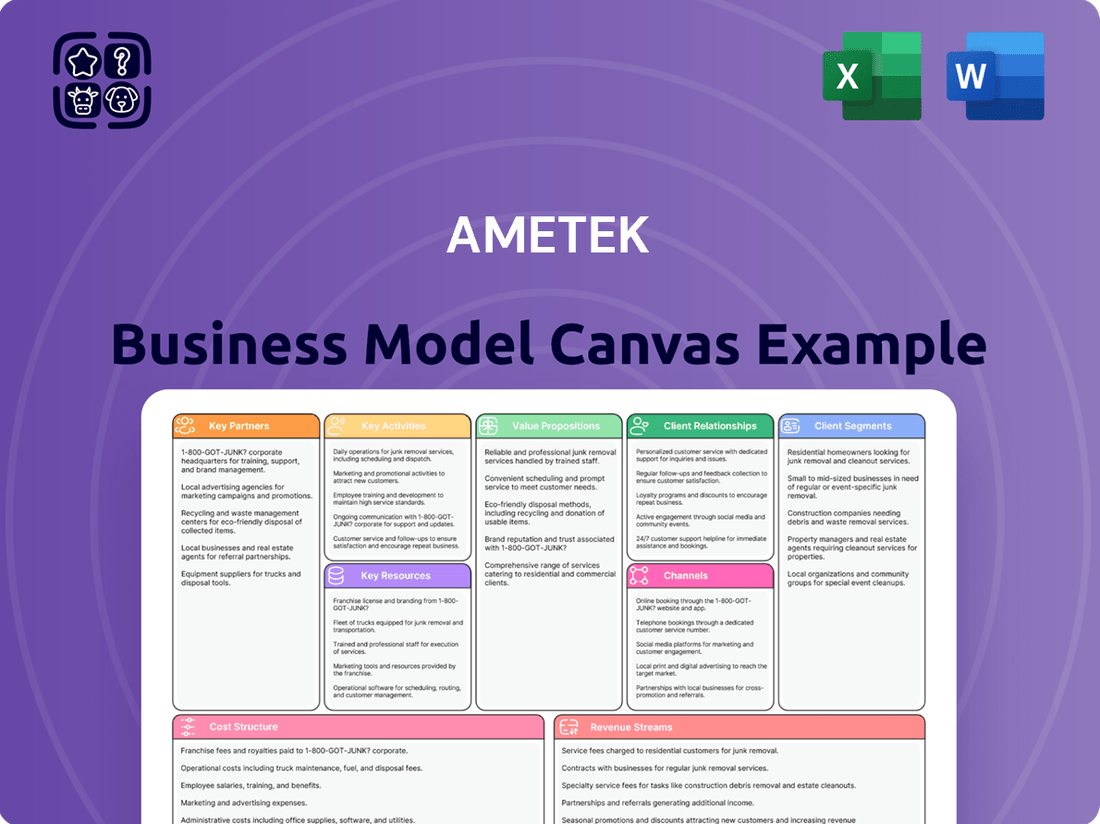

Ametek Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ametek Bundle

Discover the strategic engine driving Ametek's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they create, deliver, and capture value across their diverse operations. Gain unparalleled insights into their customer relationships, key resources, and revenue streams, perfect for anyone looking to understand or replicate their winning formula.

Partnerships

AMETEK actively seeks acquisitions that align with its strategic, technical, and cultural objectives, often targeting companies in growing or related sectors with overlapping product lines and innovative technologies. This approach was evident in their recent acquisition of FARO Technologies, a leader in 3D metrology, and Virtek Vision International, enhancing their position in advanced manufacturing solutions.

AMETEK's commitment to innovation is bolstered by strategic technology and research collaborations. These partnerships with leading research institutions and other technology firms are crucial for accelerating new product development and driving technological advancements.

While AMETEK typically doesn't publicize specific collaboration partners in its financial reports, its consistent and substantial investment in research and development, which reached $488.5 million in fiscal year 2023, strongly indicates the presence of such external relationships. These collaborations enable AMETEK to enhance its differentiated technology solutions, ensuring they remain at the cutting edge and effectively address complex customer challenges.

AMETEK's global distribution networks are crucial for their market penetration. They collaborate with specialized distributors and sales representatives worldwide to ensure their products reach a broad customer base efficiently. This strategy is particularly effective for their Electronic Instruments Group (EIG).

The EIG segment, for instance, relies on these established global networks, complementing their direct sales force. This dual approach is vital for marketing and selling technically advanced instruments, facilitating market expansion, especially in high-growth emerging economies.

Original Equipment Manufacturers (OEMs)

AMETEK's partnerships with Original Equipment Manufacturers (OEMs) are foundational, particularly in demanding sectors like aerospace and defense. These relationships are built on trust and the consistent delivery of high-quality, precision components. For example, AMETEK's Sensors and Fluid Management Systems division is a key supplier to major engine and airframe manufacturers, integrating their reliable solutions into critical aircraft systems.

These OEM collaborations are vital for AMETEK's ability to embed its technology directly into the manufacturing process of larger, complex products. This integration ensures that AMETEK's offerings meet the rigorous performance and safety specifications demanded by industries like aerospace. In 2023, AMETEK reported that its aerospace and defense segment represented a significant portion of its revenue, underscoring the importance of these OEM relationships.

- Long-term engagements with engine and airframe OEMs.

- Enabling seamless integration of AMETEK components into complex systems.

- Ensuring adherence to stringent industry standards and certifications.

- Driving innovation through collaborative product development with OEMs.

Supply Chain and Component Suppliers

AMETEK’s key partnerships with supply chain and component suppliers are critical for its global manufacturing operations. The company sources a wide array of raw materials and specialized components for its electronic instruments and electromechanical devices from these partners. For instance, in 2024, AMETEK continued to emphasize strategic procurement to ensure a steady flow of high-quality inputs, a move that directly impacts production efficiency and cost management.

These relationships are vital for mitigating supply chain risks, including those arising from geopolitical shifts and trade policies. AMETEK actively pursues supply chain localization strategies, aiming to reduce reliance on single sources and buffer against potential disruptions. This focus on building a resilient supply base is a cornerstone of their operational strategy, ensuring business continuity and competitive pricing.

AMETEK's supplier network is essential for maintaining its product quality and innovation pipeline. The company collaborates closely with key suppliers to ensure adherence to stringent specifications and to co-develop new components. This collaborative approach is particularly important given the advanced nature of many of AMETEK's products, where specialized materials and cutting-edge components are often required.

- Global Sourcing Network: AMETEK partners with a diverse range of suppliers worldwide to procure essential raw materials and specialized components for its extensive product portfolio.

- Risk Mitigation through Localization: The company actively works to localize its supply chain, reducing dependence on distant suppliers and mitigating risks associated with trade uncertainties and tariffs, a strategy reinforced in 2024.

- Quality and Innovation Collaboration: Strategic partnerships with suppliers are crucial for maintaining high product quality and fostering innovation, often involving joint development of advanced components.

AMETEK's key partnerships extend to its distribution channels, leveraging specialized distributors and sales representatives globally to ensure efficient market penetration for its advanced instruments, particularly within the Electronic Instruments Group (EIG). These collaborations are vital for reaching a broad customer base, especially in emerging economies.

Furthermore, AMETEK cultivates deep relationships with Original Equipment Manufacturers (OEMs), notably in the aerospace and defense sectors. These long-term engagements involve embedding AMETEK's precision components into critical systems, ensuring adherence to rigorous industry standards and driving collaborative product innovation.

Supply chain partnerships are also fundamental, with AMETEK working closely with component suppliers to secure raw materials and specialized parts. This includes efforts in 2024 to localize supply chains for risk mitigation and to foster joint development for advanced components, ensuring both quality and innovation.

| Partnership Type | Key Focus | Impact | 2023/2024 Relevance |

|---|---|---|---|

| Acquisition Targets | Strategic, technical, and cultural alignment | Market expansion, technology enhancement | Acquisition of FARO Technologies |

| Technology & Research | Accelerating new product development | Driving technological advancements | R&D investment of $488.5 million in FY23 |

| Distribution Networks | Market penetration, sales reach | Efficient product delivery globally | Crucial for EIG segment growth |

| OEMs (e.g., Aerospace) | Component integration, quality assurance | Embedding technology in critical systems | Significant revenue driver in Aerospace & Defense |

| Supply Chain & Component Suppliers | Raw material sourcing, risk mitigation | Ensuring product quality and innovation | Focus on supply chain localization in 2024 |

What is included in the product

A detailed, pre-written business model canvas that maps AMETEK's diverse portfolio, highlighting its customer segments, value propositions, and revenue streams.

This canvas provides a clear overview of AMETEK's operational strategy, key resources, and cost structure, making it ideal for understanding their market approach.

The Ametek Business Model Canvas acts as a pain point reliver by providing a structured, visual framework that simplifies the complex task of understanding and communicating a company's strategy, saving valuable time and effort in analysis and planning.

Activities

AMETEK's strategic acquisitions and integration are central to its business model, focusing on identifying and absorbing companies that complement its existing portfolio and growth objectives. This process involves meticulous due diligence and careful financial structuring to maximize value.

The company actively pursues integration to unlock synergies and bolster its technological capabilities. For instance, the acquisition of FARO Technologies in late 2023, valued at approximately $581 million, significantly expanded AMETEK's offerings in 3D measurement and imaging solutions.

Further strengthening its market position, AMETEK also acquired Virtek Vision International, a move that enhanced its laser projection and inspection technologies. These strategic moves underscore AMETEK's commitment to expanding its technological reach and market penetration through targeted M&A activity.

AMETEK's core strength lies in its robust Research, Development, and Engineering (RD&E) activities. The company strategically channels substantial resources into creating novel products and refining its current offerings. This dedication to innovation is a primary driver for sustained growth and solidifies its position as a market leader.

The company's RD&E efforts are focused on tackling intricate customer problems through the development of unique technological solutions. This forward-thinking approach ensures AMETEK remains at the forefront of its industries. For 2024, AMETEK projected a significant investment of $400 million in RD&E, underscoring its unwavering commitment to pioneering advancements.

AMETEK's core activity centers on manufacturing advanced electronic instruments and electromechanical devices, a process managed through a distributed global network of specialized facilities. This intricate production chain is fundamental to delivering their diverse product portfolio to market.

Operational Excellence is a cornerstone of AMETEK's growth strategy, driving continuous improvements in manufacturing efficiency, rigorous cost control measures, and unwavering quality management across all operations. This focus is essential for maintaining competitive pricing and product reliability.

The company actively pursues expansion of its manufacturing capabilities by strategically establishing and enhancing facilities in key international locations. For instance, in 2023, AMETEK continued to invest in its global footprint, with capital expenditures supporting advanced manufacturing technologies and capacity increases in regions offering both cost advantages and proximity to growing markets.

Global Sales, Marketing, and Customer Support

AMETEK drives global growth through robust sales, marketing, and customer support. They employ a multi-channel approach, leveraging direct sales teams, a network of specialized distributors, and strategically located service centers to connect with customers across diverse industries and geographies. This ensures localized expertise and responsive service.

Their strategy encompasses both the acquisition of new customers and the cultivation of long-term relationships through comprehensive aftermarket support. This commitment to the entire customer lifecycle is a key differentiator.

- Global Reach: AMETEK's sales and marketing infrastructure spans continents, enabling them to serve customers in over 150 countries.

- Channel Diversity: The company utilizes a mix of direct sales, independent distributors, and value-added resellers to maximize market penetration.

- Customer Focus: Emphasis is placed on understanding specific customer needs within various end markets, from aerospace to medical technology, to tailor solutions.

- Aftermarket Services: Post-sale support, including maintenance, repair, and upgrades, represents a significant and growing portion of their revenue, contributing to customer loyalty and recurring income.

Financial Management and Capital Deployment

AMETEK's financial management is centered on maximizing shareholder value through disciplined capital allocation. This involves strategically deploying capital towards acquisitions that align with their growth objectives, funding organic growth initiatives to expand existing businesses, and returning capital to shareholders via dividends and share repurchases.

The company's commitment to strong cash generation underpins its capital deployment strategy. AMETEK consistently targets double-digit percentage growth in earnings per share (EPS) and aims for superior returns on its total capital, reflecting a focus on efficient financial operations and profitable investment.

- Capital Allocation Priorities: Strategic acquisitions, organic growth, and shareholder returns (dividends, buybacks).

- Financial Discipline: Emphasis on strong cash generation and efficient capital deployment.

- Performance Targets: Aiming for double-digit EPS growth and superior return on total capital.

- 2024 Financial Snapshot (Illustrative): While specific forward-looking numbers are proprietary, AMETEK's historical performance demonstrates a consistent ability to generate robust free cash flow, often exceeding 10% of revenue, which fuels its capital deployment activities. For instance, in fiscal year 2023, the company reported strong operational performance that supported its ability to reinvest in the business and return capital to shareholders.

AMETEK's key activities revolve around strategic acquisitions, robust Research, Development, and Engineering (RD&E), efficient manufacturing, and strong customer engagement. These pillars support its mission to deliver advanced solutions across diverse markets.

The company's acquisition strategy, highlighted by the ~ $581 million purchase of FARO Technologies in late 2023, continuously broadens its technological capabilities. Simultaneously, significant RD&E investment, projected at $400 million for 2024, fuels innovation in complex problem-solving. Operational excellence in manufacturing, supported by global facility expansion and advanced technologies, ensures product quality and cost-competitiveness.

Furthermore, AMETEK cultivates customer loyalty through a multi-channel sales approach and comprehensive aftermarket services, ensuring sustained growth and market leadership.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Strategic Acquisitions | Acquiring complementary businesses to expand technological reach and market penetration. | FARO Technologies acquisition for ~$581 million (late 2023). |

| Research, Development, & Engineering (RD&E) | Investing in innovation to create novel products and solve complex customer challenges. | Projected $400 million investment in RD&E for 2024. |

| Manufacturing & Operational Excellence | Efficient production of advanced instruments and devices through a global network, focusing on quality and cost control. | Continued investment in global manufacturing footprint and advanced technologies in 2023. |

| Sales, Marketing, & Customer Support | Multi-channel customer engagement and post-sale support to foster long-term relationships. | Serving customers in over 150 countries through direct sales, distributors, and service centers. |

What You See Is What You Get

Business Model Canvas

The Ametek Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive business model framework. Once your order is complete, you'll gain full access to this professionally structured and ready-to-use document, enabling you to immediately apply its insights to your strategic planning.

Resources

AMETEK's competitive edge is deeply rooted in its robust portfolio of intellectual property and proprietary technologies. This includes a significant number of patents covering their advanced analytical, monitoring, testing, and motion control solutions, alongside valuable trade secrets and specialized engineering expertise.

The company consistently invests in research and development, fostering innovation that translates into unique product offerings. For instance, in 2023, AMETEK's R&D expenses were approximately $500 million, a testament to their commitment to technological advancement.

This strong IP foundation allows AMETEK to deliver differentiated value to its customers, creating a distinct competitive advantage in highly specialized markets.

AMETEK’s highly skilled workforce, especially its experienced engineers and technical staff, represents a cornerstone of its business model. This talent is indispensable for driving innovation through new product development, ensuring operational efficiency across its diverse segments, and providing robust customer support.

The company explicitly identifies attracting, retaining, and developing this specialized talent as paramount to the continued success and long-term viability of its growth strategy. For instance, in 2023, AMETEK invested significantly in employee development programs, with a focus on upskilling its engineering teams to meet the evolving demands of advanced technologies.

AMETEK's global footprint is a cornerstone of its business model, encompassing over 220 facilities strategically located in more than 30 countries. This vast network includes advanced manufacturing plants, vital sales and service centers, and dedicated engineering hubs.

This extensive infrastructure is crucial for AMETEK's operational efficiency and market reach. It enables the company to support sophisticated manufacturing processes, drive innovation through research and development, and provide localized sales support and comprehensive customer service globally.

The presence of these facilities directly fuels AMETEK's strategy for global expansion and market penetration. By operating close to its customers, AMETEK can better understand and respond to regional needs, thereby strengthening its competitive position and driving revenue growth.

Strong Financial Capital and Balance Sheet

AMETEK's strong financial capital and healthy balance sheet are cornerstones of its business model, providing the necessary firepower for strategic expansion. This robust financial position allows the company to pursue growth opportunities, whether through internal development or opportunistic acquisitions, without straining its operational capacity.

The company's ability to generate substantial cash flow and its disciplined approach to capital allocation are critical enablers. This financial strength supports significant investments in research and development, crucial for maintaining a competitive edge in its diverse markets, and also fuels its active merger and acquisition strategy.

For example, AMETEK consistently demonstrates strong financial performance, often exceeding expectations. In their 2024 reporting, the company highlighted continued earnings growth, a testament to their effective capital deployment and operational efficiency. This financial discipline allows them to reinvest in innovation and pursue strategic M&A targets that align with their growth objectives.

- Strong Balance Sheet: Provides significant financial flexibility for strategic initiatives.

- Robust Cash Generation: Enables consistent funding for R&D and M&A activities.

- Disciplined Capital Deployment: Supports long-term growth and value creation.

- Consistent Financial Performance: Evidenced by increasing earnings guidance and operational results in 2024.

Established Brand Reputation and Customer Relationships

AMETEK's established brand reputation, built over decades of operation since 1930, is a cornerstone of its business model. This strong reputation for precision, reliability, and durability translates into significant customer loyalty and trust, particularly with original equipment manufacturers (OEMs) who rely on AMETEK's components.

The company's long-standing presence on the NYSE for over 90 years further solidifies this trust and provides a stable foundation for its operations. These deep, enduring relationships with a diverse customer base are invaluable assets, driving repeat business and creating a competitive advantage.

- Brand Longevity: Founded in 1930, AMETEK boasts nearly a century of operational history, reinforcing its market presence.

- NYSE Listing: A continuous NYSE listing for over 90 years signifies financial stability and market confidence.

- Customer Trust: AMETEK's reputation for quality fosters strong, long-term relationships with key customers, including major OEMs.

- Repeat Business: The established trust and proven product performance lead to consistent repeat orders and customer retention.

AMETEK's intellectual property and proprietary technologies are critical resources, encompassing a vast portfolio of patents and specialized engineering know-how. This technological foundation allows for the development of unique, high-performance solutions, driving AMETEK's competitive edge in niche markets.

The company's deep investment in R&D, exemplified by its approximately $500 million spend in 2023, continuously fuels innovation. This commitment ensures AMETEK remains at the forefront of technological advancements in its specialized sectors.

These key resources enable AMETEK to deliver differentiated products and maintain strong customer relationships, underpinning its market leadership.

Value Propositions

AMETEK's advanced, differentiated technology solutions are central to their value proposition, enabling customers to tackle intricate problems across various sectors. These solutions are not merely off-the-shelf products; they represent specialized engineering designed for demanding applications.

The company's dedication to innovation is evident in their substantial investments in research and development. For instance, AMETEK consistently allocates a significant portion of its revenue to new product development, ensuring their analytical, monitoring, testing, and motion control offerings remain at the forefront of technological advancement.

This focus on cutting-edge technology allows AMETEK to command premium pricing and maintain strong market positions. Their ability to deliver unique and highly effective solutions provides a clear competitive advantage, as seen in their consistent revenue growth, with reported sales reaching approximately $6.5 billion in 2023.

AMETEK's value proposition of precision, reliability, and durability is a cornerstone of its success, particularly in demanding sectors like aerospace and defense. For over six decades, the company has built a reputation for engineering solutions that perform flawlessly under extreme conditions, meeting the highest industry benchmarks.

This unwavering commitment to quality is directly reflected in their financial performance. In 2023, AMETEK reported record revenue of $6.9 billion, a testament to the trust customers place in their robust and dependable products. This focus on long-lasting, high-performance equipment ensures consistent demand and a strong market position.

AMETEK's commitment extends beyond initial sales, providing robust aftermarket support. This includes a steady supply of new OEM replacement parts and essential spare parts, crucial for maintaining operational continuity.

Their FAA/EASA certified repair and overhaul services are a cornerstone of this value proposition. These services ensure that critical components are restored to peak performance, meeting stringent aviation safety and regulatory standards.

The availability of 24/7 Aircraft on Ground (AOG) assistance is particularly vital. This rapid response capability minimizes downtime, directly translating to enhanced efficiency and cost-effectiveness for their airline and aerospace customers.

Global Reach and Localized Support

AMETEK's commitment to global reach is evident in its extensive operational footprint, boasting manufacturing facilities, sales offices, and service centers across more than 30 countries. This widespread presence ensures they can effectively serve a diverse international clientele.

This global network is strategically designed to offer localized support, meaning customers receive tailored solutions and responsive service that understands their specific regional needs. AMETEK’s 2023 annual report highlighted that approximately 60% of their net sales originated from outside North America, underscoring their international market penetration.

- Global Manufacturing Footprint: Operations in over 30 countries.

- Localized Customer Service: Tailored solutions and responsive support.

- International Sales Dominance: Significant revenue generated from global markets.

Operational Excellence and Cost-Effectiveness

AMETEK's commitment to operational excellence drives significant efficiency gains and stringent cost control. This focus directly benefits customers through competitive pricing and enhanced overall value, reinforcing AMETEK's position as a cost-effective supplier.

This dedication to lean manufacturing and process optimization allows AMETEK to maintain robust operating margins, even while delivering high-quality, advanced solutions. For instance, in 2023, AMETEK reported a strong segment operating margin of 22.3%, demonstrating the success of these initiatives.

- Efficiency Improvements: Continuous investment in automation and lean methodologies reduces waste and cycle times.

- Cost Control: Disciplined procurement and supply chain management ensure favorable input costs.

- Competitive Pricing: Cost savings are passed on to customers, offering superior value.

- Margin Strength: High operating margins support ongoing innovation and reinvestment.

AMETEK's value proposition centers on delivering highly engineered, differentiated technology solutions that solve complex customer problems across critical industries. Their focus on innovation, evidenced by consistent R&D investment, ensures their offerings in analytical, monitoring, testing, and motion control remain cutting-edge. This technological leadership allows them to command premium pricing and maintain strong market positions, as reflected in their 2023 revenue of $6.9 billion.

The company's commitment to precision, reliability, and durability, particularly in demanding sectors like aerospace, builds significant customer trust. This is reinforced by robust aftermarket support, including certified repair services and 24/7 AOG assistance, minimizing downtime for clients. AMETEK's global manufacturing and service footprint, with operations in over 30 countries and approximately 60% of 2023 sales from outside North America, ensures localized support and accessibility.

Operational excellence and stringent cost control are key to AMETEK's value delivery. Through lean manufacturing and process optimization, they achieve efficiency gains that translate to competitive pricing and strong margins, like their 2023 segment operating margin of 22.3%. This allows them to offer superior value while reinvesting in innovation and growth.

| Value Proposition Pillar | Key Attributes | Supporting Data (2023) |

|---|---|---|

| Advanced Technology Solutions | Differentiated engineering, innovation, R&D investment | Revenue: $6.9 billion |

| Precision, Reliability, Durability | High-performance in demanding sectors, quality commitment | Strong market positions |

| Aftermarket Support & Services | OEM parts, certified repair, 24/7 AOG assistance | Minimized customer downtime |

| Global Reach & Localized Support | Operations in 30+ countries, international sales focus | ~60% of net sales from outside North America |

| Operational Excellence & Cost Control | Lean manufacturing, efficiency gains, competitive pricing | Segment operating margin: 22.3% |

Customer Relationships

AMETEK cultivates robust customer connections by providing specialized sales representatives and technical support, especially for its intricate, high-tech offerings. This hands-on approach guarantees clients receive knowledgeable advice and help from initial inquiry through to ongoing product use.

In 2024, AMETEK's commitment to customer support was evident in its operational focus. For instance, the company's acquisition strategy often includes integrating businesses with strong existing customer relationships and dedicated support structures, a key element in maintaining and growing market share in specialized industrial sectors.

AMETEK cultivates deep, enduring relationships with Original Equipment Manufacturers (OEMs) across critical sectors such as aerospace and defense. These partnerships are built on a foundation of joint development, guaranteeing a steady flow of components and dependable post-sale service, which is vital for the smooth integration and optimal functioning of AMETEK's specialized products.

Ametek cultivates strong customer relationships through robust aftermarket service and maintenance contracts. These offerings, encompassing repair, overhaul, and ongoing upkeep, are crucial for ensuring product longevity and optimal performance.

These service contracts not only enhance customer satisfaction but also create predictable, recurring revenue streams for Ametek. For instance, in fiscal year 2023, Ametek reported strong performance in its Electromechanical Group, which heavily relies on such service-based revenue.

Tailored Solutions and Customization

AMETEK excels in crafting highly specialized solutions, a key aspect of their customer relationships. They frequently adapt their advanced analytical, monitoring, testing, and motion control technologies to precisely match individual client demands. This deep level of customization fosters strong bonds by directly tackling unique operational hurdles across a wide array of industries.

This tailored approach is evident in how AMETEK serves sectors like aerospace and defense, where stringent performance requirements necessitate bespoke engineering. For instance, their specialized testing equipment for aircraft components is often configured to meet specific regulatory standards and operational environments, ensuring optimal performance and safety.

- Tailored Product Development: AMETEK modifies its core technologies to meet unique customer specifications, enhancing product relevance and efficacy.

- Addressing Niche Market Needs: Customization allows AMETEK to effectively serve specialized segments within broader industries, such as advanced medical device testing.

- Strengthening Client Partnerships: By solving specific customer challenges through customization, AMETEK builds loyalty and positions itself as a strategic partner rather than just a supplier.

Direct Engagement through Digital Platforms and Events

Ametek, like many forward-thinking industrial firms, likely utilizes digital platforms and targeted events to foster strong customer relationships. This direct engagement allows for immediate feedback and tailored support.

Online portals serve as a critical touchpoint, offering customers access to essential technical documentation, comprehensive product training modules, and direct communication channels. This accessibility is paramount in the fast-paced industrial sector.

- Digital Portals: Providing 24/7 access to product manuals, specifications, and troubleshooting guides.

- Webinars and Online Training: Offering educational sessions on product usage, maintenance, and new technologies.

- Industry Events and Trade Shows: Facilitating face-to-face interactions, product demonstrations, and networking opportunities.

- Direct Communication Channels: Implementing customer support hotlines, email, and potentially live chat for prompt issue resolution.

AMETEK fosters deep customer loyalty through a combination of highly specialized product customization and robust, ongoing support. This approach ensures that clients receive solutions precisely tailored to their unique operational challenges, building trust and long-term partnerships.

The company's commitment extends to providing comprehensive aftermarket services, including maintenance and repair contracts, which not only enhance product longevity but also create stable, recurring revenue streams. This focus on post-sale support is a cornerstone of their customer relationship strategy, particularly in sectors demanding high reliability and performance.

In 2024, AMETEK continued to strengthen these relationships by integrating acquired businesses that possess strong customer ties and dedicated support infrastructures, reinforcing their market position in specialized industrial segments.

| Customer Relationship Aspect | Description | 2024 Relevance/Example |

|---|---|---|

| Specialized Sales & Technical Support | Dedicated representatives offering expert advice for complex, high-tech products. | Key to understanding and implementing AMETEK's advanced solutions in niche markets. |

| Aftermarket Services & Maintenance | Repair, overhaul, and upkeep contracts ensuring product performance and longevity. | Drives recurring revenue and customer retention, as seen in the Electromechanical Group's performance. |

| OEM Partnerships | Collaborative development and dependable post-sale service for critical sectors like aerospace. | Ensures seamless integration and optimal functioning of AMETEK components. |

| Customization & Tailored Solutions | Adapting technologies to meet specific client needs and operational hurdles. | Addresses unique demands in sectors like aerospace and defense, ensuring compliance and performance. |

Channels

AMETEK's direct sales force is a cornerstone of its strategy, especially for its Electronic Instruments Group (EIG). This approach enables them to directly connect with customers, providing deep technical expertise and fostering robust client relationships.

In 2024, AMETEK reported that its EIG segment, which heavily relies on this direct sales model, continued to be a significant contributor to its overall revenue. This direct engagement ensures that customers receive tailored solutions and support for highly specialized instrumentation.

AMETEK leverages specialized distributors and sales representatives worldwide to broaden its market presence. This strategy is particularly effective for products requiring extensive reach into diverse geographical regions and specialized market segments.

In 2024, AMETEK's extensive network of over 100,000 customers globally, many served through these channel partners, underscores their importance. These relationships are crucial for navigating complex international markets and reaching niche customer bases efficiently.

AMETEK's global network of service and support centers is a critical channel for its Business Model Canvas, ensuring customers receive prompt aftermarket assistance. These strategically placed facilities provide essential repair, maintenance, and spare parts services, directly impacting customer loyalty and satisfaction.

In 2024, AMETEK continued to invest in its service infrastructure, recognizing its role in retaining customers and generating recurring revenue. The efficiency of these centers directly contributes to AMETEK's ability to maintain high product uptime for its diverse customer base across various industries.

Online Presence and Digital Platforms

AMETEK leverages its official website, ametek.com, as a primary digital platform. This site is a vital hub for investor relations, disseminating corporate news, and showcasing detailed product information across its diverse segments.

While not a direct sales channel for every product, the website and other digital presences are critical for engaging customers, partners, and investors. It facilitates access to financial reports, press releases, and segment-specific offerings, building brand awareness and trust.

In 2024, AMETEK's commitment to digital engagement is evident in its investor relations section, which provides comprehensive data and updates. For instance, their investor portal offers easy access to quarterly earnings calls and presentations, crucial for market participants.

- Official Website: ametek.com serves as the central digital information and engagement hub.

- Investor Relations Focus: Provides crucial financial data, news, and reports for stakeholders.

- Product Information Hub: Showcases the breadth of AMETEK's technological solutions and segments.

- Engagement Tool: Connects with customers, partners, and the investment community.

Industry Trade Shows and Conferences

Industry trade shows and conferences are a vital channel for AMETEK to directly engage with its target markets, showcasing innovative products and solutions. In 2024, AMETEK actively participated in key events like the Farnborough International Airshow, a premier aerospace exhibition, demonstrating its commitment to the sector. These events facilitate face-to-face interactions, allowing for immediate feedback and relationship building with both prospective and established clients.

AMETEK leverages these platforms to highlight its technological advancements, particularly in high-growth areas such as aerospace and defense. For instance, at the 2024 European Rotors trade fair, a significant event for helicopter technology, AMETEK showcased its specialized components. Such participation helps solidify AMETEK's position as a leader and allows for the identification of emerging market trends and customer needs.

- Showcasing Innovation: AMETEK presents its latest technologies and product advancements at major industry events.

- Customer Engagement: Direct interaction with customers at trade shows fosters stronger relationships and gathers valuable market insights.

- Market Presence: Participation in events like the 2024 Farnborough Airshow reinforces AMETEK's brand visibility and leadership in sectors like aerospace.

- Lead Generation: These conferences serve as a crucial channel for identifying and nurturing new business opportunities.

AMETEK utilizes a multi-channel approach, blending direct sales with strategic partnerships to reach its diverse customer base. This ensures both deep technical engagement for specialized products and broad market penetration for wider offerings.

The company's direct sales force, particularly within the Electronic Instruments Group (EIG), is key for building strong customer relationships and providing expert solutions. In 2024, EIG's continued revenue contribution highlights the effectiveness of this direct engagement model.

Specialized distributors and global sales representatives extend AMETEK's reach into various regions and niche markets, complementing direct sales efforts. With over 100,000 global customers in 2024, these partners are vital for efficient market access.

AMETEK's global service and support centers act as a crucial channel for aftermarket care, boosting customer loyalty and recurring revenue. Investment in these centers in 2024 underscores their importance for product uptime and customer satisfaction.

Customer Segments

The aerospace and defense sector represents a significant customer base for AMETEK, especially for its Electromechanical Group (EMG) and the Sensors and Fluid Management Systems (SFMS) division. This segment is crucial, encompassing major Original Equipment Manufacturers (OEMs) for aircraft and engines, alongside defense contractors demanding highly reliable and robust components. In 2024, the global aerospace market was projected to reach over $900 billion, with defense spending also seeing substantial increases, highlighting the critical demand for AMETEK's specialized products.

AMETEK is a key supplier to the power and process industries, offering sophisticated analytical, monitoring, and testing instruments. These solutions are vital for customers in energy generation, oil and gas, and chemical processing sectors who depend on precise and dependable measurement technologies to ensure operational efficiency and safety.

In 2024, AMETEK's Power & Process Solutions segment, which encompasses these industries, demonstrated robust performance. For the fiscal year 2024, this segment reported strong revenue growth, reflecting sustained demand for high-performance instrumentation in critical infrastructure and industrial applications.

AMETEK's industrial applications segment serves a wide array of general manufacturing and automation needs. This includes customers in diverse sectors looking for advanced motion control, precision electromechanical components, and specialized industrial technologies to optimize their operations.

In 2024, AMETEK reported that its Electronic Instruments Group (EIG) and Electromechanical Group (EMG) continue to drive growth through these industrial markets. For instance, the company's solutions are integral to factory automation, process control, and material handling systems, contributing to efficiency gains across the manufacturing landscape.

Medical and Semiconductor Markets

AMETEK strategically targets the medical and semiconductor markets, recognizing their demand for high-precision components and sophisticated inspection systems. Through key acquisitions, such as Paragon Medical and Kern Microtechnik, the company has solidified its position in these critical sectors.

These markets are characterized by stringent quality requirements and rapid technological advancement, areas where AMETEK's core competencies in differentiated technology are a strong fit. For instance, in 2023, the medical device market was valued at approximately $200 billion globally, with significant growth driven by advancements in diagnostics and minimally invasive procedures.

- Medical Market Focus: AMETEK's acquisition of Paragon Medical enhances its capabilities in supplying specialized components and services to medical device manufacturers, addressing a growing need for miniaturization and biocompatibility.

- Semiconductor Industry Integration: The acquisition of Kern Microtechnik bolsters AMETEK's offerings in ultra-precision machining, crucial for producing critical components used in semiconductor manufacturing equipment.

- Technological Alignment: Both sectors demand advanced metrology and inspection solutions, aligning perfectly with AMETEK's established expertise in electronic instruments and electromechanical devices.

- Market Growth Drivers: The semiconductor industry, projected to reach over $700 billion in revenue by 2024, is fueled by demand for AI, high-performance computing, and automotive electronics, all requiring increasingly sophisticated manufacturing processes.

Research and Development Institutions

Research and Development (R&D) institutions, encompassing both academic universities and corporate research labs, represent a crucial customer segment for AMETEK. These organizations depend on AMETEK's cutting-edge analytical and testing instruments to drive innovation and scientific advancement. For instance, in 2024, AMETEK's materials analysis division saw significant demand from university research projects focused on novel material properties, contributing to a robust pipeline of future technological applications.

These institutions leverage AMETEK's sophisticated equipment for critical functions such as fundamental scientific discovery, the development of new products and technologies, and rigorous quality control processes. The precision and reliability of AMETEK's offerings are essential for achieving accurate and reproducible results in complex R&D environments. In 2023, AMETEK reported that approximately 15% of its revenue was directly attributable to sales within the academic and government research sectors, underscoring the importance of this segment.

- Academic Research: Universities and research institutes utilize AMETEK's instruments for groundbreaking studies across various scientific disciplines, from physics and chemistry to biology and engineering.

- Corporate R&D: Companies across industries, including aerospace, automotive, and pharmaceuticals, rely on AMETEK for product development, performance testing, and ensuring compliance with industry standards.

- Materials Science: A significant portion of R&D institutions use AMETEK's solutions for characterizing and analyzing new materials, crucial for next-generation product development.

- Semiconductor Industry: R&D within the semiconductor sector frequently employs AMETEK's advanced metrology and inspection tools to push the boundaries of chip design and manufacturing.

AMETEK serves a broad spectrum of industrial customers, from general manufacturing and automation to specialized sectors like oil and gas. These clients rely on AMETEK's advanced motion control, precision electromechanical components, and industrial technologies to boost efficiency. In 2024, the company's Electronic Instruments Group and Electromechanical Group reported strong performance driven by these diverse industrial applications.

Cost Structure

AMETEK dedicates a substantial part of its expenses to Research, Development, and Engineering (RD&E). This ongoing investment is crucial for creating innovative products and staying ahead technologically in its competitive markets.

These RD&E costs encompass a range of expenditures, from the salaries of its skilled engineering teams to the operational costs of its laboratories and the expenses involved in creating prototypes for new technologies.

For instance, in 2023, AMETEK reported that its operating expenses included significant investments in RD&E, reflecting its commitment to innovation. This spending underpins its strategy to offer advanced solutions across its diverse business segments.

Ametek's manufacturing and production costs are a significant component of its overall cost structure, driven by its extensive global operations. These costs encompass raw materials, the labor required for assembly across various product lines, and the overhead associated with maintaining numerous manufacturing facilities worldwide. For instance, in 2023, Ametek reported cost of sales of $4.9 billion, reflecting the substantial investment in production activities.

The company actively pursues Operational Excellence initiatives, a key strategy to manage and optimize these manufacturing expenses. These programs focus on improving efficiency, reducing waste, and streamlining production processes to enhance profitability. Such efforts are crucial for maintaining a competitive edge in the diverse markets Ametek serves.

Ametek's cost structure heavily features expenses for its global sales force, marketing initiatives, and the upkeep of its widespread distribution and service networks. These operational costs are crucial for reaching diverse customer bases and ensuring product accessibility.

In 2023, Ametek's selling, general, and administrative expenses, which encompass these categories, were approximately $1.9 billion. This figure reflects significant investment in trade shows, targeted digital marketing campaigns, and the logistics involved in efficient product delivery and after-sales support worldwide.

Acquisition-Related Costs

AMETEK's strategic growth hinges on acquisitions, which naturally bring associated costs. These include expenses for thorough due diligence to vet potential targets, costs incurred during the integration process to merge operations, and the amortization of intangible assets acquired. These upfront expenditures can temporarily reduce short-term profitability, even as they fuel long-term expansion.

For instance, in 2023, AMETEK completed several acquisitions. While specific line-item costs for each acquisition aren't always broken out publicly, the company's operating expenses reflect these integration efforts. The impact of amortization of acquired intangibles is visible in their financial statements, contributing to the overall cost structure.

- Due Diligence: Costs associated with investigating potential acquisition targets, including financial, legal, and operational reviews.

- Integration Expenses: Costs related to merging acquired businesses, such as system integration, rebranding, and severance packages.

- Amortization of Intangible Assets: The systematic expensing of acquired intangible assets like patents, trademarks, and customer lists over their useful lives.

- Impact on Profitability: These costs can create a short-term drag on earnings per share as integration proceeds and amortization is recognized.

General and Administrative (G&A) Expenses

Ametek's General and Administrative (G&A) expenses encompass the essential corporate overhead that keeps the company running smoothly. This includes significant costs associated with executive leadership, the administrative teams supporting them, and crucial functions like legal, finance, and IT. These are the foundational costs that enable strategic decision-making and overall operational efficiency across the organization.

These G&A costs are vital for maintaining Ametek's global presence and ensuring compliance. For instance, in 2023, Ametek reported total selling, general, and administrative expenses of approximately $1.4 billion. This figure reflects the investment in the infrastructure and personnel necessary to manage a diversified industrial conglomerate.

- Executive Salaries and Benefits: Compensation for top leadership driving Ametek's strategy.

- Administrative Staff: Support personnel in departments like HR, accounting, and operations.

- Legal and Compliance: Costs associated with legal counsel, regulatory adherence, and corporate governance.

- IT Infrastructure and Support: Maintaining and upgrading the technology backbone of the company.

- Facility Management: Overhead for headquarters and regional administrative offices.

AMETEK's cost structure is significantly shaped by its substantial investments in Research, Development, and Engineering (RD&E), essential for technological advancement and market leadership. Manufacturing and production costs, including raw materials and labor across its global facilities, also represent a major expense. The company's extensive sales, marketing, and distribution networks contribute considerably to its operational costs, ensuring broad market reach and customer support.

Acquisitions are a key growth driver for AMETEK, bringing with them associated costs like due diligence, integration, and amortization of acquired intangibles. General and Administrative (G&A) expenses, covering executive leadership, administrative functions, legal, finance, and IT, are fundamental to the company's overall operational efficiency and global management.

| Cost Category | 2023 Expense (Approx.) | Key Components |

| Research, Development, and Engineering (RD&E) | Significant Investment | Engineering salaries, laboratory operations, prototyping |

| Manufacturing and Production | $4.9 Billion (Cost of Sales) | Raw materials, direct labor, factory overhead |

| Selling, General, and Administrative (SG&A) | $1.9 Billion (Total SG&A) | Sales force, marketing, distribution, corporate overhead |

| Acquisition-Related Costs | Variable, reflected in operating expenses | Due diligence, integration, amortization of intangibles |

Revenue Streams

Sales of electronic instruments are a cornerstone of Ametek's revenue, driven by their Electronic Instruments Group (EIG). This segment offers sophisticated analytical, monitoring, and testing devices crucial for various industries.

EIG's instruments cater to demanding sectors like power generation, chemical processing, and general industrial manufacturing, reflecting a broad market reach. In 2023, Ametek's EIG segment reported significant revenue, demonstrating the strong demand for these specialized instruments.

Ametek's Electromechanical Group (EMG) is a key revenue driver, generating substantial income from the sale of electromechanical devices. These devices are crucial for motion control and are often integrated with specialty materials, catering to demanding sectors.

In 2024, the aerospace, defense, and general industrial markets continued to be primary beneficiaries of EMG's offerings. These industries rely on the precision and reliability of Ametek's electromechanical solutions for their critical applications.

Ametek generates recurring revenue through its aftermarket services and spare parts division. This includes essential maintenance, repair, and overhaul (MRO) services for its diverse product portfolio. The sale of spare parts and replacement components also contributes significantly, ensuring customers can maintain and extend the life of their Ametek equipment.

This focus on aftermarket support fosters continued customer relationships and enhances product longevity. For instance, in 2023, Ametek reported that its Electromechanical Group, which includes many of these service-oriented businesses, saw strong performance, underscoring the value of these ongoing revenue streams.

Revenue from Strategic Acquisitions

AMETEK's strategic acquisition approach is a significant revenue driver, fueling both organic growth and market penetration. These acquisitions bring in established revenue streams and expand the company's reach into new sectors.

For instance, the 2023 acquisition of FARO Technologies, a leader in 3D measurement and imaging solutions, immediately bolstered AMETEK's sales. Similarly, the integration of Virtek Vision International, specializing in laser projection systems, added complementary product offerings and access to new customer segments.

AMETEK's commitment to integrating acquired companies effectively ensures that their revenue potential is realized quickly. This strategy is evident in their consistent track record of integrating businesses that contribute positively to top-line growth.

- Acquisitions directly contribute to increased sales and market expansion.

- Recent acquisitions like FARO Technologies and Virtek Vision International add new product lines and customer bases.

- This strategy is a core component of AMETEK's overall growth and revenue generation.

International Sales

AMETEK's global reach is a key driver of its financial success, with a significant portion of its revenue stemming from international markets. This widespread presence underscores the company's effective market expansion strategies and its ability to cater to diverse customer needs worldwide.

Both the Electronic Instruments Group (EIG) and the Electromechanical Group (EMG) segments contribute substantially to AMETEK's international sales. These segments consistently generate robust revenue from customers located outside the United States, with Europe and Asia being particularly strong regions for the company's operations and sales growth.

- Global Revenue Contribution: International sales represent a substantial and vital component of AMETEK's overall revenue generation.

- Key Geographic Markets: Europe and Asia are highlighted as particularly strong regions for AMETEK's international sales performance.

- Segmental Impact: Both the EIG and EMG segments are significant contributors to the company's international revenue streams.

- Market Penetration: The strong international sales figures reflect AMETEK's successful market penetration and expansion efforts across the globe.

AMETEK's revenue streams are diversified, primarily through its Electronic Instruments Group (EIG) and Electromechanical Group (EMG). EIG focuses on sophisticated analytical and monitoring instruments for industries like power and chemical processing, while EMG provides essential electromechanical devices for aerospace, defense, and general industrial markets. Recurring revenue from aftermarket services, spare parts, and maintenance, repair, and overhaul (MRO) further bolsters their financial performance.

The company's strategic acquisition approach is a significant growth engine, integrating new product lines and customer bases, as seen with the 2023 acquisition of FARO Technologies. AMETEK's substantial international sales, particularly from Europe and Asia, demonstrate its global market penetration and the broad appeal of its offerings across both EIG and EMG segments.

| Revenue Segment | Key Products/Services | Target Markets | 2023 Revenue Contribution (Illustrative) |

| Electronic Instruments Group (EIG) | Analytical, monitoring, and testing devices | Power generation, chemical processing, general industrial | Significant Portion |

| Electromechanical Group (EMG) | Electromechanical devices, motion control components | Aerospace, defense, general industrial | Significant Portion |

| Aftermarket Services & Spare Parts | Maintenance, repair, overhaul (MRO), replacement components | All product users | Growing Recurring Revenue |

| Acquisitions | Integrated businesses and product lines | Expanded market reach | Directly contributes to sales growth |

Business Model Canvas Data Sources

The Ametek Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and competitive landscape analysis. These diverse data streams ensure a comprehensive understanding of Ametek's strategic positioning and operational realities.