Advanced Micro Devices Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advanced Micro Devices Bundle

Advanced Micro Devices (AMD) operates in a fiercely competitive semiconductor market, facing significant pressure from rivals and powerful buyers. Understanding the intricate interplay of these forces is crucial for any strategic evaluation. The full Porter's Five Forces Analysis unlocks a detailed examination of these dynamics, revealing the true competitive landscape that shapes AMD's success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Advanced Micro Devices’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The semiconductor industry, crucial for companies like Advanced Micro Devices (AMD), often features a limited number of specialized suppliers for essential materials such as high-purity silicon wafers and sophisticated manufacturing machinery. This concentration means AMD, and others in the sector, may have few alternative sources for these critical inputs, potentially granting suppliers considerable influence over pricing and delivery schedules.

Suppliers of highly specialized resources, like those providing advanced semiconductor manufacturing equipment or critical raw materials with unique properties, often hold a significant advantage. Their proprietary technologies and the difficulty in replicating their specialized processes mean companies like AMD often depend on them for essential components.

This dependency directly translates into increased bargaining power for these suppliers. For example, access to cutting-edge lithography machines, which are few in number and require immense technical expertise to operate, gives their manufacturers considerable leverage. AMD's need for such state-of-the-art equipment to produce its advanced processors means these suppliers can command higher prices or dictate terms.

High switching costs significantly empower suppliers to Advanced Micro Devices (AMD). For instance, integrating a new semiconductor supplier often necessitates extensive product redesigns and costly retooling of manufacturing lines. This can easily run into millions of dollars, making AMD hesitant to switch, thereby giving existing suppliers more leverage in price negotiations.

Importance of Supplier's Input to AMD's Product Differentiation

The quality and performance of components sourced from suppliers are paramount to AMD's ability to create distinct and high-performing CPUs and GPUs. When a supplier's unique technology or materials are integral to AMD's product innovation and overall performance, that supplier naturally wields greater bargaining power. This is particularly evident in AMD's reliance on TSMC for its cutting-edge foundry services, which directly impacts the company's competitive edge.

- Critical Supplier Dependence: AMD's dependence on TSMC for advanced process nodes, such as 5nm and 3nm, grants TSMC significant leverage.

- Innovation Linkage: TSMC's ability to deliver leading-edge manufacturing is directly tied to AMD's product roadmap and its capacity to offer competitive performance.

- Component Impact on Differentiation: The performance gains and power efficiency achieved through TSMC's fabrication are key differentiators for AMD's Ryzen processors and Radeon GPUs.

- Supplier's Input Value: For instance, TSMC's advanced packaging technologies are crucial for AMD's chiplet designs, enhancing performance and reducing costs, thereby increasing TSMC's bargaining power.

Potential for Forward Integration by Suppliers

The potential for suppliers to integrate forward into chip design or manufacturing, while less common, poses a significant threat to AMD's bargaining power. If a critical supplier were to make this move, they could directly enter the market as a competitor or impose more stringent conditions on the components they provide. This scenario would fundamentally alter the supply dynamic.

For instance, imagine a specialized materials supplier for advanced semiconductor fabrication deciding to develop their own chip designs. This would not only remove AMD's exclusive access to that specific material but also create a direct competitor leveraging their intimate knowledge of the supply chain. Such a development could force AMD to accept less favorable terms or seek alternative, potentially less efficient, supply sources.

- Forward Integration Threat: Suppliers moving into chip design or manufacturing could directly compete with AMD.

- Increased Supplier Leverage: This integration would allow suppliers to dictate stricter terms for essential components.

- Market Disruption: A supplier entering the design space could disrupt AMD's product roadmap and market position.

- Supply Chain Dependency: AMD's reliance on specialized suppliers makes this a critical consideration for maintaining competitive advantage.

The bargaining power of suppliers for Advanced Micro Devices (AMD) is significant, primarily due to the specialized nature of semiconductor manufacturing inputs and the limited number of qualified providers. This concentration means AMD often faces suppliers who can dictate terms, impacting costs and production timelines.

Key suppliers for critical components like advanced lithography equipment and high-purity materials hold considerable sway. For example, Taiwan Semiconductor Manufacturing Company (TSMC) is AMD's primary foundry partner, producing its most advanced chips. In 2024, TSMC's dominance in leading-edge process nodes, such as 3nm and 5nm, means AMD has very few alternatives for state-of-the-art manufacturing, giving TSMC substantial pricing power and influence over production capacity allocation.

| Supplier Category | Key Suppliers for AMD (Examples) | Impact on AMD's Bargaining Power | 2024 Data/Context |

|---|---|---|---|

| Foundry Services | TSMC | High. TSMC's technological leadership and limited competition in advanced nodes grant it significant leverage. | TSMC maintained its lead in advanced nodes, with AMD heavily reliant on its 5nm and 3nm processes for its latest Ryzen and EPYC processors. |

| Advanced Materials | Specialized Chemical and Wafer Suppliers | Moderate to High. Proprietary materials and stringent quality requirements limit alternatives. | Demand for high-quality silicon wafers and specialized chemicals remained robust in 2024, supporting supplier pricing. |

| Semiconductor Manufacturing Equipment | ASML, Applied Materials, Lam Research | High. These companies possess unique, patented technologies and face long lead times for new equipment. | ASML's EUV lithography machines are essential for advanced chip production, with limited availability and high costs, reinforcing their supplier power. |

What is included in the product

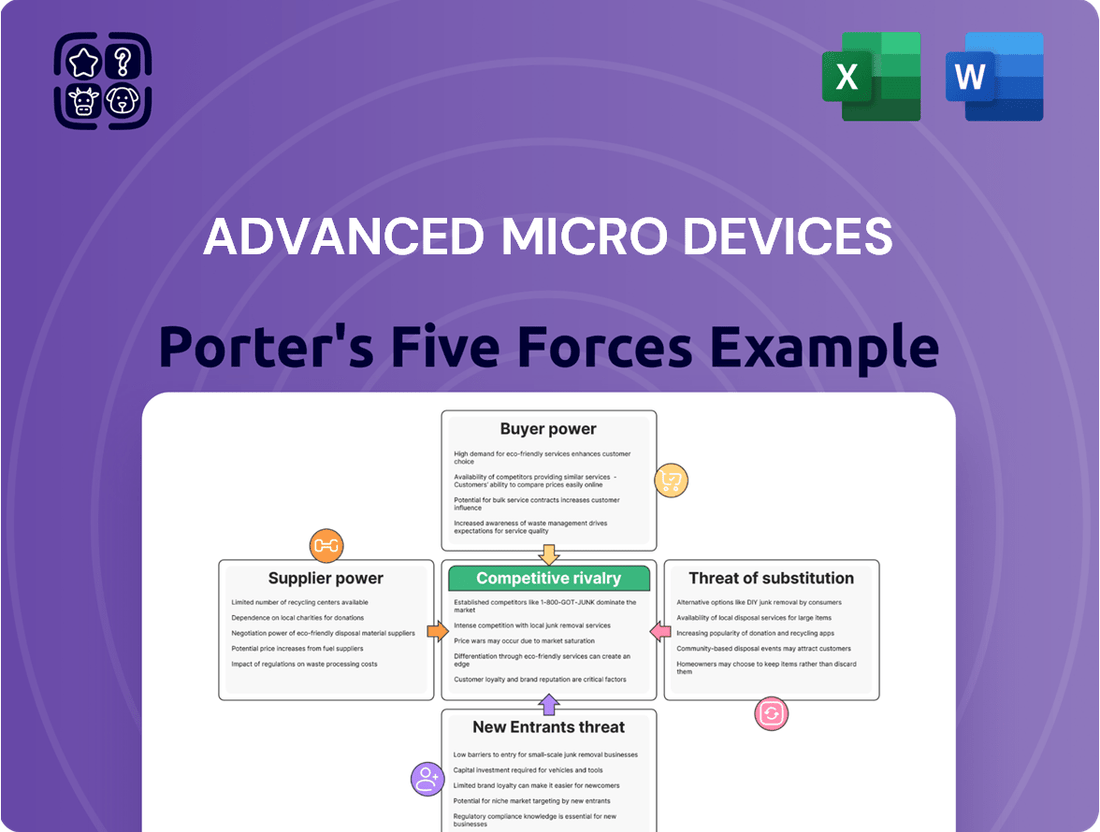

This analysis dissects the competitive landscape for Advanced Micro Devices, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting AMD.

Customers Bargaining Power

Large Original Equipment Manufacturers (OEMs), distributors, and data center operators are key customers for Advanced Micro Devices (AMD). Their substantial purchasing volumes grant them significant bargaining power, allowing them to negotiate favorable pricing and terms. For instance, major cloud providers and PC manufacturers often secure bulk discounts, directly impacting AMD's revenue per unit.

These major buyers are acutely price-sensitive, always on the lookout for the optimal performance-to-cost ratio. In 2024, the intense competition in the semiconductor market, particularly with rivals like Intel and NVIDIA, further amplifies this sensitivity. Customers can readily switch suppliers if they perceive a better value proposition, forcing AMD to remain competitive on price and features.

The availability of substitute products significantly bolsters customer bargaining power for Advanced Micro Devices (AMD). Competitors such as Intel and, increasingly, Arm-based processors offer viable alternatives, giving customers choices based on price, performance, and specific features. This competitive landscape compels AMD to continuously innovate and maintain competitive pricing to secure and retain its market share, as customers can readily switch if AMD's offerings become less attractive.

Large customers, especially hyperscalers and major cloud providers, are increasingly designing their own custom chips. For instance, Amazon's AWS Graviton processors are a prime example of this trend. This capability allows them to reduce their dependence on external chip manufacturers like AMD.

This backward integration significantly enhances their bargaining power with suppliers. It means they can negotiate more favorable terms or even develop alternatives, potentially limiting AMD's market opportunities.

Product Standardization and Differentiation

While AMD actively pursues product differentiation through cutting-edge performance and innovation, the inherent nature of certain computing components means a degree of standardization exists. This allows customers, particularly in bulk purchasing scenarios, to readily compare specifications and pricing across different suppliers, potentially increasing their bargaining power.

For instance, in the server CPU market, while AMD's EPYC processors offer distinct advantages, the fundamental function of a central processing unit remains comparable across vendors. This comparability can empower large enterprise clients to negotiate more favorable terms if they perceive minimal functional differences or readily available alternatives.

AMD's strategy to counter this involves emphasizing its unique architectural advantages, such as chiplet design and integrated security features, which are harder for competitors to replicate. Building a robust ecosystem of software and hardware partners further strengthens customer loyalty and reduces the ease of switching, thereby mitigating customer bargaining power.

- Product Standardization: Certain AMD components, like basic server CPUs, can be compared on standardized metrics, potentially increasing customer leverage.

- Differentiation Efforts: AMD counters by highlighting unique features in its EPYC and Ryzen processors, such as advanced architecture and integrated security.

- Ecosystem Strength: A strong partner network and software support contribute to customer retention, reducing the ease of switching and thus customer bargaining power.

- Market Dynamics: In 2024, the intense competition in the CPU market, especially from Intel, means customers have viable alternatives, reinforcing the need for AMD's differentiation.

Access to Market Information and Transparency

Customers in the semiconductor industry, including Advanced Micro Devices (AMD), benefit from a high degree of market information and transparency. This allows them to readily compare product specifications, pricing, and the overall capabilities of various suppliers.

This easy access to data empowers buyers, enabling them to negotiate more effectively with AMD and other chip manufacturers. Consequently, it places considerable pressure on AMD's pricing strategies and profit margins.

- Informed Decision-Making: Buyers can easily research and compare AMD's offerings against competitors, understanding performance metrics and cost structures.

- Price Sensitivity: Increased transparency often leads to greater price sensitivity among customers, pushing for competitive pricing.

- Negotiating Leverage: Armed with market data, customers can leverage this knowledge to demand better terms and pricing from AMD.

The bargaining power of customers for Advanced Micro Devices (AMD) is significant, driven by factors like large purchase volumes, price sensitivity, and the availability of substitutes. In 2024, the competitive landscape, particularly with rivals like Intel, intensifies this pressure, forcing AMD to offer competitive pricing and features to retain its customer base.

Major buyers, including large OEMs and data center operators, can leverage their substantial order sizes to negotiate favorable terms and pricing, directly impacting AMD's revenue per unit. This power is further amplified as some customers, like major cloud providers, explore in-house chip design, reducing their reliance on external suppliers.

The availability of alternatives, such as Intel CPUs and increasingly Arm-based processors, empowers customers to switch suppliers if AMD's offerings are perceived as less valuable. This necessitates continuous innovation and competitive pricing from AMD to maintain market share.

| Customer Segment | Bargaining Power Drivers | Impact on AMD | 2024 Market Context |

|---|---|---|---|

| Large OEMs (e.g., PC Manufacturers) | High volume purchases, price sensitivity | Negotiate bulk discounts, impacting revenue per unit | Intense competition from Intel and others |

| Data Center Operators (Hyperscalers) | Massive scale, custom chip development capabilities | Demand tailored solutions and competitive pricing; potential for backward integration | Growing demand for specialized server CPUs |

| Distributors | Inventory management, market reach | Influence on product availability and pricing in specific channels | Varies with overall market demand for AMD products |

Full Version Awaits

Advanced Micro Devices Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Advanced Micro Devices, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitute products for AMD. Rest assured, what you are previewing is the complete, ready-to-use analysis file, providing actionable insights without any surprises.

Rivalry Among Competitors

The semiconductor industry is a battleground, with Advanced Micro Devices (AMD) facing formidable rivals. Intel, a long-standing titan, continues to dominate the central processing unit (CPU) market, though AMD has made significant inroads in recent years with competitive offerings.

Nvidia, on the other hand, has established a commanding presence in the high-performance graphics processing unit (GPU) and artificial intelligence (AI) accelerator sectors. In 2024, Nvidia's market capitalization often surpassed that of Intel, underscoring its strength in these growth areas, which directly impacts AMD's competitive landscape in data center and gaming markets.

The semiconductor industry is experiencing robust growth, especially within the artificial intelligence sector. AMD has successfully carved out a larger share of the server and PC markets, demonstrating significant progress. However, this growth comes with intense competition, making it vital for AMD to sustain its market position against formidable rivals.

Competitive rivalry in the semiconductor industry, particularly for Advanced Micro Devices (AMD), is intensely fueled by a relentless pace of product differentiation and innovation. Companies are constantly striving to launch newer, more powerful, and energy-efficient processors and graphics cards to capture market share.

AMD's performance is directly tied to its capacity to consistently offer compelling CPUs and GPUs that can challenge established leaders. This is especially critical in burgeoning sectors like artificial intelligence (AI), where Nvidia currently holds a significant technological and market advantage, having secured a substantial portion of the AI chip market in 2024.

High Fixed Costs and Exit Barriers

The semiconductor industry, where Advanced Micro Devices (AMD) operates, is characterized by exceptionally high fixed costs. These stem from substantial investments in research and development (R&D) and the immense capital required for state-of-the-art manufacturing facilities, often referred to as fabs. For instance, building a new leading-edge semiconductor fabrication plant can cost tens of billions of dollars, with estimates for facilities capable of producing 3nm chips exceeding $20 billion as of 2024.

These substantial fixed costs, coupled with specialized, non-transferable assets, create significant exit barriers. Companies are essentially locked into the industry because divesting these highly specialized assets at a reasonable price is extremely difficult. This forces players to continue operating and competing fiercely, even when market demand softens or profitability is challenged, to spread their high fixed costs over a larger production volume.

- Massive R&D Investment: Semiconductor companies like AMD invest billions annually in R&D to stay competitive, with AMD's R&D expenses reaching approximately $4.5 billion in 2023.

- Capital-Intensive Manufacturing: Building and maintaining advanced semiconductor fabrication plants requires enormous capital outlays, often in the tens of billions of dollars.

- High Exit Barriers: Specialized nature of assets and sunk costs make exiting the industry very costly, compelling companies to remain and compete.

- Aggressive Competition: The need to achieve economies of scale to offset high fixed costs fuels intense rivalry among established players.

Strategic Alliances and Ecosystem Development

Competitive rivalry at AMD extends beyond just product performance; it's increasingly fought through strategic alliances and the creation of robust ecosystems. Companies are actively forming partnerships to influence market direction and secure customer loyalty.

The growing prominence of Arm-based architectures, for instance, presents a significant challenge, prompting established players to collaborate. A notable example is the formation of the x86 Ecosystem Advisory Group, which includes both Intel and AMD, demonstrating a united front to shape future industry standards and maintain customer choice within the x86 ecosystem.

- Ecosystem Dominance: Competitors are not only battling on product features but also through strategic alliances and ecosystem development.

- Shaping Standards: The rise of Arm-based solutions and collaborations among other players, like the x86 Ecosystem Advisory Group (Intel and AMD), intensify the rivalry by shaping future market standards.

- Customer Influence: These strategic moves directly impact customer choices and long-term market positioning, making ecosystem strength a critical competitive factor.

The competitive rivalry for Advanced Micro Devices (AMD) is exceptionally fierce, driven by constant innovation and the need to capture market share against giants like Intel and Nvidia. AMD's success hinges on its ability to deliver superior performance and value in CPUs and GPUs, especially in high-growth areas like AI where Nvidia held a commanding lead in 2024.

The semiconductor industry's intense competition is further amplified by massive R&D investments, with AMD allocating billions annually, and the astronomical costs of advanced manufacturing facilities, often exceeding $20 billion for leading-edge fabs as of 2024. These high fixed costs and exit barriers compel companies to compete aggressively to achieve economies of scale.

Strategic alliances and ecosystem development are also key battlegrounds, as seen with AMD's participation in the x86 Ecosystem Advisory Group. This highlights how companies are not just competing on products but also on shaping industry standards and influencing customer choices.

| Competitor | Key Market Focus | 2024 Market Share/Positioning Note |

|---|---|---|

| Intel | CPUs (PC, Server) | Long-standing CPU market leader, facing increased competition from AMD. |

| Nvidia | GPUs, AI Accelerators | Dominant in AI and high-performance GPUs; market capitalization often surpassed Intel in 2024. |

| Qualcomm | Mobile Processors, Emerging PC Chips | Strong in mobile, expanding into PC market with Arm-based solutions. |

SSubstitutes Threaten

The most significant threat of substitutes for Advanced Micro Devices (AMD) stems from alternative processor architectures, with ARM-based chips being a prime example. Companies like Apple, with its M-series chips, and Qualcomm are increasingly successful in integrating ARM processors into personal computers and other devices. These ARM solutions often present compelling advantages in terms of power efficiency and performance-per-watt, directly challenging AMD's traditional x86 dominance.

The rise of cloud computing and the creation of custom silicon by major cloud providers like Amazon Web Services (AWS) with its Graviton processors pose a significant threat of substitution for Advanced Micro Devices (AMD). These specialized chips are engineered for specific cloud workloads, potentially diminishing the demand for AMD's more generalized CPU and GPU offerings. For instance, AWS reported that its Graviton processors offer up to 40% better price-performance for many cloud-native applications compared to comparable x86-based instances in 2023, directly impacting the market share for traditional server processors.

Emerging computing paradigms like quantum computing and neuromorphic computing, though still in their early stages, represent a long-term threat. These technologies could eventually offer entirely new approaches to solving complex problems, potentially displacing traditional semiconductor solutions. For instance, while widespread commercial quantum computing is still years away, significant investment continues, with global spending projected to reach billions by the late 2020s, indicating its potential disruptive power.

Software-based Solutions and Virtualization

Advancements in software, particularly virtualization and optimization techniques, can present a threat by reducing the reliance on high-performance hardware. This means that existing systems might be able to handle more demanding tasks, potentially delaying the need for new AMD processors or graphics cards.

For instance, the widespread adoption of cloud computing and sophisticated software-defined infrastructure allows businesses to consolidate workloads and utilize resources more efficiently. This trend, which has been accelerating, means that even if raw computing power demand grows, the actual unit sales of physical hardware might not keep pace.

Consider the impact on the gaming industry. While graphics cards are essential, advancements in game engine optimization and cloud gaming services could, in theory, allow games to run acceptably on less powerful hardware, or even stream directly to devices, lessening the direct tie to purchasing new AMD GPUs.

- Software Optimization: Improved algorithms and code efficiency can boost performance on existing hardware, reducing upgrade cycles.

- Virtualization: Technologies like VMware and Docker allow multiple operating systems and applications to run on a single piece of hardware, maximizing its utilization.

- Cloud Computing: Services like AWS, Azure, and Google Cloud offer scalable computing power, allowing users to access resources as needed without direct hardware investment.

- Subscription Models: Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) shift the burden of hardware management and upgrades to the provider.

Integrated Solutions vs. Discrete Components

The threat of substitutes for Advanced Micro Devices (AMD) is amplified by the rise of highly integrated solutions that can replace discrete components. For instance, System-on-Chips (SoCs) that bundle CPU, GPU, and other functionalities onto a single piece of silicon present a direct substitute for users who might otherwise purchase separate AMD CPUs and GPUs. This trend is particularly relevant in markets where space and power efficiency are paramount.

AMD itself is a player in this integrated solutions space with its Accelerated Processing Units (APUs), which combine CPU and GPU capabilities. However, the broader market movement towards application-specific, highly integrated designs can still pose a substitute threat to AMD's sales of individual, discrete components. For example, in the mobile device sector, custom SoCs designed for specific smartphone or tablet functionalities can reduce the demand for off-the-shelf AMD processors.

- Integrated SoCs: Offer a single-chip solution for multiple computing tasks, potentially replacing the need for separate AMD CPUs and GPUs in certain applications.

- Application-Specific Chips: Custom-designed integrated circuits for particular tasks, like AI acceleration or networking, can serve as substitutes for general-purpose AMD processors.

- AMD's APUs: While AMD offers integrated solutions, the overall market trend towards even more specialized integration can still impact discrete component sales.

The threat of substitutes for Advanced Micro Devices (AMD) is substantial, particularly from alternative processor architectures like ARM. These chips, championed by companies such as Apple and Qualcomm, are increasingly powering personal computers and other devices, offering superior power efficiency. For instance, Apple's M-series chips have significantly impacted the laptop market, demonstrating strong performance-per-watt metrics that challenge AMD's x86 dominance.

Cloud providers developing custom silicon, such as Amazon Web Services (AWS) with its Graviton processors, also represent a significant substitute. These specialized chips are optimized for cloud workloads, potentially reducing demand for AMD's general-purpose server CPUs. AWS reported that its Graviton processors offered up to 40% better price-performance for many cloud-native applications compared to comparable x86 instances in 2023, highlighting this competitive pressure.

The increasing sophistication of software, including advanced virtualization and optimization techniques, further contributes to the threat of substitutes. These advancements allow existing hardware to handle more demanding tasks, potentially delaying the need for new AMD processors or graphics cards. For example, efficient software can reduce the reliance on raw processing power, impacting upgrade cycles for both consumer and enterprise markets.

| Substitute Technology | Key Players/Examples | Impact on AMD | 2023/2024 Trend |

|---|---|---|---|

| ARM-based Processors | Apple (M-series), Qualcomm | Power efficiency, performance-per-watt | Continued growth in laptops and mobile devices |

| Custom Cloud Silicon | AWS (Graviton), Google (TPU) | Workload optimization, cost savings | Increasing adoption for specific cloud services |

| Software Optimization | Advanced algorithms, virtualization | Reduced hardware dependency, extended upgrade cycles | Ongoing improvements in efficiency |

Entrants Threaten

The semiconductor industry, where Advanced Micro Devices (AMD) operates, presents a formidable threat of new entrants due to exceptionally high capital investment requirements. Building and equipping state-of-the-art fabrication plants, or fabs, is an undertaking that demands billions of dollars. For instance, the cost of constructing a new advanced fab can easily range from $10 billion to $20 billion, a figure that acts as a significant deterrent for any aspiring competitor.

The semiconductor industry, particularly at the advanced level where AMD operates, presents a formidable barrier to entry due to its steep learning curve and inherent technological complexity. Developing and manufacturing cutting-edge processors requires highly specialized knowledge in fields like materials science, electrical engineering, and advanced physics, along with mastery of intricate fabrication processes. This deep technical expertise is not easily acquired, making it exceptionally challenging for new entrants to match the capabilities of established firms.

The sheer capital investment needed for research and development, as well as for state-of-the-art manufacturing facilities, further exacerbates this challenge. For instance, building a modern semiconductor fabrication plant, or fab, can cost tens of billions of dollars, a sum that most aspiring newcomers cannot readily secure. This high cost of entry, coupled with the need for continuous innovation to keep pace with technological advancements, effectively limits the threat of new entrants in the advanced microchip market.

Advanced Micro Devices, like other established players in the semiconductor industry, benefits from substantial intellectual property and a deep patent portfolio. This extensive collection of patents covers critical aspects of chip design, microarchitecture, and advanced manufacturing techniques, creating a formidable barrier for any potential new entrant. Developing competing technology would necessitate either significant innovation to circumvent existing patents or costly licensing agreements, making market entry exceptionally difficult and expensive.

Brand Loyalty and Established Customer Relationships

Advanced Micro Devices (AMD) benefits from significant brand loyalty and deeply entrenched customer relationships, making the threat of new entrants relatively low in this regard. For decades, AMD and its main rivals have invested heavily in building brand recognition and fostering strong ties with key players like original equipment manufacturers (OEMs), large data centers, and individual consumers. This established trust creates a substantial barrier for any new company attempting to enter the market.

New entrants would face a considerable challenge in gaining the confidence of these established customers and securing crucial design wins for their products. For instance, in the server market, which is a key growth area for AMD, long-term contracts and proven reliability are paramount. A new entrant would need to demonstrate not only competitive technology but also a robust supply chain and unwavering support to even be considered against incumbents with years of successful deployment history.

Consider the PC market, where brand preference plays a significant role. AMD's Ryzen processors have gained considerable traction, with many consumers and builders actively choosing AMD over competitors due to perceived performance advantages and value. This loyalty means a new entrant would need to offer a truly disruptive product or pricing strategy to sway these established preferences. In 2024, AMD continued to push its EPYC server processors and Ryzen desktop CPUs, solidifying its position with existing partners and attracting new ones through consistent performance gains.

- Brand Recognition: Decades of marketing and product development have built strong brand awareness for AMD.

- OEM Relationships: AMD has long-standing partnerships with major PC manufacturers and system builders.

- Data Center Trust: Established performance and reliability of AMD's EPYC processors foster trust with enterprise clients.

- Consumer Loyalty: Gamers and tech enthusiasts often exhibit strong brand preference for AMD's Ryzen and Radeon products.

Talent Shortages and Specialized Workforce

The semiconductor industry is grappling with a significant global shortage of highly skilled engineers, scientists, and technicians. This talent scarcity presents a substantial barrier for potential new entrants. For instance, in 2024, reports indicated a deficit of tens of thousands of specialized roles in areas like chip design and advanced manufacturing.

New companies would face immense difficulty in attracting and retaining the caliber of specialized talent essential for developing and producing advanced processors. This struggle to build a competent workforce directly impacts a new entrant's ability to compete on innovation and production capabilities.

The high demand for experienced professionals means that established players like AMD already have a significant advantage in securing top talent. This makes it even more challenging for newcomers to build the necessary expertise from the ground up.

- Global Engineer Shortage: The semiconductor sector faced an estimated deficit of over 200,000 skilled workers globally in 2024, according to industry analyses.

- High Recruitment Costs: Attracting top-tier talent in chip design and manufacturing can involve significant salary premiums and extensive relocation packages, adding substantial upfront costs for new entrants.

- R&D Expertise Gap: Developing next-generation processors requires deep expertise in areas like AI chip architecture and advanced lithography, skills that are scarce and highly sought after.

The high capital expenditure required for semiconductor manufacturing, coupled with the intense need for specialized talent and intellectual property, significantly limits the threat of new entrants for Advanced Micro Devices (AMD). For instance, building a modern semiconductor fab can cost upwards of $20 billion, a sum that presents a substantial hurdle. Furthermore, the industry's reliance on highly skilled engineers, a group experiencing a global shortage, makes it difficult for newcomers to assemble the necessary expertise. AMD's established brand loyalty and deep customer relationships, particularly in the PC and server markets, further cement its position against potential new competitors.

| Factor | Barrier Strength | Impact on AMD |

| Capital Requirements | Very High | Deters new entrants due to multi-billion dollar fab costs. |

| Technological Complexity & Expertise | Very High | Requires deep knowledge in specialized fields, difficult for newcomers to match. |

| Intellectual Property & Patents | High | Existing patent portfolio creates a formidable obstacle for competing technologies. |

| Brand Loyalty & Customer Relationships | High | Established trust with OEMs and data centers makes market penetration difficult for new players. |

| Skilled Labor Shortage | High | Difficulty for new entrants to attract and retain essential engineering talent. |

Porter's Five Forces Analysis Data Sources

Our Advanced Micro Devices Porter's Five Forces analysis is built upon a foundation of comprehensive data, including AMD's official SEC filings, investor relations reports, and earnings call transcripts. We supplement this with insights from leading technology industry research firms and market intelligence platforms.