Alinma Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

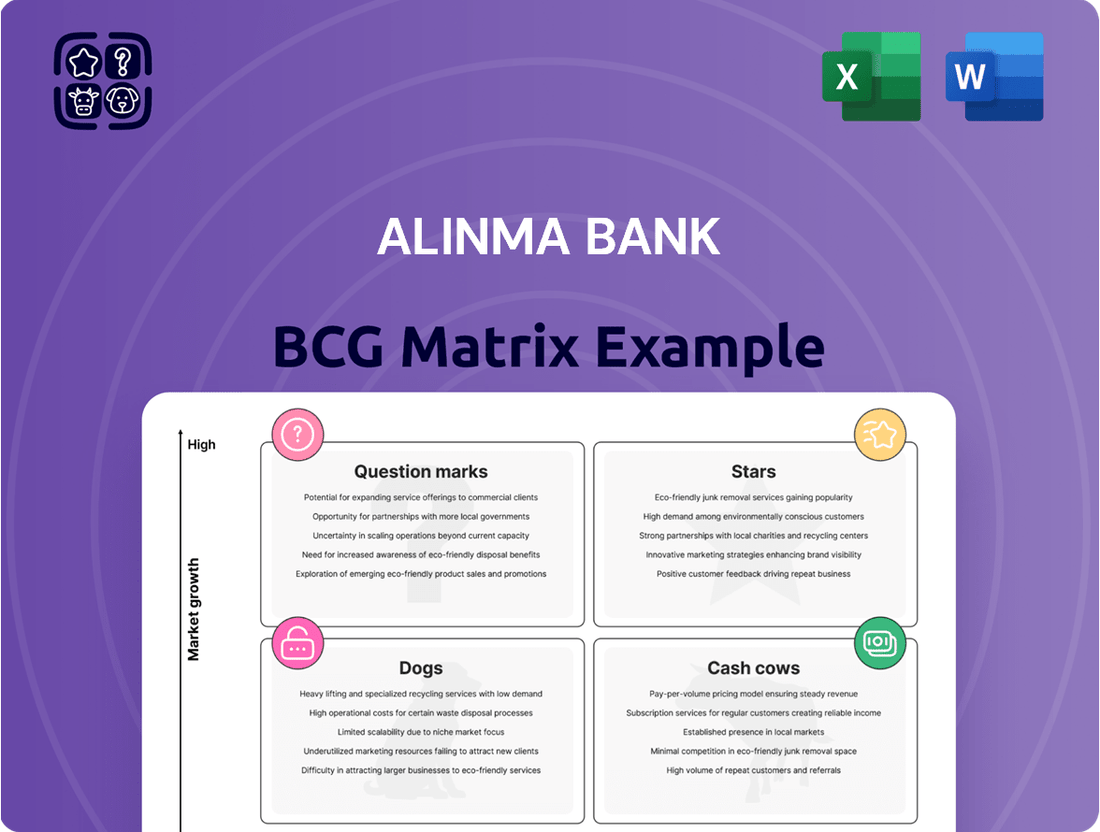

Curious about Alinma Bank's strategic product positioning? Our BCG Matrix preview offers a glimpse into how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete Alinma Bank BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions.

Don't miss out on the detailed insights and actionable strategies contained within the full report. Invest in the complete Alinma Bank BCG Matrix today and steer your financial future with confidence.

Stars

Alinma Bank is making significant strides in corporate and project financing, aligning with Saudi Arabia's Vision 2030. This focus includes robust support for Small and Medium-sized Enterprises (SMEs), a key driver of economic diversification. The bank's aggressive growth strategy in this sector reflects a substantial market share in a rapidly expanding segment of the Saudi economy.

Alinma Bank has seen a notable rise in its market share for crucial retail financing products, including mortgages and personal loans. This expansion is fueled by a growing demand within Saudi Arabia's dynamic consumer landscape for financial solutions that adhere to Sharia principles.

The bank's strategic emphasis on understanding and meeting customer needs, coupled with its broad array of financial offerings, solidifies its leading position in this rapidly expanding retail financing sector. For instance, in 2024, Alinma Bank reported a significant increase in its retail loan portfolio, reflecting this market trend.

Alinma Bank's digital banking services and platforms position it as a strong contender in the market. The bank’s strategic investments in digital transformation, including collaborations with tech leaders like IBM, Dell, and Huawei, underscore its commitment to innovation. These efforts are designed to attract and retain a digitally inclined customer base, thereby bolstering its market share in the competitive digital banking sector.

Investment and Treasury Services

Alinma Bank's Investment and Treasury Services division is a significant contributor to its overall performance, reflecting the bank's strategic focus on this high-growth area. The bank has seen a substantial rise in net income derived from its financing and investment activities, a trend directly linked to an increase in the volume of investments managed.

This growth is further bolstered by the expanding Saudi Arabian market for Islamic finance and associated investment opportunities. Alinma Bank's robust market share within this dynamic sector underscores its strong competitive standing and its ability to capitalize on prevailing market trends.

- Net Income Growth: Alinma Bank's net income from financing and investments showed a notable increase, indicating strong performance in this segment.

- Investment Volume: The expansion in investment volumes directly correlates with the rise in net income, highlighting successful asset management and client engagement.

- Market Expansion: The Saudi Arabian market for Islamic finance and investment activities is experiencing significant expansion, creating favorable conditions for growth.

- Market Share: Alinma Bank maintains a strong market share in this expanding sector, demonstrating its competitive advantage and established presence.

Overall Sharia-Compliant Banking

Alinma Bank's overall Sharia-compliant banking operations are positioned as a Star within the BCG Matrix. This classification is driven by Saudi Arabia's significant influence in the global Islamic finance sector, a market experiencing robust expansion.

The bank's financial performance in 2024 further solidifies this Star status. Alinma Bank reported substantial growth across key metrics, demonstrating its strong competitive advantage in a high-growth segment. For instance, its total assets saw a notable increase, reflecting expanded market share and customer trust.

- Strong Market Position: Alinma Bank holds a leading position in the Saudi Arabian banking sector, particularly in Sharia-compliant offerings.

- High Market Growth: The Islamic finance industry, both in Saudi Arabia and globally, continues to exhibit strong growth potential.

- Robust Financial Performance: The bank has demonstrated consistent financial strength, with significant increases in net profits and financing portfolios in 2024.

- Comprehensive Sharia Offerings: Alinma Bank provides a full suite of Sharia-compliant products and services, catering to a broad customer base.

Alinma Bank's Sharia-compliant operations are firmly positioned as Stars in the BCG Matrix, reflecting their high market share in a rapidly expanding sector. The bank's commitment to digital transformation and its strong presence in corporate and retail financing further solidify this status. In 2024, Alinma Bank's total assets grew significantly, underscoring its robust performance and expanding reach within the Saudi financial landscape.

| Business Unit | Market Share | Market Growth | BCG Category | 2024 Performance Highlight |

|---|---|---|---|---|

| Sharia-Compliant Banking | High | High | Star | Significant growth in total assets and net income from financing. |

| Corporate & Project Financing | Growing | High | Question Mark/Star | Strong support for SMEs, aligning with Vision 2030 diversification goals. |

| Retail Financing (Mortgages, Personal Loans) | Increasing | Moderate to High | Cash Cow/Star | Notable rise in loan portfolio driven by consumer demand for Sharia-compliant products. |

| Digital Banking | Expanding | High | Question Mark/Star | Strategic investments in technology to attract digitally-inclined customers. |

| Investment & Treasury Services | Strong | High | Star | Substantial rise in net income from investments, boosted by expanding Islamic finance market. |

What is included in the product

Alinma Bank's BCG Matrix analysis identifies which business units to invest in, hold, or divest based on market growth and share.

Alinma Bank's BCG Matrix offers a clear, actionable overview of its business units, relieving the pain of strategic uncertainty.

Cash Cows

Established Basic Deposit Products, like Alinma Bank's savings and current accounts, are the bedrock of its funding, reflecting a stable and mature market position. These offerings are characterized by their widespread adoption and a dedicated customer following, ensuring a steady and inexpensive source of funds for the bank.

While these products are not anticipated to drive significant growth, they reliably provide the necessary cash flow to sustain Alinma Bank's broader operations and fund future strategic initiatives. For instance, as of Q1 2024, Alinma Bank reported a substantial growth in its customer deposits, underscoring the continued strength of its core deposit products.

Alinma Bank's long-term corporate client relationships are a prime example of a Cash Cow within the BCG Matrix. These established partnerships provide stable, recurring revenue streams from financing and cash management services, demonstrating consistent profitability.

These mature relationships typically involve high transaction volumes and require minimal incremental investment to maintain, allowing Alinma Bank to leverage existing infrastructure and expertise. For instance, in 2023, Alinma Bank reported a net profit of SAR 3.2 billion, with a significant portion attributed to its corporate banking segment.

Alinma Bank's mature wealth management services cater to an established, affluent client base, acting as a significant cash cow. These services are expected to generate consistent fee-based income and management profits, a hallmark of mature, high-margin offerings. The bank's focus on this segment ensures predictable cash flows, even as the broader wealth management market evolves.

Standardized Payment Processing Services

Standardized Payment Processing Services at Alinma Bank represent a classic Cash Cow. These are the bedrock services, handling everything from salary disbursements to utility bill payments and interbank transfers. They are high-volume, mature offerings that have secured a significant market share.

These services are vital for any major bank, generating consistent, transaction-based revenue. In 2024, Alinma Bank, like its peers, likely saw continued robust activity in these areas, driven by the ongoing digital transformation and increased reliance on electronic payments. Such services typically require minimal incremental investment to maintain their strong market position, allowing them to generate substantial and stable cash flow for the bank.

- Core Payment Services: Essential for daily banking operations, including salary processing, bill payments, and interbank transfers.

- Market Dominance: These mature offerings typically hold a large market share due to their widespread adoption and necessity.

- Consistent Revenue: Generate predictable income through transaction fees, providing a stable cash flow.

- Low Investment Needs: Require minimal new capital expenditure to maintain their established position and profitability.

Conventional Trade Finance Solutions

Conventional trade finance solutions, such as Letters of Credit and Guarantees, represent a stable income stream for Alinma Bank. These services are fundamental for businesses involved in routine import and export operations, providing predictable fee-based revenue from consistent transaction volumes. In 2024, trade finance remained a cornerstone of the Saudi banking sector, with Alinma Bank leveraging its established presence to facilitate cross-border commerce.

- Predictable Fee Income: These services generate consistent revenue through established fee structures.

- Mature Offerings: Alinma Bank's trade finance products are well-developed and widely utilized.

- Support for Trade Flows: They are essential for businesses engaged in regular international trade.

- Contribution to Profitability: These mature services reliably contribute to the bank's overall financial performance.

Alinma Bank's established savings and current accounts are prime examples of Cash Cows. These offerings boast widespread adoption and a loyal customer base, ensuring a steady, low-cost funding source. While not growth drivers, they reliably generate cash flow to support operations and strategic investments.

Long-term corporate client relationships also function as Cash Cows, providing stable, recurring revenue from financing and cash management. These mature partnerships require minimal new investment, allowing Alinma Bank to leverage existing infrastructure and expertise for consistent profitability. In 2023, Alinma Bank's net profit was SAR 3.2 billion, with corporate banking a significant contributor.

Mature wealth management services, catering to an affluent clientele, are another key Cash Cow for Alinma Bank. These services are designed to generate consistent fee-based income and management profits, offering predictable cash flows. Standardized payment processing services, like salary disbursements and bill payments, are high-volume, mature offerings that secure significant market share and generate consistent, transaction-based revenue with low incremental investment needs.

| Product/Service | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Basic Deposit Products (Savings/Current Accounts) | Cash Cow | Stable funding, low cost, widespread adoption | Deposit growth in Q1 2024 |

| Long-Term Corporate Relationships | Cash Cow | Recurring revenue, minimal investment, high profitability | SAR 3.2 billion net profit in 2023 (significant corporate segment contribution) |

| Mature Wealth Management | Cash Cow | Consistent fee income, predictable profits, established client base | Focus on segment ensures predictable cash flows |

| Standardized Payment Processing | Cash Cow | High volume, market share, transaction-based revenue | Continued robust activity in 2024 driven by digital transformation |

What You See Is What You Get

Alinma Bank BCG Matrix

The Alinma Bank BCG Matrix preview you are viewing is the exact, unedited document you will receive upon purchase. This comprehensive analysis, designed for strategic insight, will be delivered to you in its complete, ready-to-use format, enabling immediate application to your business planning.

Dogs

Services still heavily reliant on in-branch, manual processes, like certain legacy loan applications or complex account management that haven't been digitized, can be categorized as dogs for Alinma Bank. These offerings are becoming increasingly irrelevant as customer behavior overwhelmingly favors digital interactions.

In 2024, the trend of customers preferring digital banking channels continued to accelerate. For instance, reports indicated that over 80% of routine banking transactions were conducted digitally, highlighting a significant decline in branch footfall for such services. This means outdated branch-centric services are likely consuming resources with minimal customer engagement and low revenue generation potential.

Niche, non-strategic legacy products represent older financial offerings that haven't kept pace with current market demands or technological advancements. These products often cater to very specific, limited customer segments and show minimal engagement, contributing little to Alinma Bank's expansion. For instance, a legacy savings account with outdated interest rate structures and no digital integration might exemplify this category.

These products can become a drain on resources, requiring maintenance without generating significant returns, effectively acting as cash traps. In 2024, Alinma Bank, like many financial institutions, would be evaluating such products to streamline operations and reallocate capital towards more growth-oriented initiatives. The low customer uptake is a key indicator, potentially showing a decline in adoption rates over recent years as newer, more competitive products emerge.

Underperforming niche lending segments within Alinma Bank's portfolio, if any exist, would be classified as dogs. These are areas where the bank has not achieved substantial market penetration or faces declining demand. Such segments typically require significant resource allocation without yielding commensurate returns or future growth prospects.

Services with High Manual Operational Costs

Banking operations heavily reliant on manual processes, such as traditional check processing or in-branch customer service for routine transactions, often fall into the 'dog' category of the BCG matrix. These services, while still functional, incur significant operational expenses due to the labor required, which can be as high as 40% of a bank's operating costs for certain manual functions.

The lack of automation in these areas directly translates to higher costs per transaction and slower service delivery compared to digitally enabled alternatives. For instance, manually processing a loan application can cost considerably more than an automated online submission and approval process.

Alinma Bank, like many financial institutions, faces the challenge of modernizing these high-cost manual operations to improve efficiency and competitiveness. Key areas include:

- Manual Account Opening Procedures: Requiring extensive paperwork and physical verification.

- Traditional Loan Application Processing: Involving significant manual data entry and review.

- In-Branch Cash Handling and Transaction Processing: Leading to higher staffing and security costs.

- Paper-Based Statement Generation and Mailing: An outdated and costly method of customer communication.

Undifferentiated Basic Advisory Services

Undifferentiated basic advisory services at Alinma Bank, much like generic offerings across the financial industry, face significant headwinds. These services, often characterized by a lack of advanced analytics or personalized client insights, struggle to stand out. In 2024, the demand for bespoke financial planning and wealth management solutions has intensified, leaving basic advisory models vulnerable.

Without a clear unique selling proposition, these services are likely to exhibit low market share and struggle with client acquisition and retention. For instance, a significant portion of wealth management clients in the Middle East, according to a 2023 Deloitte report, are seeking hyper-personalized advice, a trend that will only grow. This lack of specialization positions these offerings as potential 'dogs' within Alinma Bank's strategic portfolio, requiring careful consideration for either revitalization or divestment.

- Low Market Share: Basic advisory services may capture a small percentage of the overall market due to intense competition from specialized fintechs and wealth management firms.

- Struggling Client Acquisition: Without differentiation, attracting new clients becomes challenging as customers seek value-added services beyond generic financial guidance.

- Limited Revenue Potential: The commoditized nature of basic advice often leads to lower fee structures and reduced profitability for the bank.

- Risk of Obsolescence: As technology and client expectations evolve, undifferentiated services risk becoming outdated and irrelevant in the rapidly changing financial landscape.

Legacy products with low customer engagement and minimal revenue generation, such as outdated savings accounts with uncompetitive interest rates, are considered dogs for Alinma Bank. These offerings are often resource-intensive to maintain without contributing significantly to growth, especially as digital alternatives become the norm.

In 2024, the banking sector saw a continued shift towards digital channels, with over 80% of routine transactions occurring online. This trend exacerbates the challenge for Alinma Bank's 'dog' products, as they likely represent services with declining in-branch usage and minimal digital adoption, leading to inefficient resource allocation.

Manual banking operations, like traditional check processing, represent another category of dogs due to their high operational costs, estimated to be up to 40% of operating expenses for certain manual functions. These processes are inherently slower and more expensive than automated alternatives, making them a drag on profitability.

Alinma Bank's basic advisory services, lacking personalization and advanced analytics, also fall into the dog quadrant. With a growing demand for bespoke financial planning, these undifferentiated offerings struggle to attract and retain clients, facing low market share and limited revenue potential.

| Product/Service Category | BCG Matrix Quadrant | Key Characteristics | 2024 Market Trend Impact |

|---|---|---|---|

| Legacy Loan Applications (Manual) | Dogs | High manual processing, low digital uptake, increasing irrelevance | Accelerated digital preference by customers |

| Niche Legacy Savings Accounts | Dogs | Outdated features, limited customer segments, low engagement | Shift towards competitive digital banking products |

| Manual Check Processing | Dogs | High operational costs, slow service delivery, labor-intensive | Increased focus on automation and efficiency |

| Basic Undifferentiated Advisory | Dogs | Low market share, weak client acquisition, limited revenue | Demand for hyper-personalized financial solutions |

Question Marks

Alinma Bank's introduction of digital-only offerings like IZ Youth, IZ Business, and Nomo strategically places them in a "Question Mark" category within the BCG matrix. These ventures aim to secure a foothold in rapidly expanding digital markets, reflecting a proactive approach to future growth.

While these new propositions are engineered to attract customers in burgeoning digital sectors, they are currently in their nascent stages of adoption. This early phase necessitates substantial financial commitment for robust brand building and customer acquisition efforts.

The Freelance Card, introduced in April 2025 through a collaboration with the Social Development Bank, is a recent offering designed for the burgeoning freelance sector. This segment is experiencing significant growth, with the global freelance market projected to reach $455 billion by the end of 2024, according to Statista.

Given its newness, Alinma Bank's penetration within this specific market is likely minimal, positioning the Freelance Card as a Question Mark within the BCG matrix. This classification indicates a high-growth potential market where the bank's current market share is low, requiring substantial investment to capture a significant portion of this expanding economy.

Alinma Bank's significant investments in advanced AI and machine learning are geared towards revolutionizing customer experience and boosting operational efficiency. These initiatives are crucial for staying competitive in a rapidly evolving digital landscape.

While these technologies are in a high-growth domain, their immediate market share in terms of direct revenue generation is still maturing. This means ongoing substantial investment is necessary to realize their full potential, placing them in a position that requires careful nurturing.

Emerging Fintech Partnerships and Ecosystem Integration

Alinma Bank's strategic embrace of fintech partnerships and ecosystem integration positions these ventures squarely within the Question Mark quadrant of the BCG Matrix. This approach focuses on cultivating innovative, high-growth financial service areas through active collaboration with emerging fintech players. These new ventures, while promising, are typically in their nascent stages of market adoption, necessitating substantial investment to achieve significant scale and market penetration.

These collaborations are designed to enhance Alinma Bank's existing offerings and explore new revenue streams by leveraging the agility and specialized technology of fintechs. For instance, in 2024, the Saudi fintech sector saw substantial growth, with the number of licensed entities increasing significantly, reflecting a fertile ground for such strategic alliances. The bank’s investment in these early-stage partnerships aims to capture future market share in rapidly evolving digital financial landscapes.

- Targeting High-Growth Fintech Niches: Alinma Bank is actively seeking partnerships in areas like embedded finance, digital payments, and personalized wealth management solutions, which are projected for significant expansion.

- Early Stage Market Penetration: Joint offerings from these partnerships are likely in early development or pilot phases, requiring further investment to gain traction and customer adoption.

- Significant Investment Required: To scale these innovative ventures and realize their full potential, Alinma Bank anticipates substantial capital allocation for technology development, marketing, and operational expansion.

- Saudi Fintech Growth Context: In 2024, the Saudi Central Bank (SAMA) continued to foster fintech innovation, with over 60 fintech companies licensed and operating within the Kingdom, underscoring the strategic importance of these ecosystem integrations.

'Beyond Banking' Services Exploration

Alinma Bank's strategic digital roadmap is actively exploring 'beyond banking' services, which represent innovative, non-traditional financial solutions designed to capture new revenue streams and enhance customer engagement. These initiatives, though in their nascent stages, are strategically targeting high-growth areas outside conventional banking operations, aiming to diversify the bank's offerings and build a more resilient business model.

These 'beyond banking' ventures are categorized as Stars or Question Marks within the BCG matrix due to their high growth potential but also their significant investment requirements and unproven market viability. For instance, Alinma Bank's investment in digital wealth management platforms or embedded finance solutions falls into this category. The bank recognizes that substantial capital is needed to establish a strong market presence and demonstrate the long-term sustainability of these innovative services.

- Digital Wealth Management Platforms: Targeting a growing demand for accessible investment tools, these platforms aim to democratize wealth creation.

- Embedded Finance Solutions: Integrating financial services directly into non-financial platforms, such as e-commerce or ride-sharing apps, to offer seamless payment and lending options.

- Open Banking Initiatives: Leveraging APIs to enable third-party developers to build applications and services around Alinma Bank's financial data, fostering innovation and new customer experiences.

- Fintech Partnerships: Collaborating with agile fintech companies to rapidly deploy new digital products and services, accelerating market entry and reducing development risk.

Alinma Bank's ventures like IZ Youth, IZ Business, and Nomo, alongside the Freelance Card and fintech partnerships, are positioned as Question Marks. These initiatives are in high-growth markets but require substantial investment due to their early stage and low current market share.

The bank's focus on AI, machine learning, and 'beyond banking' services also falls into this category, demanding ongoing capital to realize their full potential and capture future market share in evolving digital financial landscapes.

The Saudi fintech sector's growth in 2024, with over 60 licensed entities, highlights the strategic importance and potential of these ecosystem integrations and early-stage partnerships.

These investments are crucial for Alinma Bank to build brand presence, acquire customers, and secure a competitive edge in rapidly expanding digital and innovative financial service areas.

| Alinma Bank Ventures (Question Marks) | Market Characteristic | Investment Need | Current Market Share | Growth Potential |

|---|---|---|---|---|

| IZ Youth, IZ Business, Nomo | Digital-only offerings | High (Brand building, customer acquisition) | Low/Nascent | High |

| Freelance Card | Freelance sector | Substantial (Market penetration) | Minimal | High (Global market projected $455 billion in 2024) |

| AI/Machine Learning Initiatives | Digital customer experience, operational efficiency | Ongoing substantial investment | Maturing | High |

| Fintech Partnerships | Embedded finance, digital payments, wealth management | Significant (Technology development, marketing) | Early stage adoption | High (Saudi fintech sector growing rapidly in 2024) |

| 'Beyond Banking' Services | Digital wealth management, embedded finance | Substantial (Market presence, sustainability) | Nascent | High |

BCG Matrix Data Sources

Our Alinma Bank BCG Matrix is constructed using Alinma's official financial statements, market share data, and industry growth forecasts to provide a comprehensive view.