Altria Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

Altria Group faces significant threats from substitutes, particularly as health consciousness rises, and intense rivalry among established players. Supplier power is moderate, while buyer power is also a key consideration in their pricing strategies. The threat of new entrants, though historically limited by regulations, still warrants attention.

The complete report reveals the real forces shaping Altria Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Altria sources tobacco from around 700 independent farmers, mainly in the United States. However, the overall acreage dedicated to tobacco farming in the U.S. has seen a notable decrease. This consolidation within the farming sector, leading to fewer, larger-scale operations, could potentially strengthen the bargaining power of these individual farmers.

Altria Group actively manages supplier power by entering into long-term contractual agreements, often spanning three to five years, with its primary agricultural suppliers. These agreements are crucial for stabilizing input costs and ensuring a consistent supply of raw materials.

These contracts typically lock in pricing and quality specifications, effectively limiting the suppliers' leverage to unilaterally increase prices or alter terms. For instance, in 2024, Altria's proactive contracting helped insulate it from some of the volatility seen in agricultural commodity markets, demonstrating the strategic advantage of such arrangements.

Altria's strategic vertical integration, where it directly controls approximately 35% of its tobacco supply chain, significantly minimizes supplier leverage. This internal sourcing capability provides a crucial buffer against external supplier demands and potential disruptions, reinforcing its bargaining power.

Impact of Climate Change and Costs

Climate change presents a growing challenge for agricultural inputs, including tobacco. Events like droughts or excessive rainfall can disrupt harvests, potentially increasing the cost of raw materials for companies like Altria. For instance, adverse weather patterns in key growing regions can lead to reduced yields, driving up prices for the tobacco leaf.

While these climate-related impacts can translate to higher input costs, Altria's established scale and global sourcing network provide a degree of resilience. The company’s ability to diversify its supply chain across various geographic locations helps mitigate the risk of localized climate events significantly impacting its overall supply and costs. This diversification is crucial for maintaining stable production in the face of environmental volatility.

- Impact on Yields: Climate-related events such as droughts and heavy rainfall can decrease tobacco crop yields, directly affecting the availability and cost of raw materials.

- Increased Production Costs: Farmers face higher operational expenses due to climate-induced challenges, which can be passed on to buyers like Altria.

- Altria's Mitigation Strategies: The company leverages its significant scale and diversified sourcing to manage these risks, aiming to stabilize input costs despite environmental pressures.

- Supply Chain Resilience: By sourcing tobacco from multiple regions, Altria reduces its vulnerability to localized climate disruptions, ensuring a more consistent supply.

Regulatory Scrutiny on Supply Chains

Regulatory scrutiny on supply chains is increasing, impacting companies like Altria. For instance, the German Act on Corporate Due Diligence in Supply Chains, effective since January 1, 2024, mandates that companies ensure human rights and environmental standards are met throughout their supply chains. Similarly, the EU Corporate Sustainability Due Diligence Directive, adopted in 2024, imposes similar obligations across the European Union.

These regulations can lead to higher compliance costs for suppliers. These increased costs may then be passed on to Altria Group, potentially affecting its procurement expenses and overall profitability.

- Increased Compliance Costs: New regulations like the German Act and EU Directive require suppliers to invest in processes and reporting to meet human rights and environmental standards.

- Potential Cost Pass-Through: Suppliers facing these higher operational costs may raise prices for raw materials and components sold to Altria.

- Supply Chain Risk: Non-compliant suppliers could face penalties or exclusion, forcing Altria to find alternative, potentially more expensive, sources.

Altria's bargaining power with suppliers is influenced by several factors, including the number of farmers, contractual agreements, and vertical integration. While Altria sources from around 700 independent farmers, a trend towards larger operations could consolidate supplier power. The company mitigates this by using long-term contracts, often three to five years, which lock in prices and quality, as seen in its 2024 performance where these contracts helped buffer against market volatility.

Furthermore, Altria's vertical integration, controlling about 35% of its supply chain, significantly reduces reliance on external suppliers. However, climate change poses a risk, potentially increasing raw material costs due to reduced yields from adverse weather. Altria counters this by diversifying its sourcing geographically, enhancing supply chain resilience.

New regulations, such as the German Act on Corporate Due Diligence and the EU Corporate Sustainability Due Diligence Directive, both effective in 2024, increase compliance costs for suppliers. This could lead to higher prices passed on to Altria, impacting procurement expenses.

| Factor | Description | Altria's Position | Impact |

| Supplier Concentration | Fewer, larger farms may increase farmer leverage. | Sources from ~700 farmers; trend towards consolidation. | Potential for increased supplier power. |

| Long-Term Contracts | Secures stable pricing and supply. | 3-5 year agreements with key suppliers. | Mitigates price volatility; strengthens Altria's position. |

| Vertical Integration | Internal control of supply chain. | Controls ~35% of tobacco supply. | Significantly reduces supplier leverage. |

| Climate Change | Impacts yields and costs. | Diversified global sourcing network. | Reduces risk of localized disruptions; potential cost increases. |

| Regulatory Compliance | Increased supplier costs due to new laws (2024). | Potential for cost pass-through from suppliers. | May increase procurement expenses. |

What is included in the product

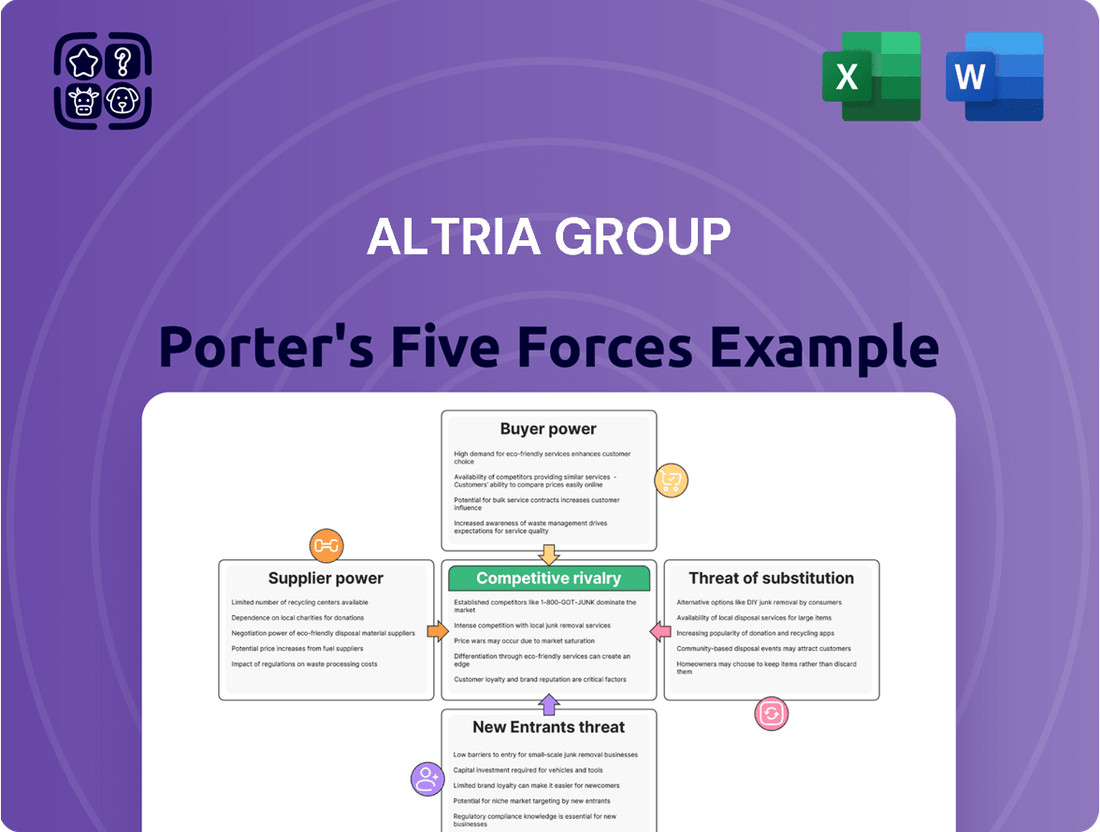

This analysis tailors Porter's Five Forces to Altria Group, dissecting the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the tobacco industry.

Simplify complex competitive dynamics by visualizing Altria's threat of new entrants and buyer bargaining power in an intuitive, easy-to-understand format.

Customers Bargaining Power

Consumers are showing more concern about prices, especially with inflation impacting budgets. This means some are looking for cheaper tobacco and nicotine options, which puts pressure on companies like Altria to be smart about their pricing to keep customers.

In 2024, the consumer price index for all urban consumers saw a notable increase, impacting household spending power. This economic climate directly influences how much consumers are willing to pay for products, making price a more significant factor in purchasing decisions for tobacco and nicotine goods.

The traditional cigarette market is facing persistent volume declines. In 2023, U.S. cigarette volumes saw a decrease of 6.8%. This trend directly impacts the bargaining power of customers, as companies vie for a shrinking consumer base.

Altria's domestic cigarette shipment volumes experienced an 8.8% drop in Q4 2024. This contraction in core product demand amplifies customer leverage, forcing companies to be more responsive to consumer needs and preferences.

The growing availability of reduced-risk products (RRPs) like e-cigarettes, heated tobacco, and nicotine pouches significantly boosts consumer bargaining power. Consumers now have a wider spectrum of choices beyond traditional cigarettes, allowing them to switch to alternatives if prices or product offerings from traditional manufacturers become less appealing. This diversification directly challenges the established market and forces manufacturers to compete more aggressively on price and product innovation.

Strong Brand Loyalty in Premium Segment

Despite a general downturn in the tobacco market, Altria's Marlboro brand continues to command significant loyalty within the premium cigarette sector. In the second quarter of 2025, Marlboro held a commanding 59.5% share of this segment, a testament to its enduring appeal and the company's ability to cultivate strong customer relationships. This established brand power provides Altria with a degree of leverage in setting prices and retaining its customer base, effectively mitigating some of the pressures from consumer bargaining power.

This strong brand loyalty translates into tangible benefits for Altria:

- Premium Pricing Power: The consistent demand for Marlboro allows Altria to maintain premium pricing, directly impacting revenue and profitability.

- Reduced Price Sensitivity: Loyal customers are less likely to switch brands based on minor price fluctuations, offering stability.

- Higher Customer Lifetime Value: Long-term brand allegiance increases the overall value derived from each customer.

- Barriers to Entry: The established brand equity makes it challenging for new entrants to capture market share from loyal Marlboro consumers.

Impact of Illicit E-Vapor Market

The burgeoning illicit e-vapor market, projected to capture over 60% of the e-vapor category in 2024, significantly amplifies the bargaining power of customers. This unregulated sector provides consumers with readily available, often cheaper, and untaxed alternatives to compliant products.

This dynamic directly challenges legitimate players like Altria's NJOY. The availability of these illicit goods broadens consumer choice, forcing compliant brands to contend with price sensitivity and the allure of unregulated, potentially lower-cost options.

- Illicit Market Dominance: Over 60% of the e-vapor market in 2024 is estimated to be illicit.

- Consumer Choice Expansion: Unregulated products offer consumers more options, often at lower price points.

- Impact on Compliant Brands: Brands like Altria's NJOY face increased pressure due to this competitive landscape.

The bargaining power of customers remains a significant force for Altria, driven by price sensitivity and the expanding alternative product market. In 2024, persistent inflation directly impacted consumer budgets, making price a more critical factor in purchasing decisions for tobacco and nicotine products. This economic reality, coupled with the ongoing decline in traditional cigarette volumes, which saw a 6.8% decrease in the U.S. in 2023, intensifies competition and amplifies customer leverage.

Altria's domestic cigarette shipment volumes fell by 8.8% in Q4 2024, underscoring the pressure to cater to consumer price expectations. Furthermore, the growing availability of reduced-risk products and a substantial illicit e-vapor market, estimated to capture over 60% of that category in 2024, provides consumers with more choices and greater power to switch if offerings are not competitive.

| Metric | 2023 Data | 2024 Data (Q4) | 2024 Projection (E-vapor) |

|---|---|---|---|

| U.S. Cigarette Volume Decline | -6.8% | ||

| Altria Domestic Cigarette Shipments | -8.8% | ||

| Illicit E-vapor Market Share | >60% |

Preview Before You Purchase

Altria Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the Altria Group, detailing the competitive landscape and strategic positioning within the tobacco industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, including insights into buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry. This is the complete, ready-to-use analysis file, precisely the same document that will be available to you instantly after buying, allowing for immediate strategic evaluation.

Rivalry Among Competitors

The U.S. tobacco landscape is a fiercely competitive arena, dominated by giants like Altria, Philip Morris International, and British American Tobacco. This intense rivalry is amplified by the continuous decline in traditional cigarette volumes, forcing these major players to battle aggressively for every remaining customer in a shrinking market.

In 2023, Altria reported a 7.9% decrease in its smokeable product shipment volume. This contraction underscores the pressure on companies to maintain market share amidst a shrinking consumer base, driving aggressive pricing and promotional strategies.

Competitive rivalry is intensifying in the rapidly evolving smoke-free product market, with companies pouring resources into research and development for e-cigarettes, heated tobacco, and nicotine pouches. Altria's 'on!' nicotine pouches have demonstrated robust growth, achieving over 10% market share in the U.S. by late 2023, indicating strong consumer adoption in this segment.

However, Altria's NJOY e-vapor product confronts considerable competition and ongoing litigation, highlighting the intense battle for market dominance in the e-cigarette space. This fierce competition necessitates continuous innovation and strategic maneuvering to capture and retain market share in these emerging categories.

Altria Group demonstrates significant pricing power within the tobacco industry, a crucial factor in managing competitive rivalry. For instance, in the first quarter of 2024, Altria reported a 2.3% increase in net revenue to $6.4 billion, driven by strategic pricing initiatives that helped offset a 5.5% decline in cigarette shipment volume. This ability to raise prices, even as volumes decrease, highlights the inelastic demand for their core products and their success in margin management.

Regulatory Compliance as a Competitive Factor

The regulatory environment, particularly concerning tobacco and nicotine products, significantly shapes competitive dynamics. For Altria, navigating the U.S. Food and Drug Administration's (FDA) marketing granted orders is a critical element of competition. This process, which involves rigorous review of product applications, means that only legally authorized products can be marketed, creating a clear distinction between compliant and non-compliant offerings.

Companies that successfully obtain these marketing orders, like Altria has for certain reduced-risk products, gain a significant advantage. This compliance acts as a barrier to entry for those unable to meet the stringent federal standards. In 2023, the FDA continued to review applications, with companies investing heavily in demonstrating product safety and efficacy to gain these crucial authorizations.

- Regulatory Hurdles: The FDA's marketing granted orders create a complex compliance landscape.

- Differentiating Factor: Adherence to federal regulations distinguishes compliant companies from illicit operators.

- Market Access: Obtaining marketing orders is essential for legal product sales, impacting market share.

- Competitive Landscape: Illicit products, operating outside regulatory frameworks, pose a challenge to compliant businesses.

Diversification Beyond Traditional Tobacco

The competitive landscape for Altria Group is increasingly defined by diversification beyond traditional cigarettes. Competitors are actively investing in reduced-harm products, such as e-cigarettes and oral nicotine pouches, and even exploring adjacent markets like cannabis. This shift means Altria faces rivals not just from other tobacco giants but also from companies specializing in these newer product categories.

Altria itself is strategically focused on transitioning adult smokers to smoke-free alternatives while continuing to manage its established combustible tobacco portfolio. This dual approach intensifies the rivalry as companies compete for the same consumer base across multiple product segments. For instance, the U.S. market for oral nicotine pouches saw significant growth, with companies like Zyn (Swedish Match, now part of PMI) capturing substantial market share, highlighting the rapid evolution of consumer preferences and competitive dynamics.

- Diversification Trend: Competitors are expanding into reduced-harm products and cannabis, broadening the competitive set beyond traditional tobacco manufacturers.

- Altria's Strategy: Altria aims to transition smokers to smoke-free options while maintaining its traditional business, creating a multi-category competitive environment.

- Market Dynamics: The rapid growth in categories like oral nicotine pouches demonstrates the intensity of competition as companies vie for market share in evolving product segments.

The competitive rivalry within the U.S. tobacco industry remains intense, driven by declining cigarette volumes and aggressive competition in smoke-free alternatives. Altria's smokeable product shipment volume saw a 7.9% decrease in 2023, reflecting the pressure to secure market share.

Altria's 'on!' nicotine pouches achieved over 10% market share in the U.S. by late 2023, showcasing fierce competition in this rapidly growing segment, where rivals are also investing heavily in R&D and market penetration.

The company's NJOY e-vapor product faces significant competitive headwinds and ongoing litigation, underscoring the challenging landscape for new product categories. Altria's strategic pricing in Q1 2024, with a 2.3% net revenue increase despite a 5.5% cigarette volume decline, highlights its efforts to manage this rivalry.

| Metric | 2023 Data | Trend |

| Altria Smokeable Shipment Volume | -7.9% | Declining |

| 'on!' Nicotine Pouch Market Share (Late 2023) | >10% | Growing |

| Altria Net Revenue (Q1 2024) | $6.4 Billion | Increased by 2.3% |

SSubstitutes Threaten

The most significant threat of substitution for Altria Group stems from the rapidly growing market for reduced-risk products (RRPs). This category includes e-cigarettes, heated tobacco products, and nicotine pouches, all gaining traction as consumers actively seek alternatives to traditional cigarettes that they perceive as less harmful.

In 2024, the RRP market continued its upward trajectory, with e-cigarettes and heated tobacco products showing particularly strong consumer interest. For instance, the global e-cigarette market was projected to reach over $30 billion in 2024, demonstrating a substantial shift in consumer preference.

This shift directly impacts Altria's core business, as consumers trading down to RRPs represent a loss of volume and revenue from their combustible cigarette segment. The increasing availability and marketing of these substitutes pose a continuous challenge to maintaining market share in traditional tobacco products.

The proliferation of illicit disposable e-vapor products presents a significant threat of substitutes for Altria. These unregulated alternatives often undercut the prices of compliant products, directly siphoning off market share and revenue. For instance, in 2024, authorities continued to seize vast quantities of these counterfeit and untaxed products, highlighting the scale of the problem.

This illicit market circumvents the rigorous federal regulations and safety standards that Altria and other legitimate manufacturers adhere to. Consumers, drawn by lower prices and accessibility, may opt for these illicit products, thereby diminishing demand for Altria's regulated e-vapor offerings like NJOY.

The increasing health consciousness among consumers presents a significant threat of substitution for Altria Group. Growing public awareness regarding the health risks associated with traditional tobacco products, like cigarettes, is a major driver. This trend pushes consumers to explore or adopt alternatives, or even to cease nicotine consumption altogether. For instance, in 2023, the U.S. adult smoking rate hovered around 11.5%, a notable decrease from previous years, indicating a shift away from traditional products.

This heightened health awareness directly impacts the demand for Altria's core offerings. As consumers become more concerned about their well-being, they actively seek out products perceived as less harmful or opt for complete cessation. This shift means that even if Altria diversifies its product portfolio, the fundamental threat of consumers moving away from nicotine-based products due to health concerns remains a powerful substitute force.

Emergence of Non-Nicotine Alternatives

The threat of substitutes for Altria Group's traditional nicotine products is evolving beyond just other tobacco or nicotine delivery systems. A notable trend, especially among younger consumers, involves exploring non-nicotine alternatives for stimulation or recreational purposes. This includes substances like cannabis and even readily available options such as coffee.

This shift signifies a broader change in consumer behavior, where the desire for a pick-me-up or a social ritual is being met by products entirely outside the nicotine category. For instance, the U.S. legal cannabis market saw significant growth, with sales reaching an estimated $32 billion in 2023, indicating a substantial consumer base seeking alternatives.

- Cannabis as a Substitute: The expanding legal cannabis market presents a direct alternative for consumers seeking altered states or relaxation, diverting spending from traditional nicotine products.

- Coffee and Energy Drinks: These widely accessible and socially accepted beverages offer a functional alternative for energy and focus, appealing to a broad consumer base that might otherwise turn to nicotine for similar effects.

- Shifting Consumer Preferences: Younger demographics, in particular, are demonstrating a willingness to experiment with a wider array of substances, moving away from a singular reliance on tobacco and nicotine.

Shifting Consumer Behavior and Convenience

Consumer preferences are rapidly evolving, with a growing demand for more convenient and discreet nicotine delivery systems. This shift is a significant substitution threat to traditional tobacco products, as consumers increasingly favor options like nicotine pouches. For instance, the U.S. nicotine pouch market experienced substantial growth in recent years, with sales reaching billions of dollars, demonstrating a clear move away from older product formats.

This evolving consumer behavior directly impacts companies like Altria Group by introducing alternative ways to consume nicotine. The emphasis on ease of use and social acceptability of newer products means that traditional cigarettes and even smokeless tobacco products face increased competition from these substitutes.

- Growing Market Share: Nicotine pouches, a key substitute, have rapidly gained market share, capturing a notable percentage of the oral nicotine market.

- Consumer Preference Shift: Consumers are actively choosing these newer, often perceived as less harmful or more socially acceptable, alternatives.

- Impact on Traditional Products: The rise of substitutes directly erodes the demand for Altria's legacy products, necessitating strategic adaptation.

The threat of substitutes for Altria Group is multifaceted, encompassing both direct nicotine alternatives and entirely different product categories that fulfill similar consumer needs. Reduced-risk products (RRPs) like e-cigarettes and heated tobacco, along with nicotine pouches, are increasingly drawing consumers away from traditional cigarettes. This trend is amplified by growing health consciousness and the availability of illicit, lower-priced disposable e-vapor products that bypass regulatory standards.

The market for these substitutes is substantial and growing. For example, the global e-cigarette market was projected to exceed $30 billion in 2024, while the U.S. nicotine pouch market already represents billions in sales. Beyond nicotine, even products like cannabis, coffee, and energy drinks are emerging as substitutes, catering to consumers seeking stimulation or relaxation through non-nicotine means. The U.S. legal cannabis market alone reached an estimated $32 billion in sales in 2023, underscoring this broader shift in consumer behavior.

| Substitute Category | Key Products | 2023/2024 Market Data/Trend | Impact on Altria |

|---|---|---|---|

| Reduced-Risk Products (RRPs) | E-cigarettes, Heated Tobacco | Global e-cigarette market projected >$30B in 2024; growing consumer interest. | Loss of volume and revenue from combustible cigarettes. |

| Oral Nicotine Products | Nicotine Pouches | U.S. nicotine pouch market sales in billions; rapid growth. | Erodes demand for traditional smokeless tobacco and cigarettes. |

| Illicit E-Vapor Products | Disposable E-cigarettes (unregulated) | Significant seizures of illicit products in 2024; lower prices. | Siphons market share from regulated products like NJOY. |

| Non-Nicotine Alternatives | Cannabis, Coffee, Energy Drinks | U.S. legal cannabis market sales ~$32B in 2023; coffee/energy drinks widely accessible. | Diverts consumer spending and rituals away from nicotine. |

Entrants Threaten

Establishing a significant presence in the U.S. tobacco and nicotine industry demands immense capital. Building out national manufacturing capabilities, securing and managing extensive distribution channels, and launching impactful, widespread marketing initiatives are all incredibly costly endeavors. For instance, the capital expenditure for a new, large-scale manufacturing facility could easily run into hundreds of millions of dollars, a figure that deters many aspiring competitors.

The tobacco and nicotine industry is a minefield of regulations, making it tough for newcomers. Think about the FDA's Premarket Tobacco Product Application (PMTA) process for e-vapor products; it's incredibly complex and costly. In 2024, companies continue to grapple with these stringent requirements, which can easily run into millions of dollars for even a single product submission.

Established brand loyalty, exemplified by Altria's Marlboro, presents a significant barrier. Marlboro's enduring appeal, cultivated over decades, makes it incredibly difficult for newcomers to capture consumer preference. This loyalty translates into consistent sales volumes, a crucial advantage for incumbents.

Consolidated Market Structure

The U.S. tobacco market is highly consolidated, with Altria Group (MO) and Reynolds American (a subsidiary of British American Tobacco) being the dominant players. This concentration means that the threat of new entrants is relatively low, as significant capital investment and established distribution networks are required to compete. For instance, in 2023, Altria's net revenues were approximately $20.5 billion, showcasing the immense scale of established companies.

The existing market structure, characterized by strong brand loyalty and extensive regulatory hurdles, further deters new companies. Smaller players struggle to achieve the economies of scale necessary to match the pricing and marketing capabilities of giants like Altria. This consolidation creates a significant barrier to entry, protecting the market share of incumbents.

- Market Dominance: Altria Group and Reynolds American control a substantial portion of the U.S. tobacco market.

- High Capital Requirements: Entering the industry necessitates massive investment in manufacturing, distribution, and marketing.

- Regulatory Barriers: Stringent regulations on tobacco products create significant compliance costs for new entrants.

- Economies of Scale: Established players benefit from lower per-unit costs due to their large production volumes.

Challenge of Illicit Market Competition

The threat of new entrants for Altria is significantly amplified by the burgeoning illicit market for e-vapor products. These unregulated offerings, often manufactured and distributed outside of established legal frameworks, bypass costly compliance measures and can therefore offer substantially lower prices. This creates an uneven playing field, making it difficult for legitimate new entrants, who must navigate stringent FDA regulations and quality control, to compete effectively on price alone.

This illicit competition directly impacts Altria's ability to introduce and gain market share with its own reduced-risk products. For instance, the U.S. Food and Drug Administration (FDA) has taken action against unauthorized e-cigarettes, highlighting the scale of the issue. In 2023, the FDA issued over 100 warning letters and import alerts to companies marketing unauthorized e-vapor products, underscoring the widespread presence of these illicit competitors.

- Unregulated E-Vapor Products: These bypass FDA regulations and quality standards.

- Price Undercutting: Illicit products are often significantly cheaper due to lack of compliance costs.

- Market Distortion: Creates an unfair competitive landscape for legitimate new entrants.

- FDA Enforcement: The FDA actively combats unauthorized e-vapor products, indicating a substantial illicit market.

The threat of new entrants in the U.S. tobacco and nicotine market remains low due to substantial barriers. High capital requirements for manufacturing and distribution, coupled with stringent regulatory hurdles like the FDA's PMTA process, demand significant investment. Established brand loyalty, particularly for brands like Marlboro, and the market's consolidation around major players like Altria further deter newcomers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | Building national manufacturing, distribution, and marketing infrastructure is extremely costly. | Deters smaller companies from entering the market. | New facility costs can reach hundreds of millions of dollars. |

| Regulatory Hurdles | Complex and expensive compliance processes, such as FDA PMTA submissions. | Adds millions in costs and significant time delays for product approval. | FDA issued over 100 warning letters for unauthorized e-vapor products in 2023. |

| Brand Loyalty | Decades of cultivated consumer preference for established brands. | Makes it difficult for new brands to gain market share. | Marlboro remains a dominant brand, indicating strong customer retention. |

| Market Consolidation | Dominance by a few large players like Altria and Reynolds American. | Limits market opportunities and bargaining power for new entrants. | Altria's 2023 net revenues were approximately $20.5 billion. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Altria Group is built upon a foundation of publicly available financial reports, SEC filings, and industry-specific market research from reputable firms. This data provides a comprehensive view of the competitive landscape, including market trends, competitor strategies, and regulatory impacts.