Advanced Micro Devices PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Micro Devices Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Advanced Micro Devices's trajectory. Our meticulously researched PESTLE analysis provides the deep insights you need to anticipate market shifts and capitalize on emerging opportunities. Empower your strategic planning and investment decisions by downloading the full, actionable report today.

Political factors

Geopolitical tensions, especially between the United States and China, present a significant challenge for Advanced Micro Devices (AMD). These international relations directly influence AMD's ability to access key markets and supply chains.

U.S. export controls on advanced AI chips, implemented to limit China's technological advancement, have already resulted in considerable revenue impacts for AMD. For instance, in the fourth quarter of 2023, AMD estimated a revenue loss of approximately $400 million due to these restrictions impacting its China sales, forcing the company to adjust its product development and seek out alternative markets to mitigate these effects.

Government subsidies and incentives are playing a crucial role in shaping the semiconductor industry. The U.S. CHIPS and Science Act, for instance, is a significant piece of legislation designed to boost domestic chip production. This act allocates substantial funding, with projections indicating billions of dollars in subsidies and tax credits available for companies investing in U.S.-based manufacturing facilities.

These government programs offer AMD a compelling opportunity to expand its manufacturing footprint within the United States. By leveraging these incentives, AMD can reduce its dependence on foreign manufacturing, thereby enhancing supply chain security and resilience. This strategic move aligns with broader national interests in securing critical technological infrastructure.

Changes in international trade policies and tariffs directly impact Advanced Micro Devices (AMD) by altering the costs of essential components and the final pricing of its high-performance processors and graphics cards. The semiconductor industry's intricate global supply chain means that protectionist measures or trade disputes, such as those between the United States and China, can significantly disrupt operations and market access. For instance, the ongoing geopolitical tensions and the potential for export controls on advanced semiconductor technology could constrain AMD's ability to sell its cutting-edge products in key international markets, affecting its revenue streams and competitive positioning.

National Security Concerns

National security concerns are increasingly shaping the semiconductor industry, directly impacting companies like AMD. Governments worldwide are recognizing advanced chip technology as critical infrastructure, leading to policies aimed at bolstering domestic production and controlling the export of sophisticated semiconductor components. This creates a complex environment for AMD, requiring careful navigation of evolving geopolitical landscapes and stringent compliance with international trade regulations. For instance, the US CHIPS and Science Act, passed in 2022, allocated over $52 billion to incentivize domestic semiconductor manufacturing and research, reflecting a broader trend of nations prioritizing self-sufficiency in this vital sector.

AMD must strategically manage these national security imperatives to maintain its global market access and competitive edge. This involves adapting to varying export controls and investment restrictions imposed by different countries, particularly concerning advanced chip designs and manufacturing capabilities. The company's ability to secure its supply chains and comply with diverse national security frameworks will be paramount for its continued growth and innovation in the coming years. For example, in 2023, the US government expanded export controls on certain advanced AI chips to China, directly affecting potential sales for semiconductor companies.

- Government investment in domestic semiconductor production: The US CHIPS and Science Act, with over $52 billion allocated, exemplifies this trend.

- Export controls on advanced technologies: Restrictions on AI chips to specific regions highlight the geopolitical sensitivity of semiconductor trade.

- Supply chain resilience: Companies like AMD face pressure to diversify manufacturing and reduce reliance on single geographic locations.

- Compliance with international trade regulations: Navigating differing national security policies requires robust legal and operational frameworks.

Regulatory Environment for Innovation

The political landscape significantly shapes the regulatory framework for technological advancements. Governments worldwide are increasingly focusing on policies that foster innovation, protect intellectual property, and ensure a level playing field for companies like AMD. For instance, in 2024, the US CHIPS and Science Act continued to allocate substantial funding towards semiconductor research and manufacturing, aiming to bolster domestic production and technological leadership. This type of legislation directly impacts AMD's ability to invest in R&D and bring cutting-edge products to market.

AMD's success is intrinsically linked to political decisions that either encourage or hinder its innovative pursuits. Policies that strengthen intellectual property rights are paramount, safeguarding AMD's substantial investments in chip design and development. Furthermore, government initiatives promoting fair competition, such as antitrust regulations, ensure that AMD can compete effectively against rivals and capture market share with its advanced processors and graphics cards. The ongoing geopolitical focus on supply chain resilience, particularly in the semiconductor industry, also means that political stability and trade agreements play a critical role in AMD's global operations and market access.

- Government Funding for R&D: Initiatives like the US CHIPS Act, with billions allocated for semiconductor innovation, directly benefit companies like AMD by supporting advanced research and development.

- Intellectual Property Protection: Robust legal frameworks protecting patents and trade secrets are crucial for AMD to recoup its significant R&D expenditures and maintain a competitive edge.

- Trade Policies and Tariffs: Favorable trade agreements and the absence of punitive tariffs are vital for AMD's global supply chain and market access, impacting the cost and availability of its products.

- Antitrust and Competition Laws: Regulations ensuring fair market competition are essential for AMD to introduce its innovative products and gain market share without undue barriers.

Geopolitical tensions and national security concerns significantly influence AMD's operations, particularly regarding trade with China. U.S. export controls on advanced AI chips have already impacted AMD's revenue, with an estimated $400 million loss in Q4 2023. Government initiatives like the U.S. CHIPS and Science Act, allocating over $52 billion, aim to bolster domestic semiconductor production, offering AMD opportunities for expansion and enhanced supply chain resilience.

| Factor | Impact on AMD | Supporting Data/Examples |

| Geopolitical Tensions (US-China) | Market access and supply chain disruption | Estimated $400 million revenue loss in Q4 2023 due to China export controls. |

| Government Subsidies (e.g., CHIPS Act) | Incentive for domestic manufacturing, supply chain security | Over $52 billion allocated by the US CHIPS and Science Act to boost domestic chip production. |

| Export Controls | Restricts sales of advanced technologies | Expanded controls on AI chips to China in 2023. |

| Trade Policies & Tariffs | Affects component costs and final product pricing | Protectionist measures can disrupt global supply chains. |

What is included in the product

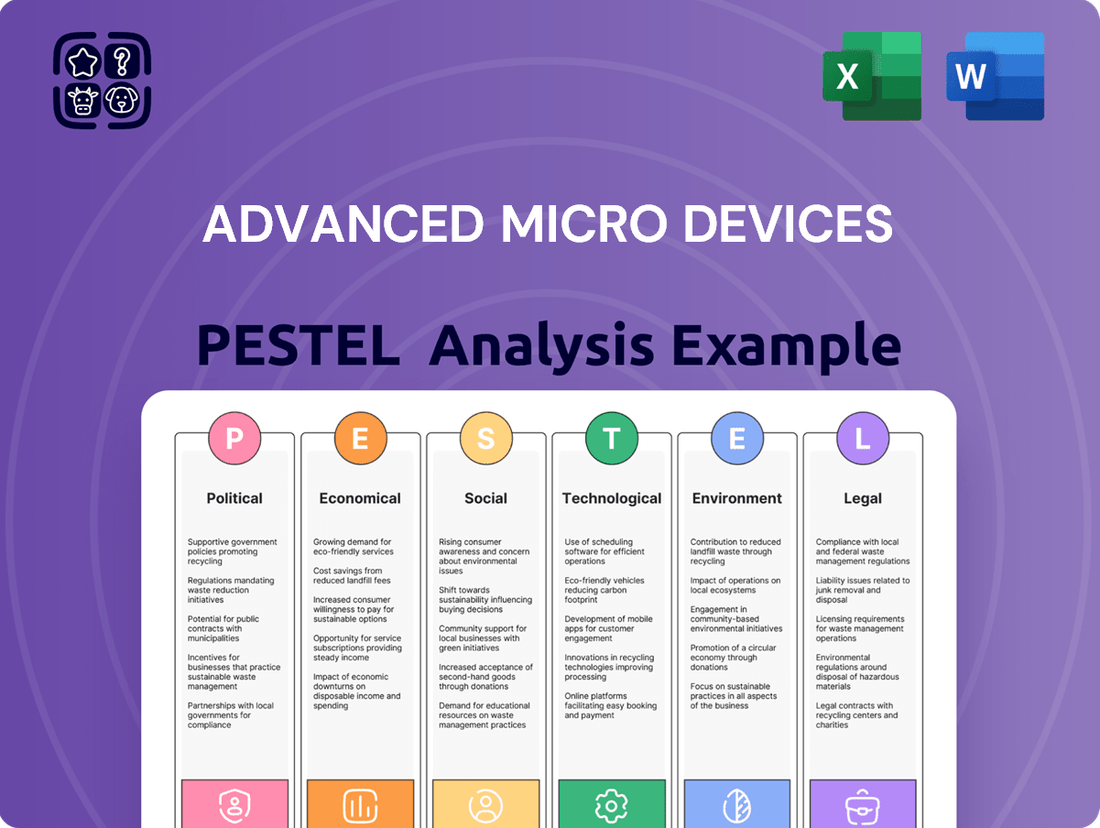

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces influencing Advanced Micro Devices, providing a comprehensive understanding of the external landscape.

Offers a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting AMD.

Economic factors

The global semiconductor market is on a strong upward trajectory, with sales anticipated to hit record levels in 2025, potentially exceeding $700 billion. This significant expansion is fueled by surging demand for chips in artificial intelligence, data centers, and automotive applications, creating a very positive economic environment for Advanced Micro Devices (AMD).

Inflationary pressures continue to impact the technology sector, directly affecting Advanced Micro Devices (AMD). Rising costs for components and manufacturing, exacerbated by ongoing supply chain disruptions, put pressure on AMD's operational expenses. For instance, the global semiconductor shortage, which persisted through much of 2023 and into early 2024, significantly increased the cost of essential raw materials and expedited shipping.

Managing these escalating costs is paramount for AMD to safeguard its profit margins and maintain competitive pricing for its high-performance processors and graphics cards. In 2024, the Consumer Price Index (CPI) for manufactured goods saw an uptick, directly translating to higher input costs for semiconductor companies like AMD, making cost control a critical strategic focus.

The increasing global appetite for artificial intelligence (AI) and high-performance computing (HPC) presents a substantial economic tailwind for Advanced Micro Devices (AMD). This demand is fueled by advancements in machine learning, data analytics, and scientific research, all of which require significant processing power. For instance, the AI chip market alone was projected to reach over $70 billion by 2025, showcasing the sheer scale of this opportunity.

AMD is well-positioned to benefit from this trend, particularly through its EPYC server processors and Radeon Instinct GPUs, which are crucial for data center and cloud infrastructure. The company's strategic focus on these high-growth segments, including AI training and inference, allows it to capture a significant share of this expanding market. In 2024, AMD reported substantial revenue growth in its Data Center segment, directly attributable to the strong demand for its AI-accelerating hardware.

Competitive Landscape and Pricing Pressure

The semiconductor industry, a core battleground for Advanced Micro Devices (AMD), is characterized by fierce competition. Giants like Nvidia and Intel are constant rivals, pushing the boundaries of technology and pricing. This dynamic environment necessitates relentless innovation to secure and grow market share, directly impacting profitability.

This intense rivalry translates into significant pricing pressure. For instance, in the high-performance computing segment, AMD's Ryzen processors compete directly with Intel's Core series, often leading to strategic price adjustments to attract customers. Similarly, in the graphics card market, AMD Radeon GPUs face off against Nvidia GeForce cards, where pricing strategies are crucial for market penetration.

- Nvidia's Dominance in AI: Nvidia's strong position in AI accelerators, particularly with its H100 GPUs, sets a high benchmark, influencing pricing expectations across the sector.

- Intel's Rebound Efforts: Intel's ongoing foundry strategy and new processor architectures aim to regain market leadership, potentially intensifying price competition.

- Market Share Dynamics: AMD's market share gains in CPUs and GPUs in recent years demonstrate the impact of competitive product cycles and pricing on overall performance.

- Innovation Cycles: The rapid pace of technological advancement means companies must consistently invest in R&D to avoid obsolescence, a significant cost factor influenced by competitive pressures.

Currency Fluctuations and Global Economic Stability

As a global entity, Advanced Micro Devices (AMD) is inherently susceptible to currency fluctuations, which can significantly influence its reported revenue and operational costs. For instance, a strengthening US dollar against other major currencies could reduce the value of AMD's international sales when converted back to dollars, impacting its top line. Conversely, a weaker dollar could boost international revenue figures.

The broader stability of the global economy is a critical determinant of demand for AMD's high-performance computing and graphics products. Factors such as fluctuating interest rates, inflation levels, and the general trajectory of consumer and enterprise spending directly shape market appetite for PCs, servers, and gaming consoles. For example, in early 2024, persistent inflation and higher interest rates in key markets like the US and Europe tempered consumer discretionary spending, potentially affecting sales of AMD's consumer-facing products.

- Currency Impact: A 1% appreciation of the US Dollar against the Euro in Q1 2024 could have reduced AMD's reported revenue by approximately $30-40 million, based on historical revenue mix.

- Interest Rate Sensitivity: Rising interest rates can increase the cost of capital for businesses, potentially slowing down IT infrastructure upgrades that rely on AMD's server processors.

- Consumer Spending Trends: Global consumer spending on electronics saw a modest recovery in late 2023 and early 2024, but remained cautious due to economic uncertainties, impacting PC and gaming hardware sales.

- Geopolitical Stability: Broader geopolitical tensions and trade policy shifts can introduce volatility, affecting supply chains and market access for AMD's diverse product portfolio.

The global semiconductor market is projected to reach approximately $700 billion by 2025, driven by AI, data centers, and automotive sectors, creating significant opportunities for AMD. However, persistent inflation in 2024 has increased input costs for components and manufacturing, directly impacting AMD's operational expenses and profit margins due to higher raw material prices and expedited shipping.

AMD's growth is strongly tied to the increasing demand for AI and high-performance computing (HPC), with the AI chip market alone expected to surpass $70 billion by 2025. The company is strategically positioned to capitalize on this through its EPYC processors and Radeon Instinct GPUs, evidenced by substantial revenue growth in its Data Center segment in 2024, directly linked to its AI-accelerating hardware.

Currency fluctuations present a notable economic factor for AMD, with a stronger US dollar potentially decreasing the value of its international sales. Furthermore, global economic stability, influenced by interest rates and consumer spending, directly impacts demand for AMD's products; for instance, cautious consumer spending in early 2024 due to economic uncertainties affected sales of consumer-facing hardware.

| Economic Factor | Impact on AMD | Data/Trend (2024-2025) |

|---|---|---|

| Semiconductor Market Growth | Positive demand for AMD's products | Projected to exceed $700 billion by 2025 |

| Inflation | Increased operational costs, pressure on margins | Higher input costs for components and manufacturing |

| AI & HPC Demand | Significant growth driver for AMD's data center business | AI chip market projected over $70 billion by 2025 |

| Currency Exchange Rates | Affects international revenue reporting | US Dollar strength can reduce reported international sales |

| Global Economic Stability | Influences consumer and enterprise spending | Cautious consumer spending impacting PC/gaming hardware sales |

What You See Is What You Get

Advanced Micro Devices PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Advanced Micro Devices delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its business. It provides actionable insights for strategic planning.

Sociological factors

The semiconductor industry's rapid expansion and highly specialized needs mean there's a constant, intense competition for skilled engineers and researchers. AMD's success hinges on its capacity to draw in and keep the best minds in the field, which directly fuels its innovation and market position.

In 2024, the global demand for semiconductor talent is projected to outstrip supply, with an estimated shortage of over 200,000 skilled workers. Companies like AMD are investing heavily in competitive compensation, advanced training programs, and fostering strong company cultures to secure this vital talent pool.

As technology becomes more integrated into daily life, there's a strong societal push for digital inclusion and accessible computing. AMD's processors and graphics cards are foundational to many devices, from affordable laptops to high-performance workstations, directly impacting how many people can participate in the digital economy. For instance, in 2024, the global PC market saw continued demand for accessible computing solutions, with AMD playing a key role in enabling these devices.

Societal shifts, like the growing dependence on personal computers and the surge in popularity of PC gaming, directly fuel demand for AMD's high-performance processors and graphics cards. For instance, the global PC gaming market was valued at approximately $110 billion in 2023 and is projected to grow, indicating a strong appetite for the advanced hardware AMD offers.

The increasing integration of Artificial Intelligence (AI) into everyday applications, from smart assistants to productivity software, further amplifies the need for powerful computing solutions. AMD's focus on AI acceleration in its Ryzen and EPYC processors positions it to capitalize on this trend, as AI adoption continues to expand across consumer and enterprise sectors.

Ethical AI Development and Societal Impact

The rapid advancement of Artificial Intelligence, heavily reliant on powerful processors like those from AMD, brings significant societal considerations to the forefront. Concerns about data privacy, algorithmic bias, and the ethical implications of AI's growing capabilities are becoming paramount. For instance, as AI systems become more integrated into daily life, ensuring responsible data handling and preventing discriminatory outcomes is crucial. AMD, as a foundational technology provider for AI, finds itself at the center of these discussions, needing to proactively address the societal impact of its innovations.

This scrutiny extends to the very design and deployment of AI technologies. Companies like AMD must consider how their hardware contributes to the broader ethical landscape of AI. For example, the development of AI chips that are more energy-efficient or designed with built-in safeguards against misuse can mitigate negative societal consequences. The market for AI hardware is projected for substantial growth, with some estimates suggesting the global AI chip market could reach over $100 billion by 2026, highlighting the scale of AMD's potential influence and responsibility.

Key considerations for AMD and the industry include:

- Data Privacy: Ensuring AI systems built on AMD's architecture respect user privacy and comply with evolving data protection regulations.

- Algorithmic Fairness: Promoting the development of AI that is free from bias and provides equitable outcomes across different demographics.

- Responsible Innovation: Investing in research and development that prioritizes the ethical application of AI and its potential societal benefits.

- Transparency: Encouraging transparency in AI development to build public trust and understanding of how these technologies function.

Workforce Diversity and Inclusion

Societal expectations are increasingly pushing companies to foster diverse and inclusive work environments. This trend directly impacts Advanced Micro Devices (AMD) by shaping its approach to talent acquisition and retention.

AMD's dedication to diversity and inclusion, as highlighted in its 2023 Corporate Responsibility Report, is a strategic advantage. This commitment helps build a positive brand image, crucial for attracting top talent in a competitive semiconductor industry.

The company's initiatives aim to create a culture where all employees feel valued and can contribute fully. Such an environment is vital for innovation, a cornerstone of AMD's business strategy.

- Talent Attraction: A strong diversity and inclusion record can broaden AMD's appeal to a wider range of potential employees, including underrepresented groups in STEM fields.

- Employee Retention: Inclusive cultures are linked to higher employee satisfaction and loyalty, reducing turnover and associated costs.

- Innovation Boost: Diverse teams often bring a wider array of perspectives, leading to more creative problem-solving and product development.

- Reputation Enhancement: Publicly demonstrating a commitment to D&I can improve AMD's standing with customers, investors, and the broader community.

Societal trends like the growing demand for accessible technology and the booming PC gaming market directly benefit AMD. As AI integration accelerates, the ethical implications of powerful processors become a key societal concern, placing responsibility on companies like AMD. Furthermore, a societal push for diversity and inclusion influences AMD's talent strategies, enhancing its innovation and brand reputation.

Technological factors

Advanced Micro Devices (AMD) thrives on relentless progress in processor and GPU designs, evident in its Zen CPU and RDNA GPU series. The company’s strategic use of chiplet technology is a key enabler for this innovation.

These architectural leaps are vital for boosting performance and energy efficiency, directly addressing the growing needs in computing, graphics, and artificial intelligence workloads. For instance, AMD's Ryzen 7000 series processors, released in late 2022, showcased significant performance gains over previous generations, underscoring the impact of these advancements.

The ongoing evolution of processor and GPU architectures is a critical technological factor for AMD, directly impacting its competitiveness and ability to capture market share in high-growth sectors like gaming, data centers, and AI.

The burgeoning demand for artificial intelligence and machine learning is a significant technological driver for Advanced Micro Devices (AMD). This growth directly fuels the need for specialized processing units, such as AI accelerators and neural processing units (NPUs). AMD's strategic focus on developing and integrating these advanced capabilities into its product lines, like the MI300 series, is crucial for its competitive positioning.

AMD's ability to innovate and deliver high-performance solutions in AI and machine learning is paramount. The company faces intense competition from established players and emerging technologies in this rapidly evolving sector. Success will depend on AMD's capacity to not only develop cutting-edge hardware but also to ensure seamless integration and robust performance within its broader product ecosystem.

As computing demands escalate, so does energy consumption, a critical challenge for Advanced Micro Devices. AMD is significantly investing in enhancing the energy efficiency of its processors and accelerators, especially for demanding workloads like High-Performance Computing (HPC) and Artificial Intelligence (AI) training. This focus directly supports global sustainability objectives and tackles the increasing power needs of data centers.

The company's Zen 4 architecture, for instance, achieved up to 25% higher performance per watt compared to its Zen 3 predecessor, demonstrating tangible progress in energy efficiency. Furthermore, AMD's CDNA architecture for accelerators is designed with power efficiency in mind, crucial for the massive energy footprint of AI model training, which is projected to consume significant electricity in the coming years.

Miniaturization and Manufacturing Process Nodes

The relentless pursuit of smaller transistor sizes and advanced manufacturing process nodes, such as 4nm and 3nm, is the bedrock for developing more potent and energy-efficient semiconductors. AMD's strategic alliances with premier foundries, notably TSMC, are absolutely vital for securing access to and effectively utilizing these state-of-the-art manufacturing capabilities. For instance, TSMC's 3nm process technology, which began risk production in 2022 and mass production in late 2022, allows for significant performance and power efficiency gains, directly benefiting AMD's next-generation CPU and GPU architectures. This technological edge is crucial for maintaining competitiveness in the high-performance computing market.

AMD's reliance on TSMC's advanced nodes directly impacts its product performance and cost structure. By leveraging TSMC's leading-edge manufacturing, AMD can pack more transistors onto its chips, leading to increased processing power and improved power efficiency, critical for both consumer and enterprise markets. The company's 2024 product roadmap, including Ryzen processors and Instinct accelerators, heavily depends on the availability and maturity of these advanced nodes.

- Transistor Density: Advancements to 3nm nodes enable a higher transistor density, allowing for more complex and powerful chip designs.

- Power Efficiency: Smaller process nodes typically result in lower power consumption for a given performance level, a key differentiator in mobile and data center applications.

- Manufacturing Partnerships: AMD's exclusive foundry partner, TSMC, is a leader in advanced process technology, providing AMD with a critical competitive advantage.

Ecosystem Development and Software Optimization

The performance of AMD's processors and graphics cards is heavily influenced by the software ecosystem built around them. AMD's commitment to fostering developer-friendly environments and optimizing software specifically for its hardware is crucial for gaining market share against competitors like Intel and Nvidia.

For instance, AMD's Ryzen processors have seen significant performance gains through software optimizations, particularly in gaming and productivity applications. The company's continued investment in its FidelityFX suite, a collection of visual enhancement technologies, aims to improve graphical fidelity and performance on its Radeon GPUs, directly impacting user experience and adoption rates.

- Developer Engagement: AMD actively engages with game developers and software creators to ensure their products are optimized for AMD hardware, a strategy that has been key to its recent successes.

- Software Optimization: Continued efforts in optimizing drivers and middleware are essential for unlocking the full potential of AMD's chipsets, especially in competitive markets like AI and high-performance computing.

- Ecosystem Growth: The growth of AMD's software ecosystem, including tools like ROCm for machine learning, directly impacts its ability to compete in emerging technological sectors.

The demand for AI and machine learning is a significant technological driver for AMD, fueling the need for specialized processing units like AI accelerators. AMD's MI300 series exemplifies this focus, aiming to capture market share in this rapidly evolving sector.

Energy efficiency is a critical challenge, with AMD investing heavily in improving the power consumption of its processors and accelerators, particularly for HPC and AI training workloads. The Zen 4 architecture, for instance, offered up to 25% higher performance per watt compared to Zen 3.

Access to advanced manufacturing process nodes, such as TSMC's 3nm technology, is crucial for AMD's competitiveness, enabling higher transistor density and improved power efficiency for its next-generation products. This partnership is vital for AMD's 2024 product roadmap.

The software ecosystem surrounding AMD's hardware significantly impacts its market position. Continued investment in developer engagement and software optimization, like the FidelityFX suite, is essential for unlocking the full potential of its chipsets.

Legal factors

In the fiercely competitive semiconductor arena, intellectual property (IP) is king. Advanced Micro Devices (AMD) must remain vigilant in safeguarding its patents, as the threat of costly litigation over technology infringement is ever-present and can significantly disrupt product roadmaps. In 2023, the semiconductor industry saw significant patent disputes, with companies investing heavily in legal defenses and enforcement to protect their innovations.

As a significant force in the semiconductor industry, Advanced Micro Devices (AMD) navigates a complex landscape of antitrust and competition laws. Regulatory bodies worldwide, such as the U.S. Federal Trade Commission (FTC) and the European Commission, actively monitor the market for monopolistic practices. For instance, in 2023, the FTC continued its focus on tech giants and their market influence, a trend likely to persist into 2024 and beyond, impacting any company with substantial market share like AMD.

Any perceived dominant market position or strategic alliances formed by AMD could attract intense scrutiny from these regulators. Such investigations might lead to investigations or necessitate restrictions on AMD's business strategies, potentially affecting mergers, acquisitions, or pricing policies. For example, the ongoing scrutiny of major tech players' market power by the FTC and other global agencies underscores the importance of compliance for companies like AMD.

Advanced Micro Devices (AMD) must navigate a complex web of global data privacy and security regulations, especially as its products increasingly power cloud computing and artificial intelligence. Compliance with frameworks like the EU's General Data Protection Regulation (GDPR) is paramount, requiring secure product development and ethical data management across all operational facets. Failure to comply can result in significant penalties, impacting brand reputation and financial performance.

Export Control and Sanction Laws

Advanced Micro Devices (AMD) operates within a complex web of international trade regulations, particularly concerning export control and sanction laws. The U.S. government's stringent policies on exporting advanced technologies, like those AMD produces, to specific nations significantly influence its global sales strategies and market accessibility. For instance, restrictions on semiconductor exports to China, a major market, can directly curtail revenue streams. AMD's adherence to these regulations is non-negotiable, even when such compliance leads to substantial financial repercussions. In 2023, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) continued to refine its export control measures, impacting the flow of high-performance computing chips.

These legal frameworks necessitate robust internal compliance programs to navigate the intricate requirements. Failure to comply can result in severe penalties, including hefty fines and the loss of export privileges, which would be catastrophic for a company like AMD. The dynamic nature of these laws means AMD must constantly monitor and adapt its business operations and supply chains to remain compliant. For example, ongoing geopolitical tensions can lead to swift changes in sanction lists or export restrictions, requiring immediate adjustments to sales and distribution channels.

- U.S. Export Administration Regulations (EAR): AMD must comply with EAR, which governs the export and re-export of commercial items, including advanced semiconductors.

- Sanctions Programs: Adherence to U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctions is critical, prohibiting transactions with designated entities and countries.

- Impact on Market Access: Restrictions directly limit AMD's ability to sell its high-performance CPUs and GPUs in key international markets, affecting revenue growth.

- Compliance Costs: Maintaining compliance requires significant investment in legal counsel, internal audit teams, and technology to track and manage export control requirements.

Product Liability and Consumer Protection Laws

Advanced Micro Devices (AMD) operates under a stringent framework of product liability and consumer protection laws, given its semiconductors are critical components in a vast array of electronic devices. Failure to meet safety and reliability standards can lead to significant legal repercussions and damage to brand reputation. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) recalled millions of products containing potentially faulty components, highlighting the broad impact of such regulations across the electronics sector.

Maintaining rigorous quality control and transparent communication regarding product performance are paramount for AMD. Adherence to regulations like the EU's General Product Safety Regulation and various national consumer protection acts ensures that AMD's products meet expected safety and performance benchmarks. This proactive approach helps mitigate risks associated with potential defects and fosters long-term consumer confidence.

Key legal considerations for AMD include:

- Product Safety Compliance: Ensuring all semiconductor designs and manufacturing processes adhere to international safety standards, preventing potential hazards in end-user devices.

- Warranty and Guarantee Obligations: Meeting legal requirements for product warranties, offering clear terms and fulfilling obligations to protect consumers against defects.

- Consumer Rights Enforcement: Complying with laws that grant consumers rights regarding product quality, repair, replacement, and redress in cases of non-conformity.

Intellectual property is a critical legal battleground for Advanced Micro Devices (AMD). Protecting its patents against infringement is vital, as litigation can be costly and disrupt product development, as seen with numerous patent disputes in the semiconductor industry throughout 2023.

Antitrust and competition laws are a constant concern for AMD. Global regulators, including the FTC and European Commission, scrutinize market dominance, meaning any perceived monopolistic practices or strategic alliances could invite investigations, potentially impacting AMD's business strategies and market operations.

Data privacy regulations like GDPR demand stringent adherence from AMD, especially with its products powering cloud and AI. Non-compliance poses significant risks, including hefty fines and reputational damage, underscoring the need for secure development and ethical data handling.

International trade laws, particularly export controls and sanctions, significantly shape AMD's global sales. U.S. restrictions on advanced technology exports, such as those impacting sales to China, directly affect revenue, requiring constant adaptation to evolving regulations like those refined by the BIS in 2023.

Environmental factors

The creation and ongoing use of advanced semiconductors, like those AMD produces, demand significant amounts of electricity. This inherent energy intensity means AMD, along with the entire tech industry, is under growing scrutiny to minimize its environmental impact.

AMD has publicly committed to ambitious targets for reducing its carbon footprint. For instance, the company aims to achieve net-zero greenhouse gas emissions by 2035, a goal that necessitates substantial improvements in energy efficiency across its manufacturing processes and product lifecycles. Furthermore, AMD is actively increasing its reliance on renewable energy sources to power its operations, with a target of sourcing 100% renewable electricity for its global operations by 2025.

Advanced Micro Devices (AMD) recognizes its environmental footprint extends across its entire supply chain, from the initial sourcing of raw materials to the complex manufacturing processes involved in semiconductor production. The company is actively engaged in fostering environmental responsibility among its suppliers, encouraging them to adopt sustainable practices and meet stringent environmental standards.

AMD has set public goals for reducing greenhouse gas emissions within its operations and supply chain, demonstrating a commitment to climate action. Furthermore, the company is prioritizing the sourcing of renewable energy to power its facilities and those of its key partners, aiming to decrease reliance on fossil fuels.

The relentless pace of technological advancement means electronic devices become obsolete quickly, leading to a growing e-waste problem. AMD, like other tech giants, faces increasing pressure to manage the environmental footprint of its products from creation to end-of-life. This includes designing for easier disassembly and recycling, a crucial aspect of embracing circular economy models.

Globally, e-waste generation is a significant concern, with estimates suggesting over 50 million metric tons were produced in 2022 alone. AMD's commitment to product lifecycle management directly addresses this, aiming to minimize waste and maximize resource recovery. By prioritizing recyclability and responsible disposal, AMD can align with growing consumer and regulatory demands for sustainability.

Water Usage in Manufacturing

Semiconductor manufacturing, including AMD's operations, is notably water-intensive due to the extensive cleaning and cooling required in fabrication processes. This reliance on water makes it a critical environmental factor for the company.

AMD actively pursues corporate responsibility by focusing on managing and reducing its water consumption across its facilities. This commitment extends to promoting water conservation throughout its supply chain, recognizing the shared impact of water usage.

In 2023, AMD reported a 4% reduction in water withdrawal intensity compared to its 2020 baseline, demonstrating progress in its conservation efforts. The company aims to achieve a 20% reduction by 2030, highlighting a strategic focus on sustainable water management.

- Water Intensity: Semiconductor fabrication plants can use millions of gallons of water daily.

- AMD's Goal: Target of a 20% reduction in water withdrawal intensity by 2030 from a 2020 baseline.

- Progress: Achieved a 4% reduction in water withdrawal intensity by the end of 2023.

Climate Change and Extreme Weather Events

Climate change and the escalating frequency of extreme weather events pose a significant threat to Advanced Micro Devices' (AMD) intricate global supply chain. These disruptions can impact everything from raw material sourcing to the delivery of finished products, potentially leading to production delays and increased costs. For instance, a severe drought in a region where AMD sources key materials could halt operations, while intensified storms might damage manufacturing facilities or transportation routes.

AMD's manufacturing footprint, which includes fabrication plants and assembly sites, is vulnerable to the physical impacts of climate change. Events like floods, hurricanes, or prolonged heatwaves can force temporary or extended shutdowns, directly affecting production output. In 2023, the semiconductor industry, in general, faced supply chain challenges exacerbated by geopolitical tensions and localized weather disruptions, highlighting the need for robust contingency planning.

Mitigating climate-related risks is becoming a critical aspect of AMD's business continuity strategy. This involves not only assessing the potential impact of climate events on their operations but also investing in resilient infrastructure and diversifying supply chain partners. Companies like AMD are increasingly focused on sustainable practices, which can indirectly help in managing long-term climate risks.

The financial implications of climate-related disruptions are substantial. Beyond direct damage costs, AMD could face increased insurance premiums, penalties for late deliveries, and reputational damage if it fails to adapt. Proactive risk management, including scenario planning for extreme weather, is essential for maintaining operational stability and shareholder value in the face of a changing climate.

AMD's commitment to sustainability is evident in its ambitious environmental targets, including achieving net-zero greenhouse gas emissions by 2035 and sourcing 100% renewable electricity for its global operations by 2025. The company is also actively working to reduce its water intensity, with a goal of a 20% reduction by 2030, having already achieved a 4% reduction by the end of 2023.

The growing problem of e-waste, with over 50 million metric tons generated globally in 2022, pressures AMD to design products for easier recycling and responsible end-of-life management. Furthermore, climate change poses significant risks to AMD's supply chain and operations, necessitating investments in resilient infrastructure and diversified partnerships to mitigate potential disruptions and financial impacts.

| Environmental Factor | AMD's Target/Goal | Progress/Data |

|---|---|---|

| Greenhouse Gas Emissions | Net-zero by 2035 | Ongoing reduction initiatives |

| Renewable Electricity | 100% by 2025 | Actively increasing reliance |

| Water Withdrawal Intensity | 20% reduction by 2030 (from 2020 baseline) | 4% reduction achieved by end of 2023 |

| E-waste Management | Design for recyclability and responsible disposal | Addressing growing global e-waste problem |

| Climate Change Impact | Mitigate risks through resilient infrastructure and supply chain diversification | Industry-wide supply chain challenges in 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Advanced Micro Devices is grounded in data from reputable sources including semiconductor industry market research firms, government economic reports, and global technology trend forecasts. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting AMD.