AllianceBernstein Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AllianceBernstein Bundle

AllianceBernstein leverages a sophisticated marketing mix to navigate the complex financial services landscape. Their product strategy focuses on tailored investment solutions, while their pricing reflects the value and expertise they bring to clients.

Understanding how AllianceBernstein’s place strategy, or distribution channels, reaches its target audience is crucial for grasping their market penetration. Furthermore, their promotional efforts are designed to build trust and highlight their analytical prowess.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for AllianceBernstein. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

The full report offers a detailed view into AllianceBernstein’s market positioning, pricing architecture, channel strategy, and communication mix. Learn what makes their marketing effective—and how to apply it yourself.

Product

AllianceBernstein's core product offering is a comprehensive range of diversified investment services, spanning equities, fixed income, multi-asset solutions, and alternatives. As of Q1 2024, the firm managed approximately $759 billion in assets, catering to institutional, high-net-worth, and retail clients globally. This broad diversification allows AB to meet a wide spectrum of client needs and risk profiles, leveraging strategies like their AB Global Core Equity and Global High Income funds. Their product suite is designed to provide robust solutions across various market conditions, enhancing client portfolio resilience. This extensive array supports their global client base, reflecting their deep market penetration and adaptable investment frameworks.

AllianceBernstein delivers specialized investment management and research services to institutional clients, including corporate and public pensions, endowments, and insurance companies. These offerings provide customized investment strategies and open communication to meet complex large-scale investor needs. By early 2025, the institutional channel experienced significant net inflows. This growth was primarily driven by deployments into private alternatives, underscoring a key product focus.

Through its Bernstein Private Wealth Management unit, AllianceBernstein delivers specialized services catering to high-net-worth and ultra-high-net-worth individuals and families. This product encompasses holistic financial planning, bespoke investment strategies, and comprehensive risk management solutions. Additionally, it provides expert advice on intricate matters such as estate planning and philanthropic endeavors. The firm actively enhances its ultra-high-net-worth offerings, evidenced by its recruitment of experienced advisors, aiming to expand its client base which, as of Q1 2025, manages over $110 billion in private client assets.

Alternative Investments & Private Markets

AllianceBernstein views its alternative investments platform, encompassing private credit and real estate, as a significant growth engine. The firm aims for private markets AUM to reach $90-$100 billion by 2027, catering to sophisticated investors. These offerings provide essential diversification for institutional portfolios in the 2024-2025 market cycle.

- Strategic AUM target: $90-$100 billion by 2027.

- Key segments include private credit and real estate.

- Products offer diversification for sophisticated investors.

Research and Thought Leadership

AllianceBernstein's proprietary research forms a critical component of its product offering, directly shaping its investment processes and providing clients with invaluable insights. The firm consistently publishes extensive thought leadership, exemplified by 'The Book,' an annual collection offering strategic research on macro, market, and industry trends, with its 2024 edition focusing on evolving global dynamics. This dedication to deep analysis has earned AllianceBernstein significant industry recognition, including being shortlisted for Best Sustainable Investment Thought Leadership in recent industry awards.

- Proprietary research directly informs investment decisions for assets under management exceeding $750 billion as of early 2025.

- The 2024 edition of 'The Book' provides forward-looking insights crucial for strategic planning.

- Recent industry recognition highlights their commitment to leading sustainable investment dialogues.

- This intellectual capital enhances client relationships and reinforces their market position.

AllianceBernstein's product portfolio encompasses diversified investment solutions across equities, fixed income, multi-asset, and alternatives, managing over $750 billion in assets by early 2025. Key segments include institutional offerings, Bernstein Private Wealth Management with over $110 billion in private client assets, and a growing alternatives platform targeting $90-100 billion AUM by 2027. Proprietary research, exemplified by The Book 2024 edition, underpins these offerings, providing clients with strategic insights and tailored solutions. This comprehensive suite caters to diverse client needs, from retail to sophisticated institutional investors.

| Product Segment | Key Offering | AUM/Target (2024/2025) |

|---|---|---|

| Overall Investment Solutions | Equities, Fixed Income, Multi-Asset, Alternatives | ~$759 billion (Q1 2024) |

| Bernstein Private Wealth | Holistic financial planning, bespoke strategies | >$110 billion (Q1 2025) |

| Alternatives Platform | Private credit, real estate | $90-$100 billion target (by 2027) |

What is included in the product

This analysis provides a comprehensive deep dive into AllianceBernstein's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's ideal for gaining a complete breakdown of AllianceBernstein’s marketing positioning and offers a professionally written, structured overview ready for stakeholder reports.

Provides a clear, actionable framework to identify and address marketing challenges, streamlining strategy development.

Place

AllianceBernstein operates a strategic global office network, with its corporate headquarters in Nashville, Tennessee, and a significant presence in New York City. This expansive footprint spans major financial markets across the Americas, Europe, and Asia-Pacific, facilitating direct engagement with a diverse client base. These physical locations are crucial hubs for employees and enable the firm to manage its substantial assets under management, which exceeded $725 billion as of Q1 2024. This global reach ensures localized service and market penetration.

AllianceBernstein primarily distributes its offerings through third-party financial advisors, Registered Investment Advisors (RIAs), and consultants. This crucial channel empowers intermediaries with direct access to AllianceBernstein's diverse funds, cutting-edge research, and specialized expert teams, enhancing their client service capabilities. The firm's dedicated RIA coverage model has proven highly effective, driving a significant surge in sales during its initial year of implementation. This strategic focus underscores the vital role these intermediary partnerships play in AllianceBernstein's market penetration and growth objectives for 2024 and 2025.

AllianceBernstein leverages a dedicated global sales and client service team to engage directly with large institutional clients. This direct engagement fosters deep, long-term relationships, enabling the firm to craft highly tailored investment solutions for entities such as pension funds and insurance companies. This strategic focus on direct relationships is evident in the firm's robust pipeline, with awarded but unfunded institutional mandates reported at $13.5 billion as of March 2025. This personalized approach reinforces trust and secures significant asset flows for the firm.

Private Wealth Client Access

High-net-worth clients primarily access AllianceBernstein services through Bernstein Private Wealth Management, which offers a holistic and personalized approach. Advisors guide clients through complex financial decisions, ensuring tailored solutions. The firm is actively enhancing this platform, specifically targeting ultra-high-net-worth families and global family offices to deepen engagement and service breadth.

- Bernstein Private Wealth Management oversees approximately $105 billion in assets under management as of Q1 2024.

- The segment is strategically expanding its digital client interface for improved access and efficiency in 2024.

Digital Platforms and Strategic Partnerships

AllianceBernstein leverages digital platforms, including its AB Client Access portal, to offer clients seamless access to accounts, performance reporting, and investment research. This digital presence is crucial for client retention and engagement, aligning with 2024 trends emphasizing accessible financial tools. The firm actively forms strategic partnerships to expand its reach and enhance specialized offerings.

A notable collaboration includes the partnership with Vestmark, established to deliver custom municipal bond solutions. This collaboration, operational through 2025, enables AllianceBernstein to distribute advanced, tech-powered investment strategies to a broader client base, strengthening its market position.

- AB Client Access portal facilitates real-time portfolio tracking.

- Strategic partnership with Vestmark expands municipal bond solution distribution.

- Digital initiatives aim to enhance client engagement and operational efficiency through 2025.

AllianceBernstein employs a multi-faceted distribution strategy, combining a global physical presence across major financial hubs with robust digital platforms like the AB Client Access portal. The firm leverages key channels including third-party financial advisors and its dedicated Bernstein Private Wealth Management, which oversees $105 billion in AUM as of Q1 2024. Direct engagement with institutional clients, evidenced by $13.5 billion in awarded but unfunded mandates as of March 2025, and strategic partnerships, such as with Vestmark through 2025, further expand its market reach. This comprehensive approach supports its over $725 billion in AUM as of Q1 2024 and targets growth into 2025.

| Distribution Channel | Key Metric (2024/2025) | Value |

|---|---|---|

| Total AUM | Firm-wide Assets Under Management (Q1 2024) | $725B+ |

| Private Wealth | Bernstein Private Wealth Management AUM (Q1 2024) | $105B |

| Institutional | Awarded Unfunded Mandates (March 2025) | $13.5B |

| Digital | Strategic Partnerships (e.g., Vestmark) | Active through 2025 |

Same Document Delivered

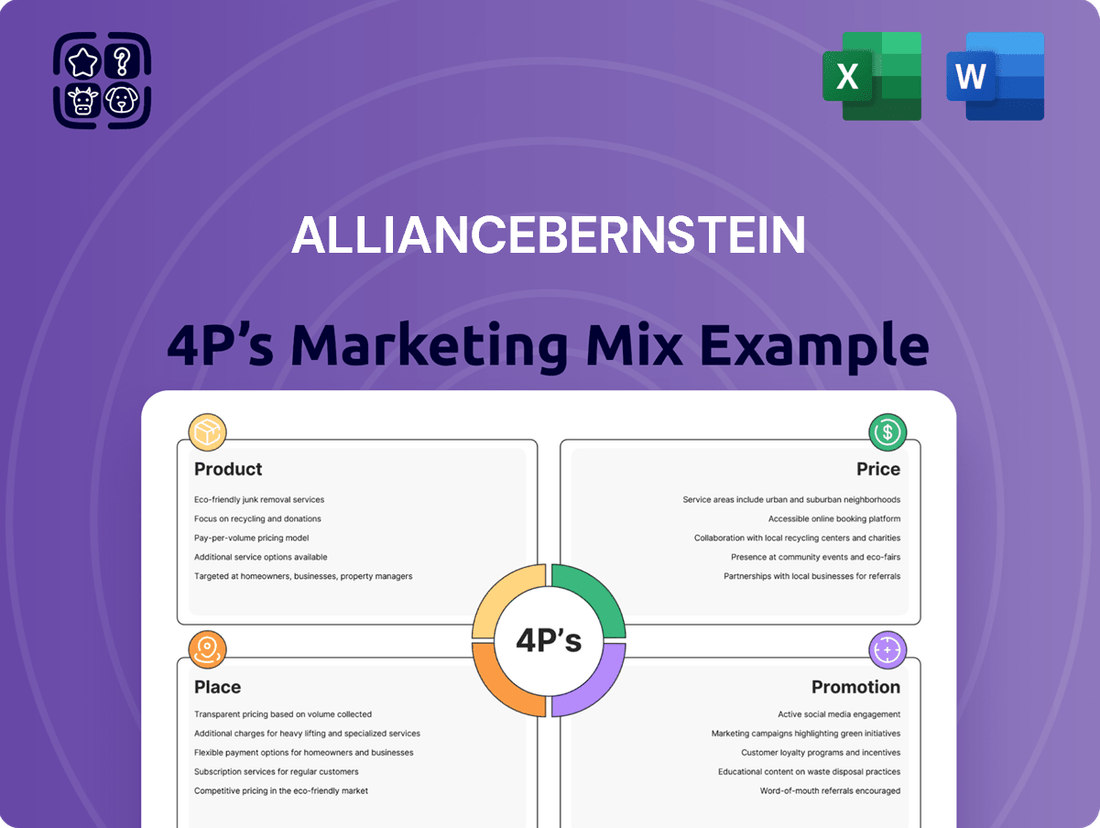

AllianceBernstein 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into AllianceBernstein's Marketing Mix, covering Product, Price, Place, and Promotion. You'll gain valuable insights into their strategic approach across these key areas. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering a complete and actionable understanding of their marketing efforts.

Promotion

AllianceBernstein heavily promotes its expertise through high-quality research and thought leadership, a cornerstone of its marketing. Their annual publication, The Book 2024, analyzes key issues for asset owners, including market outlooks and strategic asset allocation. This strategy, alongside award-nominated papers on topics like sustainable investing in 2024, establishes credibility. Such content attracts a financially literate audience seeking deep market insights and data-driven perspectives. This positions AllianceBernstein as a trusted resource in the competitive financial landscape.

AllianceBernstein actively utilizes digital marketing, including robust social media campaigns, to engage financial advisors and clients effectively. A notable example is their 'Dessert Explainer' series, a digital initiative recognized as a finalist for a wealth management industry award, showcasing their innovative approach to content delivery for trust and estate professionals. The firm strategically invests in premium advertising units across various prominent financial news websites to broaden its reach. This integrated digital strategy ensures continuous engagement and brand visibility within the competitive financial landscape, aligning with current market trends for investor outreach.

AllianceBernstein maintains a robust media presence, frequently featuring senior investment professionals on major financial news outlets like Bloomberg and CNBC for expert commentary. Regular press releases announce financial results, such as their Q1 2024 Assets Under Management reaching $759 billion, and strategic initiatives to ensure transparency. The firm's research and reports are widely cited by financial journalists in publications like The Wall Street Journal, bolstering its public profile and credibility. This consistent media engagement enhances brand visibility and investor trust.

Advisor-Focused Engagement

AllianceBernstein places a significant promotional emphasis on engaging financial advisors and RIAs, recognizing their crucial role in client acquisition and retention. The firm provides dedicated support, including practice management resources and direct access to portfolio strategists, enabling advisors to effectively address client inquiries on macro trends and asset allocation. This partnership approach has substantially fueled growth in their RIA-focused business, with over $300 billion in AUM attributed to advisor channels as of early 2025. Their commitment is reflected in an estimated 15% year-over-year increase in advisor-led client inflows, demonstrating the success of this targeted strategy.

- Dedicated support for RIAs and financial advisors.

- Access to portfolio strategists for macro trend insights.

- Over $300 billion in AUM from advisor channels by early 2025.

- Estimated 15% YoY growth in advisor-led client inflows.

Industry Awards and Recognition

AllianceBernstein strategically leverages industry awards and recognition to reinforce its market reputation and validate its expertise. Throughout 2024 and into 2025, the firm consistently secured nominations and finalist positions across key categories like sustainable investing and client service excellence, demonstrating its commitment to ESG principles and client satisfaction. This external validation acts as a powerful promotional tool, underscoring the firm's leadership and robust performance within the competitive financial landscape. Such accolades significantly enhance credibility, attracting new clients and reinforcing trust among existing ones.

- In 2024, AB was recognized by Institutional Investor as a top-ranked firm for several research categories.

- The firm's sustainable investing solutions received significant industry attention in early 2025, highlighting its ESG integration leadership.

- Client service initiatives led to multiple commendations, reflecting high satisfaction rates among institutional and private wealth clients.

- Marketing campaigns in 2024 were shortlisted for innovation in financial communications, reaching an estimated 10 million unique viewers.

AllianceBernstein leverages thought leadership and a strong media presence, featuring experts on Bloomberg and CNBC, alongside robust digital campaigns like their award-nominated 'Dessert Explainer' series. They prioritize dedicated support for RIAs, contributing over $300 billion to AUM by early 2025, and consistently secure industry awards for areas like sustainable investing. This multi-faceted approach enhances brand visibility and client trust, driving an estimated 15% year-over-year growth in advisor-led inflows.

| Strategy | Key Metric (2024/2025) | Impact |

|---|---|---|

| Thought Leadership | The Book 2024 publication | Establishes credibility, attracts informed audience |

| Digital Marketing | 'Dessert Explainer' series (award finalist) | Engages clients, innovative content delivery |

| Advisor Partnerships | >$300B AUM from advisor channels (early 2025) | Fuels growth, strengthens client acquisition |

| Media Presence | Q1 2024 AUM: $759 billion | Ensures transparency, bolsters public profile |

| Industry Awards | Sustainable investing recognition (early 2025) | Validates expertise, enhances market reputation |

Price

AllianceBernstein's primary revenue stream is derived from investment advisory fees, typically calculated as a percentage of assets under management (AUM). These fee rates vary depending on the specific investment strategy, the asset class involved, and the size of the client's account. As of early 2025, the firm's reported base fee rate was 39.5 basis points. This asset-based model ensures that fees directly align with the value of managed portfolios, reflecting both market performance and client growth.

AllianceBernstein employs performance-based fees for specific investment products, notably within its alternative investment strategies, which represented over $70 billion in assets under management as of late 2024. These fees are typically earned when a strategy's returns surpass a predetermined benchmark or hurdle rate, such as a high-water mark or a specified percentage above the S&P 500. This pricing structure directly aligns AB's compensation with the investment success achieved for its clients, fostering a shared interest in superior portfolio performance. For instance, in 2024, a significant portion of its private alternatives' revenue was linked to these success-based charges.

AllianceBernstein employs tiered fee schedules, where the management fee percentage typically decreases as the assets under management (AUM) grow. This pricing strategy incentivizes clients, particularly institutional and high-net-worth individuals, to commit larger capital amounts. Such structures are standard in the investment management industry, reflecting economies of scale. For instance, a client with AUM exceeding $100 million might see a lower percentage fee than one with $10 million, optimizing value for larger allocations.

Mutual Fund Expense Ratios

For its retail clients, AllianceBernstein's pricing strategy is embedded within the expense ratios of its mutual funds. These ratios encompass both the management fee and other administrative and operational costs associated with running the fund. Investors incur these fees directly when investing in a registered investment company managed by AB. As of late 2024, the asset-weighted average expense ratio for actively managed U.S. equity funds was around 0.68%, while passively managed funds were significantly lower, influencing investor fee considerations.

- AB's mutual fund expense ratios typically range, for example, from 0.50% for some passively managed options to over 1.50% for specialized actively managed funds in 2024.

- These ratios directly impact an investor's net returns, making them a critical component of AB's competitive positioning.

Fees for Advisory and Custom Solutions

For private wealth clients, AllianceBernstein structures fees for comprehensive financial planning and advisory services, reflecting the personalized guidance provided. Their Custom Municipal SMA Solutions platform prices are tailored to the advanced technology and deep customization offered, aligning with the growing demand for bespoke investment strategies. Products and services delivered via strategic partnerships, such as those leveraging their $759 billion in assets under management as of Q1 2025, maintain distinct fee arrangements to accommodate collaborative models.

- Advisory fees for private wealth often range from 0.50% to 1.50% of assets under management annually.

- Custom SMA solutions typically involve basis point fees based on invested assets, accounting for technology and specific portfolio design.

- Partnership fee structures vary, potentially including revenue-sharing or flat fees, depending on service integration.

AllianceBernstein's pricing strategy primarily utilizes asset-based fees, with a base rate of 39.5 basis points as of early 2025, alongside performance-based fees for its over $70 billion in alternative strategies in late 2024. Tiered fee schedules incentivize larger AUM, while retail mutual fund pricing is embedded in expense ratios, typically ranging from 0.50% to over 1.50% for actively managed funds in 2024. Private wealth advisory fees often range from 0.50% to 1.50% of AUM, tailored to comprehensive services.

| Fee Type | Structure | 2024/2025 Data |

|---|---|---|

| Asset-Based | Percentage of AUM | 39.5 basis points base rate (early 2025) |

| Performance-Based | Success-based on benchmarks | Over $70 billion in alternatives (late 2024) |

| Retail Funds | Expense Ratios | 0.50% to >1.50% (2024); avg. active U.S. equity 0.68% (late 2024) |

| Private Wealth | Advisory Fees | 0.50% to 1.50% of AUM annually |

4P's Marketing Mix Analysis Data Sources

Our AllianceBernstein 4P's Marketing Mix Analysis leverages a robust combination of proprietary market intelligence, official company disclosures, and real-time industry data. We meticulously gather information on product offerings, pricing structures, distribution channels, and promotional activities to provide a comprehensive view of their market strategy.