Altria Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

Altria Group's marketing strategy is a masterclass in navigating a complex industry. Their product portfolio, from established tobacco brands to emerging reduced-risk products, showcases a commitment to evolving consumer preferences.

Dive deeper into Altria Group's strategic brilliance. Our comprehensive 4Ps analysis unpacks their product diversification, pricing tactics, distribution channels, and promotional campaigns, offering actionable insights for your own business strategy. Get the full, editable report today!

Product

Altria's core product offering centers on combustible tobacco, with Marlboro cigarettes remaining its dominant brand and a leading player in the U.S. market. This flagship product, alongside other smokeable goods like Black & Mild cigars, continues to be a substantial revenue generator for the company.

These established brands benefit from significant consumer loyalty and a deeply entrenched market position. In the first quarter of 2024, Altria reported that its smokeable product segment, which includes Marlboro, generated $5.4 billion in net revenue, underscoring the enduring strength of these core offerings.

Altria Group commands a significant share of the oral tobacco market, particularly with its moist smokeless tobacco (MST) offerings. Brands like Copenhagen and Skoal are positioned for the premium segment, while Red Seal and Husky cater to value-conscious consumers. This dual approach ensures broad market coverage.

The company's portfolio also includes Marlboro Snus, a spit-free product designed to meet changing consumer demands for more discreet and convenient smokeless tobacco options. This strategic product development reflects Altria's adaptability to evolving preferences in the oral tobacco category.

Altria's "Next-Generation Nicotine" strategy centers on transitioning adult smokers to reduced-harm alternatives, exemplified by its investment in NJOY e-vapor products, which hold FDA authorization. This product expansion is crucial for offering consumers choices beyond traditional combustible cigarettes.

The 'on!' brand of oral nicotine pouches is a significant component of this strategy, demonstrating robust growth. In the first quarter of 2024, 'on!' achieved a 27.4% retail share, with shipment volume increasing by 47.4% compared to the previous year, highlighting its market penetration and consumer acceptance.

By focusing on NJOY and 'on!', Altria aims to capture a substantial share of the rapidly evolving smoke-free market, aligning with its commitment to responsible product innovation and adult smoker cessation from combustible tobacco.

Cannabis Investments

Altria's cannabis investment, primarily through its substantial stake in Cronos Group, represents a key element of its product strategy. This move diversifies its portfolio beyond traditional tobacco, targeting the rapidly expanding global cannabis market. As of early 2024, Altria's investment in Cronos Group was valued at approximately $1.8 billion, reflecting a long-term commitment to this emerging sector.

The pricing strategy for Altria's cannabis involvement is indirectly influenced by Cronos Group's product pricing and market positioning. Cronos Group offers a range of cannabis products, including dried flower, pre-rolls, and oils, with pricing that varies based on strain, quality, and market demand in jurisdictions where cannabis is legal. This approach allows for flexibility as regulations and consumer preferences evolve.

Placement for Altria's cannabis interests is through Cronos Group's distribution channels in markets where cannabis is legally available for sale. This includes dispensaries and online platforms in Canada and other international markets. Altria's role is that of an investor, not a direct retailer, leveraging Cronos' existing infrastructure.

Promotion of Altria's cannabis segment is inherently linked to Cronos Group's marketing efforts. Due to strict regulations on cannabis advertising, promotion often focuses on brand building, product education, and highlighting innovation within the legal framework. For instance, Cronos Group has focused on developing differentiated product offerings and expanding its brand presence in key markets.

- Product: Altria's product strategy in cannabis is executed via its investment in Cronos Group, which manufactures and distributes a variety of cannabis products including dried flower, oils, and edibles.

- Price: Pricing is determined by Cronos Group based on market conditions, product type, and quality in legal cannabis markets, with the goal of achieving competitive positioning.

- Place: Distribution occurs through Cronos Group's established channels in legal cannabis markets, primarily dispensaries and licensed online retailers.

- Promotion: Promotion is managed by Cronos Group, adhering to strict advertising regulations by focusing on brand development and product innovation rather than direct consumer advertising.

Wine Portfolio

Altria Group's product strategy extends to the wine sector through its wholly-owned subsidiary, Ste. Michelle Wine Estates. This segment significantly bolsters Altria's market reach within the premium wine category, encompassing well-regarded domestic brands such as Conn Creek and Erath Winery. Furthermore, the company strategically imports select international wine varietals to broaden its portfolio and cater to diverse consumer preferences.

The wine portfolio contributes to Altria's overall diversification strategy, offering a counterpoint to its dominant tobacco and nicotine businesses. In 2023, the U.S. wine market saw continued growth, with premium segments showing particular resilience. Ste. Michelle Wine Estates, as a key player, aims to leverage this trend by focusing on quality production and brand building. For instance, Erath Winery, known for its Oregon Pinot Noir, has consistently received accolades, reinforcing its premium positioning.

- Market Presence: Ste. Michelle Wine Estates enhances Altria's standing in the premium U.S. wine market.

- Brand Portfolio: Includes established brands like Conn Creek and Erath Winery, alongside imported international selections.

- Strategic Importance: Diversifies Altria's revenue streams beyond tobacco and nicotine products.

- Growth Focus: Aims to capitalize on the growing demand for premium wines in the U.S. market.

Altria's product portfolio is anchored by its leading smokeable tobacco brands, notably Marlboro cigarettes, which continue to dominate the U.S. market. This segment, along with other offerings like Black & Mild cigars, remains a significant revenue driver, demonstrating robust consumer loyalty and market penetration. In Q1 2024, the smokeable products segment generated $5.4 billion in net revenue, highlighting the enduring strength of these core products.

What is included in the product

This analysis offers a comprehensive examination of Altria Group's marketing mix, detailing its product portfolio, pricing strategies, distribution channels, and promotional efforts to understand its market positioning.

This analysis simplifies Altria's 4Ps strategy, offering a clear, actionable view to address market challenges and streamline decision-making.

Place

Altria boasts an extensive retail distribution network across the United States, a critical component of its marketing strategy. This network ensures widespread availability of its diverse product portfolio, which includes traditional tobacco products and emerging nicotine alternatives.

The company's products, such as Marlboro cigarettes and Copenhagen and Skoal smokeless tobacco, are readily accessible in tens of thousands of retail locations, including convenience stores, supermarkets, and drugstores. This deep penetration into the retail landscape is fundamental to maintaining market share and reaching adult consumers effectively.

The strategic acquisition of NJOY in 2023 for $350 million was a key move to bolster Altria's presence in the rapidly growing e-vapor category and further expand its retail footprint. This acquisition brought NJOY's established distribution channels and product offerings into Altria's fold, enhancing its ability to compete in the evolving nicotine market.

Altria Group leverages direct mail and age-verified branded websites as key components of its marketing strategy, specifically targeting adult tobacco consumers aged 21 and older. These channels are vital for disseminating brand information and facilitating e-commerce transactions for age-restricted products, adhering strictly to all legal requirements for tobacco sales and delivery.

Altria actively cultivates strategic partnerships to broaden its market presence. A notable example is its collaboration with Philip Morris International (PMI) concerning heated tobacco product technologies and e-vapor product licensing beyond the United States. This alliance allows Altria to leverage PMI's global infrastructure and technological advancements, thereby enhancing its international market reach.

Furthermore, the Altria Group Distribution Company plays a crucial role by offering sales and distribution services for a diverse range of products, not solely its own. This expands Altria's distribution network and provides access to new customer segments and markets, effectively increasing its overall market penetration and sales volume.

Inventory Management and Logistics

Altria's inventory management and logistics are vital for maintaining product availability across its vast distribution network. This ensures consumers can readily access its core tobacco products, a necessity given the consistent demand. Effective supply chain operations are foundational to Altria's market presence and ability to meet consumer needs efficiently.

The company's approach focuses on optimizing stock levels and transportation to minimize disruptions and costs. This includes managing a complex network of suppliers, manufacturing facilities, and distribution channels. For instance, in 2023, Altria reported net revenue of $20.9 billion, underscoring the scale of operations requiring sophisticated inventory and logistics planning.

- Product Availability: Ensuring cigarettes, smokeless tobacco, and oral nicotine products are consistently stocked in retail locations nationwide.

- Supply Chain Efficiency: Streamlining the movement of raw materials and finished goods to reduce lead times and operational expenses.

- Distribution Network: Managing a complex system of warehouses and transportation providers to reach millions of retail points of sale.

- Demand Forecasting: Utilizing data analytics to predict consumer demand and adjust inventory levels accordingly, particularly for new product introductions like on! oral nicotine pouches.

Adult-Only Facilities and Retail Merchandising

Altria Group places a strong emphasis on responsible marketing for its adult-only products. This includes supporting product launches within designated adult-only facilities, ensuring that marketing and sales activities are contained and directed exclusively at the intended consumer base. For example, in 2024, Altria continued to refine its retail strategies to align with these principles.

Collaboration with retailers is a cornerstone of Altria's merchandising strategy. They work closely with retail partners to ensure that tobacco products are displayed and promoted in a manner that is consistent with responsible marketing practices. This often involves specific planogram arrangements and point-of-sale materials designed to appeal solely to adult smokers.

- Responsible Marketing: Altria's commitment to marketing solely to adult consumers is a guiding principle for its product placement and promotional activities.

- Retailer Partnerships: The company actively engages with retailers to implement merchandising strategies that uphold responsible sales practices.

- Adult-Only Environments: Product launches and marketing initiatives are often strategically placed in environments catering exclusively to adult consumers.

- Compliance and Ethics: This approach underscores Altria's dedication to ethical marketing and regulatory compliance within the tobacco industry.

Altria's place strategy centers on deep retail penetration and strategic expansion into new channels. Their vast network ensures widespread product availability across the US, reaching adult consumers effectively. The acquisition of NJOY in 2023 for $350 million significantly boosted their presence in the e-vapor market, integrating new distribution pathways.

The company's distribution extends beyond its own products through the Altria Group Distribution Company, broadening market access. This expansive reach is supported by robust inventory management and logistics, crucial for meeting consistent demand, as evidenced by their $20.9 billion in net revenue in 2023.

| Distribution Channel | Key Products | Strategic Importance |

|---|---|---|

| Traditional Retail (Convenience Stores, Supermarkets, Drugstores) | Marlboro cigarettes, Copenhagen, Skoal | Ensures widespread availability and market share maintenance. |

| E-vapor Retail (Post-NJOY acquisition) | NJOY e-vapor products | Expands presence in the growing alternative nicotine market. |

| Direct Mail and Branded Websites | Oral nicotine products (e.g., on!) | Facilitates age-verified e-commerce for restricted products. |

| Partnerships (e.g., PMI) | Heated tobacco, e-vapor (outside US) | Leverages global infrastructure and technology for international reach. |

What You See Is What You Get

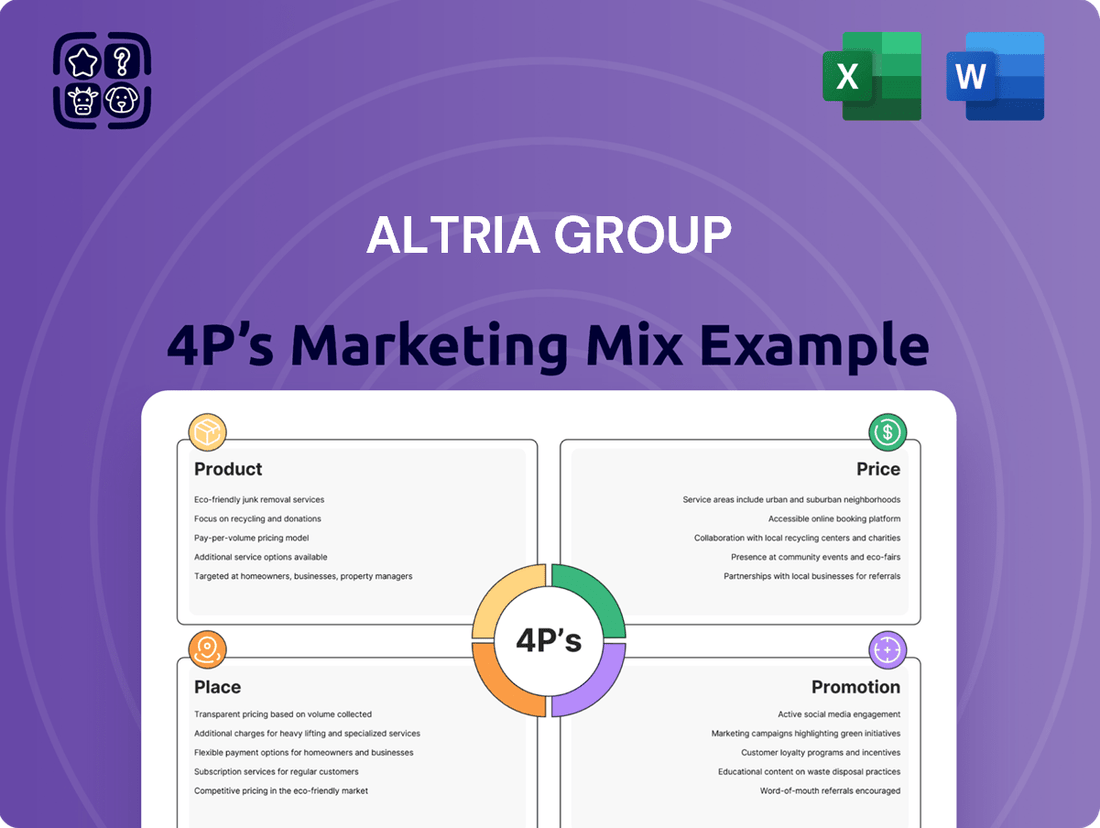

Altria Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Altria Group's 4Ps covers Product, Price, Place, and Promotion, offering a complete picture of their marketing strategy. You'll gain immediate access to this ready-to-use document upon completing your order.

Promotion

Altria's marketing efforts are meticulously crafted to engage adult tobacco consumers, strictly adhering to age restrictions for individuals 21 and older. This commitment to responsible marketing is evident in their digital outreach, employing robust age-gating mechanisms on online platforms to prevent access by underage individuals.

Furthermore, their advertising strategies are carefully curated to align with regulatory standards, such as placing advertisements solely in publications that meet the Food and Drug Administration's (FDA) criteria. This selective approach ensures that marketing messages reach the intended adult demographic without inadvertently targeting unintended audiences.

Altria Group's promotional strategies are laser-focused on building strong brand recognition and fostering deep customer loyalty for its flagship products, such as Marlboro, Copenhagen, and Skoal. These initiatives are designed to resonate with a diverse adult tobacco consumer base.

The company leverages extensive consumer research to tailor its marketing activities and communication tools, ensuring its message effectively reaches and appeals to a broad, multicultural audience. This data-driven approach helps in crafting promotions that build lasting connections.

Altria leverages digital channels, including branded e-commerce sites, to connect with adult consumers. These platforms are crucial for disseminating product information and executing promotions, acting as a direct line of communication.

Strict adherence to age verification protocols and all legal requirements for tobacco product sales and delivery is paramount on these digital platforms. This ensures responsible engagement and compliance within the regulatory framework.

In 2023, Altria reported that its e-commerce platforms played a role in its overall sales strategy, with digital engagement efforts supporting its product portfolio. Specific figures for e-commerce contribution are often integrated within broader revenue reporting, reflecting a growing trend in direct-to-consumer interactions for regulated products.

Public Relations and Regulatory Advocacy

Altria Group leverages public relations and regulatory advocacy to navigate the complexities of the tobacco industry, emphasizing harm reduction as a core principle for policy development. This strategic approach aims to foster a more favorable operating environment by influencing regulations and promoting responsible practices.

The company actively engages in lobbying efforts to combat illicit markets, which can significantly disadvantage legitimate, tax-compliant brands like NJOY. By advocating for stricter enforcement against illegal sales, Altria seeks to protect its market share and ensure a level playing field for its products.

Furthermore, Altria champions accelerated FDA market authorizations for smoke-free products. This advocacy is crucial for bringing innovative, potentially less harmful alternatives to adult smokers faster, aligning with their commitment to harm reduction and evolving consumer preferences. For instance, in 2024, the company continued its focus on supporting regulatory pathways for its reduced-risk products.

- Harm Reduction Advocacy: Altria actively promotes harm reduction as a guiding framework for tobacco regulation, aiming to influence policy discussions.

- Illicit Market Combat: The company lobbies to curb illicit tobacco markets, which negatively impact compliant brands such as NJOY.

- Accelerated FDA Authorizations: Altria advocates for faster FDA approval processes for smoke-free products to encourage consumer adoption of alternatives.

Targeted Product Launch Campaigns

Altria Group focuses its promotion strategy on targeted product launch campaigns for its smoke-free innovations, such as NJOY e-vapor and 'on!' nicotine pouches. These campaigns are designed to encourage trial and build initial consumer adoption.

Key promotional tactics include offering trial generations and bundle deals to incentivize first-time purchases. Furthermore, Altria works to enhance retail visibility and implements specific retail trade programs to ensure these new products gain traction with adult nicotine consumers.

- Targeted Campaigns: NJOY e-vapor and 'on!' nicotine pouches receive focused commercial efforts.

- Trial & Bundling: Promotions include trial generations and bundle offers to drive initial adoption.

- Retail Focus: Efforts are made to improve retail visibility and launch trade programs.

Altria's promotional activities center on building brand equity for established products like Marlboro and fostering trial for newer smoke-free offerings such as NJOY e-vapor and 'on!' nicotine pouches. These efforts are underpinned by extensive consumer research to ensure targeted messaging across diverse adult demographics, with a significant emphasis on digital channels and e-commerce platforms for direct consumer engagement.

The company's public relations and advocacy strategies are crucial, focusing on harm reduction and combating illicit markets to create a more favorable regulatory environment. Altria actively lobbies for accelerated FDA market authorizations for reduced-risk products, aiming to bring innovative alternatives to adult smokers more swiftly. For example, in 2024, the company continued to prioritize regulatory pathways for its smoke-free portfolio.

Altria's promotional mix includes targeted launch campaigns, trial incentives, and bundle deals for new products, alongside efforts to boost retail visibility through specific trade programs. This multi-faceted approach aims to drive adoption and build loyalty among adult nicotine consumers. In 2023, Altria's e-commerce platforms played a role in its overall sales strategy, reflecting a growing trend in direct-to-consumer interactions.

| Product Category | Key Promotional Tactics | Target Audience Focus | 2023/2024 Data Point |

|---|---|---|---|

| Smoke-Free Innovations (NJOY, 'on!') | Targeted launch campaigns, trial generations, bundle deals, retail trade programs | Adult nicotine consumers seeking alternatives | Continued focus on regulatory pathways for reduced-risk products in 2024. |

| Established Brands (Marlboro, Copenhagen) | Digital engagement, e-commerce, age-gated online platforms | Existing adult tobacco consumers | E-commerce platforms contributed to overall sales strategy in 2023. |

| Advocacy & PR | Harm reduction promotion, lobbying against illicit markets, accelerated FDA authorization advocacy | Regulators, policymakers, adult smokers | Emphasis on responsible practices and influencing policy development. |

Price

Altria employs a premium pricing strategy for its flagship brands like Marlboro cigarettes and Copenhagen moist smokeless tobacco. This approach capitalizes on significant brand equity and established consumer loyalty.

This premium positioning enables Altria to maintain healthy profit margins and financial resilience, even as overall cigarette volumes continue to decrease. For instance, in the first quarter of 2024, Altria reported a net revenue of $4.9 billion, with pricing contributing significantly to their performance.

Altria Group actively utilizes dynamic pricing, a strategy that allows them to adjust product prices based on fluctuating market demand, the actions of competitors, and broader economic factors like inflation. This approach is crucial for maintaining profitability in a challenging environment.

For instance, in the first quarter of 2024, Altria reported that its pricing initiatives, particularly in the combustible cigarettes segment, helped to offset a decline in shipment volumes. The company noted that higher pricing contributed to a more favorable revenue outcome despite the volume challenges.

Altria Group actively employs promotional investments and discounts as a core strategy to maintain its competitive edge and ensure product accessibility for its diverse consumer base. These efforts are crucial for defending market share in a dynamic industry.

For instance, in the first quarter of 2024, Altria reported $640 million in reduced cost of goods sold and selling, general, and administrative expenses, partly driven by these promotional activities. While these investments can temporarily affect operating income, they are vital for attracting and retaining consumers, especially in the face of evolving consumer preferences and regulatory landscapes.

Value-Based Pricing for Certain Offerings

Altria Group employs value-based pricing for certain offerings, recognizing that not all consumers seek premium products. For instance, within its oral tobacco segment, brands like Red Seal and Husky are strategically priced to appeal to a wider consumer base, ensuring accessibility across different economic strata.

This tiered pricing strategy is crucial for market penetration and capturing diverse segments. By offering value brands, Altria can effectively compete in price-sensitive markets, thereby expanding its overall market share. This approach acknowledges the varied purchasing power and preferences of its customer base.

- Value Brands: Red Seal and Husky cater to price-conscious consumers.

- Market Segmentation: This strategy allows Altria to reach a broader demographic.

- Competitive Advantage: Value pricing helps capture market share from competitors.

Considering External Factors and Regulatory Impact

Altria's pricing strategies are dynamic, constantly adjusting to external pressures like competitor price points and evolving market demand. For instance, anticipated shifts in consumer preference towards reduced-risk products could influence pricing structures for traditional cigarettes versus newer offerings.

Regulatory landscapes, particularly potential Food and Drug Administration (FDA) actions, significantly shape Altria's pricing decisions. The company's financial projections for 2024 and 2025, therefore, incorporate scenarios reflecting these regulatory impacts on product availability and consumer behavior, directly affecting pricing power and overall profitability.

- Competitor Pricing: Monitoring and responding to competitor price adjustments for cigarettes and other tobacco products.

- Market Demand: Adapting pricing based on fluctuating consumer demand for traditional versus alternative nicotine products.

- Regulatory Impact: Factoring in potential FDA restrictions or new regulations that could affect product categories and pricing flexibility.

- Financial Guidance: Incorporating these external factors into financial forecasts to manage pricing and profitability expectations.

Altria's pricing strategy is multifaceted, balancing premium positioning for core brands with value-oriented options to capture diverse market segments. This approach is crucial for navigating a declining volume market while maintaining profitability.

In Q1 2024, Altria's pricing initiatives were instrumental in offsetting shipment volume declines, demonstrating the effectiveness of their strategy. The company continues to monitor competitor pricing and regulatory impacts, such as potential FDA actions, to inform its pricing decisions for 2024 and beyond.

| Pricing Strategy | Key Brands/Segments | Rationale |

| Premium Pricing | Marlboro, Copenhagen | Leverages brand equity and consumer loyalty for higher margins. |

| Value Pricing | Red Seal, Husky | Appeals to price-sensitive consumers and expands market reach. |

| Dynamic Pricing | All Segments | Adjusts prices based on market demand, competition, and economic factors. |

4P's Marketing Mix Analysis Data Sources

Our Altria Group 4P's Marketing Mix Analysis is meticulously constructed using a blend of primary and secondary data sources. This includes official company filings such as SEC reports and annual reports, investor presentations, and press releases, alongside data from industry analysis firms and e-commerce platforms.