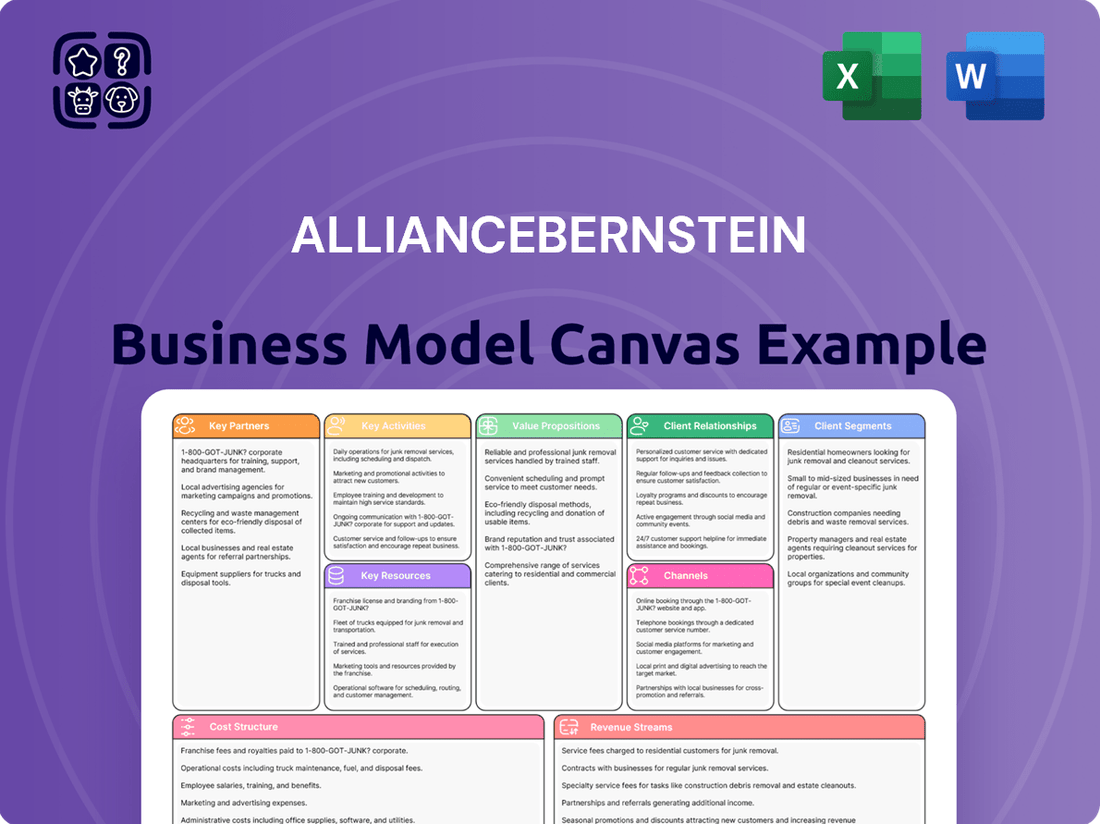

AllianceBernstein Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AllianceBernstein Bundle

Curious about how AllianceBernstein navigates the complex world of asset management? Our Business Model Canvas breaks down their core strategies, revealing how they attract diverse client segments and deliver tailored investment solutions.

Discover AllianceBernstein's key revenue streams and cost drivers, understanding how they maintain profitability in a competitive financial landscape. This canvas illuminates their unique value propositions and the channels they use to reach their target markets.

Explore the vital partnerships that underpin AllianceBernstein's operations and the critical resources they leverage to achieve their business objectives.

Ready to unlock the full strategic blueprint behind AllianceBernstein's success? This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading financial services firm, this canvas is your key to understanding their strategic framework.

Don't miss out on this opportunity to gain a comprehensive understanding of AllianceBernstein's business model. Download the full Business Model Canvas today and elevate your own strategic thinking!

Partnerships

AllianceBernstein heavily relies on a vast network of third-party financial intermediaries, including major broker-dealers, independent financial advisors, and large banking institutions.

These partners serve as the primary conduits for distributing AB's mutual funds and other retail investment products to a broad client base, contributing significantly to their reported 759 billion USD in assets under management as of March 31, 2024.

Cultivating strong relationships, offering comprehensive training, and providing robust support to this expansive network are crucial for market penetration and driving sales volume.

This collaborative model ensures AB’s products reach diverse investors, directly impacting their growth and presence across global financial markets.

AllianceBernstein partners with leading financial technology and data providers like Bloomberg, Refinitiv, and FactSet. These collaborations are crucial for accessing real-time market data, advanced analytical tools, and comprehensive research platforms. This technological backbone empowers their investment teams to conduct in-depth analysis and make informed trading decisions. Such essential data feeds, integral to the financial industry's operations in 2024, support everything from sophisticated portfolio modeling to robust risk management.

Major financial institutions like BNY Mellon and State Street serve as critical custodians, safeguarding AllianceBernstein client assets. For instance, BNY Mellon reported over $48.8 trillion in assets under custody and/or administration as of Q1 2024. Prime brokers facilitate essential trading, lending, and clearing services, particularly for complex strategies within AllianceBernstein's $725 billion AUM, as reported in April 2024. These partnerships are fundamental to ensuring the operational integrity and security of the firm's diverse investment activities. Without these robust relationships, the seamless execution of client mandates would be significantly compromised.

Equitable Holdings, Inc.

Equitable Holdings, Inc. stands as AllianceBernstein's pivotal strategic partner, maintaining a majority ownership interest of approximately 64% in AB's common units as of early 2024. This relationship ensures substantial capital stability and access to Equitable's vast distribution network, especially for insurance and retirement product synergies. The alignment profoundly influences AB's long-term corporate strategy and capital allocation decisions.

- Equitable Holdings holds roughly 64% of AB's common units as of 2024, ensuring capital stability.

- The partnership facilitates synergistic opportunities in insurance and retirement products.

- AB leverages Equitable's extensive, integrated distribution network.

- This majority stake directly influences AB's corporate strategy and capital allocation.

Retirement Plan Platforms

AllianceBernstein strategically partners with leading retirement plan administrators and record-keepers, including Fidelity, Vanguard, and Charles Schwab. This ensures their diverse investment funds are readily available as core options within 401(k)s, 403(b)s, and other defined contribution plans across the United States. This crucial channel grants AllianceBernstein access to a vast and consistent pool of long-term investment capital, derived from millions of individual retirement savers who collectively held over 38.6 trillion USD in retirement assets as of Q1 2024. These partnerships are vital for capturing significant assets under management and fostering stable growth.

- Retirement plan assets in the US exceeded 38.6 trillion USD in Q1 2024.

- Defined contribution plans, like 401(k)s, held approximately 12.1 trillion USD of these assets in Q1 2024.

- AllianceBernstein leverages these partnerships to reach millions of individual investors.

- Access to these platforms is key for long-term AUM growth and stability.

AllianceBernstein’s key partnerships span crucial areas: distribution, operations, and strategic alignment.

Their expansive network of financial intermediaries and retirement plan administrators, including firms like Fidelity, is vital for distributing products and reaching millions of investors, contributing to over $750 billion in AUM as of Q1 2024.

Strategic owner Equitable Holdings, holding about 64% of AB's common units in 2024, ensures capital stability and market synergies.

Additionally, collaborations with tech providers and custodians like BNY Mellon (managing over $48.8 trillion in Q1 2024) safeguard assets and empower data-driven investment decisions.

| Partner Type | Key Role | 2024 Data Point |

|---|---|---|

| Financial Intermediaries | Product Distribution | $750B+ AUM (Q1 2024) |

| Equitable Holdings | Strategic Ownership | 64% Common Unit Stake |

| Custodians (BNY Mellon) | Asset Safeguarding | $48.8T AUM/C (Q1 2024) |

What is included in the product

AllianceBernstein's business model canvas focuses on delivering tailored investment solutions to institutional and individual clients through a robust research and advisory framework.

It details their client relationships, revenue streams from asset management fees, and key resources like investment talent and technology.

AllianceBernstein's Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex operations for faster understanding and decision-making.

It acts as a powerful tool for identifying and addressing operational inefficiencies by providing a structured, visual representation of their entire business.

Activities

AllianceBernstein’s core activity involves rigorous, proprietary research across global markets, asset classes, and individual securities. This multifaceted approach integrates fundamental bottom-up analysis with sophisticated quantitative modeling and top-down macroeconomic forecasting. This intellectual property serves as the bedrock for their diverse investment strategies and client value proposition. As of early 2024, AB managed approximately $748 billion in assets, underscoring the scale and depth of their ongoing research efforts.

AllianceBernstein's core involves the active construction and daily management of client portfolios, tailored to meet diverse investment objectives and risk profiles.

Their portfolio managers meticulously execute buy, sell, and hold decisions, informed by the firm's extensive research and evolving market outlook.

This critical activity directly embodies AB's investment philosophy, delivering tailored strategies across various asset classes.

As of May 31, 2024, AllianceBernstein managed approximately $765 billion in assets, reflecting their ongoing commitment to client portfolio performance.

AllianceBernstein prioritizes continuous communication and tailored servicing for its diverse client base, crucial for fostering enduring relationships. This encompasses providing detailed performance reports, timely market commentary, and strategic portfolio reviews. Delivering bespoke solutions helps retain clients, contributing to their substantial Assets Under Management, which stood at $759 billion as of March 31, 2024. This dedication to client satisfaction supports sustained net inflows, such as those observed in their retail channel during Q1 2024, reinforcing trust and long-term partnerships.

Sales, Marketing, and Distribution

AllianceBernstein actively markets its services and distributes investment products through various channels. This includes creating targeted marketing materials and maintaining a dedicated sales force for institutional clients. The firm also supports a broad network of financial advisors to facilitate retail distribution. These efforts are primarily focused on growing assets under management (AUM), which stood at approximately $760 billion as of Q1 2024.

- AUM reached $760 billion in Q1 2024.

- Institutional sales drive client acquisition.

- Financial advisors are key for retail outreach.

- Marketing materials support client engagement.

Risk Management and Regulatory Compliance

A core activity for AllianceBernstein involves the continuous monitoring and management of investment, operational, and reputational risks across its global operations. This commitment ensures the firm protects its substantial assets under management, which stood at approximately $759 billion as of December 31, 2024. Simultaneously, strict adherence to a complex web of global financial regulations, including those from the SEC and other international authorities, is paramount. This robust framework safeguards both the firm’s stability and its client’s interests within the evolving regulatory landscape.

- Constant oversight of investment and operational risks.

- Strict adherence to SEC and global financial regulations.

- Protection of client interests and firm stability.

- Navigating evolving regulatory requirements in 2024 and beyond.

AllianceBernstein maintains robust technology and IT infrastructure to support global operations, including advanced trading platforms and data analytics. This includes significant investment in AI and machine learning capabilities to enhance research and optimize portfolio construction. Their secure digital ecosystem facilitates efficient client interaction and ensures operational resilience, crucial for managing $765 billion in assets as of May 31, 2024. Continuous upgrades in 2024 bolster their competitive edge.

| Area | Focus | 2024 Impact |

|---|---|---|

| Technology Infrastructure | Trading Platforms, Data Security | Enhanced operational efficiency |

| Advanced Analytics | AI/ML Integration | Improved research insights |

| Digital Client Engagement | Secure Portals | Streamlined client services |

Delivered as Displayed

Business Model Canvas

This AllianceBernstein Business Model Canvas preview is an authentic representation of the final document you will receive upon purchase. It’s not a sample or a conceptual mockup; it’s a direct snapshot from the actual, fully detailed Business Model Canvas. When you complete your transaction, you’ll gain full access to this same comprehensive document, ready for your strategic analysis and application. Rest assured, what you see here is precisely what you will download, ensuring complete transparency and a seamless experience.

Resources

AllianceBernstein's most vital resource is its expansive team of experienced portfolio managers, research analysts, and client advisors. Their collective expertise, sharp judgment, and proprietary research methodologies form the core intellectual property driving investment performance. This specialized human capital is the primary engine for generating alpha, contributing significantly to the firm's over $750 billion in assets under management as of Q1 2024. The firm's commitment to talent development ensures continuous innovation in investment strategies, directly impacting client returns.

The significant scale of AllianceBernstein's Assets Under Management (AUM) is a critical resource that provides numerous advantages.

This robust AUM, which stood at $779 billion as of May 31, 2024, generates substantial fee revenue and allows for significant operational efficiencies.

A large asset base enhances market access and strengthens negotiating power across financial markets.

This considerable AUM signals strong market trust and reinforces the firm's stability within the global financial sector.

AllianceBernstein’s global brand, cultivated over decades, is a foundational asset, embodying trust, deep expertise, and institutional quality. This strong reputation is crucial for attracting and retaining a diverse client base, from institutional investors to individual wealth managers. In the highly competitive asset management landscape, a respected brand offers a significant advantage, helping the firm stand out. For instance, as of early 2024, their established standing helps maintain over $700 billion in assets under management. This strong brand also plays a vital role in drawing in and keeping top-tier financial talent.

Technology Infrastructure and Platforms

AllianceBernstein's technology infrastructure, encompassing proprietary and third-party systems, is crucial for its global operations. These platforms facilitate advanced trading, precise portfolio management, robust data analytics, and comprehensive risk management, enabling efficient service delivery worldwide. Continuous investment ensures a competitive edge, as evidenced by the firm's ongoing technological enhancements supporting its over $700 billion in assets under management as of Q1 2024. This sophisticated digital backbone allows for scalable solutions and informed decision-making.

- Proprietary systems drive sophisticated portfolio analytics.

- Third-party integrations enhance trading and risk management capabilities.

- Technology supports global operations across 26 countries in 2024.

- Ongoing investment ensures efficiency and competitive advantage.

Global Distribution Network

AllianceBernstein leverages a robust global distribution network, a critical resource for asset gathering. This includes its dedicated institutional sales force, directly reaching large clients worldwide. The firm also maintains strong relationships with thousands of financial intermediaries, enhancing its reach to individual and smaller institutional investors. Furthermore, AllianceBernstein’s placement on major retirement and brokerage platforms ensures broad accessibility for its diverse investment offerings, securing a significant market presence.

- In 2024, AB's global distribution network supported approximately $700 billion in assets under management (AUM).

- The firm's institutional client base represents a substantial portion of its AUM, reflecting direct sales success.

- Intermediary channels, including wirehouses and independent advisors, contribute significantly to retail asset inflows.

- Placement on leading platforms enables access to millions of retail and retirement accounts.

AllianceBernstein's key resources include its specialized human capital, proprietary technology infrastructure, and expansive global distribution network. These elements collectively support its substantial Assets Under Management (AUM), which reached $779 billion as of May 31, 2024. The firm's globally recognized brand further amplifies its ability to attract and serve a diverse client base effectively. This integrated resource foundation drives its market leadership and operational efficiency.

| Resource Category | Key Metric (2024) | Impact | ||

|---|---|---|---|---|

| Human Capital | Expert team across 26 countries | Drives proprietary research and alpha generation. | ||

| Assets Under Management (AUM) | $779 billion (May 31, 2024) | Generates substantial fee revenue and operational scale. | ||

| Technology Infrastructure | Continuous investment in advanced platforms | Enables global trading, analytics, and risk management. | ||

| Global Distribution Network | Relationships with thousands of intermediaries | Expands market reach and client accessibility. |

Value Propositions

AllianceBernstein offers clients the potential for returns exceeding market benchmarks through its deep, proprietary research and disciplined active management. The firm provides expertise across diverse investment styles, from value to growth. This approach appeals to clients seeking more than just broad market exposure. As of March 2024, AllianceBernstein managed approximately $779 billion in assets, reflecting significant client trust in their differentiated strategies. Their focus remains on delivering consistent alpha through rigorous analysis.

AllianceBernstein provides a broad spectrum of investment strategies, encompassing global equities, diverse fixed income, multi-asset solutions, and various alternative investments.

This extensive offering allows clients to construct highly diversified portfolios tailored precisely to their specific goals and risk tolerance, all managed within a single firm.

This integrated, one-stop-shop capability serves as a key differentiator, streamlining investment management for a diverse client base.

As of April 30, 2024, AllianceBernstein managed approximately $765 billion in assets, underscoring its scale in delivering these comprehensive solutions globally.

AllianceBernstein delivers highly personalized wealth management to high-net-worth individuals and families, encompassing bespoke financial planning and investment oversight. This includes sophisticated estate planning, tax optimization strategies, and philanthropic advisory services, ensuring a holistic approach to their financial well-being. As of Q1 2024, AllianceBernstein managed approximately $725 billion in client assets, with a significant portion dedicated to private wealth clients seeking these tailored solutions. The core value lies in offering comprehensive, high-touch guidance that extends beyond mere investment returns, addressing the full spectrum of a client's financial life.

Actionable Thought Leadership and Market Insights

AllianceBernstein leverages its extensive global research to produce actionable thought leadership, including market outlooks and economic commentary. This content helps clients and advisors understand complex financial trends, establishing the firm as a trusted authority. For instance, their 2024 global market insights offer forward-looking perspectives on inflation and growth trajectories. This deep analysis builds confidence and reinforces client relationships.

- Global research informs over 700 publicly available market insights annually.

- 2024 economic commentary addresses key themes like interest rate paths.

- Content supports decision-making for over $750 billion in assets under management.

- Regular publications enhance client engagement and market credibility.

Access to Alternative Investments

AllianceBernstein empowers sophisticated investors by providing access to less traditional, potentially higher-return asset classes, going beyond public equities and fixed income. This includes robust offerings in private credit, real estate, and diverse hedge fund strategies. Such access allows for critical portfolio diversification, addressing the increasing demand for alternative sources of return as traditional asset correlations shift. For instance, global alternative assets under management are projected to reach $18.3 trillion by 2024.

- Alternative investments offer potential enhanced returns and portfolio diversification.

- Private credit has seen significant growth, with global assets projected to exceed $1.7 trillion in 2024.

- Real estate strategies provide tangible asset exposure, often with inflation hedging benefits.

- Hedge fund strategies aim for absolute returns regardless of market direction.

AllianceBernstein delivers active management expertise, aiming for returns beyond benchmarks, with approximately $779 billion in assets under management as of March 2024.

They offer comprehensive, tailored investment solutions across diverse asset classes, including alternative investments like private credit.

Personalized wealth management and extensive global research, including 2024 economic commentary, further enhance client value.

| Value | Focus | 2024 Data |

|---|---|---|

| Active Management | Alpha Generation | $779B AUM |

| Broad Solutions | Diversification | $1.7T Private Credit |

| Personalized Service | Holistic Planning | Q1 2024 Insights |

Customer Relationships

AllianceBernstein prioritizes a high-touch, personalized relationship model for its institutional and high-net-worth clients. Each client receives a dedicated relationship manager or private wealth advisor, serving as their primary point of contact. These professionals offer bespoke advice and conduct regular portfolio reviews, ensuring tailored strategies for client assets. With over $700 billion in assets under management as of late 2024, a significant portion benefits from this dedicated, strategic engagement. This approach fosters deep client loyalty and aims to maximize long-term financial outcomes.

AllianceBernstein cultivates robust relationships with financial advisors by offering comprehensive support. This includes providing access to dedicated portfolio specialists and a wealth of marketing materials, empowering advisors to effectively communicate value to clients. The firm also delivers practice management tools and ongoing educational resources, ensuring advisors stay current with market trends and investment strategies. By prioritizing these partnerships, AllianceBernstein aims to be the preferred asset manager for intermediaries, facilitating the recommendation and integration of its diverse product offerings. For example, AB managed over $725 billion in assets under management as of Q1 2024, significantly influenced by strong intermediary distribution channels.

AllianceBernstein empowers clients with sophisticated online portals and mobile applications, ensuring seamless 24/7 access to vital financial data. These platforms provide immediate visibility into account information, detailed performance reporting, and comprehensive transaction histories. For instance, in 2024, their digital ecosystem continues to offer proprietary research and insights, enhancing client self-service capabilities. This robust digital relationship complements the firm's personalized human advisory, fostering transparency and convenience for a diverse global client base.

Proactive and Regular Communication

AllianceBernstein maintains robust client relationships through proactive communication, ensuring clients are consistently informed. This includes detailed monthly and quarterly performance reports, alongside regular market outlook webinars featuring senior investment professionals. In 2024, the firm continued to provide timely updates during periods of market volatility, such as the Q1 2024 market shifts, reinforcing their expertise and keeping clients abreast of market developments. This commitment fosters trust and transparency with their diverse client base.

- Regular market outlook webinars provide clients with direct insights from senior investment professionals.

- Monthly and quarterly performance reports offer detailed transparency on investment outcomes.

- Timely updates during market volatility, like those seen in early 2024, keep clients informed.

- AllianceBernstein's client-centric communication strategy strengthens long-term relationships and trust.

Exclusive Client Events and Forums

AllianceBernstein cultivates strong client relationships through exclusive in-person and virtual events, including seminars and investment forums. These gatherings provide key clients direct access to portfolio managers and senior leadership, fostering a sense of community and loyalty. For instance, their 2024 client engagement strategy emphasizes these bespoke interactions, contributing to client retention. Such platforms are crucial for sharing deep insights and strengthening personal connections, reinforcing their position as a trusted advisor.

- Direct access facilitates deeper understanding of investment strategies.

- Builds community among high-net-worth individuals and institutional clients.

- Enhances client loyalty, crucial for AUM retention in 2024.

- Supports ongoing client education on market trends.

AllianceBernstein cultivates strong client relationships through a high-touch, personalized approach for institutional and high-net-worth clients. This includes dedicated advisors, robust 2024 digital platforms, and proactive market insights. Such strategies foster loyalty and transparency, crucial for managing over $725 billion in Q1 2024 AUM.

| Relationship Type | Key Feature | 2024 Impact |

|---|---|---|

| Institutional/HNW | Dedicated Advisors | Tailored advice, ~$725B AUM Q1 2024 |

| Intermediaries | Practice Management Tools | Preferred asset manager status |

| All Clients | Digital Portals, Proactive Updates | 24/7 access, enhanced transparency |

Channels

AllianceBernstein leverages a dedicated, global institutional direct sales force to cultivate and sustain relationships with key clients. This specialized team targets a diverse range of institutional investors, including pension funds, endowments, foundations, and sovereign wealth funds. Through a consultative sales approach, they provide customized investment mandates and bespoke solutions tailored to specific client needs. As of Q1 2024, AllianceBernstein managed approximately 669 billion in institutional assets, showcasing the effectiveness of this direct engagement channel.

AllianceBernstein leverages third-party financial intermediaries as a primary channel to reach the retail and mass-affluent market. This vast network includes major broker-dealers like Morgan Stanley and Merrill Lynch, alongside numerous registered investment advisors (RIAs) and banks. Through these partnerships, AllianceBernstein distributes its mutual funds and other packaged investment products, achieving broad market coverage. For instance, as of Q1 2024, the firm reported significant assets under management (AUM) attributed to these intermediary channels, reflecting their critical role in distribution strategy.

AllianceBernstein operates physical private wealth management offices in key financial centers worldwide, including major hubs like New York, London, and Singapore. These offices serve as the primary channel for engaging high-net-worth individuals and families, providing a discreet, professional environment for comprehensive financial planning and portfolio management consultations. As of 2024, these dedicated spaces facilitate direct, personalized interactions, supporting the firm's over $700 billion in private wealth assets under management. This direct channel fosters deep client relationships, offering tailored advice crucial for complex financial needs.

Digital and Online Platforms

AllianceBernstein heavily relies on its corporate website, AB.com, and various specialized microsites as pivotal digital channels.

These platforms host extensive thought leadership content, detailed fund information, and secure client portal access, crucial for client engagement.

As of 2024, digital presence is paramount, serving as a primary channel for initial research by potential clients and advisors navigating investment opportunities.

The firm continually optimizes these digital touchpoints to enhance user experience and information accessibility.

- AB.com serves as a central hub for over 100,000 unique monthly visitors seeking financial insights.

- Client portal access facilitated over 70% of routine account inquiries in early 2024.

- Digital channels are responsible for a significant portion of new client leads, estimated at 35% in 2024.

- Content downloads on thought leadership increased by 15% year-over-year by Q2 2024.

Retirement and Brokerage Platforms

AllianceBernstein leverages major defined contribution platforms, such as 401(k) plans, to distribute its funds directly to retirement savers. This also extends to self-directed brokerage fund supermarkets like Charles Schwab and Fidelity, which collectively manage trillions in client assets as of early 2024. These channels efficiently reach millions of individual investors and retirement plan participants, expanding AllianceBernstein's asset under management base.

- Defined contribution platforms: Essential for reaching retirement savers.

- Brokerage platforms: Access to millions of self-directed investors.

- Charles Schwab and Fidelity: Key distribution partners for fund access.

- Market reach: Efficiently taps into a broad individual investor base.

AllianceBernstein leverages a multi-faceted channel strategy, engaging institutional clients directly while reaching retail investors via third-party intermediaries like broker-dealers. Dedicated private wealth offices serve high-net-worth individuals, complementing robust digital platforms for broad accessibility and client support. This diversified approach ensures comprehensive market penetration across various client segments.

| Channel Type | Primary Target | 2024 AUM/Impact (Q1/Q2) |

|---|---|---|

| Institutional Direct Sales | Pension Funds, Endowments | $669 Billion (Institutional AUM) |

| Financial Intermediaries | Retail, Mass-Affluent | Significant AUM (Intermediary Channels) |

| Private Wealth Offices | High-Net-Worth Individuals | $700+ Billion (Private Wealth AUM) |

| Digital Platforms (AB.com) | All Segments | 100,000+ Monthly Visitors; 35% New Leads |

Customer Segments

AllianceBernstein serves a robust segment of institutional investors, comprising large organizations that manage substantial pools of capital. This includes corporate and public pension funds, endowments, foundations, insurance companies, and sovereign wealth funds. As of Q1 2024, AllianceBernstein reported over $725 billion in assets under management from institutional clients, highlighting their significant presence. These sophisticated clients typically require highly customized investment solutions, often spanning diverse asset classes. Their investment horizons are generally long-term, aligning with strategic objectives like funding future liabilities or perpetual growth.

High-Net-Worth (HNW) Individuals and Families represent a core segment for AllianceBernstein, encompassing affluent individuals, family trusts, and family offices. These clients, with investable assets often exceeding $1 million, seek comprehensive wealth management services. They require personalized financial planning, tailored investment portfolios, and sophisticated advice on complex matters like tax optimization, estate planning, and philanthropic legacy strategies. In 2024, the global HNW population is projected to continue growing, with a significant portion looking for bespoke solutions beyond standard offerings.

Retail Investors form a broad segment of individual investors, primarily accessing AllianceBernstein's mutual funds and exchange-traded funds.

These investors are typically reached indirectly through the extensive networks of financial advisors and brokerage platforms, such as wirehouses and independent broker-dealers.

For instance, a significant portion of AllianceBernstein's retail assets under management, which contributed to their total AUM reaching approximately $759 billion by Q1 2024, flows through these intermediary channels.

This indirect distribution model ensures their products are available to a wide array of investment and retirement accounts.

Financial Advisors and Intermediaries

Financial advisors and intermediaries, while an indirect channel, represent a distinct and crucial customer segment for AllianceBernstein. AllianceBernstein actively markets directly to these professionals, equipping them with a comprehensive suite of products, investment tools, and dedicated support to effectively serve their own end-clients. Their strong buy-in is absolutely critical for the robust distribution of retail investment solutions, particularly as the advisor-led channel continues to grow. For instance, a substantial portion of AllianceBernstein's $725 billion in assets under management as of Q1 2024 is channeled through this network.

- Advisors are key for retail product penetration.

- Direct engagement provides necessary tools and support.

- Essential for expanding client reach and AUM growth.

- Their influence drives significant distribution volume.

Sub-Advisory Clients

AllianceBernstein serves sub-advisory clients, a crucial segment comprising other financial institutions like insurance companies and smaller asset managers. These entities engage AB to manage specific investment mandates or portions of their assets, leveraging AB's expertise. In this arrangement, AB acts as a 'manager of managers,' delivering its investment capabilities under the client's own brand.

This segment contributes significantly to AB's diversified asset base. For instance, as of Q1 2024, AllianceBernstein reported total assets under management (AUM) of $759 billion, with institutional clients, including sub-advisory relationships, making up a substantial portion of this figure. This showcases the widespread trust in AB’s specialized offerings.

- Sub-advisory relationships allow other firms to offer diverse investment strategies without building in-house capabilities.

- AB's expertise in various asset classes, such as fixed income and equities, is highly sought after by these partners.

- Client firms maintain brand control while benefiting from AB's robust investment processes and performance.

- This model diversifies AB's revenue streams beyond direct retail and institutional clients.

AllianceBernstein serves a diverse client base, including large institutional investors managing over $725 billion as of Q1 2024, and high-net-worth individuals seeking tailored wealth solutions. Retail investors access products through financial advisors, a key intermediary segment driving significant distribution. Additionally, AB provides sub-advisory services to other financial institutions, contributing to their total Q1 2024 AUM of approximately $759 billion.

| Segment | Key Focus | Q1 2024 AUM (Approx.) |

|---|---|---|

| Institutional | Customized Solutions | $725B+ |

| HNW | Wealth Management | (Included in AUM) |

| Retail/Advisors | Product Distribution | $759B Total AUM |

Cost Structure

Employee compensation is AllianceBernstein’s largest expense, particularly for highly-paid portfolio managers, research analysts, and senior executives crucial for managing assets. In 2024, a significant portion of the firm's operating expenses, often exceeding 50% of net revenues, is allocated to personnel costs. Performance-based bonuses are a substantial and variable component, directly linked to investment performance and growth in assets under management. This structure aligns employee incentives with client success and firm profitability, reflecting the human capital intensity of the asset management industry.

Sales, distribution, and marketing expenses for AllianceBernstein cover essential costs like product marketing and distribution fees paid to intermediary partners. These expenses also include salaries and commissions for the dedicated sales teams. Such costs are vital for attracting new assets and retaining existing client relationships. As of Q1 2024, AB reported significant investment in distribution capabilities, reflecting their commitment to AUM growth. These expenditures directly scale with the firm's strategic efforts to expand its assets under management.

AllianceBernstein incurs substantial costs for its technology infrastructure, essential for modern asset management. These expenses cover crucial software licenses and premium data subscriptions, like those from Bloomberg and FactSet, vital for market insights and analytics. Cybersecurity measures and the continuous maintenance of sophisticated trading and portfolio management systems also represent significant outlays. For instance, technology-related expenses are a core component of general and administrative costs, which for major asset managers can represent a substantial portion of operating expenses in 2024, reflecting ongoing digital transformation efforts.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for AllianceBernstein encompass all essential operational costs needed to run their global asset management business. These include significant outlays for office leases across their worldwide footprint, prominently featuring their Nashville headquarters. Furthermore, this category covers crucial professional services like legal and audit fees, along with other corporate overhead necessary for daily operations. For the first quarter of 2024, AllianceBernstein reported operating expenses, which include G&A, as a key component of their financial structure.

- Office leases for global locations, including their Nashville headquarters.

- Professional services such as legal and audit fees.

- Other corporate overhead costs.

- These expenses are crucial for the company's day-to-day operational stability and global reach.

Regulatory Compliance and Legal Costs

AllianceBernstein incurs substantial costs to meet global regulatory requirements. This includes significant salaries for a dedicated compliance staff, legal fees for navigating complex financial regulations, and ongoing regulatory filing fees across various jurisdictions. The firm also invests in robust systems to ensure continuous adherence to industry rules, which is crucial given the evolving regulatory landscape. For instance, financial institutions globally faced an estimated 49,000 regulatory changes in 2023, underscoring the ongoing compliance burden.

- Compliance staff salaries constitute a major expense, essential for overseeing adherence to regulations.

- Legal fees are consistently incurred for advice and representation in regulatory matters.

- Regulatory filing fees are a recurring cost across all operational jurisdictions.

- Investment in compliance technology systems is ongoing to manage regulatory changes effectively.

AllianceBernstein’s cost structure is dominated by employee compensation, often exceeding 50% of net revenues in 2024, reflecting its human capital-intensive asset management model. Significant expenses also arise from sales, distribution, and marketing to attract new assets, alongside substantial investments in technology infrastructure. General and administrative costs, including office leases and professional fees, are crucial for global operations. Regulatory compliance expenses are consistently high, driven by the complex and evolving financial landscape.

| Expense Category | Key Driver | 2024 Financial Impact (Est.) |

|---|---|---|

| Employee Compensation | Personnel, Performance Bonuses | >50% of Net Revenues |

| Sales & Marketing | AUM Growth, Client Acquisition | Substantial, Variable with AUM |

| Technology | Software, Data, Cybersecurity | Significant G&A Component |

| G&A & Regulatory | Operations, Compliance | Core Operating Expense |

Revenue Streams

AllianceBernstein's core revenue stems from fees charged for managing client assets, typically calculated as a percentage of assets under management (AUM). These fees are billed on a recurring basis, reflecting the continuous nature of advisory services. For example, as of Q1 2024, AB reported AUM of $759 billion, generating substantial fee income. Fee rates vary based on asset class, strategy complexity, and client type, such as institutional or retail investors.

AllianceBernstein earns performance fees for specific investment products, particularly within their alternatives and institutional offerings. These fees are additional compensation earned only when investment returns exceed a predetermined benchmark or hurdle rate. This structure directly aligns the firm's revenue generation with the achievement of superior client success. Such performance-based revenue can significantly contribute to their profitability, especially as their assets under management (AUM) in higher-fee strategies, like alternatives, grow; AB reported AUM of $767 billion as of March 31, 2024.

AllianceBernstein generates revenue from wealth management service fees, primarily for its high-net-worth clients. These fees compensate for comprehensive financial planning and advisory services, distinct from asset management fees on underlying investments. This stream includes charges based on assets under management or a fixed fee structure. For instance, private wealth services contributed significantly to the firm's overall fee revenues, with AUM in private wealth reaching approximately $118 billion as of Q1 2024.

Distribution and Servicing Fees

AllianceBernstein generates revenue through distribution and servicing fees, primarily from certain mutual fund share classes.

These fees, including 12b-1 fees and administrative servicing fees, are designed to compensate the firm for the costs associated with distributing and servicing retail fund accounts.

For instance, in their Q1 2024 earnings, AB reported total net revenues, with a portion attributable to these ongoing service and distribution arrangements, crucial for their retail investor base.

- Revenue from specific mutual fund share classes.

- Includes 12b-1 fees and administrative servicing fees.

- Compensates for distribution and servicing costs of retail accounts.

- Contributes to overall net revenues reported by the firm.

Sub-Advisory Fee Revenue

AllianceBernstein generates significant revenue by serving as a sub-advisor for other financial institutions, leveraging its deep investment management expertise. These institutions compensate AB with a fee to manage specific investment strategies on behalf of their own clients. This arrangement provides a consistent revenue stream, as AB's specialized capabilities are utilized to enhance other firms' offerings.

- For Q1 2024, AllianceBernstein reported an increase in total assets under management (AUM) to $759 billion, reflecting its broad management capabilities that include sub-advisory mandates.

- The firm's expertise spans various asset classes, which can be deployed in sub-advisory roles for diverse client needs.

AllianceBernstein primarily generates revenue from asset management fees, calculated as a percentage of AUM, totaling $759 billion as of Q1 2024.

Performance fees from alternatives and institutional offerings contribute significantly, aligning compensation with client success, especially as AUM in higher-fee strategies grows.

Wealth management service fees for high-net-worth clients, approximately $118 billion in AUM in Q1 2024, and distribution fees from mutual funds like 12b-1 fees further diversify income.

Sub-advisory services to other institutions also provide a consistent revenue stream, leveraging AB's investment expertise.

| Revenue Stream | Primary Source | 2024 Data Point |

|---|---|---|

| Asset Management Fees | Percentage of AUM | $759B AUM (Q1 2024) |

| Performance Fees | Exceeding benchmarks | AUM $767B (March 2024) |

| Wealth Management Fees | Private wealth services | $118B AUM (Q1 2024) |

| Distribution & Servicing Fees | Mutual fund share classes | Contributes to Q1 2024 net revenues |

| Sub-Advisory Fees | Managing for other institutions | Reflected in $759B AUM (Q1 2024) |

Business Model Canvas Data Sources

The AllianceBernstein Business Model Canvas is constructed using a blend of internal financial data, extensive market research, and strategic insights derived from industry analysis. This multi-faceted approach ensures each component of the canvas is grounded in robust, actionable intelligence.