Advanced Micro Devices Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Micro Devices Bundle

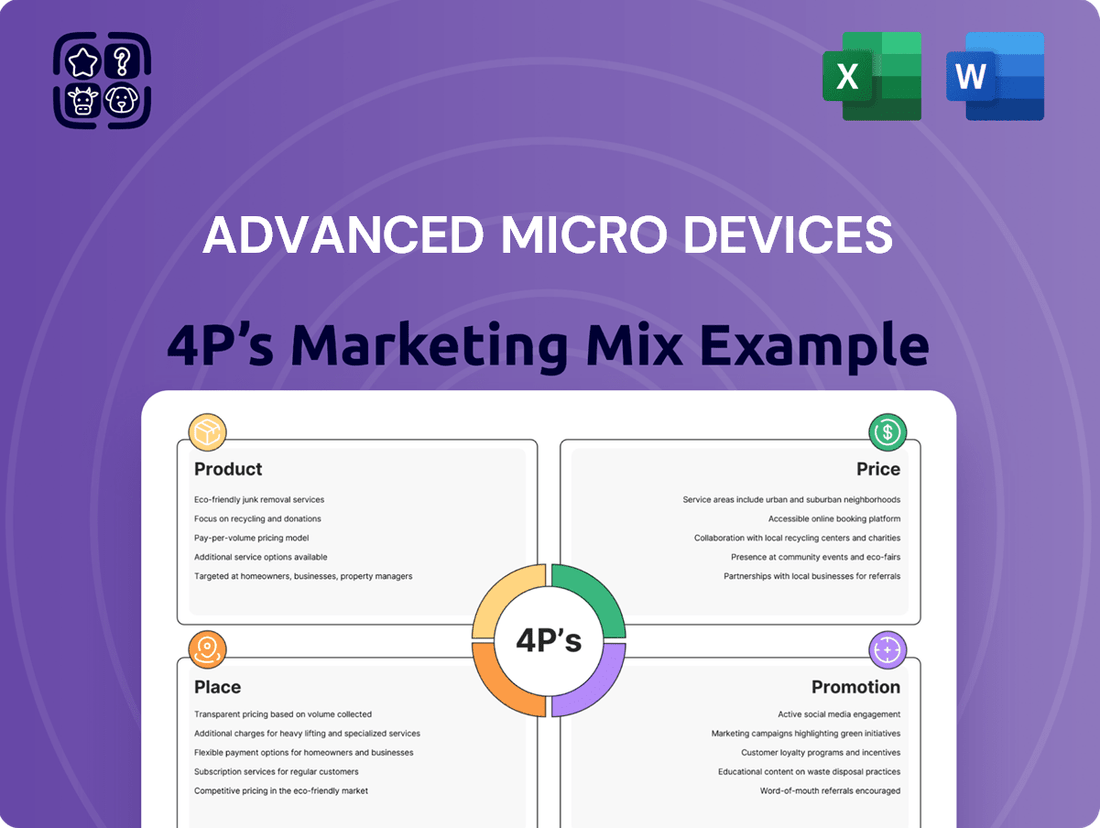

Advanced Micro Devices (AMD) masterfully crafts its marketing by focusing on powerful products, competitive pricing, strategic distribution, and impactful promotion. This intricate dance of the 4Ps drives their significant market presence and technological innovation.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering AMD's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

AMD's Ryzen CPUs, like the recently launched Ryzen 8000G and anticipated Ryzen 9000 series, dominate the consumer space by offering exceptional performance for gaming and content creation, often featuring impressive integrated graphics capabilities. This focus on user experience and raw processing power has solidified Ryzen's position in the PC market.

For the demanding data center and enterprise environments, AMD's EPYC processors, exemplified by the upcoming 5th Gen EPYC Turin, are setting new benchmarks with their high core counts and power efficiency. These processors are increasingly chosen by hyperscalers and major enterprises for their ability to handle complex server workloads, reflecting a growing market share in critical infrastructure.

AMD's advanced GPUs are split into two main categories: Radeon for gamers and creators, and Instinct for serious data center tasks like AI and high-performance computing. The Radeon RX 7600 XT, launched in early 2024, offers impressive gaming performance with its 16GB of GDDR6 memory and advanced raytracing, appealing to a broad consumer base.

For the booming AI market, AMD's Instinct MI300X is a powerhouse, boasting 192GB of HBM3 memory, making it a strong contender against NVIDIA's offerings. AMD has projected significant growth in their data center segment, with the Instinct MI300 series expected to drive substantial revenue, potentially reaching billions in sales by the end of 2024, as they ramp up production and adoption for AI training and inference.

Through its acquisition of Xilinx, AMD significantly bolstered its product portfolio by integrating Field-Programmable Gate Arrays (FPGAs) and Adaptive System-on-Chips (SoCs). These offerings provide unparalleled hardware flexibility, catering to diverse sectors like embedded systems and edge AI. AMD's strategic move into this space positions it to capitalize on the growing demand for reconfigurable computing solutions.

AMD's adaptive SoCs, such as the Versal AI Edge Series Gen 2, exemplify the company's commitment to innovation in this segment. This particular product line merges programmable logic, advanced AI engines, and embedded CPUs onto a single chip, delivering powerful, adaptable performance for edge computing applications. This integration allows for on-the-fly hardware optimization, a crucial advantage in rapidly evolving technological landscapes.

The market for FPGAs and adaptive SoCs is robust, with projections indicating continued strong growth. For instance, the global FPGA market was valued at approximately $7.2 billion in 2023 and is expected to reach around $12.6 billion by 2028, growing at a compound annual growth rate of roughly 11.9%. This expansion is driven by increasing demand in data centers, automotive, and industrial automation, all areas where AMD's Xilinx-based products are well-positioned.

Integrated AI Capabilities (Ryzen AI)

AMD is making significant strides in integrating artificial intelligence directly into its processors, a key part of its product strategy. This is most evident in their Ryzen mobile and desktop CPUs, which now feature dedicated AI engines known as NPUs. These NPUs, such as the XDNA 2 architecture, work alongside traditional CPU cores and Radeon graphics to perform AI tasks locally on the PC.

This on-device AI processing is designed to boost productivity and creativity for users. Think of tasks like enhanced noise cancellation in video calls, faster photo editing, or more intelligent content creation tools. By enabling these capabilities directly on the PC, AMD is aiming to capture a significant share of the burgeoning AI PC market and edge AI applications, where localized processing is crucial for speed and efficiency.

The company's commitment to this area is substantial. For instance, AMD announced in early 2024 that its Ryzen AI technology would be a cornerstone of its upcoming processor generations, targeting a significant increase in AI performance. This strategic focus positions AMD to benefit from the projected growth in AI-accelerated computing, with analysts anticipating the AI PC market to reach hundreds of millions of units by 2027.

- Dedicated AI Engines: Integration of Neural Processing Units (NPUs) like XDNA 2 for efficient local AI computation.

- Enhanced PC Performance: Enabling AI-driven features directly on the device to improve user productivity and creative workflows.

- Market Opportunity: Targeting the rapidly expanding AI PC and edge AI sectors, a key growth area for semiconductors.

- Strategic Investment: AMD's continued R&D and product roadmap heavily emphasize AI capabilities across its processor portfolio.

Software Ecosystem (ROCm)

AMD's Software Ecosystem, spearheaded by ROCm (Radeon Open Compute platform), is a critical component of its marketing mix, extending value beyond its hardware. This open-source initiative is designed to unlock the full potential of AMD GPUs for demanding AI and high-performance computing workloads.

ROCm provides developers and enterprises with a powerful, flexible platform for AI development and deployment, directly competing with established proprietary software stacks. Its growing support for popular AI models and frameworks, including PyTorch and TensorFlow, is key to its adoption. For instance, AMD announced in late 2023 that ROCm 6.0 offered significant performance gains, with some benchmarks showing up to a 3x improvement in inference speeds for certain large language models compared to previous versions, making it a compelling choice for AI innovation.

- Open-Source Advantage: ROCm fosters an open environment, promoting collaboration and innovation in AI development, a stark contrast to closed ecosystems.

- Performance Optimization: The platform is engineered for AMD's Instinct accelerators, delivering optimized performance for AI training and inference tasks.

- Growing Framework Support: ROCm's compatibility with leading AI frameworks democratizes access to powerful GPU computing for a wider range of developers.

- Competitive Positioning: By offering a robust, open-source alternative, AMD aims to capture market share in the rapidly expanding AI hardware and software landscape.

AMD's product strategy centers on delivering high-performance, adaptable computing solutions across diverse markets. From consumer-focused Ryzen CPUs with integrated graphics to enterprise-grade EPYC processors, the company prioritizes raw power and efficiency. Their GPU offerings, Radeon and Instinct, cater to gaming and AI/HPC respectively, with the MI300X proving a formidable AI accelerator. Furthermore, the integration of Xilinx's FPGAs and adaptive SoCs, like the Versal AI Edge Gen 2, expands AMD's reach into flexible, edge computing applications.

| Product Category | Key Series/Examples | Target Market | 2024/2025 Focus |

|---|---|---|---|

| CPUs | Ryzen (8000G, 9000 series), EPYC (5th Gen Turin) | Consumer, Data Center, Enterprise | AI integration, core count, power efficiency |

| GPUs | Radeon (RX 7600 XT), Instinct (MI300X) | Gaming, Content Creation, AI, HPC | AI performance, memory capacity (HBM3), raytracing |

| Adaptive SoCs/FPGAs | Versal AI Edge Series Gen 2 | Embedded Systems, Edge AI, Automotive | Hardware flexibility, AI engines, on-device processing |

What is included in the product

This analysis provides a comprehensive breakdown of Advanced Micro Devices' (AMD) marketing mix, detailing their product innovation, competitive pricing strategies, strategic distribution channels, and impactful promotional campaigns.

Simplifies complex AMD marketing strategies by presenting the 4Ps in a clear, actionable format, alleviating the pain of deciphering intricate plans for quick understanding.

Place

Original Equipment Manufacturers (OEMs) are crucial for AMD's distribution strategy, as they integrate AMD's processors and graphics cards into their finished products. Key partners like Dell, HP, and Lenovo ensure AMD's technology reaches a wide consumer and enterprise audience. This OEM model is vital for AMD's market penetration, allowing them to focus on chip design and innovation.

AMD's data center business thrives through strategic partnerships with major cloud service providers (CSPs) and hyperscalers. These collaborations are crucial for the widespread adoption of AMD's EPYC CPUs and Instinct AI accelerators. For instance, Microsoft Azure, Oracle Cloud, and Google Cloud are actively integrating AMD's latest Instinct MI300 series accelerators to power their advanced AI and high-performance computing (HPC) offerings.

This direct sales channel and partnership model ensures AMD's cutting-edge silicon reaches massive cloud infrastructure. By securing design wins with these industry giants, AMD gains significant market penetration for its data center solutions. The demand for AI and HPC capabilities within these cloud environments directly translates into substantial revenue opportunities for AMD, particularly with the MI300X accelerator showing strong adoption in 2024.

AMD's reach extends directly to end-users via a robust distribution network. This includes major national and regional distributors, as well as a wide array of retailers and sub-retailers. This structure is crucial for making discrete components, such as their popular Ryzen processors and Radeon graphics cards, accessible to individual PC builders and tech enthusiasts.

System integrators are another vital channel, assembling and marketing custom-built PCs that prominently feature AMD hardware. In 2024, the DIY PC market continued to show resilience, with a significant portion of high-performance builds opting for AMD components, contributing to AMD's market share gains in the consumer CPU space.

Online Platforms and Direct Marketing

AMD strategically utilizes online platforms and direct marketing to connect with its audience. Their official website serves as a central hub for detailed product specifications, customer support, and often directs users to authorized resellers, streamlining the purchasing journey. This digital-first approach is vital for engaging with a technically inclined customer base that heavily relies on online research.

The company's digital marketing efforts are designed to capture the attention of both individual consumers and enterprise IT professionals. By investing in online engagement, AMD ensures its latest innovations and competitive advantages are clearly communicated to those actively seeking high-performance computing solutions. This focus on digital channels is a cornerstone of their modern marketing strategy.

- Website as a Sales and Information Gateway: AMD's website (amd.com) is a primary touchpoint, offering comprehensive product details, driver downloads, and support resources. In Q1 2024, AMD reported a significant portion of its revenue generated through direct online channels and partnerships facilitated by its digital presence.

- Targeted Digital Advertising: AMD employs targeted digital advertising campaigns across tech-focused websites, social media platforms, and professional networks to reach key demographics. This includes reaching gamers researching new GPUs and IT managers evaluating server processors.

- Content Marketing and SEO: The company invests in creating valuable content, such as benchmark comparisons, technology explainers, and case studies, optimized for search engines. This organic reach is crucial for attracting users actively searching for solutions AMD provides, contributing to lead generation and brand awareness.

- E-commerce Integration: While often linking to partners, AMD's direct sales capabilities or clear pathways to purchase are increasingly important. For instance, during major product launches in 2024, the website saw substantial traffic spikes, highlighting the importance of seamless online purchasing options.

Strategic Acquisitions and Partnerships

Advanced Micro Devices (AMD) strategically bolsters its market position through key acquisitions and partnerships, significantly enhancing its product portfolio and market penetration. The acquisition of Xilinx in February 2022 for approximately $49 billion, and later Nod.ai, broadened AMD's capabilities in adaptive computing and artificial intelligence, respectively. These moves are crucial for diversifying its revenue streams beyond traditional CPUs and GPUs.

Collaborations, such as the ongoing partnership with Dell Technologies for commercial PCs, ensure AMD's Ryzen processors and Radeon graphics are integrated into a wide array of client devices. This strengthens AMD's presence in the lucrative enterprise and consumer PC markets, driving adoption of its latest technologies.

AMD's strategic integrations aim to embed its silicon and software solutions across diverse computing environments, from data centers to edge devices. This multi-faceted approach allows AMD to capitalize on emerging trends, particularly in AI and high-performance computing, solidifying its competitive edge.

- Xilinx Acquisition: Completed in February 2022 for roughly $49 billion, integrating adaptive computing and AI capabilities.

- Nod.ai Acquisition: Bolsters AMD's software expertise for AI inference and deployment.

- Dell Partnership: Continues to drive AMD's presence in the commercial PC market with Ryzen and Radeon technologies.

- Market Expansion: Acquisitions and partnerships enable deeper penetration into enterprise, AI infrastructure, and diverse computing segments.

AMD's place strategy focuses on broad availability through Original Equipment Manufacturers (OEMs) like Dell and HP, ensuring their processors and graphics cards are integrated into a vast range of consumer and enterprise devices. This OEM model is critical for market penetration, allowing AMD to concentrate on chip design. Furthermore, strategic alliances with cloud service providers such as Microsoft Azure and Google Cloud are paramount for deploying AMD's EPYC CPUs and Instinct AI accelerators in massive data center environments. These partnerships are vital for AMD's growth in the high-performance computing and AI sectors, with the MI300X accelerator seeing significant adoption in 2024.

Preview the Actual Deliverable

Advanced Micro Devices 4P's Marketing Mix Analysis

The document you see here is not a sample; it's the final version you’ll get right after purchase. This comprehensive analysis of AMD's 4Ps Marketing Mix is fully complete and ready for immediate use, ensuring no surprises. You are previewing the exact same editable and comprehensive file that’s included in your purchase.

Promotion

AMD's promotional efforts strongly focus on its relentless pursuit of innovation and its position as a performance leader across its diverse product portfolio, encompassing CPUs, GPUs, and AI accelerators. This commitment to advancement is a cornerstone of their marketing strategy.

Campaigns consistently showcase architectural breakthroughs, such as the Zen CPU architecture and CDNA GPU architecture, illustrating how AMD's offerings consistently redefine the limits of computing power and graphical capabilities. For instance, the Ryzen 7000 series processors, launched in 2022, continued to push core counts and clock speeds, setting new benchmarks.

This messaging is strategically designed to firmly establish AMD as a forward-thinking technology provider, adept at disrupting established industry paradigms and offering compelling alternatives to competitors. Their market share gains in the server CPU market, reaching approximately 20% by late 2023, underscore the effectiveness of this positioning.

AMD excels at reaching specific customer groups through focused marketing. They connect with tech enthusiasts, gamers, content creators, and crucial IT decision-makers in businesses and data centers.

AMD uses content marketing, works with influencers, and runs special campaigns. These efforts are designed to speak directly to what each group needs and prefers, highlighting how AMD products solve their specific problems.

For instance, AMD's Ryzen processors saw significant market share gains in the DIY PC segment in 2024, driven by strong performance in gaming and content creation. Their EPYC processors continued to gain traction in enterprise and cloud computing, with reports indicating substantial year-over-year revenue growth in the data center market by early 2025.

AMD actively cultivates strategic partnerships with leading Original Equipment Manufacturers (OEMs) like Dell, HP, and Lenovo. These collaborations are crucial for promoting AMD's processors and graphics cards by ensuring their integration into a vast array of consumer and enterprise devices. For instance, the widespread availability of AMD Ryzen processors in Dell's XPS line and HP's Spectre laptops showcases this promotional synergy.

Collaborations extend to major cloud service providers, including Microsoft Azure and Oracle Cloud Infrastructure. These partnerships highlight the performance and efficiency of AMD EPYC server processors in demanding cloud environments. The increasing adoption of AMD-powered instances by these cloud giants, with reports indicating significant growth in AMD's data center revenue in 2024, underscores the promotional impact of these alliances.

Joint marketing initiatives and co-branded announcements with these partners serve as powerful promotional tools. They effectively demonstrate the real-world application and value proposition of AMD technologies, reinforcing brand credibility and expanding market reach. These efforts often feature joint press releases and marketing campaigns that emphasize the performance gains and cost efficiencies achieved through AMD's presence in popular platforms.

Digital Marketing and Social Media Engagement

AMD leverages digital marketing and social media extensively to reach its target audiences. Platforms like LinkedIn, Facebook, and X (formerly Twitter) are key channels for communication and engagement. Content amplification through influencer sharing further extends their reach, ensuring messages are seen by relevant communities.

Specific campaigns, such as #BusinessesLoveAMD, are designed to resonate with business-to-business (B2B) cohorts, particularly highlighting AI-powered processors. This strategic approach aims to generate significant impressions and engagement by delivering persuasive messages through carefully selected online channels. For instance, in Q1 2024, AMD reported a 2% year-over-year increase in data center revenue, partly driven by strong demand for their AI-accelerated computing solutions, which are often promoted through these digital channels.

- Digital Channels Utilized: LinkedIn, Facebook, X (formerly Twitter)

- Campaign Focus: AI-powered processors targeting B2B segments

- Engagement Strategy: Content amplification via influencer sharing

- Objective: Drive impressions and engagement with persuasive messaging

Industry Events and Developer Programs

AMD actively participates in key industry events such as CES and Computex, showcasing its latest innovations and engaging with a broad audience. These platforms are crucial for product unveilings and sharing the company's strategic direction. In 2024, AMD continued its 'Advancing AI' event series, highlighting its commitment to the artificial intelligence sector and fostering developer relationships.

Beyond major trade shows, AMD hosts dedicated developer conferences and its 'Advancing AI' events. These gatherings provide direct interaction opportunities with the tech community, enabling AMD to gather feedback and build stronger relationships. For instance, the AMD Developer Cloud offers developers early access to cutting-edge chips for testing and development, a move that encourages broader adoption of their technologies.

- Industry Event Presence: AMD's participation in events like CES and Computex in 2024 and early 2025 serves as a vital channel for product launches and brand visibility.

- Developer Ecosystem: Initiatives like the AMD Developer Cloud aim to cultivate an open ecosystem, providing crucial access to hardware for innovation and driving adoption of AMD's solutions.

- AI Focus: Dedicated 'Advancing AI' events underscore AMD's strategic push into the artificial intelligence market, targeting developers and enterprise customers.

AMD's promotional strategy hinges on highlighting its technological leadership and performance superiority across its product lines, from CPUs and GPUs to AI accelerators. This narrative is consistently reinforced through campaigns showcasing architectural advancements like the Zen and CDNA architectures, aiming to position AMD as an innovative disruptor.

AMD effectively targets specific customer segments, including gamers, content creators, and enterprise IT decision-makers, with tailored messaging. They leverage content marketing, influencer collaborations, and specialized campaigns to address the unique needs of each group, demonstrating how AMD products provide solutions.

Strategic partnerships with OEMs like Dell, HP, and Lenovo, as well as cloud providers such as Microsoft Azure, are central to AMD's promotional efforts. These collaborations ensure AMD's technology is integrated into a wide range of devices and cloud services, amplifying their reach and demonstrating real-world value.

Digital channels, including LinkedIn, Facebook, and X, are vital for AMD's communication and engagement, with content amplification through influencers boosting reach. Campaigns like #BusinessesLoveAMD specifically target B2B audiences, emphasizing AI capabilities and driving engagement by delivering persuasive messages through carefully chosen online platforms.

| Metric | 2023 Data (Approx.) | 2024 Outlook/Early 2025 Data (Approx.) | Impact on Promotion |

|---|---|---|---|

| Server CPU Market Share | ~20% | Continued growth, targeting 25%+ | Reinforces messaging of enterprise adoption and performance leadership. |

| Data Center Revenue Growth | Significant YoY growth | Continued strong growth, driven by AI demand | Supports promotional claims of AI and high-performance computing capabilities. |

| DIY PC Market Share (Ryzen) | Strong gains | Sustained momentum in gaming and content creation segments | Validates promotional focus on performance for enthusiasts and creators. |

Price

AMD's pricing strategy is a cornerstone of its market penetration, focusing on delivering superior performance at a more accessible cost than key competitors. For example, in the competitive desktop CPU market of late 2024 and early 2025, AMD's Ryzen 7000 series processors have often presented a compelling value proposition, offering comparable or superior multi-core performance to Intel's offerings at a lower MSRP, thereby attracting a significant segment of PC enthusiasts and budget-minded builders.

This value-oriented approach extends to their graphics card division, where products like the Radeon RX 7000 series have been priced to challenge NVIDIA's dominance, particularly in the mid-range to high-end segments. By undercutting rivals on price while maintaining strong performance metrics, AMD effectively broadens its customer base, from individual gamers to enterprise clients requiring robust computing solutions without the premium price tag.

Advanced Micro Devices (AMD) employs a dynamic pricing strategy that shifts significantly across its varied product lines. For instance, consumer-focused Ryzen processors and Radeon graphics cards often compete on a performance-per-dollar basis, making them accessible to a broad market. This approach aims to capture market share by offering compelling value propositions to gamers and everyday users.

In contrast, AMD's high-performance data center solutions, such as the recently announced Instinct MI350 accelerators, are positioned with premium pricing. This strategy reflects the cutting-edge technology, substantial R&D investment, and the critical role these chips play in demanding AI and high-performance computing workloads. The MI350, built on a 3nm process, is expected to command higher prices due to its advanced architecture and the immense demand from enterprises seeking to scale their AI capabilities, with the AI hardware market projected to reach over $200 billion by 2027.

AMD employs dynamic pricing, adjusting its product costs based on fluctuating market demand, competitor actions, and the broader economic climate. This agility allows them to capitalize on emerging opportunities and maintain competitiveness.

For example, the pricing for their MI350 AI GPUs demonstrates this strategy. Following strong performance benchmarks and a growing demand for AI accelerators, AMD has strategically priced these units to capture significant value in the burgeoning AI sector, even pushing the boundaries of traditional pricing models.

Discounts and Promotional Offers

To boost sales and stay ahead, Advanced Micro Devices frequently employs discounts and promotional offers, especially for consumers. These strategies are crucial for making their high-performance processors and graphics cards more attractive. For instance, in the competitive PC hardware market, AMD often provides rebates on popular Ryzen CPUs and Radeon GPUs, directly lowering the out-of-pocket cost for end-users.

Bundling is another key tactic. AMD frequently partners with software developers to include popular games or productivity suites with their hardware purchases. This adds significant perceived value, making the overall package more compelling than buying components separately. System builders also benefit from special pricing programs, encouraging them to integrate AMD components into their pre-built systems, thereby expanding market reach.

Looking at recent trends, AMD's Ryzen 7000 series processors have seen competitive pricing adjustments throughout 2024, with some models dropping by as much as 20-30% from their initial launch prices to counter competitor offerings. Similarly, Radeon RX 7000 series GPUs have experienced promotional discounts, particularly during key sales periods like Black Friday and back-to-school events, with savings often reaching 10-15% on select models.

- Rebate Programs: Direct cash back offers on CPUs and GPUs, increasing affordability.

- Bundled Software/Games: Value-added packages that enhance product appeal.

- System Builder Pricing: Special discounts for OEMs and system integrators.

- Seasonal Promotions: Targeted price reductions during major retail events.

Consideration of Total Cost of Ownership (TCO) for Enterprise

For enterprise and data center clients, AMD’s pricing strategy heavily leans on the Total Cost of Ownership (TCO). This means they focus on demonstrating how their EPYC CPUs and Instinct accelerators offer superior energy efficiency and performance-per-watt, which translates to significant long-term savings. This value proposition is crucial for businesses meticulously tracking operational expenses and maximizing their return on investment.

AMD’s emphasis on TCO is backed by tangible benefits. For instance, their EPYC processors are designed to reduce power consumption in data centers, a major operational cost. This focus on efficiency directly impacts the bottom line, making AMD a compelling choice for organizations prioritizing sustainable and cost-effective computing solutions. The 2024 market continues to see a strong demand for these cost-saving technologies.

- Energy Efficiency: AMD EPYC processors offer leading performance per watt, reducing electricity costs in data centers.

- Performance Gains: Higher performance can lead to fewer servers needed, lowering capital expenditure and operational overhead.

- Long-Term Value: By focusing on TCO, AMD highlights the enduring economic benefits that extend far beyond the initial purchase price.

- Competitive Advantage: This pricing approach appeals to businesses seeking to optimize their IT infrastructure for both performance and cost-effectiveness.

AMD's pricing strategy balances aggressive market penetration with premium positioning for high-end solutions. For consumer products like Ryzen CPUs and Radeon GPUs, this often translates to a performance-per-dollar advantage, with frequent discounts and bundles enhancing appeal. For instance, throughout 2024, select Ryzen 7000 series CPUs saw price drops of up to 30%, and Radeon RX 7000 GPUs were available with 10-15% discounts during major sales events.

In contrast, AMD's data center offerings, such as the Instinct MI350 accelerators, are priced to reflect their advanced technology and critical role in AI workloads. The total cost of ownership (TCO) is a key selling point for enterprise clients, emphasizing energy efficiency and performance-per-watt to demonstrate long-term savings, a crucial factor in the projected over $200 billion AI hardware market by 2027.

| Product Segment | Pricing Strategy | Key Tactics | Example (2024/2025) |

|---|---|---|---|

| Consumer CPUs/GPUs | Value-oriented, Performance-per-dollar | Rebates, Bundles, Seasonal Promotions | Ryzen 7000 series price drops (up to 30%), Radeon RX 7000 series discounts (10-15%) |

| Data Center Accelerators (e.g., Instinct MI350) | Premium, TCO-focused | Highlighting energy efficiency, performance-per-watt | Positioned for high demand in the AI sector, targeting enterprise savings |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Advanced Micro Devices is meticulously constructed using a blend of official company disclosures, including SEC filings and investor presentations, alongside comprehensive industry reports and competitive intelligence.