Ally Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ally Financial Bundle

Ally Financial operates within a dynamic landscape shaped by evolving political regulations, economic shifts, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential opportunities or threats.

Our comprehensive PESTLE analysis delves deep into these critical factors, offering actionable insights tailored to Ally Financial's unique position. Gain a competitive edge by uncovering how global trends are impacting the financial services sector and Ally's future growth. Download the full version now and equip yourself with the intelligence needed to make informed decisions.

Political factors

Ally Financial's operations are deeply intertwined with governmental fiscal and monetary policies. The Federal Reserve's monetary policy, particularly its stance on interest rates, directly influences Ally's core business of lending and deposit-taking. For example, the Fed's decision to maintain interest rates at a low level, as seen in periods following economic downturns, can compress net interest margins for banks like Ally.

Conversely, the tightening of monetary policy, characterized by rising interest rates, presents a dual effect. While Ally may see higher yields on its loan portfolio, it also faces increased costs for funding and potentially a slowdown in consumer demand for credit products, such as auto loans, a significant segment for Ally. In 2024, the anticipation of potential rate cuts by the Federal Reserve has been a key market driver, impacting Ally's strategic planning for deposit pricing and loan origination volumes.

The financial services sector is a prime example of an industry under intense regulatory scrutiny, and any shifts in these frameworks can significantly affect Ally Financial. This encompasses a broad range of rules governing consumer protection, how loans are issued, the safeguarding of personal data, and the amount of capital financial institutions must hold. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued its focus on fair lending practices and overdraft fees, areas directly impacting Ally's retail banking operations.

Ally Financial, like its peers, navigates a landscape of ongoing regulatory and supervisory risks. Potential changes to these rules, such as adjustments to capital adequacy ratios or new compliance mandates, can influence how Ally operates and the costs associated with adhering to them. For example, discussions around potential updates to the Community Reinvestment Act (CRA) in 2024 could lead to new obligations for banks like Ally to serve low- and moderate-income communities, impacting their strategic planning and operational expenditures.

Ally Financial's operations, especially its significant auto finance segment, are indirectly influenced by broader political stability and evolving trade policies. For instance, the imposition of tariffs on imported vehicles or automotive parts, as seen in various global trade discussions, can dampen vehicle sales. This, in turn, can reduce the demand for auto loans, impacting Ally's core business.

A stable political environment is crucial for financial services companies like Ally. Predictability in governance and regulation fosters confidence, encouraging consumer spending and business investment, which are vital for loan origination and overall financial sector health. The U.S. political landscape, for example, continues to shape economic policy, affecting interest rates and consumer credit availability.

Government Initiatives and Support for Digitalization

Government initiatives and support for digitalization significantly impact Ally Financial's business model. Policies promoting digital banking adoption and fintech innovation create a fertile ground for Ally, which operates exclusively online. For instance, the Biden-Harris administration's focus on increasing broadband access, with over $42 billion allocated through the Broadband Equity, Access, and Deployment (BEAD) program as of early 2024, indirectly supports digital financial services by expanding internet connectivity for potential customers.

Government incentives for technological advancement in finance can directly bolster Ally's growth strategy. These could include tax credits for R&D in AI or cybersecurity, areas crucial for an online-only bank. Conversely, regulations that impose significant compliance burdens on digital-first institutions or create barriers to seamless online customer onboarding could present challenges.

- Digital Infrastructure Investment: Government programs like the BEAD initiative enhance broadband availability, crucial for Ally's online customer base.

- Fintech Regulatory Environment: Favorable regulations for digital banking and fintech can accelerate Ally's expansion and product development.

- Cybersecurity Mandates: Evolving cybersecurity regulations require continuous investment and adaptation to protect customer data and maintain trust.

Consumer Protection Regulations

Consumer protection regulations significantly shape Ally Financial's operational landscape. Laws governing fair lending, debt collection, and transparency in financial product offerings directly impact how Ally interacts with its customers. Staying compliant is paramount for preserving customer trust and avoiding costly legal repercussions. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces rules designed to prevent predatory practices, with fines often levied for violations.

The increasing focus on data privacy and security by regulators underscores the critical need for robust consumer data protection measures. Recent class-action lawsuits, such as those stemming from data breaches, serve as stark reminders of the potential financial and reputational damage that can arise from inadequate security protocols. In 2024, regulatory scrutiny on data handling practices intensified, with new guidelines emerging regarding breach notification and consumer recourse.

- Fair Lending Enforcement: Ally must adhere to regulations like the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act, ensuring no discriminatory practices in lending.

- Debt Collection Standards: Compliance with the Fair Debt Collection Practices Act (FDCPA) is essential to maintain ethical collection processes and avoid consumer complaints.

- Transparency Requirements: Regulations mandate clear disclosure of fees, terms, and conditions for all financial products, fostering informed consumer decisions.

- Data Breach Liability: Increased regulatory penalties for data breaches, as seen in recent enforcement actions, highlight the financial risks associated with consumer data protection failures.

Government fiscal and monetary policies significantly influence Ally Financial's profitability and strategic direction. The Federal Reserve's interest rate decisions directly impact Ally's net interest margins, with rising rates in 2024 generally benefiting lending income but increasing funding costs.

Regulatory frameworks, including those from the Consumer Financial Protection Bureau (CFPB), impose compliance burdens and shape Ally's product offerings and customer interactions. For example, the CFPB’s continued focus on fair lending in 2024 affects Ally’s auto loan and mortgage operations.

Government investments in digital infrastructure, such as broadband expansion initiatives, indirectly support Ally's online-only business model. Conversely, evolving cybersecurity regulations necessitate ongoing investment to protect sensitive customer data and maintain operational integrity.

Political stability is crucial for consumer confidence and business investment, which are key drivers for Ally's loan origination volumes, particularly in its significant auto finance sector.

What is included in the product

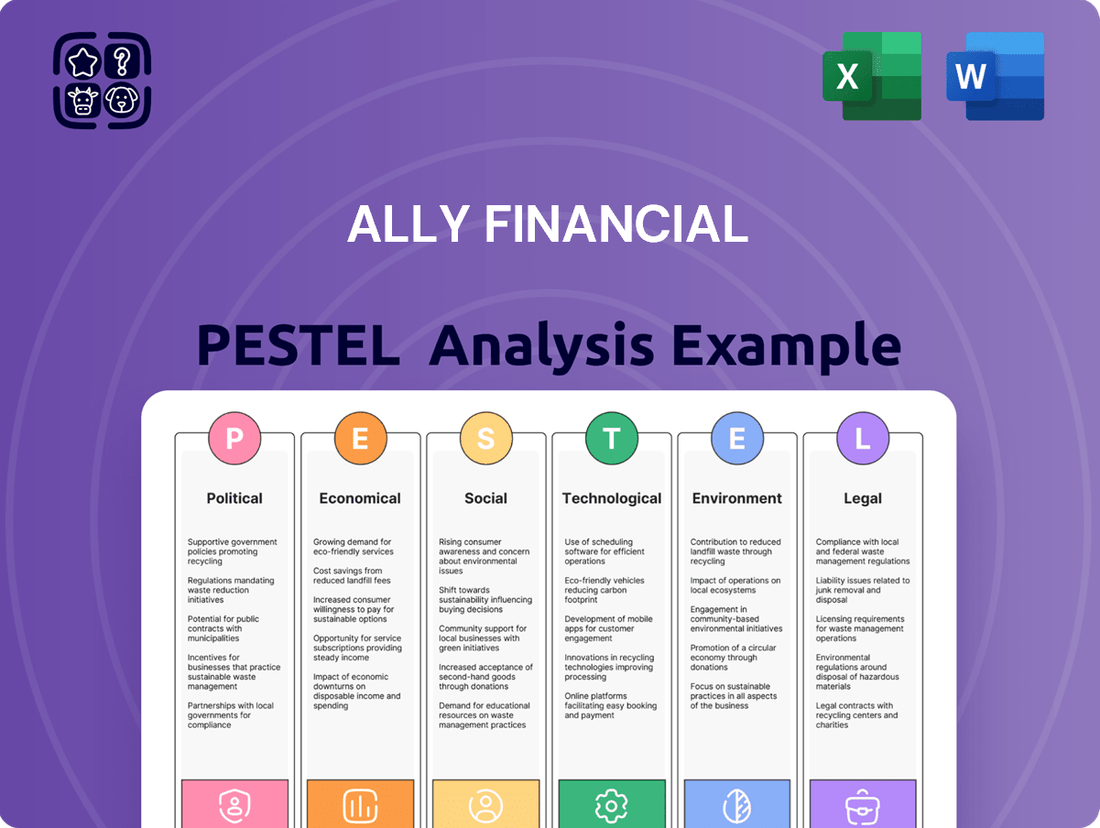

This PESTLE analysis examines the external macro-environmental factors influencing Ally Financial, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

Provides a concise version of Ally Financial's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risks and market positioning for Ally Financial during planning sessions by offering a structured overview of the PESTLE landscape.

Economic factors

Interest rate fluctuations are a major economic consideration for Ally Financial, impacting both its lending and deposit operations. For instance, the Federal Reserve's monetary policy decisions directly influence Ally's cost of funds and the rates it can charge on loans. In 2024, with interest rates remaining elevated compared to the preceding years, Ally's net interest margin is directly affected.

Higher interest rates can increase borrowing costs for consumers, potentially dampening demand for Ally's core auto loans. However, these higher rates also allow Ally to earn more on its loan portfolio, boosting net interest income. Conversely, a scenario with lower interest rates would reduce Ally's funding costs but could also compress the yields on its assets.

Consumer spending and credit health are pivotal for Ally Financial. In early 2024, consumer spending remained resilient, though some signs of moderation began to appear as inflation persisted. The overall credit health of consumers, as indicated by credit scores and delinquency rates, directly influences Ally's auto and mortgage portfolios.

A robust economy typically fuels higher consumer spending, which translates to increased demand for Ally's financing products. For instance, in 2024, auto sales saw steady demand, benefiting Ally's significant auto lending segment. Conversely, economic slowdowns or rising interest rates can strain consumer finances, potentially increasing loan defaults and impacting Ally's profitability.

Ally's performance is closely tied to the financial well-being of its customers. As of Q1 2024, Ally reported stable delinquency rates across its major loan segments, reflecting the generally sound, albeit cautious, credit environment for many consumers. However, ongoing economic uncertainties mean that shifts in consumer spending patterns or credit quality could rapidly affect the company's outlook.

Inflation directly impacts Ally Financial by eroding consumer purchasing power and increasing operational costs. While inflation rates have shown signs of cooling, the persistence of higher interest rates, a common response to inflation, will continue to affect borrowing costs and investment returns for financial institutions throughout 2024 and into 2025.

Economic growth is a key driver for Ally Financial. A robust economy generally leads to higher employment rates and increased consumer confidence, which in turn boosts demand for loans and improves borrowers' ability to repay. Conversely, economic slowdowns can dampen loan demand and elevate the risk of defaults, posing challenges for Ally's profitability and asset quality.

Automotive Market Dynamics

Ally Financial, as a major player in auto finance, is deeply intertwined with the health of the automotive market. Fluctuations in new and used vehicle sales directly impact the volume of loans Ally can originate. For instance, in 2024, projections indicated continued demand for used vehicles, though new vehicle inventory challenges persisted, influencing financing opportunities.

Vehicle pricing and inventory levels are critical. Higher vehicle prices can lead to larger loan amounts, but also increase the risk of default if economic conditions worsen. As of early 2025, while new car inventory has seen some recovery from pandemic-era lows, prices remain elevated compared to pre-2020 levels, impacting affordability for consumers and thus loan demand.

The accelerating shift towards electric vehicles (EVs) presents a dual-edged sword for Ally. While EV adoption creates new lending avenues, it also necessitates adjustments in underwriting and risk assessment. The market share of EVs in new vehicle sales is steadily growing, with forecasts suggesting it will reach significant double-digit percentages by 2025, requiring Ally to adapt its product offerings and expertise.

- New Vehicle Sales: While 2024 saw some recovery, new vehicle sales in the US were projected to remain below pre-pandemic peaks, impacting overall financing volume.

- Used Vehicle Market: The used vehicle market continued to show resilience in 2024 and into 2025, offering a stable, albeit potentially higher-risk, segment for auto lenders.

- EV Growth: Electric vehicle market share in new car sales was expected to surpass 15% in the US by the end of 2025, presenting both growth opportunities and the need for specialized financing products.

- Vehicle Affordability: Elevated vehicle prices in 2024 and 2025, driven by supply chain issues and inflation, continued to challenge consumer affordability, potentially moderating loan demand.

Competition in Digital Banking

The digital banking sector is experiencing fierce competition, with established banks enhancing their online services and a surge of agile fintech companies entering the market. This dynamic environment directly challenges Ally Financial's capacity to draw in and hold onto its deposit base.

Ally's strategic emphasis on a digital-first approach and robust customer retention programs becomes paramount for maintaining its competitive edge. For instance, as of Q1 2024, Ally reported a 1.5% increase in total deposits year-over-year, reaching $134.5 billion, a testament to its efforts in a crowded market.

- Increased Market Saturation: Fintechs and traditional banks alike are heavily investing in digital platforms, leading to a more crowded marketplace for customer acquisition.

- Customer Acquisition Costs: The heightened competition is driving up the cost of acquiring new customers, putting pressure on profitability.

- Product Innovation: Competitors are rapidly introducing new features and services, requiring Ally to continually innovate to meet evolving customer expectations and retain market share.

Economic growth significantly influences Ally Financial's performance, with a strong economy typically boosting loan demand and improving borrower repayment capabilities. Conversely, economic downturns can lead to reduced loan origination and increased default risks, directly impacting Ally's profitability and asset quality throughout 2024 and into 2025.

Interest rate movements are critical for Ally, affecting its net interest margin. Elevated rates in 2024, while increasing funding costs, also allow for higher loan yields. The Federal Reserve's monetary policy continues to shape these dynamics, influencing both Ally's cost of funds and the rates it can charge on its diverse loan portfolio.

Consumer credit health and spending patterns are pivotal. In early 2024, consumer spending remained robust, though inflation presented challenges. Ally's auto and mortgage portfolios are particularly sensitive to delinquency rates, which remained stable in Q1 2024, reflecting a generally sound, yet cautious, consumer credit environment.

| Economic Factor | Impact on Ally Financial | 2024/2025 Data Point |

|---|---|---|

| Economic Growth | Drives loan demand and credit quality. | US GDP growth projected around 2-2.5% for 2024, moderating slightly in 2025. |

| Interest Rates | Affects net interest margin and loan demand. | Federal Funds Rate held steady in the 5.25%-5.50% range through early 2025. |

| Inflation | Impacts consumer purchasing power and operational costs. | CPI inflation showed signs of cooling in 2024, aiming for the Fed's 2% target by late 2025. |

| Consumer Spending | Influences demand for financing products. | Retail sales showed resilience in early 2024, with continued growth expected, albeit at a slower pace. |

Full Version Awaits

Ally Financial PESTLE Analysis

The Ally Financial PESTLE Analysis you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ally Financial. You'll gain valuable insights into the strategic landscape for this leading financial services provider.

Sociological factors

Ally Financial's success is deeply tied to the growing societal preference for digital banking. As more consumers embrace online platforms for their financial needs, Ally's all-digital model directly caters to this trend. This shift is evident, with a significant portion of banking transactions now occurring online. For instance, by the end of 2024, it's projected that over 80% of all banking interactions will be digital, a substantial increase from previous years.

The company's commitment to user-friendly interfaces and seamless digital solutions directly reflects evolving customer expectations. People want convenience and accessibility, and Ally's digital-first approach meets these demands head-on. This aligns with broader societal changes where digital engagement is becoming the norm across all service industries, not just finance.

Societal financial literacy levels directly influence how consumers interact with Ally Financial's offerings. A population with higher financial understanding is more likely to engage with sophisticated products, while lower literacy may necessitate simpler, more guided experiences. For instance, a 2023 FINRA study indicated that while 70% of Americans could answer basic financial questions, only 34% could answer intermediate ones, highlighting a significant gap Ally can address through its educational initiatives.

Ally's commitment to simplifying money management, encapsulated in its 'Do It Right' ethos, aligns well with the challenge of varying financial literacy. By prioritizing transparency and clear communication, Ally can build trust and empower a broader customer base. This approach is particularly relevant as digital banking becomes more prevalent, requiring consumers to navigate complex online platforms and understand digital financial tools.

Shifting demographics are a significant factor for Ally Financial. The increasing prominence of millennials and Gen Z, who are digital natives, means a greater demand for online banking and seamless digital experiences. This aligns perfectly with Ally's digital-first approach.

These younger generations, comprising a substantial portion of the consumer base, often prioritize convenience and self-service options. For instance, by the end of 2024, it's projected that over 40% of the US workforce will be comprised of millennials and Gen Z, indicating a powerful consumer segment that Ally is well-positioned to serve.

Consumer Trust and Data Privacy Concerns

Consumer trust is a critical asset for Ally Financial, especially given the increasing societal concerns around data privacy and cybersecurity. A 2024 survey indicated that over 70% of consumers are highly concerned about how their financial data is handled by online institutions. This heightened awareness means Ally must prioritize the security of its digital platforms and be transparent about its data protection practices to maintain customer confidence.

Recent high-profile data breaches across the financial sector have amplified these anxieties. For instance, a major breach in late 2023 exposed millions of customer records, underscoring the need for continuous investment in advanced cybersecurity measures. Ally's commitment to safeguarding customer information is therefore not just a regulatory requirement but a fundamental aspect of its brand reputation and customer retention strategy.

- Data Privacy Concerns: A significant majority of consumers express worry over how their financial information is collected, stored, and used by digital banks.

- Cybersecurity Threats: The evolving landscape of cyber threats necessitates robust, multi-layered security protocols to prevent breaches and protect sensitive customer data.

- Trust as a Differentiator: In a competitive digital banking market, a strong track record of data security and transparent communication can be a key differentiator for Ally.

- Regulatory Scrutiny: Increasing governmental focus on data privacy, such as potential updates to consumer protection laws in 2025, will likely place further emphasis on compliance and security standards for financial institutions.

Social Responsibility and Community Engagement

Societal expectations are increasingly pushing companies like Ally Financial to demonstrate genuine social responsibility and actively engage with their communities. This focus directly impacts how consumers perceive the brand and, consequently, their loyalty. For instance, a 2024 survey indicated that over 70% of consumers consider a company's social impact when making purchasing decisions.

Ally's dedication to community development and environmental sustainability plays a crucial role in shaping its social standing. These efforts are not just about good practice; they are becoming a competitive differentiator. Ally's 2023 Corporate Social Responsibility report highlighted a 15% increase in community investment compared to the previous year, focusing on financial literacy programs and affordable housing initiatives.

- Increased Consumer Demand for Ethical Practices: A significant portion of the population now prioritizes businesses that align with their values, influencing purchasing behavior and brand preference.

- Impact of CSR on Brand Reputation: Positive community engagement and sustainability efforts directly enhance Ally's brand image, fostering trust and potentially attracting a wider customer base.

- Ally's Community Investment Growth: The company's commitment is reflected in tangible increases in its financial support for community programs, demonstrating a proactive approach to social impact.

- Focus on Financial Literacy and Housing: Ally's strategic allocation of resources towards improving financial literacy and supporting affordable housing addresses critical societal needs, reinforcing its role as a responsible corporate citizen.

The increasing preference for digital channels in banking significantly benefits Ally Financial, given its all-digital model. This trend is projected to continue, with over 80% of banking interactions expected to be digital by the close of 2024, a substantial leap from previous years.

Ally's user-friendly digital platforms directly address evolving customer expectations for convenience and accessibility. This aligns with a broader societal shift towards digital engagement across all service sectors, making Ally's core offering highly relevant.

Financial literacy levels among the population directly impact engagement with Ally's products. While a 2023 FINRA study showed 70% of Americans could answer basic financial questions, only 34% could handle intermediate ones, presenting an opportunity for Ally's educational resources.

Shifting demographics, particularly the rise of digital-native millennials and Gen Z, favor Ally's approach. By 2024, these groups are expected to constitute over 40% of the US workforce, representing a key consumer segment that values self-service and digital convenience.

Consumer trust is paramount, especially with growing concerns about data privacy and cybersecurity. A 2024 survey revealed that over 70% of consumers are highly concerned about how their financial data is handled by online institutions, underscoring the need for Ally's robust security measures.

Societal expectations now demand that companies demonstrate social responsibility, influencing brand perception and loyalty. A 2024 survey indicated that over 70% of consumers consider a company's social impact in their purchasing decisions, making Ally's community investments crucial.

| Sociological Factor | Description | Ally Financial Relevance | Supporting Data/Trend |

|---|---|---|---|

| Digital Adoption | Growing preference for online and mobile banking services. | Directly aligns with Ally's digital-first business model. | Over 80% of banking interactions projected to be digital by end of 2024. |

| Financial Literacy | Varying levels of consumer understanding of financial products and management. | Opportunity for Ally to provide educational resources and simplified offerings. | Only 34% of Americans could answer intermediate financial questions (FINRA, 2023). |

| Demographic Shifts | Increasing influence of younger generations (Millennials, Gen Z) who are digital natives. | These demographics prioritize convenience and self-service, fitting Ally's model. | Millennials and Gen Z expected to be over 40% of the US workforce by end of 2024. |

| Trust and Security Concerns | Heightened consumer awareness and anxiety regarding data privacy and cybersecurity. | Requires Ally to maintain strong security protocols and transparent communication. | Over 70% of consumers concerned about financial data handling (2024 survey). |

| Social Responsibility Expectations | Consumer demand for companies to engage in ethical practices and community support. | Ally's CSR initiatives enhance brand reputation and customer loyalty. | Over 70% of consumers consider social impact in purchasing decisions (2024 survey). |

Technological factors

Ally Financial is strategically embedding artificial intelligence across its business, notably through its internal Ally.ai platform. This integration aims to streamline operations and elevate customer interactions by automating routine tasks such as generating email responses and summarizing customer calls. For instance, AI-powered fraud detection systems are a key component, with financial institutions like Ally reporting significant improvements in identifying and preventing fraudulent transactions.

As an all-digital bank, Ally Financial's technological landscape is dominated by cybersecurity and data protection. The constant threat of sophisticated cyberattacks and potential data breaches means substantial, ongoing investment in advanced security infrastructure is non-negotiable to safeguard sensitive customer information.

In 2023, the financial services sector experienced a significant rise in cyber threats, with ransomware attacks increasing by an estimated 70% year-over-year, according to industry reports. Ally Financial, like its digital-first peers, must allocate a considerable portion of its technology budget to stay ahead of evolving threats, ensuring the integrity and confidentiality of its operations and customer data.

Ally's core business model is intrinsically tied to its advanced digital platforms, which are central to its online banking and auto finance operations. The company’s commitment to innovation in these digital services is paramount for staying ahead in a competitive market and satisfying customer demands for seamless, accessible financial solutions.

In 2024, Ally continued to invest heavily in its digital infrastructure, aiming to enhance user experience and expand its service offerings. For instance, its mobile app saw significant updates designed to streamline common banking tasks, reflecting a broader industry trend where digital engagement is a key differentiator. This focus on digital development is essential for attracting and retaining customers in an increasingly online-first financial landscape.

Cloud Computing and Infrastructure

Ally Financial's reliance on cloud computing and robust IT infrastructure is paramount for its digital-first strategy. This infrastructure underpins all customer interactions, transaction processing, and data analytics. In 2024, the company continued to invest heavily in its technology stack, with a significant portion of its operational budget allocated to cloud services and infrastructure upgrades to ensure agility and efficiency.

Ensuring the scalability, reliability, and security of Ally's cloud environment is critical for maintaining seamless service delivery and effective data management. Disruptions can directly impact customer trust and operational continuity. For instance, a robust cloud strategy allows Ally to handle fluctuating customer demand, a key consideration in the competitive financial services landscape. By mid-2025, Ally aims to have further optimized its cloud spend, targeting a 15% increase in operational efficiency through enhanced cloud utilization.

Key technological factors impacting Ally Financial's cloud operations include:

- Cloud Service Provider Partnerships: Ally leverages major cloud providers, such as Amazon Web Services (AWS) and Microsoft Azure, for its computing needs, ensuring access to cutting-edge technologies and economies of scale.

- Data Security and Compliance: Maintaining stringent data security protocols and adhering to financial regulations within the cloud environment is a continuous priority, especially with evolving cyber threats.

- Infrastructure Modernization: Ongoing investment in modernizing its IT infrastructure, including migrating legacy systems to cloud-native architectures, enhances performance and reduces operational costs.

- Disaster Recovery and Business Continuity: Implementing resilient cloud-based disaster recovery solutions is essential to guarantee uninterrupted service availability in the event of unforeseen incidents.

Fintech Partnerships and Ecosystem

Ally Financial's technological advancement is significantly shaped by its engagement with the broader fintech ecosystem. Strategic partnerships with innovative technology providers can bolster Ally's capabilities, offering access to cutting-edge solutions that might otherwise be cost-prohibitive or time-consuming to develop internally. This collaborative approach is crucial for maintaining a competitive edge in a rapidly evolving digital financial landscape.

Collaborations and potential acquisitions within the fintech space present a clear pathway for Ally to enhance its product suite and streamline operations. For instance, integrating advanced AI-driven customer service platforms or novel payment processing technologies can directly improve customer experience and operational efficiency.

By actively participating in and leveraging the fintech ecosystem, Ally aims to stay ahead of market trends.

- Increased Investment in Fintech: Global fintech investment reached $150 billion in 2023, indicating a robust environment for potential partnerships and acquisitions for Ally.

- API Economy Growth: The increasing adoption of Application Programming Interfaces (APIs) facilitates seamless integration of third-party fintech solutions into Ally's existing infrastructure.

- Digital Transformation Focus: Many financial institutions, including Ally, are prioritizing digital transformation, making partnerships with agile fintech firms a strategic imperative to accelerate innovation.

- Customer-Centric Solutions: Fintech partnerships often focus on developing user-friendly, personalized digital experiences, aligning with Ally's strategy to enhance customer engagement.

Ally Financial's commitment to AI, evident in its Ally.ai platform, is transforming operations by automating tasks and enhancing customer service. This focus on AI, particularly for fraud detection, is crucial as financial institutions reported significant improvements in identifying illicit activities. The company's digital-first model necessitates continuous investment in cybersecurity, a sector that saw a 70% increase in ransomware attacks in 2023, underscoring the importance of robust security measures.

Legal factors

Ally Financial navigates a stringent regulatory environment, overseen by bodies like the Federal Reserve and the FDIC. These regulations, including those aimed at consumer protection, dictate everything from capital requirements to lending practices. Failure to comply can result in substantial penalties, impacting profitability and operational stability.

Ally Financial, like all financial institutions, operates under increasingly stringent data privacy and security laws. Regulations such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), along with federal laws like the Gramm-Leach-Bliley Act (GLBA), mandate how Ally must collect, store, use, and protect personally identifiable information (PII). Failure to comply can result in significant penalties. For instance, CCPA violations can lead to statutory damages of $100 to $750 per consumer per incident, or actual damages, whichever is greater. This legal landscape directly influences Ally's operational costs and requires substantial investment in cybersecurity infrastructure and compliance programs.

Laws governing lending practices, credit reporting, and debt collection are fundamental to Ally Financial's operations, especially in its auto and mortgage finance sectors. Compliance with fair lending statutes, truth-in-lending acts, and various state-specific regulations is paramount to mitigating legal risks and avoiding significant penalties.

For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations like the Equal Credit Opportunity Act (ECOA), which prohibits discrimination in credit transactions. In 2023, the CFPB continued its focus on oversight of auto lending, highlighting the importance of Ally's adherence to these consumer protection laws.

Consumer Protection Litigation

Ally Financial, like many financial institutions, navigates a landscape fraught with potential consumer protection litigation. Class-action lawsuits, often stemming from data breaches or perceived lapses in consumer safeguarding, represent a significant legal risk. For instance, in 2023, financial institutions faced an increasing number of data privacy lawsuits, with some settlements reaching tens of millions of dollars.

Such legal battles can carry substantial financial penalties, impacting profitability and requiring significant legal resources. Beyond direct monetary costs, these cases can inflict considerable reputational damage, eroding consumer trust. For example, a major bank's settlement in early 2024 related to alleged deceptive practices amounted to over $100 million, highlighting the scale of potential financial exposure.

- Increased scrutiny on data privacy: Regulatory bodies and consumer advocacy groups are intensifying their focus on how financial firms handle sensitive customer information.

- Potential for large financial penalties: Litigation outcomes can lead to substantial fines, legal fees, and compensation payouts, directly impacting a company's bottom line.

- Reputational impact: Negative publicity from consumer protection lawsuits can deter new customers and alienate existing ones, affecting long-term growth.

Anti-Money Laundering (AML) and Sanctions Laws

Ally Financial, like all financial institutions, must navigate a complex web of anti-money laundering (AML) and sanctions laws. These regulations are designed to prevent financial crimes and terrorism financing. Failure to comply can result in severe penalties, including hefty fines and reputational damage. For instance, in 2023, financial institutions globally faced billions in AML-related fines, underscoring the critical importance of robust compliance programs.

To adhere to these laws, Ally invests significantly in sophisticated internal controls, transaction monitoring systems, and thorough customer due diligence processes. This includes verifying customer identities and understanding the nature of their financial activities to identify and report suspicious transactions to relevant authorities. The regulatory landscape is constantly evolving, requiring continuous updates to these systems and procedures.

- Regulatory Scrutiny: Financial institutions face ongoing scrutiny from regulators regarding AML and sanctions compliance.

- Compliance Costs: Significant investment is required in technology and personnel to maintain effective AML programs.

- International Sanctions: Ally must monitor and comply with sanctions lists issued by various governments and international bodies, impacting cross-border transactions.

- Reporting Obligations: Timely and accurate reporting of suspicious activities to authorities is a key legal requirement.

Ally Financial's legal environment is shaped by stringent consumer protection laws, with regulators like the CFPB actively enforcing rules against discriminatory lending practices. For example, in 2023, the CFPB's continued focus on auto lending underscored the critical need for Ally to adhere to fair lending statutes and prevent any semblance of bias in its credit decisions.

The company also faces significant legal risks from consumer litigation, particularly class-action lawsuits related to data privacy and alleged deceptive practices. Settlements in such cases can reach tens of millions of dollars, as seen with other financial institutions in 2023 and early 2024, impacting profitability and brand reputation.

Furthermore, Ally must maintain robust Anti-Money Laundering (AML) and sanctions compliance programs, a critical area where financial institutions globally incurred billions in fines in 2023. This necessitates substantial investment in technology and personnel to monitor transactions and verify customer identities, ensuring adherence to evolving international regulations.

| Legal Factor | Impact on Ally Financial | 2023/2024 Data/Trend |

|---|---|---|

| Consumer Protection Laws | Requires strict adherence to fair lending, truth-in-lending, and anti-discrimination statutes. | CFPB's ongoing focus on auto lending in 2023 highlights continued regulatory oversight. |

| Data Privacy & Security | Mandates robust protection of PII under laws like CCPA/CPRA and GLBA, impacting operational costs. | CCPA violations can incur statutory damages of $100-$750 per incident; financial institutions faced increasing data privacy lawsuits in 2023. |

| Litigation Risk | Exposure to class-action lawsuits, particularly concerning data breaches and consumer safeguarding. | Major bank settlements in early 2024 reached over $100 million for alleged deceptive practices. |

| AML & Sanctions Compliance | Necessitates significant investment in controls, monitoring, and due diligence to prevent financial crimes. | Global financial institutions faced billions in AML-related fines in 2023, emphasizing compliance importance. |

Environmental factors

Climate change poses indirect risks to Ally Financial. Extreme weather events can devalue financed assets, such as vehicles in flood-prone areas or properties impacted by wildfires, potentially leading to higher loan losses. For example, the increasing frequency of severe weather events in 2024, like the widespread flooding and storms across the US, could affect the collateral backing auto and mortgage loans held by Ally.

These physical risks can also disrupt Ally's operations or those of its customers, indirectly impacting loan performance and the broader economy. Increased insurance claims or business interruptions for customers in affected regions might strain their ability to meet financial obligations, including loan repayments to Ally.

Investors and regulators are increasingly scrutinizing environmental, social, and governance (ESG) performance, directly impacting how Ally Financial reports and conducts its business. This heightened focus means companies like Ally must demonstrate tangible progress in areas like sustainability and ethical operations to attract capital and maintain compliance.

Ally's proactive engagement with ESG, evidenced by its participation in CDP reporting for greenhouse gas emissions, signals a clear understanding of these evolving stakeholder expectations. For instance, in its 2023 reporting, Ally disclosed Scope 1 and 2 emissions, a key metric for environmental accountability.

Ally Financial, as a significant auto financier, is intrinsically linked to the environmental shifts within the automotive sector. The accelerating adoption of electric vehicles (EVs) and increasingly fuel-efficient internal combustion engine (ICE) vehicles directly impacts the portfolio of vehicles Ally finances, shaping its strategic direction in a rapidly evolving market.

By mid-2024, EV sales continued their upward trajectory, with projections for the full year indicating a significant increase over 2023 figures, potentially reaching over 1.5 million new EVs sold in the U.S. alone. This growing demand for greener transportation necessitates that Ally adapts its financing products and risk assessments to accommodate the expanding EV market, including considerations for battery life, charging infrastructure, and resale values.

Furthermore, regulatory pressures and consumer preferences are pushing automakers to invest heavily in electrification and sustainable manufacturing processes. Ally's ability to support these transitions by offering competitive financing for EVs and hybrid vehicles will be crucial for maintaining its market share and aligning with broader environmental goals.

Resource Consumption and Operational Footprint

Even as a predominantly digital financial institution, Ally Financial maintains an operational footprint. This includes energy consumption for its data centers and office spaces, contributing to its overall environmental impact. For instance, in 2023, Ally reported a reduction in its Scope 2 greenhouse gas emissions, a key indicator of its efforts to mitigate energy-related environmental effects.

Ally is actively working to minimize its direct environmental impact through various initiatives. These efforts often focus on reducing natural gas consumption and improving energy efficiency across its facilities. The company's sustainability reports highlight progress in these areas, demonstrating a commitment to responsible resource management.

- Energy Efficiency Initiatives: Investments in more efficient data center cooling and office building upgrades to lower electricity usage.

- Renewable Energy Sourcing: Exploring options to increase the proportion of renewable energy powering its operations.

- Waste Reduction Programs: Implementing strategies to minimize waste generation and increase recycling rates in its physical locations.

- Scope 2 Emission Targets: Setting and working towards specific goals for reducing emissions associated with purchased electricity, steam, heating, and cooling.

Green Initiatives and Partnerships

Ally Financial actively participates in green initiatives and forms partnerships with environmental organizations. This engagement is crucial for bolstering brand reputation and meeting growing societal expectations for corporate environmental responsibility. For instance, Ally's internal 'Green Teams' demonstrate a commitment to fostering planet-friendly priorities within the company.

These efforts are not just about image; they often translate into tangible environmental improvements and stronger stakeholder relationships. As of late 2024, many financial institutions are increasing their investment in sustainable practices, with reports indicating a significant rise in ESG (Environmental, Social, and Governance) focused partnerships across the sector. While specific financial figures for Ally's environmental partnerships are not publicly detailed, the trend suggests a strategic allocation of resources towards sustainability.

- Brand Enhancement: Participation in environmental initiatives like those championed by Ally's Green Teams can significantly boost public perception and attract environmentally conscious customers and investors.

- Societal Alignment: Aligning with planet-friendly priorities helps Ally meet the increasing demand for corporate social responsibility, fostering trust and goodwill.

- Industry Trends: The financial sector, including companies like Ally, is increasingly prioritizing ESG factors, with many forming strategic alliances to promote sustainability.

Climate change presents indirect risks to Ally Financial, as extreme weather events can devalue financed assets like vehicles and properties, potentially increasing loan losses. For example, the rising frequency of severe weather events in 2024, such as widespread flooding, could impact collateral for auto and mortgage loans. These physical risks can also disrupt Ally's operations or those of its customers, indirectly affecting loan performance and the broader economy.

The accelerating adoption of electric vehicles (EVs) directly impacts Ally's auto financing portfolio, requiring adaptation to this evolving market. With EV sales projected to exceed 1.5 million in the U.S. for 2024, Ally must adjust its financing products and risk assessments for this growing segment. Furthermore, regulatory pressures and consumer demand are driving automakers toward electrification, making Ally's support for EV financing crucial for maintaining market share and aligning with environmental goals.

Ally Financial is actively working to minimize its direct environmental impact through energy efficiency and waste reduction programs. In 2023, Ally reported a reduction in its Scope 2 greenhouse gas emissions, demonstrating efforts to mitigate energy-related environmental effects. The company's sustainability reports highlight progress in reducing natural gas consumption and improving energy efficiency across its facilities.

Ally's participation in green initiatives and partnerships with environmental organizations enhances its brand reputation and meets societal expectations for corporate responsibility. As of late 2024, the financial sector is increasingly investing in sustainable practices, with many companies forming strategic alliances to promote sustainability. These efforts align Ally with industry trends and foster stronger stakeholder relationships.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ally Financial is built on a foundation of data from reputable financial news outlets, government regulatory bodies like the CFPB and SEC, and industry-specific reports from organizations such as the American Bankers Association. We also incorporate economic data from sources like the Bureau of Labor Statistics and the Federal Reserve to ensure a comprehensive understanding of the macro-environment.