Altria Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

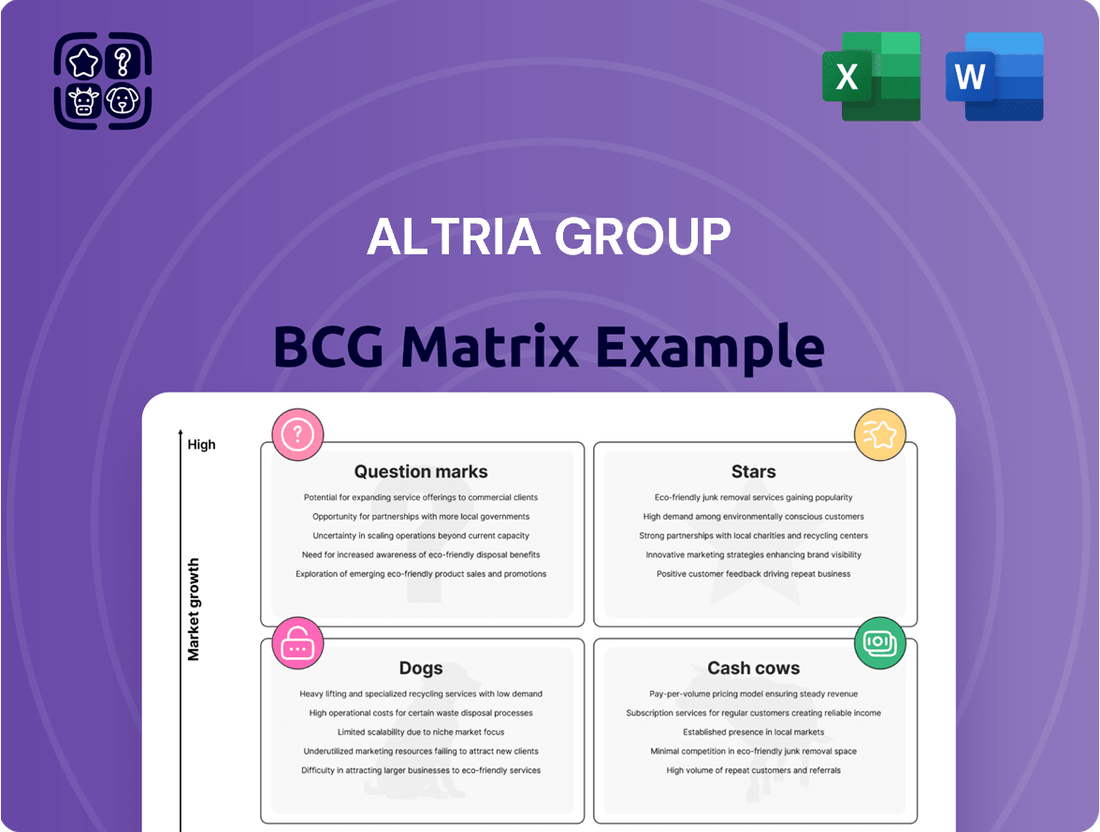

Curious about Altria Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed investment decisions and optimize your strategy.

Don't miss out on the actionable insights and detailed quadrant breakdowns that will guide your path to market leadership. Invest in the full BCG Matrix today and transform your strategic planning.

Stars

Altria's on! nicotine pouches are a shining example of a 'Star' in the BCG matrix, thriving in a U.S. nicotine pouch market that saw an impressive 40% expansion in 2024.

The brand's trajectory is exceptionally strong, with shipment volumes experiencing a significant 26.5% year-over-year increase by Q2 2025.

Despite facing robust competition, on! has carved out a notable 8.7% retail share within the U.S. oral tobacco category as of Q2 2025, consistently contributing to the growth of Altria's oral tobacco segment.

Altria is making a significant strategic push into oral nicotine products, especially nicotine pouches, viewing them as a key engine for future expansion and its shift towards a smoke-free environment. This concentrated effort is designed to solidify Altria's leading position in a rapidly expanding market, moving away from its reliance on traditional cigarettes.

The oral tobacco products segment has demonstrated robust financial performance, with its operating companies income (OCI) surging to $931 million in the first half of 2025. This substantial increase highlights the segment's growing importance and profitability within Altria's overall business strategy.

Altria's Emerging Smoke-Free Portfolio represents its strategic pivot towards a future less reliant on traditional tobacco. This segment is crucial for its long-term growth, aiming to capture market share as consumer preferences shift. The company is actively investing in this area, expecting it to become a significant driver of revenue and profitability.

The company's vision, 'Moving Beyond Smoking,' underpins its development of a robust pipeline of smoke-free alternatives. This strategy is designed to secure a high-growth, high-share position in evolving markets. By catering to adult consumers seeking alternatives, Altria aims to preemptively address changing regulations and consumer demands.

Altria's financial projections for 2025 highlight substantial investments allocated to bolstering this smoke-free portfolio. These capital expenditures are intended to accelerate product development, market penetration, and consumer adoption of its innovative offerings. The company anticipates these investments will yield significant returns as the smoke-free category matures.

Innovation in Harm-Reduced Products

Altria Group is heavily invested in developing and marketing harm-reduced products, a strategic pivot aimed at transitioning adult smokers to potentially less harmful alternatives. This commitment drives significant innovation in product development, seeking to capture evolving consumer preferences.

The success of these innovative products, such as heated tobacco and oral nicotine pouches, could propel them to 'Star' status within the BCG matrix by securing substantial market share. Altria’s objective is to broaden the range of nicotine product choices available to adult consumers within a well-regulated framework.

- Market Share Growth: Altria's oral nicotine pouch brand, *on!*, has shown rapid growth, capturing approximately 17% of the U.S. oral nicotine pouch market by the end of 2023, indicating strong potential for 'Star' status.

- Investment in Innovation: The company has committed billions to developing its portfolio of reduced-risk products, including its stake in heated tobacco technology, underscoring its dedication to this category.

- Regulatory Environment: Altria actively engages with regulators to shape a path for regulated, reduced-risk products, aiming to provide adult smokers with clearer, safer options.

Expansion within Oral Tobacco Category

Altria is actively pursuing expansion within the oral tobacco category, aiming to leverage the significant growth observed in this segment. Beyond the strong performance of its 'on!' brand, the company is focused on increasing its overall market share in U.S. oral tobacco. This strategic push indicates a pipeline of new products or variants designed to capitalize on the market's upward trend.

The U.S. nicotine pouch category, a key driver of oral tobacco growth, reached 52.0% of the total U.S. oral tobacco market by Q2 2025. This substantial penetration highlights the category's momentum and Altria's opportunity to introduce and scale additional offerings.

- Market Share Growth: Altria seeks to broaden its dominance beyond the 'on!' brand within the expanding U.S. oral tobacco market.

- Product Development: The company is likely developing or scaling other oral tobacco products and new variants to capture further market share.

- Category Dominance: With nicotine pouches comprising 52.0% of the U.S. oral tobacco market as of Q2 2025, Altria is positioned to benefit from this segment's rapid expansion.

- Future Stars: These new or scaled products have the potential to become additional Stars within Altria's portfolio as the market continues its robust growth.

Altria's 'on!' nicotine pouches are a clear 'Star' in the BCG matrix, dominating a U.S. nicotine pouch market that expanded by 40% in 2024.

The brand's shipment volumes saw a substantial 26.5% year-over-year increase by Q2 2025, solidifying its strong market position.

With an 8.7% retail share in the U.S. oral tobacco category as of Q2 2025, 'on!' significantly contributes to Altria's oral tobacco segment growth.

Altria's strategic focus on oral nicotine products, particularly nicotine pouches, positions them as a key growth engine for the company's transition to a smoke-free future.

| Product Category | Market Growth (2024) | Market Share (Q2 2025) | Volume Growth (YoY, Q2 2025) | Altria's Position |

|---|---|---|---|---|

| U.S. Nicotine Pouches | 40% | N/A | N/A | Leading |

| 'on!' Nicotine Pouches | N/A | 8.7% (U.S. Oral Tobacco Category) | 26.5% | Star |

| U.S. Oral Tobacco Market | N/A | 52.0% (Nicotine Pouches Penetration) | N/A | Growing |

What is included in the product

Altria's BCG Matrix analysis categorizes its diverse portfolio, highlighting opportunities for growth and areas for divestment.

The Altria Group BCG Matrix provides a clear, one-page overview of its business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Marlboro, Altria's leading cigarette brand, functions as a classic Cash Cow within the BCG Matrix. In 2024, it commanded an impressive 42% share of the U.S. cigarette market, a position it largely maintained with a 41.0% share in Q2 2025.

Even with an industry-wide decline in cigarette volumes, estimated at 8.5% in Q2 2025, Marlboro consistently delivers significant operating income. This resilience is largely due to its strong foothold in the premium segment of the market.

The smokeable products segment, heavily influenced by Marlboro's performance, generated a substantial adjusted operating companies income (OCI) of $2.95 billion in Q2 2025, underscoring its role as a reliable profit generator for Altria.

Copenhagen, a cornerstone of Altria's portfolio, operates as a classic Cash Cow within the U.S. smokeless tobacco market. Despite a general softening in the moist smokeless tobacco (MST) category, Copenhagen remains a powerhouse, driving substantial revenue and profit for Altria's oral tobacco products segment. This segment alone generated $1,407 million in net revenues during the first half of 2025, underscoring Copenhagen's enduring financial strength and market dominance.

Skoal stands as a cornerstone within Altria's robust smokeless tobacco offerings, functioning as a dependable Cash Cow. Despite a non-cash impairment of the Skoal trademark in 2024, the brand consistently generates stable cash flow within a mature market. Its enduring market position significantly bolsters the profitability of the oral tobacco segment.

John Middleton Cigars (Black & Mild)

John Middleton Cigars, particularly the Black & Mild brand, is a cornerstone Cash Cow for Altria Group. Altria commands the second-largest share in the U.S. machine-made cigar market, with Black & Mild being a significant driver of this position.

This product line is a consistent generator of revenue and profit for Altria. In the second quarter of 2025, the company reported a notable 3.7% increase in cigar shipment volume, underscoring the sustained demand for these products.

- Market Position: Number two in the U.S. machine-made cigar market.

- Performance Indicator: 3.7% increase in cigar shipment volume in Q2 2025.

- Financial Characteristic: Generates steady cash flow with minimal reinvestment requirements.

- Strategic Role: Stable contributor to Altria's overall revenue and profitability.

Anheuser-Busch InBev (ABI) Equity Stake

Altria Group holds an 8% equity stake in Anheuser-Busch InBev (ABI), the global leader in brewing. This significant investment operates as a Cash Cow within Altria's portfolio, generating a steady stream of dividend income that bolsters Altria's financial health and supports shareholder returns.

This stake in ABI, though not a direct operational product for Altria, is characterized by its high market share within the beverage industry and a relatively low growth environment. Consequently, it acts as a reliable generator of substantial passive income for Altria.

- Altria's ABI Stake: 8% equity interest.

- ABI's Market Position: World's largest brewer.

- Financial Contribution: Consistent dividend income, enhancing financial stability.

- BCG Matrix Classification: Functions as a Cash Cow due to high market share and low growth.

These established brands, like Marlboro and Copenhagen, represent Altria's mature products with dominant market shares. They consistently generate substantial profits with minimal need for further investment, making them reliable cash generators for the company.

Despite industry challenges, these Cash Cows continue to deliver strong financial performance. For instance, Altria's smokeable products segment, driven by Marlboro, reported $2.95 billion in adjusted OCI in Q2 2025, highlighting their enduring profitability.

| Product/Investment | BCG Classification | Market Share (Approx.) | 2025 Financial Contribution (Key Metric) |

|---|---|---|---|

| Marlboro | Cash Cow | 41.0% (U.S. Cigarette Market, Q2 2025) | Significant contributor to $2.95 billion adjusted OCI (Smokeable Products, Q2 2025) |

| Copenhagen | Cash Cow | Dominant in Moist Smokeless Tobacco (MST) | Key driver of $1,407 million net revenues (Oral Tobacco Products, H1 2025) |

| Black & Mild (John Middleton Cigars) | Cash Cow | #2 in U.S. Machine-Made Cigars | Drove 3.7% shipment volume increase (Cigars, Q2 2025) |

| Anheuser-Busch InBev (ABI) Stake | Cash Cow | N/A (Equity Investment) | Provides consistent dividend income |

Delivered as Shown

Altria Group BCG Matrix

The Altria Group BCG Matrix you are currently previewing is the identical, fully comprehensive document you will receive upon purchase. This means no watermarks or demo content will obscure the strategic insights; you'll gain immediate access to the complete, professionally formatted analysis ready for your business planning. The preview accurately represents the final report, ensuring you know precisely what you're acquiring for your strategic decision-making. This is the actual, analysis-ready file, designed for clarity and immediate application to your business strategy.

Dogs

Altria's NJOY e-vapor products are currently positioned as a 'Dog' in the BCG Matrix. This classification stems from substantial headwinds, notably a significant non-cash goodwill impairment of $873 million recorded in the first quarter of 2025.

The NJOY brand's market share has stagnated, holding steady at 2.5% as of March 2025. This lack of growth occurs within a competitive landscape increasingly dominated by disposable e-vapor products that operate outside of regulatory compliance, thereby impacting NJOY's ability to gain traction.

The segment is characterized by its high cash consumption without delivering commensurate returns, a hallmark of a 'Dog' in the BCG framework. Consequently, Altria may consider strategic options such as divestiture or a substantial operational restructuring for NJOY.

The U.S. cigarette market is experiencing a significant downturn, with an estimated 8.5% volume decline in the second quarter of 2025. This accelerated industry-wide contraction firmly places the traditional cigarette category as a 'Dog' within a BCG Matrix framework, indicating low market growth.

This shrinking market environment makes substantial volume expansion for any cigarette brand incredibly difficult, compelling companies to focus on pricing strategies to offset declining sales. For Altria Group, this trend is evident in its smokeable products segment, which recorded an 11.0% volume decrease during the first half of 2025.

While Altria's oral tobacco segment is generally growing thanks to 'on!' nicotine pouches, some older Moist Smokeless Tobacco (MST) products are seeing their sales volumes drop. These specific MST products are in a mature part of the market and are losing ground, placing them in the category of 'Dogs' within Altria's overall oral tobacco offerings.

For instance, Altria's total oral tobacco shipment volume saw a 1% decrease in the second quarter of 2025. This dip was primarily due to lower volumes from these traditional MST products, a trend that 'on!' nicotine pouches' growth couldn't fully counteract.

Less Prominent Combustible Tobacco Brands

Beyond its dominant Marlboro brand, Altria Group manages several less prominent combustible tobacco brands. These brands, including names likely found in the value segment or with niche appeal, are more susceptible to the ongoing decline in U.S. cigarette and cigar consumption. For instance, the U.S. cigarette market volume saw a decline of approximately 4-5% in 2023, a trend that disproportionately impacts smaller brands.

These less prominent brands are categorized as Dogs in the BCG Matrix. They operate in a contracting market, meaning their market share is likely low and shrinking. Consequently, they contribute minimally to Altria's overall profit and cash flow, often requiring management attention without yielding significant returns. In 2024, the continued pressure on traditional tobacco products means these brands face an uphill battle for market relevance.

- Low Market Share: These brands hold a small fraction of the U.S. combustible tobacco market, which itself is contracting.

- Declining Industry Impact: The overall decrease in cigarette and cigar consumption directly reduces the sales potential for these brands.

- Minimal Profit Generation: They are unlikely to be significant profit drivers for Altria, potentially even incurring costs to maintain.

- Strategic Challenge: Altria must decide whether to divest these brands or manage them for minimal cash generation amidst industry headwinds.

Impact of Illicit E-vapor Market on Regulated Products

The surge of illicit disposable e-vapor products, now dominating over 60% of the e-vapor market, creates a challenging landscape for regulated offerings like NJOY. This trend severely hinders Altria's compliant e-vapor products from capturing market share and reaching profitability.

Consequently, these compliant products are effectively categorized as 'Dogs' within the BCG matrix. Their growth potential is significantly curtailed due to the overwhelming presence and competitive pressure from the unregulated sector.

- Illicit Market Dominance: Over 60% of the e-vapor category is now comprised of illicit disposable products.

- Impact on NJOY: This illicit market growth creates a hostile environment for regulated products such as NJOY.

- Compromised Profitability: Altria's compliant e-vapor offerings struggle to gain market share and achieve profitability.

- 'Dog' Quadrant Placement: The limited growth prospects due to illicit competition push these products into the 'Dog' quadrant.

Altria's NJOY e-vapor products, along with certain older Moist Smokeless Tobacco (MST) products and less prominent combustible tobacco brands, are currently categorized as 'Dogs' in the BCG Matrix. These segments face significant challenges, including declining market share, intense competition from unregulated products, and an overall contraction in their respective industries.

The U.S. cigarette market, for instance, saw an estimated 8.5% volume decline in Q2 2025, a trend that disproportionately affects smaller brands with limited market appeal. Similarly, the e-vapor market is heavily influenced by illicit disposable products, which now account for over 60% of the category, severely impacting compliant offerings like NJOY.

These 'Dog' classifications highlight areas of low market share and low growth, often characterized by high cash consumption with minimal returns. Altria may need to consider strategic actions such as divestiture or significant restructuring for these underperforming segments to optimize its portfolio. For example, Altria's total oral tobacco shipment volume decreased by 1% in Q2 2025, driven by declines in traditional MST products.

The company recorded a substantial non-cash goodwill impairment of $873 million related to NJOY in Q1 2025, underscoring the financial challenges within this segment. NJOY's market share remained stagnant at 2.5% as of March 2025, further solidifying its 'Dog' status.

| Product Category | BCG Classification | Key Challenges | Recent Performance Data (2025) | Strategic Considerations |

| NJOY E-vapor | Dog | Illicit market dominance (>60%), stagnant market share (2.5% as of Mar 2025), high cash consumption. | $873 million goodwill impairment (Q1 2025). | Divestiture, restructuring. |

| Certain MST Products | Dog | Declining volumes in mature market segment, competition from newer oral products. | 1% decrease in total oral tobacco shipment volume (Q2 2025). | Portfolio optimization, focus on growth drivers like 'on!' pouches. |

| Lesser Combustible Brands | Dog | Contraction in U.S. cigarette market (est. 8.5% volume decline Q2 2025), low market share, declining consumption. | U.S. cigarette market volume declined ~4-5% in 2023. | Divestiture, minimal cash generation. |

Question Marks

Altria's substantial 41% ownership in Cronos Group positions it as a classic 'Question Mark' within Altria's business portfolio, according to the BCG Matrix framework. This classification highlights Cronos's presence in a rapidly expanding, yet uncertain, market.

The cannabis sector is undeniably a high-growth arena, and Cronos Group has demonstrated this with a notable 28% year-over-year revenue increase reported in the first quarter of 2025. This growth trajectory suggests significant market potential and increasing consumer adoption.

However, Cronos Group's financial performance also reveals a 'Question Mark' characteristic: negative free cash flow. This indicates that the company is currently a cash consumer, requiring ongoing investment to fuel its growth and operational needs, rather than generating surplus cash.

The need for substantial investment to achieve market leadership and sustainable profitability is a key factor defining Cronos Group as a 'Question Mark' for Altria. Its future success hinges on its ability to navigate market challenges and convert its growth potential into consistent financial returns.

Altria's majority-owned joint venture, Horizon Innovations, focused on heated tobacco stick products in the U.S., is positioned as a 'Question Mark' in the BCG Matrix. This classification reflects the segment's global growth potential contrasted with its nascent stage and evolving consumer acceptance within the American market. Significant investment is ongoing to build market share and drive adoption, making its future trajectory uncertain.

Altria is heavily investing in research and development for next-generation smoke-free products. These emerging innovations are considered question marks in the BCG matrix because they operate in high-growth potential categories but currently hold minimal market share. For instance, Altria's investment in heated tobacco products and oral nicotine pouches, while showing promise, requires substantial R&D and marketing to capture significant market share and potentially become future stars.

New Nicotine Delivery Systems

New nicotine delivery systems, particularly those that are highly experimental or in early development stages for Altria, would be classified as Question Marks in a BCG Matrix. These products typically demand significant investment for research, development, and market introduction, with their future success being highly uncertain.

The nicotine market is dynamic, and Altria's exploration of novel formats means these ventures carry high risk but also the potential for substantial future growth if they capture consumer interest. For instance, the total U.S. nicotine market, including traditional and next-generation products, is substantial, and capturing even a small segment of a new category can be lucrative.

- High Investment: Development and market entry for novel nicotine products can cost hundreds of millions of dollars, as seen in the R&D budgets of major tobacco and nicotine companies.

- Uncertain Market Acceptance: Consumer adoption rates for entirely new product categories are difficult to predict, often requiring extensive marketing and education campaigns.

- Regulatory Hurdles: New nicotine delivery systems face evolving regulatory landscapes, which can impact their development, marketing, and ultimate availability to consumers.

- Competitive Landscape: Altria competes with established players and emerging brands in the nicotine space, making it challenging to gain traction with unproven products.

Strategic Partnerships in Emerging Nicotine Technologies

Altria's exploration of strategic partnerships in emerging nicotine technologies, like advanced oral nicotine pouches or next-generation e-vapor systems, positions these ventures as potential Stars in the BCG matrix. These nascent technologies, while holding significant future growth potential, currently represent a small fraction of Altria's overall revenue, reflecting their low market share.

These partnerships often require substantial capital for research, development, and market penetration, aligning with the characteristics of Question Marks. For instance, Altria's 2024 investments in innovative nicotine product development aim to capture future market share in a rapidly evolving landscape.

- High Growth Potential: Emerging nicotine technologies are poised to capture significant market share as consumer preferences shift away from traditional combustible cigarettes.

- Low Current Market Share: Despite their promise, these technologies are still in early stages of adoption and have not yet achieved widespread market penetration.

- Capital Intensive: Scaling these ventures requires considerable investment in R&D, manufacturing, and marketing to compete effectively.

- Strategic Guidance Needed: Partnerships provide Altria with the opportunity to offer expertise and resources to nurture these nascent businesses towards profitability and market leadership.

Altria's investment in Cronos Group, a significant stake in the burgeoning cannabis market, exemplifies a Question Mark in the BCG matrix. While the cannabis industry shows robust growth, projected to reach over $50 billion in the U.S. by 2025, Cronos's profitability remains elusive, reporting a net loss of $105 million in Q1 2025. This necessitates substantial ongoing investment to capitalize on market expansion and achieve positive cash flow.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Rationale |

| Cronos Group (Cannabis) | High | Low | Question Mark | Operates in a high-growth industry but has not yet achieved significant market share or profitability. Requires substantial investment to compete and grow. |

| Horizon Innovations (Heated Tobacco) | Medium to High | Low | Question Mark | Niche product in an evolving U.S. market with potential but facing consumer acceptance challenges and significant competition. Investment is crucial for market penetration. |

| New Nicotine Delivery Systems (R&D) | High | Very Low | Question Mark | Represents early-stage, experimental products in a dynamic market. High R&D costs and uncertain consumer adoption demand significant capital and strategic focus. |

BCG Matrix Data Sources

The Altria Group BCG Matrix is constructed using a blend of official company filings, detailed industry research, and macroeconomic trend analysis to provide a comprehensive view of market positions.