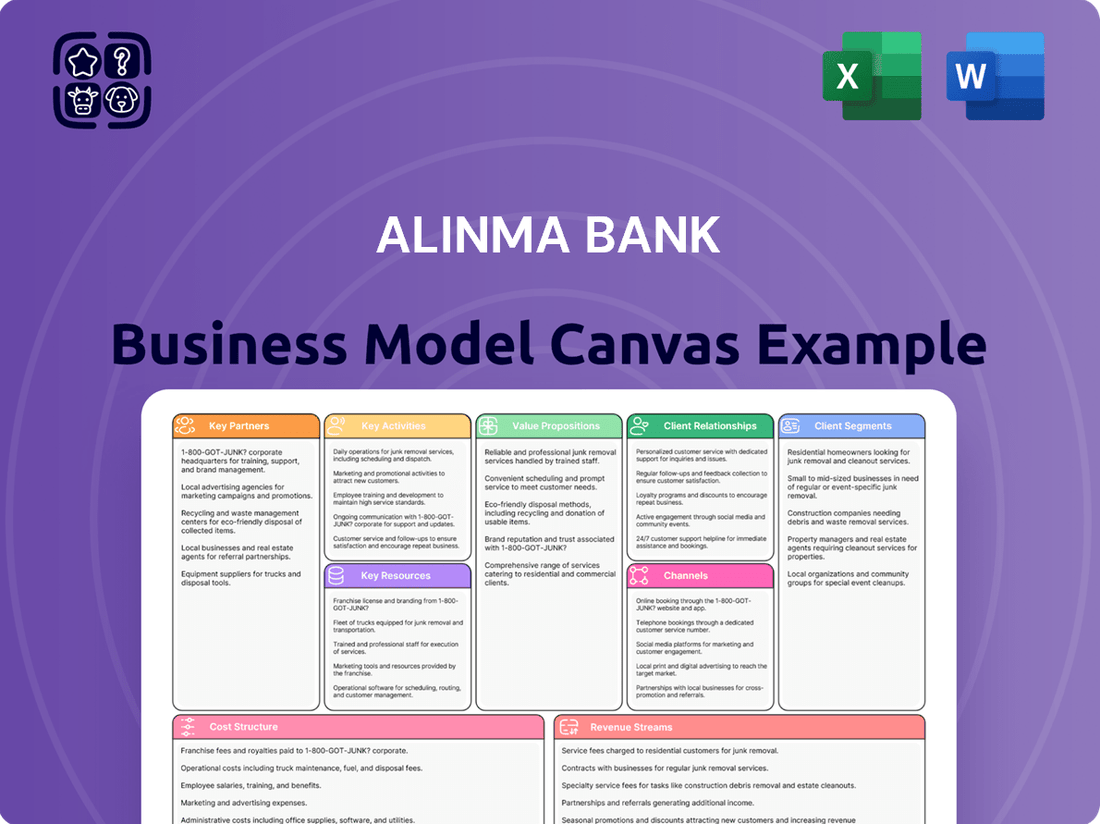

Alinma Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alinma Bank Bundle

Unlock the strategic blueprint of Alinma Bank's success with our comprehensive Business Model Canvas. Discover how they connect with customers, deliver value, and generate revenue in the competitive financial sector. Download the full, detailed canvas to gain actionable insights for your own business strategy.

Partnerships

Alinma Bank strategically partners with key technology providers like IBM and Dell Technologies. These collaborations are vital for bolstering the bank's digital infrastructure and rolling out cutting-edge banking solutions. For example, IBM's expertise in hybrid cloud, AI integration, and API management directly supports Alinma's digital advancement goals.

Alinma Bank actively collaborates with government and semi-government bodies to align with national development agendas. This strategic partnership is crucial for fostering economic growth and supporting key sectors.

A prime example is the bank's cooperation with the Cultural Development Fund, offering tailored financial products to nurture cultural businesses. Furthermore, Alinma Bank launched the Freelance Card in partnership with the Social Development Bank, demonstrating a commitment to supporting emerging economic segments.

Alinma Bank is strategically partnering with FinTech companies to drive innovation and enhance its digital services. This collaboration allows FinTechs to leverage Alinma's API platform, facilitating easy integration with the bank's digital services and opening up new avenues for revenue generation.

By embracing these partnerships, Alinma Bank aims to solidify its position as a frontrunner in FinTech innovation within Saudi Arabia. This approach is particularly relevant as the Saudi Arabian FinTech market is experiencing significant growth, with projections indicating continued expansion in the coming years, driven by digital transformation initiatives.

Educational and Training Institutions

Alinma Bank actively partners with educational and training institutions, such as The Financial Academy (TFA), to foster sustainability awareness and create specialized training programs. These collaborations are crucial for developing a skilled workforce within the financial sector, directly supporting Saudi Arabia’s Vision 2030 objectives for a more sustainable economy.

These strategic alliances enhance human capital development by equipping professionals with the knowledge and skills needed to navigate the evolving landscape of sustainable finance. For instance, TFA’s programs aim to build capacity in areas like green finance and ESG (Environmental, Social, and Governance) investing, which are increasingly vital for financial institutions.

- Human Capital Development: Partnerships with institutions like TFA directly contribute to building a talent pool proficient in sustainable financial practices.

- Sustainability Awareness: Collaborations help disseminate knowledge and promote the adoption of sustainable principles across the financial industry.

- Alignment with National Vision: These efforts support Saudi Arabia’s broader goals for economic diversification and environmental stewardship as outlined in Vision 2030.

Corporate Clients and Businesses

Alinma Bank cultivates key partnerships with a diverse range of corporate clients and businesses, offering Sharia-compliant financing solutions tailored to their strategic objectives and expansion plans. These collaborations are vital for fostering economic growth and supporting large-scale projects within the Kingdom.

The bank actively engages in financing agreements with major corporations, a testament to its commitment to driving national development. For instance, Alinma Bank has provided significant financing to entities such as Bahri, a global leader in logistics and transportation, and ACWA Power, a prominent developer of water and energy projects. These partnerships underscore the bank's substantial role in the Kingdom's economic diversification and infrastructure development initiatives.

- Sharia-Compliant Financing: Alinma Bank provides financing structures that adhere to Islamic principles, catering to businesses seeking ethical investment and operational frameworks.

- Strategic Project Support: The bank offers credit facilities and funding for significant corporate projects, contributing to key sectors like logistics, energy, and infrastructure.

- Economic Development Contribution: Partnerships with major entities like Bahri and ACWA Power highlight Alinma Bank's direct impact on Saudi Arabia's Vision 2030 objectives and economic diversification efforts.

- Relationship Building: Alinma Bank focuses on building long-term, mutually beneficial relationships with its corporate clientele, acting as a financial partner in their growth journey.

Alinma Bank's key partnerships are diverse, spanning technology providers like IBM for digital infrastructure, government bodies for national development alignment, and FinTech companies to drive innovation. These collaborations are crucial for enhancing digital services and supporting emerging economic segments, as seen with the Freelance Card initiative in partnership with the Social Development Bank.

The bank also strengthens human capital through partnerships with educational institutions like The Financial Academy (TFA), focusing on sustainable finance and aligning with Saudi Arabia’s Vision 2030. Furthermore, Alinma Bank partners with major corporations such as Bahri and ACWA Power, providing Sharia-compliant financing for strategic projects and contributing significantly to economic diversification.

| Partner Type | Example Partner(s) | Strategic Focus | Impact |

|---|---|---|---|

| Technology Providers | IBM, Dell Technologies | Digital infrastructure, AI, Cloud | Enhanced digital banking solutions |

| Government/Semi-Government | Cultural Development Fund, Social Development Bank | National development, supporting sectors | Tailored financial products, support for emerging segments |

| FinTech Companies | Various | Innovation, API integration | Expanded digital service offerings, revenue generation |

| Educational Institutions | The Financial Academy (TFA) | Human capital development, sustainability awareness | Skilled workforce in sustainable finance, alignment with Vision 2030 |

| Corporate Clients | Bahri, ACWA Power | Sharia-compliant financing, large-scale projects | Economic growth, infrastructure development |

What is included in the product

A detailed Alinma Bank Business Model Canvas outlining its customer segments, value propositions, and key partnerships, providing a strategic blueprint for its Sharia-compliant banking services.

Alinma Bank's Business Model Canvas offers a structured approach to address the pain points of complex financial operations by providing a clear, one-page snapshot of key activities and customer segments.

This visual tool helps Alinma Bank streamline its service delivery and resource allocation, effectively relieving the pain of inefficient processes and unclear strategic alignment.

Activities

Alinma Bank's primary function is providing a full spectrum of banking services, all meticulously designed to comply with Sharia law. This encompasses everything from everyday personal banking needs to complex corporate finance and investment solutions, ensuring every transaction and product meets Islamic ethical standards.

In 2024, Alinma Bank continued to solidify its position as a leading Sharia-compliant financial institution. The bank reported significant growth in its customer deposit base, reaching SAR 145 billion by the end of Q3 2024, a testament to the trust and demand for its ethical banking practices.

Key activities include offering Sharia-compliant financing, such as Murabaha and Ijarah, to both individuals and businesses. The bank also focuses on ethical investment funds and treasury services, ensuring all financial activities align with Islamic principles of fairness and social responsibility.

Alinma Bank's core activities heavily revolve around driving digital transformation and fostering innovation. This includes the strategic adoption of cutting-edge technologies such as artificial intelligence, hybrid cloud infrastructure, and robust API platforms. These advancements are crucial for elevating the customer banking experience, optimizing internal operational efficiency, and pioneering novel digital banking products and services.

The bank's dedicated 'digital factory' serves as the central hub for these innovation initiatives. This specialized unit is tasked with accelerating the development and deployment of new digital solutions, ensuring Alinma Bank remains at the forefront of technological advancements in the financial sector.

In 2024, Alinma Bank continued to emphasize digital channels, reporting a significant increase in digital transactions. For instance, a substantial portion of customer service inquiries were handled through AI-powered chatbots, reducing wait times and improving customer satisfaction. The bank also launched several new digital features, including enhanced personalized financial management tools, which saw strong adoption rates among its user base.

Alinma Bank's financing activities are a cornerstone of its business model, focusing on providing a diverse range of credit facilities to both individuals and corporations. This includes significant engagement in Murabaha financing, a popular Sharia-compliant sales contract, and the provision of term loan facilities tailored to various business needs.

The bank demonstrates a robust commitment to growing its financing portfolio, a key driver of its revenue. As of the first quarter of 2024, Alinma Bank's total financing portfolio stood at SAR 137.6 billion, reflecting substantial growth and a strong market presence in the Saudi Arabian banking sector.

Beyond direct financing, Alinma Bank actively participates in investment activities, seeking to generate returns through strategic placements and management of assets. This dual approach of providing credit and engaging in investments allows the bank to cater to a broader spectrum of financial needs and opportunities within the economy.

Customer Relationship Management

Alinma Bank prioritizes building and maintaining robust customer relationships, a cornerstone of its business. This involves delivering highly personalized banking services designed to meet individual client needs and foster long-term loyalty. The bank actively works to enhance the customer experience across all interaction points, from digital platforms to branch visits.

Understanding and anticipating evolving customer needs is central to Alinma Bank's strategy. For instance, in 2024, the bank continued to invest in digital transformation initiatives aimed at providing seamless and convenient banking solutions. This focus on customer-centricity is reflected in their ongoing efforts to gather feedback and adapt their offerings, ensuring they remain relevant in a dynamic financial landscape.

- Digital Onboarding Enhancements: Streamlining the account opening process through digital channels to improve initial customer experience.

- Personalized Product Offerings: Utilizing data analytics to present tailored financial products and services based on customer profiles and transaction history.

- Proactive Customer Support: Implementing advanced customer service technologies, including AI-powered chatbots and dedicated relationship managers, to address inquiries efficiently.

- Loyalty Programs and Rewards: Developing and refining incentive programs to recognize and reward long-term customer engagement and value.

Risk Management and Compliance

Alinma Bank actively engages in robust risk management and strict adherence to regulatory and Sharia compliance as core activities. This ensures the bank's operational integrity, financial stability, and preserves its standing as a dependable Islamic financial institution.

These key activities are critical for safeguarding the bank's assets and reputation. For instance, in 2023, Saudi banks, including Alinma, operated within a framework where the Saudi Central Bank (SAMA) maintained a firm stance on compliance and risk mitigation, a trend expected to continue through 2024.

- Risk Identification and Assessment: Continuously identifying and evaluating potential risks across all banking operations, including credit, market, operational, and liquidity risks.

- Compliance Monitoring: Ensuring all activities and products strictly adhere to Saudi Arabian banking regulations and Sharia principles, with regular internal and external audits.

- Capital Adequacy: Maintaining sufficient capital reserves to absorb potential losses and meet regulatory requirements, a key indicator of financial health. For example, Saudi banks generally maintain strong Capital Adequacy Ratios (CAR) well above the Basel III minimums, reflecting prudent risk management.

- Fraud Prevention and Control: Implementing advanced systems and procedures to prevent and detect fraudulent activities, protecting both the bank and its customers.

Alinma Bank's key activities center on providing Sharia-compliant financial solutions, driving digital innovation, and fostering strong customer relationships. These efforts are supported by rigorous risk management and regulatory adherence.

Full Document Unlocks After Purchase

Business Model Canvas

The Alinma Bank Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a mockup; it's a direct representation of the comprehensive analysis and strategic framework you'll gain access to. Upon completing your order, you'll download this same, fully detailed Business Model Canvas, ready for your immediate use and application.

Resources

Alinma Bank's Sharia Board is a cornerstone of its business model, providing essential expertise in Islamic jurisprudence. This board ensures that all banking products and services adhere strictly to Sharia principles, a critical differentiator in the market.

The accumulated intellectual capital of the Sharia Board is not just a compliance mechanism but a core asset that underpins Alinma Bank's identity and operational integrity. This expertise is vital for maintaining customer trust and expanding its reach within the Islamic finance sector.

Alinma Bank's financial capital, a robust asset base, and significant customer deposits are the bedrock of its business model, enabling crucial functions like extending financing and managing investments. As of the first quarter of 2024, Alinma Bank reported total assets of SAR 174.1 billion, highlighting its substantial financial strength.

This substantial financial foundation directly fuels Alinma Bank's ability to offer a wide array of financial products and services, from personal loans to corporate financing, thereby supporting its growth trajectory and market presence. The bank's commitment to attracting and retaining customer deposits, which form a core component of its funding, further solidifies its capacity to operate and expand.

Alinma Bank's technology infrastructure, featuring hybrid cloud solutions and advanced AI capabilities, is a core asset. This robust digital backbone, supported by extensive API platforms, underpins its ability to deliver seamless digital banking services and drive operational efficiency.

In 2024, Alinma Bank continued to invest heavily in these digital platforms to enhance customer experience. For instance, the bank reported a significant increase in digital transaction volumes, demonstrating the effectiveness of its technology investments in attracting and serving its customer base.

Human Capital and Skilled Workforce

Alinma Bank's success hinges on its human capital, a blend of banking expertise, IT proficiency, and Sharia compliance knowledge. This skilled workforce is the backbone for delivering top-tier financial services and fostering innovation. The bank actively recruits varied talent and invests in upskilling its teams, particularly in digital competencies.

By prioritizing employee development, Alinma Bank ensures it stays competitive in the rapidly evolving financial landscape. This focus on a skilled and adaptable workforce is crucial for maintaining service quality and driving future growth.

- Skilled Workforce: Banking professionals, IT specialists, and Sharia scholars form the core of Alinma Bank's human capital.

- Talent Acquisition: The bank emphasizes attracting diverse talent to enrich its employee base.

- Digital Capabilities: Significant investment is made in developing and enhancing digital skills within the workforce.

- Service Delivery & Innovation: A highly skilled team is fundamental to providing quality services and driving innovation.

Brand Reputation and Customer Trust

Alinma Bank's standing as a prominent and forward-thinking Sharia-compliant financial institution in Saudi Arabia is a cornerstone of its business model. This reputation, built over time, directly fuels customer acquisition and fosters loyalty among its substantial customer base.

The trust Alinma Bank has cultivated with its approximately 5.8 million customers is a critical intangible asset. This deep-seated confidence allows the bank to effectively attract new clients and retain existing ones, significantly reducing customer churn.

- Leading Sharia-Compliant Innovator: Alinma Bank is recognized for its commitment to Sharia principles and its adoption of innovative financial solutions.

- Customer Base Growth: The bank serves a significant customer base, numbering around 5.8 million individuals.

- Trust as a Key Driver: The strong trust Alinma Bank has earned directly supports its ability to attract and retain customers.

- Brand Equity: This positive brand image and customer trust represent invaluable intangible resources that enhance market position.

Alinma Bank's key resources are multifaceted, encompassing its Sharia Board's expertise, substantial financial capital, advanced technology infrastructure, a skilled human capital base, and a strong brand reputation built on trust. These elements collectively enable the bank to operate effectively, innovate, and maintain its competitive edge in the Islamic finance market.

| Resource Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Intellectual Capital | Sharia Board Expertise | Ensures Sharia compliance and product innovation. |

| Financial Capital | Total Assets, Customer Deposits | SAR 174.1 billion in total assets (Q1 2024); funding for operations and growth. |

| Technology Infrastructure | Hybrid Cloud, AI, APIs | Drives digital services, operational efficiency, and enhanced customer experience. |

| Human Capital | Skilled Workforce, Digital Competencies | Essential for service delivery, innovation, and adapting to market changes. |

| Brand & Reputation | Customer Trust, Market Position | Approximately 5.8 million customers; strong reputation as a Sharia-compliant innovator. |

Value Propositions

Alinma Bank provides a complete suite of banking and financial services, all strictly adhering to Sharia principles. This commitment ensures ethical financial solutions for individuals, businesses, and investors alike, setting it apart in the financial landscape.

In 2024, Alinma Bank reported significant growth in its Sharia-compliant offerings, with customer deposits for Islamic financing products increasing by 12% year-over-year. This demonstrates a strong market demand for their ethical financial solutions.

Alinma Bank's commitment to an innovative digital banking experience is central to its value proposition. Customers benefit from a sophisticated mobile app and online portal designed for ultimate convenience and speed. This digital-first approach aims to simplify transactions and enhance user satisfaction, setting a new standard in banking accessibility.

Alinma Bank's commitment to customer-centric service is a cornerstone of its business model, aiming to provide an exceptional and personalized experience. This focus is evident in their strategy and new identity, 'One Step Ahead,' which underscores their dedication to anticipating and fulfilling customer needs.

In 2024, Alinma Bank continued to invest in digital transformation to enhance service delivery. For instance, their mobile banking app saw a significant increase in active users, reflecting customer preference for convenient and accessible banking solutions.

Financial Growth and Stability

Alinma Bank champions financial growth and stability for its customers through secure and dependable financial services. This commitment is underpinned by the bank's consistently strong financial performance and diligent asset management practices, fostering a sense of assurance and confidence among its clientele.

In 2024, Alinma Bank demonstrated robust financial health. For instance, its net profit after tax reached SAR 3,488 million for the nine months ending September 30, 2024. This financial strength directly translates to the stability and growth opportunities it can offer its customers.

- Secure and Reliable Services: Alinma Bank provides a foundation of trust for customer financial endeavors.

- Customer Financial Growth: The bank actively facilitates and supports the expansion of customer wealth.

- Robust Financial Performance: Demonstrated through consistent profitability and sound financial management.

- Strong Asset Management: Ensuring the security and optimal performance of managed assets for client benefit.

Contribution to National Vision and Community Development

Alinma Bank actively supports Saudi Arabia's Vision 2030 by channeling financing into key sectors, fostering economic diversification. This commitment translates into tangible community development, with the bank playing a role in cultural initiatives and the growth of small and medium-sized enterprises (SMEs).

For example, in 2023, Alinma Bank's financing for SMEs reached SAR 22.4 billion, a significant increase that directly fuels job creation and local economic expansion. This strategic alignment demonstrates a value proposition that goes beyond traditional banking, contributing to the Kingdom's broader national aspirations.

- Alignment with Vision 2030: Directly supports national economic and social development goals.

- SME Empowerment: Provided SAR 22.4 billion in financing to SMEs in 2023, fostering growth and employment.

- Sectoral Support: Contributes to the development of various economic sectors, including culture.

- Community Impact: Extends value beyond financial services to enhance community well-being and progress.

Alinma Bank offers a comprehensive range of Sharia-compliant financial services, catering to individuals and businesses with an emphasis on ethical practices. This core value proposition is enhanced by a commitment to digital innovation, providing a seamless and convenient banking experience through advanced mobile and online platforms. Furthermore, the bank prioritizes customer growth and financial stability, backed by strong financial performance and diligent asset management.

| Value Proposition | Description | Key Data/Impact |

|---|---|---|

| Sharia-Compliant Banking | Full suite of ethical financial services for all customer segments. | Customer deposits for Islamic financing products increased by 12% in 2024. |

| Digital Innovation | User-friendly mobile app and online portal for enhanced convenience. | Significant increase in active users of the mobile banking app in 2024. |

| Customer Financial Growth & Stability | Secure services fostering wealth expansion and confidence. | Net profit after tax reached SAR 3,488 million for the nine months ending Sep 30, 2024. |

| Vision 2030 Alignment | Supporting national economic diversification and community development. | SAR 22.4 billion in SME financing in 2023, fostering job creation. |

Customer Relationships

Alinma Bank focuses on a personalized digital engagement strategy, utilizing its sophisticated mobile application and online portals to deliver customized services and assistance. This approach ensures that digital interactions are intuitive and cater to the distinct needs of various customer segments.

Alinma Bank assigns dedicated relationship managers to its corporate and high-net-worth clients. This approach ensures a highly personalized service, offering tailored financial advice and solutions to meet complex needs. For instance, in 2024, the bank continued to invest in training these managers to deepen their expertise in areas like wealth management and corporate finance, aiming to enhance client satisfaction and retention.

Alinma Bank provides a robust suite of self-service digital channels, allowing customers to manage accounts, conduct transactions, and access a wide array of banking services anytime, anywhere. This digital empowerment significantly boosts operational efficiency and customer independence.

In 2024, Alinma Bank reported a substantial increase in digital transaction volumes, with over 85% of customer interactions occurring through its mobile app and online banking platforms. This highlights the growing reliance and preference for self-service digital solutions.

Community Engagement and Social Responsibility Initiatives

Alinma Bank actively cultivates strong customer relationships by investing in community engagement and corporate social responsibility (CSR) initiatives. These programs are designed to foster goodwill and deepen the bank's connection with the broader society it serves.

In 2024, Alinma Bank continued its commitment to social impact. For instance, its support for educational programs aimed at financial literacy reached over 15,000 students across Saudi Arabia. This aligns with the bank's strategy to build trust and demonstrate value beyond transactional banking.

- Community Investment: Alinma Bank's CSR spending in 2024 focused on areas like education and environmental sustainability, reflecting a commitment to long-term societal benefit.

- Customer Loyalty: By participating in and sponsoring local events, the bank enhances its brand visibility and fosters a sense of belonging among its customers, contributing to increased loyalty.

- Social Impact Metrics: Key performance indicators for these initiatives include volunteer hours contributed by employees and the measurable impact of supported projects on community well-being.

Transparent Communication and Sharia Guidance

Alinma Bank prioritizes transparent communication regarding its Sharia-compliant operations, fostering trust with customers who value ethical financial practices. By clearly explaining Islamic financial principles, the bank strengthens its customer relationships.

To ensure this transparency, Alinma Bank makes resources readily available, such as its 'Sharia Provisions and Controls for Alinma Products and Services.' This commitment to clarity empowers customers to understand the ethical framework underpinning their banking experience.

- Sharia Compliance: Alinma Bank's dedication to transparently communicating its adherence to Sharia principles is a cornerstone of its customer relationship strategy.

- Customer Trust: Providing clear guidance on Islamic finance builds a strong foundation of trust, particularly with a segment of the market that actively seeks ethical banking solutions.

- Resource Availability: The publication of documents like 'Sharia Provisions and Controls for Alinma Products and Services' demonstrates a tangible commitment to educating and informing customers.

- Ethical Banking: For customers prioritizing ethical banking, this transparency is not just a feature but a critical factor in choosing and maintaining a relationship with Alinma Bank.

Alinma Bank cultivates deep customer relationships through a blend of personalized digital engagement and dedicated human interaction. Its sophisticated mobile app and online portals offer intuitive, customized services, while relationship managers provide tailored advice to corporate and high-net-worth clients. This dual approach, emphasizing both digital convenience and personal touch, is key to fostering loyalty and meeting diverse customer needs.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Digital Engagement | Mobile app & online portals for customized services | Over 85% of customer interactions via digital channels |

| Dedicated Relationship Management | Assigned managers for corporate & HNW clients | Investment in training for enhanced wealth management expertise |

| Community & Social Engagement | CSR initiatives in education and sustainability | Financial literacy programs reached over 15,000 students |

| Transparency in Sharia Compliance | Clear communication of Islamic finance principles | Availability of 'Sharia Provisions and Controls' document |

Channels

Alinma Bank's digital banking platforms, encompassing its mobile app and online banking portal, serve as the core channels for customer engagement and service delivery. These platforms are designed to offer a seamless and comprehensive banking experience, allowing customers to manage their finances efficiently.

Through these digital touchpoints, Alinma Bank provides an extensive range of services, from the initial account opening process to executing sophisticated financial transactions. This digital-first approach aims to enhance customer convenience and accessibility, making banking services available anytime, anywhere.

In 2024, Alinma Bank reported significant growth in its digital channel usage. For instance, over 90% of customer transactions were conducted through digital channels, with the mobile app handling a substantial majority of these. This indicates a strong customer preference for self-service banking, reinforcing the importance of these platforms to Alinma Bank's business model.

Alinma Bank operates a physical branch network throughout Saudi Arabia, serving customers who value in-person interactions for complex needs or personalized advice. This network complements their digital offerings, ensuring broad accessibility and a human element for a diverse customer base. As of early 2024, Alinma Bank had a significant presence with over 180 branches, demonstrating their commitment to physical touchpoints alongside their digital transformation.

Alinma Bank leverages an extensive network of ATMs and self-service kiosks to offer unparalleled convenience for essential banking tasks. This widespread accessibility ensures customers can perform cash withdrawals, deposits, and manage routine transactions efficiently, forming a cornerstone of basic service delivery.

In 2024, Alinma Bank's commitment to digital accessibility was evident, with a significant portion of its customer transactions occurring through these self-service channels. For instance, ATM transactions represented a substantial volume of daily customer interactions, underscoring their importance in the bank's operational strategy and customer reach.

Call Centers and Customer Service Hotlines

Alinma Bank utilizes dedicated call centers and customer service hotlines as crucial channels for direct customer engagement. These hotlines are instrumental in addressing inquiries, resolving issues, and providing essential support, ensuring a responsive customer experience.

In 2024, Alinma Bank likely handled millions of customer interactions through its call centers, reflecting the significant volume of service requests. The efficiency and accessibility of these channels are paramount for customer satisfaction and retention.

- Customer Support: Providing immediate assistance for banking inquiries and transactions.

- Issue Resolution: Addressing customer complaints and technical difficulties promptly.

- Information Dissemination: Communicating bank services, product updates, and security alerts.

- Accessibility: Offering a vital touchpoint for customers who prefer voice communication.

Partnership Ecosystems and APIs

Alinma Bank leverages its robust API platform to foster a dynamic partnership ecosystem, enabling seamless integration of its financial services with third-party FinTechs and businesses. This strategic approach opens up innovative channels for customer acquisition and service delivery, embedding Alinma's banking capabilities directly into the digital experiences customers already engage with.

By exposing its core banking functionalities through APIs, Alinma Bank allows partners to build tailored financial solutions. For instance, a retail company could integrate Alinma's payment gateway directly into its e-commerce checkout, offering customers a streamlined payment experience. This expands Alinma's reach beyond its traditional customer base, tapping into new markets and user segments.

- API Monetization: Alinma Bank can generate revenue by charging partners for access to its API services, creating a new income stream.

- Expanded Distribution: Partnerships through APIs allow Alinma Bank to reach customers through channels it might not otherwise access, such as embedded finance solutions in non-banking applications.

- Innovation Acceleration: Collaborating with FinTechs via APIs fosters rapid development of new financial products and services, keeping Alinma Bank at the forefront of digital banking innovation.

- Data-Driven Insights: API integrations can provide valuable data on customer behavior and market trends, enabling Alinma Bank to refine its offerings and strategies.

Alinma Bank's channels are a blend of digital and physical touchpoints, designed to cater to a wide range of customer preferences. The bank prioritizes its digital platforms, including its mobile app and online portal, as the primary means for customer interaction and service delivery, facilitating seamless financial management.

Complementing its digital offerings, Alinma Bank maintains a physical branch network across Saudi Arabia, with over 180 branches as of early 2024, to support customers requiring in-person assistance. Additionally, an extensive network of ATMs and self-service kiosks ensures widespread accessibility for everyday banking needs.

Direct customer engagement is further supported through dedicated call centers, which handle a significant volume of inquiries and provide essential support. The bank also strategically utilizes its API platform to integrate with FinTech partners, expanding its service reach and fostering innovation through embedded finance solutions.

| Channel Type | Primary Function | 2024 Data/Observation |

|---|---|---|

| Digital Platforms (Mobile App, Online Banking) | Core service delivery, account management, transactions | Over 90% of customer transactions conducted digitally; mobile app handles the majority. |

| Physical Branches | In-person service, complex needs, personalized advice | Over 180 branches across Saudi Arabia. |

| ATMs & Self-Service Kiosks | Convenience for essential tasks (withdrawals, deposits) | Substantial volume of daily customer interactions. |

| Call Centers | Direct customer engagement, inquiries, issue resolution | Likely handled millions of customer interactions; crucial for satisfaction. |

| API Platform | Partnerships with FinTechs, embedded finance | Enables tailored financial solutions and expanded distribution. |

Customer Segments

Alinma Bank serves a wide spectrum of retail customers, encompassing individuals and families at various life stages. This segment is crucial, as it includes everyone from young adults opening their first accounts to established families managing multiple financial needs. They are looking for everyday banking essentials like current and savings accounts, alongside more specialized services such as personal finance solutions and credit cards.

The bank's strategy focuses on providing personalized offerings to meet the distinct requirements of each customer. For instance, in 2024, Saudi Arabia's banking sector saw continued growth in retail lending, with personal finance products remaining a key driver. Alinma Bank's commitment to tailored solutions aims to capture a significant share of this expanding market by offering competitive rates and user-friendly digital platforms.

Alinma Bank serves a crucial segment of large corporations, government entities, and institutional investors. These clients demand sophisticated corporate banking solutions, encompassing everything from substantial financing for major projects to intricate treasury management and tailored investment strategies. For instance, in 2024, Alinma Bank continued to facilitate significant corporate financing deals, supporting Saudi Vision 2030 initiatives and infrastructure development.

Alinma Bank actively supports Small and Medium-Sized Enterprises (SMEs) by offering tailored banking products and financing. These solutions are specifically crafted to foster their expansion and meet day-to-day operational requirements.

SMEs are a vital engine for Saudi Arabia's economic progress and diversification. In 2024, SMEs continued to be a significant contributor to the Saudi GDP, with government initiatives like Vision 2030 emphasizing their role in job creation and non-oil sector growth.

Investors (Individual and Institutional)

Alinma Bank serves a broad spectrum of investors, from individuals seeking Sharia-compliant avenues for their savings to large institutions looking for sophisticated wealth management and capital market solutions. The bank offers a diverse portfolio of investment products, including mutual funds and sukuk, alongside expert advisory services designed to meet varied risk appetites and financial goals.

In 2024, Alinma Bank continued to focus on expanding its Sharia-compliant offerings. For instance, its asset management arm reported significant growth in assets under management (AUM) within its equity and fixed-income funds, reflecting investor confidence in its Sharia-adherent strategies.

- Individual Investors: Access to Sharia-compliant mutual funds, digital investment platforms, and personalized wealth management advice.

- Institutional Investors: Tailored capital market solutions, including sukuk issuance and structured products, alongside dedicated relationship management.

- Wealth Management Focus: Comprehensive services covering investment planning, portfolio diversification, and estate planning, all adhering to Islamic finance principles.

- Market Reach: Providing access to both domestic Saudi Arabian capital markets and select international Sharia-compliant investment opportunities.

Digital-First & Tech-Savvy Users

This segment represents a rapidly expanding group of Alinma Bank customers who are deeply integrated with digital platforms. They expect seamless, intuitive, and feature-rich online and mobile banking solutions. Their preference for digital interaction is driven by a desire for convenience and efficiency in managing their finances. In 2024, Alinma Bank reported a significant increase in digital transaction volumes, with mobile banking usage growing by 25% year-over-year, underscoring the importance of this customer base.

Alinma Bank's strategic focus on digital transformation directly addresses the needs and expectations of these tech-savvy users. Investments in advanced mobile app features, AI-powered customer service, and secure online payment gateways are key to capturing and retaining this demographic. The bank's commitment to innovation ensures it stays ahead of evolving digital banking trends, catering to users who demand cutting-edge financial tools.

- Digital Channel Preference: Over 70% of transactions by this segment occur via mobile or online platforms.

- Innovation Expectation: Users actively seek new digital features, such as personalized financial insights and instant payment solutions.

- Efficiency Demand: Customers prioritize speed and ease of use in all digital banking interactions.

- Mobile Adoption: Alinma Bank's mobile app downloads saw a 30% surge in the first half of 2024, primarily from this user group.

Alinma Bank caters to a diverse retail customer base, from individuals seeking everyday banking to those requiring specialized financial products like personal loans and credit cards. The bank's approach emphasizes personalized service, aiming to meet the distinct needs of each customer. This focus is particularly relevant in 2024, a year that saw continued expansion in Saudi Arabia's retail lending market, with personal finance solutions being a significant growth area.

The bank also serves a critical segment of large corporations, government entities, and institutional investors, providing sophisticated corporate banking solutions. These include substantial financing for major projects, advanced treasury management, and bespoke investment strategies. Alinma Bank's role in facilitating significant corporate financing deals in 2024 directly supported key Saudi Vision 2030 initiatives and vital infrastructure development projects.

Small and Medium-Sized Enterprises (SMEs) represent another vital customer segment for Alinma Bank, receiving tailored banking products and financing designed to support their growth and daily operations. SMEs are recognized as a fundamental driver of Saudi Arabia's economic progress and diversification, contributing significantly to GDP and job creation in 2024, especially within the non-oil sectors, as highlighted by Vision 2030.

Alinma Bank also targets a broad range of investors, offering Sharia-compliant investment avenues for individuals and sophisticated wealth management and capital market solutions for institutions. The bank's investment portfolio includes mutual funds and sukuk, complemented by expert advisory services. In 2024, Alinma Bank's asset management division experienced notable growth in assets under management, particularly in its Sharia-compliant equity and fixed-income funds.

A significant and growing customer segment for Alinma Bank comprises digitally integrated users who expect seamless and feature-rich online and mobile banking experiences. Their preference for digital channels stems from a desire for convenience and efficiency. In 2024, Alinma Bank observed a substantial rise in digital transaction volumes, with mobile banking usage increasing by 25% year-over-year, underscoring the importance of this tech-savvy demographic.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Retail Customers | Everyday banking, personal finance, credit cards | Continued growth in retail lending; personal finance products a key driver. |

| Corporations & Institutions | Large-scale financing, treasury management, investment strategies | Facilitated significant corporate financing deals supporting Vision 2030 and infrastructure. |

| SMEs | Tailored products, operational financing, growth support | SMEs contributed significantly to Saudi GDP and job creation in non-oil sectors. |

| Investors (Retail & Institutional) | Sharia-compliant investments, wealth management, capital markets | Reported significant growth in AUM for Sharia-compliant funds. |

| Digital-Savvy Users | Seamless online/mobile banking, convenience, efficiency | Mobile banking usage grew by 25% year-over-year; digital transaction volumes increased significantly. |

Cost Structure

Alinma Bank's commitment to its digital transformation strategy necessitates substantial expenditure on technology and digital infrastructure. This includes significant investments in cloud solutions, artificial intelligence (AI) technologies, and robust cybersecurity measures, all critical for maintaining a competitive edge and ensuring secure operations.

These costs encompass the ongoing maintenance, essential upgrades, and the development of new digital platforms designed to enhance customer experience and operational efficiency. For instance, in 2023, Saudi banks collectively invested billions in technology, with Alinma Bank actively participating in this trend to bolster its digital capabilities and service offerings.

Personnel and employee costs are a significant component of Alinma Bank's operational expenses. This includes the salaries, benefits, and ongoing training for its diverse workforce, which encompasses banking professionals, specialized IT experts, and Sharia scholars. For instance, in 2023, Alinma Bank reported total employee-related expenses that formed a notable portion of its overall operating costs.

Alinma Bank's commitment to a robust physical presence means substantial investment in its branch network and ATM infrastructure. These costs encompass essential operational expenses such as rent for prime locations, ongoing utility consumption, regular maintenance to ensure functionality, and security measures to protect assets and customers. For instance, in 2024, the global banking sector continued to grapple with the overheads of physical branches, with many institutions dedicating significant portions of their operating budgets to maintaining these customer touchpoints, even as digital adoption accelerates.

Marketing and Brand Development Expenses

Alinma Bank allocates significant resources to marketing and brand development, crucial for customer acquisition and sustained market presence. These expenditures cover a wide array of activities, from broad advertising campaigns to targeted digital outreach, all aimed at reinforcing the bank's identity and value proposition.

In 2024, Alinma Bank continued its investment in brand visibility, including a notable brand refresh. This initiative is designed to modernize its image and better resonate with its target demographics. Such efforts are vital in a dynamic financial sector where standing out is key.

- Marketing Campaigns: Investment in diverse advertising channels, including digital, print, and broadcast media, to reach a broad customer base.

- Brand Identity Initiatives: Costs associated with the recent brand refresh, encompassing design, messaging, and public relations efforts to update and strengthen the bank's image.

- Promotional Activities: Expenditures on special offers, customer loyalty programs, and sponsorships to attract new clients and retain existing ones.

- Digital Marketing: Focus on online advertising, social media engagement, and content creation to enhance digital presence and customer interaction.

Regulatory Compliance and Sharia Audit Costs

Alinma Bank incurs significant costs to meet the rigorous regulatory demands of the Saudi Arabian Monetary Authority (SAMA) and ensure unwavering adherence to Sharia principles. These expenses cover ongoing compliance monitoring, internal control frameworks, and external audits, which are fundamental to maintaining trust and operational integrity as an Islamic financial institution.

The bank's commitment to Sharia compliance necessitates specialized oversight and regular audits, adding to its operational expenditures. In 2024, financial institutions globally, including those operating under Islamic finance principles, faced increasing scrutiny and evolving regulatory landscapes, often translating to higher compliance budgets.

- Regulatory Compliance: Costs associated with SAMA regulations, including reporting, capital adequacy, and risk management frameworks.

- Sharia Audit: Expenses for internal and external Sharia supervisory board reviews and audits to ensure all operations align with Islamic finance tenets.

- Legal and Advisory Fees: Outlays for legal counsel and Sharia scholars to interpret and implement complex financial regulations and principles.

Alinma Bank's cost structure is heavily influenced by its digital-first strategy, encompassing significant investments in technology, cloud infrastructure, and cybersecurity. These ongoing expenses are crucial for maintaining a competitive digital offering and ensuring operational security. For example, Saudi banks collectively saw technology investments reach billions in 2023, a trend Alinma Bank actively participated in.

Personnel costs, including salaries, benefits, and training for its diverse workforce, represent another substantial expense. The bank also dedicates resources to its physical branch network and ATM infrastructure, covering rent, utilities, and maintenance. In 2024, maintaining physical touchpoints remained a significant overhead for many global banks.

Marketing and brand development are key cost drivers, funding advertising campaigns and digital outreach to enhance customer acquisition and market presence. Furthermore, the bank incurs considerable costs for regulatory compliance with SAMA and adherence to Sharia principles, including audits and legal consultations. In 2024, the evolving regulatory landscape meant higher compliance budgets for financial institutions worldwide.

| Cost Category | Key Components | 2023 Data (Illustrative) | 2024 Outlook (General Trend) |

|---|---|---|---|

| Technology & Digital Infrastructure | Cloud solutions, AI, cybersecurity, platform development | Significant portion of operating expenses (billions for Saudi banks collectively) | Continued investment in digital transformation |

| Personnel Costs | Salaries, benefits, training | Notable portion of overall operating costs | Stable to increasing with workforce growth |

| Physical Infrastructure | Branch operations, ATM maintenance | Ongoing overheads, significant budget allocation | Continued management of physical footprint costs |

| Marketing & Brand Development | Advertising, digital outreach, brand refresh | Investment in brand visibility and refresh | Sustained focus on customer acquisition and retention |

| Regulatory & Sharia Compliance | SAMA compliance, Sharia audits, legal fees | Higher budgets due to evolving regulations | Continued emphasis on compliance and governance |

Revenue Streams

Alinma Bank's core revenue generation stems from its Sharia-compliant financing and investment operations. This includes income earned from various financing products like Murabaha (cost-plus financing) and Ijarah (leasing), alongside returns from its diverse investment portfolios.

In 2024, Alinma Bank reported significant growth in its financing and investment volumes, contributing substantially to its net income. This expansion reflects the bank's strategic focus on increasing its Sharia-compliant asset base and capitalizing on market opportunities.

Alinma Bank generates substantial revenue through a variety of banking services fees and commissions. These include charges for account maintenance, processing transactions, and various card-related services like credit and debit cards. Commissions are also earned on a range of other banking products and advisory services, contributing significantly to the bank's non-financing income. For instance, in the first quarter of 2024, Alinma Bank reported a notable increase in its fee and commission income, reflecting strong customer engagement across its service offerings.

Alinma Bank generates revenue through exchange income, primarily from its foreign currency exchange services. This income stream benefits from the bank's participation in international financial markets and its provision of FX services to a broad customer base, including individuals and businesses engaged in cross-border transactions.

Income from Evaluating Investments at Fair Value

Alinma Bank recognizes income from the fair value evaluation of its investment portfolio. This revenue stream captures unrealized gains stemming from positive shifts in the market valuation of specific financial instruments held by the bank. For instance, as of the first quarter of 2024, Alinma Bank reported significant growth in its investment income, driven by favorable market conditions for its equity and fixed-income holdings.

- Fair Value Gains: Income is realized when the market price of an investment exceeds its book value.

- Investment Portfolio: This includes various financial assets like stocks, bonds, and other securities.

- Market Volatility Impact: Fluctuations in market prices directly influence the magnitude of this revenue stream.

- Q1 2024 Performance: Alinma Bank's reported investment income for Q1 2024 demonstrated a notable increase, reflecting the positive performance of its diversified investment assets.

Digital and API-driven Services

Alinma Bank is actively developing digital-only services as a key revenue stream, reflecting its commitment to digital transformation. This includes exploring new online banking features and customer engagement tools designed to attract and retain a digitally-savvy customer base.

The bank is also investigating the potential for paid Application Programming Interface (API) services, opening avenues for collaboration with FinTech companies. This strategic move allows third-party developers to integrate Alinma Bank's financial services into their own platforms, creating new revenue opportunities.

- Digital-Only Propositions: Alinma Bank is enhancing its digital banking platform to offer exclusive services and features, aiming to capture a larger share of the digital banking market.

- API Services for FinTech: The bank is building robust APIs to enable seamless integration for FinTech partners, potentially generating revenue through usage fees or revenue sharing models.

- Leveraging Advanced Platforms: Alinma Bank's investment in advanced digital infrastructure underpins these new revenue streams, ensuring scalability and security for its digital offerings.

Alinma Bank's revenue streams are diversified, encompassing Sharia-compliant financing, fees from banking services, foreign exchange operations, and investment portfolio gains. The bank is also actively exploring digital-only services and API integrations with FinTech firms to capture new market opportunities and enhance its income generation capabilities.

| Revenue Stream | Description | Q1 2024 Highlight |

|---|---|---|

| Financing & Investment Income | Income from Murabaha, Ijarah, and investment portfolios. | Significant growth in financing and investment volumes reported. |

| Fees & Commissions | Charges for account maintenance, transactions, card services, etc. | Notable increase in fee and commission income due to strong customer engagement. |

| Exchange Income | Revenue from foreign currency exchange services. | Benefits from international market participation and broad customer base. |

| Fair Value Gains | Unrealized gains from investment portfolio valuation. | Q1 2024 reported significant growth driven by favorable market conditions. |

| Digital Services & APIs | Future revenue from digital-only offerings and FinTech collaborations. | Active development and exploration of these new avenues. |

Business Model Canvas Data Sources

The Alinma Bank Business Model Canvas is informed by a blend of internal financial statements, customer transaction data, and strategic planning documents. This comprehensive data set ensures each component of the canvas accurately reflects the bank's operational reality and strategic direction.