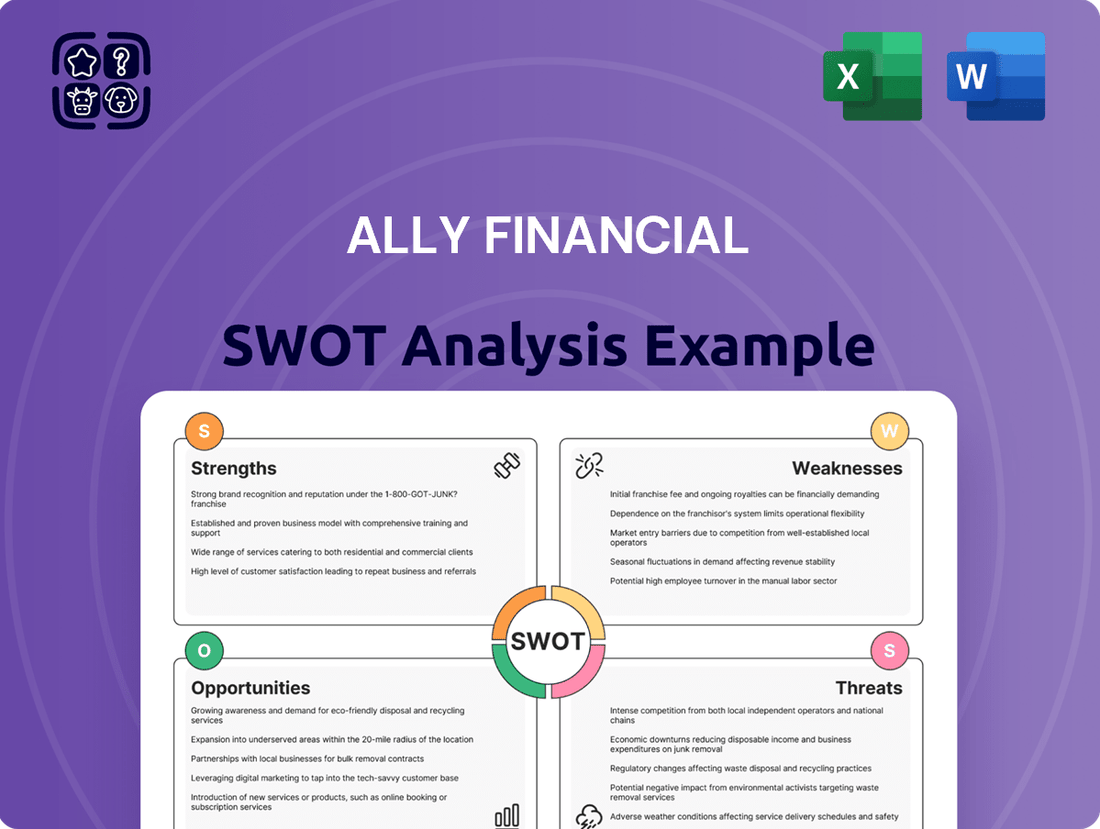

Ally Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ally Financial Bundle

Ally Financial, a digital-first bank, leverages its strong online presence and customer-centric approach as key strengths. However, it faces challenges from intense competition and evolving regulatory landscapes, which are critical factors to consider. Understanding these dynamics is vital for anyone looking to invest or strategize within the financial sector.

Want the full story behind Ally Financial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ally Financial's digital-first banking model is a significant strength, offering unparalleled convenience and accessibility. This online-only approach allows for streamlined operations and a superior customer experience compared to traditional banks. As of the first quarter of 2024, Ally reported a substantial increase in its digital customer base, underscoring the success of this strategy.

Ally Financial boasts robust leadership in the auto finance sector, consistently ranking as a premier auto lender within the United States.

In 2024, Ally originated an impressive $39.2 billion in auto loans, achieving an average yield of 10.4%, which underscores its strong profitability and market sway in this crucial area.

The company's performance in the second quarter of 2025 further highlights its momentum, with notable increases in both auto originations and application volume.

Ally Financial's core business segments, including auto finance, insurance, and corporate finance, offer a diversified revenue base. This strategic focus, following a repositioning, bolsters stability and resilience.

The corporate finance division has demonstrated impressive performance, achieving high returns on equity. This segment's profitability is a key strength, contributing significantly to Ally's overall financial health.

Ally's insurance segment recorded its highest written premiums in recent history, signaling robust growth and market penetration. This strong performance in insurance further diversifies income and reduces reliance on any single business line.

Robust Deposit Base and Customer Loyalty

Ally Bank's robust deposit base is a significant strength, with 3.4 million customers holding $143 billion in balances as of the first quarter of 2024. A substantial portion of these deposits are FDIC-insured, providing a stable foundation for the company's operations.

The company's commitment to customer growth is evident in its impressive track record. Ally has achieved 65 consecutive quarters of net customer growth, demonstrating consistent expansion and market penetration.

Customer loyalty is another key advantage, underscored by a remarkable 95% customer retention rate. This high retention signifies strong customer satisfaction and a dependable, low-cost funding source for Ally Financial.

- 3.4 million customers served by Ally Bank.

- $143 billion in deposit balances as of Q1 2024.

- 65 consecutive quarters of net customer growth.

- 95% customer retention rate highlights strong loyalty.

Effective Strategic Repositioning and Cost Management

Ally Financial has demonstrated strength through effective strategic repositioning, notably divesting its credit card business and exiting consumer mortgage originations. This sharpens its focus on core, profitable operations, enhancing long-term financial stability.

Disciplined cost management is another key strength, with controllable expenses seeing a decrease for several consecutive quarters as of the first quarter of 2024. These strategic adjustments and cost controls are designed to boost capital efficiency and overall profitability.

- Strategic Divestitures: Exited credit card and consumer mortgage businesses to concentrate on core strengths.

- Cost Control Initiatives: Consistent reduction in controllable expenses, improving operational efficiency.

- Focus on Core Operations: Streamlining business to enhance profitability and capital allocation.

- Improved Financial Stability: Strategic moves aimed at bolstering the company's long-term financial health.

Ally Financial's digital-first approach provides a competitive edge, offering customers a seamless banking experience. This strategy has fueled significant customer acquisition, with Ally Bank serving 3.4 million customers and holding $143 billion in deposits as of Q1 2024.

Its leading position in auto finance is a cornerstone, evidenced by $39.2 billion in auto loan originations in 2024, yielding an average of 10.4%. The company also benefits from a diversified revenue stream through insurance and corporate finance, with its insurance segment achieving record written premiums.

Ally's consistent customer growth, marked by 65 consecutive quarters of net increases, and a high 95% customer retention rate, highlight strong brand loyalty and a stable funding base. Strategic divestitures, such as exiting the credit card business, and disciplined cost management, including a decrease in controllable expenses in Q1 2024, further strengthen its operational efficiency and financial stability.

| Metric | Value (as of Q1 2024/2024) | Significance |

|---|---|---|

| Ally Bank Customers | 3.4 million | Indicates broad reach and digital adoption. |

| Ally Bank Deposit Balances | $143 billion | Provides a substantial and stable funding source. |

| Auto Loan Originations (2024) | $39.2 billion | Demonstrates market leadership and revenue generation. |

| Auto Loan Average Yield (2024) | 10.4% | Highlights profitability within the auto finance segment. |

| Net Customer Growth Quarters | 65 consecutive | Shows sustained and consistent expansion. |

| Customer Retention Rate | 95% | Signifies strong customer satisfaction and loyalty. |

What is included in the product

Analyzes Ally Financial’s competitive position through key internal and external factors, highlighting its digital strengths and opportunities in the evolving financial landscape, while also acknowledging potential threats and weaknesses.

Helps identify critical competitive advantages and potential threats for Ally Financial, enabling proactive risk mitigation and opportunity capitalization.

Weaknesses

Ally Financial experienced a GAAP net loss of $(0.82) per share in the first quarter of 2025. This marks a notable downturn compared to prior reporting periods, indicating immediate financial headwinds for the company.

The primary drivers behind this loss were strategic repositioning efforts. These included significant pre-tax losses stemming from the sale of securities and other non-recurring charges, illustrating the short-term financial strains and inherent volatility prevalent in the financial services sector.

Ally Financial's significant concentration in consumer automotive finance presents a notable weakness, exposing the company to substantial credit risk, particularly during economic downturns. This reliance on a single sector means that a slowdown in auto sales or a rise in unemployment can directly impact loan performance.

The company's 2024 performance reflected this vulnerability, with higher net charge-offs recorded in its consumer automotive portfolio. While Q2 2025 demonstrated some recovery, with a reported net charge-off rate of 0.68% for the automotive segment, the ongoing need to meticulously manage loan portfolio quality remains a critical challenge for Ally.

Ally Financial's profitability is closely tied to interest rate movements, directly impacting its net interest margin (NIM). For instance, in the first quarter of 2024, Ally reported a NIM of 4.17%, a slight decrease from the previous year, highlighting this sensitivity. Unexpected shifts in Federal Reserve policy can compress this margin if funding costs rise faster than loan revenues, or vice versa.

Short-Term Financial Impact of Strategic Shifts

Ally Financial's strategic repositioning, while aimed at long-term stability, has led to notable short-term financial impacts. The company reported a $495 million pre-tax loss from securities sales in the first quarter of 2025, a direct consequence of these strategic adjustments.

These one-time expenses and losses have temporarily pressured Ally's financial performance. This pressure is evident in the resulting increase in the efficiency ratio, which directly affects near-term profitability as the company navigates this transition.

- Significant One-Time Expenses: Q1 2025 saw a $495 million pre-tax loss from securities sales, impacting immediate financial results.

- Higher Efficiency Ratio: These costs contribute to a less favorable efficiency ratio, indicating higher operational costs relative to revenue in the short term.

- Temporary Profitability Strain: The financial burden of strategic shifts can temporarily weigh on earnings, affecting investor sentiment in the immediate period.

Heavy Reliance on Auto Lending Volume

Ally Financial's significant dependence on auto lending volume presents a notable weakness. While auto finance is a core strength, this concentration makes the company's financial health highly susceptible to fluctuations in the automotive market and consumer appetite for vehicle financing.

This reliance means that external factors impacting the auto sector, such as shifts in vehicle prices, persistent supply chain disruptions, or the imposition of tariffs, can directly affect Ally's auto lending volumes and the residual values of the vehicles it finances. For instance, in the first quarter of 2024, Ally reported total originated auto finance receivables of $12.1 billion, highlighting the sheer scale of its auto lending operations.

- Concentration Risk: Over-reliance on a single business segment (auto lending) exposes Ally to sector-specific downturns.

- Market Sensitivity: Performance is directly tied to the health of the automotive industry and consumer spending on vehicles.

- Impact of External Factors: Vehicle prices, supply chain issues, and trade policies can significantly influence lending volumes and asset values.

Ally's significant concentration in consumer automotive finance is a key weakness, leaving it vulnerable to economic downturns impacting auto sales and credit quality. For example, the first quarter of 2024 saw elevated net charge-offs in this segment, underscoring the inherent credit risk. This reliance on a single sector means that industry-specific challenges, such as fluctuating vehicle prices or supply chain disruptions, can directly affect Ally's lending volumes and the value of its financed assets.

| Weakness | Description | Relevant Data (Q1 2024/2025) |

| Auto Lending Concentration | High reliance on the automotive sector creates significant credit risk and market sensitivity. | Originated auto finance receivables: $12.1 billion (Q1 2024). Net charge-off rate for automotive segment: 0.68% (Q2 2025). |

| Interest Rate Sensitivity | Profitability is closely tied to net interest margin (NIM), which is affected by interest rate fluctuations. | NIM: 4.17% (Q1 2024), a slight decrease year-over-year, indicating sensitivity to rate changes. |

| Strategic Repositioning Costs | One-time expenses from strategic shifts can temporarily pressure profitability and increase operational costs. | Pre-tax loss from securities sales: $495 million (Q1 2025). |

Full Version Awaits

Ally Financial SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Ally Financial's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing critical factors influencing Ally Financial's market position and future growth potential.

Opportunities

Anticipated Federal Reserve rate cuts in 2024 and 2025 present a significant opportunity for Ally Financial. Lower interest rates directly reduce Ally's cost of funds, potentially widening its net interest margin.

This environment is also likely to boost consumer demand for auto loans and other credit products. Increased origination volumes could translate into substantial revenue growth for Ally.

Ally's Corporate Finance division is a powerhouse, consistently delivering robust performance with high return on equity. Notably, this segment has maintained a remarkable track record of zero net charge-offs, showcasing exceptional risk management.

There's a significant opportunity to broaden this successful segment. Exploring new avenues like infrastructure financing, for instance, could tap into a growing market. Ally's proven disciplined approach to growth and risk management positions it well to enhance this division's contribution to overall profitability.

Ally's strong digital foundation and ongoing tech investments, including its Ally.ai platform, offer a significant growth avenue. This allows for deeper customer personalization and the creation of novel financial solutions, keeping Ally ahead in the digital banking race.

By utilizing these advanced digital tools, Ally can streamline operations and boost efficiency. This strategic advantage is crucial for maintaining a competitive edge as the financial industry continues its digital transformation.

Strategic Partnerships and Targeted Acquisitions

Ally Financial's robust financial standing, evidenced by its strong capital ratios, provides significant opportunities for growth through strategic alliances and acquisitions. For instance, as of Q1 2024, Ally reported a Common Equity Tier 1 (CET1) ratio of 13.2%, well above regulatory requirements, indicating ample capacity for strategic investments. These moves could unlock new revenue streams and enhance market share.

Targeted acquisitions could bolster Ally's presence in key growth areas or integrate innovative technologies. For example, acquiring a fintech firm specializing in digital lending or wealth management could rapidly expand Ally’s product suite and customer base. Such strategic moves are crucial for staying competitive in the rapidly evolving financial services landscape.

- Expand Market Presence: Acquire smaller regional banks or specialized lenders to gain immediate access to new customer segments and geographic markets.

- Diversify Product Offerings: Integrate businesses that offer complementary financial products, such as insurance or investment services, to create a more comprehensive customer value proposition.

- Technology Integration: Invest in or acquire companies with advanced AI, data analytics, or cybersecurity capabilities to enhance operational efficiency and customer experience.

- Strengthen Core Segments: Pursue acquisitions that deepen Ally's expertise and market share in its existing core businesses like auto finance or direct banking.

Growth in Electric Vehicle (EV) Financing

Ally Financial is strategically expanding its financing offerings to include battery-electric and plug-in hybrid vehicles. This move aligns with the significant growth observed in the electric vehicle (EV) market, a trend expected to continue through 2024 and 2025. By focusing on this burgeoning segment, Ally aims to secure a more substantial portion of the automotive financing landscape as consumer preference shifts towards sustainable transportation solutions.

The EV market is experiencing robust expansion, presenting a clear opportunity for financial institutions like Ally. For instance, global EV sales reached approximately 13.6 million units in 2023, a substantial increase from previous years, and projections for 2024 and 2025 indicate continued double-digit growth. This expanding market directly translates into increased demand for vehicle financing, creating a fertile ground for Ally to grow its loan portfolio.

- EV Market Expansion: Global EV sales are projected to exceed 16 million units in 2024, with further growth anticipated through 2025.

- Ally's Strategic Focus: The company is actively developing and promoting financing options tailored for EVs and plug-in hybrids.

- Market Share Capture: This specialization allows Ally to target a growing customer base actively seeking to purchase electric vehicles.

- Sustainable Transportation Alignment: Ally's efforts support the broader societal shift towards environmentally friendly mobility options.

Ally's robust capital position, with a CET1 ratio of 13.2% as of Q1 2024, provides ample room for strategic acquisitions. This financial strength allows Ally to pursue targets that enhance its market presence or technological capabilities, potentially integrating fintechs for expanded digital lending or wealth management services.

The company's focus on financing electric vehicles (EVs) taps into a rapidly expanding market, with global EV sales projected to surpass 16 million units in 2024. By specializing in EV financing, Ally can capture a growing segment of environmentally conscious consumers.

Ally's Corporate Finance division, which has demonstrated exceptional risk management with zero net charge-offs, presents an opportunity for expansion into new areas like infrastructure financing, leveraging its proven disciplined growth strategy.

Anticipated Federal Reserve rate cuts in 2024-2025 are poised to benefit Ally by lowering its cost of funds, potentially improving net interest margins, and stimulating consumer demand for auto loans, thereby driving origination volumes.

Threats

Ally Financial operates in a fiercely competitive landscape. Traditional banking giants, with their established customer bases and extensive branch networks, continue to pose a significant threat. For instance, major banks like JPMorgan Chase and Bank of America consistently report strong deposit growth and offer a wide array of services, directly competing for Ally's customer segments.

Adding to this pressure are nimble fintech startups that are rapidly innovating and capturing market share, particularly in areas like digital payments, lending, and wealth management. These companies often have lower overheads and can adapt quickly to changing consumer preferences, forcing established players like Ally to invest heavily in technology and digital transformation. The digital-only model of many fintechs allows them to offer competitive rates and user-friendly experiences.

Furthermore, other non-bank financial institutions, including credit unions and specialized lenders, also contribute to the intense competition. These entities often focus on specific niches or offer tailored products that can appeal to particular customer groups. This multi-faceted competition means Ally must constantly differentiate itself through superior customer service, innovative product offerings, and competitive pricing to maintain and grow its market position.

Broader economic uncertainties, including persistent inflation and elevated interest rates, are a significant threat to Ally Financial by straining consumer financial health. This challenging environment increases the risk of higher loan delinquencies and amplified credit losses across Ally's diverse loan portfolios.

The consumer auto finance segment, a core area for Ally, is particularly vulnerable to these economic pressures. Increased defaults in this segment could directly impact Ally's profitability and overall financial performance, especially as the Federal Reserve maintained its benchmark interest rate at 5.25%-5.50% through early 2024, a level that continues to affect borrowing costs and consumer spending power.

Ally Financial operates within a highly regulated environment, and adverse regulatory changes pose a significant threat. For instance, the ongoing evolution of capital requirements and consumer protection laws, such as those influenced by the Consumer Financial Protection Bureau (CFPB), can directly impact Ally's operational costs and strategic planning. Increased compliance burdens could divert resources from growth initiatives, potentially affecting profitability.

New regulations could also force Ally to alter its core business models, particularly in areas like auto lending or digital banking, which are central to its strategy. For example, stricter rules on indirect auto lending, a significant revenue driver for Ally, could limit its market reach or necessitate costly adjustments to its partnership agreements. Such changes might also restrict its ability to innovate or offer competitive products, thereby weakening its market position.

Risk of Increased Loan Defaults

Even with Ally Financial's careful management of credit risk, there's a persistent worry about more borrowers failing to repay their loans. This risk sharpens if the economy takes a downturn or if more people lose their jobs. For instance, a significant rise in unemployment could strain consumer finances across the board.

Should default rates climb, Ally would need to set aside more money to cover potential losses from these bad loans. This directly eats into the company's profits, impacting its bottom line. In the first quarter of 2024, Ally reported provisions for credit losses of $291 million, a figure that could see upward pressure in a worsening economic climate.

- Economic Downturn Impact: A recession or significant slowdown could lead to higher unemployment, directly increasing the likelihood of loan defaults.

- Increased Loan Loss Provisions: A rise in defaults would force Ally to increase its provisions for credit losses, negatively affecting profitability.

- Impact on Net Income: Higher provisions directly reduce Ally's net income, potentially leading to lower earnings per share and impacting investor sentiment.

- Portfolio Concentration: While not explicitly stated, a concentration of loans in sectors more vulnerable to economic shocks could exacerbate this risk.

Market Volatility and Investor Sentiment

Ally Financial's stock performance is inherently tied to broader market swings and how investors feel about the economy. Even when Ally is doing well internally, negative news about inflation or interest rates, for example, can cause its stock price to drop. This was evident in early 2024, when despite solid earnings reports, Ally's stock experienced pullbacks alongside the broader financial sector due to concerns about potential interest rate hikes by the Federal Reserve.

Investor sentiment can shift rapidly, impacting Ally's valuation. For instance, a sudden increase in unemployment figures or worries about a recession could make investors more cautious about financial institutions, leading to a sell-off. In the first half of 2024, a noticeable dip in consumer confidence surveys correlated with a period of underperformance for many bank stocks, including Ally, as investors braced for potential economic headwinds.

Ally's susceptibility to these external factors means that even strong operational execution might not always translate into immediate stock price gains. The company's reliance on net interest margin, a key profitability driver for banks, makes it particularly sensitive to changes in interest rate expectations. For example, if the market anticipates a prolonged period of higher rates, it can create uncertainty about future loan demand and profitability, affecting investor outlook.

- Market Volatility Impact: Ally's stock can mirror broader market downturns, as seen in periods of economic uncertainty in 2024.

- Investor Sentiment Shifts: Changes in investor confidence, driven by macroeconomic concerns, can lead to increased caution and price fluctuations for Ally.

- Interest Rate Sensitivity: Ally's profitability is closely linked to interest rates, making it vulnerable to market speculation on monetary policy.

- Sector-Specific Risks: Broader concerns within the financial sector, such as regulatory changes or credit quality worries, can disproportionately affect Ally's stock.

Ally Financial faces significant threats from intense competition, both from established banks and agile fintech firms, forcing continuous investment in digital innovation. Broader economic uncertainties, including persistent inflation and elevated interest rates as seen through early 2024, strain consumer finances and increase the risk of loan delinquencies and credit losses, particularly impacting its core auto finance segment. Adverse regulatory changes, such as evolving capital requirements and consumer protection laws, can increase operational costs and necessitate costly business model adjustments.

The company's stock performance is also vulnerable to broader market swings and shifts in investor sentiment, often reacting to macroeconomic concerns like inflation or interest rate expectations, as observed throughout 2024. For instance, while Ally reported a net income of $674 million in Q1 2024, its stock price, like many in the financial sector, experienced volatility tied to economic outlooks.

SWOT Analysis Data Sources

This Ally Financial SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide actionable strategic insights.