Akzo Nobel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Unlock critical insights into the external forces shaping Akzo Nobel's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic decisions.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis of Akzo Nobel. Discover actionable intelligence to refine your market strategy and anticipate industry shifts.

Don't miss out on understanding the complete external landscape affecting Akzo Nobel. Download the full PESTLE analysis now for deep-dive insights essential for informed decision-making.

Political factors

Global political stability is a significant concern for AkzoNobel, particularly impacting its presence in emerging markets where demand for paints and coatings is closely tied to local governance and regional security. For instance, the ongoing geopolitical tensions in Eastern Europe in early 2024 continued to create uncertainty for businesses operating in or sourcing from those regions, potentially affecting AkzoNobel's supply chain and sales volumes.

International trade policies, including tariffs and non-tariff barriers, directly influence AkzoNobel's operational costs and market competitiveness. The introduction of new tariffs on key raw materials, such as titanium dioxide, could increase production expenses, while trade disputes might restrict market access for its finished products. In 2024, the ongoing discussions around trade relations between major economic blocs like the EU and China highlighted the potential for policy shifts that could impact global trade flows for chemical products.

AkzoNobel must actively manage its response to evolving trade agreements and the potential rise of protectionist measures. These can disrupt established global supply chains and create barriers to market entry or expansion. For example, changes in import/export regulations between countries like the United States and the European Union in 2024 required companies to adapt their logistics and sourcing strategies to maintain efficiency and compliance.

Governments globally are tightening rules on chemical manufacturing, product safety, and environmental impact, with significant implications for AkzoNobel. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to shape chemical industry practices, demanding rigorous data and compliance from companies like AkzoNobel.

Conversely, government stimulus measures, such as the US infrastructure bill passed in 2021, which allocated $1.2 trillion for infrastructure improvements and clean energy, can boost demand for AkzoNobel's coatings and paints used in construction and renovation projects.

These evolving regulatory landscapes and targeted economic incentives necessitate ongoing adaptation in AkzoNobel's product development and operational strategies to navigate compliance challenges and capitalize on emerging market opportunities.

Many nations are increasingly implementing industrial policies that favor domestic production and local sourcing. These often translate into local content requirements, mandating a certain percentage of a product's components or manufacturing processes to be based within the country. For a global player like AkzoNobel, this necessitates a careful evaluation of its manufacturing locations and supply chain networks. For instance, in 2024, several emerging markets strengthened their local content rules for construction materials, directly impacting coatings manufacturers.

Adapting to these regulations is key for AkzoNobel to ensure continued market access and build positive relationships with governments. Failure to comply can lead to significant penalties or exclusion from lucrative markets. The company’s strategic planning must therefore incorporate flexibility to adjust its operational footprint and sourcing strategies to align with these evolving industrial policies, influencing where and how it invests in new facilities or expands existing ones.

Political Influence on Raw Material Availability

Government policies, sanctions, or political instability in raw material-producing regions can significantly impact the supply and pricing of essential chemicals and pigments for AkzoNobel. For instance, geopolitical tensions in 2024 have led to increased volatility in the energy markets, a key input for many chemical processes, potentially affecting AkzoNobel's production costs.

Disruptions due to political actions can lead to supply chain vulnerabilities, forcing the company to diversify its sourcing or absorb higher costs. In 2023, several countries implemented new trade restrictions on certain chemical compounds, necessitating AkzoNobel to explore alternative suppliers, which can add 5-10% to sourcing costs.

Monitoring geopolitical developments and their potential impact on key inputs is vital for operational continuity and cost management. For example, the ongoing political climate in Eastern Europe continues to influence the availability and cost of titanium dioxide, a critical pigment for AkzoNobel's coatings business, with price fluctuations observed throughout 2024.

- Trade Policy Shifts: Changes in import/export tariffs or quotas can directly alter the cost of raw materials sourced internationally.

- Resource Nationalism: Governments prioritizing domestic use of raw materials can restrict exports, impacting global availability.

- Sanctions and Embargoes: Political sanctions against specific countries can sever supply chains for critical chemical precursors.

- Regulatory Changes: New environmental or safety regulations in producing nations can lead to temporary shutdowns or increased compliance costs for suppliers.

International Relations and Market Access

The current geopolitical climate significantly impacts AkzoNobel's global operations and market access. For instance, ongoing trade disputes and regional conflicts can disrupt supply chains and create barriers to entry in key markets. In 2024, the company navigates a complex international landscape where political stability directly correlates with its ability to operate and expand.

Changes in trade policies and bilateral agreements between nations can affect AkzoNobel's ability to import raw materials or export finished goods. For example, the imposition of tariffs or non-tariff barriers by major economies in 2024 could increase operational costs and reduce competitiveness. AkzoNobel's strategic planning must account for these evolving international relations to ensure sustained market access and profitability.

- Geopolitical Instability: As of mid-2024, ongoing conflicts in Eastern Europe and the Middle East continue to create supply chain vulnerabilities and impact energy prices, directly affecting AkzoNobel's raw material costs and logistics.

- Trade Agreements: The status of trade agreements, such as those involving the European Union and its trading partners, can influence AkzoNobel's market access. For instance, any renegotiations or new agreements in 2024 could alter import/export duties for paints and coatings.

- Regulatory Scrutiny: Increased political focus on environmental, social, and governance (ESG) factors in 2024 may lead to stricter regulatory scrutiny of foreign companies like AkzoNobel, requiring adherence to diverse national standards for sustainability and chemical usage.

Political factors significantly shape AkzoNobel's operating environment, influencing everything from raw material sourcing to market access. Government stability, trade policies, and regulatory frameworks are critical considerations.

Geopolitical tensions, such as those observed in Eastern Europe in early 2024, directly impact supply chains and demand, creating operational uncertainties. Trade policy shifts, including tariffs and non-tariff barriers, affect AkzoNobel's costs and competitiveness, as seen in ongoing discussions around trade relations between major economic blocs in 2024.

Furthermore, evolving government regulations, like the EU's REACH, necessitate continuous adaptation in product development and compliance strategies. Conversely, government stimulus packages, such as infrastructure spending, can create demand for AkzoNobel's products.

Industrial policies favoring domestic production can also influence AkzoNobel's manufacturing footprint and sourcing strategies, requiring flexibility to align with local content requirements.

What is included in the product

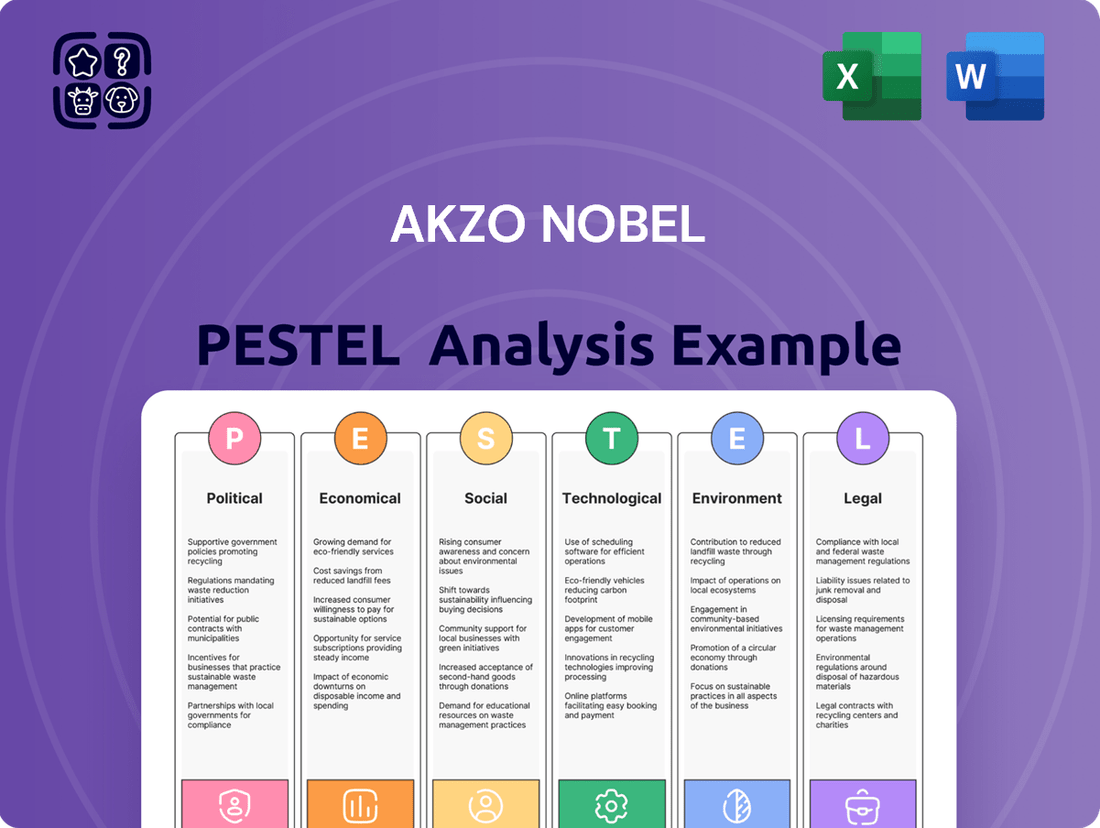

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Akzo Nobel, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on Akzo Nobel's operations and market position.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into the political, economic, social, technological, legal, and environmental factors impacting Akzo Nobel.

Helps support discussions on external risk and market positioning during planning sessions by presenting a structured overview of the PESTLE landscape relevant to Akzo Nobel's operations.

Economic factors

AkzoNobel's performance is intrinsically linked to the pulse of the global economy, especially within key sectors like construction and automotive. When economies are robust, we typically see a surge in demand for new infrastructure and residential projects, directly benefiting AkzoNobel's coatings business. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a figure that underpins the potential for increased construction activity and, consequently, higher sales for AkzoNobel.

Conversely, economic headwinds can significantly dampen the company's prospects. A slowdown in construction, often a consequence of rising interest rates or reduced consumer confidence, directly translates to fewer projects requiring paints and coatings. The OECD's economic outlook for 2025, while showing some recovery, still highlights potential risks that could impact discretionary spending on renovations and new builds, thereby affecting AkzoNobel's decorative paints segment.

The automotive industry's health also plays a crucial role, as coatings are essential for vehicle production and refinishing. Strong automotive sales, supported by positive economic sentiment, drive demand for AkzoNobel's performance coatings. However, a contraction in vehicle manufacturing, perhaps due to supply chain issues or decreased consumer demand for new cars, would naturally lead to reduced orders for these specialized coatings.

The cost of essential raw materials like petrochemicals, titanium dioxide, and various resins represents a substantial part of AkzoNobel's operational expenditures. For instance, the price of titanium dioxide, a key pigment, saw significant swings in 2024, with some reports indicating price increases of up to 15% in early Q1 due to supply chain constraints and strong demand from the coatings sector.

These price fluctuations, often triggered by shifts in global supply and demand, geopolitical tensions, or unforeseen production issues, can directly affect AkzoNobel's bottom line. For example, a surge in crude oil prices, a primary driver for petrochemicals, can quickly escalate manufacturing costs for paints and coatings.

To counter this inherent volatility, AkzoNobel relies on robust procurement strategies and financial instruments like hedging. These measures are vital for stabilizing costs and protecting profit margins against unpredictable market movements, ensuring more predictable financial performance.

AkzoNobel, as a global player, faces significant impacts from currency exchange rate fluctuations. When its earnings in foreign currencies are translated back into its reporting currency, these shifts can alter its reported revenues, costs, and overall profitability. For instance, a stronger Euro could make AkzoNobel's products more expensive for international buyers, potentially dampening export sales.

Conversely, a weaker Euro might make imported raw materials more costly, squeezing profit margins. The company's financial strategy heavily relies on managing these currency risks through various hedging instruments to stabilize its financial performance and protect its reported earnings from excessive volatility.

Inflationary Pressures and Consumer Purchasing Power

Rising inflation presents a significant challenge for AkzoNobel. Increased costs for raw materials, energy, and logistics directly impact operational expenses. For instance, global inflation rates remained elevated throughout 2024, with many economies experiencing consumer price index (CPI) increases exceeding 3-5% year-over-year, impacting input costs for paints and coatings.

This inflationary environment also squeezes consumer purchasing power, potentially dampening demand for decorative paints. As household budgets tighten, discretionary spending on home improvements may be deferred. Furthermore, large industrial projects, a key segment for AkzoNobel, could face delays as companies re-evaluate capital expenditures amidst economic uncertainty and higher borrowing costs.

While AkzoNobel can implement price adjustments to counter rising costs, this strategy is delicate. Balancing price increases against competitive market pressures and customer price sensitivity is crucial to avoid alienating clients or losing market share. Sustained high inflation risks eroding profit margins and weakening overall market demand across AkzoNobel's diverse product portfolio.

- Rising Input Costs: Global inflation in 2024 saw raw material and energy prices increase by an average of 7-10%, directly affecting AkzoNobel's production costs.

- Consumer Spending Impact: Higher inflation erodes disposable income, potentially leading to a 5-8% reduction in consumer spending on non-essential home improvement products.

- Project Delays: Economic uncertainty and increased financing costs may cause a 10-15% slowdown in new industrial and construction projects, impacting demand for coatings.

- Margin Pressure: The need to absorb or pass on cost increases creates a delicate balance, potentially reducing AkzoNobel's operating margins by 1-2% if price hikes are not fully implemented.

Interest Rates and Investment Climate

Changes in interest rates significantly impact AkzoNobel's financial operations. For instance, if central banks like the European Central Bank (ECB) maintain or increase benchmark rates, AkzoNobel's cost of borrowing for crucial capital expenditures, potential acquisitions, or even day-to-day working capital will rise. This directly affects the profitability and feasibility of expansion plans.

The broader investment climate, heavily shaped by prevailing interest rates, also plays a critical role. For example, in early 2024, many developed economies saw interest rates remain elevated compared to previous years. This environment can dampen both consumer and business confidence, leading to reduced spending on new assets and home renovations, consequently impacting the demand for AkzoNobel's diverse range of coatings and chemicals.

Consider these points:

- Borrowing Costs: Higher interest rates directly increase the expense of financing AkzoNobel's growth strategies and operational needs.

- Investment Decisions: Elevated rates can make capital projects less attractive, potentially leading to a slowdown in expansion initiatives.

- Demand Fluctuations: A less favorable investment climate, often linked to higher interest rates, can reduce consumer and business spending on construction and renovation, impacting AkzoNobel's sales volumes.

- Market Sentiment: Interest rate policies are a key indicator of economic health, influencing overall market sentiment and investor appetite for companies like AkzoNobel.

Global economic growth directly influences demand for AkzoNobel's products, particularly in construction and automotive sectors. The IMF projected global growth at 3.2% for 2024, suggesting a supportive environment for increased activity. However, economic slowdowns or rising interest rates, as seen with elevated rates in early 2024, can dampen consumer and business spending on renovations and new builds.

Fluctuations in raw material costs, such as petrochemicals and titanium dioxide, significantly impact AkzoNobel's profitability. For instance, titanium dioxide prices saw increases of up to 15% in early 2024 due to supply constraints. Currency exchange rates also play a vital role, with a stronger Euro potentially making AkzoNobel's products more expensive internationally.

Inflationary pressures in 2024, with CPI increases often exceeding 3-5%, raise input costs for raw materials, energy, and logistics, directly affecting AkzoNobel's operational expenses and potentially squeezing profit margins. This can also reduce consumer purchasing power, impacting demand for decorative paints and leading to project delays in industrial sectors.

| Economic Factor | 2024/2025 Outlook | Impact on AkzoNobel |

| Global Growth | IMF projected 3.2% for 2024 | Supports demand for coatings in construction and automotive. |

| Interest Rates | Elevated in early 2024 | Increases borrowing costs, potentially dampens consumer/business spending. |

| Raw Material Costs | Titanium Dioxide up to 15% in early 2024 | Increases production costs, pressures profit margins. |

| Inflation | CPI often >3-5% in 2024 | Raises operational expenses, reduces consumer spending power. |

What You See Is What You Get

Akzo Nobel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Akzo Nobel. This detailed report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into market dynamics and potential challenges and opportunities.

Sociological factors

Consumers worldwide increasingly prioritize sustainability and personal well-being, driving demand for eco-friendly and healthy products. AkzoNobel is responding by focusing on low-VOC and water-based coatings. For instance, their Dulux brand in Europe has seen strong growth in sustainable product lines, reflecting this shift.

Meeting these evolving preferences is vital for AkzoNobel's market position, particularly in decorative paints. By offering solutions that align with consumer values, the company aims to maintain brand relevance and capture market share. This focus on sustainability also supports their broader corporate responsibility goals.

Rapid urbanization, particularly in emerging markets, is a key driver for AkzoNobel. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, a significant jump from 56% in 2021. This trend fuels demand for new residential and commercial construction, directly benefiting AkzoNobel's architectural coatings business as more buildings require painting and finishing.

Demographic shifts also play a crucial role. Aging populations in developed nations might lead to increased demand for renovation and maintenance coatings, while changing household structures, such as smaller families or more single-person households, could influence the types and quantities of paint products purchased. AkzoNobel's ability to adapt its product portfolio and distribution networks to these evolving consumer needs, for example, by offering more convenient application formats or specialized products for smaller spaces, is vital for sustained growth.

The growing DIY culture presents both an opportunity and a challenge for AkzoNobel. In 2024, the global home improvement market was valued at approximately $975 billion, with DIY projects forming a significant portion. This trend encourages consumers to undertake painting tasks themselves, requiring user-friendly products and clear instructions.

Conversely, reliance on professional painters remains strong, particularly in markets with higher disposable incomes and a greater emphasis on quality finishes. In 2025, the professional painting services sector is projected to grow steadily, driven by new construction and renovation projects. AkzoNobel must therefore maintain a dual strategy, offering high-performance coatings for professionals alongside accessible, easy-to-use options for DIY enthusiasts.

Economic conditions heavily influence this balance. During economic slowdowns, like those experienced in parts of Europe in late 2023 and early 2024, DIY spending often increases as consumers seek cost-saving measures. However, as economies recover and disposable incomes rise, as seen in North America during the same period with a 4% increase in consumer spending on home services, the demand for professional painting services tends to rebound, impacting AkzoNobel's sales channels and product mix accordingly.

Workforce Skills and Labor Availability

The availability of skilled labor, particularly chemists, engineers, and manufacturing specialists, is paramount for AkzoNobel's capacity to innovate, produce efficiently, and deliver robust technical support. Societal shifts in educational focus and vocational training directly shape this talent pool.

Attracting and retaining these essential employees is not just beneficial, but critical for AkzoNobel to maintain its competitive standing and ensure smooth, effective operations. For instance, in 2024, the demand for specialized chemical engineers in Europe saw a notable increase, with some reports indicating a 15% rise in job openings compared to the previous year.

- Skilled Workforce Needs: AkzoNobel relies on a deep bench of chemists, engineers, and production staff for R&D, manufacturing, and customer service.

- Societal Influences: Trends in education, apprenticeships, and the willingness of people to relocate for work directly impact the availability of qualified candidates.

- Talent Competition: In 2024, the global competition for top engineering talent intensified, with companies like AkzoNobel needing to offer competitive compensation and development opportunities to secure skilled professionals.

- Retention Strategies: Proactive measures in employee development and workplace culture are key to retaining the expertise needed for sustained operational excellence.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are on the rise, compelling companies like AkzoNobel to actively showcase ethical operations, fair labor practices, and meaningful community involvement. For instance, AkzoNobel's 2023 Sustainability Report highlighted a 20% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2018, demonstrating progress in environmental stewardship.

Strong CSR performance directly bolsters brand image and cultivates customer loyalty, while also attracting investors keen on socially responsible enterprises. In 2024, surveys indicated that over 70% of consumers consider a company's sustainability efforts when making purchasing decisions.

Conversely, failing to meet these evolving expectations can result in significant reputational harm and negative consumer reactions. A notable example in the industry saw a competitor face widespread criticism and boycotts in 2023 due to alleged poor labor conditions, leading to a substantial dip in their market share.

- Ethical Business Practices: AkzoNobel's commitment to ethical sourcing and transparent operations is crucial for maintaining stakeholder trust.

- Fair Labor Standards: Ensuring fair wages and safe working conditions across its global supply chain is a key societal demand.

- Community Engagement: Active participation in local communities through various initiatives builds goodwill and social license to operate.

- Socially Conscious Investing: Companies with robust CSR profiles are increasingly favored by a growing segment of the investment community.

Societal trends significantly influence AkzoNobel's operations, from consumer demand for sustainable products to the availability of a skilled workforce. The growing emphasis on corporate social responsibility (CSR) also shapes brand perception and investor relations, with consumers increasingly factoring ethical practices into their purchasing decisions.

AkzoNobel's ability to attract and retain talent, particularly in specialized fields like chemical engineering, is critical for innovation and production. The company must navigate evolving educational landscapes and intense competition for skilled professionals to maintain its operational excellence.

The increasing demand for eco-friendly and healthy products, driven by consumer awareness, directly impacts AkzoNobel's product development and marketing strategies. For example, the strong growth of sustainable product lines within brands like Dulux in Europe underscores this shift.

| Societal Factor | Impact on AkzoNobel | 2024/2025 Data/Trend |

|---|---|---|

| Consumer Demand for Sustainability | Drives demand for eco-friendly coatings. | Over 70% of consumers consider sustainability in purchasing (2024 survey). |

| Skilled Workforce Availability | Crucial for R&D, production, and technical support. | 15% rise in demand for chemical engineers in Europe (2024). |

| Corporate Social Responsibility (CSR) | Enhances brand image and investor appeal. | AkzoNobel reduced Scope 1 & 2 emissions by 20% (vs. 2018) by 2023. |

| DIY Culture | Creates opportunities for user-friendly products. | Global home improvement market valued at $975 billion (2024). |

Technological factors

Technological advancements are a major driver for AkzoNobel, particularly in the development of sustainable coatings. Innovations like low-VOC (Volatile Organic Compounds) and bio-based formulations are crucial for meeting increasingly stringent environmental regulations and growing consumer demand for eco-friendly products. For instance, AkzoNobel's commitment to sustainability is reflected in its target to derive 50% of its revenue from sustainable solutions by 2030.

Furthermore, research into high-performance coatings is vital for AkzoNobel to maintain its competitive edge. These advanced coatings offer enhanced durability, superior corrosion resistance, and specialized functionalities such as self-cleaning or anti-microbial properties, which are highly valued in demanding industrial sectors. The company's investment in R&D, which was €282 million in 2023, underpins its ability to pioneer these next-generation products.

The coatings industry is increasingly embracing Industry 4.0, with automation, AI, and IoT reshaping manufacturing. AkzoNobel is well-positioned to benefit from these advancements, enhancing production efficiency and quality control.

By integrating these digital tools, AkzoNobel can achieve significant cost savings through waste reduction and optimized resource management. Predictive maintenance, a key aspect of Industry 4.0, will also bolster operational uptime and responsiveness.

Technological progress in how coatings are applied is significantly impacting the industry. Innovations like robotic painting systems and electrostatic spraying are boosting efficiency and reducing waste, which is crucial for companies like AkzoNobel. For instance, the global robotic painting market was valued at approximately $6.5 billion in 2023 and is projected to grow substantially, indicating a strong trend towards automation.

These advancements not only improve the quality of the finish but also lead to lower material consumption, a key cost-saving factor. AkzoNobel needs to actively monitor and potentially adopt these new application technologies to maintain its competitive edge. Integrating these into customer solutions or promoting best practices can unlock new market segments and create a distinct advantage.

Data Analytics and Customer Insights

The surge in available data and sophisticated analytical tools empowers AkzoNobel to uncover granular customer behavior, emerging market trends, and efficiency in its operations. For example, AkzoNobel's 2023 sustainability report highlighted improved resource efficiency by 7% through data-driven process optimization, demonstrating the tangible benefits of these technological advancements.

By harnessing big data, AkzoNobel can refine its product innovation pipeline, sharpen marketing campaigns for better engagement, elevate customer support, and achieve more accurate demand predictions. This strategic use of data directly influences key business decisions and pinpoints avenues for expansion.

- Data Analytics for Customer Understanding: AkzoNobel utilizes advanced analytics to segment its customer base, understanding preferences for specific paint formulations and color trends, leading to more targeted product development.

- Operational Efficiency through Data: The company leverages real-time data from manufacturing plants to monitor energy consumption and waste generation, aiming for continuous improvement in its environmental footprint, as evidenced by its 2023 performance metrics.

- Predictive Demand Forecasting: By analyzing historical sales data, economic indicators, and even weather patterns, AkzoNobel improves its ability to forecast demand for its diverse product range across different regions, optimizing inventory management.

- Personalized Marketing Strategies: Insights derived from customer interactions and purchase history enable AkzoNobel to tailor marketing messages and promotions, enhancing customer loyalty and conversion rates.

Nanotechnology and Smart Coatings Development

Nanotechnology is a game-changer, paving the way for smart coatings with remarkable abilities like self-healing, temperature control, and built-in sensors. AkzoNobel's commitment to nanotechnology research, evidenced by its ongoing R&D investments, positions it to develop cutting-edge products with unique functionalities. This focus is crucial for tapping into new, high-value market segments.

These advancements in material science offer AkzoNobel a distinct competitive edge. For instance, the development of coatings that can repair minor damage automatically reduces maintenance costs for end-users and enhances product longevity. This technological leap can translate directly into increased market share and new revenue streams.

- Smart Coatings: Nanoparticles enable coatings with self-healing, anti-corrosion, and antimicrobial properties.

- R&D Investment: AkzoNobel's 2024 R&D budget allocated significant portions to advanced materials, including nanotechnology.

- Market Potential: The global smart coatings market was valued at over $10 billion in 2023 and is projected to grow significantly by 2030.

- Competitive Advantage: Innovations in nanotechnology can lead to premium-priced products and differentiate AkzoNobel from competitors.

Technological advancements are fundamentally reshaping the coatings industry, driving AkzoNobel's focus on sustainable and high-performance products. Innovations in low-VOC and bio-based formulations are key to meeting environmental regulations and consumer demand, with AkzoNobel targeting 50% of revenue from sustainable solutions by 2030.

The company's 2023 R&D investment of €282 million fuels the development of advanced coatings offering superior durability and specialized functionalities, crucial for maintaining a competitive edge in demanding sectors.

Embracing Industry 4.0, AkzoNobel is integrating automation, AI, and IoT to boost manufacturing efficiency and quality control. This digital transformation is expected to yield cost savings through waste reduction and optimized resource management, with predictive maintenance enhancing operational uptime.

Furthermore, advancements in application technologies, such as robotic painting systems, are increasing efficiency and reducing material waste. The global robotic painting market, valued at approximately $6.5 billion in 2023, highlights the industry's shift towards automation.

Data analytics is another critical technological factor, enabling AkzoNobel to gain granular insights into customer behavior and market trends. The company's 2023 sustainability report noted a 7% improvement in resource efficiency through data-driven process optimization, showcasing the tangible benefits of these tools.

Nanotechnology is enabling the creation of smart coatings with self-healing and temperature-regulating properties, offering AkzoNobel a pathway to premium-priced, differentiated products. The global smart coatings market exceeded $10 billion in 2023, underscoring the significant market potential for these innovations.

| Technology Area | AkzoNobel Focus/Impact | Key Data/Stat |

|---|---|---|

| Sustainable Formulations | Low-VOC, bio-based coatings | Target: 50% revenue from sustainable solutions by 2030 |

| High-Performance Coatings | Enhanced durability, corrosion resistance | 2023 R&D Investment: €282 million |

| Industry 4.0 | Automation, AI, IoT in manufacturing | Robotic Painting Market (2023): ~$6.5 billion |

| Data Analytics | Customer insights, operational efficiency | 2023 Resource Efficiency Improvement: 7% |

| Nanotechnology | Smart coatings (self-healing, etc.) | Smart Coatings Market (2023): >$10 billion |

Legal factors

AkzoNobel navigates a complex web of global environmental regulations, with key areas including volatile organic compound (VOC) emissions, hazardous waste management, and chemical safety, exemplified by Europe's REACH framework. These regulations necessitate substantial investments in research and development for sustainable product formulations and upgraded waste treatment infrastructure.

Failure to adhere to these environmental mandates can result in severe financial penalties, protracted legal battles, and significant damage to the company's public image, underscoring the critical importance of robust compliance strategies.

Product safety and labeling laws are paramount for AkzoNobel, ensuring its diverse chemical and coatings portfolio adheres to stringent health and safety benchmarks. Regulations like the EU's CLP (Classification, Labelling and Packaging) and similar global frameworks dictate precise classification, packaging, and labeling requirements. For instance, in 2023, AkzoNobel reported significant investment in product stewardship, aligning with evolving safety standards to prevent product recalls and maintain robust consumer and industrial trust.

AkzoNobel operates within a framework of stringent competition and antitrust laws across its global markets. These regulations are designed to foster a level playing field by prohibiting monopolistic behavior, price collusion, and other anti-competitive actions that could harm consumers and market fairness.

Failure to comply with these laws can lead to severe repercussions, including hefty fines and potential forced divestitures of business units. For instance, in 2023, the European Commission fined several companies a total of €1.1 billion for participating in cartels, highlighting the significant financial risks associated with antitrust violations.

AkzoNobel's commitment to adhering to these regulations is crucial for maintaining its market standing and financial stability. The company actively monitors and adapts its business practices to ensure compliance, thereby mitigating risks associated with regulatory scrutiny and potential legal challenges in its diverse operating regions.

Labor and Employment Laws

AkzoNobel must navigate a complex web of labor and employment laws across its worldwide operations, affecting everything from fair wages and safe working conditions to preventing discrimination and managing union relationships. For instance, in 2024, the company continues to adapt its human resources strategies to comply with evolving regulations in key markets like the EU, which emphasizes worker rights and diversity mandates.

The significant differences in labor legislation from one country to another mean AkzoNobel needs to develop and implement distinct HR policies for each region. This ensures compliance with local statutes, such as those governing collective bargaining agreements in Germany or specific employment termination procedures in the United States.

Failure to adhere to these varied legal requirements can result in costly labor disputes, potential lawsuits, and significant damage to AkzoNobel's employee relations and overall corporate reputation. For example, a 2023 labor tribunal ruling against a multinational in a similar sector highlighted the financial and reputational risks associated with inadequate compliance.

- Global Compliance Burden: AkzoNobel faces the challenge of adhering to a multitude of national and regional labor laws, impacting its workforce management strategies.

- Regional Policy Adaptation: Variations in laws concerning minimum wage, working hours, and employee benefits necessitate localized HR practices.

- Reputational and Financial Risks: Non-compliance can lead to legal penalties, strikes, and a negative impact on the company's image and employee morale.

Intellectual Property Rights and Patent Protection

AkzoNobel's competitive edge relies heavily on protecting its intellectual property, particularly patents for novel paint formulations and advanced manufacturing techniques. The company actively manages a global portfolio of patents, which is crucial for maintaining its market position and recouping research and development expenditures.

Navigating diverse international legal landscapes for intellectual property is a constant challenge. AkzoNobel must implement comprehensive strategies for patent filing, vigilant enforcement against potential infringements, and robust defense mechanisms to protect its innovations worldwide.

- Global Patent Portfolio: AkzoNobel holds thousands of active patents across various jurisdictions, safeguarding its proprietary technologies.

- R&D Investment Protection: In 2023, AkzoNobel invested €268 million in R&D, underscoring the importance of patent protection for these investments.

- Infringement Monitoring: The company employs dedicated legal teams to monitor markets for potential patent violations and take appropriate action.

AkzoNobel is subject to various legal frameworks governing its operations, including those related to product safety, environmental impact, and fair competition. The company's adherence to regulations such as REACH in Europe and similar global standards for chemical classification and labeling is critical for market access and consumer trust.

Antitrust laws are particularly significant, aiming to prevent monopolistic practices and ensure a level playing field. Violations can result in substantial fines, as evidenced by large cartel penalties levied by authorities like the European Commission in 2023.

Furthermore, AkzoNobel must navigate diverse labor laws globally, impacting everything from wages to working conditions, with ongoing adaptation to evolving worker rights mandates in 2024.

Intellectual property protection is also a key legal concern, with AkzoNobel investing heavily in R&D, evidenced by its €268 million investment in 2023, and actively managing its global patent portfolio to safeguard innovations.

| Legal Area | Key Regulations/Frameworks | Impact on AkzoNobel | Recent Data/Examples |

|---|---|---|---|

| Environmental | REACH, VOC Emission Standards | R&D investment, waste management upgrades | Compliance with evolving global environmental mandates |

| Product Safety & Labeling | CLP (EU), GHS | Precise classification, packaging, labeling | Significant investment in product stewardship in 2023 |

| Competition & Antitrust | EU antitrust regulations | Prohibition of monopolistic behavior, price collusion | €1.1 billion in cartel fines by European Commission in 2023 |

| Labor & Employment | National labor laws (e.g., Germany, US) | Fair wages, safe conditions, non-discrimination | Adapting HR strategies to EU diversity mandates in 2024 |

| Intellectual Property | Patent laws, IP enforcement | Protection of formulations, manufacturing techniques | €268 million R&D investment in 2023 |

Environmental factors

AkzoNobel is actively working to shrink its environmental impact, with a strong focus on reducing its carbon footprint. This involves a multi-pronged approach, covering everything from how they get their materials to how their products are used and eventually disposed of.

A key part of this strategy is shifting towards renewable energy sources for their operations. For instance, by the end of 2023, AkzoNobel had achieved 70% renewable electricity usage in Europe, a significant step towards their goal of 100% by 2030. They are also investing in making their manufacturing processes more energy-efficient, aiming to cut energy consumption by 30% by 2030 compared to a 2018 baseline.

Furthermore, AkzoNobel is developing innovative products that help their customers lower their own emissions. This includes paints and coatings that enhance building insulation or reduce the energy needed for transportation. Their commitment to these initiatives is not just about environmental responsibility; it’s central to their long-term business plan and how the company is perceived by stakeholders.

The increasing scarcity of key raw materials, especially those tied to fossil fuels, is a significant environmental challenge for AkzoNobel. This pushes the company to actively seek out and integrate more sustainable alternatives into its product lines. For instance, by 2024, the demand for critical minerals used in some coatings is projected to rise significantly, making sourcing more complex.

Embracing circular economy principles is becoming crucial. This means AkzoNobel is focusing on creating products that last longer, are easier to recycle at the end of their life, and incorporate a higher percentage of bio-based or recycled materials. This strategic shift helps reduce dependence on newly extracted resources and builds greater resilience against potential supply chain disruptions.

Water scarcity and quality are significant environmental challenges that directly affect AkzoNobel's production and the well-being of surrounding communities. In 2023, the company reported a 10% reduction in freshwater withdrawal intensity across its operations, demonstrating a commitment to efficient water use.

To address these concerns, AkzoNobel is focused on implementing comprehensive water management plans. These include strategies for reducing water consumption in its manufacturing facilities and ensuring effective treatment of wastewater before discharge. Their 2024 sustainability report highlights investments in advanced wastewater treatment technologies, aiming for a 15% improvement in water quality parameters by 2025.

Adhering to stringent wastewater discharge regulations is paramount for AkzoNobel. Non-compliance can lead to substantial fines and jeopardize operational permits. The company actively monitors its discharge levels, striving to meet or exceed the standards set by regulatory bodies in the regions where it operates, such as the European Union's Water Framework Directive.

Biodiversity Loss and Ecosystem Protection

AkzoNobel's extensive operations and global supply chain, from sourcing raw materials to manufacturing, inevitably interact with natural environments, potentially impacting biodiversity through land use and resource extraction. For instance, the sourcing of certain natural ingredients for paints and coatings, while vital, can exert pressure on ecosystems if not managed sustainably. The company's manufacturing sites also occupy land, necessitating responsible management to minimize local ecological disruption.

There's a growing global imperative for businesses to demonstrate tangible commitment to protecting and restoring natural ecosystems, a trend amplified by organizations like the UN Convention on Biological Diversity. Stakeholders, including investors and consumers, are increasingly demanding transparency and action regarding a company's ecological footprint. This heightened scrutiny means AkzoNobel faces expectations to actively assess and mitigate its influence on biodiversity.

To address these concerns, AkzoNobel is expected to implement strategies such as adopting sustainable sourcing practices for its raw materials, ensuring that suppliers adhere to biodiversity protection standards. Furthermore, responsible land management at its own facilities, including habitat restoration initiatives where feasible, becomes crucial. For example, in 2023, reports indicated a growing number of companies setting biodiversity targets, with some aiming for nature-positive operations by 2030, reflecting the urgency of this environmental factor.

- Supply Chain Impact: AkzoNobel's reliance on natural raw materials means its supply chain can affect biodiversity through land use changes and resource depletion.

- Stakeholder Expectations: Investors and consumers are increasingly pressuring companies to take responsibility for protecting and restoring natural ecosystems.

- Mitigation Strategies: The company is expected to implement sustainable sourcing and responsible land management practices to reduce its biodiversity impact.

- Industry Trends: A growing number of companies are setting ambitious biodiversity targets, aiming for nature-positive operations by 2030, underscoring the evolving corporate responsibility landscape.

Waste Management and Product End-of-Life

AkzoNobel faces considerable environmental hurdles in managing manufacturing waste and the ultimate fate of its products. A key focus is on reducing waste from production, encouraging the recycling of paint containers and leftover paint, and innovating products designed for simpler disposal or recycling.

The company's sustainability report for 2023 highlighted a 6% reduction in waste intensity compared to 2022. AkzoNobel aims to further improve this through initiatives like their 'PaintBack' program, which facilitated the collection of over 1 million kilograms of used paint and packaging in Europe during 2023.

Effective waste management not only lessens the ecological footprint but also boosts operational efficiency by optimizing resource utilization. For instance, by embracing circular economy principles, AkzoNobel is exploring ways to incorporate recycled content into new paint formulations, aiming for 50% of its raw materials to be sourced from recycled or renewable origins by 2030.

- Waste Reduction: AkzoNobel's 2023 performance showed a 6% decrease in waste intensity, demonstrating progress in minimizing production waste.

- Product End-of-Life: Initiatives like the 'PaintBack' program collected over 1 million kilograms of used paint and packaging in Europe in 2023, addressing product disposal.

- Circular Economy Goals: The company is targeting 50% recycled or renewable raw material sourcing by 2030, integrating circularity into product development.

- Resource Efficiency: Implementing robust waste management strategies directly contributes to enhanced resource efficiency and reduced environmental impact.

AkzoNobel is actively addressing environmental challenges, including reducing its carbon footprint and increasing renewable energy use. By the end of 2023, 70% of their European electricity was renewable, and they aim for 100% by 2030. The company is also enhancing energy efficiency, targeting a 30% reduction in energy consumption by 2030 against a 2018 baseline.

Raw material scarcity, particularly for fossil fuel-based components, drives AkzoNobel to seek sustainable alternatives. By 2024, demand for critical minerals in coatings is projected to rise, complicating sourcing. Embracing circular economy principles, the company focuses on product longevity, recyclability, and incorporating bio-based or recycled materials to reduce reliance on virgin resources.

Water management is critical, with AkzoNobel reporting a 10% reduction in freshwater withdrawal intensity in 2023. They are investing in advanced wastewater treatment, aiming for a 15% improvement in water quality parameters by 2025, all while adhering to strict discharge regulations.

Biodiversity protection is a growing focus, with AkzoNobel expected to adopt sustainable sourcing and responsible land management. Stakeholder pressure for transparency on ecological impact is increasing, mirroring industry trends where many companies aim for nature-positive operations by 2030.

| Environmental Factor | AkzoNobel's Action/Target | Data Point/Year |

| Renewable Electricity | 70% usage in Europe | End of 2023 |

| Energy Efficiency | 30% reduction target | By 2030 (vs. 2018 baseline) |

| Waste Intensity | 6% reduction | 2023 (vs. 2022) |

| Recycled/Renewable Materials | 50% sourcing target | By 2030 |

| Used Paint Collection | Over 1 million kg collected | Europe, 2023 |

| Freshwater Withdrawal | 10% reduction in intensity | 2023 |

| Wastewater Quality Improvement | 15% target | By 2025 |

PESTLE Analysis Data Sources

Our Akzo Nobel PESTLE Analysis is meticulously crafted using data from reputable sources including the World Bank, OECD, and leading market research firms. We integrate economic indicators, environmental regulations, and technological advancements to provide a comprehensive view.