Alinma Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

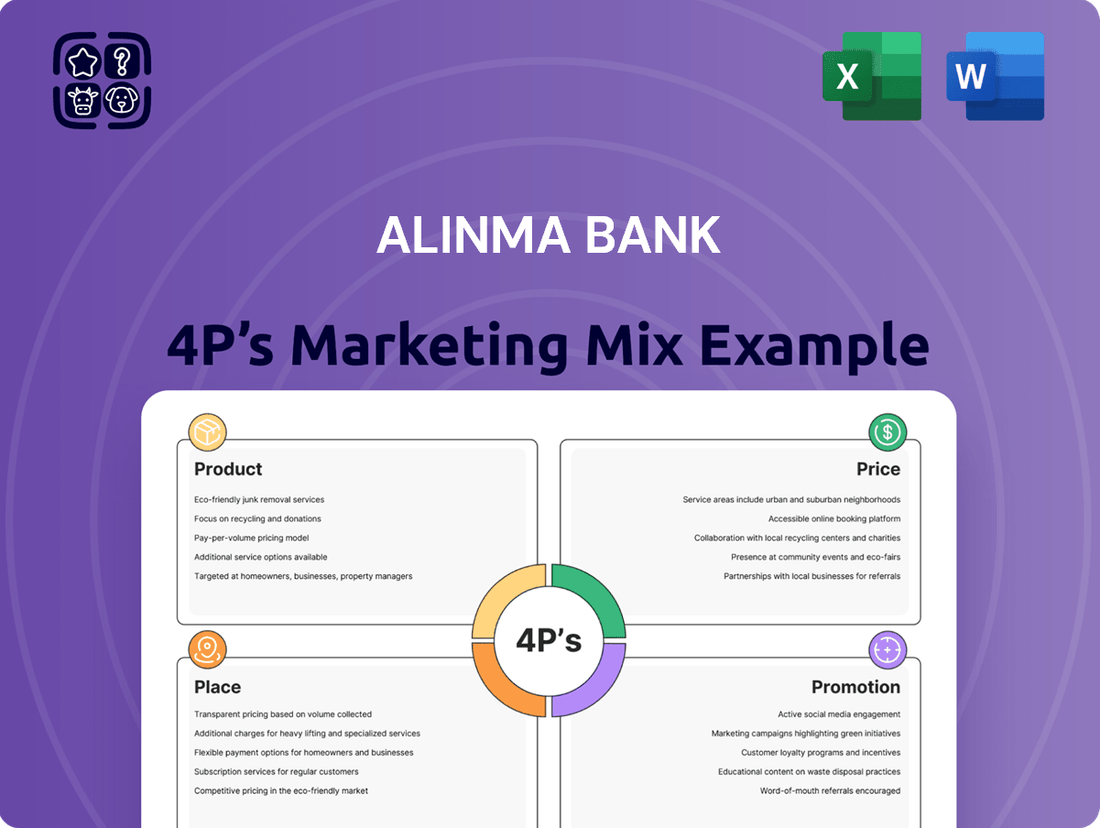

Alinma Bank strategically leverages its product offerings, competitive pricing, accessible distribution channels, and targeted promotional activities to capture market share. Understanding how these elements intertwine reveals a powerful engine for customer acquisition and loyalty.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Alinma Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Alinma Bank's Sharia-compliant financial solutions form a cornerstone of its product offering, ensuring all banking and financial services align with Islamic principles. This commitment is vital for attracting and serving a significant segment of the market seeking ethical financial products.

The bank provides a diverse suite of corporate financing options, including Murabaha, Bai Al-Ajel, Ijara, Forward Ijara, and Musharaka. These products are designed for businesses that prioritize Sharia-compliant growth and capital management, reflecting a growing demand for ethical business practices in the financial sector.

Beyond corporate offerings, Alinma Bank extends its Sharia-compliant framework to retail banking, investment services, and treasury operations. This holistic approach ensures that customers across various segments can access a full spectrum of financial services that meet their ethical and financial requirements, reinforcing the bank's market position.

Alinma Bank's product strategy heavily emphasizes digital banking innovations, a core component of its 'One Step Ahead' vision. This focus aims to boost customer experience and streamline operations.

The bank is actively collaborating with tech leaders like IBM and Dell to build sophisticated digital tools. These include intuitive mobile banking applications, efficient digital sales platforms, and enhanced data analysis features, reflecting a commitment to cutting-edge technology.

Alinma Bank's digital development plan, spanning 2022 through 2024, targets key areas such as digital marketplaces, home financing solutions, and wealth management. A significant part of this roadmap involves leveraging AI and machine learning to introduce novel digital-only banking products and services.

Alinma Bank's retail banking services cater to individual needs with a comprehensive suite of products. This includes various account types like current, education, and family accounts, complemented by convenient self-service banking options. For spending and transactions, customers have access to a diverse range of cards, including debit, credit, traveler, purchase, and prepaid options.

Further supporting its retail clientele, Alinma Bank offers a robust selection of Sharia-compliant financing solutions. These cover essential needs such as car, real estate, personal, and education financing, demonstrating a commitment to providing accessible and religiously aligned financial tools. As of Q1 2024, Alinma Bank reported a net profit of SAR 1.1 billion, reflecting the strong demand for its diverse banking offerings.

Corporate and SME Banking

Alinma Bank's Corporate and SME Banking segment offers Sharia-compliant financial solutions designed to support businesses across the spectrum, from large corporations to small and medium enterprises. This commitment is demonstrated through specialized financing options, including those for SMEs, payroll, asset acquisition, and invoice financing.

The bank actively fosters business growth by providing essential digital platforms. These include robust payroll management systems, secure e-payment gateways, and direct B2B connectivity solutions, all aimed at enhancing operational efficiency and promoting financial inclusion for entrepreneurs. In 2024, Alinma Bank reported a significant increase in SME client acquisition, reflecting its strategic focus on this vital economic sector.

- Tailored Sharia-Compliant Financing: Specialized products for SMEs, payroll, assets, and invoices.

- Digital Business Platforms: Payroll management, e-payment gateways, and B2B direct connections.

- Focus on Empowerment: Aims to empower entrepreneurs and drive financial inclusion.

- Market Growth: Alinma Bank saw a notable rise in SME client engagement throughout 2024.

Investment and Treasury Services

Alinma Bank's Investment and Treasury Services offer Sharia-compliant avenues for wealth growth, extending beyond conventional banking. These services cater to both individual and corporate clients seeking ethical financial management. For instance, by the end of 2023, Alinma Bank reported a significant increase in its assets under management, reflecting growing client trust in its specialized investment offerings.

These offerings are vital for clients prioritizing Islamic principles in their financial strategies. The bank provides direct investment options, allowing clients to participate actively in markets while adhering to ethical guidelines. This commitment to Sharia compliance is a cornerstone of their value proposition in the competitive financial landscape.

- Sharia-Compliant Investment Products: Alinma Bank ensures all investment products adhere strictly to Islamic finance principles, providing ethical investment opportunities.

- Direct Investment Options: Clients have access to a range of direct investment vehicles, facilitating active participation in various asset classes.

- Treasury Services for Corporates: Businesses can leverage Alinma Bank's treasury services for efficient cash management and liquidity solutions aligned with Islamic finance.

- Wealth Management Focus: The services are designed to support comprehensive wealth management for individuals and institutions seeking Sharia-compliant growth.

Alinma Bank's product portfolio is deeply rooted in Sharia-compliant principles, offering a comprehensive range of financial solutions for both retail and corporate clients. This commitment ensures ethical alignment across all banking services, from personal accounts and financing to complex corporate and investment products. The bank's strategy also heavily emphasizes digital innovation, aiming to enhance customer experience through advanced technology and user-friendly platforms.

| Product Category | Key Offerings | Sharia Compliance | Digital Integration | Recent Performance Indicator |

|---|---|---|---|---|

| Retail Banking | Current accounts, savings accounts, personal finance (car, real estate), debit/credit cards | Yes | Mobile app, online banking, self-service kiosks | SAR 1.1 billion net profit (Q1 2024) |

| Corporate & SME Banking | Murabaha, Ijara, Musharaka, invoice financing, payroll solutions | Yes | Digital payroll management, e-payment gateways, B2B connectivity | Notable rise in SME client engagement (2024) |

| Investment & Treasury | Direct investment options, wealth management, treasury services | Yes | Online investment portals, digital advisory tools | Significant increase in assets under management (end of 2023) |

What is included in the product

This analysis provides a comprehensive deep dive into Alinma Bank's marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities.

It's designed for stakeholders seeking to understand Alinma Bank's market positioning and competitive advantages through a detailed breakdown of its 4P strategies.

Simplifies Alinma Bank's marketing strategy by highlighting how its 4Ps address customer pain points, offering a clear, actionable overview for strategic decision-making.

Place

Alinma Bank operates a significant physical footprint across Saudi Arabia, boasting a network of branches designed for direct customer engagement. As of early 2024, the bank continued to strategically invest in its physical locations, recognizing their importance as a key element in its customer service strategy, even as digital channels expand. This commitment ensures that customers have accessible points for resolving complex financial matters and receiving personalized support.

Alinma Bank has heavily invested in its digital infrastructure, offering Alinma Internet, Alinma Mobile, and smart device applications. This digital-first approach ensures customers can manage their finances conveniently, anytime and anywhere. The bank's extensive ATM network further complements these digital channels, providing widespread accessibility.

In 2024, Alinma Bank reported a significant increase in digital transaction volumes, with mobile banking transactions growing by 35% year-over-year. This highlights the growing reliance on digital platforms for daily banking needs, demonstrating the effectiveness of their investment in customer experience and operational efficiency.

Alinma Bank actively cultivates strategic partnerships to broaden its market presence and enhance its service portfolio. These alliances are crucial for delivering a more comprehensive and integrated customer experience.

Collaborations with key technology firms, including IBM and Dell Technologies, are instrumental in driving Alinma Bank's digital transformation. These partnerships focus on accelerating the development and deployment of cutting-edge data center solutions, ensuring the bank remains at the forefront of technological innovation.

Furthermore, Alinma Bank's integration into broader financial ecosystems, such as its role as an approved digital channel for the government-backed 'Sah' savings sukuk, significantly expands its accessibility and reach to a wider customer base.

Customer-Centric Digital Onboarding

Alinma Bank prioritizes a seamless customer journey by focusing on digital channels for new customer acquisition. This commitment to customer-centricity is evident in their digital onboarding process, designed for maximum efficiency and ease of use.

The bank has seen substantial success in this area, with a remarkable 87% of all new customer acquisitions completed through digital onboarding in 2024. This high adoption rate underscores the effectiveness of their digital strategy in meeting customer expectations for convenience.

This digital-first approach not only enhances the customer experience by reducing friction but also significantly improves operational efficiency for the bank. It allows Alinma Bank to scale its customer acquisition efforts effectively while maintaining a high standard of service.

- Digital Onboarding Efficiency: Alinma Bank has streamlined the process for new customers to open accounts entirely online.

- High Digital Adoption: In 2024, 87% of all new customer acquisitions utilized the digital onboarding platform.

- Customer Convenience: This digital focus ensures a quick and hassle-free experience for individuals joining the bank.

- Operational Improvement: The high percentage of digital onboarding contributes to increased efficiency and reduced manual processing for Alinma Bank.

Accessibility for Diverse Segments

Alinma Bank's distribution strategy actively reaches a broad customer base, encompassing retail, corporate, and treasury clients. This commitment extends to specialized segments such as the youth market and small businesses, for whom innovative digital-only offerings are being developed.

This inclusive distribution model ensures that a wide array of financially-literate decision-makers, from individual investors to corporate strategists, can readily access Alinma Bank's Sharia-compliant financial solutions.

- Digital Reach: Alinma Bank's digital channels are a cornerstone of accessibility, with a significant portion of its customer base actively utilizing its mobile app and online banking platforms for transactions and service inquiries. For instance, in Q1 2024, digital transactions accounted for over 85% of all retail banking operations.

- Branch Network Optimization: While embracing digital, Alinma Bank maintains a strategic physical presence. As of late 2024, the bank operates 150 branches across key economic hubs in Saudi Arabia, ensuring convenient access for customers who prefer in-person services or require specialized corporate banking support.

- Targeted Segment Solutions: The bank is actively enhancing its offerings for specific demographics. For example, its youth banking program, launched in 2023, had onboarded over 100,000 new accounts by mid-2024, demonstrating strong uptake among younger customers seeking tailored financial products.

- SME Focus: Recognizing the vital role of small and medium-sized enterprises, Alinma Bank introduced dedicated digital onboarding and financing solutions in early 2024, aiming to streamline the process for entrepreneurs. This initiative saw a 20% increase in SME account openings in the first half of 2024 compared to the previous year.

Alinma Bank's place strategy is a dual-pronged approach, balancing an extensive physical branch network with robust digital platforms. This ensures broad accessibility for all customer segments, from individual investors to large corporations.

The bank's digital channels, including its mobile app and internet banking, are central to its distribution, handling the majority of daily transactions. This digital-first ethos is supported by a physical branch network of 150 locations across Saudi Arabia as of late 2024, catering to diverse customer needs and preferences.

Alinma Bank's commitment to reaching specific markets is evident in its targeted offerings, such as its youth banking program which had over 100,000 new accounts by mid-2024, and its specialized digital solutions for SMEs, which saw a 20% increase in account openings in early 2024.

| Channel | Key Features | Customer Segment Focus | 2024 Data Point |

|---|---|---|---|

| Physical Branches | Direct engagement, complex issue resolution, personalized support | All segments, particularly corporate and high-net-worth | 150 branches nationwide (late 2024) |

| Digital Platforms (App/Internet) | Convenience, 24/7 access, transaction management | Retail, youth, SMEs | Over 85% of retail transactions (Q1 2024) |

| ATM Network | Cash withdrawal, basic transactions | All segments | Extensive network nationwide |

| Strategic Partnerships | Enhanced service offerings, broader reach | All segments | Integration with government savings sukuk |

Full Version Awaits

Alinma Bank 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished Alinma Bank 4P's Marketing Mix analysis you’ll own. You'll receive this exact, comprehensive document instantly after purchase, allowing you to immediately leverage its insights.

Promotion

Alinma Bank positions Sharia-compliance as a cornerstone of its marketing, distinguishing itself by adhering strictly to Islamic financial principles across all products and services. This commitment is a primary communication theme, attracting clients who seek ethically aligned financial solutions.

The bank actively promotes its Sharia adherence, even releasing an English version of its 'Sharia Provisions and Controls for Alinma Products and Services' to broaden its appeal and inform a global audience about its foundational principles.

Alinma Bank heavily invests in digital marketing to boost awareness and customer interaction, a key part of its promotion strategy. The bank's commitment to digital transformation is evident in its advanced online platforms and potential use of social media to highlight its unique product offerings.

The bank's dedicated digital factory is at the forefront of creating innovative digital solutions for diverse customer groups. This initiative is likely bolstered by precise digital marketing campaigns designed to reach and resonate with specific market segments, driving engagement and adoption of new services.

In 2024, Alinma Bank reported significant growth in its digital customer base, with over 1.5 million active digital users, underscoring the effectiveness of its digital promotion efforts. This digital focus aims to enhance customer experience and solidify its market position.

Alinma Bank demonstrates a strong commitment to Corporate Social Responsibility through its 'AMAD' program, focusing on sustainability and social impact. This aligns directly with Saudi Vision 2030's goals for national development and economic diversification.

Key CSR activities include fostering financial inclusion, boosting financial literacy, and providing support for entrepreneurs. These efforts not only enhance Alinma Bank's public image but also solidify its dedication to the community's advancement.

The bank backs these initiatives by allocating 1% of its net profits, showcasing a concrete financial commitment to its social and environmental objectives. For instance, in 2023, this commitment translated to a significant investment in programs designed to uplift various segments of Saudi society.

Awards and Recognitions

Alinma Bank actively leverages its awards and recognitions to bolster its brand image. For instance, being named the Best Islamic Digital Bank in Saudi Arabia for 2024 and the top-performing Saudi bank in 2025 by The Banker magazine are key promotional assets. These accolades serve as tangible proof of the bank's commitment to excellence and innovation.

These recognitions directly contribute to Alinma Bank's marketing mix by reinforcing its credibility and trustworthiness. By highlighting achievements like these, the bank aims to attract and retain customers who value reliability and superior service. This strategy directly addresses the 'Promotion' element of the 4P's by showcasing validated strengths.

The bank's consistent performance, as evidenced by such awards, translates into a stronger market position. For example, The Banker's recognition for 2025 underscores sustained operational success and strategic execution, which are critical selling points for both retail and corporate clients.

Key promotional highlights include:

- Best Islamic Digital Bank in Saudi Arabia 2024

- Best-performing Saudi bank for 2025 by The Banker magazine

- Validation of innovation and customer experience

- Enhancement of reputation and trustworthiness

Investor Relations and Financial Performance Highlights

Alinma Bank actively promotes its robust financial performance to attract and reassure investors, including individual investors and financial professionals. The bank consistently highlights its strong net profit growth, with a reported net profit of SAR 3,526 million for the fiscal year 2023, a significant increase from SAR 2,808 million in 2022. This growth, coupled with an expanding asset base and a commitment to consistent dividend distributions, serves as a key promotional message.

Transparency in financial reporting and a focus on sustainability efforts are crucial for building investor confidence. Alinma Bank's detailed disclosures regarding its financial results and its strategic initiatives in environmental, social, and governance (ESG) areas provide valuable data for academic stakeholders and business strategists conducting thorough research.

- Net Profit Growth: Alinma Bank's net profit reached SAR 3,526 million in 2023, up from SAR 2,808 million in 2022.

- Asset Expansion: The bank's total assets continued to grow, reflecting its expanding operational scale.

- Dividend Policy: Consistent dividend distributions demonstrate a commitment to shareholder returns, a key factor for investors.

- Transparent Reporting: Clear and regular financial disclosures build trust and facilitate informed decision-making for all stakeholders.

Alinma Bank's promotion strategy heavily emphasizes its Sharia-compliant nature and digital innovation, attracting a broad customer base. The bank's commitment to digital transformation is evident in its advanced online platforms and targeted digital marketing campaigns, which contributed to over 1.5 million active digital users in 2024.

Corporate Social Responsibility, particularly through its 'AMAD' program, is a key promotional tool, aligning with Saudi Vision 2030 and reinforcing the bank's community commitment. This is backed by a tangible allocation of 1% of net profits to social and environmental initiatives.

Awards and recognitions, such as being named the Best Islamic Digital Bank in Saudi Arabia for 2024 and the best-performing Saudi bank in 2025 by The Banker, serve as powerful endorsements, enhancing credibility and trustworthiness. These accolades validate the bank's innovation and customer experience, solidifying its market position.

The bank also promotes its strong financial performance, highlighting a net profit of SAR 3,526 million in 2023, up from SAR 2,808 million in 2022, to assure investors. This transparent financial reporting and consistent dividend policy are crucial for building confidence among individual investors and financial professionals.

| Promotional Aspect | Key Data/Fact | Impact |

|---|---|---|

| Sharia Compliance | Core brand differentiator | Attracts ethically-minded customers |

| Digital Engagement | 1.5M+ active digital users (2024) | Enhances customer experience, market reach |

| CSR Initiatives (AMAD) | 1% of net profits allocated | Builds brand reputation, community trust |

| Awards & Recognition | Best Islamic Digital Bank 2024, Best Performing Saudi Bank 2025 (The Banker) | Boosts credibility, validates innovation |

| Financial Performance | SAR 3,526M net profit (2023) | Reassures investors, demonstrates stability |

Price

Alinma Bank's pricing is built on competitive market positioning and strict Sharia compliance, ensuring no interest is charged. This means financing and investment products are structured to earn permissible profits through methods like Murabaha, where the bank adds a pre-agreed profit margin to the cost of goods. For instance, in 2024, Alinma Bank's competitive financing rates, particularly in home financing, have been a key driver of customer acquisition, with profit rates often benchmarked against prevailing market conditions while remaining within Sharia guidelines.

Alinma Bank provides a comprehensive suite of financing options tailored for both individual and business clients, including specialized products for car, real estate, personal needs, and Small and Medium-sized Enterprises (SMEs). These offerings are designed to be readily accessible, reflecting the bank's commitment to Sharia-compliant financial solutions.

In 2024, Alinma Bank's financing portfolio continued to grow, with a notable increase in retail lending, particularly in real estate and personal finance, driven by Saudi Vision 2030 initiatives. The bank's flexible credit terms aim to meet diverse customer needs while maintaining prudent risk management, supporting its market position as a trusted financial partner.

Alinma Bank's approach to shareholder returns, particularly through its dividend policy, is a key element of its equity pricing strategy. The bank has demonstrated a commitment to rewarding its investors, reflecting a stable and profitable operational base.

For the fiscal year 2023, Alinma Bank announced a total dividend distribution of SAR 1.25 billion, translating to SAR 0.50 per share. This payout underscores the bank's financial strength, which was further evidenced by a net profit of SAR 3.6 billion in the same period, a notable increase from SAR 2.9 billion in 2022. The bank also reported a return on equity of approximately 13.8% for 2023, indicating efficient use of shareholder capital.

Value-Based Pricing for Digital Services

Alinma Bank's value-based pricing for digital services aligns with the enhanced convenience, speed, and security offered. This strategy aims to capture the perceived value by customers, fostering loyalty and potentially commanding premium pricing for innovative digital-only solutions. For instance, a digital account opening process that takes minutes versus traditional days adds significant customer value, justifying a pricing structure that reflects this efficiency.

The bank's approach focuses on delivering tangible benefits that translate into customer satisfaction and operational efficiency. By prioritizing faster, easier, and more effective digital products, Alinma Bank can differentiate itself in a competitive market. This is crucial as digital banking adoption continues to surge; by mid-2024, over 80% of banking transactions in Saudi Arabia were conducted digitally, highlighting the demand for seamless online experiences.

- Customer Value: Pricing reflects the time saved and ease of use in digital transactions.

- Operational Efficiency: Reduced costs from digital processes can support competitive pricing.

- Market Positioning: Premium pricing for unique digital features can be justified by superior value.

- Revenue Growth: Value-based pricing can lead to increased adoption and higher revenue streams from digital offerings.

Consideration of Market Conditions and Economic Factors

Alinma Bank's pricing strategy is deeply intertwined with Saudi Arabia's economic climate and competitive banking sector. For instance, the Saudi Central Bank (SAMA) has maintained its benchmark repo rate at 5.00% and reverse repo rate at 4.50% as of late 2024, influencing the cost of funds for all banks, including Alinma. This environment necessitates competitive yet sustainable pricing for Alinma's diverse financial products and services, balancing market demand with the bank's operational costs and profitability goals.

The bank's ability to adapt to evolving market conditions and regulatory frameworks, such as potential changes in capital requirements or digital banking mandates, is crucial for maintaining its pricing relevance. Alinma's financial strength, evidenced by its consistent profitability and strong capital adequacy ratios, provides the flexibility to adjust pricing strategies in response to competitor actions and shifts in customer demand. This strategic agility ensures that Alinma Bank can effectively navigate the dynamic Saudi financial landscape, offering competitive pricing that supports both customer acquisition and long-term business sustainability.

- Competitor Pricing: Alinma Bank actively monitors the pricing of similar products and services offered by major Saudi banks, such as Saudi National Bank and Riyad Bank, to ensure its own offerings are competitive.

- Market Demand: Pricing for retail loans and corporate financing is adjusted based on current market demand, with higher demand potentially allowing for more competitive rates to capture market share.

- Economic Conditions: With Saudi Arabia's GDP growth projected around 3.0% for 2024-2025, Alinma's pricing considers the overall economic health and consumer spending power.

- Regulatory Influence: SAMA's monetary policy decisions, including interest rate adjustments, directly impact Alinma's cost of funds and, consequently, its pricing of loans and deposits.

Alinma Bank's pricing strategy is a careful balance of Sharia compliance, market competitiveness, and value delivery. The bank avoids interest, instead structuring products to earn permissible profits through mechanisms like Murabaha, where a profit margin is added to the cost of goods sold. This approach ensures that financing rates, particularly for home loans in 2024, remain competitive while adhering to Islamic principles. For instance, profit rates are often benchmarked against market conditions, reflecting Alinma's commitment to fair and ethical financial practices.

The bank's pricing also reflects the value derived from its digital offerings, emphasizing convenience and speed. This value-based approach aims to foster customer loyalty and potentially justify premium pricing for innovative digital solutions. With over 80% of banking transactions in Saudi Arabia conducted digitally by mid-2024, Alinma's focus on seamless online experiences is a key differentiator.

Alinma Bank's pricing is also influenced by the broader economic landscape and regulatory environment. The Saudi Central Bank's benchmark repo rate, maintained at 5.00% in late 2024, directly impacts the bank's cost of funds and necessitates competitive yet sustainable pricing across its product portfolio. This strategic pricing ensures Alinma can effectively navigate the dynamic Saudi financial market.

| Key Pricing Influences | 2024/2025 Data Point | Impact on Alinma Bank |

| Sharia Compliance | No interest charged; profit earned via Murabaha, Ijarah, etc. | Defines product structure and profit margins. |

| Market Competitiveness | Home financing profit rates benchmarked against market conditions. | Aims for customer acquisition and market share. |

| Digital Service Value | Enhanced speed and convenience in digital transactions. | Supports value-based pricing for digital-only solutions. |

| Monetary Policy | SAMA Repo Rate at 5.00% (late 2024). | Influences cost of funds and loan pricing. |

| Economic Growth | Saudi GDP growth projected ~3.0% (2024-2025). | Affects consumer spending power and loan demand. |

4P's Marketing Mix Analysis Data Sources

Our Alinma Bank 4P's Marketing Mix Analysis is constructed using a blend of Alinma Bank's official disclosures, including annual reports and investor presentations, alongside insights from reputable financial news outlets and banking industry reports. This approach ensures a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.