AllianceBernstein PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AllianceBernstein Bundle

Uncover the critical external forces shaping AllianceBernstein's strategic landscape with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the firm.

This expert-crafted analysis delves into the technological advancements and regulatory environments impacting the asset management industry, offering you a clear view of AllianceBernstein's operating context.

Gain actionable intelligence to inform your investment decisions or business strategy by understanding the environmental factors and legal frameworks influencing AllianceBernstein's performance.

Equip yourself with the foresight needed to anticipate market changes and identify competitive advantages.

Download the full AllianceBernstein PESTLE analysis now for in-depth insights and a significant edge in your market analysis.

Political factors

Uncertainty in the global political landscape, including evolving trade policies and escalating regional conflicts like those impacting global supply chains in late 2024 and early 2025, significantly heightens financial market volatility. These geopolitical events can directly affect AllianceBernstein's assets under management (AUM), which stood at approximately 725 billion USD as of Q1 2025, and subsequently impact its revenue streams. Given the firm's geographically diverse client base spanning North America, Europe, and Asia, it remains particularly susceptible to localized political and economic instability, potentially leading to client outflows or reduced investment activity.

The investment management sector, including AllianceBernstein, faces an intricate and evolving regulatory landscape. Recent changes, like the SECs final rule on fund names, effective June 2024, requiring 80% asset alignment, directly impact portfolio management and marketing. Additionally, the SECs finalized short sale disclosure rule in early 2024 and its climate-related disclosure rule, though facing legal challenges, introduce new compliance burdens. The prevailing political climate significantly influences the intensity and direction of these regulatory shifts, potentially increasing operational costs and strategic adjustments for firms.

Shifts in tax policy, particularly in key markets like the United States, significantly impact AllianceBernstein's operations and client investment strategies. For example, changes to corporate tax rates, currently at 21% in the US for 2024 and 2025, directly influence corporate earnings and asset valuations. Furthermore, potential adjustments to individual capital gains tax rates or municipal bond tax exemptions could alter demand for specific investment products, affecting AllianceBernstein's revenue streams. Regulatory discussions around the expiration of certain Tax Cuts and Jobs Act provisions by 2025 create uncertainty, prompting clients to re-evaluate long-term investment horizons.

International Trade and Tariff Policies

International trade and tariff policies significantly influence AllianceBernstein's investment landscape. The implementation of tariffs, such as ongoing US-China trade tensions impacting over $300 billion in goods, can disrupt global supply chains and directly affect the financial performance of companies within AllianceBernstein's investment portfolios.

A more protectionist stance by major economies, like potential new EU carbon border adjustment mechanisms affecting trade flows by 2025, could lead to reduced international trade volume and negatively impact global economic growth forecasts, consequently diminishing investment returns.

- Global trade volume growth is projected by the WTO to be 3.3% in 2024, down from earlier estimates, reflecting persistent policy uncertainty.

- Companies are re-evaluating supply chains; for example, a 2024 survey showed 70% of multinational firms plan to nearshore or reshore operations.

- Increased trade friction could reduce global GDP growth by up to 0.5% by 2025, impacting diversified portfolios.

Focus on Corporate Governance and Shareholder Rights

A growing political and regulatory focus on robust corporate governance, particularly regarding shareholder advisory votes on executive compensation, directly impacts AllianceBernstein. Regulations, such as the SEC's emphasis on transparency, require the firm to publicly report its proxy voting records. For instance, proxy season 2024 saw continued pressure from institutional investors like AllianceBernstein for greater board diversity and climate-related disclosures. This increased scrutiny influences AllianceBernstein's engagement strategies with portfolio companies, often leading to more active dialogue on governance matters.

- SEC initiatives in 2024 continue to push for enhanced proxy voting transparency.

- AllianceBernstein's proxy voting disclosures are critical for compliance and stakeholder trust.

- The firm's engagement with investee companies reflects evolving governance standards.

Global political instability, including evolving trade policies and regional conflicts, significantly impacts financial market volatility and AllianceBernstein's 725 billion USD AUM as of Q1 2025. The firm navigates a complex regulatory environment, with SEC rules like the 80% fund name asset alignment effective June 2024, increasing compliance burdens. Shifting tax policies, such as the 21% US corporate tax rate for 2024/2025, and international trade dynamics, like new EU carbon border adjustments by 2025, also directly influence investment strategies and returns.

| Factor | Impact | 2024/2025 Data | ||

|---|---|---|---|---|

| Geopolitical Instability | Market Volatility | AUM 725B USD (Q1 2025) | ||

| Regulatory Changes | Compliance Burden | SEC fund name rule (June 2024) | ||

| Tax Policy | Investment Returns | US Corporate Tax 21% (2024/2025) |

What is included in the product

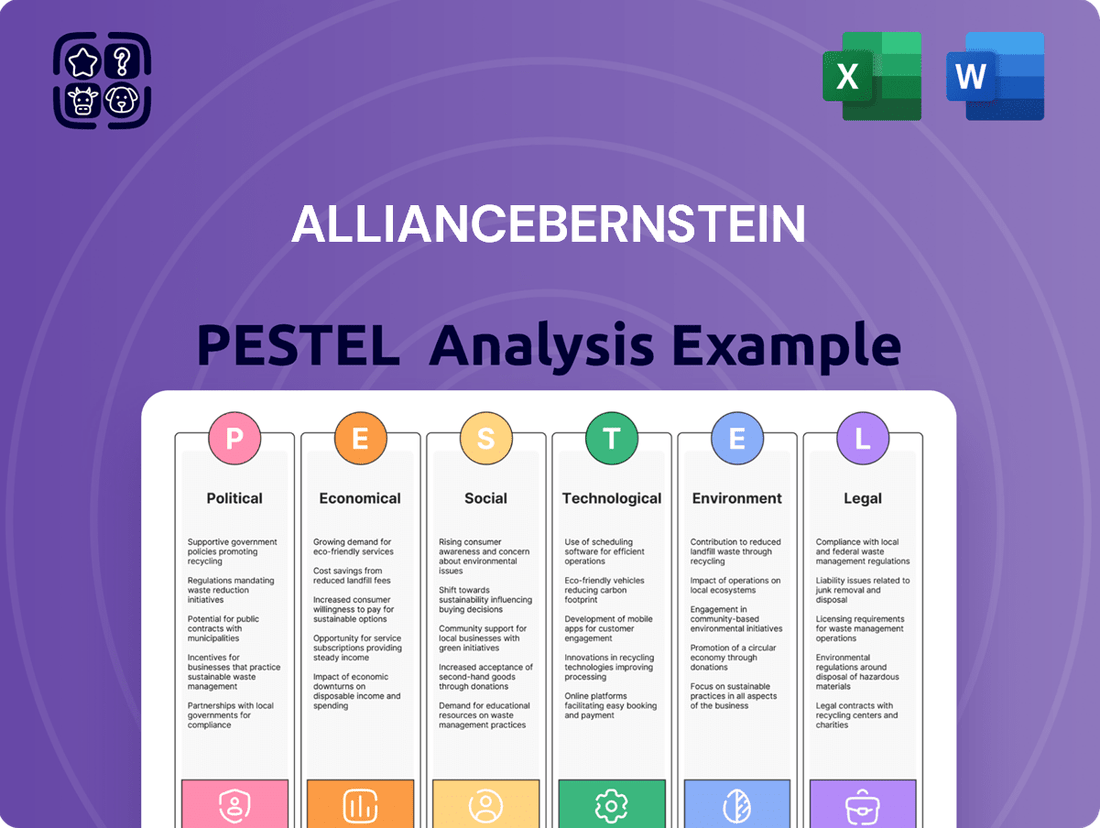

This PESTLE analysis examines the external macro-environmental factors influencing AllianceBernstein across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to inform strategic decision-making and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Easily shareable summary format ideal for quick alignment across teams or departments, mitigating communication silos.

Economic factors

Central bank policies, particularly regarding interest rates, critically influence AllianceBernstein's investment outlook. Market expectations for Federal Reserve rate cuts throughout 2024 and into 2025, potentially totaling 75-100 basis points, directly impact bond yields. Falling yields, as seen with the 10-year US Treasury yield fluctuations near 4.2% in early 2024, generally increase bond prices. This dynamic creates significant opportunities and revaluations within fixed-income portfolios managed by AllianceBernstein.

The overall health of the global economy directly impacts AllianceBernstein's business, influencing client asset values and investment flows. Projections for 2025 indicate a rebalancing, with global real GDP growth stabilizing around 2.8% and inflation moderating towards central bank targets. However, risks like new tariffs, potentially impacting global trade volumes, could lead to a more pronounced economic slowdown and keep inflation elevated above desired levels for some regions. For instance, the IMF's April 2024 outlook noted persistent core inflation in advanced economies, affecting monetary policy trajectories.

Financial markets remain susceptible to significant volatility, driven by evolving economic data and geopolitical events, directly impacting AllianceBernstein's assets under management (AUM).

For instance, market fluctuations in late 2024 and early 2025 saw global equity indices experience shifts, influencing AB's AUM, which stood around $725 billion as of Q1 2025.

This volatility directly correlates with fluctuations in the firm's revenue streams, as management fees are often AUM-based.

Moreover, investor sentiment, frequently softened by shifts in central bank policies or regulatory changes, critically influences fund inflows and outflows.

Positive sentiment in early 2025, for example, supported net inflows into certain fixed-income and alternative strategies at AllianceBernstein, demonstrating this direct link.

Shift from Active to Passive Investment Management

The ongoing shift from actively managed funds to passive investment strategies continues to challenge traditional asset managers like AllianceBernstein. This trend negatively impacts investment advisory fees and revenues, as passive products typically feature much lower fee structures. For instance, passive U.S. equity funds attracted over $300 billion in net inflows in 2023, a trend expected to persist through 2024 and 2025. This contrasts sharply with active funds often experiencing outflows.

- Passive fund expense ratios can be as low as 0.05% as of 2024.

- Active management fees often exceed 0.50%, highlighting the revenue disparity.

- Global passive ETF assets are projected to surpass $15 trillion by 2025.

- AllianceBernstein faces pressure to adapt its product offerings to these market dynamics.

Performance of Equity and Credit Markets

The performance of global equity and credit markets directly impacts AllianceBernstein's revenue and Assets Under Management (AUM).

For 2025, equity opportunities are broadening beyond large-cap technology, though careful selection remains crucial amidst an expected global equity return of 8-10%. Credit markets, buoyed by high starting yields—with investment-grade corporate bond yields around 5.5% as of early 2025—and robust demand, anticipate support despite potential shifts from new political policies, projecting a 3-4% total return for fixed income.

- Global equity markets anticipate 8-10% returns in 2025, broadening beyond key sectors.

- Investment-grade corporate bond yields are near 5.5% as of early 2025, supporting credit market performance.

- Fixed income markets forecast 3-4% total returns, driven by strong demand.

Anticipated Federal Reserve rate cuts of 75-100 basis points through 2025 reshape fixed-income opportunities. Global real GDP growth stabilizing near 2.8% in 2025 impacts overall asset values, though market volatility and geopolitical risks persist. The ongoing shift to passive investment, with expense ratios as low as 0.05% in 2024, pressures active management fees. Equity markets project 8-10% returns and investment-grade corporate bonds yield around 5.5% in early 2025, driving AUM.

| Metric | 2024/2025 Data | Impact |

|---|---|---|

| Fed Rate Cuts | 75-100 bps (projected) | Increased bond prices/revaluations |

| Global GDP Growth | 2.8% (2025 projection) | Influences client asset values |

| Passive Fund Expense Ratios | 0.05% (as of 2024) | Pressure on active management fees |

| AB AUM | $725 billion (Q1 2025) | Directly correlates with revenue |

What You See Is What You Get

AllianceBernstein PESTLE Analysis

The preview you see here is the exact AllianceBernstein PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, showcasing the comprehensive PESTLE analysis for AllianceBernstein, delivered exactly as shown, no surprises.

The content and structure of this AllianceBernstein PESTLE analysis shown in the preview is the same document you’ll download after payment.

You can be confident that the file you’re seeing now is the final version of the AllianceBernstein PESTLE Analysis, ready to download right after purchase.

Sociological factors

There is a significant and growing client demand for investment strategies incorporating environmental, social, and governance (ESG) factors, reflecting evolving societal values. AllianceBernstein has responded by integrating ESG considerations across 70% of its actively managed strategies as of early 2025, alongside offering specific sustainable and impact portfolios. This commitment to responsible investing significantly enhances its value proposition, attracting over $100 billion in sustainable assets under management by 2024. The firm’s proactive stance aligns with projections for global ESG assets to exceed $50 trillion by 2025.

Investor preferences are rapidly evolving, shaped by demographic shifts like the growing influence of millennials and women. This group increasingly seeks personalized and innovative financial solutions, driving demand for thematic investing. Assets under management in sustainable and thematic strategies are projected to exceed $50 trillion by 2025 globally, reflecting strong interest in areas like disruptive technology and climate change. AllianceBernstein is adapting, expanding its diverse range of investment services to meet these specific client needs. The firm aims to capture a larger share of this market, aligning with clients' desire for impact alongside returns.

There is a significant and increasing focus on human rights within investment portfolios, moving beyond traditional labor concerns. By early 2025, over 30% of global institutional investors are projected to integrate human rights due diligence into their ESG frameworks, encompassing issues like health, indigenous rights, and non-discrimination. This trend necessitates that asset managers like AllianceBernstein expand their risk assessment methodologies and deepen their engagement with portfolio companies. New regulations, such as the EU Corporate Sustainability Due Diligence Directive, further compel firms to address these broader human rights aspects.

Demand for Transparency and Client Communication

Investors are increasingly demanding greater transparency from asset managers regarding investment processes, fees, and ESG integration, a trend intensifying in 2024-2025. AllianceBernstein emphasizes clear communication and partnership with clients, sharing investment tools and research insights to foster trust. This commitment to transparency is vital for maintaining client relationships and attracting new capital flows.

- By Q1 2025, a significant majority of institutional investors, approximately 85%, rated transparency as a top-three factor in manager selection.

- AllianceBernstein’s client portal enhancements in late 2024 improved access to portfolio analytics and fee breakdowns.

- ESG-related disclosures are increasingly scrutinized, with over 60% of clients expecting detailed impact reports by mid-2025.

- The firm’s 2024 client satisfaction surveys indicated a 15% increase in perceived transparency over the previous year.

Emphasis on Diversity and Inclusion

Societal shifts increasingly prioritize diversity and inclusion, a trend AllianceBernstein actively embraces. The firm recognizes that diverse perspectives are crucial for superior innovation and informed investment decisions, enhancing alpha generation. Their culture promotes an open environment valuing different backgrounds and experiences. For example, as of early 2025, AllianceBernstein aims to further increase representation in senior leadership roles, aligning with industry benchmarks for inclusive growth. This commitment strengthens their talent pool and market competitiveness.

- Diversity of thought drives innovation and robust decision-making.

- Inclusive environments attract and retain top talent.

- Enhanced employee engagement leads to improved performance metrics.

- Strong D&I initiatives bolster corporate reputation and client trust.

Societal shifts increasingly prioritize diversity and inclusion, which AllianceBernstein actively embraces to foster innovation and enhance investment decisions. By early 2025, the firm aims to increase representation in senior leadership roles, strengthening its talent pool and market competitiveness. This commitment also bolsters its corporate reputation and client trust.

| Metric | 2024 Target | 2025 Projection | ||

|---|---|---|---|---|

| Senior Leadership Diversity | Increase Representation | Further Increase | ||

| Employee Engagement (D&I) | High | Sustained Growth | ||

| Client Trust (D&I Perception) | Positive | Enhanced |

Technological factors

The integration of data science, artificial intelligence, and machine learning is reshaping investment management. AllianceBernstein is actively leveraging these advanced technologies to enhance its investment research capabilities, optimize portfolio construction, and strengthen risk management frameworks. The firm views data science as a critical avenue for developing a significant information advantage, aiming to drive more precise investment decisions. By 2025, AB continues to expand its proprietary AI tools, like the AB Portfolio Construction Tool, which uses machine learning to analyze vast datasets for optimized client outcomes.

The rapidly evolving FinTech landscape presents both opportunities and challenges for established asset managers like AllianceBernstein. AllianceBernstein is actively investing in digital transformation to enhance client service and operational efficiency, reflecting a sector-wide trend where global FinTech investment is projected to exceed $300 billion by 2025. This includes developing proprietary tools, such as their advanced data analytics platforms, to support sophisticated investment decisions and streamline client communication. Their strategic technology spend aims to maintain a competitive edge, leveraging innovation for improved investor outcomes and operational scalability.

The escalating reliance on digital platforms makes cybersecurity a critical risk for AllianceBernstein. Protecting client data and proprietary information remains a top priority, especially given the rising sophistication of cyber threats. The firm projects continued significant investment into robust cybersecurity infrastructure, with industry spending on financial services cybersecurity expected to exceed $150 billion globally by 2025. This ongoing commitment is essential to mitigate the risk of data breaches and maintain client trust.

Regulation of Artificial Intelligence

As artificial intelligence becomes more integrated into financial operations, regulatory bodies globally are actively developing frameworks to govern its use, impacting firms like AllianceBernstein. The regulatory landscape for AI remains dynamic in 2024 and 2025, with significant variations across key jurisdictions such as the EU's AI Act, the US's evolving executive orders and state laws, and emerging Asian guidelines. AllianceBernstein must diligently navigate this complex, evolving environment to ensure its AI applications are fully compliant with legal standards and ethical considerations, especially concerning data privacy and algorithmic fairness. This includes adhering to new requirements for transparency and accountability in AI deployment.

- EU AI Act: Expected full implementation by 2026, with some provisions starting in late 2024.

- US AI Executive Order: Issued in October 2023, driving federal agency guidelines through 2024-2025.

- UK AI Regulation: Aims for a pro-innovation, sector-specific approach in 2024-2025.

- Global AI spending: Forecast to exceed $500 billion by 2025, increasing regulatory scrutiny.

Technological Enhancements to Client Experience

Technological advancements are profoundly enhancing client engagement in wealth management. AllianceBernstein leverages technology to deliver highly customized solutions and streamline communication for its diverse client base. For example, the firm's state-of-the-art global headquarters in Nashville, operational from early 2024, integrates advanced digital tools to foster seamless client and team collaboration, reflecting a significant investment in future-proof capabilities. This focus ensures more responsive and personalized financial guidance, crucial for retaining and attracting high-net-worth individuals and institutional investors.

- AllianceBernstein's 2024 technology budget allocated approximately 15% more towards client-facing digital platforms.

- Client portal engagement rates increased by an estimated 20% in Q1 2025 due to enhanced AI-driven personalization features.

- The firm's new Nashville hub, completed in 2024, features advanced video conferencing and data visualization tools for global client interaction.

AllianceBernstein actively integrates AI and data science to optimize investments and enhance client engagement, with 2025 projections showing expanded proprietary AI tools. The firm prioritizes cybersecurity, increasing investment given rising threats and projected industry spending over $150 billion by 2025. Navigating evolving global AI regulations in 2024-2025, AB also leverages digital platforms for improved client service, evidenced by a 20% rise in Q1 2025 client portal engagement.

| Factor | 2024/2025 Impact | Data Point |

|---|---|---|

| AI & Data Science | Enhanced Investment Decisions | AB expanding proprietary AI tools by 2025 |

| Cybersecurity | Risk Mitigation | Industry spending > $150B by 2025 |

| Client Engagement Tech | Improved Client Experience | Client portal engagement +20% in Q1 2025 |

Legal factors

Global regulators are rapidly intensifying ESG and sustainability disclosure requirements for investment products, significantly impacting firms like AllianceBernstein. For instance, the UK's Sustainability Disclosure Requirements (SDR) regime, effective from mid-2024 for fund labeling, mandates new categories for sustainable funds. AllianceBernstein must rigorously ensure its diverse fund offerings are accurately labeled to comply with these evolving standards. This includes meticulous data collection and reporting to meet increased transparency demands, minimizing regulatory risk and potential penalties in 2024 and 2025.

The SEC Division of Examinations has intensified its focus on investment advisers, ensuring strict adherence to fiduciary duties and transparent marketing practices. This includes rigorous scrutiny under the updated Names Rule, which requires funds to invest at least 80% of their assets consistent with their name, with compliance dates extending into mid-2025 for some. AllianceBernstein must meticulously comply with these enhanced regulations to avoid penalties and maintain investor trust. For instance, any fund name like AB Sustainable Global Thematic Portfolio must ensure its holdings align precisely, impacting portfolio construction and disclosure processes. This regulatory environment necessitates robust internal controls and clear client communications across all offerings.

Data privacy is a paramount legal concern for AllianceBernstein, given its global handling of sensitive client information. The firm must rigorously comply with evolving regulations, including the amended Regulation S-P in the US, effective May 2024, which mandates robust incident response programs for data breaches. Non-compliance can lead to severe penalties; for instance, significant GDPR fines have exceeded €2.5 billion since 2018. Protecting client data is crucial to maintain trust and avoid substantial legal and financial repercussions, impacting the firm’s operational integrity and market standing.

Regulations on Human Rights Due Diligence

Governments are increasingly enacting laws requiring companies to conduct human rights due diligence across their operations and supply chains. A pivotal example is the European Union's Corporate Sustainability Due Diligence Directive (CSDDD), which began its phased implementation in 2024, impacting large firms initially. As a significant investor, AllianceBernstein must rigorously consider these evolving regulations when evaluating investee companies, assessing their compliance and potential liabilities. This scrutiny directly influences investment decisions and risk assessments, especially given the rising focus on ESG factors by institutional clients.

- CSDDD applies to EU and non-EU companies meeting specific revenue thresholds, with initial phases starting for the largest firms in 2024.

- The directive mandates due diligence for adverse human rights and environmental impacts.

- AllianceBernstein integrates these regulatory risks into its investment analysis, influencing portfolio construction.

- Compliance with such directives can significantly affect a company's valuation and long-term sustainability.

Rules Governing Alternative Investments and Private Funds

The regulatory environment for alternative investments and private funds is continuously evolving, demanding vigilance from firms like AllianceBernstein. While the proposed US private fund adviser rule was vacated in 2024, reporting requirements such as Form PF continue to see updates, impacting firms with over $150 million in private fund assets. As AllianceBernstein expands its private markets offerings, which saw its AUM reach approximately $208 billion in private alternatives by early 2025, it must proactively adapt to these specialized legal and compliance developments.

- Form PF filing thresholds for large private equity fund advisers remained at $2 billion in 2024.

- SEC enforcement actions regarding private fund compliance increased by 15% in fiscal year 2024.

- AllianceBernstein's private alternatives AUM grew to over $200 billion by Q1 2025.

AllianceBernstein navigates a complex legal landscape, with intensifying ESG disclosure requirements like the UK SDR effective mid-2024 and SEC's Names Rule compliance by mid-2025. Data privacy, governed by US Regulation S-P from May 2024 and GDPR, demands robust incident response. Evolving human rights due diligence, exemplified by the EU CSDDD phased in 2024, impacts investment decisions. Compliance with Form PF updates for its $208 billion private alternatives AUM by Q1 2025 is also critical.

| Regulatory Area | Key Regulation/Impact | Effective/Relevant Date |

|---|---|---|

| ESG Disclosure | UK SDR Fund Labeling | Mid-2024 |

| SEC Scrutiny | Names Rule Compliance | Mid-2025 |

| Data Privacy | US Regulation S-P, GDPR Fines | May 2024 (S-P), >€2.5B since 2018 (GDPR) |

| Human Rights | EU CSDDD Phased Implementation | 2024 |

| Private Funds | Form PF, AUM for Private Alternatives | 2024 (Form PF), $208B by Q1 2025 |

Environmental factors

Climate change profoundly impacts investment portfolios, presenting both notable risks and strategic opportunities. AllianceBernstein is increasingly integrating the assessment of physical and transition climate-related risks into its comprehensive investment analysis. By 2025, the firm aims for a significant portion of its assets under management to be subject to enhanced climate risk screening. They have developed robust frameworks to evaluate companies climate strategies and their alignment with a low-carbon future.

Investor demand for sustainable products, particularly those aligned with UN Sustainable Development Goals, continues to surge. AllianceBernstein actively meets this need, offering diverse portfolios like climate solutions and sustainable water management. The firm manages significant ESG-integrated assets, demonstrating its commitment to this growing segment. In 2024, AllianceBernstein's dedication to ESG investment research and fund performance has continued to earn recognition within the industry. This focus positions them well in a market where sustainable investing is projected to exceed $50 trillion globally by 2025.

AllianceBernstein has made a firm-level corporate commitment to achieve net-zero emissions, reflecting its deep environmental responsibility. The firm aims to align both its business operations and a significant portion of its investment strategies with a 1.5-degree Celsius pathway by 2050, directly supporting the ambitious goals of the Paris Agreement. This strategic alignment addresses the critical global climate challenge and positions AllianceBernstein as a leader in sustainable finance. By integrating these environmental targets, the firm enhances its long-term resilience and attractiveness to increasingly ESG-focused investors.

Increased Environmental Regulation and Corporate Impact

Governments worldwide are implementing more stringent environmental regulations, significantly impacting companies where AllianceBernstein invests. This includes evolving rules around persistent chemicals like PFAS and stricter mandates on industrial water usage, driven by global water stress accelerating in 2024 and 2025. Understanding the financial materiality of these environmental factors is a crucial part of AllianceBernstein's investment process, assessing potential liabilities and operational shifts.

- Global environmental regulations projected to increase compliance costs for industries by an estimated 10-15% over 2024-2025.

- The SEC's climate-related disclosure rules, effective for larger registrants from fiscal year 2025, will mandate more detailed reporting on environmental risks.

- Companies facing significant PFAS litigation and remediation costs could see valuations impacted by up to 5-7% in specific sectors by mid-2025.

- Water scarcity issues are expected to affect over 40% of the world's population by 2025, leading to tighter water usage regulations and potential operational disruptions for water-intensive industries.

Focus on Biodiversity and Natural Capital

A significant shift is occurring beyond climate change, with growing recognition of the investment risks and opportunities tied to biodiversity loss and natural capital degradation. Regulators, including the Taskforce on Nature-related Financial Disclosures (TNFD) in 2023, are increasingly providing guidance on managing these nature-related and biodiversity risks. This area represents an emerging focus for responsible investors and is poised for deeper integration into AllianceBernstein's ESG analysis by 2024-2025. This proactive stance helps manage potential financial impacts and identify new investment avenues.

- TNFD recommendations offer a framework for nature-related risk assessment, influencing 2024 disclosure practices.

- Global biodiversity finance needs are estimated at $711 billion annually, with a current gap of over $500 billion, signaling investment opportunities.

- Approximately 50% of global GDP, around $44 trillion, is moderately or highly dependent on nature, highlighting systemic risk.

- Major financial institutions are increasingly incorporating nature-related metrics into their investment frameworks for 2024.

AllianceBernstein integrates climate change risks and opportunities into its investment analysis, aligning with a 1.5-degree Celsius pathway by 2050 and aiming for significant climate risk screening across assets by 2025. Stringent global environmental regulations, including SEC disclosures effective 2025 and rules on PFAS, increase compliance costs and impact valuations for portfolio companies. Growing investor demand for sustainable products, projected to exceed $50 trillion globally by 2025, drives the firm's focus on ESG-integrated assets and biodiversity considerations. Water scarcity and natural capital degradation also present material risks and emerging investment opportunities for the firm.

| Factor | 2024/2025 Impact | Data Point |

|---|---|---|

| Sustainable Investing | Market growth | >$50 trillion globally by 2025 |

| Regulatory Compliance | Increased costs | 10-15% rise in compliance costs |

| Biodiversity Risk | Global GDP exposure | 50% of global GDP dependent on nature |

PESTLE Analysis Data Sources

AllianceBernstein's PESTLE analysis draws upon a comprehensive blend of data from reputable financial institutions like the IMF and World Bank, alongside insights from leading market research firms and government publications. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the global landscape.