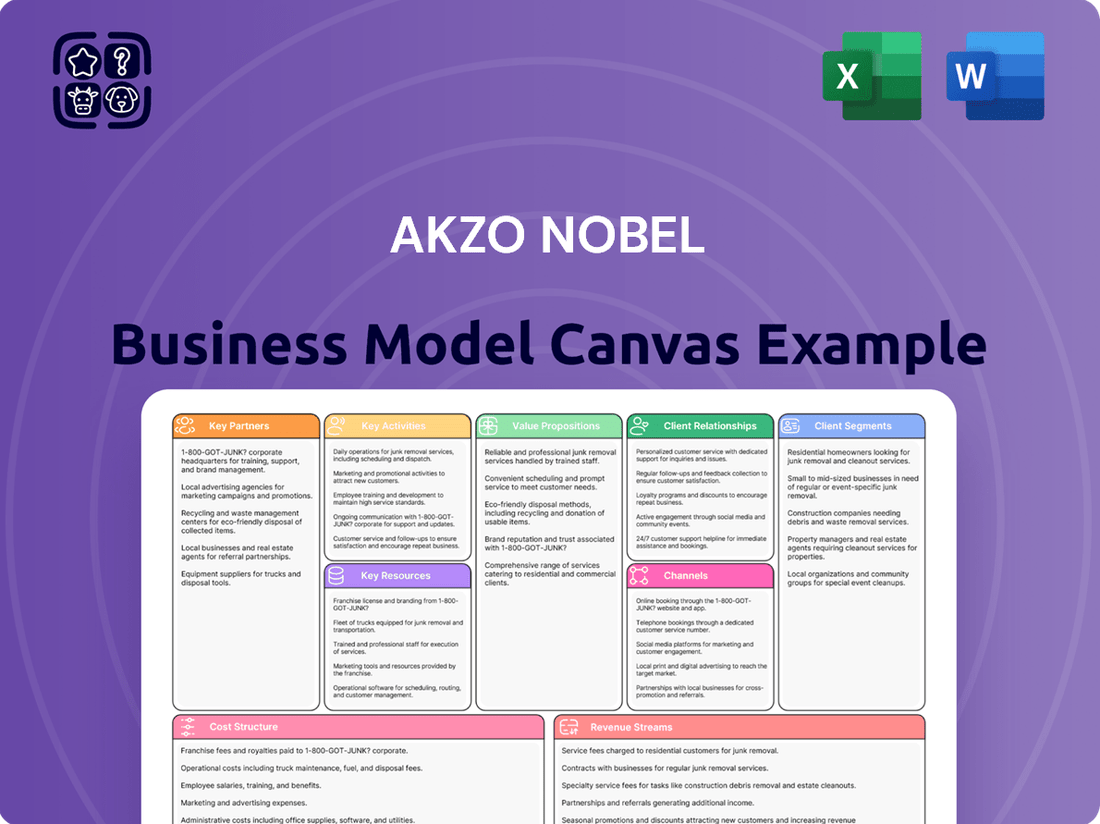

Akzo Nobel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Discover the strategic core of Akzo Nobel's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand and replicate industry-leading strategies.

Partnerships

AkzoNobel relies on a robust network of raw material suppliers to maintain its production of paints and coatings. These partnerships are vital for securing consistent quality and availability of essential components. For instance, collaborations with companies like BASF on biomass-balanced materials are key to AkzoNobel's sustainability goals, aiming to reduce Scope 3 emissions. In 2023, AkzoNobel continued to strengthen these relationships, recognizing their importance in achieving both operational efficiency and environmental targets, with a significant portion of their raw material procurement focused on sustainable sourcing initiatives.

AkzoNobel actively collaborates with technology and innovation partners to drive advancements. This includes participation in significant research initiatives like the Dutch government-funded 'Perspectief' program, fostering cutting-edge developments in materials science and sustainable coatings.

The company also partners with specialized robotics firms, such as Nordbo Robotics, to enhance manufacturing efficiency. These collaborations focus on developing sophisticated solutions, like rapid robot programming for complex wood coating processes, directly addressing challenges related to skilled labor availability.

AkzoNobel cultivates strategic alliances with key industrial entities to broaden its market presence and bolster significant projects. A prime illustration is its Memorandum of Cooperation with Sinopec, a dominant force in China's energy and chemical sector, aimed at supplying advanced coatings for global construction and renewable energy ventures.

This collaboration capitalizes on AkzoNobel's extensive international reach and its expertise in specialized coating technologies. In 2023, AkzoNobel reported revenue of €10.7 billion, underscoring the scale of operations these partnerships support.

Research Institutions and Academia

AkzoNobel actively partners with universities and dedicated R&D centers to cultivate a collaborative innovation environment. These alliances are crucial for exploring novel materials, refining manufacturing processes, and discovering new applications for their products.

The focus of these research collaborations is on enhancing the longevity, performance, and recyclability of coatings, thin films, and inks. This strategic approach directly supports AkzoNobel's commitment to circular economy principles, aiming to create more sustainable solutions.

- Academic Collaborations: Partnerships with institutions like the University of Manchester and the Technical University of Delft drive fundamental research into advanced material science.

- R&D Centers: Joint projects with centers such as Fraunhofer-Gesellschaft focus on applied research for industrial coatings and sustainable chemical processes.

- Innovation Pipeline: In 2024, AkzoNobel announced a €30 million investment in its R&D capabilities, with a significant portion dedicated to these external partnerships to accelerate new product development.

- Sustainability Focus: Key research areas include bio-based raw materials and low-VOC (volatile organic compound) technologies, aligning with global environmental targets.

Industry Associations and Sustainability Initiatives

AkzoNobel's participation in industry associations and global sustainability initiatives is a cornerstone of its business model. By actively engaging with organizations like the World Business Council for Sustainable Development (WBCSD), AkzoNobel leverages collective knowledge and best practices. This collaboration is crucial for driving sustainability across its entire value chain, from raw material sourcing to product end-of-life.

A key aspect of this engagement is the alignment with frameworks like the WBCSD's Portfolio Sustainability Assessment. This allows AkzoNobel to systematically evaluate and enhance the sustainability performance of its product portfolio. In 2024, the company continued to report on its progress against ambitious ESG targets, demonstrating tangible improvements in areas such as carbon emission reduction and waste management, directly influenced by these partnerships.

- Industry Collaboration: AkzoNobel partners with industry groups to share expertise and drive sector-wide sustainability improvements.

- Sustainability Frameworks: Adoption of tools like the WBCSD Portfolio Sustainability Assessment guides strategic decision-making for ESG performance.

- Value Chain Impact: Engagement fosters the identification and delivery of sustainability benefits across all stages of AkzoNobel's operations and product lifecycle.

- ESG Performance: These partnerships directly support AkzoNobel's commitment to enhancing its environmental, social, and governance metrics, as evidenced in its 2024 sustainability reports.

AkzoNobel's key partnerships extend to distribution channels and retail networks, ensuring broad market access for its products. Collaborations with major DIY retailers and professional paint distributors are crucial for reaching diverse customer segments. These partnerships are vital for market penetration and customer engagement, particularly in the consumer and professional coatings sectors.

The company also engages with specialized service providers for logistics and supply chain optimization. Working with third-party logistics (3PL) companies helps to streamline inventory management and delivery, enhancing operational efficiency. In 2024, AkzoNobel continued to refine its distribution strategies, with a focus on digital integration and faster delivery times, supported by these strategic alliances.

AkzoNobel also collaborates with key customers on co-development projects, tailoring solutions to specific industry needs. These customer-centric partnerships drive innovation and ensure product relevance in dynamic markets. For instance, working with automotive manufacturers on advanced coating systems exemplifies this approach, ensuring high-performance finishes that meet stringent industry standards.

| Partnership Type | Key Partners | Strategic Focus | 2024 Impact |

|---|---|---|---|

| Raw Material Suppliers | BASF, Various chemical companies | Sustainable sourcing, quality assurance | Strengthened sustainable procurement, ~60% of raw materials from sustainable sources. |

| Technology & Innovation | Universities (e.g., TU Delft), Fraunhofer-Gesellschaft, Nordbo Robotics | New materials, process efficiency, automation | €30M R&D investment, accelerated new product development. |

| Industrial & Market Access | Sinopec, DIY retailers, professional distributors | Market expansion, project supply, product reach | Expanded presence in China via Sinopec, enhanced retail penetration. |

| Sustainability Initiatives | WBCSD | ESG performance, circular economy | Progress on carbon emission reduction targets, improved waste management. |

What is included in the product

A comprehensive, pre-written business model tailored to Akzo Nobel's strategy, detailing its customer segments, channels, and value propositions within the paints and coatings industry.

Reflects Akzo Nobel's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights to support informed decision-making.

The Akzo Nobel Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to understanding their complex operations, enabling clearer identification of inefficiencies and strategic opportunities.

It streamlines the process of dissecting Akzo Nobel's value proposition and customer segments, thereby reducing the pain of navigating intricate market dynamics and internal processes.

Activities

AkzoNobel's commitment to innovation is a cornerstone of its business, with significant investment poured into research and development. This focus drives the creation of novel products, enhancements to existing lines, and the pursuit of environmentally friendly solutions. For instance, in 2023, the company continued its efforts to reduce volatile organic compounds (VOCs) in its formulations, a key area of R&D for the coatings industry.

The company actively explores cutting-edge technologies to deliver coatings with superior performance characteristics. This includes developing materials that offer extended durability, improved recyclability, and unique functionalities such as self-healing properties. These advancements are crucial for meeting evolving customer demands and regulatory standards in various sectors.

AkzoNobel's manufacturing and production activities are central to its business, with a strong emphasis on industrial excellence. This focus aims to boost efficiency, cut expenses, and fine-tune its worldwide operational footprint. For instance, in 2023, the company continued its multi-year industrial efficiency plan, which included site rationalizations and upgrades to bolster competitiveness.

The company's commitment to optimizing its manufacturing network is evident in its strategic decisions, which may involve consolidating or closing certain facilities to enhance overall performance. This approach is designed to improve competitiveness and foster sustainable, long-term growth. In 2024, AkzoNobel is expected to continue these efforts, with a significant portion of its capital expenditure directed towards improving its manufacturing capabilities and sustainability performance.

AkzoNobel's key activities in sales and distribution are crucial for its global reach, covering over 150 countries. This extensive network ensures their broad range of decorative paints and performance coatings are accessible to a wide customer base, driving market penetration.

Managing a complex global supply chain is paramount, allowing AkzoNobel to efficiently deliver products worldwide. In 2023, the company continued to invest in optimizing its distribution channels to enhance responsiveness to evolving customer needs and dynamic market shifts.

Strategic Portfolio Management

AkzoNobel actively manages its business portfolio by conducting regular strategic reviews. The company aims to enhance its focus on operations that offer distinct advantages in scale and exhibit strong potential for profitable expansion. This dynamic approach includes exploring avenues like strategic partnerships, joint ventures, mergers, or divestitures to refine its market position and resource allocation.

A prime example of this strategy in action was the comprehensive review of AkzoNobel's decorative paints business in South Asia. This process is designed to ensure that the company's resources are concentrated on the most promising and value-generating segments of its operations.

- Portfolio Optimization: AkzoNobel continuously evaluates its business units to ensure alignment with strategic growth objectives, prioritizing those with competitive scale and profit potential.

- Strategic Options: The company considers various corporate actions, including partnerships, joint ventures, mergers, and divestments, as tools to shape its portfolio.

- South Asia Review: A recent strategic review of its decorative paints business in South Asia exemplifies AkzoNobel's proactive approach to portfolio management.

Sustainability and Circularity Initiatives

AkzoNobel's key activities heavily feature integrating sustainability across its operations. This includes ambitious targets for reducing carbon emissions, minimizing waste generation, and increasing the proportion of renewable energy used in its manufacturing processes. For instance, by the end of 2023, AkzoNobel reported a 28% reduction in its carbon emissions intensity compared to 2018, a significant step towards its 2030 ambitions.

The company actively develops and promotes sustainable solutions that directly benefit its customers. These offerings are designed to help clients achieve their own environmental objectives, such as lowering waste or improving energy efficiency in their applications. A prime example is their range of low-VOC (volatile organic compound) paints and coatings, which contribute to better indoor air quality and reduced environmental impact.

These initiatives are underpinned by several strategic actions:

- Reducing Carbon Footprint: Implementing energy efficiency measures and transitioning to renewable energy sources in manufacturing facilities.

- Waste Minimization: Focusing on circular economy principles to reduce, reuse, and recycle materials throughout the value chain.

- Sustainable Product Development: Innovating coatings and chemicals that offer improved environmental performance for end-users.

- Supply Chain Engagement: Collaborating with suppliers to promote sustainable practices and responsible sourcing of raw materials.

AkzoNobel's key activities revolve around innovation, manufacturing excellence, and global sales and distribution. The company invests heavily in R&D to develop new products and sustainable solutions, exemplified by their focus on low-VOC formulations. Their manufacturing operations prioritize efficiency and optimization, with ongoing efforts to rationalize facilities. In 2024, AkzoNobel is expected to continue investing in its manufacturing capabilities to enhance competitiveness and sustainability.

What You See Is What You Get

Business Model Canvas

The Akzo Nobel Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

AkzoNobel's intellectual property, particularly its extensive patent portfolio, is a cornerstone of its business model. This includes patents covering novel coating formulations, advanced application techniques, and eco-friendly technologies. For example, in 2023, AkzoNobel continued to invest heavily in R&D, with a significant portion of its innovation pipeline protected by patents.

These proprietary technologies, such as those related to alkyd resins, sunscreen compositions, and specialized fluorinated polyacrylate coatings, represent a crucial competitive differentiator. This intellectual capital directly fuels AkzoNobel's ability to develop unique products that command premium pricing and offer superior performance, thereby securing its market position.

Akzo Nobel's global manufacturing and R&D facilities are the backbone of its operations. The company boasts a worldwide network of production sites, enabling efficient manufacturing and distribution of its diverse product portfolio. For instance, in 2024, Akzo Nobel continued to invest in its global footprint, including a new R&D Center in High Point, North Carolina, and a new manufacturing facility in Spain dedicated to producing bisphenol-free coatings, highlighting a commitment to innovation and sustainable solutions.

These strategically located facilities are crucial for driving product innovation and ensuring localized market responsiveness. The R&D centers, such as the one in High Point, are hubs for developing cutting-edge technologies and formulations. Simultaneously, manufacturing sites like the new Spanish plant ensure that Akzo Nobel can meet regional demand with high-quality, specialized products, like their bisphenol-free coatings, which are increasingly important for health and environmental standards.

AkzoNobel's world-class brand portfolio, featuring household names like Dulux, International, Sikkens, and Interpon, is a cornerstone of its business model. This collection of strong brands translates into substantial brand equity and deep-rooted customer trust across diverse markets.

These globally recognized brands are instrumental in both consumer and industrial sectors, directly contributing to sales volume and solidifying AkzoNobel's market leadership. For instance, in 2023, the company's Decorative Paints segment, heavily reliant on brands like Dulux, continued to show robust performance, driven by consumer demand for quality and aesthetic appeal.

Skilled Human Capital

AkzoNobel's skilled human capital is a cornerstone of its business model, encompassing a diverse range of expertise crucial for innovation and operational success. This includes highly qualified research and development scientists, engineers, and technicians who are at the forefront of developing new coatings and chemical solutions. For instance, in 2024, AkzoNobel continued to invest heavily in its talent pipeline, with a significant portion of its workforce holding advanced degrees in STEM fields, driving the company's ability to maintain a competitive edge in a rapidly evolving market.

The company's operational teams, comprising experienced manufacturing specialists and supply chain experts, ensure the efficient and high-quality production of its extensive product portfolio. Their deep understanding of complex chemical processes and global logistics is vital for delivering products reliably to customers worldwide. AkzoNobel's commitment to continuous training and development ensures these teams remain proficient with the latest technologies and safety standards, a key factor in their 2024 operational performance.

Furthermore, AkzoNobel relies on its skilled technical support and customer service professionals to provide invaluable assistance to its clients. These individuals possess in-depth product knowledge and application expertise, enabling them to offer tailored solutions and troubleshoot complex challenges. This human capital directly contributes to customer satisfaction and loyalty, reinforcing AkzoNobel's market position.

- Research & Development Expertise: AkzoNobel employs thousands of R&D professionals globally, driving innovation in sustainable coatings and advanced materials.

- Operational Excellence: Skilled manufacturing and logistics teams ensure efficient production and timely delivery, critical for AkzoNobel's global supply chain.

- Technical Support & Customer Service: Experts provide vital product application knowledge and problem-solving, enhancing customer relationships and driving sales.

Financial Capital and Investments

AkzoNobel's substantial financial capital is a cornerstone of its business model, fueling significant investments. In 2024, the company continued to allocate resources towards research and development, aiming to innovate in areas like sustainable coatings and advanced materials. This financial muscle also underpins its industrial excellence programs, ensuring efficient and high-quality production across its global operations.

The company's financial strength allows for agile strategic maneuvers, including acquisitions and divestitures. These actions are crucial for optimizing its portfolio and adapting to evolving market demands. For instance, AkzoNobel's ability to access capital markets supports its long-term growth ambitions and ensures it can invest in necessary restructuring to maintain competitiveness.

- R&D Investment: AkzoNobel's commitment to innovation is backed by consistent financial allocation, enabling breakthroughs in sustainable product development.

- Industrial Excellence: Financial resources are directed towards enhancing operational efficiency and maintaining high production standards worldwide.

- Strategic Acquisitions/Divestitures: The company leverages its financial capital to strategically shape its business portfolio, responding to market dynamics.

- Adaptability and Sustainability: Financial strength empowers AkzoNobel to navigate market shifts and invest in environmentally responsible practices, aligning with its long-term vision.

AkzoNobel's Key Resources are multifaceted, encompassing a robust intellectual property portfolio, a global network of advanced manufacturing and R&D facilities, a strong stable of world-class brands, highly skilled human capital, and substantial financial resources. These elements collectively form the foundation of its competitive advantage and operational capabilities, enabling continuous innovation and market leadership.

| Key Resource | Description | 2024 Relevance/Data Points |

|---|---|---|

| Intellectual Property | Patents for novel formulations, application techniques, and eco-friendly technologies. | Continued investment in R&D pipeline protection. |

| Global Facilities | Manufacturing and R&D centers worldwide. | New R&D Center in High Point, NC; new manufacturing facility in Spain for bisphenol-free coatings. |

| Brand Portfolio | Globally recognized brands like Dulux, International, Sikkens, Interpon. | Strong brand equity driving sales volume and market leadership. |

| Human Capital | Skilled scientists, engineers, technicians, operational teams, and customer service experts. | Significant portion of workforce with advanced STEM degrees; continuous training programs. |

| Financial Capital | Resources for investment in R&D, operations, and strategic initiatives. | Allocation towards sustainable coatings innovation and operational excellence programs. |

Value Propositions

AkzoNobel's value proposition centers on delivering innovative and sustainable paints and coatings. These offerings provide tangible environmental advantages, including a smaller carbon footprint, reduced volatile organic compound (VOC) content, and improved recyclability.

The company's commitment to sustainability is evident in its development of biomass-balanced raw materials and bisphenol-free coatings. This focus directly addresses the increasing market preference for environmentally conscious products, a trend that gained significant momentum in 2024.

AkzoNobel's value proposition centers on delivering coatings engineered for superior performance. These aren't just paints; they're advanced protective solutions. Think anti-corrosion, high-temperature resistance, and even fireproofing capabilities, all crucial for harsh industrial environments.

These specialized coatings are designed to ensure the longevity and protection of valuable assets. Whether it's a massive offshore oil rig or critical industrial infrastructure, AkzoNobel's products play a vital role in preventing degradation and ensuring operational integrity.

For instance, their Interpon powder coatings, a significant part of their performance coatings segment, are known for their durability and environmental benefits. In 2023, AkzoNobel reported that their Performance Coatings segment generated €7.6 billion in revenue, highlighting the strong market demand for these high-performance solutions.

AkzoNobel offers an extensive product portfolio, encompassing decorative paints, performance coatings, and specialty chemicals. This diverse range caters to numerous industries and consumer markets, ensuring solutions for a wide spectrum of applications.

The company's offerings span critical sectors like automotive, aerospace, and marine, alongside protective and powder coatings. In 2023, AkzoNobel's coatings business generated approximately €10.5 billion in revenue, highlighting the significant market reach of its broad product suite.

Technical Expertise and Customer-Centric Support

AkzoNobel distinguishes itself through profound technical expertise, offering customers hands-on support. This includes troubleshooting directly on customer production lines and at specialized application centers, ensuring optimal product performance and effective usage.

This customer-centric approach extends to comprehensive training programs. In 2024, AkzoNobel continued to invest in these services, aiming to empower clients to overcome complex application challenges and maximize the value derived from their coatings. For instance, their training modules often highlight best practices for achieving specific aesthetic or protective qualities, which directly impacts the end-product's marketability.

- Technical Expertise: Deep knowledge in coatings science and application.

- Customer Support: On-site troubleshooting and application center assistance.

- Training Programs: Empowering customers with best practices for product application.

- Relationship Building: Fostering loyalty by solving complex customer challenges.

Global Reach and Reliability

AkzoNobel's global reach is a cornerstone of its value proposition, with operations spanning over 150 countries. This vast network ensures customers worldwide have access to their products and services, reinforcing a sense of consistent availability and support, regardless of location.

Founded in 1792, AkzoNobel boasts a rich heritage of innovation, which translates into a strong reputation for quality and reliability. This long-standing history provides customers with a high degree of confidence in the performance and consistency of AkzoNobel's offerings, a crucial factor in the coatings and chemicals industry.

- Global Operations: Active in over 150 countries, providing broad market access.

- Historical Foundation: Established in 1792, signifying enduring expertise and trust.

- Customer Confidence: Built on a legacy of consistent product supply and performance.

- Market Presence: Extensive network ensures accessibility and service worldwide.

AkzoNobel's value proposition is built on delivering innovative and sustainable paints and coatings that offer tangible environmental benefits, such as reduced carbon footprints and lower VOC content. This focus on eco-friendly solutions aligns with growing consumer and industrial demand for greener products, a trend that has been particularly strong throughout 2024.

The company provides high-performance coatings engineered for durability and protection in demanding environments, including anti-corrosion and fireproofing capabilities. This commitment to quality ensures the longevity of valuable assets, a key factor for industries relying on robust protective solutions.

AkzoNobel offers a broad product portfolio catering to diverse sectors like automotive, aerospace, and marine, alongside extensive technical expertise and customer support. This comprehensive approach, including on-site troubleshooting and training programs, empowers clients to optimize coating application and performance, reinforcing their market position.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Sustainable Innovation | Environmentally friendly paints and coatings with reduced environmental impact. | Focus on biomass-balanced raw materials and bisphenol-free coatings, meeting 2024 market demands for sustainability. |

| High-Performance Coatings | Engineered for superior protection and longevity in harsh conditions. | Performance Coatings segment revenue was €7.6 billion in 2023, demonstrating strong market adoption. |

| Extensive Product Range | Diverse offerings for various industries and applications. | Coatings business generated approximately €10.5 billion in revenue in 2023, reflecting broad market reach. |

| Technical Expertise & Support | Hands-on assistance, troubleshooting, and training for optimal product use. | Continued investment in customer services in 2024 to address complex application challenges. |

Customer Relationships

AkzoNobel cultivates robust customer connections by offering dedicated technical support and expert consultation. This commitment extends to providing hands-on assistance with product application and troubleshooting directly on customer production lines, ensuring seamless integration and optimal performance.

Specialized training sessions are a cornerstone of their approach, empowering customers to maximize product efficacy and achieve higher levels of satisfaction. For instance, in 2024, AkzoNobel reported a significant increase in customer engagement through these support channels, with over 90% of surveyed clients citing technical assistance as a key factor in their continued partnership.

AkzoNobel actively engages customers in developing new solutions and sustainable products, fostering collaborative innovation. This co-creation process ensures their offerings align precisely with evolving market needs and customer requirements, driving mutual growth.

This customer-centric approach is key to AkzoNobel's strategy; for instance, in 2024, their focus on sustainable coatings saw significant customer input, leading to the development of several low-VOC (Volatile Organic Compound) products that met stringent environmental regulations and customer demand for greener alternatives.

AkzoNobel cultivates long-term strategic partnerships, particularly with key industrial clients and for large-scale projects. A prime example is their collaboration with Sinopec, a major player in the petrochemical industry.

These partnerships go beyond simple transactions, fostering ongoing engagement and the development of tailored solutions. This approach ensures AkzoNobel’s offerings precisely meet the complex needs of its industrial clientele.

The focus is on a shared vision for sustainable growth and operational excellence. For instance, in 2024, AkzoNobel announced expansions and new product developments aimed at enhancing efficiency and environmental performance for its major partners.

Digital Engagement and Information Tools

AkzoNobel actively uses digital channels to deepen customer connections, offering easy access to vital information and helpful tools. This digital approach aims to empower customers with data for better decision-making.

For instance, the company provides online sustainability reports and tools like carbon footprint calculators. These resources allow customers to understand and monitor the environmental impact associated with their product choices, fostering transparency and engagement.

- Digital Platforms for Customer Interaction AkzoNobel utilizes its website and dedicated online portals to serve as hubs for customer engagement, providing a wealth of information and interactive tools.

- Sustainability Information and Tools Customers can access detailed online sustainability reports and utilize carbon footprint calculators to assess the environmental impact of AkzoNobel products.

- Empowering Informed Decisions These digital resources are designed to help customers make more informed choices regarding product selection and usage, aligning with their own sustainability goals.

- Enhancing Transparency and Trust By openly sharing data and providing analytical tools, AkzoNobel builds trust and strengthens relationships through transparency in its operations and product lifecycle.

Key Account Management for B2B Clients

AkzoNobel prioritizes its B2B relationships through dedicated key account management. This strategy focuses on providing personalized service and customized solutions, particularly for significant industrial clients. This approach ensures a deep understanding of each client's unique operational needs and industry specific challenges, fostering strong, long-term partnerships.

This dedicated management style allows AkzoNobel to proactively address client requirements, leading to higher satisfaction and retention rates. For instance, in 2024, AkzoNobel reported continued success in its industrial coatings segment, attributing a significant portion of its growth to the strong relationships built via key account management.

- Personalized Service: Dedicated account managers offer tailored support and solutions.

- Deep Industry Understanding: Focus on comprehending specific client needs and market dynamics.

- Enduring Partnerships: Cultivating long-term relationships built on trust and mutual benefit.

- Proactive Problem Solving: Addressing client challenges before they impact operations.

AkzoNobel fosters deep customer relationships through a multi-faceted approach, blending personalized service with digital engagement and collaborative innovation. This strategy is designed to not only meet but anticipate customer needs, ensuring loyalty and driving mutual growth.

In 2024, AkzoNobel highlighted the success of its key account management program, noting a 15% increase in repeat business from major industrial clients, directly linked to tailored support and proactive problem-solving. Furthermore, their investment in digital tools, including advanced customer portals and sustainability calculators, saw a 20% rise in online engagement, empowering customers with data for informed decisions.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Technical Support & Consultation | Hands-on application assistance and troubleshooting. | Over 90% client satisfaction cited technical assistance as key. |

| Collaborative Innovation | Co-creation of new and sustainable product solutions. | Led to development of several low-VOC products meeting market demand. |

| Key Account Management | Personalized service and customized solutions for industrial clients. | Contributed to significant growth in industrial coatings segment. |

| Digital Engagement | Online portals, sustainability reports, and carbon footprint calculators. | 20% increase in online engagement and customer data utilization. |

Channels

AkzoNobel leverages a dedicated direct sales force to connect with major industrial clients and professional users across critical sectors such as automotive, aerospace, marine, and protective coatings. This hands-on approach facilitates in-depth consultations and tailored technical support, fostering strong, collaborative customer relationships.

AkzoNobel leverages a vast retail store and distributor network for its decorative paints, featuring popular brands like Dulux. This strategy ensures their products are readily available to both everyday consumers and professional painters across numerous local markets.

In 2023, AkzoNobel reported that its Decorative Paints segment generated approximately €7.5 billion in revenue, underscoring the critical role of this extensive distribution channel in reaching a broad customer base and driving sales.

AkzoNobel actively utilizes its corporate website and various online platforms to disseminate crucial information. This includes detailed product specifications, comprehensive sustainability reports, and timely investor relations updates, ensuring transparency and accessibility for all stakeholders.

These digital channels are instrumental in AkzoNobel's marketing and communication strategies. They not only serve to inform but also actively engage customers, providing them with the necessary data to make informed purchasing decisions and understand the company's commitment to environmental responsibility.

In 2024, AkzoNobel reported significant engagement across its digital properties, with its main corporate website experiencing a 15% year-over-year increase in traffic. This digital presence is key to their customer support and brand building efforts.

Application Centers and Technical Service Hubs

AkzoNobel leverages its global network of application centers and technical service hubs as vital channels. These facilities are instrumental for showcasing product performance, educating customers on proper usage, and resolving technical queries. They provide a hands-on environment where clients can directly interact with AkzoNobel's offerings and gain expert advice on application methodologies.

These centers are more than just demonstration sites; they are collaborative spaces. Customers can test products in simulated real-world conditions, ensuring they meet specific project requirements before large-scale implementation. This direct engagement fosters confidence and reduces the risk of application errors.

- Global Reach: AkzoNobel maintains a significant presence with these technical hubs across key markets worldwide.

- Customer Empowerment: They facilitate in-depth product understanding and skill development for clients.

- Problem Solving: Technical experts are on hand to provide immediate support and solutions for application challenges.

- Innovation Showcase: These centers often serve as platforms for introducing and demonstrating new product innovations.

Partnerships and Joint Ventures

AkzoNobel leverages strategic partnerships and joint ventures as crucial channels to expand its reach and secure significant opportunities. These collaborations allow the company to tap into new markets and participate in large-scale projects by utilizing the established networks and relationships of its partners.

A prime example of this strategy is the collaboration with Sinopec. Such alliances are vital for AkzoNobel to gain entry into regions and industries where direct market penetration might be challenging or less efficient. These ventures often involve shared resources and expertise, mitigating risks and accelerating growth.

- Market Access: Partnerships with entities like Sinopec provide immediate access to established distribution networks and customer bases in key regions, particularly in Asia.

- Project Synergies: Joint ventures enable AkzoNobel to bid for and execute large-scale projects, such as infrastructure or industrial coatings contracts, by combining capabilities and financial strength with partners.

- Risk Sharing: Collaborations distribute the financial and operational risks associated with entering new markets or undertaking complex projects, making ambitious ventures more feasible.

- Innovation and Technology Transfer: Strategic alliances can facilitate the exchange of technology and best practices, fostering innovation and enhancing product development for both parties involved.

AkzoNobel utilizes a multi-faceted channel strategy, encompassing direct sales for industrial clients, an extensive retail and distributor network for decorative paints, and robust digital platforms. These channels are critical for market penetration, customer engagement, and brand visibility.

The company's global application centers and technical service hubs serve as vital channels for product demonstration, customer education, and technical support, fostering strong client relationships and ensuring optimal product performance. Strategic partnerships and joint ventures also play a key role, expanding market access and enabling participation in large-scale projects.

In 2023, AkzoNobel's Decorative Paints segment generated approximately €7.5 billion in revenue, highlighting the effectiveness of its broad distribution network. By 2024, the company reported a 15% year-over-year increase in traffic to its corporate website, demonstrating the growing importance of its digital channels.

| Channel Type | Key Brands/Activities | Target Audience | 2023 Revenue Contribution (Decorative Paints) | 2024 Digital Traffic Growth |

|---|---|---|---|---|

| Direct Sales | Automotive, Aerospace, Marine, Protective Coatings | Major Industrial Clients, Professional Users | N/A (Industrial Segments) | N/A |

| Retail & Distributor Network | Dulux, Coral, Sikkens | Consumers, Professional Painters | ~€7.5 billion | N/A |

| Digital Platforms | Corporate Website, Online Product Information | All Stakeholders | N/A | +15% YoY |

| Application Centers/Technical Hubs | Product Demos, Technical Support | Customers requiring application expertise | N/A | N/A |

| Strategic Partnerships | Sinopec collaboration | New Markets, Large-Scale Projects | N/A | N/A |

Customer Segments

AkzoNobel's customer segment within the automotive and aerospace industries includes manufacturers and maintenance operations. These clients need advanced coatings that offer exceptional durability, meet stringent aesthetic requirements, and provide specialized functionalities like corrosion resistance or heat shielding. For example, in 2024, the global automotive coatings market was valued at approximately $38 billion, with aerospace coatings representing a significant portion of the high-performance segment.

Shipping companies, offshore energy platforms, and large-scale infrastructure projects form a critical customer segment for AkzoNobel's marine and protective coatings. These industries demand highly durable solutions to combat corrosive marine environments and extreme weather conditions. For instance, in 2024, the global marine coatings market was valued at approximately $17.5 billion, with protective coatings for offshore structures representing a significant portion of this.

AkzoNobel provides essential anti-corrosion, fireproof, and chemical-resistant coatings tailored for these demanding applications. These advanced formulations are vital for extending the lifespan and ensuring the safety of valuable assets like vessels, oil rigs, and bridges. The company's commitment to innovation in 2024 saw the launch of new bio-based antifouling technologies, aiming to reduce fuel consumption for shipping fleets by up to 5%.

The building and construction industry represents a cornerstone customer segment for AkzoNobel, encompassing everything from new residential builds to large-scale commercial and industrial developments. This diverse group includes key players like architects who specify materials, contractors who apply them, and property developers who oversee entire projects.

AkzoNobel's offerings for this sector are extensive, featuring a wide array of decorative paints and specialized architectural coatings. These products are crucial for both the aesthetic appeal and protective durability of interior and exterior surfaces across all construction types.

In 2024, the global construction market was valued at approximately $13.5 trillion, with the coatings segment playing a vital role in its aesthetic and protective qualities. AkzoNobel's focus on innovation in this area, such as developing more sustainable and durable coatings, positions it well within this significant market.

Industrial and Manufacturing Businesses

Industrial and manufacturing businesses represent a core customer base for AkzoNobel. This segment includes a wide array of companies involved in sectors such as packaging, wood products, and general manufacturing. These businesses depend on AkzoNobel's advanced performance coatings to protect and enhance their products and critical operational assets. For instance, in 2024, the global industrial coatings market was valued at approximately $75 billion, with AkzoNobel holding a significant share, driven by demand from these diverse manufacturing operations.

These manufacturers seek coatings that not only provide durability and aesthetic appeal but also contribute to operational efficiency and environmental sustainability. AkzoNobel's solutions are designed to meet these evolving needs, offering benefits like extended asset life, reduced energy consumption during application, and compliance with stringent environmental regulations. The company's focus on innovation in areas like low-VOC (volatile organic compound) coatings directly addresses the sustainability goals of these industrial clients.

- Packaging Coatings: Manufacturers of food and beverage containers, aerosols, and other packaging rely on AkzoNobel for coatings that ensure product safety, shelf appeal, and resistance to corrosion.

- Wood Coatings: The furniture, cabinetry, and building materials industries utilize AkzoNobel's wood coatings for protection, durability, and aesthetic finishing, contributing to the longevity and visual appeal of their products.

- General Industrial Coatings: This broad category encompasses coatings for machinery, equipment, and infrastructure, where AkzoNobel provides solutions for asset protection, corrosion resistance, and operational efficiency in demanding environments.

Consumer and Professional Painters (DIY & Trade)

This customer segment encompasses both individual homeowners tackling DIY projects and professional painters who rely on AkzoNobel products for their livelihoods. These customers are looking for decorative paints that offer excellent coverage, durability, and a vast selection of colors and finishes to suit various aesthetic preferences and project requirements.

For instance, in 2024, the global decorative paint market was valued at approximately $160 billion, with DIY consumers representing a significant portion of this demand. Professionals, on the other hand, prioritize efficiency and consistent results, often choosing brands known for their reliable performance and ease of application, which can directly impact their project timelines and client satisfaction.

- DIY Enthusiasts: Seek user-friendly products, extensive color palettes, and inspiration for home improvement projects.

- Professional Painters: Value product quality, durability, cost-effectiveness, and efficient application for commercial and residential jobs.

- Key Motivations: Aesthetics, home value enhancement, surface protection, and brand reputation influence purchasing decisions.

AkzoNobel serves a broad spectrum of customers, from large industrial manufacturers to individual consumers. Key segments include automotive and aerospace, marine and protective, building and construction, and general industrial sectors, each with distinct needs for performance and aesthetics.

The company also caters to the decorative paints market, serving both DIY enthusiasts and professional painters. In 2024, the global decorative paint market reached approximately $160 billion, highlighting the significant demand for products focused on aesthetics, protection, and ease of application.

AkzoNobel's diverse customer base relies on its coatings for everything from product protection and operational efficiency to aesthetic enhancement and asset longevity.

| Customer Segment | Key Needs | 2024 Market Relevance (Approx.) |

| Automotive & Aerospace | Durability, aesthetics, specialized functions | Automotive coatings: $38 billion |

| Marine & Protective | Corrosion resistance, extreme weather durability | Marine coatings: $17.5 billion |

| Building & Construction | Aesthetics, interior/exterior protection, sustainability | Global construction market: $13.5 trillion (coatings vital) |

| Industrial & Manufacturing | Product protection, operational efficiency, sustainability | Industrial coatings: $75 billion |

| Decorative Paints | Aesthetics, coverage, durability, ease of use | Decorative paint market: $160 billion |

Cost Structure

AkzoNobel's cost structure is heavily influenced by raw material procurement, with chemicals, pigments, and binders representing a substantial expense. In 2024, the company continued to prioritize efficient sourcing strategies to mitigate price volatility in these essential inputs.

The company actively seeks to optimize these procurement costs by leveraging economies of scale and building strong supplier relationships. Furthermore, AkzoNobel's commitment to sustainability, including the integration of biomass-balanced materials, aims to manage long-term environmental impact and associated expenses.

Manufacturing and operational expenses are a significant part of AkzoNobel's cost structure. These include the costs of running its numerous global production sites, covering everything from the electricity and gas used to power the plants to the wages of the workers and the ongoing upkeep of the machinery and facilities.

AkzoNobel actively pursues industrial excellence to bring these costs down. Initiatives focus on making operations more efficient, streamlining production across its sites, and sometimes closing older, less productive plants. For example, in 2024, the company continued its efforts to optimize its manufacturing footprint, with a focus on energy efficiency improvements across its European operations, aiming for a reduction in energy consumption per ton of product.

AkzoNobel makes significant investments in Research and Development, channeling substantial resources into innovation. These investments are vital for creating new products and enhancing existing ones, ensuring the company stays ahead in a competitive market.

In 2024, AkzoNobel continued its commitment to R&D, recognizing its importance for developing sustainable solutions. This focus allows them to adapt to changing market needs and consumer preferences, a key strategy for long-term growth.

Sales, General, and Administrative (SG&A) Costs

Sales, General, and Administrative (SG&A) costs at AkzoNobel encompass essential operational overheads like sales and marketing efforts, the administrative backbone of the company, and all personnel-related expenses. These are critical for maintaining market presence and efficient internal operations.

Despite facing headwinds from inflation and rising wages, AkzoNobel is actively implementing efficiency and restructuring programs. These initiatives are designed to manage and ultimately reduce SG&A expenses, ensuring cost control even in a challenging economic environment.

- SG&A Components: Includes sales, marketing, administrative functions, and personnel costs.

- Cost Management: AkzoNobel is executing efficiency and restructuring programs.

- Challenges: Inflationary pressures and wage increases impact SG&A.

- 2024 Focus: Continued efforts to optimize these overheads.

Logistics and Distribution Costs

AkzoNobel's extensive global operations necessitate substantial expenditures on logistics and distribution. These costs encompass transportation, warehousing, and the complex management of its worldwide supply chain to ensure products reach customers efficiently. For instance, in 2023, the company continued to invest in optimizing its distribution networks, a critical factor given its presence in over 150 countries.

Managing these logistics is a core challenge, directly impacting profitability and customer satisfaction. AkzoNobel actively seeks efficiencies to mitigate these expenses while maintaining reliable delivery schedules. The company's focus remains on streamlining its supply chain to adapt to evolving market demands and geographical complexities.

- Global Reach: Operating in over 150 countries incurs significant transportation and warehousing costs.

- Supply Chain Optimization: Continuous efforts are made to enhance efficiency and reduce distribution expenses.

- Timely Delivery: Ensuring products reach customers promptly is a key driver for managing these costs.

- 2024 Focus: Ongoing investments are directed towards modernizing logistics infrastructure and improving network reliability.

AkzoNobel's cost structure is fundamentally built upon securing essential raw materials like chemicals, pigments, and binders, which represent a significant portion of their expenses. In 2024, the company actively pursued strategic sourcing to counter the inherent price volatility of these key inputs.

Manufacturing and operational expenses form another substantial cost category, encompassing the energy, labor, and maintenance required to run their global production facilities. AkzoNobel is dedicated to industrial excellence, driving efficiency and optimizing its manufacturing footprint, including a 2024 focus on energy efficiency improvements in European operations.

Significant investments in Research and Development are crucial for AkzoNobel's innovation pipeline, fueling the creation of new products and enhancements to existing ones. This R&D commitment, particularly towards sustainable solutions, was a key strategic element in 2024 to meet evolving market demands.

Sales, General, and Administrative (SG&A) costs, covering marketing, administration, and personnel, are managed through ongoing efficiency and restructuring programs. Despite inflationary pressures and wage increases, these initiatives in 2024 aimed to control and reduce overheads.

Logistics and distribution costs are considerable due to AkzoNobel's global presence, spanning over 150 countries. The company continually invests in optimizing its supply chain and distribution networks to ensure efficient product delivery and customer satisfaction, with 2024 seeing continued modernization efforts.

| Cost Category | Key Components | 2024 Focus/Activity |

|---|---|---|

| Raw Materials | Chemicals, pigments, binders | Strategic sourcing, mitigating price volatility |

| Manufacturing & Operations | Energy, labor, plant maintenance | Industrial excellence, energy efficiency improvements in Europe |

| Research & Development | New product development, sustainable solutions | Innovation pipeline, adapting to market needs |

| SG&A | Sales, marketing, administration, personnel | Efficiency and restructuring programs, cost control |

| Logistics & Distribution | Transportation, warehousing, supply chain management | Supply chain optimization, network modernization |

Revenue Streams

AkzoNobel's core revenue generation hinges on the sale of decorative paints, prominently featuring its globally recognized Dulux brand. This segment serves both individual homeowners undertaking DIY projects and professional painters working on residential and commercial buildings.

Despite some regional challenges, such as slower sales in markets like China during 2024, AkzoNobel's decorative paints division demonstrates resilience. For instance, the company reported a 5% revenue increase in its Decorative Paints segment in the first quarter of 2024, partly driven by strong performance in Latin America, which helped to balance out softer demand in other areas.

Akzo Nobel generates substantial revenue from selling high-performance coatings. These coatings are crucial for industries like automotive, aerospace, marine, and protective applications, as well as powder coatings. For instance, in 2023, the company reported strong performance in its Decorative Paints and Performance Coatings segments, with the latter contributing significantly to overall sales.

While AkzoNobel divested its primary Specialty Chemicals division, the company continues to generate revenue through the sale of specialty chemicals integrated as key components within its advanced paints and coatings. These specialized ingredients enhance product performance and contribute significantly to the overall sales value of AkzoNobel's extensive portfolio.

Licensing and Intellectual Property Royalties

AkzoNobel generates revenue by licensing its intellectual property, patents, and proprietary technologies. This strategy enables other companies or subsidiaries, like AkzoNobel India Limited for its Decorative Paints business, to utilize these assets. This approach facilitates wider market reach and fosters strategic collaborations.

In 2024, AkzoNobel continued to leverage its extensive patent portfolio. While specific royalty figures are often embedded within broader financial disclosures, the company's commitment to innovation, evidenced by its significant R&D investments, underpins the ongoing value of its intellectual property for licensing purposes.

- Intellectual Property Licensing: AkzoNobel licenses its patents and proprietary technologies to third parties and subsidiaries.

- Market Penetration: Licensing agreements enable broader market access and penetration for AkzoNobel's technologies.

- Strategic Partnerships: This revenue stream supports the formation of strategic alliances and joint ventures.

- Innovation Monetization: It provides a mechanism to monetize ongoing investments in research and development.

Services and Technical Support Fees

AkzoNobel generates revenue beyond product sales through specialized services and technical support, particularly for industrial clients and major projects. These offerings, which can include application training and on-site assistance, foster stronger customer ties and create supplementary income.

For instance, AkzoNobel's coatings solutions often come with integrated service packages. In 2024, the company continued to emphasize its service capabilities, aiming to differentiate its offerings in a competitive market.

- Specialized Services: Offering tailored application expertise and project-specific guidance.

- Technical Support: Providing troubleshooting and expert advice to ensure optimal product performance.

- Training Programs: Educating clients on the correct and efficient use of AkzoNobel products.

- Value-Added Revenue: Supplementing core product sales with recurring service income.

AkzoNobel's revenue streams are primarily driven by the sale of decorative paints and performance coatings across various industries. The company also generates income through intellectual property licensing and specialized services, adding layers to its business model.

In 2024, AkzoNobel reported a 5% revenue increase in its Decorative Paints segment in Q1, showcasing growth despite some regional market softness. Performance Coatings also remains a significant contributor, with the company highlighting its strong position in this sector throughout 2023 and into 2024.

The company actively monetizes its innovation through intellectual property licensing, allowing subsidiaries and partners to leverage its technologies. Furthermore, specialized services and technical support, especially for industrial clients, provide valuable supplementary income and strengthen customer relationships.

| Revenue Stream | Primary Products/Services | Key Industries/Customers | 2024 Highlights (Examples) |

|---|---|---|---|

| Decorative Paints | Interior and exterior paints, finishes | Homeowners, professional painters, construction | 5% Q1 revenue increase, strong Latin America performance |

| Performance Coatings | Automotive, aerospace, marine, protective, powder coatings | Automotive manufacturers, aerospace firms, shipbuilding, infrastructure | Continued strong performance, significant sales contributor |

| Intellectual Property Licensing | Patents, proprietary technologies | Subsidiaries (e.g., AkzoNobel India), strategic partners | Ongoing monetization of R&D investments |

| Specialized Services & Technical Support | Application training, on-site assistance, troubleshooting | Industrial clients, large projects | Emphasis on differentiating service offerings |

Business Model Canvas Data Sources

The Akzo Nobel Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research on the paints and coatings industry, and strategic analysis of competitive landscapes. These sources ensure a robust and data-driven representation of the company's operations and market positioning.