Altria Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

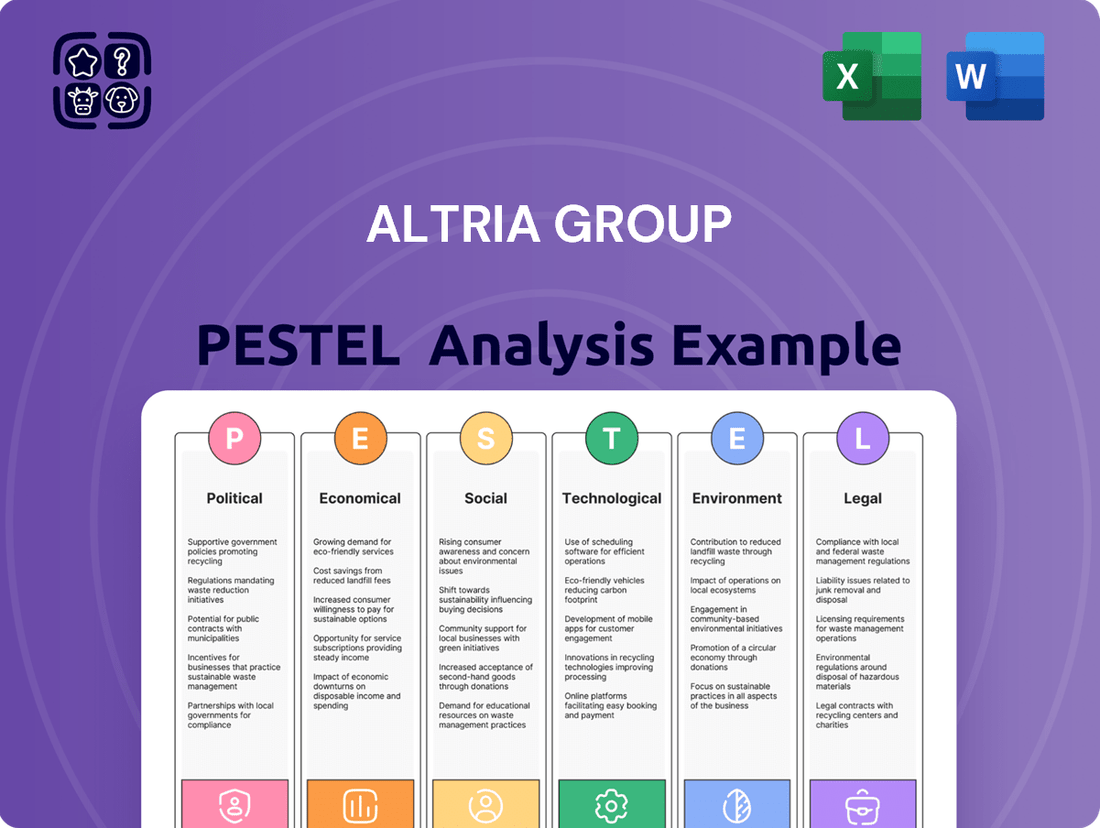

Navigating the complex landscape for Altria Group requires a deep dive into external forces. Our PESTLE analysis unpacks the political, economic, social, technological, legal, and environmental factors that are critically shaping its future. Understand the regulatory headwinds and evolving consumer preferences that demand strategic adaptation. Download the full version now to gain a comprehensive understanding and sharpen your competitive edge.

Political factors

Altria operates within a heavily regulated landscape, subject to continuous and rigorous federal, state, and local rules governing tobacco products. The Food and Drug Administration's (FDA) Center for Tobacco Products significantly influences Altria's strategic decisions, imposing limitations on advertising and product specifications.

Recent regulatory measures, such as the finalized rules increasing the minimum age for tobacco purchases to 21 and mandating photo identification checks for those under 30, directly impact Altria's market access and sales strategies. These evolving regulations are a critical factor for Altria to navigate in 2024 and beyond.

Federal and state tobacco excise taxes directly influence Altria's profitability, with significant increases observed over the last two decades, consistently exceeding inflation rates. For instance, the federal excise tax on cigarettes has remained at $1.01 per pack since 2009, but numerous states have implemented their own, often substantial, increases.

The evolving tax landscape now extends to alternative nicotine products. Many states and local jurisdictions are introducing or increasing excise taxes on e-vapor products and oral nicotine pouches, with tax structures that can differ based on product type and volume, creating a complex compliance environment for Altria.

Political discourse surrounding tobacco control is largely bifurcated between harm reduction and prohibition. Altria actively champions a harm reduction strategy, focusing on policies that steer adult smokers toward FDA-authorized, reduced-risk smoke-free alternatives instead of outright product or flavor bans.

This political positioning directly shapes Altria's product innovation and its lobbying initiatives. For example, Altria's significant investment in heated tobacco products and e-cigarettes reflects this commitment to offering alternatives to traditional combustible cigarettes, aligning with their advocacy for a harm reduction framework.

Potential Federal Cannabis Legalization

Altria's strategic investments, such as its substantial stake in Cronos Group, underscore its preparedness for potential federal cannabis legalization in the United States. This positioning allows Altria to capitalize on new market opportunities should federal regulations shift. As of early 2024, the U.S. cannabis market was projected to reach approximately $33 billion, with significant growth anticipated as more states legalize.

The company is closely observing evolving federal policies, recognizing that changes in cannabis legality could unlock considerable expansion and investment avenues. For instance, the SAFE Banking Act, if passed, would ease financial restrictions for cannabis businesses, a development Altria is undoubtedly monitoring.

- Altria's investment in Cronos Group: A key indicator of its interest in the cannabis sector.

- U.S. cannabis market growth: Projected to continue expanding significantly, driven by state-level legalization.

- Federal regulatory monitoring: Altria's active watch on potential policy changes impacting the industry.

Illicit Market Enforcement

The increasing prevalence of illicit markets, especially for disposable e-vapor products, presents a substantial hurdle for Altria and the broader regulated tobacco sector. Despite some enforcement efforts by regulatory bodies, their effectiveness in significantly curtailing the spread of these unauthorized products has been minimal.

This ongoing challenge directly impedes Altria's progress toward its objectives for smoke-free volume and revenue generation. For instance, the U.S. Food and Drug Administration (FDA) has issued warning letters and taken other actions, but the sheer volume of illicit products entering the market continues to be a concern. Estimates suggest that a significant percentage of the e-vapor market may operate outside of regulatory approval, impacting the market share of compliant manufacturers like Altria.

- Illicit Market Growth: The disposable e-vapor segment, in particular, has seen a surge in products that have not received FDA marketing authorization.

- Limited Enforcement Impact: Regulatory actions, while present, have not demonstrably reduced the availability of these unauthorized products.

- Revenue and Volume Goals: The unchecked growth of illicit markets directly siphons potential sales and revenue from Altria's regulated product portfolio.

- Competitive Disadvantage: Illicit products often bypass taxes and compliance costs, creating an uneven playing field for legitimate businesses.

Political factors significantly shape Altria's operational environment, with ongoing debates around tobacco harm reduction and prohibition influencing regulatory approaches. The company actively advocates for policies that encourage adult smokers to transition to reduced-risk smoke-free alternatives, a strategy reflected in its significant investments in products like heated tobacco and e-cigarettes.

The potential for federal cannabis legalization in the U.S. is a key political consideration for Altria, as evidenced by its substantial investment in Cronos Group, positioning it to capitalize on market shifts. As of early 2024, the U.S. cannabis market was valued at approximately $33 billion, with projections indicating continued robust growth driven by evolving state and federal policies.

The prevalence of illicit markets, particularly for disposable e-vapor products, presents a persistent challenge, with regulatory enforcement having a limited impact on curbing their spread. This situation directly hinders Altria's ability to achieve its smoke-free volume and revenue targets, creating a competitive disadvantage against unregulated products.

What is included in the product

This Altria Group PESTLE analysis dissects the impact of political, economic, social, technological, environmental, and legal forces on the company's operations and strategic outlook.

It provides a comprehensive understanding of the external landscape, highlighting key trends and potential challenges that shape Altria's business environment.

This PESTLE analysis for Altria Group offers a clear, summarized version of complex external factors, simplifying strategic discussions and reducing the burden of sifting through raw data.

It provides a concise, easily shareable format ideal for quick alignment across teams, ensuring everyone understands the political, economic, social, technological, environmental, and legal landscape impacting Altria.

Economic factors

Altria's primary revenue driver, traditional cigarettes, is experiencing a sustained decline in U.S. shipment volumes. This trend is largely due to fewer people smoking, increased sensitivity to cigarette prices, and a growing interest in alternative nicotine products.

Despite these headwinds, Altria's flagship brand, Marlboro, continues to hold its dominant market position and pricing strength. This allows the company to partially mitigate the impact of falling sales volumes.

For instance, in the first quarter of 2024, Altria reported a 6.1% decrease in total cigarette shipment volumes compared to the same period in 2023, yet its pricing actions helped to offset some of this volume loss.

Macroeconomic conditions, particularly inflation, directly impact the discretionary income of adult tobacco consumers. When inflation rises, consumers have less money available for non-essential purchases, which can lead them to seek out more affordable options.

This shift in consumer behavior often means a move towards lower-priced or discount brands, directly affecting Altria's shipment volumes and overall revenue. For instance, in the first quarter of 2024, Altria reported a slight increase in net revenue despite a decrease in cigarette shipment volumes, highlighting the impact of pricing strategies.

Altria's strategy of raising prices on its premium brands, such as Marlboro, helps to offset some of the negative impacts of reduced consumer spending power. This pricing power allows them to maintain revenue even when unit sales decline, though it also risks alienating price-sensitive consumers.

Altria's economic performance is increasingly shaped by its diverse holdings, encompassing oral tobacco, cigars, heated tobacco, cannabis via Cronos Group, and wine through Ste. Michelle Wine Estates. This diversification is crucial for navigating evolving consumer preferences and regulatory landscapes.

The on! nicotine pouch brand has been a standout performer, driving substantial growth within Altria's oral tobacco segment. In the first quarter of 2024, Altria reported that on! achieved an impressive 28.7% volume growth, signaling its increasing market penetration and consumer adoption, which helps to cushion declines in traditional smokeable products.

While the smokeable products segment, historically Altria's core business, continues to face volume declines, the growth in oral tobacco and other diversified investments is vital for overall financial stability. For instance, Altria's net revenue from smokeable products declined by 5.1% in Q1 2024, highlighting the ongoing need for these newer revenue streams to offset this trend.

Dividend Performance and Shareholder Returns

Altria Group has a strong track record of returning capital to shareholders, primarily through dividends. The company's progressive dividend policy aims for mid-single digit annual growth in its dividend per share. This commitment is supported by its robust financial health, consistent profitability, and substantial cash flow generation.

For example, as of its latest reported figures, Altria's dividend yield has remained attractive, often exceeding industry averages. This focus on shareholder returns makes Altria a compelling option for investors prioritizing income. The company's ability to sustain and grow these payouts is a key element of its investment appeal.

- Dividend Growth: Altria targets mid-single digit annual growth in its dividend per share.

- Shareholder Returns: The company consistently generates significant cash flow, enabling substantial returns to shareholders.

- Financial Health: Robust profitability and strong cash flow generation underpin its dividend policy.

- Investor Appeal: Altria is attractive to income-focused investors due to its consistent dividend performance.

Operational Efficiency and Cost Savings

Altria is making significant strides in operational efficiency and cost savings through its 'Optimize & Accelerate' program. This strategic initiative is designed to streamline operations and reduce expenditures across the organization. These efforts are crucial for maintaining Altria's competitive edge in a dynamic market.

The cost savings generated from these efficiency drives are not merely retained but strategically reinvested. A primary focus for this reinvestment is the development and promotion of Altria's smoke-free product portfolio. This allocation supports the company's long-term transition strategy.

- 'Optimize & Accelerate' Program: Altria's ongoing commitment to operational improvements.

- Reinvestment in Growth: Funds directed towards smoke-free product development.

- Margin Enhancement: Efficiency gains contribute to strong operating margins.

- Financial Resilience: Cost savings bolster overall financial health and flexibility.

Economic factors significantly influence Altria's performance, with inflation impacting consumer spending on discretionary items like tobacco. Despite declining cigarette volumes, Altria's pricing power, particularly with Marlboro, helps offset revenue loss, as seen in Q1 2024 where net revenue rose slightly despite a volume dip. The company's diversification into oral tobacco, with brands like on! showing strong growth (28.7% volume increase in Q1 2024), is crucial for navigating these economic shifts and maintaining financial stability.

| Metric | Q1 2024 | Year-over-Year Change |

|---|---|---|

| Total Cigarette Shipment Volumes | Declined 6.1% | N/A |

| on! Nicotine Pouch Volume Growth | 28.7% | N/A |

| Smokeable Products Net Revenue | Declined 5.1% | N/A |

Preview Before You Purchase

Altria Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Altria Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future strategies.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping the tobacco and alternative products industry, providing valuable insights for strategic decision-making.

Sociological factors

Public awareness regarding the health risks of tobacco use continues to grow, significantly impacting traditional cigarette sales. This societal shift towards healthier lifestyles directly shrinks Altria's core customer base for combustible products.

In response, Altria is strategically prioritizing the transition of adult smokers to products it deems to be reduced in harm. For instance, by the end of 2024, the company aims to achieve a 50% reduction in combustible cigarette volume compared to 2022, signaling a clear pivot in its product portfolio.

Millions of adult nicotine consumers are actively seeking smoke-free options, driven by evolving lifestyles and increased health consciousness. This trend is a significant societal shift influencing the tobacco industry.

Altria's strategic pivot towards smoke-free products like e-vapor, oral nicotine pouches, and heated tobacco is a direct response to this growing demand. For instance, the oral nicotine pouch category saw substantial growth, with Altria's on! brand achieving a retail market share of approximately 12.5% by the end of 2023, demonstrating the market's receptiveness to these alternatives.

This demand represents a transformative business opportunity, pushing companies like Altria to invest heavily in research, development, and marketing of these innovative products to capture a larger share of this expanding market segment.

Societal concerns regarding underage tobacco use remain a significant driver for Altria Group. In 2024, the company continued to highlight its responsible marketing practices and adherence to strict age verification protocols, a critical element in preventing youth access.

Governmental efforts, including stricter enforcement of sales regulations and public awareness campaigns, directly influence Altria's operational strategies. For instance, the U.S. Food and Drug Administration (FDA) continues its focus on preventing tobacco product sales to individuals under 21, a policy Altria publicly supports through its compliance measures.

Changing Social Norms Around Smoking

Social attitudes toward smoking have dramatically shifted, with more public spaces implementing smoking bans and a general decline in the social acceptability of traditional cigarettes. This evolution directly impacts consumer choices, pushing demand towards less conspicuous and smoke-free nicotine products.

For Altria, this means a continued need to adapt its product portfolio. For instance, while traditional cigarette volumes declined, Altria reported a 1.4% increase in its smoke-free product shipment volume in the first quarter of 2024, signaling a tangible market response to these changing norms.

- Declining Traditional Cigarette Consumption: Public health campaigns and increased awareness of smoking's risks continue to reduce the appeal of traditional cigarettes.

- Rise of Smoke-Free Alternatives: Growing consumer interest in products like heated tobacco and oral nicotine pouches is a direct consequence of evolving social acceptance.

- Regulatory Impact: Restrictions on public smoking and marketing of traditional products further accelerate the shift towards alternatives.

- Brand Adaptation: Companies like Altria are investing heavily in developing and promoting smoke-free options to align with societal trends and maintain market relevance.

Influence of Public Health Campaigns

Public health campaigns and anti-smoking advocacy groups significantly influence how people view tobacco and, consequently, how much they smoke. These efforts often focus on the health risks associated with smoking, which can lead to lower cigarette sales. For instance, the U.S. Department of Health and Human Services' "Tips From Former Smokers" campaign has been shown to encourage quit attempts.

This evolving public perception directly impacts companies like Altria Group. As cigarette volumes decline due to these campaigns, Altria is compelled to adapt its strategy. This involves a greater focus on harm reduction and developing alternative products that may pose fewer risks than traditional cigarettes.

- Public Health Impact: Campaigns by organizations like the Campaign for Tobacco-Free Kids aim to reduce youth smoking rates, which directly affects the future customer base for traditional tobacco products.

- Shifting Consumer Behavior: Increased awareness of smoking-related illnesses, often amplified by public health initiatives, contributes to a gradual decrease in per capita cigarette consumption in many developed markets.

- Regulatory Pressure: Public health advocacy often translates into stricter regulations, such as higher taxes and marketing restrictions, further pressuring tobacco companies to diversify their product portfolios.

- Altria's Response: Altria's investment in reduced-risk products, like heated tobacco and oral nicotine pouches, reflects a strategic pivot driven by these societal and public health trends.

Societal shifts toward health and wellness continue to reshape the tobacco landscape, directly impacting Altria's traditional cigarette business. Millions of adult smokers are actively seeking smoke-free alternatives, a trend Altria is responding to with significant investment in reduced-harm products. For instance, the oral nicotine pouch category, where Altria's on! brand competes, saw substantial growth, with the brand achieving approximately 12.5% retail market share by the end of 2023.

Public health campaigns and increased awareness of smoking-related risks are driving down traditional cigarette consumption. This societal pressure, coupled with stricter regulations and a decline in the social acceptability of smoking, compels companies like Altria to adapt. Altria reported a 1.4% increase in its smoke-free product shipment volume in the first quarter of 2024, indicating a tangible market response to these evolving norms.

Concerns regarding underage tobacco use remain a critical societal factor, prompting companies like Altria to emphasize responsible marketing and strict age verification protocols. The U.S. Food and Drug Administration's ongoing focus on preventing tobacco sales to individuals under 21, a policy Altria publicly supports through its compliance measures, further underscores this societal concern.

The demand for smoke-free options presents a significant business opportunity, driving Altria's strategic pivot. By the end of 2024, the company aimed for a 50% reduction in combustible cigarette volume compared to 2022, signaling a clear commitment to transitioning adult smokers to products it deems to be reduced in harm.

| Sociological Factor | Description | Altria's Response/Impact | Supporting Data (2023/2024) |

| Health Consciousness | Growing public awareness of smoking's health risks. | Drives demand for smoke-free alternatives. | on! oral nicotine pouch market share ~12.5% (end of 2023). |

| Social Acceptance of Smoking | Declining social acceptability of traditional cigarettes; increased smoking bans. | Accelerates shift to less conspicuous products. | 1.4% increase in smoke-free product shipment volume (Q1 2024). |

| Youth Prevention | Societal concern over underage tobacco use. | Emphasis on responsible marketing and age verification. | Continued adherence to FDA's under-21 sales regulations. |

| Harm Reduction Trend | Consumer interest in products perceived as less harmful. | Strategic investment in heated tobacco and oral nicotine pouches. | Aim for 50% reduction in combustible cigarette volume by end of 2024 (vs. 2022). |

Technological factors

Altria is significantly channeling resources into research, development, and regulatory advocacy for novel smoke-free product categories. This includes advancements in e-vapor technology, the burgeoning market for oral nicotine pouches such as on!, and the development of heated tobacco products.

Technological breakthroughs are paramount in crafting attractive and potentially less harmful alternatives to conventional cigarettes. This strategic focus aims to align with shifting consumer demands for reduced-risk options.

In 2023, Altria reported that its oral nicotine pouch brand on! achieved a 12.4% retail share in the U.S. category, underscoring the market's rapid growth and the importance of innovation in this segment.

Technological advancements are rapidly reshaping the nicotine landscape, offering adult consumers alternatives to traditional combustible cigarettes. Innovations in e-cigarette technology, such as improved battery life and more consistent vapor production, continue to emerge. For instance, the market for oral nicotine pouches, a category experiencing significant growth, saw sales in the billions globally in 2024, driven by discreet and smoke-free options.

Heated tobacco systems, designed to reduce exposure to harmful combustion byproducts, are also gaining traction. These sophisticated devices are being refined to offer a more satisfying user experience and a wider range of flavor profiles. Altria's own investment in heated tobacco products reflects this trend, with the company aiming to capture a significant share of this evolving market segment.

The increasing consumer preference for online purchasing is a significant technological factor influencing Altria. This trend is particularly evident in the smokeless product category, where digital channels are becoming a primary avenue for discovery and acquisition. Altria's ability to effectively leverage digital marketing and robust e-commerce platforms is therefore crucial for capturing market share.

As of early 2025, e-commerce sales in the consumer goods sector continue their upward trajectory, with projections indicating sustained double-digit growth throughout the year. Altria's investment in optimizing its online presence and digital marketing strategies directly addresses this shift, aiming to connect with consumers actively seeking smokeless alternatives through digital touchpoints.

Data Analytics for Consumer Insights

Altria leverages advanced data analytics to gain deeper insights into adult tobacco consumer behavior, a critical technological factor. By analyzing purchasing patterns and the uptake of smoke-free alternatives, the company can refine its product development and marketing efforts. This data-driven approach helps Altria better understand evolving consumer preferences and market trends.

The company's technological capabilities allow for more precise risk mitigation and resource conservation. For instance, detailed consumer data can inform more efficient supply chain management and targeted product distribution. This focus on technology is essential for navigating the complex regulatory and consumer landscape in the tobacco industry.

- Enhanced Consumer Understanding: Data analytics allows Altria to segment consumers and understand their purchasing habits and preferences for both traditional and smoke-free products.

- Informed Product Development: Insights from data analysis guide the innovation and refinement of new products, particularly in the rapidly growing smoke-free category.

- Optimized Marketing Strategies: By understanding consumer dynamics, Altria can tailor its marketing campaigns for greater effectiveness and efficiency.

- Risk Mitigation and Resource Management: Technology-driven insights contribute to better risk assessment and more sustainable operational practices.

Challenges with Illicit E-vapor Technologies

The surge of illicit disposable e-vapor products, often built on unregulated technologies, poses a significant technological hurdle. These products, easily accessible, directly challenge the market share of Altria's regulated NJOY brand, hindering its competitive standing in the e-vapor sector.

This technological disparity allows illicit operators to bypass stringent quality control and safety standards inherent in regulated products. For instance, the U.S. Food and Drug Administration (FDA) has been actively working to curb the sale of unauthorized e-vapor products, with reports indicating a substantial number of these illicit devices entering the market throughout 2024 and into early 2025.

- Unregulated Technology: Illicit products frequently utilize components and manufacturing processes that do not adhere to established safety and performance benchmarks, unlike NJOY's compliant devices.

- Market Disruption: The widespread availability of these cheaper, unregulated alternatives directly siphons consumers away from legitimate, tax-paying e-vapor brands, impacting revenue streams for companies like Altria.

- Enforcement Challenges: Tracking and seizing these illicit devices is a continuous technological and logistical challenge for regulatory bodies, allowing their proliferation to persist.

Technological advancements are central to Altria's strategy, particularly in developing smoke-free alternatives like oral nicotine pouches and heated tobacco. The company's investment in brands like on! highlights this focus, with on! capturing a significant 12.4% retail share in the U.S. oral nicotine pouch market in 2023, demonstrating rapid consumer adoption of these innovative products.

Altria is also leveraging advanced data analytics to understand adult consumer behavior, enabling more targeted product development and marketing. This data-driven approach is crucial for navigating evolving preferences and the increasing shift towards digital channels for product discovery and purchase, with e-commerce sales in consumer goods projected for sustained double-digit growth through 2025.

However, Altria faces challenges from unregulated, illicit disposable e-vapor products. These products, often utilizing uncertified technologies, bypass safety standards and directly compete with Altria's regulated NJOY brand, impacting market share. Regulatory bodies are actively working to curb the proliferation of these unauthorized devices, a persistent issue throughout 2024 and into early 2025.

Legal factors

Altria operates under stringent FDA regulations, encompassing product standards and marketing limitations, and must secure premarket tobacco product applications (PMTAs) for novel offerings. This regulatory framework significantly impacts product development and market entry strategies.

Securing and maintaining FDA marketing granted orders for Altria's smoke-free portfolio, including brands like NJOY and on!, is paramount for their continued market presence and competitive edge. For instance, the PMTA process involves rigorous scientific review, and delays or rejections can substantially alter a product's commercial trajectory.

Altria, like other major tobacco companies, navigates a landscape fraught with persistent litigation. These legal challenges primarily revolve around product liability claims, often stemming from alleged health impacts of traditional tobacco products. Governmental investigations also represent a significant legal hurdle, scrutinizing marketing practices and product development.

The financial ramifications of these legal battles can be substantial. Beyond direct settlements and judgments, Altria has faced costs associated with regulatory compliance and potential importation bans for certain products. For instance, recent legal proceedings have involved patent infringement disputes concerning Altria's NJOY e-cigarette products, highlighting the evolving legal risks in the next-generation product space.

Federal and state tobacco excise tax rates significantly impact Altria's pricing and bottom line. For example, in 2024, the federal excise tax on cigarettes remains $1.01 per pack, a rate that has been in place for years but is constantly under review by lawmakers. Many states also levy substantial excise taxes, with rates varying widely; for instance, New York's state excise tax on cigarettes is $4.35 per pack, contributing to a high overall tax burden.

Altria closely tracks legislative proposals that could alter these tax structures. The company has historically supported shifts from ad valorem (percentage-based) taxes to specific (per-unit) taxes for certain products, like moist smokeless tobacco. This advocacy aims to create a more predictable and potentially fairer tax environment, especially when product prices fluctuate.

Cannabis Legalization and Regulation

Altria's significant investment in Cronos Group, a Canadian licensed producer, places it directly within the dynamic and often complex legal framework surrounding cannabis. This exposure means Altria must closely track legislative changes, both domestically and internationally, that could impact its operations and the valuation of its cannabis holdings.

The ongoing discussions and potential for federal cannabis legalization in the United States present a critical juncture for Altria. A clear, federally regulated market would unlock substantial opportunities, but also require careful navigation of compliance and operational standards. Altria is actively monitoring these developments to strategically position itself for future growth in this sector.

- US Federal Legalization: The U.S. federal government is considering various approaches to cannabis reform, with potential implications for interstate commerce and taxation.

- State-Level Regulations: Individual U.S. states continue to implement diverse regulations for medical and adult-use cannabis, creating a patchwork of legal environments.

- International Markets: Countries like Canada have established mature regulatory frameworks, offering insights into market structures and compliance requirements that Altria observes.

- Cronos Group Performance: As of Q1 2024, Cronos Group reported net revenue of CAD 27.0 million, reflecting ongoing market penetration and product development within its operating jurisdictions.

Advertising and Marketing Restrictions

Altria Group faces significant legal hurdles in advertising and marketing its tobacco and nicotine products. These restrictions, largely a consequence of past litigation and evolving Food and Drug Administration (FDA) regulations, profoundly shape how the company can engage with consumers, especially concerning traditional cigarettes. For instance, the Master Settlement Agreement (MSA) of 1998 continues to influence marketing practices, limiting brand advertising, sponsorships, and product placement.

The FDA's authority over tobacco products, particularly under the Family Smoking Prevention and Tobacco Control Act of 2009, imposes further constraints. This includes regulations on packaging, labeling, and the types of claims manufacturers can make. While Altria is actively promoting its reduced-risk products, advertising for these also falls under FDA scrutiny, requiring careful adherence to guidelines to avoid misrepresentation.

Key advertising and marketing restrictions impacting Altria include:

- Prohibitions on brand-name sponsorships of events, teams, and activities.

- Restrictions on advertising featuring cartoon characters or targeting minors.

- Mandatory health warnings on packaging and advertisements.

- Limitations on direct-to-consumer advertising for certain product categories.

Altria's legal landscape is dominated by FDA regulations, requiring premarket tobacco product applications (PMTAs) for new offerings like NJOY and on!, with successful approval critical for market access. The company also navigates extensive litigation, primarily product liability claims related to traditional tobacco, alongside governmental investigations into marketing practices, leading to substantial financial implications from settlements and compliance costs.

Excise taxes, both federal and state, significantly affect Altria's pricing and profitability; for instance, the federal cigarette excise tax remains $1.01 per pack as of 2024, while states like New York impose much higher rates, such as $4.35 per pack. Furthermore, Altria's investment in Cronos Group exposes it to the evolving legal framework of cannabis, necessitating close monitoring of legislative changes for potential impacts on its holdings and future growth opportunities in this sector.

| Legal Factor | Description | Impact on Altria | 2024/2025 Data/Trend |

|---|---|---|---|

| FDA Regulations | Premarket Tobacco Product Applications (PMTAs), marketing orders for smoke-free products. | Crucial for market entry and continued sales of next-generation products. | Ongoing scrutiny of PMTA submissions for products like NJOY and on! |

| Litigation & Investigations | Product liability claims, governmental investigations into marketing. | Significant financial exposure through settlements, judgments, and compliance costs. | Persistent legal challenges and potential for new investigations. |

| Excise Taxes | Federal and state taxes on tobacco and nicotine products. | Directly impacts pricing, sales volume, and profitability. | Federal rate at $1.01/pack; state rates vary widely (e.g., NY at $4.35/pack). |

| Cannabis Legalization | Regulation of cannabis markets, impacting Altria's Cronos Group investment. | Creates opportunities and compliance challenges in a developing legal space. | Monitoring of US federal and state-level cannabis reforms. |

Environmental factors

Altria Group acknowledges the significant impacts and risks posed by climate change, integrating science-based practices to manage these challenges. This commitment involves a thorough understanding of how climate shifts affect their operations and the entire supply chain, from agricultural inputs to consumer distribution.

The company is actively setting targets for greenhouse gas (GHG) emissions reduction. For instance, in their 2023 sustainability report, Altria noted progress towards their 2030 GHG reduction goals, aiming for a substantial decrease in Scope 1 and Scope 2 emissions. This proactive approach aims to mitigate environmental footprint and ensure long-term business resilience.

Altria Group is committed to conserving natural resources crucial for its operations and the communities it serves. This commitment translates into integrating environmentally sustainable practices across its value chain, from the cultivation of tobacco to manufacturing and distribution.

In 2023, Altria continued to focus on responsible sourcing and efficient resource utilization. For instance, efforts in water stewardship aimed to reduce consumption in manufacturing facilities, a key area given the agricultural needs of tobacco farming. The company reported progress in its 2023 sustainability initiatives, highlighting a reduction in water withdrawal intensity by 1.5% compared to the previous year across its major manufacturing sites.

Altria Group is actively working to lessen the environmental impact of its products and packaging. This involves a strong focus on waste management and enhancing recycling efforts across its operations.

The company is exploring innovative approaches to product design and material sourcing, aiming for more sustainable options. For instance, in 2023, Altria reported progress in its packaging sustainability goals, with a significant portion of its packaging materials being recyclable.

Supply Chain Sustainability

Environmental considerations are deeply ingrained in Altria's value chain, particularly concerning the agricultural practices involved in tobacco cultivation. The company is actively working with its suppliers to foster more sustainable farming methods and ensure responsible resource management, aiming to reduce the overall environmental footprint throughout its extensive supply chain.

These efforts include initiatives focused on water conservation, soil health, and reduced pesticide use. For instance, in 2023, Altria reported continued progress in its supplier sustainability programs, with a focus on key agricultural regions. While specific figures for 2024 are still emerging, the company's commitment to reducing greenhouse gas emissions from its agricultural operations remains a priority, aligning with broader industry trends towards climate-resilient agriculture.

- Supplier Engagement: Promoting sustainable farming practices among tobacco growers to enhance environmental stewardship.

- Resource Management: Implementing strategies for responsible water usage and soil conservation in agricultural operations.

- Environmental Impact Reduction: Minimizing the ecological footprint across the entire value chain, from farm to finished product.

- Climate Resilience: Adapting agricultural practices to mitigate the impacts of climate change and ensure long-term sustainability.

ESG Reporting and Transparency

Altria Group places a strong emphasis on transparent reporting regarding its environmental, social, and governance (ESG) initiatives. This commitment is demonstrated through detailed disclosures on their progress toward environmental objectives, such as achieving net-zero emissions targets.

The company actively aligns its sustainability disclosures with the evolving expectations of stakeholders. For instance, in their 2023 ESG report, Altria highlighted a 25% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions compared to their 2020 baseline, demonstrating tangible progress toward their net-zero goals.

- Net-Zero Emissions: Altria is working towards achieving net-zero GHG emissions across its value chain.

- Water Stewardship: The company reports on its water usage and conservation efforts, aiming for responsible water management.

- Sustainable Packaging: Efforts are underway to reduce the environmental impact of packaging materials used for Altria's products.

- Stakeholder Engagement: Altria actively engages with investors, employees, and communities to understand and address sustainability concerns.

Altria is committed to reducing its environmental impact, focusing on greenhouse gas (GHG) emissions and resource management. The company reported a 25% reduction in Scope 1 and 2 GHG emissions by 2023, against a 2020 baseline, demonstrating progress toward net-zero goals.

Water stewardship is a key environmental focus, with efforts to reduce consumption in manufacturing. In 2023, Altria reported a 1.5% reduction in water withdrawal intensity across major manufacturing sites.

Sustainable packaging initiatives are also underway, with a focus on increasing the recyclability of materials used for its products.

Environmental considerations extend to agricultural practices, with supplier engagement aimed at promoting sustainable tobacco farming methods, including water conservation and soil health.

| Environmental Focus Area | 2023 Progress/Data | Target/Goal |

|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 25% reduction vs. 2020 baseline | Net-zero emissions |

| Water Withdrawal Intensity | 1.5% reduction | Responsible water management |

| Packaging Recyclability | Significant portion recyclable | Enhance recycling efforts |

| Sustainable Agriculture | Supplier engagement on conservation | Reduce agricultural footprint |

PESTLE Analysis Data Sources

Our PESTLE analysis for Altria Group is built on comprehensive data from reputable sources including government reports, financial market data, industry-specific publications, and reputable news outlets. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.