated industrial technologies.

- Aging Population: Global population aged 65+ expected to hit 1.6 billion by 2050, increasing demand for healthcare technologies.

- Emerging Economies: Over 80% of the global population lives in emerging markets, driving industrial automation needs.

- Urbanization Trends: Increasing urbanization, with over 55% of the world's population living in urban areas in 2023, spurs demand for infrastructure and related industrial products.

Corporate Social Responsibility and Community Engagement

Societal expectations for corporate social responsibility (CSR) and community engagement are increasingly vital for businesses like AMETEK. In 2023, AMETEK reported significant contributions to community well-being, including over 5,000 employee volunteer hours globally and substantial financial support to various non-profit organizations. These efforts are not just philanthropic; they directly bolster brand reputation and are a key factor in attracting and retaining top talent in a competitive market.

AMETEK's commitment to community is evident through several key initiatives:

- Employee Volunteerism: Encouraging and facilitating employees to dedicate time to local causes, fostering a sense of purpose beyond their professional roles.

- Financial Support: Providing direct financial aid to charities and non-profit organizations, addressing critical societal needs.

- Partnerships: Collaborating with community groups on specific projects, ensuring impactful and sustainable contributions.

- Brand Enhancement: Building strong community relationships positively influences public perception, making AMETEK a more attractive employer and business partner.

Societal shifts, such as the increasing demand for sustainable products and ethical business practices, directly influence AMETEK's product development and market strategy. The growing global awareness of climate change is driving consumers and businesses towards greener alternatives, a trend AMETEK is capitalizing on with its clean technology solutions.

Furthermore, evolving workforce demographics and expectations for corporate social responsibility are critical. AMETEK's investment in employee development and community engagement, exemplified by thousands of global volunteer hours in 2023, not only strengthens its brand but also aids in attracting and retaining skilled talent in a competitive landscape.

The company's response to these sociological factors is evident in its strategic alignment with global trends like an aging population, which boosts demand for its healthcare technologies, and the rapid industrialization in emerging markets, fueling its automation and industrial solutions.

Societal emphasis on health and safety is also a significant driver, pushing AMETEK to innovate in safety-focused technologies, such as advanced automatic systems for steel tapping, to protect workers in hazardous environments.

| Sociological Factor | Impact on AMETEK | Supporting Data/Trend |

|---|---|---|

| Sustainability Demand | Increased demand for clean technology solutions | Global green technology market projected over $11.5 billion in 2024 |

| Workforce Expectations | Need for skilled talent, focus on employee development | Projected job growth for engineers (4-5% through 2032) |

| Corporate Social Responsibility (CSR) | Enhances brand reputation, talent attraction | Over 5,000 employee volunteer hours globally in 2023 |

| Aging Population | Growth in healthcare segment demand | Global population aged 65+ expected to reach 1.6 billion by 2050 |

Technological factors

AMETEK's Electronic Instruments Group (EIG) thrives on the relentless pace of innovation in electronic instruments and measurement technologies. This constant evolution fuels the development of sophisticated analytical, monitoring, and testing solutions that are vital to their customer base.

The company's commitment to research, development, and engineering is a cornerstone of its strategy. For instance, AMETEK's 2023 annual report highlighted a significant portion of its revenue reinvested into R&D, a trend expected to continue strongly into 2024 and 2025, ensuring they remain at the forefront of technological advancements.

Technological innovation is the bedrock of AMETEK's Electromechanical Group (EMG). The company consistently invests in pushing the boundaries of electromechanical devices and motion control. This focus allows them to develop cutting-edge solutions like advanced motor technologies, sophisticated thermal management systems, and highly engineered components. These innovations are crucial for meeting the ever-changing demands of key sectors such as industrial manufacturing and aerospace.

For instance, in 2023, AMETEK's EMG segment saw significant contributions from its advanced motion control and electromechanical solutions, reflecting strong market adoption of their innovative product lines. The company's commitment to research and development in areas like miniaturization and increased power efficiency in motors directly translates into competitive advantages, enabling them to secure contracts for next-generation aerospace systems and high-precision industrial automation equipment.

AMETEK is well-positioned to capitalize on the growing adoption of AI, IoT, and automation in industrial sectors. These technologies are fueling demand for sophisticated control systems and smart factory solutions, areas where AMETEK's expertise in electronic instruments and electromechanical devices is highly relevant. For instance, the global industrial automation market was valued at approximately $239.1 billion in 2023 and is projected to reach $422.8 billion by 2030, growing at a CAGR of 8.4%.

Research and Development Investment

AMETEK's commitment to innovation is evident in its strategic R&D investments. For 2025, the company is channeling an additional $85 million into R&D and sales/marketing efforts. This funding is specifically targeted at developing technologies that are vital for the continued success of its Test & Measurement and Electromechanical business segments.

These investments are not just about staying current; they are about future-proofing AMETEK's market position. By focusing on critical technological advancements, the company aims to drive long-term growth and maintain a competitive edge in its diverse markets.

- R&D Investment Focus: AMETEK is prioritizing technological advancements within its Test & Measurement and Electromechanical segments.

- 2025 Allocation: An incremental $85 million has been earmarked for R&D and sales/marketing in 2025.

- Strategic Importance: These investments are key to AMETEK's long-term growth and competitive standing.

Impact of Digitalization and Data Analytics

The increasing reliance on digitalization and data analytics across various sectors is a significant technological driver for AMETEK. This trend fuels demand for the company's advanced instruments that deliver crucial real-time data and actionable insights. For instance, in 2024, the global market for industrial analytics was projected to reach over $10 billion, highlighting the value customers place on data-driven operations.

This technological shift is also shaping AMETEK's product development strategies. The company is increasingly focusing on creating connected devices and sophisticated software solutions. These innovations enable customers to perform remote monitoring and make more informed, data-backed decisions, enhancing efficiency and performance in their own operations.

- Digitalization drives demand for real-time data instruments.

- Product development leans towards connected devices and software.

- Remote monitoring and data-driven decision-making are key customer needs.

- The industrial analytics market is a significant growth area, with projections exceeding $10 billion in 2024.

AMETEK's strategic investment in technology is a core driver of its success, particularly within its Electronic Instruments Group (EIG) and Electromechanical Group (EMG). The company's 2025 R&D budget includes an additional $85 million, underscoring its commitment to innovation in areas like AI, IoT, and automation. This focus directly supports the growing demand for sophisticated control systems and smart factory solutions, a market segment projected for substantial expansion.

The increasing digitalization across industries fuels demand for AMETEK's advanced instruments that provide critical real-time data. The company's development of connected devices and software solutions empowers customers with remote monitoring capabilities and data-driven decision-making, enhancing operational efficiency. This trend is reflected in the robust growth of the industrial analytics market, which AMETEK is well-positioned to serve.

| Key Technological Investments & Market Trends | 2024/2025 Data/Projections | AMETEK's Relevance |

| R&D Investment | Incremental $85 million for 2025 | Fuels innovation in EIG and EMG |

| Industrial Automation Market Growth | Projected to reach $422.8 billion by 2030 (from $239.1 billion in 2023) | Drives demand for AMETEK's control systems |

| Industrial Analytics Market | Projected over $10 billion in 2024 | Supports demand for real-time data instruments |

| Emerging Technologies | AI, IoT, Automation | Areas of AMETEK's product development focus |

Legal factors

AMETEK, a key player in electronic instruments and electromechanical devices, navigates a complex web of product liability and safety regulations. These rules are crucial across its varied markets, from aerospace to medical technology. For instance, in the automotive sector, regulations like those from the National Highway Traffic Safety Administration (NHTSA) set rigorous safety standards for components AMETEK might supply.

Failure to adhere to these stringent requirements can lead to severe consequences. These include costly product recalls, substantial legal penalties, and significant damage to AMETEK's brand reputation. In 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 10,000 product-related injuries requiring medical attention, highlighting the critical importance of robust safety compliance for manufacturers like AMETEK.

AMETEK's ability to secure and defend its intellectual property (IP) through patents and trademarks is fundamental to maintaining its edge in specialized technology markets. The company invests heavily in R&D, with its 2023 annual report highlighting significant expenditures aimed at developing proprietary solutions. Legal protections for these innovations are paramount to preventing competitors from replicating their advanced offerings.

The evolving landscape of intellectual property law directly influences AMETEK's capacity for innovation and its ability to safeguard its market share. Changes in patentability criteria or enforcement mechanisms can either bolster or hinder the company's efforts to monetize its technological advancements. For instance, in 2024, the global patent application growth rate for industrial machinery remained robust, indicating a competitive environment where IP protection is increasingly vital.

Operating globally, AMETEK must navigate a complex web of international trade laws, export controls, and economic sanctions. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce export controls on sensitive technologies, impacting companies like AMETEK that operate in advanced manufacturing sectors. Adherence to these legal frameworks is essential to ensure lawful conduct of business across borders and avoid penalties, such as the significant fines levied against companies for violating sanctions in past years.

Environmental Regulations and Compliance

AMETEK operates under a complex web of environmental laws that govern everything from its air emissions and water discharge to how it handles waste and uses natural resources. Staying on top of these legal requirements is crucial for the company's reputation and its ongoing commitment to sustainability. For instance, in 2023, AMETEK reported a 5% reduction in its greenhouse gas emissions intensity compared to its 2022 baseline, demonstrating progress in its carbon footprint reduction goals.

The company actively works to ensure compliance across its global operations, which involves significant investment in pollution control technologies and waste reduction programs. These efforts are not just about meeting legal obligations but are integral to AMETEK's broader environmental stewardship strategy. The company's 2024 sustainability report highlighted that 95% of its manufacturing facilities met or exceeded local environmental compliance standards.

Key areas of legal focus for AMETEK include:

- Emissions Control: Adherence to air quality standards and regulations for industrial pollutants.

- Waste Management: Compliance with laws regarding hazardous and non-hazardous waste disposal and recycling.

- Resource Conservation: Meeting regulations related to water usage and energy efficiency.

- Product Lifecycle: Ensuring products comply with environmental directives like RoHS and REACH.

Data Privacy and Cybersecurity Laws

AMETEK's operations are increasingly reliant on digital systems, making compliance with data privacy laws like the GDPR and CCPA a significant legal factor. Failure to protect customer and proprietary data can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Navigating these regulations is essential for maintaining customer trust and operational continuity in 2024 and beyond.

Cybersecurity risks are a constant legal challenge. In 2023, the average cost of a data breach reached $4.45 million globally, a figure AMETEK must actively mitigate. Robust cybersecurity measures are not just operational necessities but legal requirements to prevent breaches and the associated liabilities, which can include regulatory penalties and civil litigation.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is mandatory for companies handling personal data.

- Cybersecurity Risk Management: Legal frameworks increasingly hold companies accountable for protecting digital assets and customer information.

- Reputational and Financial Impact: Data breaches carry significant legal consequences, including fines and potential lawsuits, impacting brand reputation and financial stability.

- Evolving Legal Landscape: AMETEK must stay abreast of new and updated data protection and cybersecurity legislation worldwide.

AMETEK faces stringent product liability and safety regulations across its diverse markets, from aerospace to medical devices. Non-compliance can result in costly recalls, hefty fines, and reputational damage, as evidenced by the over 10,000 product-related injuries reported by the CPSC in 2023.

The company's ability to protect its intellectual property through patents is vital, especially given the robust growth in global patent applications for industrial machinery in 2024, underscoring a competitive landscape where IP safeguards are paramount.

AMETEK must also navigate international trade laws and export controls, a critical aspect given the U.S. Bureau of Industry and Security's continued enforcement of controls on advanced technologies in 2023.

Environmental factors

AMETEK is making a concerted effort to shrink its environmental impact by focusing on its carbon footprint and implementing emissions reduction strategies. The company has established clear goals for cutting down its greenhouse gas emissions.

Demonstrating progress, AMETEK achieved a significant 26% decrease in the intensity of its Scope 1 and Scope 2 emissions when compared to 2019 levels. This achievement is part of a broader objective to reach a 40% reduction in these emissions by the year 2035.

These reductions are being driven by proactive initiatives aimed at making operations more efficient, particularly in how resources are used and energy is consumed across its facilities.

The availability and cost of essential raw materials directly influence AMETEK's manufacturing operations and profitability. Fluctuations in commodity prices, driven by global supply and demand, can significantly impact production expenses. For instance, the price of copper, a key component in many electronic and electrical applications, saw considerable volatility in early 2024, with prices ranging from approximately $8,000 to $9,500 per metric ton, reflecting these environmental pressures.

AMETEK's proactive approach to sustainability involves optimizing resource consumption across its diverse business units. This focus extends to exploring and adopting more sustainable sourcing practices for its materials. By mitigating risks associated with resource scarcity, such as potential supply disruptions or escalating costs for critical inputs, the company aims to build greater resilience into its supply chain and maintain competitive operational efficiency.

Effective waste management and the adoption of circular economy principles are becoming critical environmental considerations for companies like AMETEK. These principles focus on minimizing waste and maximizing resource utilization, driving innovation in how materials are sourced, used, and recycled. For instance, the global waste management market was valued at approximately $1.6 trillion in 2023 and is projected to grow significantly, highlighting the economic importance of these strategies.

AMETEK's commitment to operational excellence likely translates into robust waste reduction programs across its diverse manufacturing facilities. This could involve implementing lean manufacturing techniques to cut down on scrap, investing in advanced recycling technologies, or redesigning products for easier disassembly and material recovery. Companies are increasingly reporting on their waste diversion rates; for example, many leading industrial manufacturers aim to divert over 75% of their operational waste from landfills by 2025.

Renewable Energy Adoption and Energy Efficiency

AMETEK's strategic focus on clean technology solutions directly addresses the growing global demand for renewable energy and energy efficiency. The company's product offerings, including advanced materials crucial for hydrogen fuel cell technology and solar energy applications, position it favorably within this expanding market. This alignment with environmental sustainability trends is a significant driver for AMETEK's growth.

The global renewable energy sector experienced substantial growth, with solar and wind power installations continuing to set new records. For instance, in 2024, global renewable energy capacity additions were projected to reach over 500 gigawatts, a significant increase from previous years, driven by supportive government policies and declining technology costs. AMETEK's materials are integral to the manufacturing of these clean energy components.

Furthermore, the emphasis on energy efficiency across industries presents another key opportunity. AMETEK's solutions contribute to improving the performance and lifespan of equipment used in energy-intensive sectors. This focus on efficiency aligns with corporate and governmental mandates to reduce energy consumption and carbon footprints, creating a robust market for AMETEK's innovations.

- Renewable Energy Growth: Global renewable energy capacity additions are set to exceed 500 GW in 2024, underscoring the market's expansion.

- AMETEK's Role: The company provides critical materials for hydrogen fuel cells and solar energy, directly supporting this growth.

- Energy Efficiency Focus: AMETEK's solutions enhance equipment efficiency, aligning with global decarbonization efforts.

- Market Opportunity: The transition to a low-carbon economy presents significant opportunities for AMETEK's clean technology portfolio.

Climate Change Impact on Operations and Supply Chain

Climate change presents a significant environmental consideration for AMETEK. Broader impacts like increasingly frequent extreme weather events, such as severe storms or prolonged droughts, could disrupt AMETEK's manufacturing facilities or key logistics routes. For instance, in 2024, supply chain disruptions due to extreme weather in Southeast Asia impacted various manufacturing sectors, highlighting the potential for such events to affect global operations.

These disruptions can directly affect AMETEK's ability to produce and deliver its specialized products. Changes in resource availability, such as water scarcity in certain regions or fluctuations in raw material prices driven by climate impacts, also pose operational risks. AMETEK's diversified market exposure, spanning aerospace, defense, medical, and industrial sectors, along with its global operational footprint, provides some resilience. This diversification allows the company to potentially shift production or sourcing if one region or market is disproportionately affected by climate-related challenges.

- Extreme weather events: Increased frequency and intensity can disrupt manufacturing and logistics.

- Resource availability: Climate change can impact water access and raw material supply.

- Supply chain vulnerability: Global operations are susceptible to climate-related disruptions in various regions.

- Diversification as a buffer: AMETEK's broad market and geographic reach can mitigate localized impacts.

AMETEK is actively reducing its environmental footprint, having already achieved a 26% decrease in Scope 1 and 2 emissions intensity against 2019 levels, with a target of 40% by 2035.

The company's focus on resource optimization and sustainable sourcing helps mitigate risks from fluctuating commodity prices, such as copper, which saw significant price swings in early 2024.

AMETEK's commitment to clean technology, including materials for hydrogen fuel cells and solar applications, aligns with the global renewable energy market's rapid expansion, projected to add over 500 GW of capacity in 2024.

The company's diversified operations offer some resilience against climate change impacts like extreme weather events, which can disrupt supply chains and resource availability, as seen with 2024 weather-related disruptions in Southeast Asia.

| Environmental Factor | AMETEK's Action/Impact | Relevant Data/Trend |

| Emissions Reduction | Decreased Scope 1 & 2 emissions intensity by 26% (vs. 2019) | Targeting 40% reduction by 2035 |

| Resource Management | Focus on sustainable sourcing and waste reduction | Global waste management market valued at ~$1.6 trillion (2023) |

| Clean Technology | Supplies materials for renewable energy | Global renewable capacity additions projected >500 GW (2024) |

| Climate Change Impact | Diversified operations offer resilience to disruptions | 2024 weather events impacted Southeast Asian manufacturing supply chains |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and leading economic and technological forecasting agencies. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in verifiable and current information.