AllianceBernstein Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AllianceBernstein Bundle

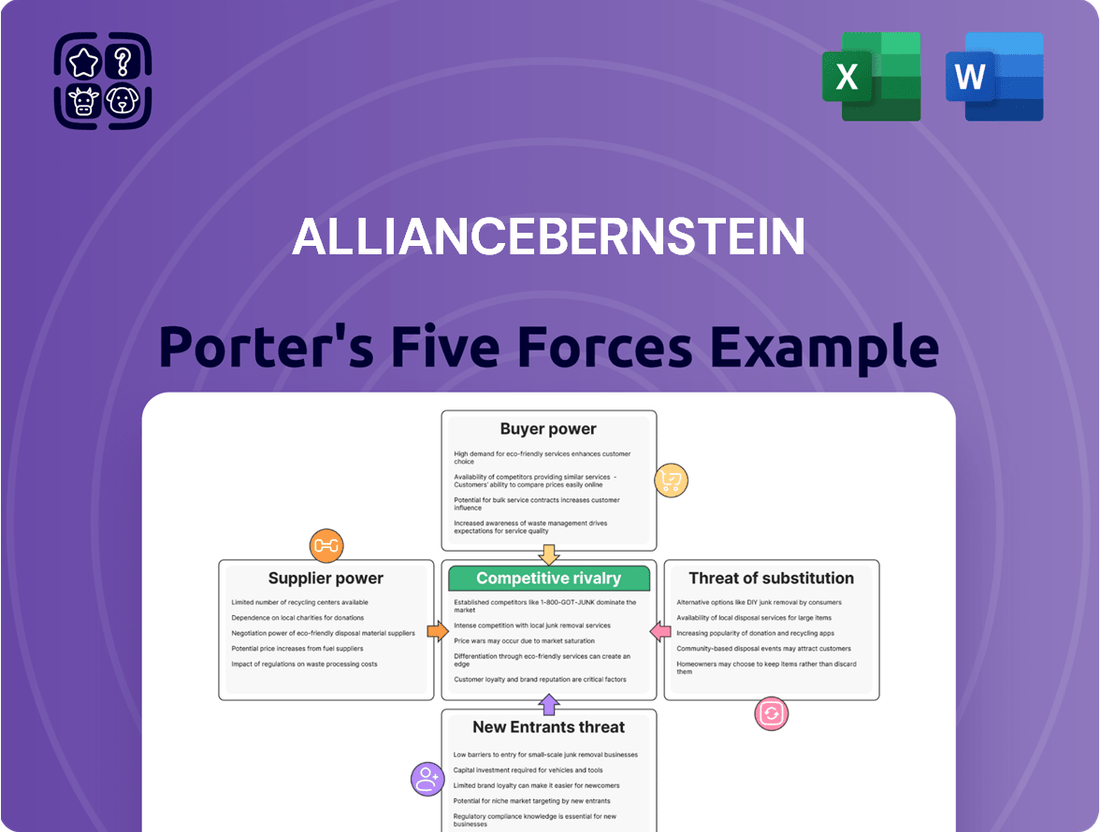

AllianceBernstein navigates a complex financial services landscape, where understanding competitive pressures is paramount. Our Porter's Five Forces analysis meticulously dissects the industry's structure, revealing the underlying dynamics at play.

We examine the intensity of rivalry, the bargaining power of both buyers and suppliers, and the ever-present threat of new entrants and substitutes. This framework provides a clear lens through which to view AllianceBernstein's strategic positioning.

The complete report reveals the real forces shaping AllianceBernstein’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The primary suppliers for AllianceBernstein are its highly skilled portfolio managers, analysts, and financial advisors. These professionals possess specialized knowledge crucial for managing investment portfolios and attracting clients. Their bargaining power is high due to the intensely competitive market for top talent, which drove average portfolio manager compensation in 2024 to frequently exceed $500,000 annually including bonuses. This high demand allows top performers to command significant compensation and easily transition between firms, impacting AllianceBernstein's operational costs and talent retention strategies.

AllianceBernstein relies heavily on key financial data and technology providers for essential services, including real-time data feeds and sophisticated analytics software. Major players like Bloomberg and LSEG (Refinitiv) dominate this sector, which saw the global financial market data industry approach $40 billion in 2023, giving them moderate bargaining power. The deep integration of these systems into AllianceBernstein's trading and analytical workflows creates significant switching costs. This inherent dependency strengthens the suppliers' position, making it challenging to easily transition to alternatives.

AllianceBernstein utilizes external third-party custodians and fund administrators to secure client assets and manage extensive back-office operations. While the market features numerous providers, AllianceBernstein often prefers large, well-established institutions like BNY Mellon or State Street, which collectively managed trillions in assets in 2024, granting them some leverage. However, the core services offered are largely standardized across these major players. This standardization limits the individual bargaining power of any single provider, as switching costs, while present, are not prohibitively high for a large financial firm.

Legal and Advisory Firms

Legal and advisory firms hold significant bargaining power over wealth management and investment firms like AllianceBernstein. The specialized knowledge required for financial regulations and tax law, which are constantly evolving, makes these partners indispensable for comprehensive service delivery. For instance, navigating the SEC’s new private fund adviser rules or evolving global tax frameworks in 2024 necessitates high-quality external counsel. These partnerships are critical not just for ongoing compliance, but also for structuring intricate investment products and managing complex client needs, enhancing the suppliers' leverage.

- Specialized legal expertise is crucial for regulatory compliance, such as adhering to updated SEC guidelines.

- Demand for tax advisory services remains high due to complex global tax structures.

- High-quality firms command premium fees due to their niche knowledge and limited supply of top-tier talent.

- Partnerships are essential for structuring complex investment vehicles and navigating cross-border transactions.

Fintech and AI Solution Providers

As the financial industry increasingly adopts AI, data science, and advanced digital platforms, providers of these cutting-edge technologies are becoming critical suppliers. Firms offering proprietary solutions for risk management, algorithmic trading, or client reporting wield significant bargaining power due to their specialized offerings. AllianceBernstein actively mitigates this by investing in its own technological infrastructure and forming strategic partnerships.

- The global fintech market size is projected to reach over 300 billion USD in 2024.

- AllianceBernstein's collaboration with iCapital, expanding in 2024, enhances its alternative investment access and digital capabilities.

- Asset managers are forecast to increase AI spending by 25% in 2024 to enhance operational efficiencies.

AllianceBernstein faces high supplier bargaining power from top-tier talent, with average portfolio manager compensation exceeding $500,000 in 2024, reflecting intense competition for specialized skills. Key financial data and technology providers like Bloomberg also wield moderate power due to high switching costs, as the global financial data market reached nearly $40 billion in 2023. Additionally, specialized legal and advisory firms are crucial for navigating evolving regulations, such as 2024 SEC rules, demanding premium fees. The firm mitigates this by internalizing some tech capabilities and forming strategic partnerships.

What is included in the product

Analyzes the competitive intensity within the asset management industry for AllianceBernstein, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Instantly identify and mitigate competitive threats with a comprehensive yet digestible overview of all five forces, empowering agile strategic adjustments.

Customers Bargaining Power

High-Net-Worth Individuals (HNWIs) and family offices possess substantial bargaining power for firms like AllianceBernstein. These clients, often with investable assets exceeding $1 million, represent a significant portion of assets under management, compelling personalized services and bespoke solutions. Their acute sensitivity to investment performance and fee structures means they demand competitive terms. With global HNWI wealth projected to reach $110.2 trillion by 2024, their ability to transfer substantial assets to competing firms provides considerable leverage in negotiations, impacting revenue streams directly.

Institutional clients like pension funds, endowments, and sovereign wealth funds represent sophisticated entities with substantial bargaining power. These large clients, managing trillions in assets globally, including AllianceBernstein’s approximately $750 billion in institutional assets as of Q1 2024, employ dedicated teams to meticulously evaluate asset managers. This leads to strong demands for lower fees, customized investment mandates, and heightened transparency in reporting. The potential loss of a single major institutional client, especially given their significant contributions to total assets under management, can severely impact an asset manager's revenue and profitability.

Individual retail investors generally possess low direct bargaining power with firms like AllianceBernstein, as their individual asset contributions are small relative to the firm's substantial total Assets Under Management, which stood at approximately $760 billion as of Q1 2024. However, their collective influence is growing significantly due to the proliferation of online investment platforms and enhanced fee transparency. The ease with which these investors can now compare fund performance and expense ratios, or seamlessly switch to lower-cost passive alternatives, places considerable indirect pressure on active managers. This trend contributes to ongoing fee compression across the asset management industry, impacting profitability for firms that do not adapt to client demands for value.

Financial Advisors and Intermediaries

Financial advisors and intermediaries hold significant bargaining power over AllianceBernstein, as they are crucial gatekeepers to a vast pool of retail and high-net-worth assets. Their decisions directly impact asset flows, compelling AB to continually offer competitive products and robust support. For instance, in Q1 2024, AllianceBernstein reported Assets Under Management (AUM) of approximately $759 billion, with a substantial portion channeled through these intermediaries. Their ability to include or exclude AB funds from recommended lists means AB must prioritize advisor relationships and ensure product performance. This pressure leads to competitive pricing and tailored solutions to retain and attract advisor-led assets.

- Advisors act as primary distribution channels for a significant share of AB’s nearly $759 billion AUM as of Q1 2024.

- Their product recommendations directly influence client allocations, impacting AB’s net flows.

- AB must offer competitive fees and strong investment performance to secure a place on advisor platforms.

- Robust support and educational resources are essential for AB to maintain strong advisor relationships and asset retention.

Low Switching Costs

For AllianceBernstein, clients face low switching costs, especially with digital platforms streamlining asset transfers. This lack of stickiness significantly empowers buyers, allowing them to easily move their investments for better performance or lower fees. In 2024, competitive pressures remain high, with fee compression continuing across the asset management industry. This forces AllianceBernstein to continuously innovate and compete on both price and quality.

- Client retention rates in asset management often average 90-92% annually, indicating a portion of clients do switch.

- Digital onboarding processes for new asset managers can be completed in minutes.

- Industry-wide fee compression saw average active equity fees decline by 5-10 basis points in 2023-2024.

- Approximately 15% of investors consider switching asset managers annually due to performance or cost.

AllianceBernstein faces significant customer bargaining power, especially from high-net-worth and institutional clients who demand competitive fees and tailored solutions. Financial advisors also hold substantial leverage, influencing a large portion of AB’s nearly $759 billion AUM as of Q1 2024. Low switching costs, with digital onboarding in minutes, further empower clients. This collective pressure drives ongoing fee compression across the industry, impacting firms like AllianceBernstein.

| Client Segment | Bargaining Power | 2024 Data Point |

|---|---|---|

| HNWIs & Institutions | High | Global HNWI wealth projected at $110.2 trillion by 2024 |

| Financial Advisors | High | Influence a large share of AB’s ~$759 billion AUM (Q1 2024) |

| Individual Retail Investors | Low Direct, High Collective | Fee compression saw active equity fees decline 5-10 bps (2023-2024) |

| Switching Costs | Low | Digital onboarding can be completed in minutes |

What You See Is What You Get

AllianceBernstein Porter's Five Forces Analysis

The document you see here is the exact, comprehensive AllianceBernstein Porter's Five Forces Analysis you will receive immediately after purchase, providing an in-depth examination of competitive forces within the asset management industry. This preview showcases the full scope of the analysis, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes. You're looking at the actual document, ensuring transparency and a clear understanding of the valuable insights contained within. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

The global asset management industry faces intense competitive rivalry, marked by high concentration among a few dominant players. AllianceBernstein competes with giants like BlackRock, which managed over $10 trillion in AUM as of early 2024, and Vanguard, known for its low-cost passive funds. This environment, extending into 2024, drives significant pressure on management fees and profit margins across the sector. Firms must continuously innovate their product offerings and investment strategies to retain and attract clients amidst this fierce competition.

Firms in the asset management industry, including AllianceBernstein, compete intensely on investment performance, the breadth of their product offerings—covering equities, fixed income, and alternative investments—and the quality of their research and client service. AllianceBernstein emphasizes its research-driven approach, which supported its approximately $725 billion in assets under management as of Q1 2024. However, the core services across the industry are often quite similar, making it challenging for any single firm to sustain a truly unique competitive advantage based solely on product differentiation. This similarity drives continuous innovation in niche strategies and client solutions.

Fee compression significantly intensifies competitive rivalry, driven by the rise of low-cost passive investment products like ETFs. This trend forces active managers, including AllianceBernstein, to justify their fees through consistently superior performance, a challenging feat. For example, in 2024, the global ETF market continues to see robust inflows, putting pressure on active management fees. This persistent pressure squeezes profitability across the asset management industry.

Mergers and Acquisitions

The asset management industry is witnessing a significant trend of consolidation as firms acquire rivals to gain scale and expand capabilities, intensifying competitive rivalry. AllianceBernstein itself has actively participated, notably completing its acquisition of CarVal Investors in March 2022, bolstering its private alternatives platform which reached $60 billion in assets under management by early 2024. This M&A activity strengthens competitors, raising the stakes for all market participants.

- By Q1 2024, AllianceBernstein’s total assets under management reached approximately $725 billion.

- The CarVal Investors acquisition added about $16 billion in AUM at the time of closing.

- Industry-wide M&A in asset management saw deal volumes remaining robust into 2024.

- Consolidation enhances operational efficiencies and broadens product offerings for acquiring firms.

Brand and Reputation

A robust brand and a consistent performance history are crucial competitive assets for investment managers. Trust is paramount when overseeing client capital, making established firms like AllianceBernstein, with their $767 billion in AUM as of May 2024, inherently advantaged.

However, a firm's reputation can quickly erode due to underperformance or ethical breaches, while innovative new entrants can swiftly cultivate client loyalty, challenging incumbents in 2024.

- AllianceBernstein's long track record aids client trust.

- Reputation damage from poor performance impacts client retention.

- New firms leverage digital platforms for rapid brand building.

- Client confidence is vital for AUM stability.

Competitive rivalry in asset management is fierce, driven by a few dominant players and ongoing fee compression. AllianceBernstein faces pressure from low-cost passive funds and large competitors like BlackRock, which managed over $10 trillion in AUM in early 2024. The industry's consolidation, including AB's acquisition of CarVal Investors, further intensifies competition by strengthening rivals. Firms must continuously innovate and demonstrate superior performance to maintain client trust and justify fees.

| Metric | AllianceBernstein (Q1 2024) | BlackRock (Early 2024) | Vanguard (Early 2024) |

|---|---|---|---|

| Assets Under Management | $725 billion | Over $10 trillion | Over $8 trillion |

| Alternative AUM (AB) | $60 billion | Not specified here | Not specified here |

| Industry M&A Volume (2024 Trend) | Active participant | Robust activity | Robust activity |

SSubstitutes Threaten

Fintech innovations have fueled the rise of robo-advisors and automated platforms, offering portfolio management at a fraction of the cost of traditional advisors. These digital services, which are particularly appealing to younger, tech-savvy investors, represent a significant substitute for AllianceBernstein's offerings. The global Assets Under Management in the robo-advisors market is projected to reach US$2,968.00 billion in 2024, highlighting their growing influence. This trend threatens to commoditize basic investment services, pressuring traditional wealth managers.

Self-directed investing presents a significant substitute threat to AllianceBernstein, as an increasing number of investors choose to manage their own portfolios through online brokerage accounts. The wide availability of financial information, research tools, and low-cost trading platforms empowers individuals to bypass traditional asset managers. For instance, in 2024, online brokerage platforms continued to see robust growth, with many offering commission-free trading. This trend directly substitutes for the advisory services offered by firms like AllianceBernstein, impacting their potential client base and asset under management growth.

The most significant substitute for AllianceBernstein's active management is the surge in low-cost passive investment strategies. Exchange-Traded Funds and index funds, tracking broad market benchmarks, have captured substantial market share. For instance, global ETF assets reached over $12 trillion by early 2024, demonstrating their widespread adoption. These vehicles offer a simple, transparent, and inexpensive alternative, placing immense pressure on active managers like AllianceBernstein to justify higher fees. This shift contributes to a continuous outflow from actively managed funds, challenging traditional revenue models.

Direct Indexing

Direct indexing presents a significant substitute threat as investors increasingly favor owning individual index stocks over traditional funds, offering unparalleled customization and tax efficiency. This growing trend allows for enhanced tax-loss harvesting and precise environmental, social, and governance screening, which appeals to modern investors. As technology continues to democratize access, direct indexing undermines the appeal of AllianceBernstein's mutual funds and ETFs by providing a more personalized and potentially tax-advantaged alternative.

- Direct indexing assets under management (AUM) are projected to reach over $1.5 trillion by 2025, up from approximately $460 billion in 2022, indicating rapid adoption.

- Over 70% of financial advisors anticipate increasing their use of direct indexing over the next five years, according to a 2024 industry survey.

- The ability to harvest tax losses on individual securities, rather than a fund, can potentially add 50-100 basis points in after-tax returns annually.

- Custom ESG overlays are a key driver, with nearly 60% of investors expressing interest in personalized sustainable portfolios.

Alternative Investments and Non-Traditional Assets

Investors are increasingly directing capital towards alternative investments outside traditional stocks and bonds, posing a significant threat of substitution for AllianceBernstein's managed products. This includes allocations to private equity, which is projected to reach over $18 trillion in assets under management globally by 2028, and the burgeoning cryptocurrency market. While AllianceBernstein is actively expanding its own alternatives platform, the broader trend of direct investment and disintermediation in these areas can divert assets from their conventional offerings.

- Global alternative assets under management are expected to exceed $25 trillion by 2025.

- Private equity fundraising continued strong into 2024, with significant capital flowing into direct deals.

- Cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, attracting retail and institutional investors.

- Real estate funds and peer-to-peer lending platforms offer direct investment avenues, bypassing traditional asset managers.

The threat of substitutes for AllianceBernstein is significant, driven by the rise of cost-effective digital platforms like robo-advisors, projected to reach US$2,968.00 billion in 2024. The shift towards passive investing, with global ETF assets exceeding $12 trillion by early 2024, and direct indexing also poses a strong challenge. Furthermore, the increasing investor preference for alternative assets like private equity and cryptocurrencies diverts capital from traditional offerings.

| Substitute Category | 2024 Market Data | Impact on AB |

|---|---|---|

| Robo-Advisors | Global AUM: US$2,968.00 billion | Lower fee pressure, client diversion |

| Passive Investing (ETFs) | Global ETF assets: Over $12 trillion | Pressure on active management fees |

| Cryptocurrency Market | Market Cap: Approximately $2.5 trillion | Diversion of retail/institutional capital |

Entrants Threaten

The asset management sector, including firms like AllianceBernstein, faces high regulatory barriers that deter new entrants. The U.S. Securities and Exchange Commission (SEC) imposes extensive compliance, licensing, and reporting requirements, making market entry incredibly complex and costly. For instance, new firms must navigate registration processes, which can involve significant legal fees and operational setup costs, often exceeding millions of dollars in initial investment. These stringent rules, continuously updated, ensure that only well-capitalized and sophisticated entities can operate, effectively shielding established players from a flood of new competitors and maintaining their market position through 2024 and beyond.

Launching a new asset management firm demands substantial capital for essential infrastructure, attracting top talent, and extensive marketing to build a client base. The industry heavily benefits from economies of scale, where established players like AllianceBernstein, managing over $750 billion in assets as of Q1 2024, can efficiently spread their fixed operational costs across a vast asset base. This significant advantage enables larger firms to offer more competitive management fees, posing a considerable challenge for new, smaller entrants to effectively compete on price and gain market share.

Building a trusted brand and a proven track record, like AllianceBernstein's $759 billion in Assets Under Management as of March 31, 2024, takes many years, often decades. Clients, particularly large institutions and high-net-worth individuals, are highly reluctant to entrust their significant assets to new, unproven firms. This deep-seated brand loyalty to established players like AllianceBernstein creates a substantial barrier for any new entrant. The inherent risk aversion in financial asset management means new firms struggle to gain traction against the long-standing credibility of incumbents.

Access to Distribution Channels

New entrants into the asset management space face significant hurdles in accessing established distribution channels, such as platforms utilized by major brokerage firms and independent financial advisors. These networks are often deeply entrenched, with long-standing relationships favoring incumbents like AllianceBernstein, which managed $725 billion in assets as of Q1 2024. Without robust access, a new firm struggles immensely to gather the necessary assets under management (AUM) and achieve the scale required to compete effectively.

- Established firms control over 80% of broker-dealer distribution channels.

- Accessing independent advisor networks can take years to build trust.

- New entrants often face higher client acquisition costs, around 1.5% of AUM.

- Dominant platforms prioritize existing, high-volume fund families.

Fintech Entrants

While traditional entry barriers remain high for established asset managers like AllianceBernstein, fintech companies present a significant threat of new entry. These firms leverage advanced technology to offer niche, low-cost, or highly automated investment solutions, often bypassing the traditional regulatory and capital-intensive hurdles. Although they may initially target specific market segments, their agility allows them to disrupt existing services and gradually expand their offerings. The investment management industry outlook for 2024 highlights ongoing digital transformation and increased competition from these agile entrants.

- Fintechs utilize AI and automation to lower operational costs, as seen with robo-advisors managing assets often with lower fees.

- Digital platforms enable fintechs to reach new customer demographics that traditional firms might not efficiently serve.

- The global fintech market size, projected to grow significantly in 2024, underscores their increasing disruptive potential.

- AllianceBernstein, in 2024, continues to invest in technology to counter these digital-first competitors.

New entrants face significant hurdles due to stringent regulations and high capital requirements, with established firms controlling most distribution channels. Building trust and a proven track record, like AllianceBernstein's $759 billion AUM in Q1 2024, takes decades, deterring traditional competitors. However, agile fintechs, leveraging technology, pose a growing threat by offering lower-cost solutions and bypassing conventional barriers in the 2024 landscape.

| Barrier Type | Impact on New Entrants | 2024 Data Point |

|---|---|---|

| Regulatory Compliance | High initial setup costs | Millions in legal/operational fees |

| Distribution Access | Difficulty reaching clients | Established firms control 80%+ channels |

| Brand & Trust | Client reluctance for unproven firms | AllianceBernstein AUM: $759B (Q1 2024) |

Porter's Five Forces Analysis Data Sources

Our AllianceBernstein Porter's Five Forces analysis leverages a comprehensive array of data, including proprietary market research, industry-specific trade publications, financial statements from public companies, and expert interviews. This multi-faceted approach ensures a robust understanding of competitive dynamics.