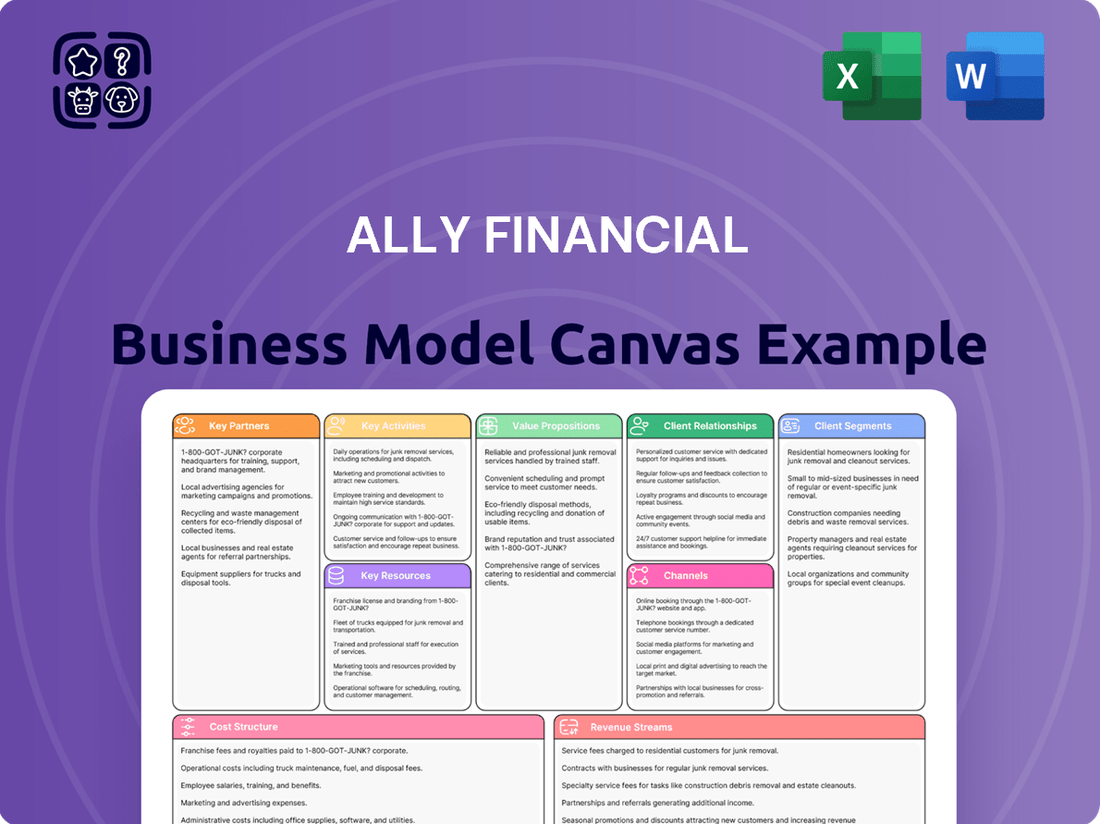

Ally Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ally Financial Bundle

Ally Financial's Business Model Canvas breaks down its digital-first banking strategy, focusing on customer acquisition through competitive rates and a streamlined user experience. Discover how they leverage technology and strategic partnerships to deliver value and capture market share in the evolving financial landscape.

Want to understand the core drivers of Ally Financial's success? Our comprehensive Business Model Canvas details their customer relationships, revenue streams, and cost structures, offering a clear roadmap for anyone looking to analyze or replicate their innovative approach.

Unlock the strategic blueprint behind Ally Financial's digital banking dominance. This in-depth Business Model Canvas reveals how the company effectively targets customer segments, builds key partnerships, and drives revenue. Ideal for strategists and innovators seeking to learn from a market leader.

Partnerships

Ally Financial's automotive dealership partnerships are foundational, acting as a primary channel for auto loan originations. In 2024, a substantial portion of Ally's auto loan volume, often exceeding 70%, is attributed to its extensive dealer network, highlighting the critical nature of these relationships for business growth.

These collaborations with dealerships are not merely transactional; they involve deep integration, enabling Ally to offer a wide array of financing products directly at the point of sale. This strategic alignment ensures a consistent flow of new and used vehicle financing, a core component of Ally's revenue generation.

Furthermore, Ally extends its reach by partnering with automotive manufacturers. These alliances allow for the co-creation of attractive financing incentives and special programs, which in turn drive vehicle sales and solidify Ally's position as a preferred financing partner within the automotive ecosystem.

Ally Financial, as a fully digital bank, depends critically on its technology and digital banking provider partnerships to offer a smooth customer experience. These collaborations are fundamental to its operations, enabling everything from secure data management to innovative product delivery.

Key alliances include those with cloud infrastructure providers like Microsoft Azure, ensuring robust and scalable digital services. For customer relationship management, Salesforce is a vital partner, helping Ally personalize interactions and manage client data effectively. Financial data integration is powered by companies such as Plaid, facilitating seamless connections for customers linking external accounts.

Furthermore, core banking software solutions from providers like Temenos are essential for Ally's back-end operations. These strategic relationships are not just about maintaining current services but are crucial for driving innovation and staying ahead in the competitive digital banking landscape. In 2024, the digital banking sector continued to see significant investment, with companies like Ally leveraging these partnerships to enhance user interfaces and expand service offerings.

Ally Financial cultivates essential relationships with credit bureaus such as Experian, TransUnion, and Equifax. These collaborations are fundamental, granting Ally access to vital consumer credit reports and a wealth of financial data.

This data access is crucial for Ally's operations, enabling them to perform thorough risk assessments and make well-informed lending decisions across their wide array of financial products. For instance, in Q1 2024, Ally reported a total loan and lease origination volume of $32.6 billion, underscoring the volume of decisions reliant on this data.

Insurance Company Partners

Ally Financial leverages key partnerships with major insurance providers to offer a more complete financial ecosystem to its customers. These collaborations are crucial for integrating insurance products directly with Ally's core lending and banking services, creating a seamless experience for consumers seeking both financing and protection.

Notable partners include industry leaders like Progressive Insurance, Nationwide Insurance, and Liberty Mutual. These relationships enable Ally to bundle insurance solutions, such as auto insurance, with their auto loans and other financial products, thereby enhancing customer value and potentially increasing customer loyalty. For instance, in 2024, Ally continued to strengthen these integrations, aiming to capture a larger share of the automotive financing market by offering a one-stop-shop solution.

These strategic alliances are mutually beneficial. Ally gains access to a wider range of insurance products to offer its customer base, while the insurance companies benefit from Ally's extensive customer reach and distribution channels. This synergy allows for more competitive product offerings and a broader market penetration for both parties involved in these financial service integrations.

- Progressive Insurance: A long-standing partner, offering a range of auto insurance products integrated with Ally's auto financing.

- Nationwide Insurance: Collaborates with Ally to provide diversified insurance options, including auto and potentially other lines of coverage.

- Liberty Mutual: Another key partner, contributing to Ally's ability to offer comprehensive insurance solutions alongside its financial services.

Equity Sponsors and Asset Managers

Ally Financial's Corporate Finance division heavily relies on its partnerships with equity sponsors and asset managers. These relationships are foundational, providing the capital necessary for Ally's lending activities within the middle market. The success of this segment is directly tied to the strength and continuity of these alliances.

These key partnerships are crucial drivers of Ally's financial performance. In 2023, for instance, Ally's Corporate Finance segment demonstrated robust activity, reflecting the ongoing demand for capital solutions from private equity firms and other institutional investors. The stability and growth of these relationships directly impact Ally's overall profitability and its ability to generate attractive returns on equity.

- Equity Sponsors: Ally's Corporate Finance business originates capital for transactions led by private equity firms, including leveraged buyouts and recapitalizations.

- Asset Managers: Partnerships with asset managers provide additional avenues for capital deployment and investment opportunities, diversifying Ally's funding sources.

- Financial Performance Impact: These collaborations are significant contributors to Ally's pretax income, underscoring their strategic importance.

- Relationship Value: Maintaining strong, long-term relationships with these entities is paramount for sustained business growth and profitability in this segment.

Ally Financial's automotive dealership partnerships are foundational, acting as a primary channel for auto loan originations. In 2024, a substantial portion of Ally's auto loan volume, often exceeding 70%, is attributed to its extensive dealer network, highlighting the critical nature of these relationships for business growth.

These collaborations with dealerships are not merely transactional; they involve deep integration, enabling Ally to offer a wide array of financing products directly at the point of sale. This strategic alignment ensures a consistent flow of new and used vehicle financing, a core component of Ally's revenue generation.

Furthermore, Ally extends its reach by partnering with automotive manufacturers. These alliances allow for the co-creation of attractive financing incentives and special programs, which in turn drive vehicle sales and solidify Ally's position as a preferred financing partner within the automotive ecosystem.

Ally Financial, as a fully digital bank, depends critically on its technology and digital banking provider partnerships to offer a smooth customer experience. These collaborations are fundamental to its operations, enabling everything from secure data management to innovative product delivery.

Key alliances include those with cloud infrastructure providers like Microsoft Azure, ensuring robust and scalable digital services. For customer relationship management, Salesforce is a vital partner, helping Ally personalize interactions and manage client data effectively. Financial data integration is powered by companies such as Plaid, facilitating seamless connections for customers linking external accounts.

Furthermore, core banking software solutions from providers like Temenos are essential for Ally's back-end operations. These strategic relationships are not just about maintaining current services but are crucial for driving innovation and staying ahead in the competitive digital banking landscape. In 2024, the digital banking sector continued to see significant investment, with companies like Ally leveraging these partnerships to enhance user interfaces and expand service offerings.

Ally Financial cultivates essential relationships with credit bureaus such as Experian, TransUnion, and Equifax. These collaborations are fundamental, granting Ally access to vital consumer credit reports and a wealth of financial data.

This data access is crucial for Ally's operations, enabling them to perform thorough risk assessments and make well-informed lending decisions across their wide array of financial products. For instance, in Q1 2024, Ally reported a total loan and lease origination volume of $32.6 billion, underscoring the volume of decisions reliant on this data.

Ally Financial leverages key partnerships with major insurance providers to offer a more complete financial ecosystem to its customers. These collaborations are crucial for integrating insurance products directly with Ally's core lending and banking services, creating a seamless experience for consumers seeking both financing and protection.

Notable partners include industry leaders like Progressive Insurance, Nationwide Insurance, and Liberty Mutual. These relationships enable Ally to bundle insurance solutions, such as auto insurance, with their auto loans and other financial products, thereby enhancing customer value and potentially increasing customer loyalty. For instance, in 2024, Ally continued to strengthen these integrations, aiming to capture a larger share of the automotive financing market by offering a one-stop-shop solution.

These strategic alliances are mutually beneficial. Ally gains access to a wider range of insurance products to offer its customer base, while the insurance companies benefit from Ally's extensive customer reach and distribution channels. This synergy allows for more competitive product offerings and a broader market penetration for both parties involved in these financial service integrations.

- Progressive Insurance: A long-standing partner, offering a range of auto insurance products integrated with Ally's auto financing.

- Nationwide Insurance: Collaborates with Ally to provide diversified insurance options, including auto and potentially other lines of coverage.

- Liberty Mutual: Another key partner, contributing to Ally's ability to offer comprehensive insurance solutions alongside its financial services.

Ally Financial's Corporate Finance division heavily relies on its partnerships with equity sponsors and asset managers. These relationships are foundational, providing the capital necessary for Ally's lending activities within the middle market. The success of this segment is directly tied to the strength and continuity of these alliances.

These key partnerships are crucial drivers of Ally's financial performance. In 2023, for instance, Ally's Corporate Finance segment demonstrated robust activity, reflecting the ongoing demand for capital solutions from private equity firms and other institutional investors. The stability and growth of these relationships directly impact Ally's overall profitability and its ability to generate attractive returns on equity.

- Equity Sponsors: Ally's Corporate Finance business originates capital for transactions led by private equity firms, including leveraged buyouts and recapitalizations.

- Asset Managers: Partnerships with asset managers provide additional avenues for capital deployment and investment opportunities, diversifying Ally's funding sources.

- Financial Performance Impact: These collaborations are significant contributors to Ally's pretax income, underscoring their strategic importance.

- Relationship Value: Maintaining strong, long-term relationships with these entities is paramount for sustained business growth and profitability in this segment.

Ally Financial's key partnerships are vital for its operational efficiency and market reach. These include collaborations with automotive dealerships, which are primary channels for auto loan originations, representing over 70% of loan volume in 2024. Furthermore, partnerships with technology providers like Microsoft Azure and Salesforce are crucial for its digital banking services, ensuring a smooth customer experience and effective data management.

Ally also relies on credit bureaus such as Experian for risk assessment and insurance providers like Progressive Insurance to offer bundled solutions, enhancing customer value. In its Corporate Finance division, partnerships with equity sponsors and asset managers are essential for capital sourcing, directly impacting profitability.

| Partner Type | Key Partners | Role/Impact | 2024 Data/Context |

|---|---|---|---|

| Automotive Dealerships | Extensive Dealer Network | Primary channel for auto loan originations; point-of-sale financing | Exceeds 70% of auto loan volume |

| Technology Providers | Microsoft Azure, Salesforce, Plaid, Temenos | Cloud infrastructure, CRM, data integration, core banking software | Essential for digital banking operations and innovation |

| Credit Bureaus | Experian, TransUnion, Equifax | Access to credit reports for risk assessment | Supports $32.6 billion in Q1 2024 loan/lease origination volume |

| Insurance Providers | Progressive Insurance, Nationwide Insurance, Liberty Mutual | Bundled insurance solutions with financial products | Enhances customer value and loyalty in automotive financing |

| Capital Providers | Equity Sponsors, Asset Managers | Capital sourcing for middle-market lending | Significant contributors to Corporate Finance segment's pretax income |

What is included in the product

Ally Financial's business model focuses on providing a full spectrum of digital-first financial services, emphasizing customer acquisition and retention through competitive pricing and user-friendly technology.

It leverages a low-cost operating model and a broad range of financial products to serve a diverse customer base, including individuals and businesses.

Ally Financial's Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex financial services for easier understanding and comparison.

This structured approach within the Business Model Canvas helps Ally Financial pinpoint and address customer pain points by clearly defining value propositions and customer relationships.

Activities

A primary activity for Ally Financial is the robust management of its digital banking platform, which handles a massive volume of online deposits and transactions daily. This ensures seamless, secure, and intuitive experiences for its vast customer base across both web and mobile channels.

In 2024, Ally continued to see strong engagement with its digital offerings. For instance, the company reported that a significant majority of its customer interactions occur through digital channels, underscoring the critical nature of these operations. This focus on digital efficiency directly supports their ability to process millions of transactions efficiently and securely.

Ally Financial's core activities revolve around originating and servicing consumer auto loans, a sector where they hold a significant market position. This involves efficiently processing a high volume of loan applications and actively managing a substantial portfolio of auto-related earning assets.

In 2024, Ally continued to demonstrate its strength in auto financing. The company reported originating approximately $47.5 billion in new auto loans during the first three quarters of the year, reflecting robust demand and their capacity to handle a large influx of business. This volume underscores their commitment to credit quality and diligent risk management within their extensive auto loan portfolio.

Historically, a significant key activity for Ally Financial was the origination of both mortgage and personal loans directly to consumers. This process involved assessing borrower creditworthiness and facilitating the loan application and approval stages.

However, Ally has been strategically shifting its focus. By the second quarter of 2025, the company plans to have completed the winding down of its consumer mortgage originations. This move is part of a broader strategy to concentrate on its core banking and automotive finance operations.

The sale of its credit card business also underscores this strategic pivot. These divestitures allow Ally to streamline its operations and dedicate resources to areas where it sees greater growth potential and competitive advantage.

Investment Services through Ally Invest

Ally Invest, a division of Ally Financial, actively supports customers in managing their savings and growing their wealth through comprehensive securities brokerage and investment advisory services. This involves facilitating trades, providing research tools, and offering guidance to help clients meet their financial objectives.

Key activities include the meticulous handling of brokerage functions, ensuring efficient and secure execution of customer trades across various asset classes. This operational backbone is crucial for client trust and the smooth functioning of investment activities.

Furthermore, Ally Invest provides specialized investment advisory services. As of the first quarter of 2024, Ally Financial reported that Ally Invest continued to be a significant contributor to its overall customer engagement, with millions of accounts active and demonstrating consistent growth in assets under management.

- Securities Brokerage: Facilitating stock, ETF, and mutual fund trading.

- Investment Advisory: Offering personalized financial planning and portfolio management.

- Customer Support: Providing resources and assistance for wealth management.

- Platform Development: Continuously enhancing the Ally Invest digital experience.

Commercial and Corporate Finance Lending

Ally Financial's commercial and corporate finance lending is a core activity, focusing on providing essential capital to middle-market businesses and private equity sponsors. This segment actively manages a diverse portfolio of corporate loans, aiming to generate profitable returns through specialized sector knowledge.

In 2024, Ally continued to build its presence in corporate finance, demonstrating a commitment to supporting business growth. The company's strategy involves leveraging its expertise to underwrite and manage a range of credit facilities tailored to the needs of its corporate clients.

- Middle-Market Focus: Ally targets companies with revenues typically between $50 million and $1 billion, offering flexible financing solutions.

- Sponsor Finance: The company partners with private equity firms, providing debt financing for acquisitions, recapitalizations, and growth initiatives.

- Portfolio Management: Ally actively manages its corporate loan portfolio, seeking to optimize risk-adjusted returns through diligent oversight and strategic adjustments.

- Industry Expertise: The team possesses deep knowledge across various industries, enabling them to provide tailored financing and identify profitable opportunities.

Ally Financial's digital banking platform is a cornerstone, facilitating millions of daily transactions and deposits with a focus on seamless user experience across web and mobile. In 2024, digital channels continued to be the primary touchpoint for customer interactions, highlighting the platform's efficiency and security.

The company's significant activity in auto lending involves originating and servicing a vast portfolio of consumer auto loans. This segment saw approximately $47.5 billion in new auto loan originations in the first three quarters of 2024, demonstrating strong market presence and effective risk management.

Ally Invest's key activities encompass securities brokerage and investment advisory services, supporting wealth growth for millions of active accounts. As of Q1 2024, assets under management within Ally Invest showed consistent growth, underscoring its role in customer engagement.

Commercial and corporate finance lending is another vital activity, with Ally providing capital to middle-market businesses and private equity sponsors. This segment leverages industry expertise to manage a diverse loan portfolio, focusing on profitable opportunities in sectors like sponsor finance.

Full Version Awaits

Business Model Canvas

The Ally Financial Business Model Canvas preview you see is the actual document you will receive upon purchase, ensuring complete transparency. This isn't a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this exact file, ready to be utilized for strategic planning and business development.

Resources

Ally Financial's entirely online operation is powered by a sophisticated technology infrastructure, featuring its proprietary AI platform, Ally.ai. This digital backbone supports all banking, lending, and investment services, providing customers with unparalleled convenience and accessibility. In 2024, Ally continued to invest heavily in its digital capabilities, aiming to enhance customer experience and operational efficiency.

The advanced platform allows Ally to manage a vast array of customer interactions and transactions seamlessly. This technological advantage is crucial for maintaining a competitive edge in the digital banking landscape, enabling personalized services and faster processing times for loans and other financial products.

Ally Bank's direct banking model cultivates a substantial and expanding customer deposit base, serving as a primary, low-cost funding engine. This robust deposit growth directly fuels the company's extensive lending operations, demonstrating its critical role as a key resource.

As of the first quarter of 2024, Ally Financial reported total customer deposits exceeding $130 billion, a testament to the strength and loyalty of its deposit holders. This significant deposit pool provides a stable and cost-effective foundation for Ally's diverse financial product offerings.

Ally's deep, long-standing relationships with auto dealerships are a cornerstone of its business model. These partnerships are not merely transactional; they are built on trust and mutual benefit, allowing Ally to consistently secure a significant share of auto financing business.

This robust network of dealerships is a critical enabler for Ally's market leadership in automotive finance. It directly translates into a high volume of auto loan originations, as dealerships often prefer to work with established and reliable financing partners like Ally.

In 2024, Ally continued to leverage these deep ties, reporting substantial auto originations. For instance, the company's retail originations have consistently shown strength, demonstrating the ongoing power of these dealer relationships in driving business volume.

Experienced Financial and Technology Talent

Ally Financial's experienced financial and technology talent is a cornerstone of its operations. The expertise within its workforce, especially in financial services, risk management, and digital innovation, is a critical resource that fuels its competitive edge.

Ally actively invests in its employees, cultivating a team proficient in harnessing emerging technologies, including artificial intelligence. This focus on upskilling is designed to enhance operational efficiency and elevate the customer experience. For instance, in 2023, Ally reported that its technology and operations workforce represented a significant portion of its total employees, underscoring the importance of this talent pool.

- Deep Expertise: Workforce possesses specialized knowledge in banking, lending, and investment services.

- Digital Acumen: Strong capabilities in developing and managing digital platforms and customer interfaces.

- Innovation Focus: Employees are encouraged and trained to leverage new technologies for process improvement.

- Risk Management Proficiency: A significant segment of talent is dedicated to robust risk assessment and mitigation strategies.

Strong Brand Recognition and Reputation

Ally Financial's strong brand recognition is a cornerstone of its business model, built on a reputation for customer-centricity and a digital-first strategy. This established presence in the financial sector fosters significant customer loyalty and provides a distinct competitive advantage.

The brand’s association with innovation and accessibility has resonated with consumers, particularly those seeking convenient online banking solutions. This perception is crucial in attracting and retaining a broad customer base in a crowded market.

- Brand Recognition: Ally is consistently ranked among top financial brands for customer satisfaction.

- Digital Leadership: Recognized for its user-friendly online and mobile platforms.

- Customer Loyalty: High retention rates attributed to trust and service quality.

- Market Perception: Viewed as a modern, reliable alternative to traditional banks.

Ally Financial's proprietary technology platform, including its AI capabilities, is a fundamental key resource. This digital infrastructure underpins all operations, from customer interactions to lending processes, enabling efficiency and innovation. In 2024, Ally continued to enhance this platform, focusing on AI-driven personalization and operational streamlining.

The company's substantial customer deposit base, cultivated through its direct banking model, serves as a critical low-cost funding source. This stable and growing deposit pool, exceeding $130 billion as of Q1 2024, directly supports Ally's extensive lending activities, particularly in auto finance.

Ally's deeply entrenched relationships with a vast network of auto dealerships are a vital resource. These partnerships facilitate significant auto loan originations, solidifying Ally's market leadership in this sector. The company's retail originations in 2024 continued to reflect the strength derived from these dealer connections.

The expertise of Ally's workforce, particularly in financial services, technology, and risk management, is a key asset. This skilled talent pool drives digital innovation and operational excellence, with a significant portion of employees dedicated to technology and operations roles in 2023.

Ally's strong brand recognition and reputation for customer-centricity and digital leadership are invaluable resources. This established brand equity fosters customer loyalty and provides a distinct competitive advantage in the financial services market.

Value Propositions

Ally Financial champions convenient and accessible digital banking by offering 100% online services, underscored by their continuously improved mobile app. This digital-first approach allows customers to manage their finances, from checking balances to applying for loans, at any time and from virtually any location.

In 2024, Ally reported a significant portion of its customer interactions occurring through digital channels, highlighting the success of this strategy. Their mobile app, frequently updated with new features, consistently receives high user ratings, demonstrating strong customer adoption and satisfaction with the ease of access to banking services.

Ally Bank differentiates itself by offering highly competitive interest rates on both savings and checking accounts, as well as on its loan products. This focus on attractive rates directly benefits customers by helping their money grow faster and reducing the cost of borrowing.

Furthermore, Ally's commitment to a no-to-low fee structure significantly enhances its value proposition. For instance, in 2024, Ally continued its practice of offering accounts with no monthly maintenance fees, no overdraft fees, and no ATM fees from in-network machines, a stark contrast to many traditional banks.

This dual approach of maximizing customer financial well-being through high yields and low costs is designed to attract and retain a broad base of cost-conscious consumers and businesses looking for a more advantageous banking experience.

Ally Financial, despite its digital-first approach, places a significant emphasis on personalized customer support. They offer a 24/7 live customer care team, ensuring that assistance is always available. This commitment aims to foster strong relationships and boost customer satisfaction.

In 2023, Ally reported a customer satisfaction score of 85%, highlighting the effectiveness of their dedicated service model. This focus on passionate support differentiates them in the digital banking space.

Diverse Range of Financial Products

Ally Financial provides a broad spectrum of financial products designed to cater to a wide array of customer needs. This extensive offering includes core services like auto finance, which is a significant part of their business, alongside other financial solutions.

The company's historical involvement in mortgage finance, insurance, and commercial banking further broadens its reach. Ally also offers accessible deposit accounts, personal loans, and has historically provided credit card services, solidifying its position as a comprehensive financial provider.

This diverse product range allows Ally to serve multiple segments of the financial market, aiming to be a one-stop shop for many consumers and businesses. For instance, in the first quarter of 2024, Ally reported total assets of $133.6 billion, underscoring the scale of its operations across these varied financial sectors.

- Auto Finance: A cornerstone of Ally's business, serving millions of customers.

- Deposit Accounts: Offering competitive rates on savings and checking accounts.

- Insurance Services: Providing protection for vehicles and other assets.

- Commercial Banking: Supporting businesses with various financial tools and services.

Financial Education and Tools

Ally Financial actively champions financial literacy, offering a wealth of educational resources and practical tools designed to empower customers. Their commitment extends to breaking down economic barriers, with a significant focus on financial education initiatives. For instance, in 2024, Ally continued to invest in programs aimed at improving financial well-being for a broad customer base.

These offerings are designed to foster informed decision-making, covering topics from budgeting to investing. Ally’s platform provides access to articles, calculators, and personalized insights. This approach is crucial in today's complex financial landscape, where understanding financial products is key to achieving personal economic goals.

- Financial Literacy Programs: Ally offers online modules and workshops to enhance customers' understanding of personal finance.

- Digital Tools: Access to budgeting tools, savings calculators, and investment simulators to aid in financial planning.

- Economic Mobility Initiatives: Focused efforts to provide financial education to underserved communities, aiming to improve their economic standing.

- Customer Empowerment: The core value proposition is to equip customers with the knowledge and tools needed for confident financial management.

Ally Financial's value proposition centers on providing a superior, digitally-driven banking experience coupled with highly competitive rates and minimal fees. This strategy is further bolstered by robust, accessible customer support and a comprehensive suite of financial products, all while actively promoting financial literacy.

In 2024, Ally continued to emphasize its digital-first model, with a majority of customer interactions occurring online, supported by a well-regarded mobile app. They maintained their commitment to offering industry-leading interest rates on deposit accounts and competitive pricing on loans, alongside a structure largely free of common banking fees like monthly maintenance or overdraft charges.

The company's broad product portfolio, including its significant auto finance segment, alongside deposit accounts, insurance, and commercial banking services, allows it to serve a diverse customer base. This comprehensive offering, combined with a dedication to customer education and support, aims to make Ally a preferred financial partner.

| Value Proposition | Key Features | 2024 Data/Impact |

| Digital Convenience | 100% online banking, advanced mobile app | High customer interaction via digital channels; positive app reviews |

| Competitive Rates & Low Fees | High yields on deposits, competitive loan rates, no/low fees | Attracts cost-conscious customers; no monthly maintenance fees |

| Comprehensive Product Suite | Auto finance, deposits, insurance, commercial banking | Total assets of $133.6 billion (Q1 2024); broad market reach |

| Customer Support & Financial Literacy | 24/7 live support, educational resources | 85% customer satisfaction (2023); investment in financial education programs |

Customer Relationships

Ally's customer relationships lean heavily on self-service, powered by robust online and mobile platforms. This digital-first approach allows customers to manage their accounts, conduct transactions, and access a broad spectrum of banking services with ease and independence.

The company's commitment to digital enhancement is evident in its continuous investment in user experience. For instance, Ally reported that in Q1 2024, its digital channels, including web and mobile, handled the vast majority of customer interactions, underscoring the effectiveness of its self-service model.

Ally Financial cultivates customer relationships through a deeply ingrained customer-obsessed culture, prioritizing the principle of 'Doing It Right.' This commitment translates into award-winning technology and financial services designed to simplify customers' financial lives. For instance, in 2023, Ally reported a customer satisfaction score of 85%, highlighting their success in delivering user-friendly experiences.

Continuous innovation is a cornerstone of Ally's approach, directly fueled by customer feedback. The company actively solicits input to refine its offerings, ensuring its digital platforms and financial products remain intuitive and valuable. This focus on user experience is evident in their mobile app, which saw a 15% increase in active users during the first half of 2024.

Ally Financial's commitment to 24/7 live customer care and support is a cornerstone of its customer relationships, especially complementing its digital-first strategy. This round-the-clock availability ensures customers can get help whenever they need it, fostering a sense of reliability and trust in an increasingly online banking world.

In 2024, financial institutions are increasingly recognizing the importance of accessible support. For Ally, this means having a robust team ready to address inquiries, resolve issues, and provide guidance, which is crucial for retaining customers and building long-term loyalty in a competitive market. This proactive approach helps differentiate Ally by offering a human touch alongside its digital convenience.

Community Engagement and Social Impact

Ally Financial actively cultivates strong customer relationships by showcasing a deep commitment to community well-being through its corporate social responsibility efforts. These initiatives, which include significant investments in crucial areas like affordable housing, comprehensive financial education programs, and targeted workforce development, directly resonate with customer values and build trust.

This dedication to social impact not only bolsters Ally's brand reputation but also creates a tangible, positive connection with its customer base. For instance, in 2023, Ally Bank’s Ally Changemakers program supported 10 organizations focused on financial literacy and economic mobility, directly impacting thousands of individuals.

- Community Investment: Ally's commitment to affordable housing and community development projects saw substantial investment in 2023, contributing to local economic growth and stability.

- Financial Literacy: Through various educational outreach programs, Ally aims to enhance financial understanding and empower individuals to make sound financial decisions.

- Workforce Development: Investments in job training and career advancement initiatives help build stronger communities and foster economic opportunity.

- Brand Affinity: Demonstrating a commitment to social good strengthens customer loyalty and enhances Ally's overall brand image, fostering deeper engagement.

Data-Driven Personalization

Ally Financial leverages sophisticated data analytics and artificial intelligence to craft highly personalized customer journeys. This data-driven approach allows them to anticipate needs and offer relevant products and services, fostering deeper engagement and satisfaction. For instance, in 2024, Ally reported a significant increase in digital adoption, with over 80% of customer interactions occurring through their digital channels, a testament to the success of their personalized digital experiences.

This focus on data-driven personalization translates into tangible benefits for both Ally and its customers. By understanding individual financial behaviors and preferences, Ally can proactively suggest solutions, whether it's a tailored savings plan or a more suitable loan product. This not only enhances customer loyalty but also drives operational efficiency by streamlining service delivery.

- Data-Driven Personalization: Ally uses AI and analytics to tailor customer experiences.

- Enhanced Satisfaction: Personalized offerings lead to higher customer satisfaction and engagement.

- Digital Adoption: Over 80% of Ally's customer interactions were digital in 2024, showcasing personalized digital service success.

- Proactive Solutions: Understanding customer behavior allows for proactive and relevant financial product suggestions.

Ally Financial's customer relationships are built on a foundation of digital self-service, enhanced by a commitment to personalized experiences and robust support. This strategy leverages technology to empower customers while maintaining human connection through accessible customer care and community engagement.

The company's digital-first approach is validated by its Q1 2024 performance, where digital channels managed the majority of customer interactions. This focus on user experience is further supported by a customer-obsessed culture, aiming to simplify financial lives, as reflected in their 85% customer satisfaction score in 2023.

Continuous innovation, driven by customer feedback, ensures Ally's platforms remain intuitive and valuable, evidenced by a 15% increase in active mobile app users in the first half of 2024. Furthermore, their 24/7 live customer care complements digital convenience, fostering trust and loyalty in a competitive market.

| Key Customer Relationship Aspect | Description | Supporting Data/Initiative |

|---|---|---|

| Digital Self-Service | Empowering customers through online and mobile platforms. | Vast majority of customer interactions via digital channels (Q1 2024). |

| Customer Obsession & Satisfaction | Prioritizing user experience and simplifying finances. | 85% customer satisfaction score (2023). |

| Continuous Innovation & Feedback | Refining offerings based on customer input. | 15% increase in active mobile app users (H1 2024). |

| 24/7 Live Support | Providing accessible human assistance alongside digital tools. | Round-the-clock availability to build reliability and trust. |

| Community Engagement & Social Impact | Building trust through corporate social responsibility. | Ally Changemakers program supported financial literacy organizations (2023). |

| Data-Driven Personalization | Tailoring experiences using AI and analytics. | Over 80% of customer interactions digital in 2024; proactive solutions offered. |

Channels

Ally Financial's primary channels are its robust online and mobile banking platforms. These digital avenues offer customers seamless access to a full spectrum of financial products, from checking and savings accounts to loans and investments. The company has heavily invested in its mobile app, which underwent a significant revamp, underscoring a commitment to user experience and convenience.

These digital channels are designed for maximum accessibility, allowing customers to manage their finances anytime, anywhere. For instance, as of the first quarter of 2024, Ally reported over 11 million total customers, with a significant majority engaging through these digital interfaces, highlighting their critical role in customer acquisition and retention.

Ally Financial leverages direct-to-consumer digital marketing and advertising to expand its reach, employing targeted online campaigns across various platforms and third-party websites. This strategy aims to efficiently acquire new customers and guide them towards Ally's banking and financial product offerings.

In 2024, digital advertising spend by financial services companies continued to be a significant driver of customer acquisition. Ally's investment in these channels allows for precise audience segmentation, ensuring marketing messages resonate with potential customers actively seeking financial solutions, thereby optimizing conversion rates.

Ally Financial's automotive dealership network is a cornerstone of its auto finance operations, acting as the primary channel for originating consumer loans. These partnerships are vital, facilitating a substantial flow of financing for vehicle purchases.

In 2024, Ally continued to leverage its vast network, which includes thousands of dealerships across the United States. This extensive reach allows Ally to capture a significant share of the auto loan market by providing financing solutions directly at the point of sale.

Customer Service Contact Centers

Ally Financial leverages customer service contact centers as a crucial channel, even with its strong digital focus. These centers act as a vital support layer, ensuring customers can receive personalized assistance when self-service options aren't sufficient. This hybrid approach allows Ally to cater to a broader range of customer needs and preferences, reinforcing its commitment to comprehensive support.

These contact centers are designed to handle a variety of inquiries, from complex account issues to general product information. They complement Ally's robust digital platforms, offering a human touch that builds trust and loyalty. For instance, in Q1 2024, Ally reported that while digital engagement remained high, a significant portion of customer interactions still benefited from direct contact with service representatives, underscoring the continued importance of this channel.

- Digital First, Human Support: While Ally emphasizes digital self-service, contact centers are available for more complex needs.

- Complementary Channel: These centers enhance the overall customer experience by providing a direct line for assistance.

- Customer Engagement: In early 2024, a substantial percentage of customer inquiries still required direct contact with service agents, highlighting their ongoing relevance.

Ally Invest Online Platform

The Ally Invest online platform serves as a primary channel for Ally Financial, directly connecting clients with its securities brokerage and investment advisory services. This digital-first approach is central to reaching a broad customer base seeking self-directed investment tools and guidance.

In 2024, Ally Financial continued to emphasize its digital capabilities, with Ally Invest offering a comprehensive suite of tools. This includes features like commission-free online trading for stocks and ETFs, along with access to research and educational resources, all accessible through their web and mobile interfaces.

- Digital Brokerage: Ally Invest provides a robust online platform for trading stocks, options, ETFs, and mutual funds, emphasizing ease of use and accessibility.

- Investment Advisory: Beyond self-directed trading, the platform offers robo-advisory services, allowing clients to access managed portfolios tailored to their financial goals.

- Customer Engagement: The online channel facilitates customer support, account management, and the delivery of market insights, reinforcing Ally's commitment to a seamless digital experience.

Ally Financial’s channels are predominantly digital, focusing on its online and mobile banking platforms to offer a comprehensive suite of financial products. These digital avenues are crucial for customer acquisition and engagement, with a significant portion of its millions of customers interacting through these interfaces. The company also utilizes direct-to-consumer digital marketing to reach potential clients efficiently.

The automotive dealership network remains a vital channel for Ally’s auto finance business, serving as the primary point of sale for originating consumer loans. This extensive network, comprising thousands of dealerships nationwide, allows Ally to maintain a strong presence in the auto loan market. In 2024, this channel continued to be instrumental in facilitating vehicle financing.

Customer service contact centers are a key complementary channel, providing essential human support for customers who require assistance beyond self-service digital options. These centers handle a range of inquiries, reinforcing customer trust and loyalty. Data from Q1 2024 indicated that a notable percentage of customer interactions still benefited from direct contact with service agents, underscoring the channel's ongoing importance.

Ally Invest’s online platform is a primary channel for its brokerage and investment advisory services, catering to self-directed investors. In 2024, this platform offered tools like commission-free trading and robo-advisory services, accessible via web and mobile interfaces, to a broad customer base seeking investment solutions.

Customer Segments

Digitally savvy consumers are a core focus for Ally Financial, representing individuals who are comfortable and adept at managing their banking and financial needs entirely through online platforms and mobile applications. This segment actively seeks out financial institutions that offer seamless digital experiences, prioritizing convenience and immediate access to their accounts.

Ally's all-digital banking model is perfectly aligned with the preferences of these customers, who value the ability to conduct transactions, monitor accounts, and access financial tools anytime, anywhere. In 2024, a significant portion of Ally's customer base actively utilized its mobile app, with mobile banking sessions consistently showing high engagement rates, reflecting the segment's reliance on technology for financial management.

Ally Financial's auto purchasers and owners segment is a cornerstone, encompassing individuals needing financing for both new and used cars. This group represents a significant portion of the automotive lending market.

Ally's strength lies in serving a wide range of credit profiles, from prime to subprime borrowers. In 2024, the automotive finance industry continued to see robust demand, with Ally actively participating in providing essential capital for vehicle acquisition.

Beyond financing, this segment also includes those seeking auto insurance solutions. Ally's integrated approach aims to capture a larger share of the customer lifecycle, offering a comprehensive suite of products to vehicle owners.

Savers and investors are a core customer segment for Ally Financial, encompassing individuals seeking high-yield deposit accounts like savings, checking, and money market accounts. For instance, Ally Bank consistently offers some of the most competitive interest rates in the market, often exceeding national averages for savings accounts. In 2024, the average savings account APY hovered around 0.46%, while Ally's offerings have frequently been in the 4% to 5% range, attracting significant deposit balances.

This segment also includes those who utilize Ally Invest for their self-directed trading needs or seek guidance through advisory services. Ally Invest provides a platform for trading stocks, ETFs, and options, catering to a range of investment experience levels. The growth in retail investing, particularly among younger demographics, further bolsters this segment's importance, with millions of individuals actively managing their portfolios.

Middle-Market Companies and Equity Sponsors

Ally Financial's Corporate Finance division actively engages with middle-market companies and established equity sponsors, providing crucial capital solutions. This business-to-business (B2B) segment relies on Ally's robust commercial lending capabilities to fuel growth, acquisitions, and other strategic initiatives.

The demand for financing within this segment remains strong. For instance, middle-market M&A activity saw significant momentum in 2024, with deal volumes indicating a consistent need for capital. Equity sponsors, in particular, are leveraging debt financing to optimize their portfolio company performance and execute buyouts.

- Target Clients: Middle-market companies and private equity firms.

- Financing Needs: Capital for acquisitions, growth, recapitalizations, and buyouts.

- Ally's Role: Providing commercial lending expertise and structured finance solutions.

- Market Context: Driven by robust middle-market M&A and private equity investment activity.

Existing Ally Bank Customers (Cross-Sell Opportunities)

Ally Bank leverages its extensive base of deposit customers to introduce them to a wider array of financial solutions. This strategy capitalizes on established trust and familiarity, making the introduction of new products like personal loans and investment services a natural progression.

The bank's success in cross-selling is evident in its customer engagement metrics. For instance, Ally reported that a significant portion of its customers utilize multiple products, demonstrating the effectiveness of this approach in deepening customer relationships and increasing wallet share.

- Targeting Deposit Customers: Ally actively promotes its other offerings, including personal loans and wealth management services, to its existing deposit account holders.

- Leveraging Relationships: The bank's deep understanding of its customers' financial profiles allows for highly personalized cross-selling efforts.

- Product Adoption: A substantial percentage of Ally's customer base engages with more than one of the bank's financial products, reflecting successful cross-selling initiatives.

Ally Financial serves a broad spectrum of customers, from digitally adept individuals managing their finances online to those seeking automotive loans and insurance. The company also caters to savers and investors looking for competitive rates and investment platforms, as well as middle-market companies and private equity firms needing commercial financing. This diversified approach allows Ally to capture various financial needs across different customer types.

In 2024, Ally's digital banking segment continued to show strong engagement, with a high percentage of customers actively using its mobile app for daily transactions. The auto finance sector remained a significant contributor, with Ally providing capital for vehicle purchases across a range of credit profiles. Furthermore, the bank's focus on high-yield savings accounts and investment services attracted a substantial base of savers and investors, with Ally's deposit rates frequently outperforming national averages.

The company's corporate finance division actively supports middle-market businesses and equity sponsors, facilitating growth and acquisitions, areas that saw robust activity in 2024. Ally also excels at cross-selling, leveraging its existing deposit customer relationships to introduce them to a wider range of products like personal loans and investment services, with a notable portion of customers utilizing multiple Ally products.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Points |

|---|---|---|

| Digitally Savvy Consumers | Comfortable with online/mobile banking | High mobile app engagement rates |

| Auto Purchasers & Owners | Need auto financing and insurance | Robust demand in auto lending industry |

| Savers & Investors | Seek high-yield accounts and investment platforms | Competitive savings APYs (often 4-5%) vs. national average (~0.46%) |

| Middle-Market Companies & Equity Sponsors | Require commercial lending for growth/acquisitions | Strong middle-market M&A activity |

Cost Structure

Ally Financial dedicates a substantial portion of its expenses to building and maintaining its robust digital banking platform and underlying technology infrastructure. This includes significant outlays for cloud computing services, artificial intelligence development, and ongoing application enhancement.

In 2024, Ally continued its strategic investments in technology, with a focus on areas like AI-powered customer service and advanced data analytics to improve operational efficiency and customer experience. Cybersecurity remains a critical cost center, ensuring the protection of sensitive customer data and the integrity of its digital operations.

As a digital bank, Ally Financial's primary funding cost stems from the interest paid on its substantial customer deposit base. In 2024, managing these interest expenses is crucial for optimizing its net interest margin. Ally strategically adjusts its deposit rates, aiming to attract and retain a strong deposit base while keeping funding costs competitive.

Employee salaries and benefits are a significant cost driver for Ally Financial, encompassing compensation for a diverse workforce. This includes the thousands of employees in customer service, technology development, risk management, and various corporate functions essential to its digital-first banking model.

In 2024, Ally Financial’s commitment to its employees is reflected in its compensation and benefits packages, which are crucial for attracting and retaining talent in the competitive financial services industry. These costs are a substantial portion of their overall operating expenses, directly impacting profitability.

Marketing and Advertising Expenses

Ally Financial dedicates significant resources to marketing and advertising, primarily through digital channels, to attract new customers and highlight its wide array of financial products. This strategic spending is crucial for its customer acquisition efforts.

In 2023, Ally Financial reported marketing and advertising expenses of $545 million. This figure reflects a notable increase from the $490 million spent in 2022, underscoring a heightened investment in customer growth initiatives.

- Digital Advertising: Significant portion allocated to online ads across various platforms to reach a broad audience.

- Partnerships: Collaborations with third-party websites and financial influencers to expand reach and credibility.

- Brand Awareness: Campaigns designed to build and reinforce Ally's brand identity in the competitive financial services landscape.

Loan Loss Provisions and Credit Risk Management

Ally Financial, as a major lender, allocates significant resources to loan loss provisions. These provisions are crucial for absorbing potential losses from borrowers who may default on their loans. For instance, in the first quarter of 2024, Ally reported a provision for credit losses of $280 million. This figure reflects the ongoing assessment of credit quality across their extensive loan portfolio.

Beyond direct provisions, the cost structure includes substantial expenses for robust credit risk management. This encompasses the costs associated with meticulously assessing the creditworthiness of potential borrowers through underwriting processes. Furthermore, ongoing monitoring and collection efforts for existing loans also contribute to these operational expenses, ensuring the health of their loan book.

- Loan Loss Provisions: Essential for hedging against potential borrower defaults.

- Credit Risk Assessment: Costs incurred for evaluating borrower creditworthiness during underwriting.

- Underwriting Expenses: Costs associated with the process of approving or denying loan applications.

- Collections Costs: Expenses related to managing and recovering outstanding loan balances.

Ally Financial's cost structure is heavily influenced by its digital-first operational model. Key expenses include maintaining its advanced technology infrastructure, which involves significant spending on cloud services and AI development, as seen in its 2024 focus on these areas. A substantial portion of costs also relates to employee compensation and benefits, critical for attracting talent in the competitive financial sector.

Funding costs, primarily interest paid on customer deposits, are a significant component. Ally strategically manages these costs to optimize its net interest margin. Additionally, marketing and advertising expenses, particularly in digital channels, are crucial for customer acquisition, with spending increasing to $545 million in 2023.

Loan loss provisions and credit risk management represent another major cost area. In Q1 2024, Ally reported $280 million in provisions for credit losses, reflecting ongoing efforts to manage potential defaults and maintain a healthy loan portfolio.

| Cost Category | 2023 Data | 2024 Focus/Data |

| Technology Infrastructure & Development | Significant investment | Continued investment in AI & data analytics |

| Employee Compensation & Benefits | Substantial portion of operating expenses | Crucial for talent retention |

| Interest Expense on Deposits | Major funding cost | Strategic rate management for net interest margin |

| Marketing & Advertising | $545 million (2023) | Increased focus on digital channels for customer acquisition |

| Loan Loss Provisions | Ongoing assessment | $280 million (Q1 2024) |

Revenue Streams

Ally Financial's core revenue generator is net interest income. This is the profit made from lending money, specifically the difference between the interest earned on its various loans and the interest paid out on customer deposits.

The company's loan portfolio is quite diverse, encompassing auto loans, which have been a significant driver, along with personal loans and commercial loans. While Ally historically offered mortgage finance, its focus has shifted, but interest from outstanding mortgage loans still contributes.

For the first quarter of 2024, Ally reported total net interest income of $2.2 billion. This highlights the crucial role that managing its lending and deposit costs plays in its overall profitability and business model.

Ally Financial generates revenue from fees tied to its banking services, even as it champions a low-fee model. These can include charges for specific transactions, overdrafts, or other account management services.

Ally Financial generates significant revenue from its insurance segment, primarily through written premiums and commissions. This business offers crucial products like vehicle service contracts and guaranteed asset protection (GAP) insurance, safeguarding customers against unexpected automotive expenses and potential loan shortfalls.

In 2024, Ally's insurance operations are a key contributor to its financial performance. While specific segment revenue figures fluctuate, the company's broader focus on auto finance, where insurance is often bundled, indicates a robust and consistent stream from these offerings.

Gains from Investment Activities

Ally Financial generates revenue through its investment activities, specifically from gains realized on its securities portfolio and other investment holdings. These gains are a crucial component of its overall income, reflecting the performance of its managed assets.

The company actively manages its securities portfolio, making strategic adjustments to optimize its net interest income. This involves decisions about which securities to hold, buy, or sell, aiming to maximize the spread between interest earned and interest paid.

- Securities Portfolio Gains: Ally realizes income from the appreciation and sale of its investment securities.

- Strategic Repositioning: Management actively adjusts the portfolio to enhance net interest income.

- 2024 Performance Insight: While specific 2024 figures for this segment are still emerging, Ally's strong focus on optimizing its balance sheet in prior years suggests continued efforts to leverage its investment activities for revenue generation. For instance, in 2023, Ally reported significant gains from its investment portfolio, contributing positively to its financial results.

Corporate Finance Income

Ally Financial's Corporate Finance division brings in income by offering vital capital and financing solutions. This includes providing loans and other financial services specifically tailored for middle-market companies and equity sponsors. The revenue generated comes from interest earned on these commercial loans, as well as various fees associated with these transactions.

This segment of Ally's business is crucial for supporting the growth and operational needs of businesses within the middle market. By providing access to capital, Ally enables these companies to expand, invest, and manage their financial structures effectively. The income streams here are directly tied to the volume and success of these financing arrangements.

- Interest Income: Earned on the principal amounts of commercial loans provided to middle-market companies and equity sponsors.

- Fees: Generated from various services such as loan origination, advisory services, and other financing-related activities.

- Financing Solutions: Providing capital for mergers, acquisitions, recapitalizations, and general corporate purposes.

Ally Financial's revenue streams are diverse, with net interest income from its extensive loan portfolio, including auto, personal, and commercial loans, forming the bedrock. This is complemented by fee income from its banking services, even as it maintains a low-fee approach.

The insurance segment is a significant contributor, generating revenue through written premiums and commissions on products like vehicle service contracts and GAP insurance, often bundled with auto loans. Furthermore, Ally realizes gains from its investment securities portfolio, actively managing its assets to enhance income.

Ally's Corporate Finance division also generates income by providing capital and financing solutions to middle-market companies and equity sponsors through interest on commercial loans and associated fees.

| Revenue Stream | Primary Source | 2024 Data/Insight |

|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits | Q1 2024: $2.2 billion reported. |

| Fee Income | Banking services (transaction, overdraft, account management) | Contributes to overall revenue despite low-fee model. |

| Insurance Revenue | Written premiums and commissions (vehicle service contracts, GAP insurance) | Key contributor, especially linked to auto finance. |

| Investment Gains | Appreciation and sale of securities portfolio | Active management aims to optimize income; strong performance in 2023 suggests continued focus. |

| Corporate Finance | Interest on commercial loans and fees for middle-market financing | Supports middle-market companies with capital for growth and operations. |

Business Model Canvas Data Sources

The Ally Financial Business Model Canvas is informed by a blend of internal financial disclosures, comprehensive market research on the financial services sector, and strategic analyses of industry trends and competitor activities.