Akzo Nobel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

AkzoNobel, a global leader in paints and coatings, leverages its strong brand recognition and extensive distribution network as key strengths. However, the company faces challenges from intense competition and fluctuating raw material costs, impacting its profitability and market share.

Want the full story behind AkzoNobel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AkzoNobel commands a leading position in the global paints and coatings industry, boasting a robust portfolio of renowned brands such as Dulux, International, Sikkens, and Interpon. This strong brand equity and extensive global reach, spanning over 150 countries, translate into a significant competitive edge, cultivating customer loyalty and facilitating market access.

AkzoNobel’s commitment to innovation is a significant strength, driving the development of advanced products and cutting-edge technologies, particularly in sustainable solutions. This focus directly addresses the growing market demand for environmentally friendly products.

The company’s proactive approach to sustainability is clearly demonstrated by its impressive progress in reducing its carbon footprint. AkzoNobel has achieved a 41% reduction in Scope 1 and 2 carbon emissions against its 2018 baseline, with an ambitious target of a 50% reduction by 2030. This aligns perfectly with increasing regulatory pressures and appeals strongly to increasingly eco-conscious consumers and business partners.

AkzoNobel has demonstrated remarkable financial resilience, navigating a complex economic landscape characterized by inflation and currency fluctuations. The company achieved notable organic sales growth throughout 2024, a testament to its robust market positioning and effective pricing strategies.

Further bolstering its performance, AkzoNobel reported an expansion in its adjusted EBITDA for both the full year 2024 and the first quarter of 2025. This profitability growth underscores the success of its ongoing cost reduction initiatives and efficiency improvements, allowing it to maintain strong financial health even amidst market headwinds.

Strategic Industrial Transformation and Efficiency Actions

AkzoNobel is undertaking a significant industrial transformation to boost efficiency. This multi-year program involves closing less productive manufacturing sites and reducing its global workforce. These decisive actions are designed to streamline operations and cut down on complexity.

The company's strategic self-help measures are on track, with efficiency actions reportedly ahead of schedule. The primary goals are to lower operating costs and sharpen its competitive edge in the market. For instance, by the end of 2023, AkzoNobel had completed 80% of its planned site closures and workforce adjustments as part of this transformation.

- Industrial Transformation: Multi-year program to optimize operations.

- Site Closures: Underperforming manufacturing sites are being shut down.

- Workforce Reduction: Global workforce adjustments are part of the efficiency drive.

- Efficiency Ahead of Schedule: Strategic measures are progressing faster than initially planned.

Diversified End-User Segments

AkzoNobel's broad reach across diverse end-user segments, encompassing automotive, aerospace, marine, protective, and powder coatings, alongside household and industrial applications, significantly reduces its vulnerability to downturns in any single market. This wide-ranging customer base offers resilience and multiple growth channels.

The company experienced notable growth in its marine, protective, and powder coatings segments during 2024, highlighting the strength derived from this diversification. For example, the marine coatings sector saw a robust increase in demand, partly driven by new shipbuilding orders and increased maintenance activity.

This strategic diversification is a key strength, enabling AkzoNobel to leverage opportunities across various economic cycles and industries. The company's ability to serve both high-volume industrial clients and specialized consumer markets ensures a stable revenue stream.

- Broad Market Penetration: AkzoNobel's coatings are utilized in sectors ranging from automotive and aerospace to marine and construction.

- Resilience Against Sector-Specific Shocks: Diversification mitigates risks associated with dependence on any single industry's performance.

- Targeted Growth Areas: Key segments like marine, protective, and powder coatings demonstrated significant growth in 2024, underscoring the benefits of this varied market approach.

AkzoNobel’s strong brand portfolio, featuring names like Dulux and Sikkens, coupled with a presence in over 150 countries, provides a significant competitive advantage and broad market access.

The company's dedication to innovation, particularly in sustainable coatings, aligns with increasing market demand for eco-friendly solutions and strengthens its product offering.

AkzoNobel's commitment to sustainability is evident in its 41% reduction in Scope 1 and 2 carbon emissions by the end of 2024 against an 2018 baseline, moving towards its 2030 goal.

Financial performance in 2024 and Q1 2025 showed organic sales growth and expanded adjusted EBITDA, reflecting effective pricing and cost management strategies.

| Strength | Description | Supporting Data/Example |

| Brand Equity & Global Reach | Leading brands and extensive international presence. | Brands include Dulux, International, Sikkens; operates in 150+ countries. |

| Innovation & Sustainability Focus | Development of advanced, eco-friendly products. | Focus on sustainable solutions addresses growing market demand. |

| Environmental Progress | Significant reduction in carbon emissions. | 41% reduction in Scope 1 & 2 emissions (vs. 2018 baseline) by end of 2024. |

| Financial Resilience | Navigating economic challenges with sales growth and profit expansion. | Organic sales growth in 2024; expanded adjusted EBITDA in 2024 and Q1 2025. |

What is included in the product

Delivers a strategic overview of Akzo Nobel’s internal and external business factors, highlighting its market strengths and potential areas for improvement.

Helps identify and address critical market vulnerabilities and capitalize on emerging opportunities.

Weaknesses

AkzoNobel's decorative paints segment has faced headwinds, with sales showing flatness or even declines in crucial markets like China and other parts of Asia. This underperformance is a significant concern, especially given the consumer-centric nature of this business.

The EMEA region has also contributed to this weakness, experiencing a general softness that further impacts the decorative paints division's overall performance. While other segments might be performing well, this drag in a key area can hinder AkzoNobel's broader revenue growth and market share expansion efforts.

AkzoNobel has faced significant currency headwinds, with the strong euro impacting reported revenue. For instance, in the first half of 2025, currency movements contributed negatively to the company's top-line performance.

Operating in volatile global markets presents another challenge, leading to unpredictable demand. This was evident in the second quarter of 2025, where market uncertainties created fluctuations in sales volumes and profitability for certain business segments.

AkzoNobel's leverage remains a concern, with S&P Global Ratings-adjusted funds from operations (FFO) to debt hovering below their target levels. This suggests a slower deleveraging process than anticipated, potentially constraining financial maneuverability.

While the company has stated its intention to reduce leverage in the medium term, the current elevated debt levels could impact its credit ratings and overall financial flexibility.

Restructuring Costs and Free Cash Flow Generation

While AkzoNobel's restructuring initiatives are designed for long-term efficiency, they have led to substantial upfront costs. These expenses have directly impacted the company's operating profit and, consequently, its ability to generate free cash flow in the immediate term.

The free cash flow performance in 2024 has been a point of concern for analysts. This disappointment stems from the fact that anticipated working capital releases, typically a benefit of restructuring, did not materialize as expected. This shortfall is directly attributable to the continued cash outflows associated with ongoing restructuring activities.

- Significant costs incurred from ongoing restructuring efforts have negatively impacted short-term operating profit.

- Analysts noted disappointment with 2024 free cash flow due to the absence of expected working capital releases.

- Restructuring cash-outs in 2024 have offset potential working capital benefits, hindering free cash flow generation.

Competition and Pricing Pressure

AkzoNobel operates in a highly competitive landscape, facing formidable global rivals in the paints and coatings sector. This intense competition, coupled with fluctuating market dynamics, often translates into significant pricing pressures. For instance, in 2023, the company navigated a challenging environment where raw material costs remained volatile, impacting its ability to fully pass on increases to customers, thereby compressing profit margins.

The constant need to innovate and maintain cost efficiencies becomes paramount to counteract these pressures. AkzoNobel's strategy involves ongoing investments in research and development to differentiate its product offerings and optimize production processes. However, the sheer scale of some competitors allows them to leverage economies of scale, further intensifying the pricing challenge for AkzoNobel.

- Intense Global Competition: AkzoNobel competes with major global players like PPG Industries, Sherwin-Williams, and Nippon Paint, all vying for market share.

- Pricing Pressure Impact: In 2023, the company reported that pricing power was constrained in certain segments due to the competitive environment, affecting profitability.

- Raw Material Volatility: Fluctuations in the cost of key raw materials, such as titanium dioxide and various petrochemicals, directly impact production costs and pricing strategies.

- Efficiency as a Differentiator: Continuous operational improvements and cost management are critical for AkzoNobel to maintain its competitive edge against larger, more diversified competitors.

AkzoNobel's decorative paints segment has experienced a slowdown, with sales showing flatness or declines in key markets like China and other parts of Asia. The EMEA region also contributed to this weakness, experiencing general softness that impacted the decorative paints division's overall performance.

The company faces significant currency headwinds, with the strong euro negatively impacting reported revenue, as seen in the first half of 2025. Operating in volatile global markets also presents a challenge, leading to unpredictable demand and fluctuations in sales volumes and profitability, as observed in Q2 2025.

AkzoNobel's leverage remains a concern, with S&P Global Ratings-adjusted funds from operations (FFO) to debt hovering below target levels, indicating a slower deleveraging process. While the company aims to reduce leverage, current debt levels could impact credit ratings and financial flexibility.

Restructuring initiatives have led to substantial upfront costs, directly impacting operating profit and immediate free cash flow generation. In 2024, free cash flow disappointed analysts due to the absence of expected working capital releases, with ongoing restructuring cash-outs offsetting potential benefits.

The company operates in a highly competitive landscape with significant pricing pressures from global rivals. In 2023, AkzoNobel navigated volatile raw material costs, impacting its ability to fully pass on increases, thereby compressing profit margins.

Preview the Actual Deliverable

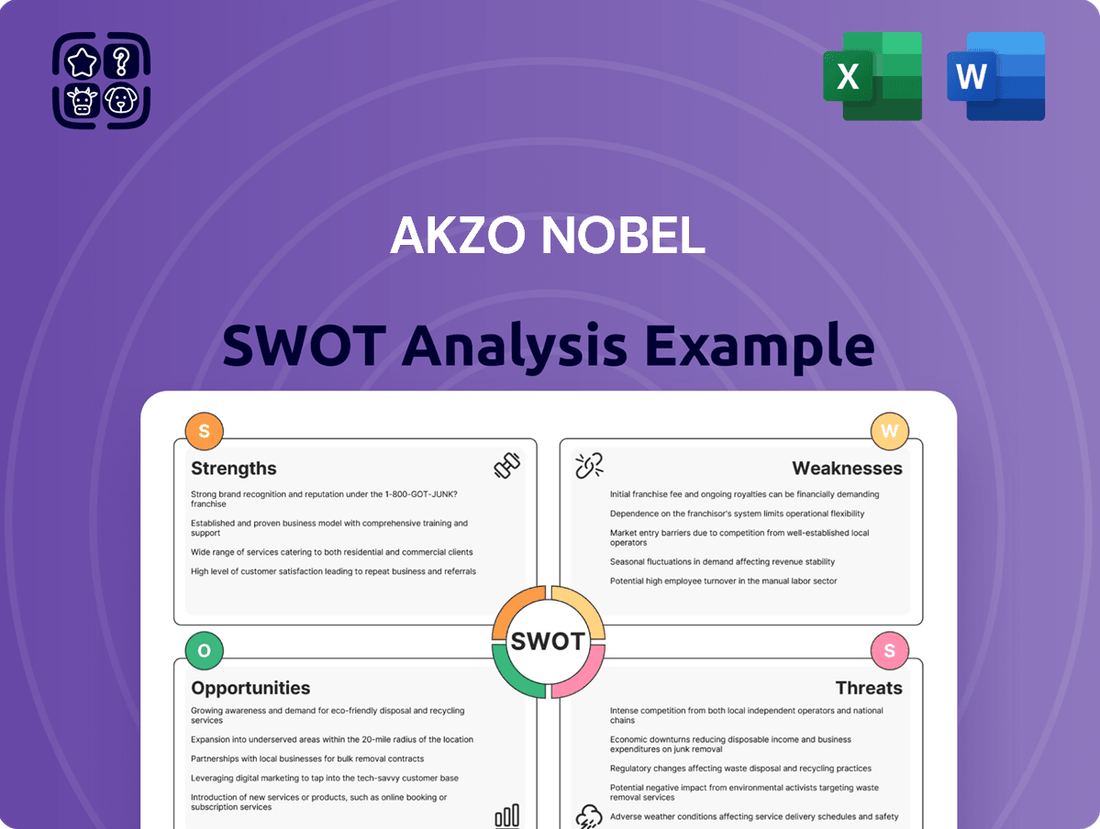

Akzo Nobel SWOT Analysis

This is the actual Akzo Nobel SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, allowing for informed strategic decision-making.

The preview below is taken directly from the full Akzo Nobel SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key internal and external factors impacting the organization's competitive landscape.

This is a real excerpt from the complete Akzo Nobel SWOT analysis. Once purchased, you’ll receive the full, editable version, offering actionable insights for strategic planning and business development.

Opportunities

The global market for sustainable coatings is expanding rapidly, fueled by heightened environmental consciousness and increasingly stringent regulations, such as those outlined in the EU's Corporate Sustainability Reporting Directive (CSRD). AkzoNobel's dedication to sustainability and its continuous development of eco-friendly coating technologies position it favorably to capitalize on this trend.

Emerging markets present significant opportunities for AkzoNobel, with industrialization and urbanization in regions like Asia and Latin America fueling demand for paints and coatings. For instance, the global paints and coatings market is projected to reach over $200 billion by 2027, with emerging economies contributing a substantial portion of this growth.

Specific high-growth segments, such as powder coatings, marine coatings, and protective coatings, offer avenues for AkzoNobel to capitalize on its established expertise and market presence. The global powder coatings market alone is expected to grow at a compound annual growth rate of around 6% through 2028, driven by their environmental benefits and durability.

Technological advancements are significantly reshaping the paints and coatings sector. Innovations like smart coatings, which can change properties based on environmental stimuli, and the integration of nanotechnology for enhanced durability and functionality are driving new product development. Digitalization in manufacturing processes, including AI-driven quality control and predictive maintenance, is also boosting efficiency.

AkzoNobel is well-positioned to leverage these opportunities. By continuing to invest in research and development, the company can bring cutting-edge products to market. For instance, their commitment to sustainability aligns with the growing demand for eco-friendly coatings, often enabled by new technologies. In 2023, AkzoNobel reported a 6% increase in revenue for their Decorative Paints segment, partly driven by innovation.

Infrastructure Development and Automotive Sector Growth

Global infrastructure projects are on the rise, with the International Monetary Fund projecting a 1.5% growth in global infrastructure spending for 2024, reaching an estimated $3.7 trillion. This expansion, coupled with a robust automotive sector, particularly the surge in electric vehicle (EV) sales which accounted for over 13% of global car sales in 2023 according to the International Energy Agency, creates a substantial demand for AkzoNobel's advanced coating solutions.

AkzoNobel is well-positioned to capitalize on these trends, offering high-performance and specialty coatings essential for both new infrastructure and the growing automotive market. The company's expertise in durable and aesthetically pleasing coatings directly addresses the needs for protection against corrosion and environmental factors in infrastructure, as well as the sophisticated finishes required for modern vehicles, especially EVs.

The increasing emphasis on sustainability in both sectors also presents an opportunity. AkzoNobel's development of eco-friendly coatings aligns with the market's push for greener solutions, enhancing its appeal to infrastructure developers and automotive manufacturers alike.

- Infrastructure Spending: Global infrastructure investment is projected to increase, creating demand for protective and decorative coatings.

- Automotive Growth: The expanding automotive market, with EVs forming a significant part, requires advanced and visually appealing coatings.

- EV Market Share: Electric vehicles represented over 13% of global car sales in 2023, highlighting a key growth area for automotive coatings.

- Demand for Specialty Coatings: Durable, high-performance, and sustainable coatings are increasingly sought after in both infrastructure and automotive applications.

Strategic Portfolio Optimization and Divestments

AkzoNobel's ongoing strategic review of its portfolio, exemplified by the announced sale of its India business, presents a significant opportunity to sharpen its focus. This divestment, part of a broader effort to concentrate on core global coatings markets, allows for more efficient capital allocation and resource deployment.

By streamlining its operations and divesting non-core assets, AkzoNobel can unlock substantial value. This strategic realignment is designed to bolster the company's position in high-growth segments, paving the way for more robust and sustainable expansion in its key markets. For instance, the sale of Akzo Nobel India was reported to be valued at approximately €260 million, underscoring the financial impact of such strategic moves.

- Focus on Core Strengths: Divesting non-core units allows AkzoNobel to concentrate resources on its leading global coatings businesses.

- Capital Reallocation: Proceeds from divestments can be reinvested in high-growth areas or returned to shareholders, enhancing overall financial performance.

- Improved Market Position: A more focused portfolio can lead to stronger competitive advantages in key geographical regions and product categories.

- Enhanced Shareholder Value: Strategic optimization often translates into improved profitability and a higher valuation for the company.

AkzoNobel is strategically positioned to benefit from the global shift towards sustainable coatings, a market bolstered by regulations like the EU's CSRD. The company's ongoing investment in eco-friendly technologies, such as low-VOC (volatile organic compound) paints, directly addresses this growing demand. Furthermore, advancements in nanotechnology and smart coatings offer opportunities for product differentiation and enhanced performance, aligning with the market's appetite for innovation.

The company can leverage the expansion of emerging markets, where industrialization and infrastructure development are driving significant demand for paints and coatings. For example, the global paints and coatings market is anticipated to exceed $200 billion by 2027, with emerging economies playing a crucial role in this growth. AkzoNobel's established presence and product portfolio in these regions provide a strong foundation for capturing market share.

High-growth segments like powder coatings and protective coatings present lucrative avenues for AkzoNobel. The powder coatings market, for instance, is projected to grow at a compound annual growth rate of approximately 6% through 2028, driven by their environmental advantages and durability. AkzoNobel's expertise in these specialized areas allows it to capitalize on these expanding markets.

The increasing global infrastructure spending, estimated to reach around $3.7 trillion in 2024, coupled with the robust growth in the automotive sector, particularly electric vehicles (EVs), presents substantial opportunities. EVs alone accounted for over 13% of global car sales in 2023, creating a strong demand for advanced automotive coatings. AkzoNobel's high-performance and specialty coatings are well-suited to meet the protective and aesthetic requirements of these expanding sectors.

Threats

Fluctuations in the price of raw materials, often tied to global supply chain dynamics and crude oil markets, represent a persistent threat to AkzoNobel's cost base and profit margins. While some supply chain pressures have lessened, securing specific pigments and additives remains a challenge.

For instance, in 2023, AkzoNobel reported that raw material costs were a significant factor impacting their performance, with specific chemical inputs seeing price increases of up to 15% year-on-year. This volatility directly affects the company's ability to maintain consistent pricing for its coatings and chemicals.

The paints and coatings sector is a crowded arena, with AkzoNobel facing formidable rivals both globally and within its local markets. This intense competition, particularly in the mass and economy segments, often triggers price wars, which can significantly squeeze profit margins. For instance, in 2024, the global paints and coatings market experienced heightened price pressures as numerous players sought to capture market share, making it difficult for established companies to maintain premium pricing strategies.

A general slowdown in global economic growth, exacerbated by ongoing geopolitical tensions and trade uncertainties, poses a significant threat by dampening consumer confidence and reducing industrial demand for paints and coatings. This can directly impact AkzoNobel's sales volumes across various end markets.

AkzoNobel itself acknowledges the indirect effects of this slowing customer demand and global trade uncertainty. Despite their strategic localization efforts to mitigate some risks, the broader economic climate and potential trade disruptions remain a persistent challenge for the company's performance.

Regulatory Changes and Environmental Compliance Costs

AkzoNobel faces growing pressure from stricter environmental rules, particularly concerning volatile organic compounds (VOCs) and emerging issues like PFAS. These regulations demand substantial investments in research and development to reformulate products and adapt manufacturing processes. For instance, the European Union's ongoing review of its chemical legislation, including REACH, could introduce new restrictions on substances used in paints and coatings, potentially requiring costly product redesigns.

The financial implications of non-compliance or the need for extensive reformulations are significant. Companies like AkzoNobel must allocate capital towards ensuring their product portfolios meet evolving environmental standards, which can impact operating margins and profitability. Failure to adapt could lead to market access restrictions or penalties. In 2023, the coatings industry, in general, saw increased R&D spending focused on sustainability, with many companies earmarking portions of their capital expenditure for compliance-driven innovation.

- Increased R&D Investment: Anticipated rise in R&D spending to meet new VOC limits and PFAS regulations.

- Compliance Costs: Potential for higher manufacturing expenses due to process modifications and raw material substitutions.

- Market Access Risks: Non-compliance could restrict access to key markets with stringent environmental laws.

- Profitability Impact: Costs associated with reformulation and compliance may affect profit margins in the short to medium term.

Currency Fluctuations and Adverse Exchange Rate Impacts

Currency fluctuations, particularly a strong euro, pose a significant threat to AkzoNobel's financial performance. This can reduce the value of earnings generated in weaker currencies when translated back into euros, impacting reported revenue and profitability. For instance, in the first half of 2024, AkzoNobel noted that adverse currency movements had a negative impact on its results.

These currency headwinds can create volatility in financial reporting, making it harder to forecast and manage earnings. The company's extensive global footprint means it is exposed to a wide range of currency risks across its various markets.

- Adverse currency impacts: A stronger euro can decrease the reported value of sales and profits earned in other currencies.

- Recent challenges: Currency headwinds were cited as a notable challenge for AkzoNobel in financial quarters leading up to mid-2024.

- Global operations exposure: AkzoNobel's international presence exposes it to a broad spectrum of currency exchange rate risks.

Intensifying competition and potential price wars in key markets represent a significant threat to AkzoNobel's profitability, especially in price-sensitive segments. Furthermore, a general economic slowdown globally could dampen demand for paints and coatings, directly impacting sales volumes and revenue streams.

SWOT Analysis Data Sources

This Akzo Nobel SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial reports, comprehensive market research, and insights from industry experts to provide a robust and accurate assessment.