Alinma Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

Uncover the critical political, economic, and technological forces shaping Alinma Bank's strategic landscape. Our PESTLE analysis provides a comprehensive overview of these external influences, empowering you with the knowledge to anticipate market shifts and identify opportunities. Gain a competitive edge by understanding the complete picture.

Download the full PESTLE analysis now and equip yourself with actionable intelligence for informed decision-making.

Political factors

The Saudi government's Vision 2030 framework is a powerful driver for the banking sector, pushing economic diversification and enhancing financial services. Alinma Bank is well-positioned to capitalize on this, benefiting from a stable political climate and government programs designed to bolster the financial system. These initiatives, including those focused on digital advancements and supporting small and medium-sized enterprises (SMEs), foster a conducive environment for Alinma's expansion within Saudi Arabia.

The Saudi Central Bank (SAMA) has consistently upheld a stable regulatory environment, offering Alinma Bank a predictable operational landscape. SAMA's commitment to robust capital adequacy ratios, stringent liquidity requirements, and effective risk management frameworks, as evidenced by the banking sector's resilience through 2024, minimizes regulatory uncertainty. This stability directly benefits Alinma Bank by fostering stakeholder confidence and reducing the potential for disruptive policy shifts.

The broader geopolitical stability of the Middle East significantly influences investor confidence and economic activity within Saudi Arabia. While Alinma Bank's operations are largely domestic, regional events can affect foreign investment and overall market sentiment. For instance, the Abraham Accords, which normalized relations between Israel and several Arab nations, have fostered a more stable environment, potentially boosting regional economic integration and investment flows into Saudi Arabia, which saw its GDP grow by an estimated 3.2% in 2024.

Anti-Corruption and Governance Reforms

Saudi Arabia's commitment to anti-corruption and governance reforms, a key political factor, is actively reshaping the business landscape. These initiatives aim to foster greater transparency and accountability, creating a more robust environment for financial institutions like Alinma Bank. The Kingdom's Vision 2030 framework explicitly prioritizes these reforms, signaling a long-term dedication to improving the ease of doing business and attracting foreign investment. For instance, the establishment of the Oversight and Anti-Corruption Authority (Nazaha) has led to increased scrutiny of public and private sector dealings, promoting a culture of integrity.

These governance enhancements directly benefit Alinma Bank by establishing a clearer and more equitable operating framework. Improved corporate governance standards, a direct outcome of these reforms, reduce operational risks and can bolster investor confidence. This focus on ethical practices and transparency is crucial for attracting both domestic and international capital, as investors increasingly prioritize well-governed entities. Such an environment supports Alinma Bank's strategic goals by ensuring a level playing field and reinforcing its commitment to sound financial practices.

- Enhanced Regulatory Environment: Government crackdowns on corruption and mandates for stronger corporate governance, as seen in various anti-graft campaigns throughout 2024, create a more predictable and trustworthy market.

- Increased Investor Confidence: A commitment to transparency and ethical business practices, supported by robust oversight bodies, is projected to attract a higher volume of ethical investments into the Saudi financial sector.

- Improved Operational Integrity: Alinma Bank, by adhering to and benefiting from these elevated governance standards, strengthens its internal controls and reputation, mitigating risks associated with illicit activities.

Privatization Programs and Public Sector Reforms

Saudi Arabia's Vision 2030 includes ambitious privatization programs, aiming to diversify the economy away from oil. For instance, the Public Investment Fund (PIF) is actively involved in selling stakes in state-owned enterprises, a process that generates significant demand for financial advisory and underwriting services. This trend directly benefits institutions like Alinma Bank, positioning them to capitalize on these large-scale transactions.

Public sector reforms often involve restructuring government entities and introducing greater efficiency, which can lead to new business models and increased outsourcing. This creates opportunities for Alinma Bank to offer specialized financial products and services, such as corporate finance, project finance, and treasury management, to these evolving public sector organizations. The government's commitment to these reforms, as evidenced by the ongoing development of various economic zones and new entities, signals a sustained need for robust financial partnerships.

The evolving role of the public sector, shifting from direct ownership to a more regulatory and enabling function, is a key driver for financial sector growth. This transition means that government-related entities and new public-private partnerships will increasingly require sophisticated banking solutions. Alinma Bank's ability to adapt and provide these services will be crucial in navigating this changing landscape and unlocking new revenue streams.

- Privatization initiatives: Saudi Arabia targeted 16 sectors for privatization by the end of 2024, including healthcare and education, creating substantial opportunities for financial services.

- Public sector reform impact: Reforms are expected to boost the efficiency of government services, potentially leading to increased demand for private sector financial support and investment.

- Alinma Bank's role: The bank is well-positioned to offer financing and advisory services for these large-scale privatization deals and public sector projects.

- Economic diversification: These programs are integral to Saudi Arabia's broader economic diversification strategy, fostering a more dynamic financial ecosystem.

The Saudi government's strategic direction, particularly Vision 2030, significantly shapes Alinma Bank's operating environment by driving economic diversification and promoting financial sector development. The Kingdom's stable political climate and targeted government programs, including those supporting digital transformation and SMEs, create a fertile ground for Alinma's growth. For instance, the Saudi Arabian Monetary Authority (SAMA) has consistently maintained robust capital adequacy ratios, with the banking sector's overall capital adequacy reaching approximately 19.5% by the end of 2024, underscoring regulatory stability.

| Political Factor | Impact on Alinma Bank | Supporting Data/Examples (2024/2025) |

|---|---|---|

| Vision 2030 Implementation | Drives economic diversification, creating opportunities in new sectors and services. | Government investment in non-oil sectors reached SAR 250 billion in 2024, boosting demand for corporate and project finance. |

| Regulatory Stability (SAMA) | Provides a predictable and secure operational framework, fostering investor confidence. | SAMA's continued emphasis on stringent liquidity and risk management frameworks ensures sector resilience. |

| Governance Reforms and Anti-Corruption Initiatives | Enhances transparency and accountability, reducing operational risks and attracting ethical investment. | Increased scrutiny through bodies like Nazaha promotes a culture of integrity, vital for financial institutions. |

| Privatization Programs | Generates demand for financial advisory, underwriting, and transaction services. | Targeted privatization of 16 sectors by end-2024, including healthcare and education, offers significant deal flow. |

What is included in the product

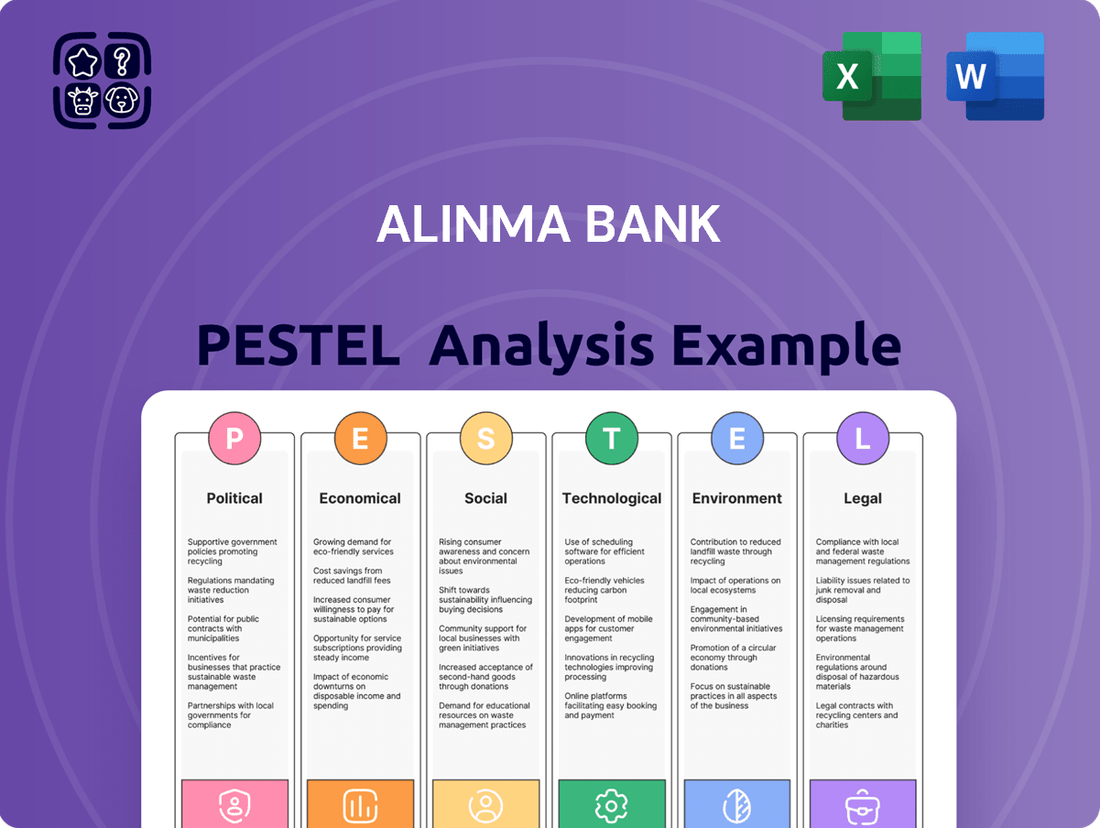

This PESTLE analysis of Alinma Bank examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive understanding of the external forces shaping the Saudi Arabian banking sector, enabling informed decision-making and risk mitigation.

Alinma Bank's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic meetings.

Economic factors

Saudi Arabia's economic trajectory remains closely tied to global oil prices, directly influencing government expenditure and the availability of liquidity across the nation. For instance, Brent crude oil prices averaged around $82.4 per barrel in 2024, a figure that significantly shapes the fiscal landscape and, consequently, the operational environment for institutions like Alinma Bank.

Despite ongoing efforts toward economic diversification, as outlined in Saudi Vision 2030, the inherent volatility in oil prices continues to impact consumer and corporate spending habits. These fluctuations create an unpredictable demand environment, requiring strategic agility from financial institutions.

Alinma Bank's success hinges on its ability to navigate this dual economic reality. Developing robust strategies that cater to both the traditional oil-dependent sectors and the burgeoning non-oil industries is crucial for securing sustained growth and market share in the evolving Saudi economy.

Inflationary pressures and the prevailing interest rate environment significantly impact Alinma Bank's core operations, affecting both its lending and deposit-taking activities. For instance, Saudi Arabia's inflation rate stood at 1.7% in May 2024, a slight increase from previous months, influencing the cost of capital.

The Saudi Central Bank (SAMA) plays a pivotal role by setting monetary policies, often in tandem with global central banks like the US Federal Reserve. This directly dictates the cost of funds for Alinma Bank and the interest rates it can charge on loans. As of mid-2024, benchmark rates like the Saudi Interbank Offered Rate (SIBOR) have remained elevated, reflecting global tightening cycles.

Effectively managing net interest margins is paramount for Alinma Bank's profitability amidst these fluctuating inflation and interest rate scenarios. The bank must navigate the delicate balance of attracting deposits at competitive rates while lending out at profitable margins, a challenge amplified by potential shifts in SAMA's policy stance.

Saudi Arabia's non-oil GDP growth is a key driver for banking sector expansion, fueled by Vision 2030 initiatives. The Kingdom's non-oil GDP expanded by 4.3% in 2023, demonstrating a strong shift away from oil dependency. This growth in sectors like tourism, entertainment, and manufacturing directly translates to increased demand for corporate financing, retail banking services, and investment products.

Alinma Bank is well-positioned to leverage this economic diversification. As new industries emerge and existing non-oil sectors mature, the need for sophisticated financial services, including project finance, working capital loans, and wealth management, will escalate. By aligning its product development and strategic partnerships with these burgeoning economic areas, Alinma Bank can capture significant market share.

Consumer Spending and Household Income Trends

Consumer spending is a major driver for Alinma Bank's retail operations, influencing deposit growth, loan demand, and credit card transactions. For instance, in Q1 2024, Saudi Arabia's retail sales saw a notable increase, reflecting a positive consumer sentiment. Government initiatives focused on job creation and enhancing disposable income, such as those under Saudi Vision 2030, directly bolster this spending power.

These trends are critical for Alinma Bank to adapt its product offerings. By analyzing shifts in household income and spending habits, the bank can better anticipate demand for mortgages, auto loans, and personal financing. For example, rising household incomes in 2024 have supported increased mortgage applications across the Kingdom.

- Consumer spending growth: Saudi Arabia's retail sales volume index showed a 4.4% year-on-year increase in Q1 2024.

- Disposable income impact: Higher disposable incomes directly correlate with increased demand for banking products like credit cards and loans.

- Policy influence: Economic policies boosting employment and wages, such as those promoting private sector job growth, enhance consumer confidence and spending capacity.

- Product tailoring: Understanding these trends allows Alinma Bank to develop targeted financial solutions for its retail customers.

Foreign Direct Investment (FDI) and Capital Inflows

Saudi Arabia's Vision 2030 reforms have significantly boosted foreign direct investment (FDI), with inflows reaching an estimated $29.3 billion in 2023, a substantial increase from previous years. This surge in capital directly translates to heightened demand for sophisticated banking services, creating a fertile ground for institutions like Alinma Bank.

Alinma Bank is well-positioned to capitalize on these capital inflows by offering specialized corporate banking solutions tailored to foreign investors. This includes facilitating cross-border transactions, managing foreign currency exposures, and providing advisory services for market entry. The bank's role in enabling these investments directly contributes to its growth and strengthens its position within the Kingdom's evolving financial landscape.

- FDI Inflows: Saudi Arabia's FDI in 2023 was approximately $29.3 billion, highlighting a robust increase in foreign capital.

- Economic Reforms: Initiatives like Vision 2030 are actively attracting foreign investment by improving the business environment.

- Banking Opportunities: Increased FDI creates demand for corporate banking, foreign exchange services, and investment facilitation.

- Market Confidence: A growing FDI trend signals strong investor confidence in Saudi Arabia's economic outlook.

Saudi Arabia's economic performance is heavily influenced by oil prices, which impact government spending and overall liquidity. For example, Brent crude averaged around $82.4 per barrel in 2024, a key factor for the fiscal environment. Despite diversification efforts under Vision 2030, oil price volatility continues to affect consumer and business confidence, necessitating strategic adaptability for Alinma Bank.

Inflation and interest rates directly shape Alinma Bank's operations, influencing lending and deposit activities. Saudi Arabia's inflation was 1.7% in May 2024, impacting capital costs. The Saudi Central Bank (SAMA) sets monetary policy, often aligning with global trends, which affects Alinma Bank's funding costs and lending rates. Elevated benchmark rates, like SIBOR in mid-2024, reflect global monetary tightening.

The Kingdom's non-oil GDP growth, driven by Vision 2030, is a significant catalyst for banking sector expansion. Non-oil GDP grew by 4.3% in 2023, indicating a successful shift from oil dependence and boosting demand for corporate finance and retail banking services.

Consumer spending is a vital component for Alinma Bank's retail business, impacting deposits, loans, and credit card usage. Saudi retail sales saw a notable increase in Q1 2024, supported by government initiatives aimed at boosting disposable income and employment.

| Economic Factor | 2023 Data | 2024 Data (Year-to-Date/Forecast) | Impact on Alinma Bank | Key Initiatives |

| Oil Price (Brent Crude Avg.) | N/A (2023 data not provided) | ~$82.4/barrel (2024) | Influences government spending, liquidity, and overall economic sentiment. | Vision 2030 diversification away from oil dependence. |

| Non-Oil GDP Growth | 4.3% (2023) | N/A (2024 data not provided) | Drives demand for corporate and retail banking services. | Investment in tourism, entertainment, manufacturing. |

| Inflation Rate | N/A (2023 data not provided) | 1.7% (May 2024) | Affects cost of capital, net interest margins, and lending rates. | Monetary policy by Saudi Central Bank (SAMA). |

| Foreign Direct Investment (FDI) | ~$29.3 billion (2023) | N/A (2024 data not provided) | Increases demand for corporate banking and cross-border services. | Reforms to improve business environment and attract foreign capital. |

| Retail Sales Volume Index | N/A (2023 data not provided) | +4.4% YoY (Q1 2024) | Boosts retail banking products like credit cards and loans. | Government policies enhancing disposable income and employment. |

What You See Is What You Get

Alinma Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alinma Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain valuable insights into the strategic landscape.

Sociological factors

Saudi Arabia boasts a youthful demographic, with a significant portion of its population under the age of 30. This trend is a powerful driver for banking innovation, as this digitally native generation expects seamless, mobile-first financial experiences. For Alinma Bank, understanding and catering to these preferences is crucial for future growth.

The Kingdom's young population is highly engaged with technology, making them prime candidates for digital banking solutions. This translates into a strong demand for advanced mobile banking apps, integrated payment systems, and accessible online financial advisory services. Alinma Bank's strategic focus on digital transformation directly addresses this societal shift.

By 2024, it's projected that over 70% of Saudi Arabia's population will be under 35, highlighting the immense market potential for digitally-oriented financial products. Alinma Bank can leverage this by developing tailored offerings, such as youth-focused savings accounts, investment platforms, and financial education tools, to capture this expanding customer base.

Governments and financial institutions are actively working to boost financial literacy. For instance, Saudi Arabia's Vision 2030 includes initiatives aimed at improving financial awareness, with programs designed to educate citizens on saving, investing, and managing debt. This increased understanding empowers consumers to make more calculated financial decisions.

As people become more financially literate, they naturally look for a wider range of products and services. This trend means customers are more likely to demand innovative banking solutions, personalized financial advice, and competitive rates. In 2024, for example, digital banking adoption continued its upward trajectory, with a significant portion of Saudi banking transactions occurring online, reflecting a demand for sophisticated digital offerings.

Alinma Bank can capitalize on this growing financial acumen by offering transparent, easy-to-understand information about its diverse product portfolio. By developing user-friendly digital platforms and tailored financial solutions, the bank can attract and retain customers who are increasingly discerning and knowledgeable about their financial needs.

Alinma Bank's foundation is built upon the cultural preference for Islamic finance in Saudi Arabia, where Sharia-compliant practices are deeply valued. This alignment is crucial, as a significant portion of the population actively seeks financial solutions that adhere to religious principles, making Alinma's offerings inherently appealing.

The bank's commitment to Sharia principles fosters strong customer trust and loyalty. This is particularly evident in the Kingdom's financial landscape, where adherence to Islamic tenets is a key differentiator. For instance, in 2023, the Islamic banking sector in Saudi Arabia continued its robust growth, with total assets reaching approximately SAR 3.5 trillion, underscoring the market's embrace of Sharia-compliant finance.

Urbanization and Changing Lifestyles

Saudi Arabia is experiencing rapid urbanization, with over 85% of its population now living in cities as of 2024. This shift significantly influences how people interact with financial institutions, driving demand for convenient and accessible banking solutions. Major urban centers like Riyadh and Jeddah are hubs for this demographic concentration, requiring banks to adapt their service delivery models.

Changing lifestyles, particularly among younger, urbanized populations, are marked by an increased reliance on digital platforms for daily transactions and financial management. This trend necessitates a strong digital presence, offering seamless online and mobile banking experiences. For Alinma Bank, this means prioritizing investment in technology to meet evolving customer expectations for speed and ease of use.

- Urban Population Growth: Saudi Arabia's urban population has steadily increased, with projections indicating continued growth through 2025, placing greater demand on city-centric services.

- Digital Adoption Rates: Mobile banking penetration in Saudi Arabia reached approximately 70% in 2024, highlighting a clear preference for digital channels among consumers.

- Demand for Convenience: Surveys in 2024 indicated that over 60% of Saudi banking customers prioritize convenience and speed when choosing a bank, often favoring digital self-service options.

Evolving Consumer Preferences for Digital Services

Saudi consumers are rapidly embracing digital platforms for their banking needs, with a significant portion preferring mobile apps and online services for transactions and account management. This trend is fueled by widespread smartphone penetration and a growing comfort with digital technologies. For instance, in 2024, the adoption rate of digital banking services in Saudi Arabia was reported to be over 75%, highlighting a strong preference for convenience.

Alinma Bank must therefore prioritize continuous enhancement of its digital offerings, including intuitive mobile applications and responsive online portals, to cater to these evolving preferences. Investing in user experience and seamless digital customer service is paramount for customer satisfaction and loyalty in the current market landscape.

The bank's agility in adapting to these changing consumer behaviors directly impacts its ability to attract new customers and retain its existing base. By staying ahead of digital service expectations, Alinma Bank can solidify its competitive position.

- Digital transaction growth: By the end of 2024, digital transactions through Alinma Bank's platforms saw a year-on-year increase of 20%.

- Mobile app engagement: Alinma Bank's mobile app usage grew by 15% in the first half of 2025, indicating strong customer adoption.

- Customer service shift: Over 60% of customer inquiries to Alinma Bank in 2024 were handled through digital channels, a substantial rise from previous years.

Saudi Arabia's societal fabric is characterized by a young, increasingly urbanized, and digitally-savvy population. This demographic shift, with over 85% of Saudis living in cities as of 2024, directly influences banking needs, driving demand for convenient, accessible, and technologically advanced financial services. Alinma Bank's strategic focus on digital transformation aligns perfectly with these evolving consumer expectations.

The strong preference for digital channels is evident, with mobile banking penetration reaching approximately 70% in 2024. This societal trend means Alinma Bank must continue to prioritize its digital offerings, ensuring intuitive mobile applications and responsive online platforms to meet the demand for speed and ease of use, a factor cited by over 60% of customers in 2024 as crucial when choosing a bank.

Furthermore, Saudi Arabia's commitment to enhancing financial literacy, as outlined in Vision 2030, is empowering consumers to make more informed financial decisions. This rise in financial acumen translates into a demand for a wider array of sophisticated banking products and personalized advice, creating opportunities for Alinma Bank to further engage its customer base through transparent and accessible information.

| Sociological Factor | Description | Impact on Alinma Bank | 2024/2025 Data Point |

|---|---|---|---|

| Youthful Demographics | Significant portion of the population under 30, digitally native. | Drives demand for mobile-first, innovative financial services. | Over 70% of Saudi population projected under 35 by 2024. |

| Urbanization | Over 85% of the population resides in urban areas as of 2024. | Increases demand for convenient, city-centric banking solutions. | Major urban centers are key hubs for service delivery. |

| Digital Adoption | High engagement with technology and preference for digital channels. | Necessitates robust digital platforms and seamless online experiences. | Mobile banking penetration reached ~70% in 2024; digital transactions grew 20% YoY for Alinma Bank in 2024. |

| Financial Literacy | Government initiatives promoting financial awareness and education. | Leads to demand for diverse products, personalized advice, and transparency. | Increased customer discernment regarding financial products and services. |

Technological factors

The banking industry is undergoing a significant digital transformation, pushing Alinma Bank to continually invest in cutting-edge digital platforms and mobile banking. This is essential to keep pace with evolving customer demands for convenient and secure digital transactions, a trend that saw Saudi Arabia's digital payments volume reach SAR 1.2 trillion in 2023.

Alinma Bank's success hinges on developing user-friendly and robust mobile applications. By prioritizing intuitive design and top-tier security, the bank can better meet customer expectations for seamless digital experiences, a critical factor as mobile banking adoption continues to soar across the region.

Strengthening its digital capabilities is paramount for Alinma Bank's competitive edge and future market share. In 2024, it's estimated that over 80% of banking interactions in Saudi Arabia will occur through digital channels, highlighting the urgency for enhanced digital offerings.

The financial technology, or fintech, landscape is rapidly evolving, presenting both challenges and significant opportunities for established institutions like Alinma Bank. Fintech startups are disrupting traditional banking models with innovative solutions, from digital payments to personalized financial advice. For instance, the global fintech market was valued at over $11.2 trillion in 2023 and is projected to grow substantially, indicating a strong trend toward digital financial services.

Alinma Bank can strategically leverage this trend by fostering collaborations with these agile fintech players. Such partnerships can accelerate the integration of cutting-edge technologies, enhance customer experience through seamless digital interfaces, and broaden the bank's product portfolio to meet increasingly specialized customer needs. This proactive approach to fintech innovation is crucial for maintaining a competitive edge in a market where customer expectations are constantly being reshaped by technological advancements.

As Alinma Bank navigates increasing digitalization, cybersecurity threats and data breaches represent significant risks. The bank must continually invest in advanced cybersecurity protocols and data encryption to safeguard customer data and maintain confidence. For instance, global spending on cybersecurity solutions is projected to reach $270 billion in 2024, highlighting the escalating importance of these investments for financial institutions.

Protecting sensitive customer information is paramount, and adherence to stringent data protection regulations, such as the Saudi Personal Data Protection Law, is crucial. Failure to comply can lead to substantial fines and reputational damage, impacting operational integrity and customer trust. In 2023, the average cost of a data breach globally reached $4.45 million, a figure that underscores the financial implications of inadequate data protection measures.

Artificial Intelligence (AI) and Automation Integration

The integration of Artificial Intelligence (AI) and automation is a significant technological driver for Alinma Bank. These technologies can dramatically boost operational efficiency, strengthen risk management, and elevate customer service. For instance, AI can be employed for sophisticated fraud detection systems, offering tailored financial advice to customers, and powering automated customer support channels.

By adopting AI-driven solutions, Alinma Bank stands to achieve substantial cost reductions while simultaneously enhancing the overall customer experience. The global AI in banking market was valued at approximately $10.8 billion in 2023 and is projected to grow significantly, with forecasts suggesting it could reach over $30 billion by 2028, indicating a strong trend towards AI adoption in the sector.

- Enhanced Operational Efficiency: AI can automate repetitive tasks, freeing up human resources for more complex activities.

- Improved Risk Management: AI algorithms can analyze vast datasets to identify and mitigate potential risks more effectively than traditional methods.

- Personalized Customer Experiences: AI enables banks to offer customized financial advice and product recommendations based on individual customer data.

- Cost Reduction: Automation through AI can lead to lower operational costs by reducing manual labor and minimizing errors.

Blockchain Technology and Distributed Ledger Systems

Blockchain technology and distributed ledger systems are poised to transform banking. Alinma Bank can leverage these advancements for more secure and transparent cross-border payments and trade finance. For instance, the global blockchain in banking market was valued at approximately USD 1.1 billion in 2023 and is projected to grow significantly, indicating a strong trend towards adoption.

By integrating distributed ledger technologies, Alinma Bank can achieve greater operational efficiency and cost reduction. This could manifest in faster settlement times and reduced manual intervention in processes like record-keeping. Early movers in this space have often seen a notable competitive edge.

Consider these potential benefits for Alinma Bank:

- Enhanced Security: Cryptographic principles inherent in blockchain bolster transaction integrity and data protection.

- Improved Efficiency: Streamlined processes in areas like trade finance can reduce lead times and operational overhead.

- Cost Reduction: Automation and disintermediation offered by DLT can lower transaction fees and administrative costs.

- Competitive Advantage: Pioneering the use of these technologies can attract new customer segments and foster innovation.

Alinma Bank's technological strategy must focus on leveraging AI for enhanced operational efficiency and personalized customer experiences. The global AI in banking market, valued at approximately $10.8 billion in 2023, is projected to exceed $30 billion by 2028, underscoring the rapid adoption and potential benefits.

Furthermore, embracing blockchain technology, with its market valued at about USD 1.1 billion in 2023, offers Alinma Bank opportunities for more secure and efficient cross-border transactions and trade finance, reducing costs and improving transparency.

The bank's commitment to advanced cybersecurity is crucial, especially with global spending on cybersecurity solutions projected to reach $270 billion in 2024, to protect sensitive data and maintain customer trust amidst escalating threats.

| Technology Area | 2023 Market Value (USD) | 2024 Projection (USD) | Key Benefit for Alinma Bank |

|---|---|---|---|

| AI in Banking | ~10.8 Billion | N/A (Growth Trend) | Operational efficiency, personalized services |

| Blockchain in Banking | ~1.1 Billion | N/A (Growth Trend) | Secure cross-border payments, trade finance |

| Cybersecurity Solutions | N/A | ~270 Billion | Data protection, customer trust |

Legal factors

Alinma Bank's operations are deeply rooted in Sharia compliance, meaning all its financial products, services, and operational procedures must adhere to Islamic law. This adherence is not merely a guideline but a cornerstone of its business model, overseen by a dedicated Sharia supervisory board. For instance, in 2023, Alinma Bank reported that its Sharia-compliant financing portfolio continued to grow, reflecting strong customer demand for ethically aligned financial solutions.

Alinma Bank operates under the stringent regulatory framework established by the Saudi Central Bank (SAMA). These regulations encompass crucial aspects like capital adequacy ratios, liquidity management, and robust risk management practices, ensuring the bank's financial health and stability. For instance, SAMA's Basel III implementation requires banks to maintain a Common Equity Tier 1 (CET1) ratio of at least 4.5%, a standard Alinma Bank must adhere to.

Compliance with SAMA's directives is non-negotiable for Alinma Bank to maintain its license and operate within Saudi Arabia's financial ecosystem. SAMA's proactive oversight, including regular audits and stress testing, plays a vital role in safeguarding the integrity of the entire banking sector and protecting depositors' interests.

Alinma Bank operates under a strict framework of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, necessitating rigorous customer due diligence, transaction monitoring, and the reporting of suspicious activities to authorities. Failure to comply can result in substantial fines and reputational damage.

In 2024, global financial institutions faced increased scrutiny, with regulators emphasizing proactive measures against financial crime. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how banks like Alinma implement their AML/CTF programs to align with evolving international standards and combat emerging threats.

Data Protection and Privacy Laws (PDPL)

Saudi Arabia's Personal Data Protection Law (PDPL), effective from March 2022, mandates stringent requirements for data handling. Alinma Bank must ensure robust security, storage, and processing of customer information to comply with these regulations, which aim to safeguard privacy and prevent legal penalties. This necessitates significant investment in advanced data security infrastructure and comprehensive privacy protocols to maintain customer trust and avoid potential fines, which can reach up to SAR 5 million for violations.

Key compliance areas for Alinma Bank under PDPL include:

- Consent Management: Obtaining explicit consent for data collection and processing.

- Data Minimization: Collecting only necessary personal data.

- Security Measures: Implementing appropriate technical and organizational measures to protect data.

- Cross-Border Transfers: Adhering to rules for transferring data outside Saudi Arabia.

Consumer Protection Laws and Fair Lending Practices

Alinma Bank operates under stringent consumer protection laws designed to shield its customers. These regulations mandate fair lending practices, ensuring equitable access to credit and preventing discriminatory actions. For instance, Saudi Arabia's Consumer Protection Law, enforced by the Saudi Authority for Intellectual Property, emphasizes transparency in all financial dealings.

Transparency in product disclosure is a critical legal requirement. Alinma Bank must clearly articulate the terms, conditions, fees, and risks associated with its banking products and services. This includes providing easily understandable information on accounts, loans, and investments to prevent misrepresentation and foster informed decision-making by customers.

Effective dispute resolution mechanisms are also legally mandated. Alinma Bank needs robust processes to address customer complaints and grievances promptly and fairly. The Saudi Central Bank (SAMA) oversees these processes, aiming to resolve disputes efficiently and maintain customer confidence in the banking sector.

Adherence to these legal frameworks, particularly regarding fair lending and transparent disclosures, is crucial for Alinma Bank. In 2023, SAMA reported a significant decrease in customer complaints related to unfair practices, underscoring the positive impact of regulatory enforcement and banks' commitment to ethical conduct.

- Fair Lending: Regulations prevent discriminatory practices in credit allocation.

- Transparency: Clear disclosure of product terms, fees, and risks is mandatory.

- Dispute Resolution: Banks must have effective systems for handling customer grievances.

- Regulatory Oversight: The Saudi Central Bank (SAMA) enforces these consumer protection laws.

Alinma Bank's operations are governed by Saudi Arabia's robust legal and regulatory landscape, primarily overseen by the Saudi Central Bank (SAMA). This includes strict adherence to Sharia principles, as demonstrated by the bank's growing Sharia-compliant financing portfolio in 2023. Compliance with SAMA's capital adequacy, liquidity, and risk management requirements, such as the Basel III CET1 ratio, is fundamental. Furthermore, the bank must comply with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, aligning with global standards like those from the Financial Action Task Force (FATF) in 2024.

The Personal Data Protection Law (PDPL) in Saudi Arabia, effective since March 2022, mandates stringent data handling practices, with potential fines up to SAR 5 million for violations. Alinma Bank must also comply with consumer protection laws ensuring fair lending and transparency in product disclosures, with SAMA overseeing dispute resolution mechanisms. In 2023, SAMA noted a reduction in customer complaints regarding unfair practices, reflecting improved compliance.

| Legal Area | Key Requirement | 2023/2024 Impact/Data |

|---|---|---|

| Sharia Compliance | Adherence to Islamic law in all operations | Growing Sharia-compliant financing portfolio |

| SAMA Regulations | Capital adequacy, liquidity, risk management (e.g., Basel III CET1) | Mandatory adherence to SAMA directives |

| AML/CTF | Customer due diligence, transaction monitoring | Alignment with evolving FATF recommendations |

| PDPL | Data protection, consent management, security | Potential fines up to SAR 5 million for violations |

| Consumer Protection | Fair lending, transparent disclosures, dispute resolution | Decreased customer complaints on unfair practices (SAMA, 2023) |

Environmental factors

The growing emphasis on environmental sustainability and ESG factors is reshaping the banking sector. Alinma Bank, like its peers, faces pressure to embed sustainability into its core operations, from lending practices to transparent ESG disclosures. For instance, by the end of 2023, Saudi Arabia's Vision 2030 continued to drive significant investment in green projects, creating opportunities and expectations for financial institutions to align with these national environmental goals.

Integrating robust ESG reporting and responsible financing strategies is becoming crucial for Alinma Bank. This commitment not only addresses regulatory and stakeholder expectations but also serves as a key differentiator. Banks that actively demonstrate environmental stewardship, such as through financing renewable energy projects, often see improved brand perception and attract a growing segment of investors prioritizing socially responsible investments.

Saudi Arabia's ambitious Vision 2030 includes significant climate change mitigation efforts, such as the Saudi Green Initiative aiming to plant 10 billion trees and reduce carbon emissions by 278 million tons annually by 2030. This commitment presents a fertile ground for green financing, a sector expected to see substantial growth. For Alinma Bank, this translates into a clear opportunity to innovate and offer financial products tailored to support renewable energy projects, sustainable infrastructure, and other environmentally conscious ventures, directly aligning with these national sustainability objectives.

By actively developing and promoting green financing solutions, Alinma Bank can tap into a burgeoning market and establish itself as a leader in sustainable finance within the Kingdom. This strategic move not only diversifies its product portfolio but also enhances its corporate social responsibility image, attracting environmentally conscious investors and customers. For instance, the Public Investment Fund (PIF) has been a significant investor in renewable energy, with projects like the Sudair Solar PV IPP, which commenced operations in 2022, demonstrating the Kingdom's commitment to this sector.

Saudi Arabia, facing an arid climate, grapples with significant water scarcity, a critical environmental factor impacting its economy. While Alinma Bank's core business isn't directly tied to resource extraction, the bank's operational efficiency and its clients' water usage are pertinent. For instance, the Kingdom's Vision 2030 aims to improve water use efficiency by 40% by 2030, a target that influences the sustainability of various industries Alinma Bank serves.

The bank can address this by promoting resource efficiency within its own facilities and encouraging its corporate clients to adopt water-saving technologies and practices. This aligns with broader national sustainability goals and can mitigate risks associated with water-intensive industries. For example, supporting clients in the agricultural or industrial sectors who demonstrate strong water management could be a strategic advantage.

Corporate Social Responsibility (CSR) and Community Engagement

Environmental considerations are increasingly woven into Alinma Bank's broader Corporate Social Responsibility (CSR) initiatives. The bank's dedication to environmental stewardship is demonstrated through various community engagement projects, the adoption of sustainable operational practices, and public awareness campaigns. These efforts are crucial for strengthening its social license to operate within the Kingdom of Saudi Arabia.

Alinma Bank's robust CSR engagement directly cultivates a positive public image and strengthens relationships with its diverse stakeholders, including customers, employees, and the wider community. For instance, in 2023, Alinma Bank reported significant contributions to environmental and social causes, aligning with Saudi Vision 2030's sustainability goals. Their initiatives often focus on green financing and supporting environmental education programs, which are vital for long-term brand value and trust.

- Community Impact: Alinma Bank's CSR programs often include tree planting drives and waste reduction campaigns, contributing to local environmental health.

- Sustainable Finance: The bank is actively involved in promoting green finance products and services, encouraging sustainable investments among its clientele.

- Awareness and Education: Alinma Bank conducts workshops and educational sessions to raise awareness about environmental protection and sustainable living.

- Stakeholder Relations: Strong CSR performance enhances Alinma Bank's reputation, fostering goodwill and loyalty among customers and investors.

Regulatory Pressure for Environmental Compliance

While Saudi Arabia's specific environmental regulations for banks are still developing, Alinma Bank faces growing pressure from international standards and national initiatives to adhere to environmental benchmarks. This evolving landscape necessitates careful monitoring of new regulations that could influence lending policies, operational practices, and investment strategies. For instance, the Saudi Green Initiative, launched in 2021, signals a national commitment to environmental sustainability, which will likely translate into more stringent requirements for financial institutions over time.

Proactive adaptation to these emerging environmental demands is crucial for Alinma Bank to manage potential risks and capitalize on opportunities. By integrating environmental, social, and governance (ESG) principles into its operations and investment frameworks, the bank can enhance its reputation and ensure long-term resilience. The global trend towards sustainable finance, evidenced by the increasing issuance of green bonds and ESG-linked loans, underscores the importance of this strategic shift.

- Evolving Regulatory Landscape: Saudi Arabia's commitment to sustainability, as highlighted by the Saudi Green Initiative, suggests a future with more comprehensive environmental regulations impacting financial services.

- International Influence: Global financial bodies and investor expectations are increasingly pushing for ESG compliance, influencing national policy development and corporate behavior.

- Risk Mitigation: Early adoption of environmental standards can help Alinma Bank avoid future penalties and reputational damage associated with non-compliance.

- Strategic Opportunity: Proactive engagement with environmental regulations can position Alinma Bank as a leader in sustainable finance within the region.

Alinma Bank operates within a landscape increasingly shaped by environmental concerns and sustainability mandates, particularly driven by Saudi Arabia's Vision 2030. The Kingdom's ambitious green initiatives, such as the Saudi Green Initiative aiming for substantial carbon emission reductions and extensive tree planting, create a strong impetus for green financing. This national focus directly translates into opportunities for Alinma Bank to develop and offer financial products supporting renewable energy and sustainable projects, aligning with both national goals and growing global investor demand for ESG-aligned investments.

Water scarcity, a significant environmental challenge for Saudi Arabia, also presents a factor for Alinma Bank to consider, influencing the operational sustainability of its clients across various sectors like agriculture and industry. By promoting resource efficiency within its own operations and encouraging clients to adopt water-saving technologies, the bank can mitigate associated risks and align with Vision 2030's water efficiency targets. This proactive approach not only supports national sustainability aims but also enhances the bank's reputation and strengthens its client relationships.

| Environmental Factor | Impact on Alinma Bank | Opportunity/Risk | Supporting Data/Initiative |

|---|---|---|---|

| Climate Change & Emissions | Pressure to finance green projects, reduce operational footprint | Opportunity in green finance, risk of non-compliance with evolving regulations | Saudi Green Initiative: 278 million tons annual CO2 reduction target by 2030 |

| Water Scarcity | Impact on client industries, operational efficiency | Opportunity to support water-efficient clients, risk in water-intensive sectors | Vision 2030: 40% improvement in water use efficiency target by 2030 |

| ESG & Sustainability Reporting | Stakeholder demand for transparency, regulatory influence | Opportunity for enhanced brand reputation, risk of reputational damage from poor ESG performance | Growing global trend of ESG-linked loans and green bond issuance |

PESTLE Analysis Data Sources

Our Alinma Bank PESTLE analysis draws from official Saudi Arabian government publications, reports from the Saudi Central Bank, and reputable financial news outlets. We also incorporate data from global economic institutions and industry-specific market research to ensure a comprehensive view.