Advanced Micro Devices Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Micro Devices Bundle

Curious about Advanced Micro Devices' strategic positioning? This glimpse into their BCG Matrix highlights key product areas, but to truly understand their market dominance and future potential, you need the full picture. Discover which segments are driving growth and which require a strategic pivot.

Unlock the complete Advanced Micro Devices BCG Matrix to gain a comprehensive understanding of their product portfolio's performance. This detailed report will equip you with the insights needed to make informed investment decisions and optimize resource allocation for maximum impact. Purchase the full version for actionable strategies.

Stars

AMD's Instinct MI300 series, including the MI300X and the anticipated MI350, are positioned as Stars in the BCG matrix. This is driven by their significant growth potential and increasing adoption within the booming AI and data center markets.

The MI300X has secured key partnerships with major cloud providers like Microsoft Azure and Meta, with Meta notably deploying it for both Llama 3 and Llama 4 inference workloads. This strong industry backing highlights the product's current market relevance and future demand.

AMD's data center AI revenue demonstrated robust performance, exceeding $5 billion in 2024. Projections suggest this figure could potentially double, surpassing $10 billion by 2025, underscoring the high-growth nature of this segment for AMD.

AMD's EPYC server CPUs are a prime example of a Star in the BCG Matrix. Their market share in the server CPU space has surged dramatically, capturing a significant portion of the market. This growth is directly contributing to AMD's strong performance in the data center sector.

The data center segment, heavily bolstered by EPYC and Instinct sales, achieved a record revenue of $12.6 billion in 2024. This represents an impressive 94% increase year-over-year, underscoring the success and demand for AMD's server solutions.

With market share climbing from a mere 2% in 2017 to an estimated 36.5% by mid-2025 and nearing 40% in Q1 2025, EPYC processors have firmly established themselves as a formidable competitor against Intel in the data center arena.

AMD's high-end Ryzen desktop processors, particularly the Ryzen 7000 and the anticipated Ryzen 9000 series with advanced 3D V-Cache technology, are capturing significant market share. These processors are in high demand among dedicated gamers and professionals requiring substantial computing power.

The client segment, encompassing desktop processors, experienced a robust 58% revenue surge in Q4 2024. This upward trend is projected to persist, driven by the ongoing demand for high-performance computing solutions.

With their consistent performance leadership and ongoing technological advancements, AMD's premium desktop CPUs are well-positioned to capitalize on the expanding PC market, solidifying their status as a key player.

Ryzen Mobile Processors (Ryzen AI 300 Series and high-performance HX/HX3D)

AMD's Ryzen AI 300 series and high-performance HX/HX3D processors are strong contenders in the current market landscape. These processors are poised for significant growth, bolstered by strategic partnerships with original equipment manufacturers (OEMs) like Dell, particularly within the commercial PC segment. This strategic positioning is expected to translate into substantial revenue generation and increased market share in the mobile computing sector, especially as the demand for AI-integrated PCs continues to surge.

The Ryzen AI 300 series, with its integrated neural processing units (NPUs), is designed to accelerate artificial intelligence tasks directly on the device. This focus on AI capabilities aligns perfectly with the growing trend of AI-enhanced user experiences in laptops. For instance, the anticipated performance gains in AI workloads for these processors are a key differentiator.

- Ryzen AI 300 Series: Focus on integrated AI acceleration for enhanced productivity and new application possibilities.

- High-Performance HX/HX3D: Catering to gaming and professional workloads demanding top-tier CPU performance.

- OEM Collaborations: Strategic partnerships with companies like Dell are crucial for broad market adoption in commercial and consumer channels.

- Market Growth: Expected to capture significant share in the rapidly expanding AI PC market, projected to reach substantial unit volumes by 2025.

Semi-Custom Chips for Gaming Consoles (Next-Gen)

While the current generation of gaming consoles is well-established, AMD's semi-custom chips are poised to dominate the next wave. These chips are the backbone of upcoming PlayStation and Xbox consoles, and are also powering the growing market for handheld gaming PCs. This strategic positioning ensures AMD's continued high market share in this specialized, high-volume segment, even as demand for current consoles naturally cycles.

AMD's dominance in the gaming console market is substantial. For instance, the PlayStation 5 and Xbox Series X/S both utilize custom AMD Zen 2 CPUs and RDNA 2 GPUs. This deep integration provides a significant competitive advantage and a strong foundation for future revenue streams as new console generations are released.

- Dominant Market Share: AMD is the primary chip supplier for the vast majority of current-generation gaming consoles.

- Future Growth Driver: The development and supply of chips for next-generation consoles represent a significant growth opportunity.

- Handheld Gaming Expansion: AMD's semi-custom solutions are also enabling the burgeoning handheld gaming PC market, diversifying their reach.

- Cyclical Resilience: While console demand can fluctuate, AMD's embedded position in future hardware ensures long-term stability.

AMD's Instinct MI300 series, including the MI300X and anticipated MI350, are strong Stars due to their high growth in the AI and data center markets. With data center AI revenue exceeding $5 billion in 2024 and projected to double by 2025, these accelerators are key revenue drivers.

AMD's EPYC server CPUs are also Stars, having dramatically increased their market share in the data center. The data center segment, powered by EPYC and Instinct, achieved a record $12.6 billion in revenue in 2024, a 94% year-over-year increase.

Premium Ryzen desktop processors, like the Ryzen 7000 and upcoming 9000 series with 3D V-Cache, are Stars, capturing significant market share among gamers and professionals. The client segment saw a 58% revenue surge in Q4 2024, indicating continued demand for high-performance computing.

AMD's semi-custom chips for gaming consoles and handheld PCs solidify their Star status in that niche. Their chips power the PlayStation 5 and Xbox Series X/S, and the growing handheld gaming PC market ensures continued high market share in this segment.

| Product Category | BCG Matrix Position | Key Growth Drivers | 2024 Performance Indicators | Future Outlook |

| Instinct MI300 Series (AI Accelerators) | Star | AI and Data Center Market Growth, Partnerships with Cloud Providers | Data Center AI Revenue > $5 Billion (2024) | Projected to exceed $10 Billion by 2025 |

| EPYC Server CPUs | Star | Increasing Data Center Market Share, Competition with Intel | Data Center Segment Revenue: $12.6 Billion (2024), +94% YoY | Estimated 36.5% Market Share by Mid-2025 |

| Premium Ryzen Desktop CPUs | Star | Demand from Gamers and Professionals, 3D V-Cache Technology | Client Segment Revenue: +58% YoY (Q4 2024) | Continued growth in PC market |

| Semi-Custom Gaming Chips | Star | Dominance in Current Consoles, Next-Gen Console Development, Handheld PCs | Powers PlayStation 5, Xbox Series X/S | Continued high market share in specialized segment |

What is included in the product

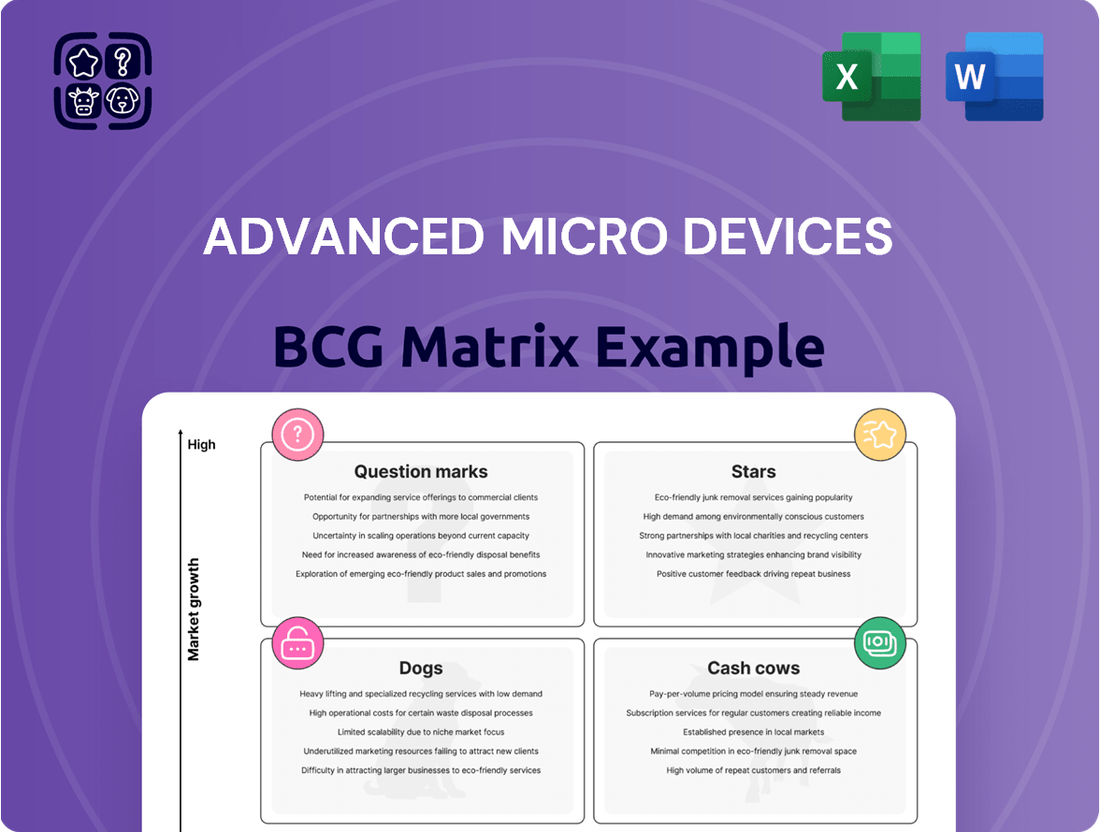

This BCG Matrix analysis highlights AMD's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic insights on investment, holding, or divestment for each quadrant.

Visualize AMD's product portfolio on a BCG matrix for strategic clarity.

This BCG matrix analysis helps identify growth opportunities and resource allocation needs.

Cash Cows

AMD's semi-custom chips powering current-generation gaming consoles, such as the PlayStation 5 and Xbox Series X|S, represent a significant cash cow. Despite the gaming market cycle maturing, these chips have secured a dominant market share throughout their tenure, consistently delivering robust cash flow with minimal incremental investment in marketing.

These established products have surpassed a remarkable milestone, with over 100 million units shipped, underscoring a vast and loyal installed base. While overall gaming revenue saw a dip in Q4 2024, a reflection of the console lifecycle, the sheer volume of these chips in circulation solidifies their position as a reliable source of substantial cash generation for AMD.

Older generation EPYC server CPUs, having secured substantial market penetration, are prime examples of Advanced Micro Devices' cash cows. These established processors continue to be a reliable source of revenue and healthy profit margins, even as newer models emerge to capture growth opportunities. Their consistent performance in existing data center and enterprise deployments solidifies their position in a mature segment of the server market.

Mainstream and budget Ryzen desktop CPUs are AMD's cash cows. These processors hold a significant market share in the mature PC segment, ensuring consistent sales volumes and contributing to stable cash flow for AMD. In 2024, AMD continued to see strong demand in this segment, with Ryzen 5 and Ryzen 3 processors being particularly popular among value-conscious consumers and builders.

Older Radeon Discrete GPUs (Mainstream/Budget)

Certain older or mainstream Radeon discrete GPUs, while not leading in cutting-edge performance, maintain a consistent market presence and generate steady revenue for AMD. These products cater to a broad segment of the gaming and consumer market, offering competitive performance at accessible price points. They contribute to cash flow without requiring substantial new R&D or marketing outlays, fitting the profile of a cash cow.

For instance, AMD's RX 6000 series, particularly models like the RX 6600, continued to be strong sellers in 2024, benefiting from their value proposition. Despite newer generations being available, these cards provided excellent performance for 1080p gaming, a resolution still dominant among many PC gamers. This sustained demand allowed AMD to maintain market share in the mid-range segment.

- Sustained Demand: The RX 6600, for example, remained a popular choice for budget-conscious gamers throughout 2024.

- Revenue Generation: These GPUs contribute consistent revenue streams, supporting AMD's overall financial performance.

- Reduced Investment: Compared to high-end or new product launches, the investment needed for these older models is significantly lower.

- Market Share: They help AMD maintain a solid foothold in the mainstream discrete GPU market.

Xilinx FPGA and Adaptive SoC Portfolio (Post-Acquisition)

The Xilinx FPGA and adaptive SoC portfolio, now part of AMD, is a prime example of a Cash Cow within the company's BCG Matrix. These products have a strong foothold in established embedded systems and specialized markets, consistently delivering significant revenue.

Xilinx's dominance in areas like industrial automation, aerospace, and defense, where its FPGAs offer high performance and customization, translates to a high market share in these niche segments. For instance, in 2023, the adaptive computing segment, largely driven by Xilinx, saw substantial growth, contributing significantly to AMD's overall financial performance.

- High Market Share: Xilinx commands a leading position in specific embedded and specialized computing markets.

- Reliable Revenue Streams: The consistent demand for FPGAs in these sectors generates predictable and substantial income for AMD.

- Profitability: Despite potentially slower growth compared to emerging AI chips, the mature and specialized nature of Xilinx products ensures strong profit margins.

- Strategic Importance: While not the primary growth engine, the Xilinx portfolio provides financial stability and supports AMD's broader diversification strategy.

AMD's semi-custom chips powering current-generation gaming consoles, such as the PlayStation 5 and Xbox Series X|S, represent a significant cash cow. These established products have surpassed a remarkable milestone, with over 100 million units shipped, underscoring a vast and loyal installed base. While overall gaming revenue saw a dip in Q4 2024, a reflection of the console lifecycle, the sheer volume of these chips in circulation solidifies their position as a reliable source of substantial cash generation for AMD.

Mainstream and budget Ryzen desktop CPUs are AMD's cash cows. In 2024, AMD continued to see strong demand in this segment, with Ryzen 5 and Ryzen 3 processors being particularly popular among value-conscious consumers and builders, ensuring consistent sales volumes and contributing to stable cash flow.

Certain older or mainstream Radeon discrete GPUs, while not leading in cutting-edge performance, maintain a consistent market presence and generate steady revenue for AMD. For instance, AMD's RX 6000 series, particularly models like the RX 6600, continued to be strong sellers in 2024, benefiting from their value proposition and providing excellent performance for 1080p gaming.

The Xilinx FPGA and adaptive SoC portfolio, now part of AMD, is a prime example of a Cash Cow. Xilinx commands a leading position in specific embedded and specialized computing markets, with the adaptive computing segment contributing significantly to AMD's overall financial performance in 2023.

| Product Category | Key Examples | Market Position | Revenue Contribution | Investment Needs |

| Semi-Custom Chips | PlayStation 5/Xbox Series X|S SOCs | Dominant in current-gen consoles | Consistent, high volume | Low (established designs) |

| Mainstream CPUs | Ryzen 5, Ryzen 3 Desktop CPUs | Significant share in PC segment | Stable, predictable | Moderate (ongoing support) |

| Mainstream GPUs | Radeon RX 6600 | Strong in mid-range gaming | Steady, reliable | Low (mature product) |

| FPGAs & Adaptive SoCs | Xilinx Portfolio | Leading in niche embedded markets | Substantial, growing | Moderate (R&D for specialized applications) |

Delivered as Shown

Advanced Micro Devices BCG Matrix

The Advanced Micro Devices BCG Matrix you are currently previewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously crafted with up-to-date market data, will be immediately available for download, allowing you to leverage its strategic insights without delay. You can confidently expect the same professional quality and actionable content that is presented here, ready for your business planning and decision-making processes.

Dogs

Older, low-performance discrete GPUs from Advanced Micro Devices (AMD) likely fall into the Dogs category of the BCG Matrix. These products, often from previous generations, command a negligible market share and face minimal growth opportunities in the rapidly evolving graphics card landscape. For instance, AMD's desktop discrete GPU market share saw a notable dip in Q1 2025, underscoring the challenges faced by their less competitive offerings.

Products in this segment may consume more resources in terms of support and development than they generate in revenue. Consequently, AMD might consider divesting or discontinuing these older GPU lines to reallocate capital and engineering talent towards more promising areas, such as their high-performance gaming GPUs or integrated graphics solutions.

Legacy CPU architectures with limited market share, such as older Opteron or certain Bulldozer-based FX processors, would fit into the Dogs category for AMD. These products have been largely phased out, with minimal market presence and likely negligible revenue generation.

AMD's strategic shift towards its Zen architecture means these older lines are no longer a focus for development or significant marketing. In 2024, the market share for these legacy CPUs is extremely low, often less than 1%, making them a drain on resources with little to no profit potential.

Certain niche embedded products within AMD's portfolio might be classified as Dogs. These are typically solutions designed for very specific, specialized markets where demand is either stagnant or declining, and AMD holds a relatively small market share. For example, older generations of embedded processors catering to industries with slow technology adoption cycles could fall into this category.

The embedded segment overall has seen varied performance for AMD, but specific sub-segments experiencing persistent demand erosion and limited growth potential warrant strategic consideration. In the first quarter of 2025, AMD's embedded segment revenue saw a 3% year-over-year decrease, hinting at potential challenges within certain product lines.

Discontinued Product Lines

Discontinued product lines at Advanced Micro Devices (AMD), such as older generations of CPUs and GPUs that have been superseded by current architectures, would fall into the Dogs category of the BCG Matrix. These products typically generate minimal revenue and have limited growth potential, often being phased out as newer technologies take precedence. For instance, AMD's transition away from certain APU lines, like some of the older A-series processors, exemplifies this classification as they are no longer a significant focus for the company's market strategy or R&D investment.

These legacy products are essentially being managed for their remaining value, with minimal investment. AMD's strategic decisions often involve prioritizing resources for high-growth areas, leaving older, less competitive product segments to naturally decline. This approach allows the company to concentrate on innovation and market expansion with its more modern and profitable offerings.

- Legacy CPU Architectures: Older processor families that have been fully replaced by newer, more performant architectures like Zen.

- Previous Generation GPUs: Graphics cards from earlier generations that are no longer competitively positioned in the market and have been supplanted by newer RDNA or CDNA architectures.

- Specialized or Niche Products: Certain older embedded or semi-custom chips that have reached the end of their lifecycle and are no longer actively marketed or supported with new developments.

Products with High Inventory and Low Sales Velocity

Products with high inventory and low sales velocity represent Advanced Micro Devices' potential "Dogs" in the BCG Matrix. These are offerings that aren't gaining traction in the market, leading to capital being tied up in unsold goods. For instance, if a specific line of older CPUs or graphics cards failed to meet sales targets throughout 2024, they would fall into this category. This situation directly impacts profitability by reducing the capital available for investment in more promising ventures.

The implications of having "Dogs" are significant. They drain resources that could be allocated to high-growth areas, hindering overall portfolio optimization. Consider a scenario where AMD had a particular chip architecture that, despite initial expectations, saw very low adoption by major PC manufacturers in 2024. This would result in substantial inventory buildup and minimal revenue generation from that product line.

Identifying these underperformers is crucial for strategic decision-making. It might involve:

- Discontinuing or phasing out products with persistently low sales.

- Implementing aggressive sales or marketing strategies to move existing inventory.

- Re-evaluating the product's market fit and potential for repositioning.

Older AMD CPU architectures, like certain Bulldozer-based FX processors, are considered Dogs due to their minimal market share and negligible revenue. These legacy products, with market share often below 1% in 2024, represent a drain on resources with little profit potential.

Previous generation discrete GPUs also fall into this category, facing stiff competition and limited growth opportunities. AMD's desktop discrete GPU market share saw a dip in Q1 2025, highlighting the challenges for less competitive offerings.

Niche embedded products with stagnant or declining demand and low market share also fit the Dogs classification. Specific sub-segments experiencing demand erosion in AMD's embedded segment saw a 3% year-over-year revenue decrease in Q1 2025.

Discontinued product lines, such as older APUs like the A-series processors, are managed for remaining value with minimal investment, allowing focus on modern, profitable offerings.

| Product Category | BCG Matrix Classification | Market Share (Approx. 2024) | Growth Potential | Strategic Implication |

| Legacy CPU Architectures (e.g., FX series) | Dogs | < 1% | Negligible | Discontinue/Phase Out |

| Previous Generation Discrete GPUs | Dogs | Low (declining) | Minimal | Divest/Discontinue |

| Niche/End-of-Life Embedded Products | Dogs | Low | Stagnant/Declining | Manage for cash/Discontinue |

Question Marks

AMD's upcoming RDNA 4 high-end graphics cards, anticipated for a 2025 launch, are positioned to compete in the enthusiast gaming segment, a market known for its rapid growth and high spending potential. However, AMD faces a significant challenge in this space, currently holding a considerably smaller share of the discrete GPU market compared to its main competitor, Nvidia.

To successfully capture a meaningful slice of this lucrative market and avoid the 'Dog' category in the BCG matrix, AMD will need to make substantial investments. These investments must focus heavily on both performance enhancements and aggressive marketing campaigns to effectively communicate the value proposition of their RDNA 4 offerings to consumers.

The second-generation Ryzen Z2 processors are designed to power the next wave of handheld gaming PCs, a burgeoning market segment. While AMD has a presence, its market share in this specific niche is still developing, indicating it's not yet a Star in the BCG Matrix. Significant investment in strategic partnerships and fostering a robust ecosystem will be crucial for substantial growth and market penetration.

AMD's Xilinx portfolio, particularly its FPGAs and adaptive SoCs, are being positioned as potential stars in emerging AI applications. While the broader Xilinx segment is a strong cash cow, these specific, high-growth, low-market-share areas demand focused investment to unlock their full potential against established AI accelerators.

AMD's strategic investments in AI development are likely to leverage these adaptive platforms. For instance, the increasing demand for customizable AI inference at the edge, where power efficiency and low latency are paramount, presents a significant growth opportunity for FPGAs and adaptive SoCs. Analysts project the edge AI market to reach over $20 billion by 2027, a testament to the potential of these technologies.

New AI-enabled Client Processors (Beyond initial adoption)

AMD's AI-enabled client processors are moving beyond initial adoption, aiming for broader market penetration in the burgeoning AI PC space. The company's Ryzen AI processors, particularly those integrated into laptops, are seeing increased adoption by OEMs. For instance, in 2024, a significant number of new laptop models featuring AMD's AI capabilities were launched across various manufacturers, indicating a growing commitment to this technology.

The long-term success hinges on several factors. Continued demand for AI-accelerated tasks on personal computers is crucial. Furthermore, the development of a robust software ecosystem that leverages these AI capabilities will be a key differentiator. AMD's ability to maintain its technological edge against competitors like Intel and Qualcomm in this rapidly evolving market will also be paramount.

- Market Expansion: AMD's AI client processors are targeting a larger share of the AI PC market, which analysts predict could reach hundreds of millions of units annually by the late 2020s.

- OEM Partnerships: Increased design wins with major laptop manufacturers in 2024 signal growing OEM confidence in AMD's AI silicon.

- Ecosystem Dependence: Software optimization for AMD's Neural Processing Units (NPUs) is critical for unlocking the full potential of AI PCs and driving consumer adoption.

- Competitive Landscape: Intel's ongoing efforts with its Core Ultra processors and Qualcomm's advancements in ARM-based AI chips present significant competition that AMD must navigate.

New Ventures into Cloud Gaming Infrastructure

Advanced Micro Devices (AMD) is actively exploring new ventures in cloud gaming infrastructure, a sector experiencing significant growth. While AMD's direct market share in this specific niche might currently be lower compared to some competitors, the company is investing in hardware solutions tailored for cloud gaming providers.

These strategic initiatives are crucial for AMD to establish a stronger presence and compete effectively. The cloud gaming market is projected to reach over $10 billion by 2027, indicating substantial opportunity. For instance, AMD's EPYC processors are being utilized in cloud gaming platforms, demonstrating their commitment to this area.

- Focus on High-Performance Processors: AMD is developing and promoting its EPYC server processors, which offer the core count and performance necessary for demanding cloud gaming workloads.

- Partnerships with Cloud Providers: Collaborations with major cloud service providers are key to integrating AMD hardware into their gaming infrastructure offerings.

- GPU Solutions for Streaming: Beyond CPUs, AMD is also looking at its Radeon Instinct GPUs as potential accelerators for game streaming services, optimizing visual fidelity and latency.

- Investment in R&D: Significant investment is being channeled into research and development to create specialized hardware and software solutions that cater to the unique requirements of cloud gaming.

AMD's RDNA 4 graphics cards face a competitive enthusiast gaming market where Nvidia currently dominates. Significant investment in performance and marketing is essential for AMD to gain market share and avoid becoming a 'Dog' in the BCG matrix.

The Ryzen Z2 processors target the growing handheld gaming PC market. AMD's current position isn't yet a 'Star,' requiring strategic partnerships and ecosystem development for substantial growth.

AMD's Xilinx FPGAs and adaptive SoCs are positioned for high-growth AI applications. While Xilinx is a strong cash cow, these specific segments need focused investment to compete against established AI accelerators.

AMD's AI client processors are gaining traction in the AI PC market, with increased OEM adoption in 2024. Continued demand for AI-accelerated tasks and a robust software ecosystem are crucial for long-term success against competitors like Intel and Qualcomm.

AMD is investing in cloud gaming infrastructure, leveraging EPYC processors and Radeon Instinct GPUs. While its current market share in this niche may be lower, the projected growth of the cloud gaming market to over $10 billion by 2027 presents a significant opportunity.

| Product/Segment | BCG Category (Assessment) | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| RDNA 4 Graphics Cards | Question Mark / Potential Star | High (Enthusiast Gaming) | Low (vs. Nvidia) | Performance enhancement, Aggressive marketing |

| Ryzen Z2 Processors | Question Mark | High (Handheld Gaming PCs) | Developing | Strategic partnerships, Ecosystem development |

| Xilinx FPGAs/Adaptive SoCs (AI) | Question Mark / Potential Star | Very High (Emerging AI) | Low (Specific AI segments) | Focused investment, AI application development |

| AI Client Processors (Ryzen AI) | Star / Cash Cow | High (AI PCs) | Growing | Software ecosystem, OEM partnerships |

| Cloud Gaming Infrastructure | Question Mark | High (Cloud Gaming) | Lower (Niche) | High-performance processors (EPYC), GPU solutions (Radeon Instinct) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from AMD's financial reports, market share analysis, and industry growth projections to accurately position its product portfolio.