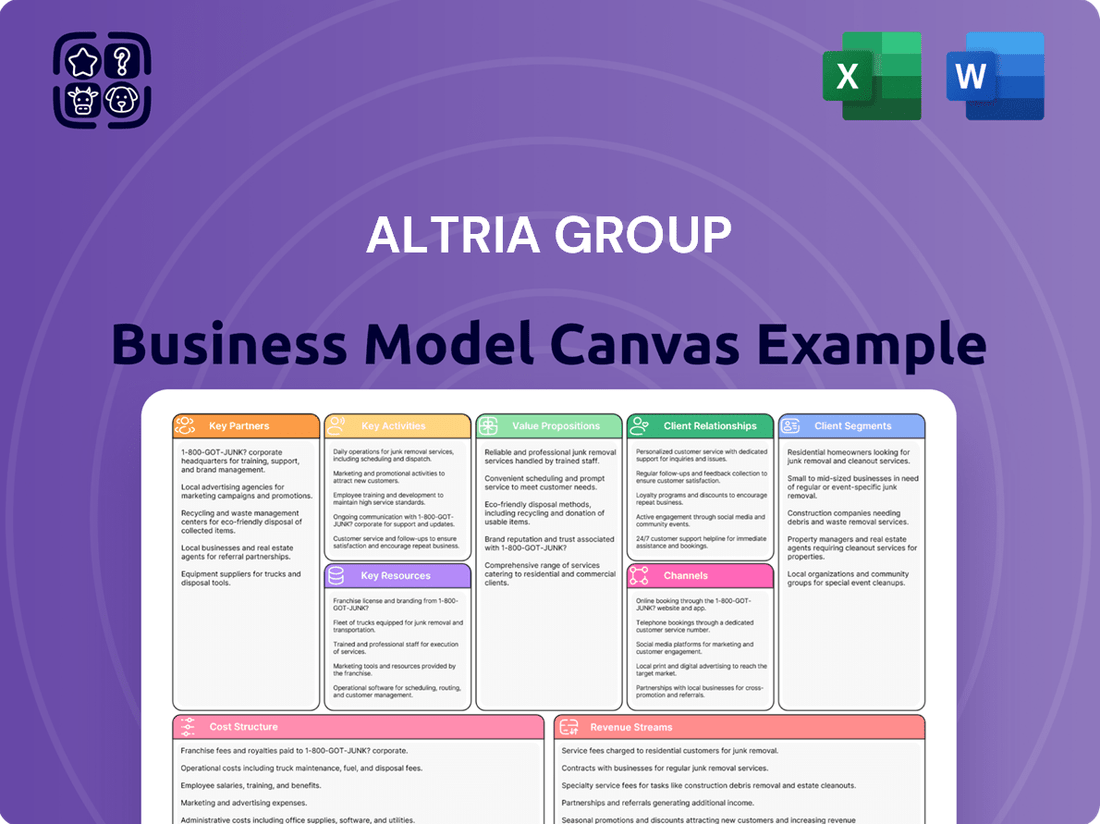

Altria Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

Unlock the strategic blueprint of Altria Group's business model. This comprehensive canvas details their customer segments, value propositions, and key revenue streams, offering a clear view of their market dominance. Gain actionable insights for your own strategic planning.

Dive into the core of Altria Group's operations with our full Business Model Canvas. It dissects their key activities, resources, and partnerships, revealing how they navigate a complex industry. Download now to understand their success drivers.

See how Altria Group builds and delivers value. Our complete Business Model Canvas covers their cost structure, channels, and customer relationships, providing a holistic view. Perfect for analysts and strategists seeking in-depth understanding.

Partnerships

Altria's strategic investments, like its substantial stake in Cronos Group, a Canadian cannabis company, demonstrate a clear move to diversify beyond traditional tobacco. This partnership, initially a significant equity investment, aims to tap into the burgeoning cannabis market, offering Altria exposure to a potentially high-growth sector.

Furthermore, Altria's long-standing investment in Anheuser-Busch InBev (ABI) highlights its strategy to maintain a presence in complementary consumer staples markets. As of early 2024, Altria holds approximately 10% of ABI's outstanding shares, a testament to its commitment to this diversified approach.

Altria's business model hinges on its extensive network of distributors and wholesalers. These partners are vital for ensuring its diverse product portfolio, which includes Marlboro cigarettes, Copenhagen oral tobacco, and potentially its heated tobacco products like IQOS (though distribution specifics for IQOS have evolved), reaches consumers across the entire U.S. This network is the backbone of Altria's market penetration and product availability.

In 2024, Altria continued to leverage this established distribution infrastructure. For instance, its traditional tobacco products are readily available through channels managed by companies like Custom Brands Inc., a wholly-owned subsidiary, and a broad base of independent wholesalers. This ensures that even as the market shifts, Altria's core offerings maintain significant accessibility.

Altria's retail partnerships are crucial for product distribution. These include convenience stores, supermarkets, and dedicated tobacco shops, ensuring adult consumers can easily access Altria's wide range of products. For instance, Altria's 2023 annual report highlights its extensive retail network, which is vital for maintaining market presence and facilitating sales.

Technology and Innovation Collaborators

Altria Group actively partners with technology and innovation collaborators to advance its smoke-free product portfolio. These partnerships are crucial for developing and refining e-vapor and oral nicotine pouch technologies, aligning with Altria's strategy to transition adult smokers to reduced-harm alternatives.

- Technology Providers: Collaborations with companies specializing in advanced materials, battery technology, and heating elements are vital for enhancing the performance and user experience of e-vapor devices.

- Research Institutions: Partnerships with universities and scientific organizations facilitate rigorous research into the long-term health impacts and product efficacy of smoke-free alternatives, ensuring scientific validation.

- Data Analytics Firms: Working with data analytics specialists helps Altria understand consumer behavior, product adoption patterns, and market trends, informing product development and marketing strategies.

- Manufacturing and Engineering Partners: Collaborations with firms possessing expertise in precision manufacturing and product engineering ensure the quality, safety, and scalability of new smoke-free products.

Regulatory Bodies and Industry Associations

Altria's engagement with regulatory bodies, such as the Food and Drug Administration (FDA), is crucial. This partnership allows Altria to advocate for science-based regulations that can shape the future of the tobacco and nicotine industry, particularly focusing on harm reduction strategies. For instance, in 2024, the FDA continued its review of modified risk tobacco product applications, a process Altria actively participates in to support its reduced-risk products.

Participation in industry associations is another vital partnership. These groups provide a platform for Altria to collaborate with peers on common challenges and opportunities. They also serve as a collective voice for advocating for responsible policies, including those aimed at enforcing illicit market regulations, which is a significant concern for the industry. In 2024, these associations remained active in discussions surrounding excise tax policies and product standards.

- FDA Engagement: Altria actively participates in the FDA's regulatory processes for tobacco and nicotine products, aiming to influence the development of science-based regulations.

- Industry Association Collaboration: Partnerships with industry groups enable collective advocacy for responsible policies and market integrity, including efforts against the illicit trade of tobacco products.

- Harm Reduction Advocacy: A key focus of these partnerships is promoting harm reduction initiatives and supporting the regulatory pathways for reduced-risk products.

Altria's key partnerships extend to its significant equity investment in Anheuser-Busch InBev (ABI), holding approximately 10% of outstanding shares as of early 2024, showcasing a strategy for diversification into complementary consumer staples. The company also maintains crucial relationships with technology and innovation collaborators to advance its smoke-free product portfolio, focusing on e-vapor and oral nicotine pouch technologies.

What is included in the product

This Altria Group Business Model Canvas provides a strategic overview of their operations, detailing customer segments, channels, and value propositions.

It reflects real-world operations and plans, organized into 9 classic BMC blocks with narrative and insights for informed decision-making.

Altria's Business Model Canvas acts as a pain point reliever by clearly mapping out its established distribution channels and customer segments, allowing for efficient identification of areas to address declining traditional product demand and explore new market opportunities.

Activities

Altria's manufacturing and production is centered on creating its core products: cigarettes, like the iconic Marlboro, and oral tobacco products, including Copenhagen and the rapidly growing on! nicotine pouches. This involves overseeing extensive manufacturing facilities and intricate global supply chains to ensure consistent product availability and quality.

In 2024, Altria continued to focus on optimizing its manufacturing processes. The company's commitment to quality control is paramount, ensuring that its diverse product portfolio meets stringent standards. This operational efficiency is crucial for maintaining market share and profitability in a competitive landscape.

Altria invests heavily in research and development to create and improve its smoke-free product offerings, such as e-vapor and heated tobacco. This commitment to innovation is key to their strategy of transitioning adult smokers to alternatives with potentially reduced harm.

In 2024, Altria continued to focus its R&D efforts on expanding its smoke-free portfolio. For instance, their investment in heated tobacco technology aims to provide adult smokers with a different experience compared to traditional cigarettes, aligning with their stated goal of harm reduction.

Altria Group's key activities heavily involve robust marketing and sales to promote its well-known brands like Marlboro and introduce innovative products to adult smokers. This includes significant investment in advertising and consumer engagement to maintain brand loyalty and attract new users.

The company also focuses on managing its extensive distribution network throughout the United States. This ensures that Altria's products are readily available in a wide range of retail locations, from convenience stores to supermarkets, maximizing market penetration.

In 2024, Altria continued its strategy of adapting to evolving consumer preferences, including a strong emphasis on reduced-risk products. For instance, their oral tobacco products saw continued growth, reflecting a shift in consumer behavior.

Regulatory Compliance and Advocacy

Altria Group's key activities heavily involve navigating the intricate and ever-changing regulatory environment. This includes meticulous adherence to federal and state laws governing tobacco and nicotine products, a process that demands constant vigilance and adaptation. Their engagement with the Food and Drug Administration (FDA) is a prime example of this ongoing effort.

Beyond mere compliance, Altria actively participates in policy advocacy. The company champions regulations that promote harm reduction strategies within the industry and seeks to counter the proliferation of illicit product markets. This advocacy aims to shape a more favorable operating landscape.

- Regulatory Navigation: Ensuring adherence to federal and state regulations, including those from the FDA, is a core operational function.

- Policy Advocacy: Actively engaging with policymakers to support harm reduction initiatives and combat illegal product sales.

- Compliance Investment: Significant resources are allocated to legal and compliance teams to manage the complex regulatory framework.

- Market Shaping: Advocating for policies that create a predictable and supportive environment for regulated product categories.

Shareholder Value Creation

Altria Group's key activity of shareholder value creation is primarily demonstrated through its robust dividend policy and strategic share repurchases. This focus aims to deliver consistent returns and bolster investor confidence.

The company has a long-standing history of increasing its dividend, reflecting its commitment to returning capital to its owners. For instance, in 2024, Altria continued its practice of providing substantial cash returns to shareholders.

- Dividend Payments: Altria consistently aims to return a significant portion of its earnings to shareholders via dividends.

- Share Repurchases: The company actively engages in share repurchase programs to reduce the number of outstanding shares, thereby increasing earnings per share.

- Financial Strength: These activities are supported by Altria's strong cash flow generation from its core businesses.

Altria's manufacturing and production focus on its core cigarette brands like Marlboro and oral tobacco products such as on! nicotine pouches, requiring oversight of extensive facilities and global supply chains. In 2024, the company emphasized optimizing these processes and maintaining stringent quality control to ensure product consistency and market competitiveness.

Research and development is a critical activity, particularly for expanding smoke-free offerings like heated tobacco products, with investments in 2024 aimed at providing alternatives to traditional cigarettes and supporting harm reduction goals.

Marketing and sales efforts concentrate on promoting established brands and introducing new products, supported by a robust distribution network across the United States to ensure broad product availability. In 2024, this included a continued emphasis on growing oral tobacco products in response to shifting consumer preferences.

Navigating complex regulatory environments, including FDA oversight, is a paramount activity, with significant investment in legal and compliance teams. Altria also engages in policy advocacy to support harm reduction and combat illicit markets, aiming to shape a more favorable operating landscape.

Shareholder value creation is a key activity, primarily through a consistent dividend policy and strategic share repurchases, reflecting a commitment to returning capital. In 2024, Altria continued its practice of substantial cash returns to shareholders, supported by strong cash flow generation.

Full Version Awaits

Business Model Canvas

The Altria Group Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited analysis of Altria's business strategy, ready for your immediate use. You can trust that the detailed breakdown of their customer segments, value propositions, channels, revenue streams, and key resources is precisely what you'll get, ensuring no surprises and full transparency.

Resources

Altria's strong brand portfolio, anchored by Marlboro, is a core asset. Marlboro alone held a substantial share of the U.S. cigarette market in 2024, demonstrating its enduring consumer loyalty and pricing power. This brand equity translates into predictable and robust revenue streams, a critical component of Altria's business model.

Altria's extensive manufacturing and distribution infrastructure is a cornerstone of its business model, ensuring efficient production and broad market reach for its products across the United States. This robust network includes numerous manufacturing facilities, allowing for scaled production and quality control.

The company's sophisticated distribution system ensures its diverse product portfolio, including Marlboro cigarettes and heated tobacco products, reaches consumers effectively. In 2024, Altria continued to leverage this infrastructure to manage its supply chain and meet demand, a critical element for maintaining its market share in a dynamic industry.

Altria's intellectual property is a cornerstone of its business, featuring a robust portfolio of patents and proprietary technologies. These innovations are particularly concentrated in its smoke-free product categories, including the NJOY e-vapor brand and on! oral nicotine pouches. This focus on intellectual property safeguards its market position and fuels future growth.

The company's commitment to research and development is evident in its continuous investment, which is crucial for maintaining a competitive edge. In 2024, Altria continued to allocate significant resources to R&D, aiming to expand its smoke-free offerings and explore new product categories. This ongoing innovation pipeline is designed to meet evolving consumer preferences and regulatory landscapes.

Financial Capital and Investments

Altria Group leverages significant financial capital, including substantial cash reserves and strategic equity stakes, to fuel its business operations and growth initiatives. As of the first quarter of 2024, Altria reported approximately $2.1 billion in cash and cash equivalents, providing ample liquidity. This financial strength enables continued investment in research and development for reduced-risk products, supports ongoing operations, and facilitates shareholder returns through dividends and share repurchases.

The company’s investment portfolio is a key component of its financial capital, offering both diversification and potential income generation. Altria holds a notable stake in Anheuser-Busch InBev, a significant beverage company, and has also invested in the cannabis sector through its holding in Cronos Group. These investments, while subject to market fluctuations, contribute to Altria's financial flexibility and provide avenues for future growth beyond its core tobacco business.

- Cash Reserves: Approximately $2.1 billion in cash and cash equivalents reported as of Q1 2024, ensuring operational and strategic flexibility.

- Strategic Investments: Holdings in Anheuser-Busch InBev and Cronos Group provide diversified income streams and potential for capital appreciation.

- Shareholder Returns: Financial capital supports consistent dividend payments and share repurchase programs, enhancing shareholder value.

- R&D Funding: Significant allocation of capital towards the development and commercialization of reduced-risk products, aligning with evolving market trends.

Human Capital and Expertise

Altria's human capital is a foundational element, encompassing a deep bench of talent in critical areas. This includes seasoned professionals in product innovation, brand stewardship, navigating complex regulatory landscapes, and optimizing intricate supply chains. Their combined expertise is the engine behind Altria's capacity for developing new products, ensuring smooth operations, and effectively managing the multifaceted challenges inherent in the tobacco and nicotine industries.

The company's workforce is a significant driver of its strategic execution and market adaptability. For instance, in 2024, Altria continued to invest in its talent pool, recognizing that specialized knowledge in areas like reduced-risk products (RRPs) and emerging consumer preferences is paramount. This focus on expertise allows Altria to respond proactively to evolving consumer demands and regulatory shifts.

- Product Development & Innovation: Expertise in chemistry, engineering, and consumer science is key to developing next-generation nicotine products.

- Marketing & Brand Management: Skilled professionals are essential for building and maintaining strong brand equity in a highly regulated environment.

- Regulatory Affairs: Deep understanding of national and international regulations is critical for compliance and market access.

- Supply Chain & Operations: Efficiency and expertise in managing complex global supply chains ensure product availability and cost-effectiveness.

Altria's key resources are its strong brand portfolio, particularly Marlboro, its extensive manufacturing and distribution network, its intellectual property in smoke-free products like NJOY and on!, its significant financial capital including substantial cash reserves and strategic investments, and its skilled human capital. These elements collectively enable Altria to maintain market leadership, innovate in reduced-risk products, and adapt to evolving consumer preferences and regulatory environments.

Value Propositions

For adult smokers who prefer traditional combustible tobacco, Altria provides trusted and satisfying products. Brands like Marlboro, a cornerstone of their portfolio, offer a consistent and high-quality experience that resonates with a loyal consumer base.

The enduring appeal of these established brands highlights their significant perceived value. In 2023, Marlboro cigarettes alone contributed approximately $23 billion in net revenue for Altria, demonstrating the substantial financial strength derived from these traditional offerings.

Altria offers adult nicotine consumers a portfolio of potentially reduced-harm alternatives to traditional cigarettes, including its on! nicotine pouches and NJOY e-vapor products. This directly caters to a growing segment of consumers actively seeking to reduce their exposure to the risks associated with smoking.

By providing these innovative options, Altria aligns with evolving consumer preferences and contributes to public health goals by offering pathways for smokers to transition away from combustible cigarettes. For instance, in the first quarter of 2024, on! nicotine pouches saw a significant increase in market share, reflecting strong consumer adoption of these alternatives.

Altria Group's commitment to consistent shareholder returns is a cornerstone of its value proposition. For investors, this translates into a reliable income stream, primarily through its robust dividend payouts. For instance, in 2023, Altria returned approximately $7.3 billion to shareholders through dividends and share repurchases, demonstrating a sustained focus on rewarding its investors.

Product Choice and Innovation for Adult Consumers

Altria Group's value proposition centers on providing adult consumers with a wide array of choices, spanning traditional tobacco products to next-generation, smoke-free alternatives. This strategy is designed to cater to evolving consumer preferences and market dynamics.

The company actively invests in innovation to develop products that may reduce harm compared to traditional cigarettes, aiming to meet the demand for potentially less risky options. This focus on product development is crucial for long-term market positioning.

- Product Diversity: Altria offers traditional cigarettes, smokeless tobacco, cigars, and oral nicotine pouches, alongside its investments in heated tobacco and e-vapor categories.

- Innovation Pipeline: Significant R&D is directed towards smoke-free products, aiming to capture future market share as regulations and consumer behavior shift.

- Consumer Preference Alignment: The portfolio is curated to address varying adult consumer needs, from established habits to the exploration of new nicotine delivery systems.

Advocacy for Responsible Regulation

Altria actively supports comprehensive regulation within the tobacco industry. This commitment is rooted in a desire to foster harm reduction strategies and effectively prevent underage access to tobacco products. This proactive stance on regulation demonstrates a dedication to responsible product stewardship and building consumer trust.

By engaging in the development of regulatory frameworks, Altria aims to create a more stable and predictable operating environment. This approach acknowledges the evolving landscape of tobacco and nicotine products, seeking to balance consumer choice with public health objectives. For instance, in 2024, discussions around the regulation of reduced-risk products continued to be a significant focus for the industry and policymakers alike.

- Advocacy for Responsible Regulation: Altria champions a fully regulated tobacco industry focused on harm reduction and preventing youth access.

- Sustainable Operating Environment: This engagement seeks to build trust and ensure a stable future for tobacco product sales and development.

- Public Health Contribution: Altria's regulatory advocacy aims to contribute positively to public health outcomes.

Altria offers adult smokers a wide range of choices, from traditional, trusted brands like Marlboro, which generated approximately $23 billion in net revenue in 2023, to innovative, potentially reduced-harm alternatives such as on! nicotine pouches and NJOY e-vapor products.

The company is committed to delivering consistent shareholder returns, a value proposition demonstrated by its substantial dividend payouts. In 2023 alone, Altria returned about $7.3 billion to shareholders through dividends and share repurchases.

Altria actively engages in advocating for comprehensive and responsible regulation within the tobacco industry. This approach aims to foster harm reduction strategies and prevent underage access, contributing to public health goals and a more stable operating environment.

Customer Relationships

Altria cultivates deep brand loyalty for its traditional tobacco products, a cornerstone of its customer relationships. This is particularly evident with Marlboro, an iconic brand that benefits from decades of consistent quality and a rich heritage, fostering a strong sense of trust among its consumers and reinforcing established consumption patterns.

Altria is committed to educating adult smokers about its smoke-free products, like heated tobacco and oral nicotine pouches, emphasizing their potential for reduced harm compared to traditional cigarettes. This consumer education is crucial for facilitating a successful transition away from combustible products.

The company provides accessible information on harm reduction options, aiming to empower smokers with knowledge to make informed choices. In 2024, Altria continued to invest in marketing and educational initiatives to support this transition, recognizing the importance of consumer understanding in driving adoption of its smoke-free portfolio.

Altria Group cultivates strong investor relationships through transparent financial reporting, including detailed quarterly and annual filings. In 2024, the company continued its practice of consistent dividend payouts, a cornerstone of its investor relations strategy, aiming to deliver reliable returns to its shareholders.

Regular earnings calls and investor conferences serve as crucial platforms for direct communication, allowing management to discuss performance, strategic initiatives, and market outlook. This ongoing dialogue is vital for building and maintaining investor confidence in Altria's long-term value proposition.

Retailer and Distributor Support

Altria Group cultivates robust relationships with its retail and wholesale partners through dedicated sales support and comprehensive marketing materials. This focus ensures their products receive prominent shelf placement and consistent availability, which is vital for driving consumer purchases. For instance, in 2024, Altria continued to invest in trade programs designed to strengthen these crucial distribution channels.

Efficient supply chain management is a cornerstone of Altria's retailer and distributor support. By ensuring timely and reliable delivery, they help partners minimize stockouts and manage inventory effectively. This operational excellence underpins the trust and reliability essential for long-term partnerships.

- Sales Support: Providing dedicated sales teams to assist retailers with product placement and promotional strategies.

- Marketing Materials: Supplying point-of-sale displays, advertising collateral, and digital assets to drive consumer demand.

- Supply Chain Efficiency: Ensuring consistent product availability through optimized logistics and inventory management.

- Partnership Development: Fostering collaborative relationships to meet evolving market needs and retail demands.

Regulatory Engagement and Dialogue

Altria actively engages with government and regulatory bodies, fostering dialogue to shape responsible industry practices. This proactive approach ensures compliance with evolving regulations and advocates for science-based policies, aiming for a constructive and collaborative relationship with regulators.

- Regulatory Dialogue: Altria maintains ongoing communication with federal, state, and local government officials and regulatory agencies.

- Policy Advocacy: The company advocates for policies that are grounded in scientific evidence and promote responsible product development and marketing.

- Compliance Focus: Altria prioritizes adherence to all applicable laws and regulations, adapting to changes in the regulatory landscape.

- Industry Shaping: Through engagement, Altria seeks to contribute to a well-regulated environment that balances consumer safety with business viability.

Altria's customer relationships are built on a foundation of brand loyalty for traditional products, exemplified by Marlboro's enduring appeal. The company also focuses on educating adult smokers about reduced-harm alternatives, a key strategy for transitioning consumers. In 2024, significant investments were made in marketing and educational initiatives to support this shift.

Channels

Altria’s extensive retail network is a cornerstone of its distribution strategy, encompassing over 200,000 retail locations across the United States. This vast footprint includes convenience stores, grocery stores, and mass merchandisers, ensuring its products, from traditional cigarettes to newer oral nicotine pouches, are readily available to adult consumers. In 2024, this network remained critical for maintaining market share and introducing new product categories.

Altria Group relies heavily on a vast network of wholesale distributors to get its products, like Marlboro cigarettes and oral nicotine pouches, into the hands of consumers. These partners are the backbone of its distribution strategy, ensuring efficient product flow from production to thousands of retail locations across the United States.

In 2024, Altria’s success in reaching consumers is directly tied to the effectiveness of these wholesale relationships. For instance, Altria’s 2023 annual report highlighted that its traditional tobacco business, while facing volume declines, still generated substantial revenue, underscoring the ongoing importance of a robust distribution system. These distributors manage inventory, logistics, and sales to a diverse range of retailers, from large convenience store chains to smaller independent shops.

Altria leverages its official websites and digital platforms primarily for investor relations, showcasing corporate responsibility efforts, and disseminating information on its product portfolio and harm reduction advancements. While direct-to-consumer sales for tobacco products face stringent regulations, these online channels serve as crucial touchpoints for stakeholders and public engagement.

Marketing and Advertising Campaigns

Altria leverages a diverse range of marketing and advertising channels, always operating within strict regulatory frameworks, to connect with adult consumers about its brands and product offerings. These efforts are designed to inform and engage, focusing on responsible communication.

- In-Store Promotions: These are crucial for brand visibility at the point of sale, influencing consumer choice directly.

- Digital Advertising: Targeted online campaigns reach specific adult demographics, providing product information and brand messaging.

- New Product Launches: Dedicated campaigns introduce innovations and educate consumers on new product features and benefits.

- Brand Building: Consistent messaging across channels reinforces brand identity and consumer loyalty.

Investor Relations Portals and Events

Altria Group maintains dedicated investor relations portals on its corporate website, offering a centralized hub for financial reports, SEC filings, and corporate governance information. These portals are crucial for providing transparency and accessibility to a wide range of stakeholders.

The company actively engages with investors and financial analysts through various events. These include quarterly earnings calls, where management discusses financial performance and outlook, and annual shareholder meetings, providing a forum for direct interaction and voting on key corporate matters.

- Investor Relations Website: Altria's IR site is a primary channel for detailed financial information and company news.

- Quarterly Earnings Calls: These events allow for real-time discussion of financial results and strategic initiatives, with transcripts often made available.

- Annual Shareholder Meetings: These meetings provide a platform for shareholders to engage with leadership and vote on important company decisions.

Altria's channel strategy is built on a massive retail presence, exceeding 200,000 locations nationwide, ensuring product accessibility. This is supported by a robust network of wholesale distributors who manage logistics and inventory flow to diverse retailers. Digital platforms primarily serve investor relations and corporate messaging, while targeted marketing efforts reach adult consumers within regulatory limits.

| Channel Type | Key Characteristics | 2024 Focus/Impact |

| Retail Network | Over 200,000 U.S. locations (convenience stores, grocery, mass merchandisers) | Market share maintenance, new product introduction |

| Wholesale Distributors | Backbone of product flow, inventory and logistics management | Efficient product delivery to retailers, supporting revenue generation |

| Digital Platforms (Websites) | Investor relations, corporate responsibility, product portfolio information | Stakeholder engagement, public information dissemination |

| Marketing & Advertising | Targeted campaigns, in-store promotions, new product launches | Brand visibility, consumer education, brand loyalty |

Customer Segments

Altria’s core customer segment comprises adult smokers, aged 21 and above, who are loyal to premium combustible cigarette brands like Marlboro. This group also includes adult cigar smokers. Despite a declining trend, this segment remains a crucial revenue driver for the company.

In 2023, Altria reported that its cigarette shipment volume decreased by 8.1%, reflecting the ongoing challenges within this market. However, the company’s premium cigarette brands, particularly Marlboro, continue to hold a significant market share, demonstrating the enduring loyalty of this customer base.

Altria's adult oral tobacco users segment primarily encompasses consumers of well-established moist smokeless tobacco brands like Copenhagen and Skoal. This core group represents a significant portion of Altria's revenue, with the smokeless tobacco category consistently demonstrating resilience.

More recently, this segment has expanded to include users of oral nicotine pouches, with Altria's on! brand showing notable growth. In 2023, the oral nicotine pouch category experienced substantial expansion, and on! has been a key player in capturing this evolving consumer preference for convenient and discreet nicotine alternatives.

This segment represents adult smokers actively seeking alternatives to traditional cigarettes, driven by a desire for reduced harm. Altria's NJOY e-vapor brand, for example, is positioned to capture this growing interest, with the e-cigarette market projected to reach over $100 billion globally by 2027.

Altria's strategy directly addresses this evolving consumer preference. In 2024, the company continued to invest in its reduced-harm product portfolio, aiming to capture a significant share of this expanding market as more consumers explore options beyond combustible cigarettes.

Investors and Shareholders

Investors and shareholders are a vital customer segment for Altria Group. They are primarily focused on the company's financial health, including its profitability and ability to generate consistent dividend income. For instance, Altria has a long history of increasing its dividend, a key attraction for income-focused investors.

These stakeholders closely monitor Altria's strategic decisions, particularly those related to its diversification efforts beyond traditional tobacco products. They seek transparency regarding the company's market position and its plans for long-term value creation in a changing regulatory landscape.

- Financial Performance: Investors evaluate Altria's revenue, earnings per share (EPS), and cash flow generation.

- Dividend Payouts: The company's dividend yield and history of increases are critical factors for many shareholders. As of the first quarter of 2024, Altria reported a dividend yield that remains attractive to income investors.

- Strategic Direction: Shareholders are interested in Altria's investments in reduced-risk products and its overall market strategy.

- Long-Term Value: The segment looks for evidence of sustainable growth and capital appreciation over time.

Regulatory Bodies and Public Health Organizations

Regulatory bodies and public health organizations represent a crucial, albeit indirect, customer segment for Altria. Their influence is paramount, shaping the operational landscape and future product innovation through policy and guidelines. For instance, the U.S. Food and Drug Administration (FDA) plays a significant role in approving new tobacco and nicotine products, impacting market access and development timelines.

Altria actively engages with these entities, seeking to foster collaborations centered on harm reduction strategies. This engagement is vital for navigating evolving public health concerns and regulatory frameworks. In 2024, the ongoing dialogue around reduced-risk products continues to be a focal point, with regulators scrutinizing scientific evidence and marketing claims.

- FDA Oversight: The FDA's authority over tobacco product manufacturing, marketing, and labeling directly impacts Altria's product portfolio and strategy.

- Harm Reduction Dialogue: Altria's commitment to harm reduction involves discussions with public health bodies regarding the potential benefits and risks of alternative nicotine delivery systems.

- Policy Impact: Regulations concerning marketing, flavor bans, and nicotine levels, as seen in various state and federal initiatives throughout 2024, significantly influence Altria's market approach.

Altria's primary customer base remains adult smokers, particularly those loyal to premium combustible brands like Marlboro, alongside adult cigar users. This segment, though facing volume declines, continues to be a significant revenue contributor, with premium brands maintaining strong market share.

A growing segment includes adult oral tobacco users, embracing both traditional moist products like Copenhagen and newer oral nicotine pouches such as Altria's on! brand. This category demonstrates resilience and captures evolving consumer preferences for convenient nicotine alternatives.

Furthermore, Altria targets adult smokers seeking reduced-harm alternatives, exemplified by its NJOY e-vapor brand, aligning with a market projected for substantial global growth as consumers explore options beyond traditional cigarettes.

Cost Structure

Altria Group's cost of goods sold primarily encompasses the direct expenses tied to producing its tobacco and nicotine items. This includes the cost of raw materials like tobacco leaf and filters, along with packaging materials and the direct labor involved in manufacturing. For instance, in 2023, Altria reported $19.7 billion in cost of goods sold, reflecting these direct production outlays.

A substantial portion of Altria's cost of sales is also made up of excise taxes, which are levied on tobacco and nicotine products. These taxes are a significant factor impacting the final price and profitability of their offerings. The company's commitment to managing these direct costs and taxes is crucial for maintaining its competitive position in the market.

Altria's cost structure includes substantial spending on marketing, administration, and research. These expenses are vital for advertising campaigns, sales force operations, general overhead, and crucial R&D for new product development. For instance, in 2023, Altria reported selling, general, and administrative expenses of $2.3 billion, reflecting the breadth of these operational costs.

The company's 'Optimize & Accelerate' strategy specifically targets these areas to achieve cost efficiencies and streamline operations. This initiative is designed to reduce expenditures across marketing, administration, and R&D without compromising their effectiveness in driving growth and innovation.

Altria Group's cost structure is heavily impacted by excise taxes on tobacco products, which vary significantly across federal, state, and local levels. For instance, in 2024, federal excise taxes on cigarettes remain a substantial component, alongside state-specific taxes that can add considerably to the final price and Altria's cost of goods sold.

Beyond direct taxation, Altria incurs significant expenses related to regulatory compliance. This includes costs for product labeling, marketing restrictions, and adherence to evolving public health mandates. These ongoing efforts to meet stringent government regulations are a continuous drain on resources.

Furthermore, the company faces substantial costs stemming from ongoing litigation and potential future legal settlements. Historically, these have been a major factor in Altria's financial performance, and managing these liabilities requires significant investment in legal defense and risk mitigation strategies.

Investment in Smoke-Free Product Development

Altria Group's commitment to smoke-free innovation involves substantial financial outlay. In 2023, the company reported significant investments in its smoke-free portfolio, reflecting a strategic pivot. This includes funding for research and development, product enhancements, and the operational costs associated with bringing new offerings to market.

The company's 2024 strategy continues to emphasize this shift, with capital allocation directed towards expanding its presence in categories like oral nicotine pouches and e-vapor. This investment is vital for future revenue streams and maintaining market share in a rapidly evolving industry.

- Research & Development: Funds allocated to scientific research, product testing, and innovation in next-generation smoke-free alternatives.

- Product Commercialization: Costs associated with manufacturing, marketing, and distribution of new smoke-free products like NJOY and on!.

- Regulatory Compliance: Investments in navigating and adhering to evolving regulatory frameworks for smoke-free products.

- Market Expansion: Capital deployed to increase market penetration and consumer adoption of existing and pipeline smoke-free offerings.

Shareholder Return Programs

Altria's shareholder return programs, encompassing dividends and share repurchases, are a significant financial commitment. In 2024, the company continued its long-standing practice of returning capital to shareholders. For instance, Altria paid quarterly dividends, with the annualized dividend rate per share being a key metric for investors.

The financial outlay for these programs is substantial, impacting Altria's overall cost of capital and requiring careful financial planning. This strategy aims to enhance shareholder value and is a cornerstone of its investor relations approach.

- Dividend Payouts: Altria consistently pays a significant dividend, a key component of its shareholder return strategy.

- Share Repurchases: The company also engages in share repurchase programs, reducing the number of outstanding shares and potentially boosting earnings per share.

- Financial Strategy Impact: These programs represent a substantial capital outflow, influencing Altria's financial planning and cost of capital.

- Shareholder Value Focus: The commitment to shareholder returns is a core element of Altria's business model, designed to attract and retain investors.

Altria's cost structure is multifaceted, encompassing direct production expenses, significant tax burdens, and substantial investments in marketing, administration, and innovation. The company's strategic focus on smoke-free products also drives considerable R&D and commercialization costs, alongside ongoing efforts in regulatory compliance and litigation management.

Key cost drivers include the cost of goods sold, which in 2023 stood at $19.7 billion, reflecting raw materials and direct labor. Excise taxes are a major component, with federal taxes on cigarettes remaining a significant factor in 2024. Selling, general, and administrative expenses were $2.3 billion in 2023, highlighting operational overhead.

| Cost Category | 2023 Value (USD Billions) | Key Components |

| Cost of Goods Sold | 19.7 | Tobacco, filters, packaging, direct labor |

| Selling, General & Administrative | 2.3 | Marketing, sales force, overhead, R&D |

| Excise Taxes | Significant Variable | Federal and state taxes on tobacco/nicotine products |

| Smoke-Free Investments | Substantial | R&D, product development, market expansion |

Revenue Streams

Altria's core revenue generation hinges on the sale of smokeable products, with its flagship Marlboro cigarettes leading the charge. This segment also includes popular cigar brands such as Black & Mild, which contribute significantly to the company's top line.

Despite a consistent decline in cigarette volumes, Altria has demonstrated remarkable pricing power. This ability to raise prices allows the company to maintain and even grow revenue from its combustible tobacco offerings, offsetting the impact of lower unit sales.

In 2023, Altria's net revenue from smokeable products was approximately $19.7 billion. While this represents a slight decrease from previous years, the segment remains the dominant revenue driver for the company.

Altria Group's revenue from oral tobacco products is primarily driven by sales of its established moist smokeless tobacco brands, Copenhagen and Skoal. These legacy products continue to be a significant revenue source for the company.

A key growth area is the burgeoning oral nicotine pouch market, spearheaded by the on! brand. This segment is experiencing rapid expansion and is increasingly contributing a substantial portion to Altria's overall revenue, reflecting a strategic shift towards newer product categories.

Altria Group's revenue streams include the sale of heated tobacco products and e-vapor offerings, notably NJOY. This segment is a key focus for the company, aiming to shift adult smokers towards smoke-free alternatives.

Despite challenges posed by the prevalence of illicit e-vapor products, Altria is committed to growing its presence in this category. For instance, in the first quarter of 2024, Altria reported that NJOY's retail market share in the U.S. vapor category reached 2.4%, demonstrating early traction.

Income from Equity Investments

Altria Group generates significant income from its substantial equity investments, notably its holdings in Anheuser-Busch InBev (ABI) and Cronos Group. These investments offer crucial diversified income streams, supplementing revenue from its primary tobacco and nicotine product segments.

In 2024, Altria's financial performance continues to be influenced by these strategic equity stakes. The income derived from these investments can fluctuate based on the performance of the underlying companies and broader market conditions.

- Anheuser-Busch InBev (ABI): Altria holds a significant stake in ABI, a global leader in the beverage industry, contributing dividend income and potential capital appreciation.

- Cronos Group: Altria's investment in Cronos Group, a cannabis company, represents a strategic play in a developing market, with income potential tied to the growth and regulatory landscape of the cannabis sector.

- Diversification Benefits: These equity investments provide Altria with a degree of financial resilience, reducing its sole reliance on traditional tobacco and nicotine product sales.

Strategic Pricing Adjustments

Altria Group strategically adjusts pricing across its diverse product lines, especially within its foundational smokeable products segment. This approach is crucial for counteracting the ongoing decline in cigarette volumes, ensuring revenue stability.

The company's pricing power is a significant driver of its sustained profitability, allowing it to manage the transition to reduced-risk products effectively.

- Pricing Power: Altria demonstrated significant pricing power in 2023, implementing price increases that contributed to revenue growth despite volume declines.

- Revenue Contribution: Smokeable products, even with falling volumes, remain a substantial revenue contributor due to these strategic pricing actions.

- Profitability Maintenance: These price adjustments are key to maintaining healthy profit margins, supporting investments in innovation and future growth areas.

Altria’s revenue streams are diverse, with smokeable products, including Marlboro and Black & Mild, forming the bedrock. Despite declining cigarette volumes, the company leverages strong pricing power to maintain revenue from this segment. For instance, in 2023, smokeable products generated approximately $19.7 billion in net revenue.

Growth is also evident in oral nicotine pouches, with the on! brand showing rapid expansion and becoming an increasingly significant revenue contributor. Heated tobacco and e-vapor products, such as NJOY, represent strategic efforts to transition consumers to smoke-free alternatives, with NJOY capturing 2.4% of the U.S. vapor retail market share in Q1 2024.

Furthermore, Altria benefits from substantial income generated through its equity investments, particularly in Anheuser-Busch InBev and Cronos Group. These investments provide crucial diversification and supplementary income, enhancing financial resilience beyond its core tobacco and nicotine offerings.

| Revenue Segment | Key Products/Brands | 2023 Net Revenue (Approx.) | Key Growth Drivers |

|---|---|---|---|

| Smokeable Products | Marlboro, Black & Mild | $19.7 billion | Pricing power, brand loyalty |

| Oral Tobacco | Copenhagen, Skoal | N/A (Significant contributor) | Legacy brand strength |

| Oral Nicotine Pouches | on! | N/A (Rapidly growing) | Market expansion, consumer shift |

| Heated Tobacco & E-Vapor | NJOY | N/A (Emerging) | Transition to smoke-free, market share growth |

| Equity Investments | Anheuser-Busch InBev, Cronos Group | Varies (Dividend & Capital Appreciation) | Strategic holdings, market performance |

Business Model Canvas Data Sources

The Altria Group Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research reports on consumer behavior and industry trends, and strategic analyses of competitive landscapes. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and strategic direction.