Ally Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ally Financial Bundle

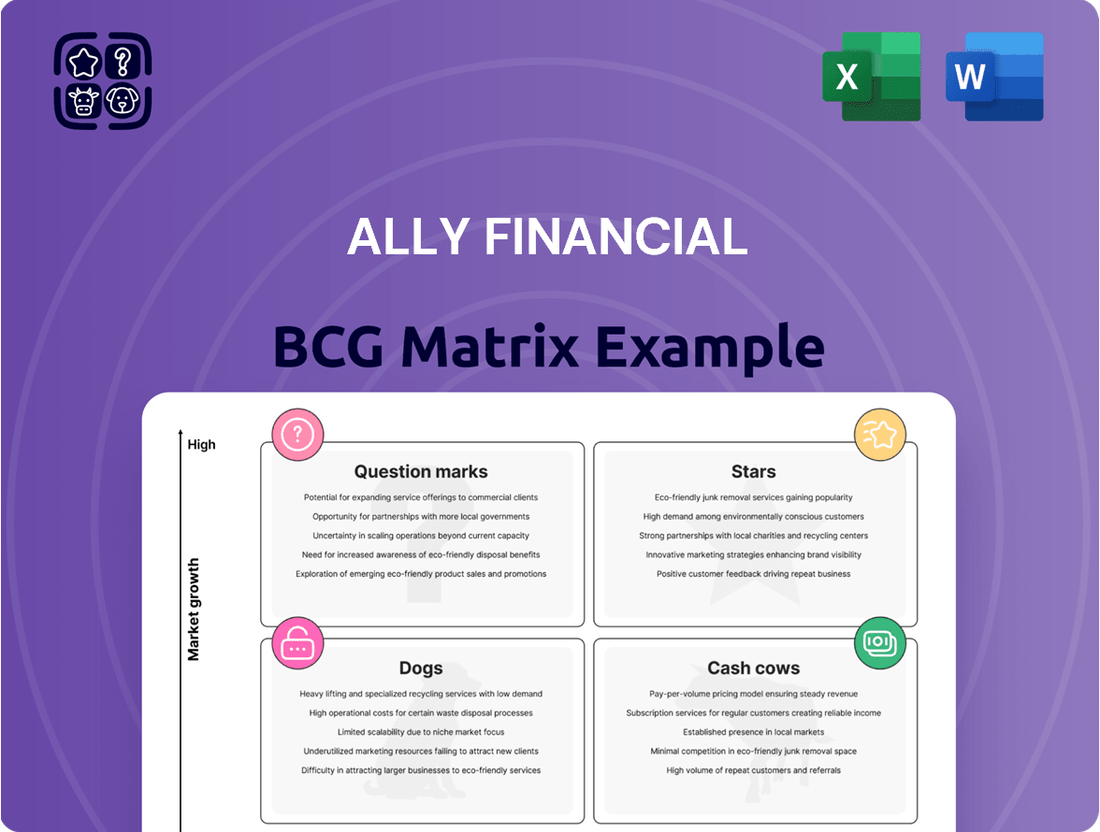

Curious about Ally Financial's strategic positioning? Our BCG Matrix preview highlights key product areas, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the detailed analysis and actionable insights that can guide your own investment and product strategies.

Ready to move beyond the basics? Purchase the complete Ally Financial BCG Matrix to gain a clear roadmap for optimizing their portfolio and capitalizing on market opportunities. This isn't just data; it's your blueprint for informed decision-making.

Stars

Ally Financial stands as a dominant force in auto finance, holding the top spot as the nation's leading bank auto lender. This positions them firmly as a Star in the BCG Matrix for this sector.

Their market dominance is further underscored by processing a remarkable 14.6 million auto applications in 2024. This substantial volume reflects both their significant reach and the ongoing expansion of the auto financing market.

Ally Financial's corporate finance segment is a standout performer, demonstrating exceptional financial health and strategic importance. In 2024, this division achieved a record pre-tax income exceeding $400 million, a testament to its operational efficiency and market strength.

The segment's return on equity (ROE) reached an impressive 37% in 2024, significantly outperforming many industry benchmarks and highlighting its ability to generate substantial profits from shareholder investments. This robust financial outcome positions the corporate finance business as a prime candidate for continued strategic investment.

Management's focus on this area underscores its recognition of the segment's high growth potential and its significant contribution to Ally's overall profitability. Its specialized market focus allows for deep expertise and tailored solutions, driving strong customer engagement and revenue generation.

Ally Financial's Dealer Financial Services stand out as a significant strength, underpinning its market position. The company cultivates robust relationships with automotive dealerships, offering a full suite of financial products that consistently drive origination volumes. This strong dealer network is a key differentiator.

Ally's commitment to a 'high-tech, high-touch' service model resonates deeply with dealers, fostering high satisfaction rates. This approach ensures seamless operations and reliable financial support, which translates into consistent business for Ally. For instance, in 2024, Ally reported strong growth in its dealer financing segment, reflecting this ongoing success.

High-Quality Auto Originations

Ally Financial is strategically prioritizing high-credit quality auto originations. In the second quarter of 2024, this segment represented a substantial 44% of its retail auto volume. This focus on prime borrowers, who secured loans at an originated yield of 10.59%, underscores Ally's commitment to attractive risk-adjusted returns.

This disciplined approach to underwriting is crucial for navigating the dynamic auto market and ensuring long-term profitability. By concentrating on creditworthy customers, Ally aims to minimize potential losses and maximize the efficiency of its capital deployment within the auto lending sector.

Key aspects of Ally's high-quality auto originations:

- Focus on Prime Borrowers: Ally targets customers with strong credit histories.

- Significant Volume Contribution: 44% of retail auto volume in Q2 2024 came from this segment.

- Attractive Yields: Originated yield for this segment was 10.59% in Q2 2024.

- Risk-Adjusted Returns: Selective underwriting aims for superior risk-adjusted profitability.

Commercial Auto Financing

Commercial auto financing and leasing are a vital component of Ally Financial's auto finance operations, serving dealerships by financing their inventory. This segment is crucial for maintaining Ally's strong market position in the automotive industry.

Ally's diversified auto finance offerings, including commercial solutions, solidify its status as a star within the BCG matrix. In 2023, Ally Financial reported significant growth in its auto finance segment, with total auto finance revenue reaching $7.1 billion, underscoring the strength of its commercial auto financing capabilities.

- Dealer Financing: Ally provides essential capital to dealerships, enabling them to stock a wide range of vehicles.

- Market Leadership: This financing support contributes to Ally's standing as a leader in the automotive finance sector.

- Revenue Contribution: The commercial auto finance segment plays a significant role in Ally's overall financial performance.

Ally Financial's auto finance operations, particularly its focus on high-credit quality originations, firmly establish it as a Star in the BCG Matrix. In Q2 2024, prime borrowers accounted for 44% of retail auto volume, with an originated yield of 10.59%. This strategic emphasis on prime customers, coupled with robust dealer financial services, drives significant market share and profitability.

The company's leadership in auto lending, processing 14.6 million applications in 2024, further solidifies its Star status. Ally's corporate finance segment also shines, reporting over $400 million in pre-tax income and a 37% ROE in 2024, demonstrating exceptional performance and strategic importance.

| Segment | BCG Category | Key Metrics (2024 Data) |

|---|---|---|

| Auto Finance (Retail) | Star | 44% of retail auto volume from prime borrowers; 10.59% originated yield (Q2 2024) |

| Auto Finance (Commercial) | Star | Total auto finance revenue: $7.1 billion (2023); Strong dealer financing growth |

| Corporate Finance | Star | Pre-tax income: >$400 million; ROE: 37% |

What is included in the product

Ally Financial's BCG Matrix provides a framework for analyzing its business units based on market share and growth potential.

It offers strategic guidance on resource allocation, identifying which units to invest in, hold, or divest for optimal portfolio performance.

The Ally Financial BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Ally Bank's digital deposit platform is a prime example of a Cash Cow for Ally Financial. As the largest all-digital bank in the U.S., it commands a substantial and expanding retail deposit base, reaching 3.3 million customers with $142 billion in deposits by the second quarter of 2024.

This robust deposit franchise acts as a remarkably efficient and cost-effective funding engine for Ally Financial. It consistently generates significant cash flow, underpinning the company's overall financial strength and enabling investments in other strategic areas.

Ally's insurance business stands as a solid Cash Cow within its portfolio, showcasing remarkable stability and consistent growth. In 2024, this segment achieved a record $1.5 billion in written premiums, a testament to its robust market position and effective strategy.

The insurance arm further demonstrated its strength with a significant 15% year-over-year increase in written premiums reported in the second quarter of 2024. This impressive performance underscores the segment's ability to generate reliable fee revenue, a crucial element for any Cash Cow.

Moreover, the inherent synergies with Ally's core auto finance operations enhance the insurance business's stability and profitability. These integrated services create a powerful ecosystem, driving cross-selling opportunities and reinforcing its position as a dependable revenue generator for Ally Financial.

Ally Financial's established retail auto loan portfolio is a prime example of a Cash Cow within the BCG Matrix. This portfolio, comprised of high-credit quality loans, consistently generates substantial net financing revenue for the company. In 2023, Ally's total auto finance receivables stood at approximately $84.6 billion, with a significant portion representing seasoned retail loans that contribute to stable earnings.

These seasoned assets offer predictable cash flows, requiring relatively lower reinvestment compared to funding new loan originations. This characteristic makes them a reliable source of income, underpinning Ally's overall financial strength and providing capital for other strategic initiatives.

Robust Customer Retention in Banking

Ally Bank's banking segment exemplifies a Cash Cow within the BCG Matrix, largely due to its exceptional customer retention. The bank consistently reports retention rates exceeding 95%, a significant achievement in the competitive financial services landscape.

This robust retention directly translates into lower customer acquisition costs, a critical factor in maximizing profitability. With a stable and loyal customer base, Ally Bank's deposit products generate predictable and substantial cash flow, reinforcing its Cash Cow status.

- Industry-Leading Retention: Ally Bank consistently achieves over 95% customer retention.

- Reduced Acquisition Costs: High retention minimizes the expense of acquiring new customers.

- Sustained Profitability: The banking segment generates consistent and strong cash flow.

- Stable Deposit Base: Loyal customers provide a reliable source of funding.

Diversified Fee Revenue Streams

Ally Financial’s diversified fee revenue streams are a key component of its Cash Cows. Beyond its core lending operations, Ally leverages platforms like SmartAuction and its Passthrough programs to generate significant fee-based income. This diversification is crucial for stable earnings.

In 2024, Ally reported a notable increase in its 'other revenue,' largely driven by these established fee-based services. These revenue streams typically carry lower associated costs compared to traditional lending, enhancing profitability and contributing to Ally's strong position as a Cash Cow.

- SmartAuction: A digital wholesale vehicle remarketing platform that generates fees from transactions.

- Passthrough Programs: Services that allow Ally to earn fees by facilitating loan sales and securitizations.

- Other Revenue Growth: Ally’s 'other revenue' saw year-over-year growth in 2024, underscoring the strength of its fee-based income.

- Stable Income: These fee-generating activities provide a consistent and predictable income stream with lower capital requirements.

Ally Financial's digital deposit platform is a prime example of a Cash Cow, boasting 3.3 million customers and $142 billion in deposits by Q2 2024. This robust franchise acts as an efficient funding engine, consistently generating significant cash flow. The insurance business is another solid Cash Cow, achieving a record $1.5 billion in written premiums in 2024, with a 15% year-over-year increase in Q2 2024, demonstrating its reliable fee revenue generation.

Ally's seasoned retail auto loan portfolio, with approximately $84.6 billion in receivables as of 2023, offers predictable cash flows from high-credit quality loans. This stability requires less reinvestment, contributing to reliable earnings. Furthermore, Ally Bank's banking segment, characterized by over 95% customer retention, minimizes acquisition costs and generates substantial, predictable cash flow from its loyal customer base.

Ally's diversified fee revenue streams, including SmartAuction and Passthrough programs, contribute significantly to its Cash Cow status. These services generate substantial fee-based income, with 'other revenue' showing growth in 2024, enhancing profitability due to lower associated costs compared to traditional lending.

| Segment | Key Metric | 2024 Data Point | Significance |

|---|---|---|---|

| Digital Deposits | Deposits | $142 Billion (Q2 2024) | Efficient funding engine, strong cash flow |

| Insurance | Written Premiums | $1.5 Billion (2024 Record) | Stable, reliable fee revenue |

| Auto Loans | Receivables | ~$84.6 Billion (2023) | Predictable cash flows, seasoned assets |

| Banking | Customer Retention | >95% | Low acquisition costs, stable cash flow |

| Fee Revenue | Other Revenue | Increased in 2024 | Diversified income, lower costs |

What You’re Viewing Is Included

Ally Financial BCG Matrix

The Ally Financial BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing Ally's business units as Stars, Cash Cows, Question Marks, or Dogs, is ready for immediate strategic application without any watermarks or demo content. You are seeing the final, polished document designed for professional use, ensuring you get precisely what you need to understand Ally's market position and inform your business decisions.

Dogs

Ally Financial's strategic decision to halt new consumer mortgage originations by January 31, 2025, signals a clear move away from a business segment underperforming against its growth and profitability objectives. This action firmly places mortgage origination within Ally's BCG Matrix as a 'Dog,' a category representing low market share and low growth potential, prompting divestment.

Ally Financial's credit card business, a portfolio valued at $2.3 billion, is being divested. This strategic move, with an anticipated closing in 2025, signals Ally's focus on shedding non-core assets.

The credit card operation was identified as a side business and experienced a goodwill impairment in 2024, further solidifying the decision to exit this segment.

Ally Financial's decision to sell its point-of-sale lending business, Ally Lending, signals a strategic shift. This move, completed in 2024, involved divesting a segment that held substantial loan receivables, effectively removing a business unit that was likely categorized as a 'Dog' in the BCG matrix.

The sale of Ally Lending, which operated in the point-of-sale financing space, aligns with Ally's strategy to concentrate on its primary banking and automotive finance operations. This divestiture, completed in the first half of 2024, allowed Ally to shed a business with significant loan assets, reinforcing its repositioning away from this particular market segment.

Underperforming Smaller Portfolios

Underperforming smaller portfolios within Ally Financial, those not fitting the company's strategic direction, are candidates for divestiture or run-off. These segments often struggle with profitability and market share, prompting a strategic pruning of assets.

Ally's focus on its core banking and automotive finance operations means that smaller, non-strategic units may be divested to streamline operations. This aligns with broader industry trends of financial institutions concentrating on their most profitable and competitive business lines.

- Divestiture Candidates: Smaller portfolios lacking strategic alignment are prime candidates for sale.

- Profitability Concerns: Low profitability is a key driver for considering divestiture or run-off.

- Market Share Weakness: Limited market share in non-core areas also signals potential underperformance.

- Restructuring Impact: These actions are part of Ally's ongoing efforts to optimize its business structure and enhance overall efficiency.

Legacy High-Risk or Non-Accrual Assets

Legacy high-risk or non-accrual assets within Ally Financial's portfolio, while not the primary focus, would fall into the question mark category of the BCG Matrix. These are assets that, despite Ally's general emphasis on higher-quality borrowers, may stem from past lending practices or specific niche products that have consistently shown elevated net charge-offs or non-performing statuses. Such assets necessitate substantial provisions for credit losses, thereby draining valuable capital and management attention that could otherwise be directed towards more promising growth areas.

For instance, if Ally Financial reported in their 2024 financial statements that provisions for credit losses related to specific legacy auto loan portfolios increased by 15% year-over-year, these particular segments would be flagged. This increase in provisions directly correlates with the drain on resources mentioned, pushing these assets towards the question mark quadrant, where their future potential for growth and profitability is uncertain and requires careful strategic evaluation.

- High Net Charge-Offs: Assets with consistently high rates of loans that are unlikely to be repaid.

- Non-Performing Status: Loans where the borrower has stopped making payments.

- Significant Provisions: Capital set aside by Ally to cover potential losses from these assets.

- Resource Drain: These assets consume management time and financial resources without generating commensurate returns.

Ally Financial's strategic divestitures of its mortgage origination, credit card, and point-of-sale lending businesses, completed in 2024 and early 2025, clearly indicate these segments are classified as Dogs in the BCG Matrix. These businesses exhibited low market share and limited growth potential, prompting Ally to shed these underperforming assets.

The company's decision to sell Ally Lending in early 2024, for instance, removed a business with significant loan receivables that was not aligned with Ally's core focus. Similarly, the sale of its credit card portfolio, valued at $2.3 billion and facing a goodwill impairment in 2024, further solidifies its Dog status.

These divestitures allow Ally to concentrate resources on its more profitable and strategically aligned segments, such as automotive finance and core banking. This pruning of non-core assets is a deliberate strategy to improve overall financial performance and efficiency.

The divestiture of Ally Lending, completed in the first half of 2024, involved a business with substantial loan receivables, reinforcing its classification as a Dog due to its limited strategic fit and likely low market share within the broader point-of-sale financing landscape.

Question Marks

Ally Financial is actively growing its presence in electric vehicle (EV) financing, a sector experiencing rapid expansion. In 2024, the company reported $1.8 billion in consumer automotive retail loan originations specifically for battery-electric and plug-in hybrid vehicles. This demonstrates a significant commitment to this burgeoning market.

While the EV market presents substantial growth opportunities, Ally's current market share within this specialized financing niche is still in its formative stages when compared to more established competitors. This positions EV financing as a 'Question Mark' within the BCG Matrix for Ally, indicating high growth potential but requiring further strategic development and investment to solidify its position.

Ally Financial is actively developing new digital banking products and enhancing its platform, focusing on customer-centric solutions and artificial intelligence. This strategic investment positions them in high-growth segments of digital finance, aiming to expand market share.

In 2024, Ally reported a significant increase in digital engagement, with over 10 million customers interacting with their online and mobile platforms. The company's commitment to innovation includes exploring features like personalized financial advice powered by AI, which could drive future customer acquisition and retention.

Ally Financial's personal loan segment, while already established, presents a compelling opportunity for expansion, aligning with a potential 'Star' or 'Question Mark' position in the BCG Matrix. The bank's robust all-digital platform provides a significant competitive advantage in reaching and serving a broad customer base, especially as it focuses on new customer acquisition. In 2024, the personal loan market saw continued demand, with many consumers seeking consolidation or funding for large purchases, a trend Ally is well-positioned to capitalize on through enhanced digital marketing and streamlined application processes.

Strategic Fintech Integrations

Ally Financial's strategic focus on technology, including responsible AI adoption, positions it well for integrating with emerging fintech solutions. These integrations often represent high-growth potential but currently have limited market share, necessitating substantial investment to capture market leadership.

The company's 2024 performance, with a reported Return on Tangible Common Equity (ROTCE) of 13.4% in Q1 2024, demonstrates its operational strength, which can support the capital allocation needed for these forward-looking fintech partnerships.

- Innovation Investment: Ally's commitment to R&D, which underpins its tech strategy, suggests a willingness to fund innovative fintech ventures.

- Market Expansion: Fintech integrations can unlock new customer segments and revenue streams, particularly in areas with lower current penetration.

- Competitive Edge: Early adoption of disruptive fintech can provide a significant competitive advantage in the evolving financial services landscape.

- AI-Driven Opportunities: Leveraging AI in partnership with fintechs can enhance customer experience, streamline operations, and improve risk management.

Targeted Niche Lending Expansion

Ally Financial, already a powerhouse in auto finance, could strategically expand into other targeted niche lending markets. Think about areas like small business lending or specialized consumer loans where a digital-first, streamlined approach can capture significant market share. These ventures would represent Ally's Stars or Question Marks in a BCG Matrix context, demanding investment for growth.

For instance, Ally could leverage its digital capabilities to offer flexible working capital loans to small businesses, a sector often underserved by traditional banks. In 2024, the small business lending market continued to show resilience, with many businesses seeking alternative financing solutions. Ally's existing technological infrastructure positions it well to compete in this space.

- Niche Market Identification: Focus on segments like equipment financing for growing industries or personal loans for specific life events, where digital onboarding and underwriting can provide a competitive edge.

- Digital-First Strategy: Implement fully online application, approval, and servicing processes to reduce overhead and enhance customer experience, mirroring the success seen in their auto loan division.

- Investment for Scale: Allocate capital for technology development, marketing, and talent acquisition to establish a strong foothold in these new, high-growth potential markets.

- Risk Management: Develop robust data analytics and credit scoring models tailored to the specific risks associated with each niche lending area to ensure profitability and sustainability.

Ally Financial's expansion into new, high-growth areas like EV financing and specialized lending segments presents them as potential Question Marks in the BCG Matrix. These ventures require significant investment to build market share, despite their promising growth trajectories. For example, Ally's $1.8 billion in EV financing originations in 2024 highlights this growth, but the market is still developing.

These emerging segments, including partnerships with fintechs and expansion into small business lending, are characterized by high market growth but currently low relative market share for Ally. This necessitates strategic capital allocation and technological development to move them towards becoming Stars.

Ally's digital-first approach and strong financial footing, evidenced by a 13.4% ROTCE in Q1 2024, provide a solid foundation for nurturing these Question Mark businesses. The key is continued investment in innovation and targeted market penetration.

The company's focus on enhancing its digital platforms and exploring AI-driven solutions further supports its efforts in these high-potential, yet unproven, market areas.

BCG Matrix Data Sources

Our Ally Financial BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.