Advanced Micro Devices Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Micro Devices Bundle

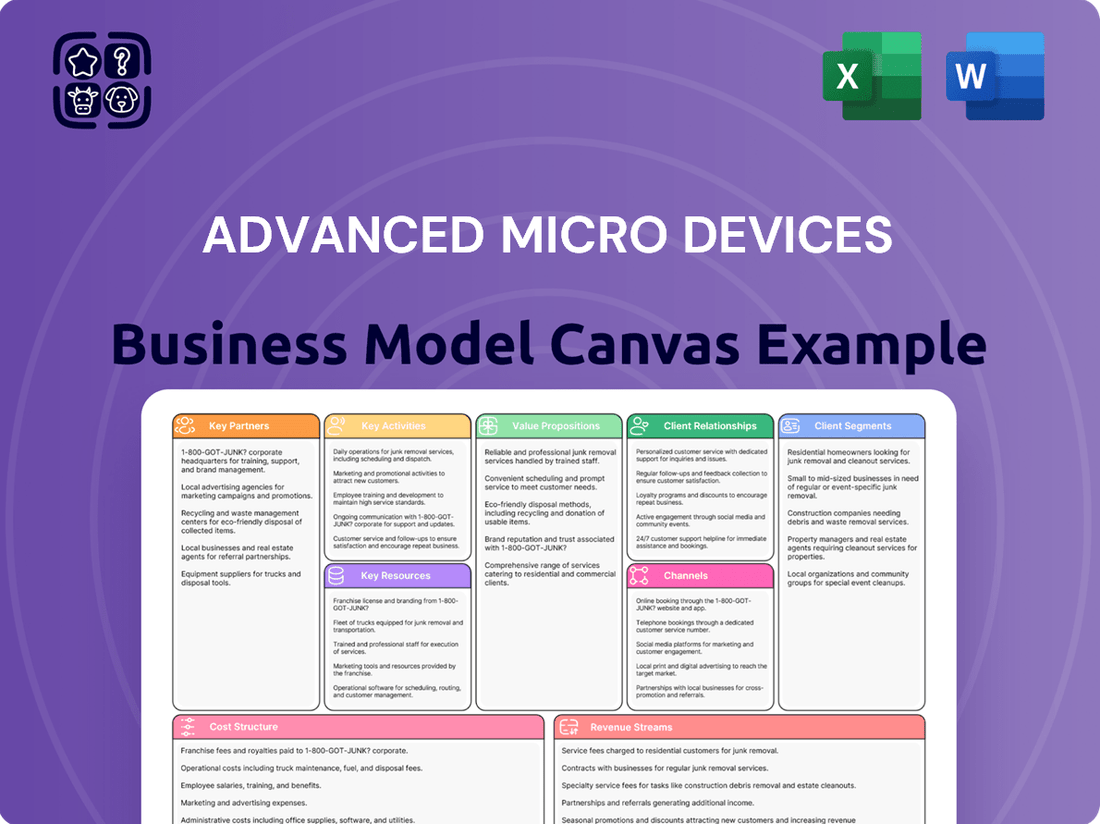

Explore the strategic brilliance behind Advanced Micro Devices's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how AMD effectively targets key customer segments, leverages strategic partnerships, and delivers innovative value propositions in the competitive tech landscape.

Unlock the full strategic blueprint behind Advanced Micro Devices's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

AMD's manufacturing strategy hinges on its critical relationship with third-party foundries, with Taiwan Semiconductor Manufacturing Company (TSMC) being its primary partner. This reliance allows AMD to leverage TSMC's advanced process technologies for producing its high-performance processors and graphics processing units (GPUs).

A notable development in this partnership is the commencement of production for key AMD processor chips at TSMC's new fabrication facility in Arizona. This move signifies AMD's commitment to diversifying its manufacturing footprint and aligns with broader trends of bringing semiconductor production back to the United States.

Advanced Micro Devices (AMD) has forged critical alliances with leading cloud service providers and hyperscalers, including giants like Google and Oracle. These collaborations are instrumental in the widespread adoption of AMD's EPYC CPUs and Instinct GPUs, powering demanding high-performance computing and artificial intelligence workloads within these massive data centers.

These aren't just casual relationships; they involve concrete product deployments and deep customer engagement. This strategic alignment directly fuels the impressive expansion observed in AMD's data center business segment, demonstrating the tangible impact of these key partnerships on its financial performance.

Strategic alliances with global system integrators, such as HCLTech, are crucial for AMD. These partnerships allow AMD to directly deliver its advanced AI and cloud solutions to enterprise clients, leveraging the integrator's extensive reach and implementation expertise. For instance, in 2024, AMD continued to deepen these relationships, focusing on joint go-to-market strategies for data center and edge computing solutions.

These collaborations frequently involve co-investment in innovation labs and specialized training programs. This ensures that the solutions developed are not only cutting-edge but also tailored to the specific needs of businesses, offering them future-ready capabilities. Such initiatives are vital for accelerating the adoption of complex technologies like AI accelerators and high-performance computing within diverse enterprise environments.

Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs)

Advanced Micro Devices (AMD) relies heavily on Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) as crucial partners. These companies integrate AMD's cutting-edge CPUs, GPUs, and APUs into a vast range of consumer and enterprise products. This collaboration is fundamental to AMD's market penetration, enabling its technology to reach consumers through a diverse ecosystem of devices.

For example, in 2024, AMD's Ryzen processors and Radeon graphics cards are integral components in numerous new laptop and desktop models launched by major OEMs. This strategic alliance ensures that AMD's innovative silicon is readily available in the market, driving sales and reinforcing its position in the competitive semiconductor landscape.

- OEM/ODM Integration: AMD's processors and graphics chips are incorporated into PCs, laptops, servers, and gaming consoles by partners.

- Market Reach: These partnerships provide AMD with extensive distribution channels, ensuring its products are accessible to a wide customer base.

- Product Diversity: Collaborations enable the creation of a broad spectrum of devices, from entry-level to high-performance computing solutions.

Technology Development Ecosystem & Open-Source Community

AMD actively collaborates with partners like Fujitsu for joint technology development, focusing on sustainable computing solutions for AI and High-Performance Computing (HPC). This strategic alliance underscores AMD's commitment to advancing the industry through shared innovation.

The company champions open-source initiatives, recognizing their power to accelerate development and broaden hardware accessibility. This approach cultivates a vibrant ecosystem where developers can readily leverage AMD's advanced architectures.

AMD's investment in its open software ecosystem, notably ROCm (Radeon Open Compute platform), is crucial. ROCm empowers developers to unlock the full potential of AMD hardware for machine learning and scientific computing, fostering a more inclusive and innovative environment.

Key partnerships within the technology development ecosystem and open-source community enable AMD to:

- Drive joint innovation in AI and HPC with strategic partners like Fujitsu.

- Foster a robust open-source software ecosystem, exemplified by ROCm, to enhance developer access and hardware utilization.

- Accelerate the adoption of AMD hardware by providing developers with powerful, open tools and platforms.

- Ensure its hardware capabilities are maximized through collaborative software development and community engagement.

AMD's key partnerships are foundational to its business model, enabling widespread product adoption and technological advancement.

The collaboration with foundries like TSMC is paramount for manufacturing, while alliances with cloud providers and OEMs ensure market reach and product integration.

Furthermore, strategic tech development partnerships and a commitment to open-source software, like ROCm, are vital for driving innovation and developer engagement.

| Partner Type | Key Partners Example | Impact on AMD | 2024 Focus/Data |

|---|---|---|---|

| Foundries | TSMC | Advanced chip manufacturing, supply chain diversification | Continued reliance on TSMC's leading-edge nodes; expansion of Arizona fab for future production. |

| Cloud Providers/Hyperscalers | Google, Oracle | Data center market penetration, AI/HPC workload acceleration | Significant adoption of EPYC CPUs and Instinct GPUs in cloud infrastructure; growing data center revenue. |

| OEMs/ODMs | Dell, HP, Lenovo | Product integration, broad market access | AMD processors and GPUs are key components in millions of consumer and enterprise devices; strong presence in PC and laptop markets. |

| System Integrators | HCLTech | Enterprise solution delivery, go-to-market strategies | Joint efforts to deliver AI and cloud solutions to enterprise clients, enhancing solution deployment. |

| Technology Development | Fujitsu | Joint innovation in AI and HPC | Collaborative development of sustainable computing solutions, pushing boundaries in specialized computing. |

What is included in the product

This Business Model Canvas outlines Advanced Micro Devices' strategy, focusing on their high-performance computing and graphics solutions for gamers, data centers, and AI markets.

It details their customer segments, channels, and value propositions, reflecting real-world operations and competitive advantages.

AMD's Business Model Canvas acts as a pain point reliever by clearly outlining its customer segments and value propositions, enabling focused innovation and resource allocation to address market needs.

It simplifies complex strategies into a digestible format, allowing stakeholders to quickly grasp how AMD delivers high-performance computing solutions and overcomes competitive challenges.

Activities

Advanced Micro Devices' core activity revolves around intensive research and development in semiconductor design. This includes creating cutting-edge architectures for CPUs, GPUs, FPGAs, and adaptive SoCs, pushing the boundaries of computing performance and efficiency.

AMD's dedication to innovation is evident in its substantial R&D investments. For 2024, the company allocated $6.456 billion to R&D, underscoring its commitment to developing future product generations such as the Zen 5 processors, RDNA 4 graphics, and the Instinct MI series accelerators.

As a fabless semiconductor company, Advanced Micro Devices (AMD) places significant emphasis on managing its relationships with leading third-party foundries. This crucial activity ensures the high-volume and high-quality production of its advanced chip designs. In 2024, AMD continued its strong partnership with Taiwan Semiconductor Manufacturing Company (TSMC), a key enabler for its Ryzen and EPYC processors, which are built on TSMC's cutting-edge process nodes.

AMD's chip manufacturing management extends to meticulous oversight of the entire production process. This includes rigorous quality control and yield management to meet stringent performance standards. The company also focuses on building a resilient global supply chain, a critical factor given the dynamic nature of semiconductor demand and geopolitical considerations affecting manufacturing hubs.

Advanced Micro Devices (AMD) prioritizes building and enhancing its software ecosystem, especially for AI and High-Performance Computing (HPC). This strategic focus is evident in platforms like ROCm, designed to unlock the full potential of AMD's hardware for developers.

Through ROCm, AMD provides essential tools, libraries, and frameworks, enabling developers to efficiently utilize AMD processors and accelerators. This commitment is crucial for fostering adoption and driving innovation in demanding computational fields.

In 2024, AMD continued to invest heavily in its software stack, aiming to close the gap with competitors and attract a broader developer base. This includes ongoing updates and expansions to ROCm, supporting the latest AI models and HPC applications.

Sales, Marketing, and Distribution

Advanced Micro Devices (AMD) drives sales and marketing through targeted campaigns for its extensive product range, spanning consumer graphics cards to enterprise server processors. Their go-to-market strategies are crucial for reaching diverse segments like PC gamers, data center operators, and embedded system developers.

The company actively manages a robust global distribution network, ensuring its products are accessible through various channels, including direct sales, retail partners, and system integrators. This multifaceted approach is key to maintaining market presence and facilitating widespread adoption of their technologies.

- Global Reach: AMD's sales and marketing efforts are globally coordinated to address diverse market needs and preferences.

- Channel Partners: A significant portion of AMD's revenue is generated through its extensive network of channel partners and distributors.

- Product Promotion: Marketing initiatives focus on highlighting performance advantages and technological innovation across their CPU, GPU, and adaptive SoC portfolios.

- Market Penetration: In 2024, AMD continued its push into enterprise markets, with significant growth reported in their data center segment, driven by strong demand for EPYC processors.

Strategic Acquisitions and Integrations

Advanced Micro Devices (AMD) actively pursues strategic acquisitions to bolster its technological prowess and competitive standing. A prime example is the August 2024 acquisition of ZT Systems, a move designed to significantly enhance AMD's capabilities in the rapidly growing artificial intelligence (AI) server market. This acquisition is expected to bring in new expertise and product lines, directly contributing to AMD's server portfolio expansion.

The integration of acquired entities is a crucial component of AMD's strategy, aimed at unlocking synergistic value and broadening its overall product and service offerings. By carefully merging operations and technologies, AMD seeks to create a more robust and diversified business, leveraging the strengths of acquired companies to accelerate innovation and market penetration.

- Strategic Acquisitions: AMD's acquisition of ZT Systems in August 2024 underscores its commitment to strengthening its AI server offerings.

- Integration for Synergy: The company focuses on integrating acquired businesses to create synergistic value and expand its technology portfolio.

- Market Position Enhancement: These activities are key to enhancing AMD's capabilities and solidifying its market position in critical technology sectors.

AMD's key activities are centered on designing and developing advanced semiconductor technologies, particularly CPUs, GPUs, and adaptive SoCs. This involves substantial R&D investment, with $6.456 billion allocated in 2024 to fuel innovation in areas like AI and high-performance computing. The company also manages its fabless manufacturing through strategic partnerships, notably with TSMC, ensuring high-quality production of its cutting-edge chips.

Furthermore, AMD actively cultivates its software ecosystem, especially with platforms like ROCm, to maximize hardware performance for developers in AI and HPC. Sales and marketing efforts are globally coordinated, utilizing a diverse distribution network to reach various market segments, including a strong push into the enterprise data center market in 2024, driven by EPYC processor demand.

Strategic acquisitions, such as the August 2024 purchase of ZT Systems, are also a critical activity, aimed at enhancing AMD's capabilities, particularly in the AI server space, and expanding its overall technology portfolio.

Full Version Awaits

Business Model Canvas

The Advanced Micro Devices Business Model Canvas preview you're currently viewing is an authentic representation of the final document you will receive. This is not a sample or mockup, but a direct snapshot of the actual file, ensuring you know precisely what you're purchasing. Upon completion of your order, you will gain full access to this identical, comprehensive document, ready for immediate use.

Resources

AMD's extensive patent portfolio, covering CPU, GPU, FPGA, and adaptive SoC designs, is a cornerstone of its business model. This intellectual property is critical for maintaining its competitive edge in the semiconductor industry, allowing for the creation of advanced processing technologies.

In 2024, AMD continued to invest heavily in R&D to expand this IP. For instance, their ongoing development in AI accelerators and high-performance computing relies on securing new patents to protect their innovative architectures and manufacturing processes.

AMD's proprietary chip architectures, such as the Zen CPU cores and RDNA GPUs, are foundational to its business model. These advanced designs, including the upcoming Zen 5 and RDNA 4, enable AMD to compete effectively in high-performance computing and gaming markets.

The intellectual property embodied in these architectures, including patents and trade secrets, represents a significant competitive advantage. This allows AMD to create differentiated products that command premium pricing and capture market share from competitors.

Advanced Micro Devices (AMD) relies heavily on its highly skilled global workforce, especially those with expertise in semiconductor design, research and development, and software engineering. This human capital is the engine behind AMD's innovation.

The company's significant investment in R&D, which reached approximately $3.1 billion in 2023, directly underscores the critical role of this talented workforce in driving technological advancements and maintaining a competitive edge in the semiconductor industry.

Global Manufacturing and Supply Chain Network

Advanced Micro Devices (AMD) relies heavily on its global manufacturing and supply chain network, a critical resource even as a fabless semiconductor company. Its strategic partnerships with leading foundries, most notably Taiwan Semiconductor Manufacturing Company (TSMC), are paramount for producing its advanced processors and graphics chips.

This intricate network ensures AMD can meet global demand for its high-performance computing solutions. In 2024, AMD's commitment to leveraging these external manufacturing capabilities, particularly with TSMC, was underscored by significant wafer orders to support the launch of its latest Ryzen and EPYC processors, built on cutting-edge process nodes.

- Foundry Partnerships: AMD's primary manufacturing resource is its deep collaboration with TSMC, which produces the vast majority of its chips.

- Global Logistics: A sophisticated logistics system manages the movement of components and finished products from foundries to distributors and customers worldwide.

- Supply Chain Resilience: Efforts in 2024 focused on diversifying suppliers and building inventory to mitigate potential disruptions, a key lesson from prior industry-wide shortages.

- Intellectual Property: AMD's core intellectual property, including its chip designs and architectures, is a foundational resource that is manufactured through this network.

Brand Reputation and Customer Loyalty

Advanced Micro Devices (AMD) has built a formidable brand reputation by consistently offering high-performance, innovative, and cost-effective processors. Its Ryzen CPUs for consumers and EPYC server processors have garnered significant acclaim, fostering a dedicated customer following. This strong brand equity translates directly into customer loyalty, a crucial intangible asset for sustained market presence and competitive advantage.

This loyalty is reflected in AMD's market share gains. For instance, in the first quarter of 2024, AMD's server CPU market share saw a notable increase, demonstrating growing customer trust and adoption of their EPYC platform. This customer preference is a direct result of their commitment to delivering superior performance per dollar.

- Brand Recognition: AMD is widely recognized for its powerful Ryzen and EPYC processor families.

- Customer Loyalty: A substantial base of repeat customers and brand advocates exists across consumer and enterprise markets.

- Value Proposition: The brand is associated with delivering strong performance at competitive price points.

- Market Share Growth: Increased adoption in key segments, like data centers in 2024, underscores customer confidence.

AMD's key resources are its intellectual property, including patents and proprietary chip architectures like Zen and RDNA, which are vital for its competitive edge. The company also leverages a highly skilled global workforce, particularly in R&D and design, supported by significant R&D investments, such as the approximately $3.1 billion spent in 2023. Furthermore, AMD's strategic partnerships with foundries, especially TSMC, are critical for manufacturing its advanced semiconductors, with substantial wafer orders placed in 2024 to meet demand for new processor launches.

| Key Resource | Description | 2023/2024 Relevance |

| Intellectual Property | Patents, chip architectures (Zen, RDNA) | Drives innovation and market differentiation. Ongoing patent filings in 2024 for AI and HPC. |

| Human Capital | Skilled global workforce (design, R&D) | Essential for developing advanced technologies. R&D investment of ~$3.1B in 2023 highlights workforce importance. |

| Foundry Partnerships | TSMC (primary manufacturer) | Enables production of leading-edge chips. Significant 2024 wafer orders for Ryzen and EPYC. |

| Brand Reputation | High-performance, value proposition | Fosters customer loyalty and market share gains, evident in Q1 2024 server CPU market share increase. |

Value Propositions

AMD's high-performance computing and graphics leadership is a core value proposition, offering industry-leading Ryzen and EPYC CPUs alongside Radeon and Instinct GPUs. These products excel in demanding tasks like gaming, professional content creation, and data center operations, providing users with unparalleled speed and efficiency.

The company's commitment to innovation is evident in its continuous rollout of new architectures. For instance, the upcoming Zen 5 CPU architecture and RDNA 4 GPU architecture are poised to further elevate performance benchmarks, solidifying AMD's position at the forefront of technological advancement.

In 2024, AMD's data center segment, powered by EPYC processors, has seen significant growth. Reports indicate substantial increases in server shipments and revenue, driven by the demand for AI and high-performance computing solutions, underscoring the market's reliance on AMD's cutting-edge technology.

AMD is a major force in the booming AI sector, providing specialized AI accelerators like the Instinct MI series, AI-ready CPUs such as Ryzen AI, and adaptive SoCs including the Versal AI Edge Series Gen 2. These offerings are designed for a wide array of AI tasks, from massive data center training to streamlined edge computing.

In 2024, AMD's commitment to innovation in AI and adaptive computing positions it to capitalize on the significant growth in this market. The company's diverse product portfolio addresses the increasing demand for high-performance, efficient computing solutions across various AI applications.

AMD consistently delivers a compelling price-to-performance ratio, making its processors and graphics cards highly attractive. For instance, in 2024, AMD's EPYC server CPUs continued to challenge Intel's dominance by offering more cores and better performance per dollar, a key factor for data centers looking to optimize spending.

This value proposition extends to the total cost of ownership (TCO). Businesses adopting AMD solutions often find that the initial purchase price, combined with lower power consumption and longer upgrade cycles, leads to significant savings over the product's lifespan. This focus on efficiency is particularly crucial for large-scale deployments.

Open Ecosystem and Software Accessibility

AMD's commitment to an open ecosystem, particularly with its ROCm platform for AI and High-Performance Computing (HPC), offers developers unparalleled flexibility and accessibility. This open strategy is a key differentiator, cultivating a collaborative environment that spurs innovation and draws in a wider user base. In 2024, AMD continued to expand its ROCm support, aiming to broaden compatibility across more hardware and software stacks.

This open approach fosters a vibrant community, enabling developers to tailor solutions and push the boundaries of what's possible with AMD hardware. The accessibility of ROCm allows for greater customization and integration, which is crucial in the rapidly evolving fields of AI and HPC. This strategy directly contrasts with more proprietary systems, providing a distinct advantage for users seeking adaptable and cost-effective solutions.

- Open Software Ecosystem: AMD's ROCm platform provides an open-source foundation for AI and HPC development, fostering flexibility and broad adoption.

- Developer Accessibility: The open nature of ROCm lowers barriers to entry, enabling a wider range of developers to leverage AMD's hardware capabilities.

- Innovation Catalyst: This collaborative environment encourages community contributions and accelerates the development of new applications and solutions.

- Competitive Differentiation: AMD's open strategy sets it apart in the market, attracting users who value choice and customization over closed systems.

Scalable and Versatile Solutions

AMD's diverse product portfolio, including CPUs, GPUs, FPGAs, and adaptive SoCs, delivers highly scalable and versatile computing solutions. This wide range allows AMD to cater to a broad spectrum of market demands, from consumer PCs and gaming to large-scale data centers and specialized embedded systems.

This versatility is a key value proposition, enabling AMD to adapt its technology across various applications. For instance, their EPYC server processors are designed for high-performance computing in data centers, while their Ryzen processors power consumer PCs and gaming. In 2023, AMD saw significant growth in its Data Center segment, with revenue increasing substantially, demonstrating the scalability of their solutions.

- Scalability: AMD's chip architectures are designed for efficient performance scaling, from individual devices to massive server deployments.

- Versatility: The integration of CPUs, GPUs, and adaptive SoCs allows for tailored solutions across diverse industries like AI, automotive, and telecommunications.

- Market Reach: This broad product offering enables AMD to address a wide array of market segments, from consumer electronics to high-performance enterprise computing.

- Innovation: Continuous development in areas like AI acceleration and high-performance graphics ensures their solutions remain relevant and competitive across evolving technological landscapes.

AMD's value proposition centers on delivering leading-edge performance and innovation across its CPU and GPU offerings. This translates to superior computing power for demanding applications, from gaming and professional content creation to critical data center operations. The company's focus on pushing technological boundaries ensures customers receive cutting-edge solutions.

The company's commitment to innovation is evident in its continuous rollout of new architectures. For instance, the upcoming Zen 5 CPU architecture and RDNA 4 GPU architecture are poised to further elevate performance benchmarks, solidifying AMD's position at the forefront of technological advancement.

In 2024, AMD's data center segment, powered by EPYC processors, has seen significant growth. Reports indicate substantial increases in server shipments and revenue, driven by the demand for AI and high-performance computing solutions, underscoring the market's reliance on AMD's cutting-edge technology.

AMD is a major force in the booming AI sector, providing specialized AI accelerators like the Instinct MI series, AI-ready CPUs such as Ryzen AI, and adaptive SoCs including the Versal AI Edge Series Gen 2. These offerings are designed for a wide array of AI tasks, from massive data center training to streamlined edge computing.

In 2024, AMD's commitment to innovation in AI and adaptive computing positions it to capitalize on the significant growth in this market. The company's diverse product portfolio addresses the increasing demand for high-performance, efficient computing solutions across various AI applications.

AMD consistently delivers a compelling price-to-performance ratio, making its processors and graphics cards highly attractive. For instance, in 2024, AMD's EPYC server CPUs continued to challenge Intel's dominance by offering more cores and better performance per dollar, a key factor for data centers looking to optimize spending.

This value proposition extends to the total cost of ownership (TCO). Businesses adopting AMD solutions often find that the initial purchase price, combined with lower power consumption and longer upgrade cycles, leads to significant savings over the product's lifespan. This focus on efficiency is particularly crucial for large-scale deployments.

AMD's commitment to an open ecosystem, particularly with its ROCm platform for AI and High-Performance Computing (HPC), offers developers unparalleled flexibility and accessibility. This open strategy is a key differentiator, cultivating a collaborative environment that spurs innovation and draws in a wider user base. In 2024, AMD continued to expand its ROCm support, aiming to broaden compatibility across more hardware and software stacks.

This open approach fosters a vibrant community, enabling developers to tailor solutions and push the boundaries of what's possible with AMD hardware. The accessibility of ROCm allows for greater customization and integration, which is crucial in the rapidly evolving fields of AI and HPC. This strategy directly contrasts with more proprietary systems, providing a distinct advantage for users seeking adaptable and cost-effective solutions.

AMD's diverse product portfolio, including CPUs, GPUs, FPGAs, and adaptive SoCs, delivers highly scalable and versatile computing solutions. This wide range allows AMD to cater to a broad spectrum of market demands, from consumer PCs and gaming to large-scale data centers and specialized embedded systems.

This versatility is a key value proposition, enabling AMD to adapt its technology across various applications. For instance, their EPYC server processors are designed for high-performance computing in data centers, while their Ryzen processors power consumer PCs and gaming. In 2023, AMD saw significant growth in its Data Center segment, with revenue increasing substantially, demonstrating the scalability of their solutions.

| Value Proposition | Description | Key Data/Fact (2024 Focus) |

|---|---|---|

| Performance Leadership | Industry-leading CPUs (Ryzen, EPYC) and GPUs (Radeon, Instinct) for demanding tasks. | Zen 5 and RDNA 4 architectures set new performance benchmarks. |

| AI & HPC Solutions | Specialized AI accelerators (Instinct MI) and AI-ready CPUs (Ryzen AI). | Significant growth in Data Center segment revenue driven by AI demand. |

| Price-to-Performance Ratio | Offers competitive performance at attractive price points. | EPYC server CPUs provide more cores and better performance per dollar than competitors. |

| Open Ecosystem (ROCm) | Flexible, accessible platform for AI and HPC development. | Expanded ROCm support in 2024 to enhance hardware and software compatibility. |

| Scalability & Versatility | Broad product portfolio (CPUs, GPUs, FPGAs, SoCs) for diverse markets. | Data Center segment revenue saw substantial growth in 2023, showcasing solution scalability. |

Customer Relationships

Advanced Micro Devices (AMD) fosters direct engagement with its enterprise and hyperscale clients, offering bespoke solutions and dedicated support. This approach is crucial for understanding the unique, high-volume demands of data centers and the burgeoning AI sector, ensuring their product roadmap aligns with market needs.

These deep relationships facilitate collaborative product development, allowing AMD to co-engineer solutions that directly address the specific performance and efficiency requirements of major cloud providers and large enterprises. For instance, AMD's EPYC processors have seen significant adoption in cloud infrastructure, with companies like Microsoft Azure and Google Cloud leveraging them for their data centers, as reported in 2024 data.

AMD actively cultivates its developer community through open-source software, notably ROCm. This fosters an environment where developers can optimize applications for AMD hardware. In 2024, AMD continued to invest heavily in developer enablement, with ROCm supporting a growing number of AI and HPC workloads, demonstrating a commitment to building a robust ecosystem.

AMD cultivates enduring collaborations with Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs). These partnerships are crucial for integrating AMD's processors and graphics into a wide array of consumer and enterprise devices.

These relationships go beyond simple supply agreements, encompassing dedicated design support and technical assistance. AMD actively engages in joint marketing initiatives to ensure that AMD-powered systems achieve successful market penetration and positive consumer reception.

In 2024, AMD's strategic OEM and ODM partnerships were instrumental in its market growth, particularly in the PC segment where it saw significant gains. For instance, its Ryzen processors continued to be a preferred choice for many leading laptop and desktop manufacturers, contributing to AMD's increasing market share in the x86 processor space.

Online Community and Social Media Interaction

AMD actively cultivates its online community and social media presence to connect with its core consumer segments, particularly PC enthusiasts and gamers. This direct engagement fosters strong brand loyalty by providing essential product information, technical support, and a platform for users to share their experiences. For instance, in 2024, AMD's social media channels saw significant growth, with its YouTube subscriber count surpassing 3 million, showcasing a highly engaged audience eager for product updates and gaming content.

These digital interactions are crucial for AMD's customer relationship strategy, enabling them to gather invaluable feedback directly from their user base. This feedback loop informs product development and marketing efforts. AMD also leverages these platforms to announce new product launches and share performance benchmarks, as seen with the widespread positive reception of their Ryzen 8000 series processors in early 2024, which generated substantial online discussion and user-generated content.

AMD's approach to customer relationships through online communities and social media includes:

- Direct Engagement: Participating in forums, responding to comments on social media, and hosting Q&A sessions with product teams.

- Content Creation: Sharing informative videos, tutorials, and gaming highlights featuring their products across platforms like Twitch and YouTube.

- Community Building: Encouraging user-generated content, running contests, and creating dedicated spaces for enthusiasts to connect.

- Feedback Integration: Actively monitoring and incorporating user suggestions and issues into future product iterations and support strategies.

Channel Partner Enablement and Training

AMD actively invests in empowering its channel partners, which include distributors, system integrators, and resellers. This focus on enablement ensures partners possess the necessary knowledge and skills to effectively market, sell, and support AMD's diverse product portfolio. For instance, in 2024, AMD continued to expand its online training modules and in-person workshops, reaching thousands of partner personnel globally.

This strategic investment directly translates to a wider market reach for AMD. By equipping partners with deep product understanding and technical expertise, AMD extends its sales and support capabilities beyond its direct teams. This allows AMD to effectively engage with a broader spectrum of customers, from enterprise clients to individual consumers, ensuring a consistent and high-quality experience.

The effectiveness of AMD's channel partner enablement is evident in their growing market share. In 2024, AMD reported significant gains in key segments, partly attributed to the strong performance of its channel network. Key aspects of this enablement include:

- Product Training: Comprehensive modules on new processor architectures, graphics technologies, and server solutions.

- Sales Enablement Tools: Providing partners with marketing collateral, competitive analysis, and sales playbooks.

- Technical Support Resources: Offering access to dedicated support engineers and online knowledge bases for pre-sales and post-sales assistance.

- Certification Programs: Recognizing and rewarding partners who achieve specific levels of expertise in AMD technologies.

AMD cultivates deep, collaborative relationships with hyperscale and enterprise clients, offering tailored solutions and dedicated support to meet the specific demands of data centers and AI workloads. These partnerships are vital for co-engineering products that align with evolving market needs, as demonstrated by the adoption of AMD EPYC processors by major cloud providers like Microsoft Azure and Google Cloud in 2024.

Channels

AMD's direct sales force is instrumental in cultivating relationships with major enterprise clients, hyperscale data centers, and cloud service providers. This approach allows for tailored discussions and the delivery of high-performance solutions like EPYC processors and Instinct accelerators, crucial for modern data center and AI infrastructure.

In 2024, AMD's data center segment continued to see robust growth, with revenues reflecting the increasing demand for their high-performance computing solutions. The direct sales channel was key to securing significant deals with leading cloud providers, driving adoption of their latest CPU and GPU architectures.

Original Equipment Manufacturer (OEM) sales form a cornerstone of AMD's business, acting as a direct conduit for their processors and graphics cards into a vast array of consumer and commercial devices. Companies like Dell, HP, and Lenovo rely on AMD's silicon to power their PCs and laptops, while console makers integrate AMD's semi-custom chips into gaming systems, ensuring broad market penetration.

This direct OEM channel is critical for AMD's market share. For instance, in 2023, AMD's revenue from computing and graphics segments, which heavily includes OEM sales, reached $19.06 billion. This demonstrates the significant volume and revenue generated by supplying components to major system builders.

AMD relies on a vast global network of distributors and wholesalers to get its processors and graphics cards into the hands of system builders and VARs, significantly expanding its reach beyond direct sales to major manufacturers.

This extensive channel strategy ensures AMD products are accessible to a wide range of customers, from small businesses to large enterprises, fostering broader market penetration and sales volume.

For example, in 2024, AMD continued to strengthen partnerships with key distributors like Ingram Micro and Tech Data, facilitating the availability of its Ryzen and Radeon product lines across numerous international markets.

Retail and E-commerce Platforms

AMD's consumer-focused products, including Ryzen CPUs and Radeon GPUs, reach a broad audience through major online retailers like Amazon and Newegg, as well as physical stores such as Best Buy. This direct-to-consumer channel is crucial for individual PC builders and upgraders. In 2024, the PC hardware market continued to see strong demand, with AMD's Ryzen processors consistently ranking among the top sellers in their categories.

These retail and e-commerce platforms are vital for AMD's market penetration, allowing enthusiasts and everyday users to access the latest technology. The accessibility through these channels directly impacts AMD's revenue streams from the consumer segment. For example, AMD reported significant growth in its Client segment, which largely relies on these retail channels, throughout 2024.

- Direct Sales: Enables individual consumers to purchase AMD components for personal use.

- Market Reach: Broad availability through online and physical retail partners.

- Brand Visibility: High visibility among PC enthusiasts and the general consumer market.

- Revenue Generation: A primary driver for AMD's consumer product sales.

Strategic Alliance and System Integrator Partnerships

AMD leverages strategic alliances with system integrators, such as HCLTech, to deliver comprehensive, full-stack solutions. These partnerships are vital for embedding AMD's high-performance computing hardware into broader enterprise offerings, facilitating digital transformation for clients. For instance, in 2024, HCLTech announced expanding its collaboration with AMD to accelerate cloud-native application development and AI adoption, highlighting the demand for integrated solutions.

These collaborations enable AMD to reach a wider enterprise customer base that requires not just chips, but complete, serviced solutions. By combining AMD's silicon with system integrators' expertise in software, implementation, and ongoing support, customers receive end-to-end digital transformation capabilities. This approach addresses the growing market need for simplified procurement and deployment of complex technology stacks.

The strategic importance of these partnerships is underscored by the market trends in 2024. The global system integration market was projected to reach over $200 billion, indicating a significant opportunity for hardware vendors like AMD to extend their reach through value-added services delivered by partners. These alliances are key to unlocking new revenue streams and deepening customer relationships.

- Strategic Alliances: Partnerships with system integrators like HCLTech are critical channels.

- Full-Stack Solutions: These alliances combine AMD hardware with services, software, and support.

- Market Reach: They enable AMD to serve enterprise clients seeking comprehensive digital transformation.

- 2024 Data: HCLTech's expanded collaboration with AMD in 2024 focused on cloud-native and AI acceleration.

AMD's channels are diverse, encompassing direct sales to hyperscale clients, OEM partnerships for broad device integration, and extensive distribution networks. Consumer products also thrive through online and physical retail, while strategic alliances with system integrators offer complete solutions.

These varied channels ensure AMD's technology reaches a wide customer base, from individual enthusiasts to large enterprises, driving both unit volume and revenue across different market segments. The effectiveness of these channels is vital for AMD's sustained growth and market penetration.

In 2024, AMD's focus on strengthening these channels continued, with particular emphasis on expanding its data center presence through direct engagement and system integrator collaborations. The company also saw continued success in the consumer market via retail and e-commerce platforms.

AMD's channel strategy is designed for maximum market penetration and revenue generation. Direct sales target key enterprise accounts, while OEM agreements ensure AMD silicon powers a vast array of consumer and commercial devices. Distributors and retailers broaden access to AMD's processors and graphics cards for smaller businesses and individual consumers.

| Channel | Key Partners/Examples | 2024 Focus/Impact |

|---|---|---|

| Direct Sales | Hyperscale Cloud Providers, Enterprise Clients | Securing significant deals for EPYC and Instinct, driving data center growth. |

| OEM | Dell, HP, Lenovo, Console Manufacturers | Powering a wide range of PCs, laptops, and gaming consoles; crucial for market share. |

| Distributors & Wholesalers | Ingram Micro, Tech Data | Ensuring broad availability of Ryzen and Radeon products globally. |

| Retail & E-commerce | Amazon, Newegg, Best Buy | Driving consumer sales and brand visibility for PC enthusiasts. |

| System Integrators | HCLTech | Delivering full-stack solutions and accelerating AI/cloud adoption for enterprises. |

Customer Segments

Data center operators and cloud service providers are a cornerstone for Advanced Micro Devices. This segment encompasses major cloud companies, often called hyperscalers, and large enterprises that demand powerful CPUs like AMD's EPYC and AI accelerators such as Instinct. These components are crucial for building out their server infrastructure, delivering cloud computing services, and powering demanding AI and high-performance computing (HPC) workloads.

The importance of this customer segment is underscored by AMD's impressive financial performance. In the first quarter of 2025, AMD reported a substantial 57% year-over-year increase in data center revenue, highlighting the growing demand for their specialized processors in this market.

PC Enthusiasts, Gamers, and Content Creators represent a core customer segment for AMD, driving demand for its high-performance Ryzen CPUs and Radeon GPUs. These users require cutting-edge processing power for demanding tasks like gaming, video editing, and graphic design. AMD's 'Zen 5' architecture has been particularly well-received, contributing to significant market share gains in the consumer CPU space, reflecting the strong appeal of their products to this performance-focused demographic.

Original Equipment Manufacturers (OEMs) for PCs represent a crucial customer segment for AMD. These are the big names in desktop and laptop manufacturing that incorporate AMD's processors and graphics chips into their diverse product lines, serving both individual consumers and businesses.

The reliance of these OEMs on AMD's technology is evident in the financial performance. For instance, AMD's client segment, which largely comprises these PC manufacturers, saw a robust revenue of $2.3 billion in the first quarter of 2025, largely fueled by the strong demand for their Ryzen processors.

Gaming Console Manufacturers

Gaming console manufacturers are a cornerstone customer segment for AMD, representing a highly specialized and lucrative market. These are the major players in the video game industry who rely on AMD for the custom System-on-Chips (SoCs) that form the very heart of their gaming platforms.

This deep integration means AMD isn't just selling components; it's partnering with these giants to create the unique performance characteristics that define their consoles. This strategic relationship is a significant driver of AMD's semi-custom revenue, particularly within its robust gaming division.

For context, AMD's gaming segment, which includes these console deals, has shown impressive growth. In 2023, AMD reported that its semi-custom business, largely driven by console sales, generated billions in revenue, with significant contributions expected to continue through the current console generation.

- Custom SoC Design: AMD's expertise in designing tailored SoCs for major console makers like Sony (PlayStation) and Microsoft (Xbox) is a critical value proposition.

- High-Volume Production: These partnerships involve substantial, high-volume manufacturing commitments, providing predictable and significant revenue streams for AMD.

- Long-Term Partnerships: Console cycles are typically several years long, fostering enduring relationships and ongoing revenue opportunities for AMD as new console iterations are developed.

Embedded System Developers & Industrial Clients

Embedded System Developers and Industrial Clients represent a crucial segment for AMD, leveraging their high-performance processors, FPGAs, and adaptive SoCs. These customers integrate AMD technology into specialized applications across diverse sectors like industrial automation, automotive systems, advanced networking infrastructure, and critical medical imaging equipment. They are driven by the need for efficient, powerful, and highly customizable processing solutions tailored to specific operational demands.

The demand for embedded solutions continues to surge, fueled by the expanding Internet of Things (IoT) and the increasing sophistication of industrial machinery. For instance, the global industrial IoT market was valued at approximately $216.7 billion in 2023 and is projected to reach over $650 billion by 2029, showcasing the immense growth potential for AMD's offerings in this space. By 2024, AMD's embedded segment is expected to benefit from these expanding markets, particularly in areas requiring real-time processing and low-latency communication.

- Target Industries: Industrial automation, automotive, aerospace, defense, networking, medical imaging, and communications.

- Key Needs: High performance, power efficiency, customization, reliability, and long-term product availability for embedded applications.

- AMD Value Proposition: Providing adaptable hardware solutions like EPYC embedded processors and Versal adaptive SoCs that offer significant performance gains and integration flexibility.

- Market Drivers: Growth in AI at the edge, 5G deployment, autonomous systems, and the increasing complexity of industrial control systems.

AMD's customer segments are diverse, catering to both high-volume consumer markets and specialized enterprise needs. Key segments include data center operators, PC manufacturers, gamers, and developers of embedded systems. The company's strategic focus on high-performance computing and adaptive solutions allows it to serve a broad range of demanding applications.

Cost Structure

Advanced Micro Devices (AMD) dedicates a significant portion of its cost structure to Research and Development (R&D), a vital investment for creating cutting-edge CPUs, GPUs, and advanced semiconductor solutions. This commitment to innovation is evident in their substantial R&D spending.

For the full year 2024, AMD reported R&D expenses amounting to $6.456 billion. This figure underscores the company's ongoing strategy to maintain a competitive edge through continuous technological advancement and product development in the fast-evolving semiconductor industry.

As a fabless semiconductor company, Advanced Micro Devices' (AMD) largest Cost of Goods Sold (COGS) component stems from payments to third-party foundries like TSMC for chip manufacturing. These expenses cover wafer fabrication, advanced packaging, and rigorous testing processes, all critical for producing their high-performance processors and graphics cards.

These manufacturing costs are directly proportional to production volume; for instance, in Q1 2024, AMD reported COGS of $1.36 billion, reflecting the significant investment in external fabrication services to meet demand for their Ryzen and Radeon products.

Sales, General & Administrative (SG&A) expenses for Advanced Micro Devices (AMD) cover essential non-production costs like marketing, sales teams, and operational overhead. In 2023, AMD reported SG&A expenses of $3.71 billion. These figures reflect ongoing investments in expanding their market reach and brand visibility.

AMD’s commitment to growth is evident in its strategic allocation of resources towards sales and marketing efforts. For instance, the company’s Q1 2024 earnings highlighted continued investments in personnel and programs aimed at capturing market share in key segments like data center and gaming.

Acquisition and Integration Costs

Acquisition and integration costs are a significant component of AMD's business model. For instance, the substantial $4.9 billion acquisition of ZT Systems in 2024 exemplifies the capital required for strategic expansion through mergers and acquisitions. This figure represents a direct investment in acquiring new capabilities and market access.

Beyond the initial purchase price, these costs encompass the complex and often lengthy processes of integrating acquired entities. This involves harmonizing technologies, streamlining operations, and merging workforces, all of which incur considerable expense. These integration efforts are crucial for realizing the full strategic and financial benefits of any acquisition.

- Strategic Acquisitions: Costs related to significant M&A activities, such as the ZT Systems deal.

- Integration Expenses: Funds allocated for merging acquired technologies, operations, and personnel.

- Synergy Realization: Investments made to achieve operational efficiencies and revenue growth post-acquisition.

Supply Chain and Logistics Expenses

Advanced Micro Devices (AMD) faces substantial supply chain and logistics expenses due to the global nature of semiconductor manufacturing and distribution. These costs encompass everything from moving raw materials to finished products across continents, including freight, warehousing, and the specialized handling required for sensitive electronic components. In 2023, AMD reported total operating expenses of $6.57 billion, a significant portion of which is attributable to its complex global supply chain operations.

Managing this intricate network involves considerable investment in inventory management systems and warehousing facilities to ensure timely delivery and minimize disruption. Furthermore, AMD, like other tech companies, navigates evolving export controls and trade regulations, which can introduce additional compliance costs and logistical complexities. For instance, the U.S. government's export restrictions on advanced semiconductors to certain countries in 2023 directly impacted supply chain strategies and associated expenses for companies like AMD.

- Logistics and Transportation: Costs associated with shipping components and finished goods globally, including air, sea, and land freight.

- Warehousing and Inventory Management: Expenses for storing raw materials, work-in-progress, and finished products, plus the systems to manage them efficiently.

- Regulatory Compliance: Costs incurred to adhere to international trade laws, export controls, and customs regulations, which can fluctuate.

- Supply Chain Risk Mitigation: Investments in diversifying suppliers, building buffer stock, and enhancing supply chain visibility to counter potential disruptions.

AMD's cost structure is heavily influenced by its fabless model, necessitating significant outlays for third-party manufacturing. Research and Development (R&D) is another major expense, crucial for maintaining its competitive edge in the dynamic semiconductor market.

Sales, General, and Administrative (SG&A) expenses support market expansion and brand visibility, while acquisition and integration costs reflect strategic growth initiatives. Global supply chain and logistics also represent substantial operational expenditures.

| Cost Category | 2023 (USD Billions) | 2024 (USD Billions) |

|---|---|---|

| Research & Development | N/A | 6.456 |

| Cost of Goods Sold (COGS) | N/A | N/A (Q1 2024: 1.36) |

| Sales, General & Administrative (SG&A) | 3.71 | N/A |

| Acquisition Costs (ZT Systems) | N/A | 4.9 |

| Total Operating Expenses | 6.57 | N/A |

Revenue Streams

The Data Center segment represents a significant and rapidly expanding revenue source for AMD. This growth is largely driven by sales of their EPYC server CPUs and Instinct AI GPUs, which are crucial components for cloud service providers, hyperscalers, and major enterprises.

In the first quarter of 2025, this segment achieved $3.7 billion in revenue, marking an impressive 57% increase compared to the same period last year. Projections indicate that this revenue stream is on track to reach tens of billions annually in the foreseeable future, underscoring its strategic importance.

Revenue from our client segment, primarily driven by the sale of AMD Ryzen CPUs for desktops and laptops, saw significant expansion. In the first quarter of 2025, this segment's revenue hit $2.3 billion, marking a substantial 68% surge compared to the previous year.

This impressive growth was largely fueled by robust demand for our cutting-edge 'Zen 5' processors, which resonated well with consumers and businesses seeking enhanced performance and efficiency in their personal computing devices.

Advanced Micro Devices' gaming segment revenue is a significant contributor, primarily driven by sales of its Radeon discrete GPUs for PCs. This segment also benefits substantially from the company's semi-custom System-on-Chips (SoCs), which are integral to major gaming consoles. For the first quarter of 2025, this crucial revenue stream generated $647 million.

Embedded Segment Revenue

Revenue within AMD's Embedded segment is generated from the sale of its specialized processors, Field-Programmable Gate Arrays (FPGAs), and adaptive System-on-Chips (SoCs). These components are crucial for a variety of demanding applications, including industrial automation systems, advanced automotive infotainment solutions, and high-performance networking infrastructure.

For the first quarter of 2025, AMD reported that its Embedded segment revenue reached $823 million. This figure highlights the significant market adoption and demand for AMD's embedded solutions across diverse industries.

- Embedded Processor Sales: Revenue from processors designed for specific, often continuous, operational tasks in devices and systems.

- FPGA and Adaptive SoC Revenue: Income derived from the sale of flexible, reconfigurable hardware solutions that can be tailored to unique design requirements.

- Market Application Focus: Revenue streams are driven by the integration of these products into industrial control systems, automotive electronics, and networking equipment.

- Q1 2025 Performance: The Embedded segment achieved $823 million in revenue during the first quarter of 2025, demonstrating strong market traction.

Licensing and Other Revenue

While not the primary driver of its income, Advanced Micro Devices (AMD) does benefit from licensing its intellectual property and receiving royalties. This segment, though smaller, contributes to revenue diversification.

In 2023, AMD reported licensing and other revenue of $413 million. This represented a slight decrease from $442 million in 2022, indicating a fluctuating but present income stream from these activities.

- Technology Licensing: AMD licenses its chip designs and related technologies to other companies.

- Patent Royalties: Income is generated from the use of AMD's patented technologies by third parties.

- Ancillary Services: This can include support services or specialized consulting related to its technology.

AMD's revenue streams are diverse, with the Data Center segment leading growth. This segment, fueled by EPYC CPUs and Instinct GPUs, generated $3.7 billion in Q1 2025, a 57% year-over-year increase. The Client segment, driven by Ryzen CPUs, also saw robust performance, with $2.3 billion in Q1 2025 revenue, up 68%.

The Gaming segment, encompassing Radeon GPUs and semi-custom console SoCs, brought in $647 million in Q1 2025. AMD's Embedded segment, featuring specialized processors and FPGAs for industrial, automotive, and networking applications, contributed $823 million in the same quarter. Licensing and royalties, while a smaller contributor, generated $413 million in 2023.

| Revenue Segment | Q1 2025 Revenue (Billions USD) | Year-over-Year Growth | Key Products |

|---|---|---|---|

| Data Center | 3.7 | 57% | EPYC CPUs, Instinct GPUs |

| Client | 2.3 | 68% | Ryzen CPUs |

| Gaming | 0.647 | N/A | Radeon GPUs, Console SoCs |

| Embedded | 0.823 | N/A | Embedded Processors, FPGAs |

| Licensing & Other | N/A | N/A | Technology Licensing, Royalties |

Business Model Canvas Data Sources

The Advanced Micro Devices Business Model Canvas is informed by AMD's financial reports, investor relations materials, and industry analyst research. These sources provide a comprehensive view of AMD's market position, product strategy, and financial performance.